Key Insights

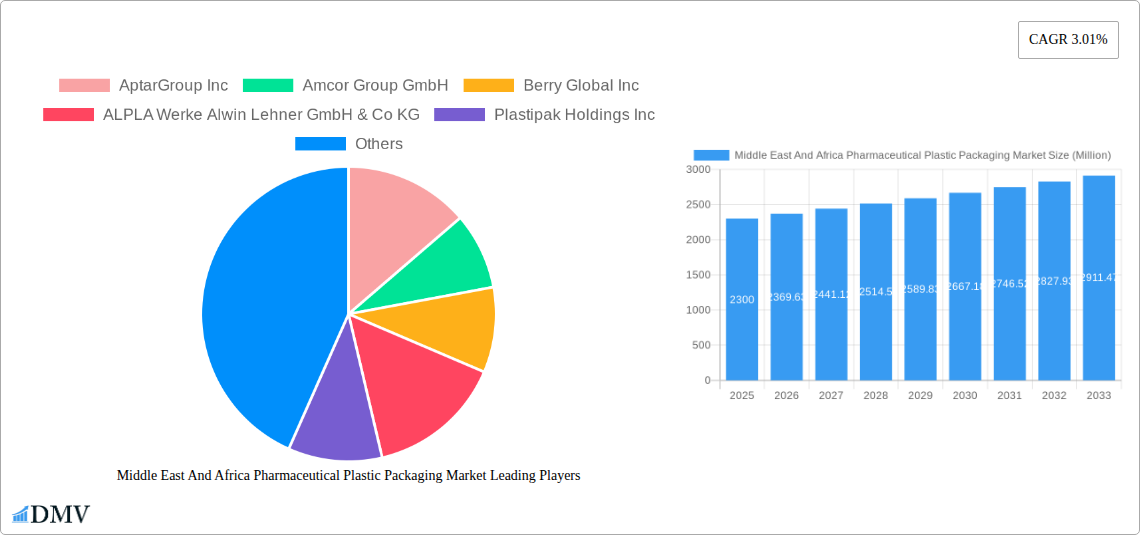

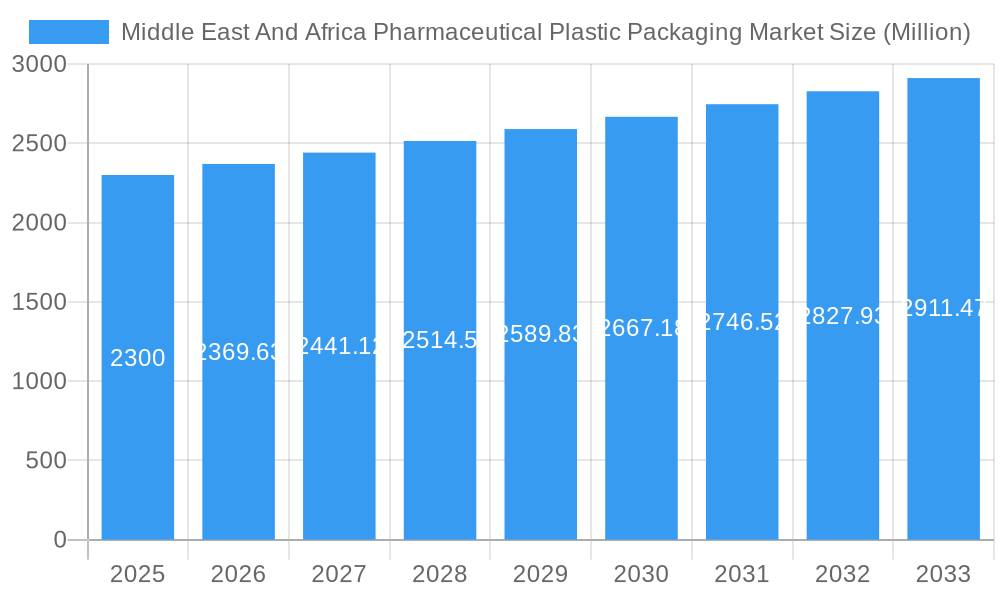

The Middle East and Africa Pharmaceutical Plastic Packaging market, valued at $2.30 billion in 2025, is projected to experience steady growth, driven by factors such as the rising prevalence of chronic diseases, increasing demand for pharmaceutical products, and the growing adoption of advanced packaging technologies to ensure drug efficacy and safety. The market's Compound Annual Growth Rate (CAGR) of 3.01% from 2025 to 2033 reflects a consistent, albeit moderate, expansion. Key drivers include the expanding healthcare infrastructure across the region, increasing government investments in healthcare, and a growing preference for convenient and tamper-evident packaging solutions. The pharmaceutical industry's stringent regulations concerning drug safety and product integrity further bolster demand for high-quality plastic packaging. However, environmental concerns surrounding plastic waste and the fluctuating prices of raw materials pose significant challenges to market growth. Segmentation within the market likely includes various types of plastic packaging (e.g., blister packs, bottles, vials, pouches), with different material compositions catering to specific drug formulations. The competitive landscape features a mix of multinational corporations and regional players, with companies such as AptarGroup Inc., Amcor Group GmbH, and Berry Global Inc. holding significant market shares. Future growth will depend on technological advancements, regulatory changes, and increasing focus on sustainability within the pharmaceutical packaging sector. The market is expected to witness a surge in demand for innovative solutions, such as smart packaging with integrated sensors, to enhance product traceability and patient compliance.

Middle East And Africa Pharmaceutical Plastic Packaging Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion, fueled by rising healthcare expenditure and population growth across the MEA region. However, the pace of growth will likely be influenced by economic conditions, technological disruptions, and the adoption of environmentally friendly alternatives. Specific regional variations within the MEA market are anticipated, influenced by factors such as economic development, healthcare infrastructure, and regulatory frameworks across different countries. Companies are likely to focus on strategic partnerships, acquisitions, and product innovation to maintain their competitiveness and cater to the diverse needs of the pharmaceutical industry.

Middle East And Africa Pharmaceutical Plastic Packaging Market Company Market Share

Middle East & Africa Pharmaceutical Plastic Packaging Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa Pharmaceutical Plastic Packaging market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of historical trends, current market conditions, and future growth projections. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Middle East And Africa Pharmaceutical Plastic Packaging Market Market Composition & Trends

This section delves into the intricate composition of the Middle East and Africa Pharmaceutical Plastic Packaging market, analyzing key trends shaping its evolution. We examine market concentration, revealing the market share distribution amongst key players. While precise figures for market share are unavailable at this time, we can infer a moderately fragmented market with a few dominant players. Mergers and acquisitions (M&A) activity is analyzed, considering deal values, which averaged approximately xx Million in the historical period. This analysis considers the impact of innovation catalysts, including advancements in materials science and packaging technologies, on market dynamics. The regulatory landscape, including evolving environmental regulations and stringent quality standards, is thoroughly evaluated. The report also assesses substitute products (e.g., glass, paper-based alternatives) and their potential impact on market growth. End-user profiles (pharmaceutical companies, hospitals, clinics) are characterized, detailing their specific packaging requirements.

- Market Concentration: Moderately fragmented, with a few dominant players.

- M&A Activity: Average deal value: xx Million (2019-2024). xx number of deals closed.

- Regulatory Landscape: Stringent quality standards and evolving environmental regulations.

- Substitute Products: Glass, paper-based packaging present limited competition.

- End-User Profiles: Pharmaceutical manufacturers, hospitals, clinics, distributors.

Middle East And Africa Pharmaceutical Plastic Packaging Market Industry Evolution

This section traces the evolution of the Middle East and Africa Pharmaceutical Plastic Packaging market, charting its growth trajectory. The market experienced a compound annual growth rate (CAGR) of xx% from 2019 to 2024, driven by factors including rising pharmaceutical production, increasing healthcare expenditure, and a growing preference for convenient and tamper-evident packaging. Technological advancements, such as the introduction of sustainable and lightweight materials, have significantly influenced market dynamics. Shifting consumer preferences, notably a growing preference for eco-friendly packaging solutions, are also analyzed. Adoption metrics for sustainable packaging are incorporated, revealing a growing trend toward eco-conscious choices.

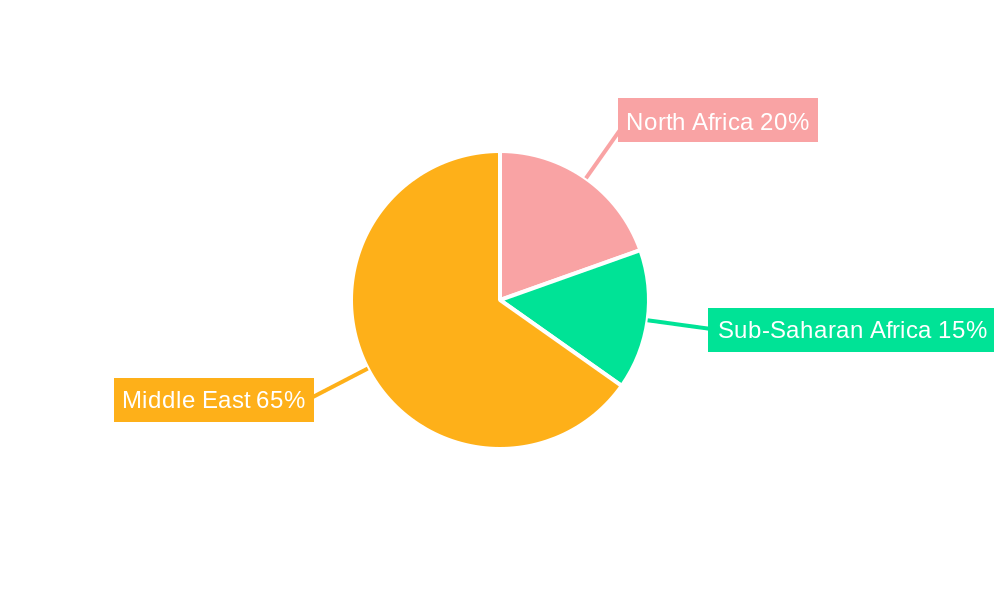

Leading Regions, Countries, or Segments in Middle East And Africa Pharmaceutical Plastic Packaging Market

This section identifies the leading regions, countries, and segments within the Middle East and Africa Pharmaceutical Plastic Packaging market. While specific data on regional dominance is not available at this time, a preliminary analysis suggests that the xx region/country is currently leading in terms of market size and growth.

- Key Drivers (xx Region):

- Increasing healthcare infrastructure development.

- Favorable government policies and incentives.

- Growing pharmaceutical industry.

- High population density and rising disposable incomes.

This dominance is attributed to a confluence of factors, including robust pharmaceutical production, a supportive regulatory environment, and a growing healthcare infrastructure. The report explores each of these factors in detail, examining their influence on market dominance.

Middle East And Africa Pharmaceutical Plastic Packaging Market Product Innovations

Recent innovations include lightweight, tamper-evident closures, improved barrier properties for enhanced drug protection, and sustainable packaging solutions made from recycled or bio-based materials. These innovations offer unique selling propositions, such as reduced environmental impact, improved product shelf life, and enhanced consumer convenience. The incorporation of smart packaging technologies, allowing for real-time tracking and authentication, is also gaining traction.

Propelling Factors for Middle East And Africa Pharmaceutical Plastic Packaging Market Growth

Several factors contribute to the growth of the Middle East and Africa Pharmaceutical Plastic Packaging market. These include rising healthcare expenditure driving demand, stringent pharmaceutical regulations demanding safe and effective packaging, and technological advancements leading to innovative packaging solutions. Economic growth, coupled with a burgeoning pharmaceutical industry, further fuels market expansion.

Obstacles in the Middle East And Africa Pharmaceutical Plastic Packaging Market Market

The market faces challenges, such as fluctuating raw material prices impacting profitability, supply chain disruptions causing delays, and intense competition among established players. Furthermore, stringent environmental regulations increase production costs and complexities. The lack of awareness regarding sustainable packaging alternatives amongst some manufacturers presents a further hurdle to market growth.

Future Opportunities in Middle East And Africa Pharmaceutical Plastic Packaging Market

Future growth opportunities lie in the increasing adoption of sustainable packaging materials, the integration of smart packaging technologies, and the expansion into untapped markets within the region. Furthermore, the growing demand for customized packaging solutions presents significant potential for market expansion.

Major Players in the Middle East And Africa Pharmaceutical Plastic Packaging Market Ecosystem

- AptarGroup Inc

- Amcor Group GmbH

- Berry Global Inc

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Plastipak Holdings Inc

- Klockner Pentaplast Group

- DWK Life Sciences GmbH

- Polycos International LLC

- Al Shifa Medical Products Co

- Revital Healthcare (EPZ) Ltd

- Swiss Pac UAE

- PACK ART PACKING & PACKAGING L L C

- Huhtamaki Oyj

*List Not Exhaustive

Key Developments in Middle East And Africa Pharmaceutical Plastic Packaging Market Industry

- April 2024: Berry Global Inc. launched its lightweight tube closure solution, reducing greenhouse gas emissions and virgin plastic consumption.

- May 2024: ALPLA Werke Alwin Lehner GmbH & Co KG launched ALPLAinject, expanding its injection molding capabilities and market reach.

Strategic Middle East And Africa Pharmaceutical Plastic Packaging Market Market Forecast

The Middle East and Africa Pharmaceutical Plastic Packaging market is poised for continued growth, driven by rising healthcare spending, a growing focus on sustainable packaging, and the adoption of innovative packaging technologies. The market's future potential is significant, with opportunities for expansion in diverse segments and geographies. The emphasis on sustainable practices and technological advancements will shape the market's trajectory in the coming years.

Middle East And Africa Pharmaceutical Plastic Packaging Market Segmentation

-

1. Raw Material

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Low Density Polyethylene (LDPE)

- 1.4. High Density Polyethylene (HDPE)

- 1.5. Other Raw Materials

-

2. Product Type**

- 2.1. Solid Containers

- 2.2. Dropper Bottles

- 2.3. Nasal Spray Bottles

- 2.4. Liquid Bottles

- 2.5. Oral Care

- 2.6. Pouches

- 2.7. Vials and Ampoules

- 2.8. Cartridges

- 2.9. Syringes

- 2.10. Caps and Closures

- 2.11. Other Product Types

Middle East And Africa Pharmaceutical Plastic Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Pharmaceutical Plastic Packaging Market Regional Market Share

Geographic Coverage of Middle East And Africa Pharmaceutical Plastic Packaging Market

Middle East And Africa Pharmaceutical Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Syringes and Injectables Driven by Aging Population and Chronic Diseases; Saudi Arabia's Pharmaceutical Packaging Market is Boosted by Health Investments and Growing Demand

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Syringes and Injectables Driven by Aging Population and Chronic Diseases; Saudi Arabia's Pharmaceutical Packaging Market is Boosted by Health Investments and Growing Demand

- 3.4. Market Trends

- 3.4.1. Rising Demand for Syringes and Injectables Driven by Aging Population and Chronic Diseases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Pharmaceutical Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Low Density Polyethylene (LDPE)

- 5.1.4. High Density Polyethylene (HDPE)

- 5.1.5. Other Raw Materials

- 5.2. Market Analysis, Insights and Forecast - by Product Type**

- 5.2.1. Solid Containers

- 5.2.2. Dropper Bottles

- 5.2.3. Nasal Spray Bottles

- 5.2.4. Liquid Bottles

- 5.2.5. Oral Care

- 5.2.6. Pouches

- 5.2.7. Vials and Ampoules

- 5.2.8. Cartridges

- 5.2.9. Syringes

- 5.2.10. Caps and Closures

- 5.2.11. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AptarGroup Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plastipak Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Klockner Pentaplast Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DWK Life Sciences GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Polycos International LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al Shifa Medical Products Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Revital Healthcare (EPZ) Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Swiss Pac UAE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PACK ART PACKING & PACKAGING L L C

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Huhtamaki Oyj*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 AptarGroup Inc

List of Figures

- Figure 1: Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Pharmaceutical Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: Middle East And Africa Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 3: Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Product Type** 2020 & 2033

- Table 4: Middle East And Africa Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Product Type** 2020 & 2033

- Table 5: Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East And Africa Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 8: Middle East And Africa Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 9: Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Product Type** 2020 & 2033

- Table 10: Middle East And Africa Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Product Type** 2020 & 2033

- Table 11: Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Middle East And Africa Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Saudi Arabia Middle East And Africa Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: United Arab Emirates Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle East And Africa Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Israel Middle East And Africa Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Qatar Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar Middle East And Africa Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Kuwait Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle East And Africa Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle East And Africa Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Bahrain Middle East And Africa Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Jordan Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Jordan Middle East And Africa Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Lebanon Middle East And Africa Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Lebanon Middle East And Africa Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Pharmaceutical Plastic Packaging Market?

The projected CAGR is approximately 3.01%.

2. Which companies are prominent players in the Middle East And Africa Pharmaceutical Plastic Packaging Market?

Key companies in the market include AptarGroup Inc, Amcor Group GmbH, Berry Global Inc, ALPLA Werke Alwin Lehner GmbH & Co KG, Plastipak Holdings Inc, Klockner Pentaplast Group, DWK Life Sciences GmbH, Polycos International LLC, Al Shifa Medical Products Co, Revital Healthcare (EPZ) Ltd, Swiss Pac UAE, PACK ART PACKING & PACKAGING L L C, Huhtamaki Oyj*List Not Exhaustive.

3. What are the main segments of the Middle East And Africa Pharmaceutical Plastic Packaging Market?

The market segments include Raw Material, Product Type**.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Syringes and Injectables Driven by Aging Population and Chronic Diseases; Saudi Arabia's Pharmaceutical Packaging Market is Boosted by Health Investments and Growing Demand.

6. What are the notable trends driving market growth?

Rising Demand for Syringes and Injectables Driven by Aging Population and Chronic Diseases.

7. Are there any restraints impacting market growth?

Rising Demand for Syringes and Injectables Driven by Aging Population and Chronic Diseases; Saudi Arabia's Pharmaceutical Packaging Market is Boosted by Health Investments and Growing Demand.

8. Can you provide examples of recent developments in the market?

April 2024: Berry Global Inc. celebrates the six-month milestone of its innovative lightweight tube closure solution, tailored for diverse personal care and pharmaceutical applications. This state-of-the-art closure seamlessly merges contemporary design and material adaptability, all while significantly curbing greenhouse gas emissions. Such advancements not only cater to customer performance needs but also reinforce Berry's dedication to reducing virgin plastic consumption.May 2024: ALPLA Werke Alwin Lehner GmbH & Co KG has launched the ALPLAinject division to bolster its injection molding operations. ALPLAinject produces high-quality injection-molded items, including closures, caps, jars, and multi-part packaging components like pumps and deodorant sticks. This expansion aims to enhance efficiency, accelerate the introduction of new products to the market, and tap into previously unexplored market segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Pharmaceutical Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Pharmaceutical Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Pharmaceutical Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Pharmaceutical Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence