Key Insights

The Middle East and Africa (MEA) flexible packaging market, valued at approximately 301.2 billion in 2025, is poised for significant expansion. This growth is attributed to rising disposable incomes, increasing urbanization, and a growing demand for convenient food solutions. The flourishing food and beverage sector, particularly in key economies like the UAE, Saudi Arabia, and Nigeria, is a primary driver. The healthcare and personal care industries also contribute substantially, leveraging flexible packaging for extended shelf life, superior product protection, and optimized logistics. The market is segmented by resin type (polyethylene, polypropylene, PVC, PET), product type (pouches, bags, films), and end-user industries. Intense competition among leading players such as Amcor, Uflex Limited, and Huhtamaki Group fuels innovation in materials, design, and sustainability. Despite challenges from raw material price volatility and regulatory landscapes, the market's positive outlook is supported by regional population growth and evolving consumer preferences.

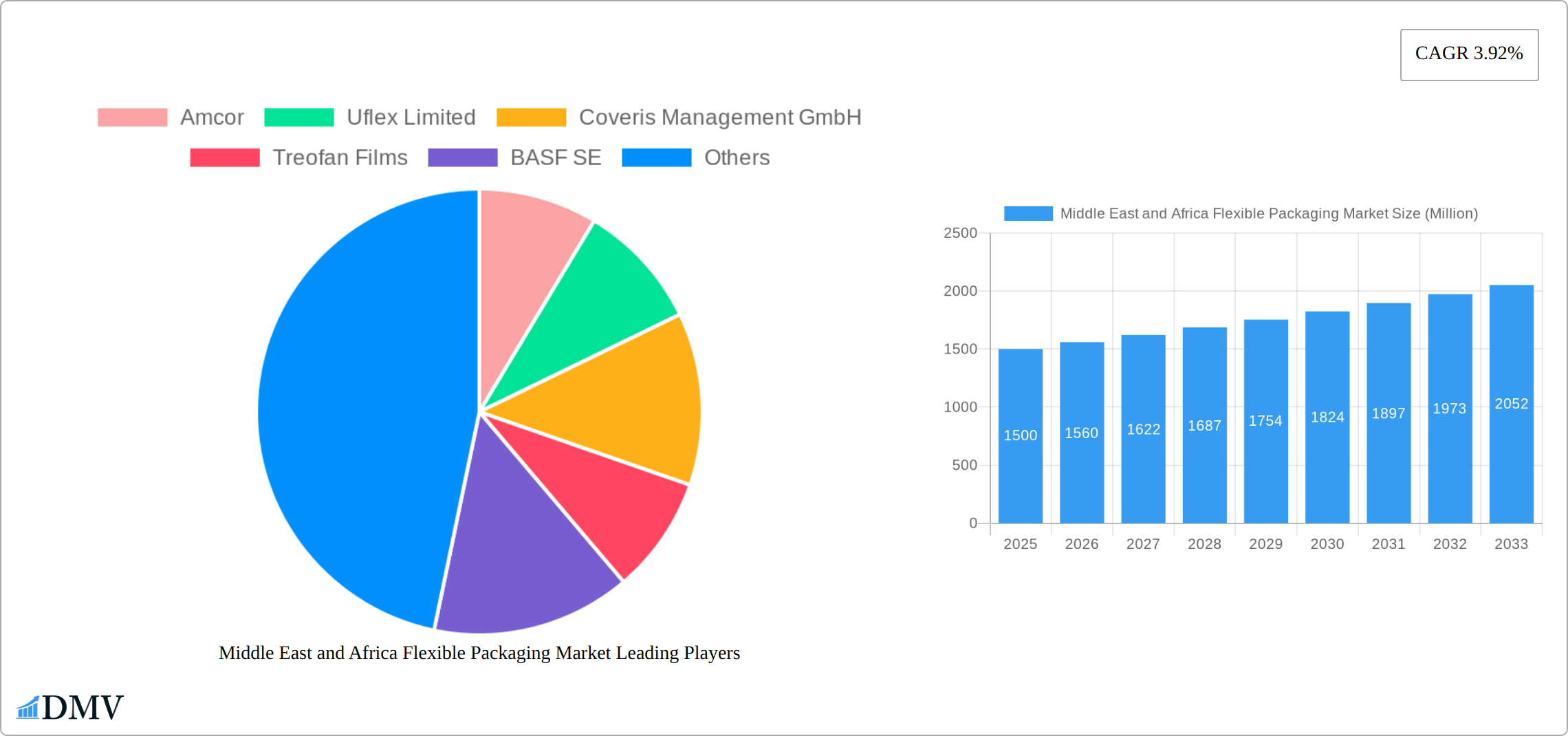

Middle East and Africa Flexible Packaging Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of 4.2%, signaling consistent market value appreciation. Key regional markets include the UAE and Saudi Arabia, benefiting from advanced infrastructure and higher per capita income, alongside Nigeria and South Africa, which present high growth potential driven by demographic and economic expansion. A significant trend is the increasing adoption of sustainable and eco-friendly packaging, necessitating a focus on recyclable and biodegradable options. This shift creates opportunities for companies adept at meeting evolving consumer and regulatory demands.

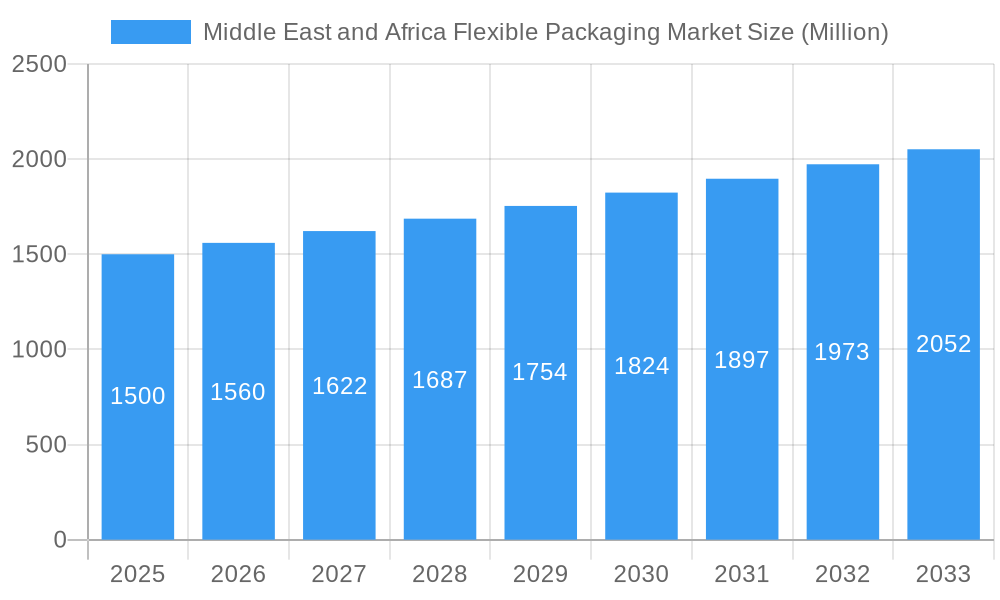

Middle East and Africa Flexible Packaging Market Company Market Share

MEA Flexible Packaging Market Analysis and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the Middle East and Africa (MEA) flexible packaging market, providing insights into its current status, future projections, and key market participants. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report is an essential resource for stakeholders navigating this dynamic market. The MEA flexible packaging market is projected to reach 301.2 billion by 2033, highlighting substantial growth prospects.

Middle East and Africa Flexible Packaging Market Composition & Trends

The MEA flexible packaging market is characterized by a moderately concentrated landscape, with key players like Amcor, Uflex Limited, and Coveris Management GmbH holding significant market share. However, the market also presents opportunities for smaller, specialized players. Innovation is driven by the increasing demand for sustainable and functional packaging solutions, particularly in the food and beverage sectors. Stringent regulatory frameworks focusing on food safety and environmental concerns are shaping industry practices. Substitute products, such as rigid packaging, pose a competitive challenge, but flexible packaging maintains its dominance due to cost-effectiveness and versatility. Mergers and acquisitions (M&A) are frequent, with deals often focusing on expanding geographic reach and product portfolios. For instance, Huhtamaki's acquisition of Elif in September 2021 significantly impacted the market landscape.

- Market Concentration: Moderately concentrated, with top players holding approximately xx% of market share in 2024.

- Innovation Catalysts: Growing demand for sustainable packaging, advancements in printing technologies (flexo printing), and increasing focus on lightweighting.

- Regulatory Landscape: Stringent food safety regulations and increasing emphasis on recyclability.

- M&A Activity: Significant activity, with deal values averaging xx Million per transaction in the past 5 years (2019-2024).

Middle East and Africa Flexible Packaging Market Industry Evolution

The MEA flexible packaging market has witnessed robust growth over the historical period (2019-2024), driven by factors such as rising disposable incomes, changing consumer preferences towards convenience, and the burgeoning food and beverage industry. Technological advancements, including the adoption of advanced printing techniques like flexography and improvements in barrier film technology, have further fueled market expansion. The shift towards sustainable and eco-friendly packaging solutions, such as recyclable and compostable materials, is a key trend reshaping the industry. This trend is being accelerated by increasing environmental awareness and stricter regulations. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Adoption of sustainable packaging materials like bioplastics is expected to increase by xx% by 2033.

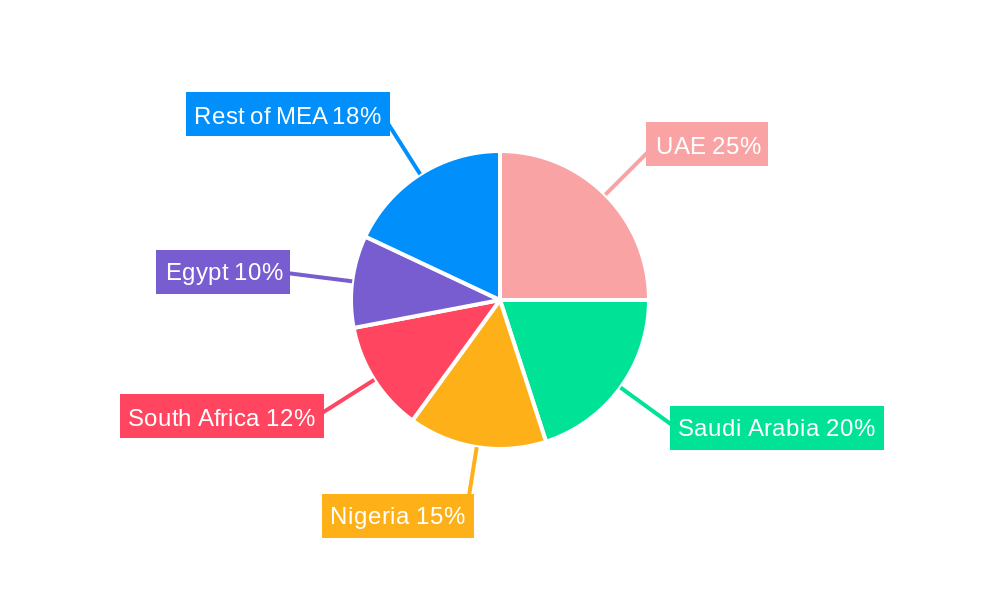

Leading Regions, Countries, or Segments in Middle East and Africa Flexible Packaging Market

The Middle East and Africa (MEA) flexible packaging market is a dynamic landscape, with the UAE and Saudi Arabia leading the way due to their robust economies, well-established food and beverage sectors, and high per capita incomes. These factors foster significant demand for diverse flexible packaging solutions. Within this market, pouches (specifically retort and stand-up pouches) command the largest share of the product type segment, followed closely by bags and films. This preference stems from their convenience, versatility, and ability to enhance product shelf life. Polyethylene (PE) remains the dominant resin type due to its cost-effectiveness and adaptability to various packaging needs. The food and beverage industry is the primary driver of demand, with significant contributions also coming from the healthcare and personal care sectors. While the Gulf Cooperation Council (GCC) nations demonstrate rapid growth, other countries like Nigeria and South Africa are exhibiting promising, albeit slower, expansion fueled by a burgeoning middle class, increasing urbanization, and a rise in packaged goods consumption.

- Key Growth Drivers (UAE & Saudi Arabia): High per capita income, sophisticated retail infrastructure, a substantial food processing industry, and government initiatives supporting the sector's development. These factors create a favorable environment for investment and expansion within the flexible packaging market.

- Emerging Market Potential (Nigeria & South Africa): Rapidly expanding middle classes in these nations are driving increased demand for consumer packaged goods, presenting substantial growth opportunities for flexible packaging providers. Further expansion is anticipated with ongoing urbanization and infrastructural development.

- Dominant Resin Type: Polyethylene (PE) continues to dominate due to its favorable cost profile, excellent processability, and suitability for a wide range of applications. However, increasing interest in sustainable alternatives is likely to influence market share in the coming years.

- Dominant Product Type: Pouches, particularly retort and stand-up pouches, remain the most popular choice, offering superior barrier properties, enhanced convenience for consumers, and efficient shelf-space utilization for retailers. This trend is expected to continue, with further innovation in pouch designs and functionalities.

Middle East and Africa Flexible Packaging Market Product Innovations

Recent innovations focus on enhancing barrier properties, improving recyclability, and incorporating smart packaging technologies. For example, the introduction of recyclable flexible pouches with improved barrier properties is meeting both consumer demand and regulatory requirements. Advancements in material science are enabling the creation of lightweight, high-performance flexible packaging.

Propelling Factors for Middle East and Africa Flexible Packaging Market Growth

The MEA flexible packaging market is propelled by several factors, including a growing population, rising disposable incomes, and increasing demand for convenience foods. Technological advancements, particularly in sustainable packaging materials and printing technologies, are also significant drivers. Government initiatives promoting the food processing industry and favorable regulatory environments contribute to market growth.

Obstacles in the Middle East and Africa Flexible Packaging Market Market

Challenges include fluctuations in raw material prices, supply chain disruptions, intense competition, and the need for continuous innovation to meet evolving consumer preferences. Regulatory compliance requirements can also pose obstacles for smaller companies.

Future Opportunities in Middle East and Africa Flexible Packaging Market

The MEA flexible packaging market presents exciting opportunities for growth and innovation. Expanding into less-developed regions within the MEA presents significant untapped potential. A strong focus on sustainable packaging solutions, utilizing bio-based and compostable materials, is crucial in responding to growing consumer and regulatory pressures. The integration of smart packaging technologies, offering features like tamper-evidence and product traceability, presents an avenue for enhancing product value and consumer trust. Furthermore, exploring the potential of flexible electronics integration within packaging opens up new possibilities for interactive and value-added packaging solutions.

Major Players in the Middle East and Africa Flexible Packaging Market Ecosystem

- Amcor

- Uflex Limited

- Coveris Management GmbH

- Treofan Films

- BASF SE

- Huhtamaki Group

- Napco Group

- Gulf Packaging Industries Limited

- Mondi Plc

- DowDuPont

Key Developments in Middle East and Africa Flexible Packaging Market Industry

- September 2021: Huhtamaki's acquisition of Elif significantly expanded its flexible packaging footprint in the MEA region, strengthening its market position and bolstering its commitment to sustainable packaging practices. This merger highlights the ongoing consolidation and strategic investments within the industry.

- [Add other recent key developments here with dates and brief descriptions] - Include mergers, acquisitions, new product launches, significant investments, and any impactful regulatory changes.

Strategic Middle East and Africa Flexible Packaging Market Market Forecast

The MEA flexible packaging market is poised for continued growth driven by favorable demographic trends, economic expansion, and ongoing innovation in packaging materials and technologies. The focus on sustainability and the adoption of advanced printing techniques will further shape the market's evolution in the coming years. The market is expected to experience strong growth, driven by increasing demand from the food and beverage industries, and a shift towards sustainable and convenient packaging.

Middle East and Africa Flexible Packaging Market Segmentation

-

1. Material Type

-

1.1. Plastics

- 1.1.1. Polyethene (PE)

- 1.1.2. Polypropylene (PP)

- 1.1.3. Polyethylene Terephthalate (PET )

- 1.1.4. Other Plastics (PVC, PA, etc.)

- 1.2. Paper

- 1.3. Aluminum

- 1.4. Compostable Materials (PLA, PBS, PHA, PBAT, etc.)

-

1.1. Plastics

-

2. Product Type

- 2.1. Pouches And Bags

-

2.2. Films And Wraps

- 2.2.1. Thermoforming Film

- 2.2.2. Stretch Films

- 2.2.3. Shrink Film

- 2.2.4. Cling Film

- 2.3. Labels And Sleeves

- 2.4. Lidding And Liners

- 2.5. Blister Packaging

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverages

- 3.3. Pharmaceuticals

- 3.4. Cosmetics And Personal Care

- 3.5. Household Care

- 3.6. Pet Care

- 3.7. Tobacco

- 3.8. Other En

Middle East and Africa Flexible Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Flexible Packaging Market Regional Market Share

Geographic Coverage of Middle East and Africa Flexible Packaging Market

Middle East and Africa Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Steady Rise in Demand for Processing Food; Move Towards Light Weighting Expected to Spur Volume Demand

- 3.3. Market Restrains

- 3.3.1. Flexible Packaging is Increasingly Turning into a Competitive Market Place Which Could Impact the Growth Products of New Entrants; Environmental Challenges Related to Recycling Although There are Expected to be Offset by Move Towards Bio-Based Products

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.1.1. Polyethene (PE)

- 5.1.1.2. Polypropylene (PP)

- 5.1.1.3. Polyethylene Terephthalate (PET )

- 5.1.1.4. Other Plastics (PVC, PA, etc.)

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.4. Compostable Materials (PLA, PBS, PHA, PBAT, etc.)

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches And Bags

- 5.2.2. Films And Wraps

- 5.2.2.1. Thermoforming Film

- 5.2.2.2. Stretch Films

- 5.2.2.3. Shrink Film

- 5.2.2.4. Cling Film

- 5.2.3. Labels And Sleeves

- 5.2.4. Lidding And Liners

- 5.2.5. Blister Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Pharmaceuticals

- 5.3.4. Cosmetics And Personal Care

- 5.3.5. Household Care

- 5.3.6. Pet Care

- 5.3.7. Tobacco

- 5.3.8. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Uflex Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coveris Management GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Treofan Films

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huhtamaki Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Napco Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gulf Pakcaging Industries Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondi Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DowDuPont*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amcor

List of Figures

- Figure 1: Middle East and Africa Flexible Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Flexible Packaging Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Middle East and Africa Flexible Packaging Market?

Key companies in the market include Amcor, Uflex Limited, Coveris Management GmbH, Treofan Films, BASF SE, Huhtamaki Group, Napco Group, Gulf Pakcaging Industries Limited, Mondi Plc, DowDuPont*List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Flexible Packaging Market?

The market segments include Material Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 301.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Steady Rise in Demand for Processing Food; Move Towards Light Weighting Expected to Spur Volume Demand.

6. What are the notable trends driving market growth?

Food and Beverage Industry is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

Flexible Packaging is Increasingly Turning into a Competitive Market Place Which Could Impact the Growth Products of New Entrants; Environmental Challenges Related to Recycling Although There are Expected to be Offset by Move Towards Bio-Based Products.

8. Can you provide examples of recent developments in the market?

September 2021-Huhtamaki acquired Elif, a flexible packaging company with nearly recyclable products. Flexo printing and polyethylene (PE) film production technologies round out the company portfolio across Europe, the Middle East, and Africa. The acquisition aligned with the company's goals of promoting talent and sustainability and aided the company's growth and competitiveness plan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence