Key Insights

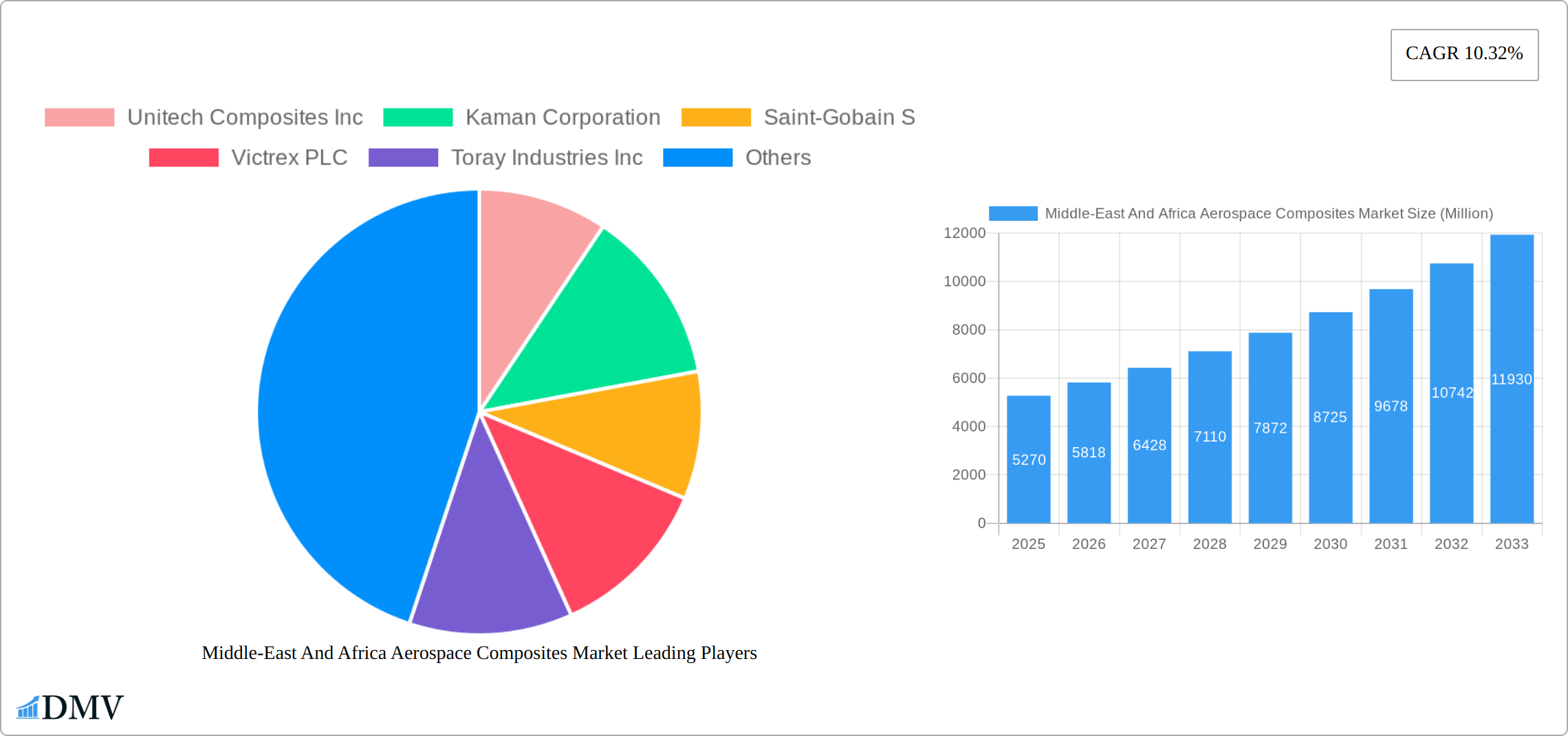

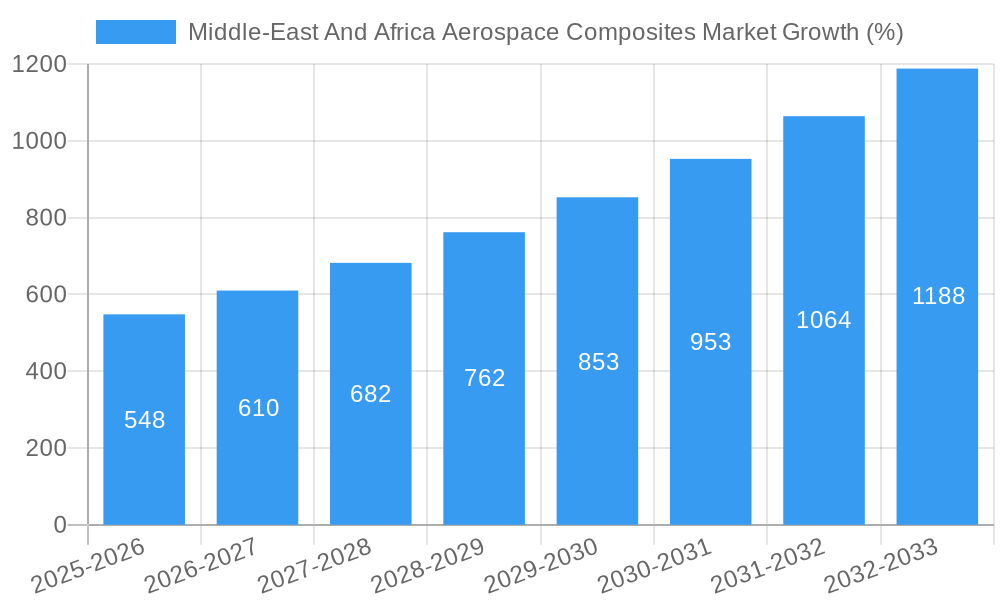

The Middle East and Africa Aerospace Composites Market is poised for significant growth, projected to reach \$5.27 billion in 2025 and experience a Compound Annual Growth Rate (CAGR) of 10.32% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for lightweight and high-performance aircraft within both commercial and military aviation sectors across the region is a primary driver. Furthermore, the burgeoning space exploration initiatives in several Middle Eastern and African nations are fueling demand for advanced composite materials in satellite construction and launch vehicles. Government investments in infrastructure development and modernization of existing fleets, alongside a rising focus on sustainable aviation technologies, are also contributing to market growth. While challenges exist, such as the price volatility of raw materials and the need for skilled labor, the overall market outlook remains positive due to the long-term strategic importance of aerospace advancements in the region.

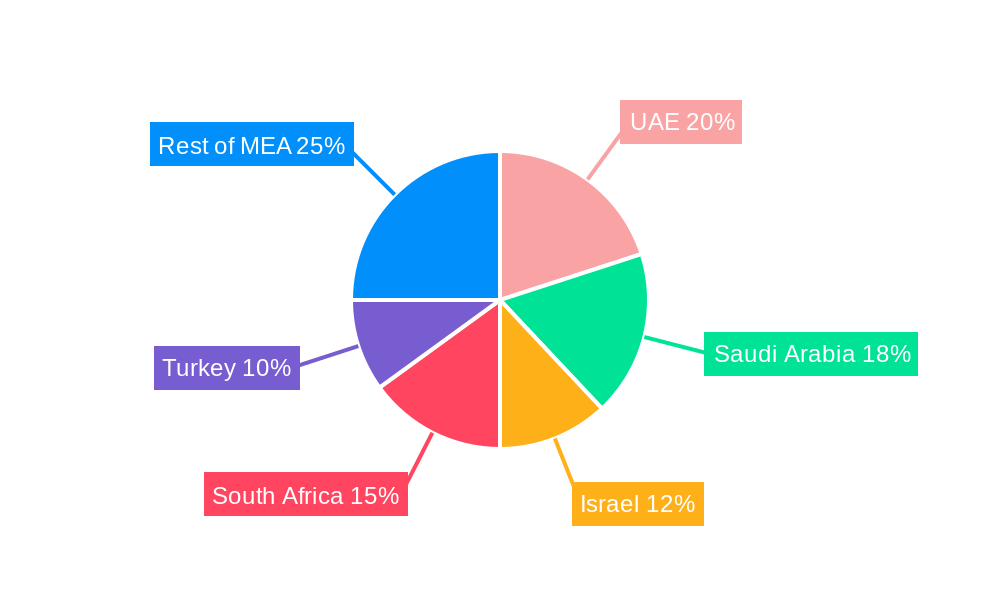

The market is segmented geographically, with key players concentrating their efforts in countries such as the United Arab Emirates, Saudi Arabia, Israel, South Africa, and Turkey. These nations represent significant investment in aerospace infrastructure and possess a robust industrial base capable of supporting composite manufacturing. The "Rest of Middle East and Africa" segment also shows promising growth potential, driven by increasing air travel and defense spending in various developing economies. The application-based segmentation reveals strong demand from both Commercial and General Aviation, and Military Aviation, with the space sector emerging as a rapidly growing segment. Major players like Unitech Composites Inc, Kaman Corporation, Saint-Gobain S.A., and others are strategically positioned to capitalize on this growth, through innovation in material science and expansion of manufacturing capabilities within the region to cater to the growing demand and local government initiatives.

Middle East & Africa Aerospace Composites Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East & Africa Aerospace Composites Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and forecast period of 2025-2033, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR.

Middle-East And Africa Aerospace Composites Market Market Composition & Trends

This section delves into the competitive landscape of the Middle East & Africa aerospace composites market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute materials, end-user demands, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. Key innovation drivers include the increasing demand for lightweight and high-strength materials in aerospace applications, coupled with advancements in composite materials technology. Stringent regulatory standards governing aerospace safety and environmental impact shape market dynamics. Competition from alternative materials like aluminum and titanium exists, yet composites' superior performance characteristics provide a strong competitive edge. End-user profiles span commercial and military aviation, space exploration, and related sectors. M&A activity has been relatively modest in recent years, with a total deal value of approximately xx Million recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2025).

- Innovation Catalysts: Lightweighting demands, advancements in composite material technology.

- Regulatory Landscape: Stringent safety and environmental standards.

- Substitute Products: Aluminum, titanium, but composites offer superior performance.

- End-User Profile: Commercial & military aviation, space, UAVs.

- M&A Activity: Total deal value of approximately xx Million (2019-2024).

Middle-East And Africa Aerospace Composites Market Industry Evolution

This section traces the evolution of the Middle East & Africa aerospace composites market, examining growth trajectories, technological advancements, and shifting consumer preferences. The market has experienced significant growth driven by increased air travel, military modernization efforts, and expanding space exploration programs. Technological advancements, such as the development of advanced fiber materials and improved manufacturing processes, have significantly enhanced the performance and cost-effectiveness of composite materials. The demand for fuel-efficient aircraft has further fueled the adoption of composites. The market witnessed a CAGR of xx% during the historical period (2019-2024), and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Adoption of advanced composites in aircraft design increased by xx% from 2019 to 2024.

Leading Regions, Countries, or Segments in Middle-East And Africa Aerospace Composites Market

The Middle East and Africa aerospace composites market is experiencing dynamic growth, driven by a confluence of factors. Key regional players, such as the United Arab Emirates (UAE) and Saudi Arabia, are leading the charge, fueled by substantial investments in their national aerospace programs and a commitment to modernizing their fleets. These investments are not limited to commercial aviation; the military aviation segment demonstrates exceptionally high growth potential, significantly bolstered by ongoing modernization initiatives and increased defense spending.

- Key Market Drivers and Leading Players:

- UAE & Saudi Arabia: These nations are spearheading regional growth through substantial investments in aerospace infrastructure, R&D, and national aerospace programs, fostering a thriving ecosystem for composite material manufacturers and integrators.

- Military Aviation: The demand for advanced, lightweight, and high-performance composite materials in military aircraft is a major driver, stimulated by regional defense budgets and modernization efforts.

- Israel: Possessing a strong technological base and a well-established aerospace industry, Israel contributes significantly to innovation and technological advancements within the regional market.

- South Africa: South Africa's growing aviation industry presents a significant opportunity for growth, although challenges related to infrastructure and skilled labor remain.

- Turkey: Turkey's expanding domestic aerospace manufacturing base, supported by government initiatives, is positioning it as a key player in the regional supply chain.

- Other Emerging Markets: Beyond these major players, several other nations across the Middle East and Africa are showing increasing interest and investment in aerospace composites, indicating a broader market expansion across the region.

The sustained growth in these regions and segments is attributed to robust economic expansion, proactive governmental policies promoting aerospace development, the presence of established aerospace industries, and a significant commitment to research and development in advanced composite materials.

Middle-East And Africa Aerospace Composites Market Product Innovations

The Middle East and Africa aerospace composites market is witnessing a wave of product innovation focused on enhancing performance, reducing costs, and improving sustainability. Lighter, stronger, and more durable composite materials with superior thermal and acoustic properties are being developed. Advanced manufacturing techniques such as automated fiber placement (AFP) and out-of-autoclave curing are streamlining production, improving efficiency, and lowering manufacturing costs. These advancements directly translate to improved aircraft performance, reduced fuel consumption, and enhanced safety. The incorporation of self-healing composites and advanced material systems with embedded sensors represents the cutting edge of innovation in the field, pushing the boundaries of what's possible in aerospace design.

Propelling Factors for Middle-East And Africa Aerospace Composites Market Growth

The growth trajectory of the Middle East & Africa aerospace composites market is propelled by several key factors. The increasing demand for fuel-efficient aircraft is a primary driver, with governments actively incentivizing the adoption of green aviation fuels and technologies. This directly translates into increased adoption of composite materials known for their lightweight properties and fuel efficiency. Furthermore, substantial defense budgets in several nations contribute significantly to the high demand for military aircraft incorporating composite structures. Finally, the ongoing development of advanced composite materials with superior properties, combined with continuous improvements in manufacturing processes, provides further momentum to market expansion.

Obstacles in the Middle-East And Africa Aerospace Composites Market Market

Despite the significant growth potential, the Middle East and Africa aerospace composites market faces certain challenges. The high cost of composite materials compared to traditional alternatives remains a barrier to wider adoption, particularly in applications sensitive to cost constraints. The complexity of manufacturing processes and the associated need for specialized skills and equipment can also present difficulties. Supply chain disruptions, regulatory hurdles, and the scarcity of skilled labor pose additional obstacles to market expansion. These factors directly impact manufacturing costs and timelines, potentially limiting the broader application of composite materials across various segments of the industry.

Future Opportunities in Middle-East And Africa Aerospace Composites Market

Future opportunities include the expansion of the unmanned aerial vehicle (UAV) sector, growing demand for lightweight and high-strength composites in space exploration, and the development of sustainable composite materials with reduced environmental impact. The integration of advanced technologies like 3D printing and additive manufacturing holds substantial promise for transforming composite manufacturing processes. The development of recyclable and bio-based composite materials presents a significant opportunity.

Major Players in the Middle-East And Africa Aerospace Composites Market Ecosystem

- Unitech Composites Inc

- Kaman Corporation

- Saint-Gobain S.A.

- Victrex PLC

- Toray Industries Inc

- DuPont de Nemours Inc

- Notus Composites

- Solvay SA

- Hexcel Corporation

- Veplas Group

Key Developments in Middle-East And Africa Aerospace Composites Market Industry

- 2024 Q4: Hexcel Corporation launched a new generation of carbon fiber prepreg materials optimized for aerospace applications, showcasing advancements in material technology and performance.

- 2023 Q3: Solvay SA announced a strategic partnership with an aerospace manufacturer to develop sustainable composite materials, highlighting the increasing focus on environmentally friendly solutions within the industry.

- 2022 Q2: Significant investment from the UAE government in expanding domestic aerospace composite manufacturing capabilities demonstrates a commitment to developing a robust and self-sufficient aerospace manufacturing sector within the region. (Further specific details would be included in the full report).

- Ongoing Developments: The market is witnessing continuous advancements in material science, manufacturing processes, and industry collaborations, promising further growth and innovation in the coming years. Specific details on these recent developments will be provided in the complete report.

Strategic Middle-East And Africa Aerospace Composites Market Market Forecast

The Middle East & Africa aerospace composites market is poised for significant growth driven by increasing investments in aerospace infrastructure, modernization of military fleets, and the burgeoning space exploration sector. The adoption of advanced composite materials will continue to rise, driven by the inherent advantages of lightweighting and enhanced performance. The focus on sustainability will further shape the market, encouraging the development and adoption of environmentally friendly composite materials and manufacturing processes. The market is projected to reach xx Million by 2033, presenting significant opportunities for industry players.

Middle-East And Africa Aerospace Composites Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle-East And Africa Aerospace Composites Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle-East And Africa Aerospace Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aviation Segment to Exhibit the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Unitech Composites Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kaman Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Saint-Gobain S

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Victrex PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Toray Industries Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DuPont de Nemours Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Notus Composites

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Solvay SA

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hexcel Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Veplas Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Unitech Composites Inc

List of Figures

- Figure 1: Middle-East And Africa Aerospace Composites Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East And Africa Aerospace Composites Market Share (%) by Company 2024

List of Tables

- Table 1: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Saudi Arabia Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Arab Emirates Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Israel Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Qatar Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Kuwait Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Oman Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Bahrain Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Jordan Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Lebanon Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East And Africa Aerospace Composites Market?

The projected CAGR is approximately 10.32%.

2. Which companies are prominent players in the Middle-East And Africa Aerospace Composites Market?

Key companies in the market include Unitech Composites Inc, Kaman Corporation, Saint-Gobain S, Victrex PLC, Toray Industries Inc, DuPont de Nemours Inc, Notus Composites, Solvay SA, Hexcel Corporation, Veplas Group.

3. What are the main segments of the Middle-East And Africa Aerospace Composites Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.27 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aviation Segment to Exhibit the Highest Growth Rate.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East And Africa Aerospace Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East And Africa Aerospace Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East And Africa Aerospace Composites Market?

To stay informed about further developments, trends, and reports in the Middle-East And Africa Aerospace Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence