Key Insights

The Australian C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) market is set for substantial expansion, driven by escalating defense expenditures, modernization of the Australian Defence Force (ADF), and the imperative for superior situational awareness and cybersecurity. The market, valued at $126.2 billion in the base year 2024, is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7%, reaching an estimated $126.2 billion by 2033. This growth is propelled by substantial investments in advanced technologies including artificial intelligence (AI), machine learning (ML), and cloud-based solutions to enhance data analytics and real-time decision-making. The land segment currently leads, followed by air and naval segments, with the space segment exhibiting strong potential due to increased reliance on satellite intelligence and communications. Government initiatives focused on national security and addressing regional geopolitical dynamics are key growth drivers. Major industry players like L3Harris Technologies, General Dynamics, and Lockheed Martin are actively engaged, securing substantial contracts and fostering technological innovation.

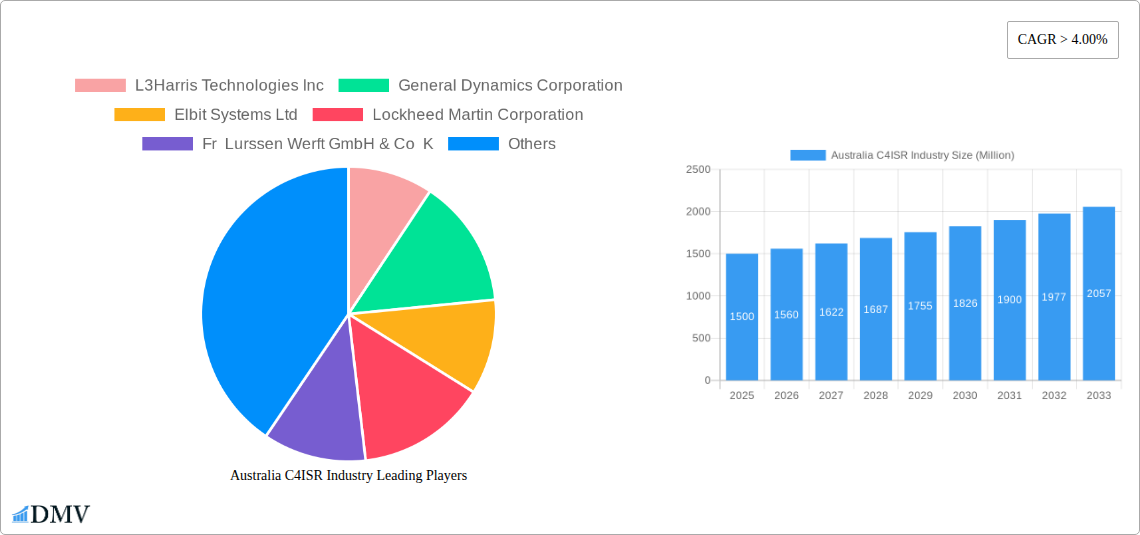

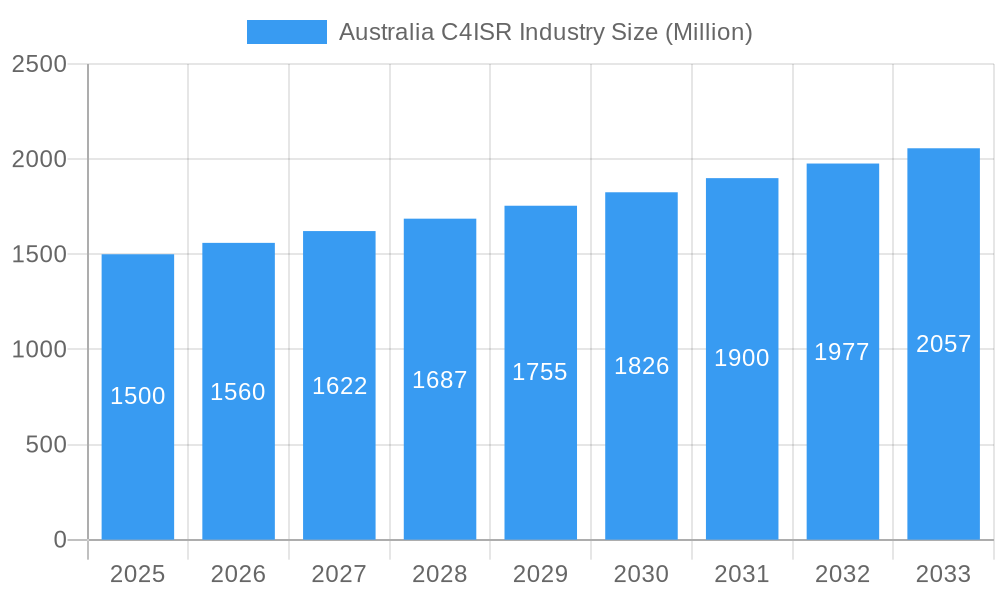

Australia C4ISR Industry Market Size (In Billion)

Challenges, including budgetary constraints, complex procurement processes, and the integration of diverse C4ISR systems, may temper growth. Furthermore, robust cybersecurity against evolving threats in a networked environment remains a paramount concern. Nevertheless, the Australian C4ISR market offers significant opportunities for established and emerging companies, especially those providing advanced solutions that enhance interoperability, data fusion, and cybersecurity resilience. Sustained government commitment to national defense, coupled with technological advancements, ensures continued market growth.

Australia C4ISR Industry Company Market Share

Australia C4ISR Industry Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Australian C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The market is segmented by platform (Land, Air, Naval, Space), providing a granular understanding of growth trajectories and key players across each segment. The total market value in 2025 is estimated at $XX Billion, projected to reach $XX Billion by 2033.

Australia C4ISR Industry Market Composition & Trends

This section delves into the competitive landscape of the Australian C4ISR market, analyzing market concentration, innovation drivers, regulatory frameworks, and the impact of substitute products. We examine end-user profiles and the influence of mergers and acquisitions (M&A) activities.

Market Concentration: The Australian C4ISR market exhibits a moderately concentrated structure, with the top five players commanding approximately XX% of the market share in 2025. This concentration is expected to slightly decrease by 2033 due to increased competition from smaller, specialized firms.

Innovation Catalysts: Government investment in defense modernization, coupled with the growing adoption of AI and advanced analytics, are key drivers of innovation within the sector. The increasing demand for cyber security solutions is also fostering significant innovation.

Regulatory Landscape: Stringent government regulations pertaining to data security and interoperability are shaping the industry's trajectory. Compliance requirements influence product development and deployment strategies.

Substitute Products: While there are limited direct substitutes for core C4ISR capabilities, emerging technologies such as commercially available off-the-shelf (COTS) solutions are presenting competitive challenges.

End-User Profiles: The primary end-users are the Australian Defence Force (ADF), with significant contributions also from government agencies and private sector entities involved in critical infrastructure protection.

M&A Activities: The historical period (2019-2024) witnessed several notable M&A deals, with a cumulative value of approximately $XX Billion. These transactions primarily focused on expanding capabilities and market reach. Future M&A activity is predicted to increase due to the consolidation of the industry.

Australia C4ISR Industry Industry Evolution

This section meticulously analyzes the evolution of the Australian C4ISR industry, highlighting market growth trajectories, technological advancements, and the shifting landscape of consumer (end-user) demands. The historical period (2019-2024) saw a Compound Annual Growth Rate (CAGR) of approximately XX%, primarily driven by increased defense spending and technological upgrades.

The projected CAGR for the forecast period (2025-2033) is estimated at XX%, fueled by the adoption of advanced technologies such as AI-powered intelligence analysis, cloud-based solutions for enhanced data sharing and collaboration, and the integration of unmanned aerial vehicles (UAVs) into C4ISR systems. Growing cyber threats are also driving demand for robust cybersecurity solutions within the C4ISR ecosystem. Furthermore, increased focus on interoperability and data fusion is significantly influencing the development and deployment strategies of C4ISR systems. The growing adoption of advanced technologies is projected to drive market growth at XX% CAGR for 2025-2033.

Leading Regions, Countries, or Segments in Australia C4ISR Industry

The Australian C4ISR market is geographically concentrated, with the largest segment being the Land segment, driven by investments in modernization of ground forces capabilities. The Land platform segment significantly contributes to the overall market value.

Key Drivers for Land Segment Dominance:

- Significant government investment in upgrading ground-based C4ISR systems.

- Growing need for enhanced situational awareness and battlefield management capabilities.

- Deployment of advanced sensors and communication networks.

In-depth Analysis: The Land platform segment's dominance is attributed to substantial investments by the Australian government to modernize its army capabilities and increase its overall defense readiness. The increasing need to maintain operational readiness in various land-based environments along with the advancement in technology has propelled the segment.

Australia C4ISR Industry Product Innovations

Recent innovations include AI-powered analytics for enhanced intelligence gathering, miniaturized sensor technology for improved portability, and the integration of quantum technologies for secure communications. These advancements enable more efficient data processing, precise targeting, and improved interoperability across different platforms. The unique selling propositions are centered around enhanced situational awareness, improved operational efficiency, and increased security.

Propelling Factors for Australia C4ISR Industry Growth

Key growth drivers include increasing government expenditure on defense modernization, the rising adoption of advanced technologies (AI, cloud computing), and the urgent need to enhance cybersecurity in the face of growing threats. The implementation of innovative defense strategies also influences growth.

Obstacles in the Australia C4ISR Industry Market

Significant barriers include the high cost of advanced C4ISR systems, potential supply chain disruptions, and the complexities of integrating diverse technologies. These factors can impede the timely deployment of these systems and impact overall market growth.

Future Opportunities in Australia C4ISR Industry

Emerging opportunities lie in the integration of IoT (Internet of Things) devices into C4ISR architectures, the development of autonomous systems, and the expansion into commercial applications of C4ISR technologies. These new areas offer significant potential for market expansion and revenue generation.

Major Players in the Australia C4ISR Industry Ecosystem

Key Developments in Australia C4ISR Industry Industry

- 2022-Q4: Successful testing of a new AI-powered intelligence analysis platform by L3Harris.

- 2023-Q1: Announcement of a joint venture between General Dynamics and Elbit Systems to develop next-generation secure communication systems.

- 2023-Q3: Launch of a new cyber security suite by Lockheed Martin.

Strategic Australia C4ISR Industry Market Forecast

The Australian C4ISR market is poised for significant growth over the forecast period, driven by increasing defense budgets, advancements in technology, and the continuous need for enhanced security and situational awareness. The integration of emerging technologies will continue to create new opportunities and redefine the landscape of this strategic market. The market is expected to experience robust growth, propelled by continued government investment and technological innovation, creating significant opportunities for market entrants and existing players alike.

Australia C4ISR Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Australia C4ISR Industry Segmentation By Geography

- 1. Australia

Australia C4ISR Industry Regional Market Share

Geographic Coverage of Australia C4ISR Industry

Australia C4ISR Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Growing Military Expenditure is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia C4ISR Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 L3Harris Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Dynamics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elbit Systems Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lockheed Martin Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fr Lurssen Werft GmbH & Co K

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thales Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BAE Systems PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northrop Grumman

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saab AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Boeing Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Australia C4ISR Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia C4ISR Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia C4ISR Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Australia C4ISR Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Australia C4ISR Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Australia C4ISR Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Australia C4ISR Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Australia C4ISR Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Australia C4ISR Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Australia C4ISR Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Australia C4ISR Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Australia C4ISR Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Australia C4ISR Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Australia C4ISR Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia C4ISR Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Australia C4ISR Industry?

Key companies in the market include L3Harris Technologies Inc, General Dynamics Corporation, Elbit Systems Ltd, Lockheed Martin Corporation, Fr Lurssen Werft GmbH & Co K, Thales Group, BAE Systems PLC, Northrop Grumman, Saab AB, The Boeing Company.

3. What are the main segments of the Australia C4ISR Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.2 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Growing Military Expenditure is Driving the Market Growth.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia C4ISR Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia C4ISR Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia C4ISR Industry?

To stay informed about further developments, trends, and reports in the Australia C4ISR Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence