Key Insights

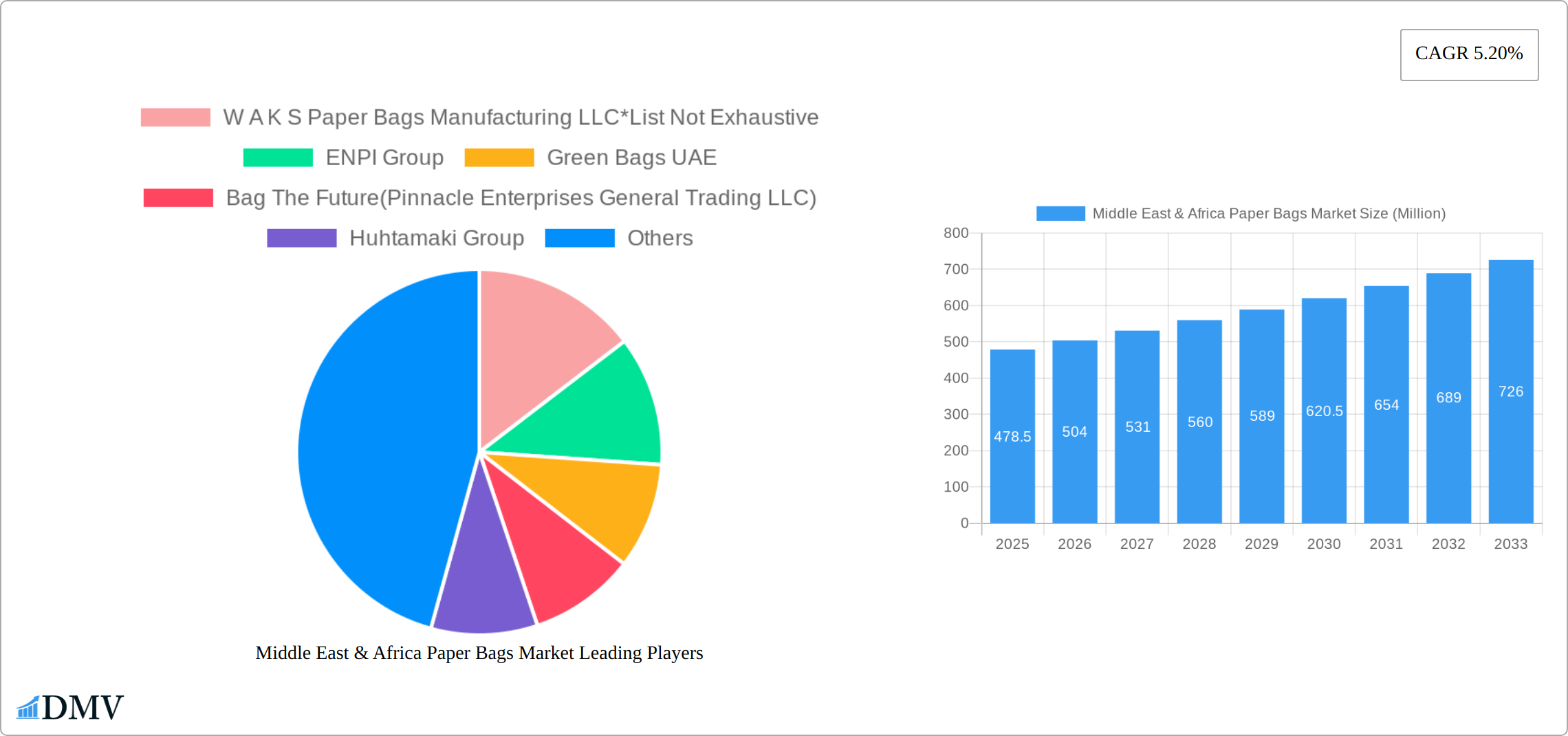

The Middle East & Africa paper bags market, valued at $478.5 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.20% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning retail sector across the region, particularly in rapidly developing economies like those in the UAE and Saudi Arabia, is a significant driver, increasing demand for packaging solutions. Furthermore, the growth of the food and beverage industry, with its need for eco-friendly and cost-effective packaging, significantly contributes to market growth. The construction and agricultural sectors also represent substantial end-user segments, relying on paper bags for various applications like cement and fertilizer packaging. Increased consumer awareness of environmental concerns and a preference for sustainable alternatives over plastic are bolstering the demand for paper bags. While challenges such as fluctuating raw material prices and competition from alternative packaging materials exist, the overall market outlook remains positive, with continued expansion anticipated throughout the forecast period.

Middle East & Africa Paper Bags Market Market Size (In Million)

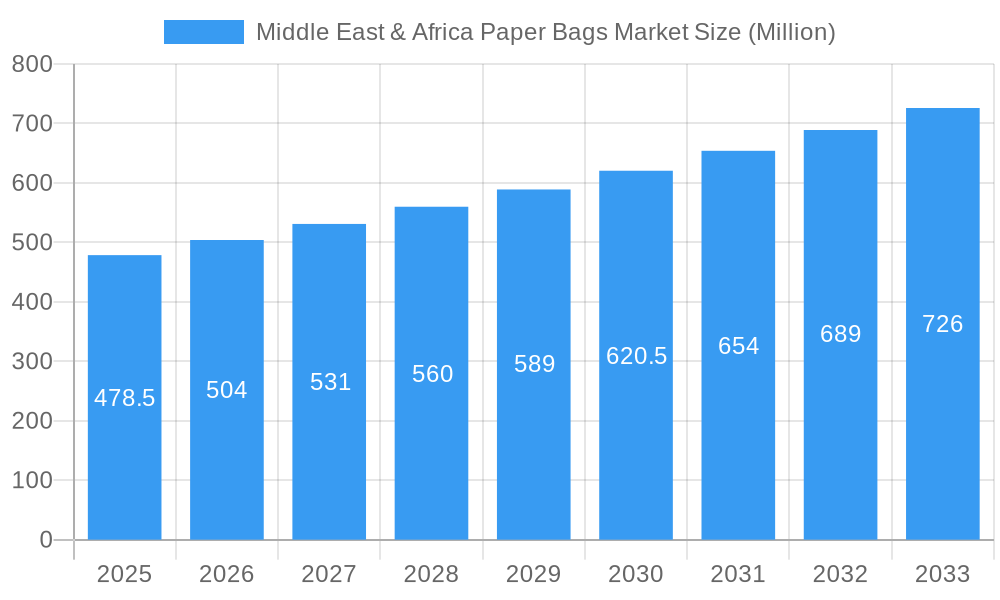

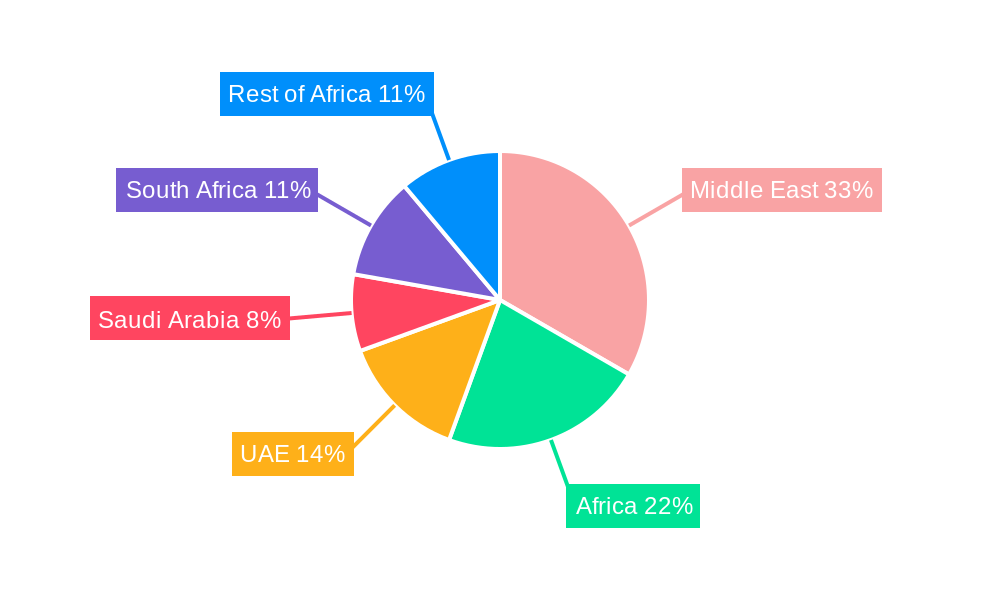

The market's segmentation reveals important regional nuances. The UAE and Saudi Arabia dominate the Middle East segment due to their advanced economies and robust retail sectors. In Africa, South Africa leads, reflecting its established infrastructure and market size. However, significant growth potential exists across other African nations as their economies develop and consumer demand increases. Key players in the market, including W A K S Paper Bags Manufacturing LLC, ENPI Group, and Huhtamaki Group, are strategically positioned to capitalize on this growth by focusing on innovation and meeting the diverse needs of various end-user segments. The future of the Middle East and Africa paper bags market will be shaped by advancements in bag design, material sourcing, and sustainability initiatives, all aimed at meeting evolving consumer preferences and environmental regulations.

Middle East & Africa Paper Bags Market Company Market Share

Middle East & Africa Paper Bags Market Market Composition & Trends

This comprehensive report provides a detailed analysis of the Middle East & Africa Paper Bags Market from 2019 to 2033, encompassing historical data (2019-2024), a base year (2025), and a forecast period (2025-2033). The report offers a granular understanding of market dynamics, including concentration, innovation, regulatory influences, competitive pressures from substitute products, and end-user segmentation. We dissect market concentration, identifying key players like Huhtamaki Group and Hotpack Packaging LLC and their respective market shares, exploring the factors driving their success. The role of technological advancements in driving innovation and shaping product development is meticulously examined. The report also analyzes the impact of government regulations and policies on market growth. Furthermore, a detailed competitive landscape analysis includes an assessment of substitute products, such as plastic bags, and their influence on market share. The end-user analysis segments the market by Retail, Food, Construction, Agriculture & Chemical, and Other End-user Types, providing insights into the specific needs and preferences of each segment. Finally, the report comprehensively covers mergers and acquisitions (M&A) activity within the industry, including deal values and their impact on market structure and consolidation.

- Market Concentration: The market exhibits a [xx]% concentration ratio (CRx), indicating [describe market concentration: high, moderate, or low]. Leading players such as Huhtamaki Group and Hotpack Packaging LLC hold significant market shares, reflecting a [describe market structure: fragmented, consolidated, or oligopolistic] market landscape. Further analysis reveals the competitive strategies employed by these key players, including [mention specific strategies like pricing, product differentiation, distribution network, etc.].

- Innovation Catalysts: The increasing demand for sustainable and eco-friendly packaging solutions is a primary driver of innovation. The market is witnessing the development and adoption of biodegradable and recyclable paper bags, compostable options, and innovative printing techniques to enhance product appeal and branding. [Add specific examples of innovative products or technologies in the market].

- Regulatory Landscape: Government regulations focused on packaging waste management, plastic bag bans, and sustainable packaging initiatives are significantly influencing material choices and recycling practices within the region. The report analyzes the impact of specific regulations in key countries, highlighting their influence on market growth and adoption of sustainable practices.

- Substitute Products: Plastic bags represent a significant competitive threat due to their lower cost. However, growing environmental awareness among consumers and stringent government regulations are gradually shifting preferences towards eco-friendly alternatives, creating opportunities for paper bag manufacturers. The report quantifies the market share of substitute products and projects their future impact based on evolving consumer preferences and regulations.

- M&A Activities: Over the past five years, [xx] M&A deals, with a total value exceeding USD xx Million, have reshaped the market landscape. These deals indicate a trend towards [describe the trend: industry consolidation, expansion into new markets, technological acquisitions, etc.], influencing market competition and innovation.

Middle East & Africa Paper Bags Market Industry Evolution

The Middle East & Africa Paper Bags Market has witnessed significant evolution over the past five years, characterized by a Compound Annual Growth Rate (CAGR) of [xx]% during the historical period (2019-2024). This growth is primarily driven by increasing consumer spending, particularly in the retail and food sectors. Technological advancements, such as improved printing techniques and automation in manufacturing processes, have enhanced product quality and efficiency. The rising preference for eco-friendly packaging has also propelled the adoption of sustainable paper bag options, made from recycled or renewable materials. Further contributing to the market's expansion is the increasing urbanization and growth of the e-commerce sector, both boosting demand for paper bags as packaging solutions. Consumer preferences are shifting towards convenience and aesthetics, resulting in a demand for more stylish and functional paper bags. The report forecasts a continued growth trajectory for the paper bags market, projecting a CAGR of [xx]% during the forecast period (2025-2033), reaching a market value of USD xx Million by 2033. This growth is expected to be fueled by ongoing economic development in the region and the continuous adoption of sustainable practices.

Leading Regions, Countries, or Segments in Middle East & Africa Paper Bags Market

The United Arab Emirates (UAE) and Saudi Arabia are currently the leading markets within the Middle East & Africa region for paper bags. However, South Africa and Nigeria also show significant promise and are experiencing rapid growth. Within the product segments, Brown Kraft paper bags currently hold the largest market share, driven by their cost-effectiveness and versatility. The retail sector is the largest end-user segment, reflecting the high volume of consumer goods distributed through retail channels.

- Key Drivers for UAE & Saudi Arabia Dominance:

- High consumer spending: Strong economic growth and rising disposable incomes fuel demand for packaged goods.

- Large retail sector: Well-established retail infrastructure creates a substantial market for paper bags.

- Government support: Regulatory policies favoring sustainable packaging practices incentivize paper bag usage.

- Growth Potential in South Africa & Nigeria:

- Expanding retail landscape: The emergence of modern retail formats drives demand for packaging solutions.

- Rising middle class: Growing purchasing power fuels consumer demand for packaged goods.

- Increasing urbanization: Urbanization leads to greater convenience-based shopping, fostering higher paper bag usage.

- Segment-Specific Growth:

- Brown Kraft: Cost-effectiveness and versatility make it the preferred choice for many applications.

- Retail: The largest end-user segment due to the volume of consumer goods sold through retail channels.

Middle East & Africa Paper Bags Market Product Innovations

Recent innovations in the Middle East & Africa paper bags market focus on enhancing sustainability and functionality. Manufacturers are increasingly using recycled paper and biodegradable materials to meet growing consumer demand for eco-friendly options. Innovative printing techniques allow for high-quality designs and customization, making paper bags more appealing for branding purposes. The incorporation of features like handles and reinforced bottoms enhances bag durability and user experience. These advancements are aimed at providing high-performing, eco-conscious packaging solutions that meet the diverse needs of the retail, food, and other end-user segments. These innovative offerings are creating unique selling propositions, offering improved functionality and aligning with sustainability goals.

Propelling Factors for Middle East & Africa Paper Bags Market Growth

Several factors are propelling the growth of the Middle East & Africa paper bags market. The increasing prevalence of e-commerce and fast-moving consumer goods (FMCG) significantly boosts demand for packaging solutions. Government regulations promoting sustainable packaging practices encourage the use of eco-friendly paper bags over plastic alternatives. Moreover, the rising middle class and increased disposable incomes in many countries within the region contribute to higher consumer spending and drive the demand for packaged goods. Lastly, technological advancements, such as automated production lines and improved printing capabilities, ensure efficiency and cost-effectiveness in the manufacturing process.

Obstacles in the Middle East & Africa Paper Bags Market Market

Several factors hinder growth in the Middle East & Africa paper bags market. Fluctuations in raw material prices (paper pulp) can impact profitability and pricing strategies. Supply chain disruptions, especially concerning the sourcing of raw materials, can lead to production delays and shortages. Competition from cheaper plastic alternatives, coupled with concerns around the environmental impact of paper bag production and disposal, also presents a significant challenge. The lack of standardized recycling infrastructure in some regions further complicates the sustainability aspect of paper bag use. These factors can limit market expansion.

Future Opportunities in Middle East & Africa Paper Bags Market

The Middle East & Africa paper bags market presents promising future opportunities. The growing demand for sustainable and eco-friendly packaging solutions opens doors for biodegradable and compostable paper bag options. Expanding e-commerce presents opportunities for customized packaging solutions. Furthermore, tapping into niche markets, such as specialty food and luxury goods, presents avenues for premium paper bag offerings. Investing in efficient recycling infrastructure will enhance the sustainability profile of the industry.

Major Players in the Middle East & Africa Paper Bags Market Ecosystem

- W A K S Paper Bags Manufacturing LLC

- ENPI Group

- Green Bags UAE

- Bag The Future (Pinnacle Enterprises General Trading LLC)

- Huhtamaki Group

- Maimoon Papers Industry

- Hotpack Packaging LLC

- Shuaiba Industrial Company (KPSC)

- Western Modern PAC

- Gulf East Paper and Plastic Industries LLC

Key Developments in Middle East & Africa Paper Bags Market Industry

- January 2024: The Public Investment Fund (PIF) invested USD xx Million in the Middle East Paper Company (MEPCO), boosting production capacity and promoting sustainable practices.

- January 2024: The Saudi Paper Manufacturing Company secured a EUR 24.9 Million (USD 26.9 Million) banking facility to fund expansion projects and improve liquidity.

Strategic Middle East & Africa Paper Bags Market Market Forecast

The Middle East & Africa paper bags market is poised for robust growth, driven by the factors discussed earlier. The increasing focus on sustainability and the expansion of e-commerce will fuel demand for eco-friendly and customized paper bag solutions. The market's growth trajectory is expected to be sustained by continuous economic development and rising consumer spending across the region. This creates significant opportunities for both established players and new entrants to capture market share and contribute to the overall growth of this dynamic sector.

Middle East & Africa Paper Bags Market Segmentation

-

1. Type

- 1.1. White Kraft

- 1.2. Brown Kraft

-

2. End-user Type

- 2.1. Retail

- 2.2. Food

- 2.3. Construction

- 2.4. Agriculture & Chemical

- 2.5. Other End-user Types

Middle East & Africa Paper Bags Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East & Africa Paper Bags Market Regional Market Share

Geographic Coverage of Middle East & Africa Paper Bags Market

Middle East & Africa Paper Bags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Growth of Paper Bags Packaging in the E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Solutions and High Initial Investments

- 3.4. Market Trends

- 3.4.1. The Retail Segment is Expected to Address a Major Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Paper Bags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. White Kraft

- 5.1.2. Brown Kraft

- 5.2. Market Analysis, Insights and Forecast - by End-user Type

- 5.2.1. Retail

- 5.2.2. Food

- 5.2.3. Construction

- 5.2.4. Agriculture & Chemical

- 5.2.5. Other End-user Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 W A K S Paper Bags Manufacturing LLC*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ENPI Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Green Bags UAE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bag The Future(Pinnacle Enterprises General Trading LLC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Huhtamaki Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Maimoon Papers Industry

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hotpack Packaging LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shuaiba Industrial Company ( KPSC )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Western Modern PAC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gulf East Paper and Plastic Industries LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 W A K S Paper Bags Manufacturing LLC*List Not Exhaustive

List of Figures

- Figure 1: Middle East & Africa Paper Bags Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East & Africa Paper Bags Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East & Africa Paper Bags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East & Africa Paper Bags Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 3: Middle East & Africa Paper Bags Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle East & Africa Paper Bags Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Middle East & Africa Paper Bags Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 6: Middle East & Africa Paper Bags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East & Africa Paper Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East & Africa Paper Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East & Africa Paper Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East & Africa Paper Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East & Africa Paper Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East & Africa Paper Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East & Africa Paper Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East & Africa Paper Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East & Africa Paper Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Paper Bags Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Middle East & Africa Paper Bags Market?

Key companies in the market include W A K S Paper Bags Manufacturing LLC*List Not Exhaustive, ENPI Group, Green Bags UAE, Bag The Future(Pinnacle Enterprises General Trading LLC), Huhtamaki Group, Maimoon Papers Industry, Hotpack Packaging LLC, Shuaiba Industrial Company ( KPSC ), Western Modern PAC, Gulf East Paper and Plastic Industries LLC.

3. What are the main segments of the Middle East & Africa Paper Bags Market?

The market segments include Type, End-user Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 478.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Growth of Paper Bags Packaging in the E-commerce Sector.

6. What are the notable trends driving market growth?

The Retail Segment is Expected to Address a Major Demand.

7. Are there any restraints impacting market growth?

Presence of Alternative Solutions and High Initial Investments.

8. Can you provide examples of recent developments in the market?

January 2024: The Public Investment Fund (PIF) finalized an investment deal with the Middle East Paper Company (MEPCO), a prominent manufacturer specializing in paper-based products in the Middle East and North Africa. PIF holds a 23.08% stake in MEPCO, achieved through a capital increase and subscription to new shares. With this investment, PIF aims to increase MEPCO's production capacity, enhance operational efficiency, and champion environmental sustainability, particularly by producing recyclable paper goods, aligning with Saudi Arabia and PIF's sustainability objectives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Paper Bags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Paper Bags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Paper Bags Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Paper Bags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence