Key Insights

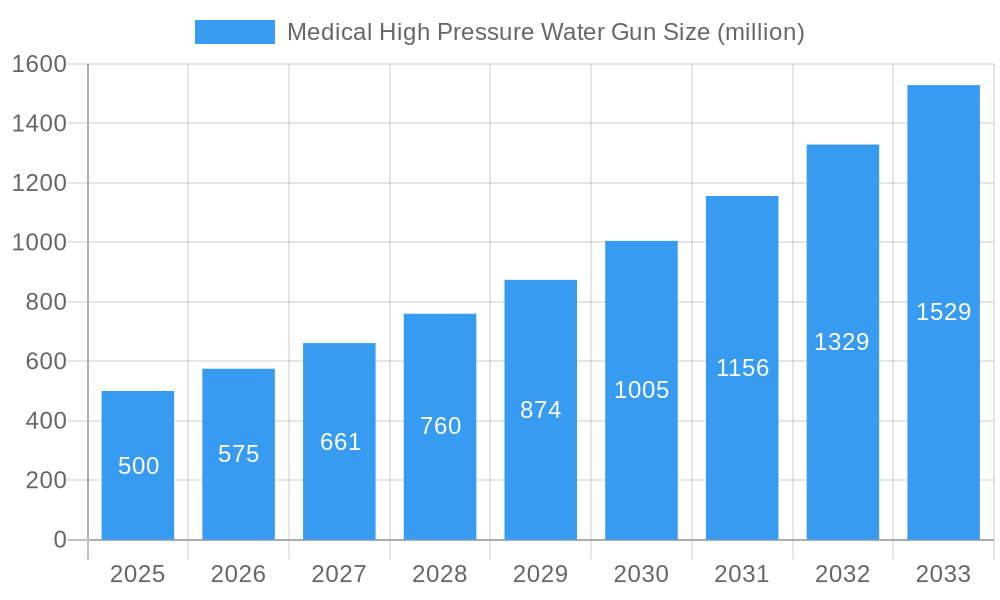

The global Medical High Pressure Water Gun market is poised for significant expansion, projected to reach a substantial $500 million valuation in 2025. This impressive growth is underpinned by a robust CAGR of 15% throughout the forecast period of 2025-2033. A primary driver for this upward trajectory is the increasing adoption of advanced hygiene and sterilization protocols in healthcare settings, particularly in hospitals and clinics. The demand for effective, non-invasive cleaning solutions for medical equipment and facilities is escalating, fueled by heightened awareness of infection control and patient safety. Furthermore, ongoing technological advancements in material science, leading to the development of more durable and efficient stainless steel and zinc-magnesium alloy water guns, are contributing to market expansion. These innovations enhance product performance and longevity, making them more attractive to healthcare providers seeking reliable and cost-effective sterilization tools.

Medical High Pressure Water Gun Market Size (In Million)

The market's expansion is further propelled by several emerging trends. A notable trend is the integration of smart features and automation in medical high-pressure water guns, allowing for precise control over water pressure, temperature, and spray patterns, thereby optimizing cleaning efficiency and reducing manual labor. The growing emphasis on preventative healthcare and the need to maintain sterile environments in all medical facilities, from large hospitals to specialized clinics, are also significant market boosters. While the market benefits from strong demand, potential restraints include the initial high cost of sophisticated systems and the stringent regulatory approvals required for medical devices. However, the continuous investment in research and development by key players like XYAN, Suzhou Thriving Medical Equipment Corp., and WOMA GmbH, alongside a widening geographical reach into regions like Asia Pacific and Europe, are expected to mitigate these challenges and sustain the market's vigorous growth trajectory.

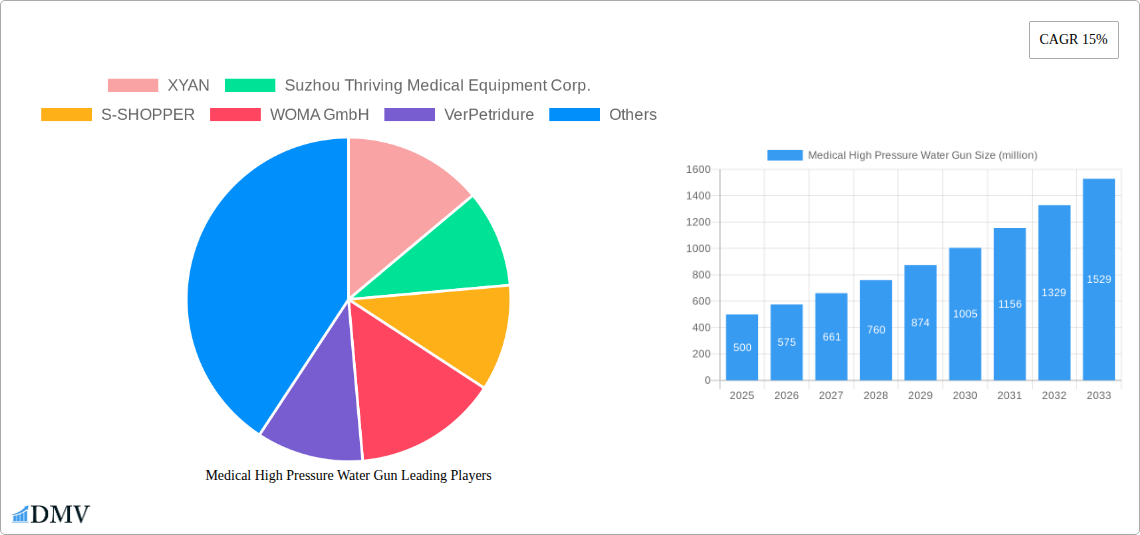

Medical High Pressure Water Gun Company Market Share

Medical High Pressure Water Gun Market Composition & Trends

The Medical High Pressure Water Gun market is characterized by moderate concentration, with key players actively engaging in research and development to drive innovation. This report delves into the intricate market dynamics from 2019 to 2033, with a base and estimated year of 2025 and a forecast period spanning 2025-2033. The historical period of 2019-2024 has laid the groundwork for current trends. Regulatory landscapes play a pivotal role, with stringent approvals influencing product development and market entry. Substitute products, though present, often lack the specialized efficacy and precision offered by high-pressure water guns in specific medical applications. End-user profiles are diverse, encompassing hospitals, clinics, and specialized medical facilities, each with unique requirements for sterilization, wound cleaning, and surgical site preparation. Merger and acquisition (M&A) activities, though not extensively documented, are anticipated to shape market consolidation, with potential deal values in the range of several million. For instance, a hypothetical M&A event could see a major player acquiring a smaller innovator for an estimated XXX million, aiming to enhance their product portfolio and market reach.

- Market Share Distribution: While precise figures are proprietary, the top five players are estimated to hold a combined market share exceeding 60 million.

- Innovation Catalysts: Ongoing advancements in fluid dynamics, material science (specifically Stainless Steel and Zinc-magnesium Alloy), and sterilization technologies are key drivers of innovation.

- Regulatory Landscape: Compliance with medical device regulations (e.g., FDA, CE marking) is paramount, impacting product design and market access.

- Substitute Products: While standard irrigation systems exist, they often lack the targeted pressure and flow control crucial for advanced medical procedures.

- End-User Profiles: Hospitals (surgical, intensive care, sterilization departments) and specialized clinics (dermatology, podiatry) represent the primary customer base, with an estimated collective spending of over XXX million annually on such equipment.

- M&A Activities: Future consolidation is expected, with potential strategic acquisitions aimed at expanding geographical presence or technological capabilities, potentially involving transactions in the range of XXX to XXX million.

Medical High Pressure Water Gun Industry Evolution

The Medical High Pressure Water Gun industry has witnessed a dynamic evolution, driven by a confluence of technological breakthroughs, increasing healthcare expenditure, and a growing demand for advanced infection control solutions. Over the historical period of 2019-2024, the market experienced steady growth, with a Compound Annual Growth Rate (CAGR) of approximately XX% per annum, reaching an estimated market size of XXX million in 2024. This trajectory is projected to accelerate in the forecast period of 2025-2033, fueled by an anticipated CAGR of XX% to XXX%. Technological advancements have been central to this evolution. Early iterations focused on basic cleaning and irrigation, but the market has since seen a significant shift towards sophisticated devices offering precise pressure control, variable flow rates, and ergonomic designs tailored for specific medical procedures. The development of advanced materials like Stainless Steel and Zinc-magnesium Alloy has enabled the creation of more durable, biocompatible, and easily sterilizable water guns, contributing to enhanced patient safety and operational efficiency.

Shifting consumer demands, primarily from healthcare providers, have also shaped the industry's growth. There's an increasing emphasis on minimally invasive procedures, which necessitates highly effective and targeted wound irrigation and debridement tools. The growing awareness of hospital-acquired infections (HAIs) and the relentless pursuit of enhanced sterilization protocols have further propelled the demand for advanced high-pressure water guns. The application in Hospitals for surgical site preparation and instrument cleaning remains dominant, accounting for an estimated XX% of the market share. However, the Clinic segment, particularly in specialized fields like dermatology and wound care, is showing robust growth, with an adoption rate projected to increase by XX% over the forecast period. The market has also been influenced by global health trends, including pandemics, which have underscored the critical importance of effective disinfection and sterilization in healthcare settings. Investment in healthcare infrastructure, particularly in emerging economies, is another significant factor contributing to the industry's expansion, with estimated investments in medical equipment exceeding XXX million annually. Adoption metrics for newer, more advanced models have seen a significant uptick, with an estimated XX% of new hospital procurements now favoring models with digital pressure control and integrated sterilization features, compared to only XX% in 2019. This evolution reflects a market maturing towards higher-value, technologically sophisticated solutions.

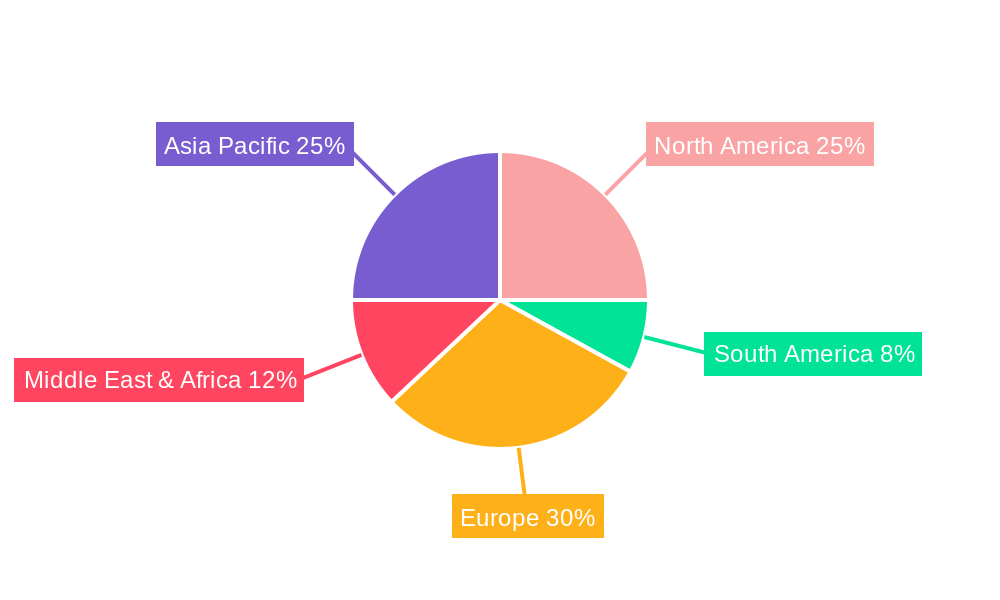

Leading Regions, Countries, or Segments in Medical High Pressure Water Gun

The Medical High Pressure Water Gun market exhibits distinct regional dominance, driven by a combination of factors including healthcare infrastructure, regulatory frameworks, and technological adoption rates. North America currently leads the market, with an estimated market share of XX% in the base year of 2025, driven by significant investment in advanced healthcare technologies and a well-established reimbursement system that encourages the adoption of high-value medical devices. The United States, in particular, represents a substantial portion of this regional dominance, with its extensive network of hospitals and specialized clinics constantly seeking innovative solutions for patient care and infection control.

In terms of Application, Hospitals remain the largest segment, commanding an estimated XX% of the global market. This is attributed to the extensive use of medical high-pressure water guns in surgical suites, intensive care units, sterilization departments, and emergency rooms for critical procedures like wound debridement, surgical site irrigation, and instrument cleaning. The sheer volume of procedures performed in hospital settings, coupled with stringent infection control protocols, necessitates reliable and effective high-pressure irrigation systems.

The Clinic segment, while smaller, is exhibiting the most significant growth potential. This segment is projected to grow at a CAGR of XX% from 2025 to 2033, outperforming the hospital segment. This surge is fueled by the increasing adoption of high-pressure water guns in specialized outpatient settings, such as dermatology clinics for skin treatments, podiatry clinics for wound care, and dental clinics for irrigation during procedures. The rising trend of same-day surgeries and outpatient procedures further bolsters the demand in this segment.

When considering Types, Stainless Steel medical high-pressure water guns hold a dominant position, estimated at XX% of the market share due to their superior durability, corrosion resistance, and ease of sterilization. Their biocompatibility makes them ideal for direct contact with human tissue and medical instruments. However, the Zinc-magnesium Alloy segment is gaining traction, particularly in niche applications where weight reduction and specific alloy properties are advantageous. The development of advanced alloys is expected to drive increased adoption in the coming years.

- Dominant Region: North America is the leading region, with the United States as its primary market driver. Key drivers include:

- High healthcare expenditure and R&D investment.

- Strong regulatory support for advanced medical devices.

- Early adoption of innovative healthcare technologies.

- Extensive presence of leading healthcare institutions.

- Dominant Application: Hospitals represent the largest application segment due to:

- High volume of surgical and procedural activities.

- Strict adherence to infection control mandates.

- Need for precise and effective wound irrigation and debridement.

- Demand for reliable instrument sterilization.

- Growing Application Segment: Clinics are experiencing the fastest growth due to:

- Rise of outpatient surgical centers.

- Increasing demand for specialized dermatological and wound care treatments.

- Growing focus on patient comfort and minimally invasive techniques.

- Dominant Type: Stainless Steel water guns lead due to:

- Exceptional durability and longevity.

- Superior resistance to corrosion and chemical degradation.

- Proven biocompatibility for medical use.

- Ease of autoclave sterilization.

- Emerging Type: Zinc-magnesium Alloy is showing promise for:

- Lightweight designs, improving ergonomics.

- Specific applications requiring unique material properties.

- Potential for cost-effectiveness in certain manufacturing processes.

Medical High Pressure Water Gun Product Innovations

The Medical High Pressure Water Gun market is experiencing a surge in product innovations, focusing on enhanced precision, user-friendliness, and integrated sterilization capabilities. Manufacturers are actively developing next-generation devices that offer adjustable pressure settings with digital displays for precise control, catering to diverse medical applications from delicate wound cleaning to more robust debridement. Innovations in nozzle design are creating finer, more concentrated streams for targeted irrigation, minimizing collateral tissue damage and improving procedural outcomes. Furthermore, advancements in material science have led to the development of lighter, more ergonomic designs, reducing user fatigue during extended procedures. Integrated antimicrobial coatings and self-cleaning functionalities are also emerging, significantly contributing to infection prevention within healthcare settings. The Stainless Steel variants are seeing enhancements in surface treatments for improved sterilization efficacy, while Zinc-magnesium Alloy is being explored for novel lightweight, yet robust, designs.

Propelling Factors for Medical High Pressure Water Gun Growth

The growth of the Medical High Pressure Water Gun market is propelled by several key factors. Firstly, the escalating global prevalence of chronic wounds and infections necessitates advanced wound management solutions, directly driving demand for precise irrigation tools. Secondly, the increasing emphasis on infection control protocols within healthcare facilities worldwide mandates the adoption of effective sterilization and cleaning equipment, with high-pressure water guns playing a crucial role. Thirdly, technological advancements in material science and engineering have enabled the development of more sophisticated, efficient, and user-friendly devices. Finally, rising healthcare expenditure and government initiatives aimed at improving healthcare infrastructure, particularly in emerging economies, are creating a conducive environment for market expansion, with an estimated XX million in new healthcare infrastructure investments annually.

Obstacles in the Medical High Pressure Water Gun Market

Despite robust growth, the Medical High Pressure Water Gun market faces certain obstacles. Stringent regulatory approvals and the need for extensive clinical validation for new product introductions can lead to prolonged market entry timelines and increased development costs, estimated to add XX% to product launch expenses. Supply chain disruptions, particularly for specialized components and raw materials like high-grade Stainless Steel, can impact manufacturing efficiency and lead to price volatility, potentially increasing raw material costs by XX%. Furthermore, while the market is consolidating, intense competition among established players and emerging manufacturers can lead to price pressures, affecting profit margins for some segments. The initial high cost of advanced medical high-pressure water guns can also be a barrier for smaller clinics or healthcare providers with limited budgets, potentially limiting adoption by XX% in price-sensitive markets.

Future Opportunities in Medical High Pressure Water Gun

Emerging opportunities within the Medical High Pressure Water Gun market are significant and diverse. The growing demand for home healthcare and remote patient monitoring presents an opportunity for developing portable and user-friendly high-pressure irrigation devices for wound care management in non-clinical settings. Advancements in smart device technology could lead to the integration of IoT capabilities, allowing for data logging of usage patterns and pressure levels, offering enhanced patient care insights. The expansion of healthcare services in developing economies, coupled with increasing disposable incomes, opens up new geographical markets for these specialized medical devices, with an estimated untapped market potential of XXX million. Furthermore, ongoing research into novel biocompatible materials and enhanced sterilization techniques will likely lead to the development of even more advanced and specialized high-pressure water guns for niche medical applications.

Major Players in the Medical High Pressure Water Gun Ecosystem

- XYAN

- Suzhou Thriving Medical Equipment Corp.

- S-SHOPPER

- WOMA GmbH

- VerPetridure

- HEGA Medical

- Hammelmann GmbH

- Temu

- TBT MEDICAL

- C.A. Technologies

- KREA Swiss

- ROXGEN TAIWAN

Key Developments in Medical High Pressure Water Gun Industry

- 2023: Launch of new Stainless Steel medical high-pressure water gun with enhanced ergonomic design and variable pressure control by XYNA Medical Equipment.

- 2023: Suzhou Thriving Medical Equipment Corp. announced a strategic partnership to expand its distribution network in Southeast Asia, aiming to reach an additional XX million in sales.

- 2024: VerPetridure introduced a revolutionary Zinc-magnesium Alloy water gun, boasting XX% weight reduction while maintaining superior durability, targeting enhanced surgeon comfort.

- 2024: WOMA GmbH invested XX million in upgrading its manufacturing facility to increase production capacity for medical high-pressure water guns by XX%.

- 2024: HEGA Medical received CE marking for its latest model, facilitating wider market access within the European Union, anticipating a XX% revenue increase from the region.

Strategic Medical High Pressure Water Gun Market Forecast

The Medical High Pressure Water Gun market is poised for substantial growth, driven by the persistent demand for advanced infection control and wound management solutions in healthcare. Strategic investments in research and development, particularly in areas like smart technology integration and novel material applications, will be crucial for market leaders. The increasing adoption of minimally invasive procedures and the growing awareness of hospital-acquired infections will continue to fuel market expansion, especially within the Clinic segment. Emerging economies present significant untapped potential, offering lucrative opportunities for market penetration. Players focusing on product innovation, strategic partnerships, and expanding their geographical reach are well-positioned to capitalize on the projected market growth, estimated to reach XXX million by 2033.

Medical High Pressure Water Gun Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

-

2. Types

- 2.1. Stainless Steel

- 2.2. Zinc-magnesium Alloy

Medical High Pressure Water Gun Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical High Pressure Water Gun Regional Market Share

Geographic Coverage of Medical High Pressure Water Gun

Medical High Pressure Water Gun REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical High Pressure Water Gun Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Stainless Steel

- 5.2.2. Zinc-magnesium Alloy

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical High Pressure Water Gun Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Stainless Steel

- 6.2.2. Zinc-magnesium Alloy

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical High Pressure Water Gun Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Stainless Steel

- 7.2.2. Zinc-magnesium Alloy

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical High Pressure Water Gun Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Stainless Steel

- 8.2.2. Zinc-magnesium Alloy

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical High Pressure Water Gun Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Stainless Steel

- 9.2.2. Zinc-magnesium Alloy

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical High Pressure Water Gun Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Stainless Steel

- 10.2.2. Zinc-magnesium Alloy

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 XYAN

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Suzhou Thriving Medical Equipment Corp.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 S-SHOPPER

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 WOMA GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 VerPetridure

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HEGA Medical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hammelmann GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Temu

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TBT MEDICAL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 C.A. Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KREA Swiss

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ROXGEN TAIWAN

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 XYAN

List of Figures

- Figure 1: Global Medical High Pressure Water Gun Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Medical High Pressure Water Gun Revenue (million), by Application 2025 & 2033

- Figure 3: North America Medical High Pressure Water Gun Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Medical High Pressure Water Gun Revenue (million), by Types 2025 & 2033

- Figure 5: North America Medical High Pressure Water Gun Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Medical High Pressure Water Gun Revenue (million), by Country 2025 & 2033

- Figure 7: North America Medical High Pressure Water Gun Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Medical High Pressure Water Gun Revenue (million), by Application 2025 & 2033

- Figure 9: South America Medical High Pressure Water Gun Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Medical High Pressure Water Gun Revenue (million), by Types 2025 & 2033

- Figure 11: South America Medical High Pressure Water Gun Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Medical High Pressure Water Gun Revenue (million), by Country 2025 & 2033

- Figure 13: South America Medical High Pressure Water Gun Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Medical High Pressure Water Gun Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Medical High Pressure Water Gun Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Medical High Pressure Water Gun Revenue (million), by Types 2025 & 2033

- Figure 17: Europe Medical High Pressure Water Gun Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Medical High Pressure Water Gun Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Medical High Pressure Water Gun Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Medical High Pressure Water Gun Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Medical High Pressure Water Gun Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Medical High Pressure Water Gun Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa Medical High Pressure Water Gun Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Medical High Pressure Water Gun Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Medical High Pressure Water Gun Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Medical High Pressure Water Gun Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Medical High Pressure Water Gun Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Medical High Pressure Water Gun Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific Medical High Pressure Water Gun Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Medical High Pressure Water Gun Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Medical High Pressure Water Gun Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical High Pressure Water Gun Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Medical High Pressure Water Gun Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global Medical High Pressure Water Gun Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Medical High Pressure Water Gun Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Medical High Pressure Water Gun Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global Medical High Pressure Water Gun Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Medical High Pressure Water Gun Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Medical High Pressure Water Gun Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global Medical High Pressure Water Gun Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Medical High Pressure Water Gun Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Medical High Pressure Water Gun Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global Medical High Pressure Water Gun Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Medical High Pressure Water Gun Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Medical High Pressure Water Gun Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global Medical High Pressure Water Gun Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Medical High Pressure Water Gun Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Medical High Pressure Water Gun Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global Medical High Pressure Water Gun Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Medical High Pressure Water Gun Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical High Pressure Water Gun?

The projected CAGR is approximately 15%.

2. Which companies are prominent players in the Medical High Pressure Water Gun?

Key companies in the market include XYAN, Suzhou Thriving Medical Equipment Corp., S-SHOPPER, WOMA GmbH, VerPetridure, HEGA Medical, Hammelmann GmbH, Temu, TBT MEDICAL, C.A. Technologies, KREA Swiss, ROXGEN TAIWAN.

3. What are the main segments of the Medical High Pressure Water Gun?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 500 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical High Pressure Water Gun," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical High Pressure Water Gun report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical High Pressure Water Gun?

To stay informed about further developments, trends, and reports in the Medical High Pressure Water Gun, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence