Key Insights

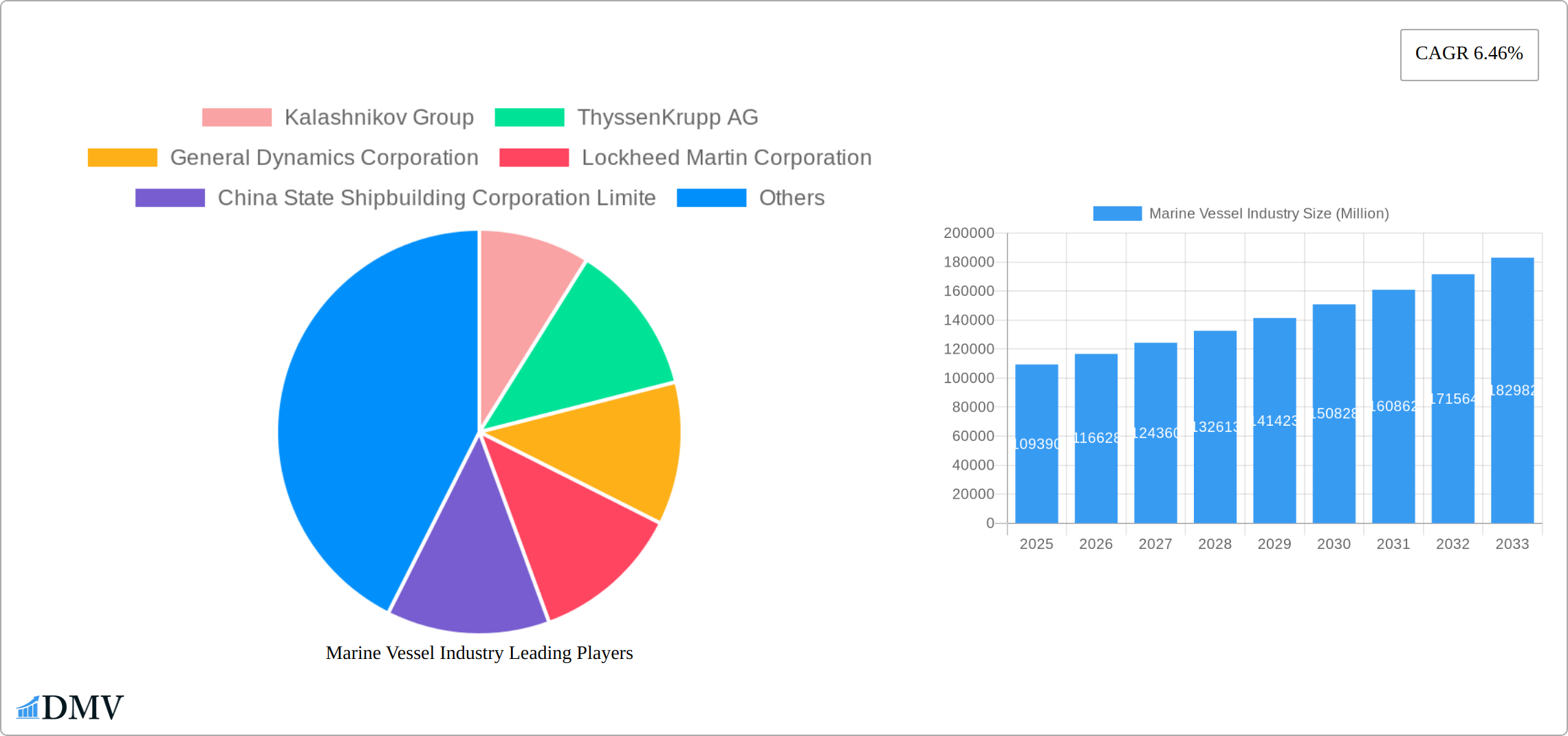

The global marine vessel market, valued at $109.39 billion in 2025, is projected to experience robust growth, driven by increasing geopolitical instability necessitating naval modernization, rising global trade volumes demanding enhanced shipping capacity, and the growing adoption of technologically advanced vessels for improved efficiency and safety. The market's Compound Annual Growth Rate (CAGR) of 6.46% from 2025 to 2033 indicates significant expansion across various vessel types, including destroyers, frigates, submarines, corvettes, aircraft carriers, and other specialized vessels. Key market drivers include government investments in defense modernization programs, the ongoing development of autonomous and remotely operated vessels, and the increasing demand for specialized vessels to support offshore energy exploration and the burgeoning cruise industry.

Significant regional variations are expected. North America and Europe will likely maintain substantial market share due to existing naval capabilities and technological advancements. However, the Asia-Pacific region is poised for rapid growth, fueled by significant investments in maritime infrastructure and expanding naval fleets within countries like China, India, and South Korea. Competitive pressures will continue among major players like Lockheed Martin, Huntington Ingalls Industries, and BAE Systems, as well as prominent international shipbuilders such as China State Shipbuilding Corporation. The market's growth trajectory will likely be influenced by fluctuating global economic conditions, geopolitical tensions, technological disruptions, and evolving maritime regulations. Successfully navigating these dynamics will be crucial for sustained success within this dynamic sector.

Marine Vessel Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global marine vessel industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, technological advancements, and competitive landscapes, offering a robust foundation for strategic decision-making. The total market value is estimated to reach xx Million by 2033.

Marine Vessel Industry Market Composition & Trends

The global marine vessel market is characterized by a dynamic and evolving landscape. While historically dominated by a moderately concentrated group of established players benefiting from economies of scale, technological prowess, and substantial capital investment, the market is increasingly experiencing a healthy injection of competition. This surge is fueled by the rapid emergence of innovative technologies and the agility of smaller, specialized firms. Regulatory frameworks, which vary significantly across different geographical regions, exert a profound influence on market dynamics. These regulations are particularly impactful concerning environmental compliance, safety standards, and the adoption of sustainable practices. Furthermore, the growing sophistication and application of substitute products, such as advanced drones and autonomous underwater vehicles (AUVs), present an evolving threat, though currently confined to specific niche applications and specialized functionalities. The end-user base is remarkably diverse, spanning critical sectors like defense forces, global commercial shipping companies, vital research institutions, and the expansive offshore energy sector. Mergers and Acquisitions (M&A) continue to be a significant feature of the market, with transactions exceeding USD [Insert Specific Value] Million in aggregate value over the past five years. A notable trend observed is the strategic consolidation of regional players to enhance operational scale, expand market reach, and fortify competitive positioning.

- Market Share Distribution (2024): The top 5 leading players collectively command approximately 60% of the global market share, underscoring the importance of established entities.

- M&A Deal Values (2019-2024): The cumulative value of M&A activities in this period has surpassed USD [Insert Specific Value] Million, highlighting significant investment and restructuring within the industry.

- Innovation Catalysts: Key drivers of innovation include the advancement of autonomous navigation systems, the integration of Artificial Intelligence (AI) for enhanced operational efficiency, and the development and application of advanced, lightweight materials.

- Regulatory Landscape: Stringent environmental regulations, such as the International Maritime Organization's (IMO) 2020 sulfur cap, are a significant catalyst for the widespread adoption of cleaner technologies and more sustainable vessel designs.

Marine Vessel Industry Industry Evolution

The marine vessel industry has undergone a remarkable transformation during the historical period spanning 2019 to 2024. This evolution has been propelled by a confluence of increasing demand from a diverse range of sectors and groundbreaking technological advancements. The market experienced a robust Compound Annual Growth Rate (CAGR) of [Insert Specific Percentage]% during this timeframe. This growth trajectory is anticipated to persist, albeit with a slightly moderated pace, into the forecast period from 2025 to 2033, projecting a CAGR of [Insert Specific Percentage]%. This projected moderation can be partly attributed to the natural maturation of certain market segments and the inherent cyclicality often associated with defense spending. Technological breakthroughs are fundamentally reshaping vessel design, operational efficiency, and overall capabilities. These include advancements in improved propulsion systems, such as hybrid and fully electric solutions, the integration of cutting-edge composite materials for lighter and stronger structures, and the widespread adoption of sophisticated, integrated digital platforms. Concurrently, evolving end-user demands are steering the industry towards a greater emphasis on environmentally friendly vessels, evidenced by the growing uptake of alternative fuels and emissions-reduction technologies. However, the increasing complexity of modern vessels and the integration of intricate systems have also contributed to escalating vessel construction costs, thus creating a potential demand-supply imbalance in certain segments.

Leading Regions, Countries, or Segments in Marine Vessel Industry

The Asia-Pacific region dominates the global marine vessel market, driven by robust investment in naval modernization and expanding commercial shipping fleets. Specifically, China and India have been major contributors to this dominance. Within vessel types, the demand for frigates and corvettes has been particularly strong due to their versatility and cost-effectiveness.

- Key Drivers for Asia-Pacific Dominance:

- Significant investments in naval expansion and modernization.

- Growing commercial shipping activities.

- Favourable government policies and incentives for shipbuilding.

- Frigates & Corvettes: High demand due to versatility and cost-effectiveness.

- Destroyers: Driven by defense requirements and technological advancements.

- Submarines: Significant growth due to national security concerns.

- Aircraft Carriers: Major investment by select nations.

The dominance is expected to continue in the forecast period though other regional players like the EU and North America are expected to contribute to the overall market growth.

Marine Vessel Industry Product Innovations

Recent innovations include the integration of advanced sensors and automation technologies, enhancing situational awareness and operational efficiency. Hybrid and electric propulsion systems are gaining traction, reducing emissions and operational costs. Lightweight composite materials are being adopted to improve fuel efficiency and reduce overall vessel weight. These innovations offer unique selling propositions (USPs) in terms of improved performance, reduced environmental impact, and enhanced safety features.

Propelling Factors for Marine Vessel Industry Growth

The continued growth of the marine vessel industry is being propelled by several key factors. Foremost among these are the relentless pace of technological advancements, particularly in the domains of autonomous systems and Artificial Intelligence (AI), which are enhancing efficiency and safety. The sustained expansion of global maritime trade, a cornerstone of the world economy, directly fuels demand for a diverse fleet of vessels. Furthermore, increasing global defense budgets are leading to significant investments in naval shipbuilding and modernization. Government regulations that actively promote environmentally sustainable shipping practices and enforce stricter safety standards also serve as crucial drivers, compelling industry players to innovate and adopt cleaner, safer technologies.

Obstacles in the Marine Vessel Industry Market

Supply chain disruptions, particularly concerning specialized components and materials, pose a significant challenge. Stringent environmental regulations, while beneficial long-term, may impose short-term cost pressures. Intense competition from established players and new entrants creates price pressures and challenges to profitability.

Future Opportunities in Marine Vessel Industry

The marine vessel industry is poised to capitalize on several promising future opportunities. The substantial expansion of the offshore wind energy sector presents a significant demand for specialized installation, maintenance, and service vessels. Concurrently, there is a growing demand for highly specialized vessels tailored for critical applications such as oceanographic research, deep-sea exploration, and environmental monitoring. The continued development and increasing adoption of autonomous vessel technologies, promising enhanced operational efficiency and reduced crewing requirements, represent another major avenue for growth. Emerging markets in developing economies, with their rapidly expanding trade and infrastructure needs, offer significant potential. Finally, the ongoing adoption and innovation in advanced materials will continue to drive the development of lighter, stronger, and more fuel-efficient vessels.

Major Players in the Marine Vessel Industry Ecosystem

- Kalashnikov Group

- ThyssenKrupp AG

- General Dynamics Corporation

- Lockheed Martin Corporation

- China State Shipbuilding Corporation Limited

- Fr Lurssen Werft Gmbh & Co KG

- Naval Group SA

- BAE Systems PLC

- Austal Limited

- Huntington Ingalls Industries Inc

- EDGE Group PJSC

- HD Korea Shipbuilding & Offshore Engineering Co Ltd

- Navantia SA SME

- Hanwha Ocean (Hanwha Group)

- FINCANTIERI SpA

- Damen Shipyards Group

- LARSEN & TOUBRO LIMITED

- PT PAL Indonesia

Key Developments in Marine Vessel Industry Industry

- April 2023: The United Kingdom's Ministry of Defence awarded a significant contract valued at USD 57 Million to BAE Systems plc. This contract focuses on providing Command, Control, Communications, Computers, and Intelligence (C4I) services for surface vessels, directly impacting the market for sophisticated C4I systems within the broader marine industry.

- March 2023: The Indian Navy has entered into a substantial agreement with Goa Shipyard Limited (GSL) and Garden Reach Shipbuilders & Engineers (GRSE) for the production of a fleet comprising 11 offshore patrol vessels and six next-generation missile vessels. This strategic procurement is expected to significantly boost demand for these specific types of vessels within the Indian and regional maritime sectors.

Strategic Marine Vessel Industry Market Forecast

The marine vessel industry is poised for continued growth, driven by technological innovation, increasing global trade, and sustained defense spending. Emerging markets and the shift toward sustainable shipping will present significant opportunities. The market is expected to reach xx Million by 2033, reflecting a robust outlook for the sector.

Marine Vessel Industry Segmentation

-

1. Vessel Type

- 1.1. Destroyers

- 1.2. Frigates

- 1.3. Submarines

- 1.4. Corvettes

- 1.5. Aircraft Carriers

- 1.6. Other Vessel Types

Marine Vessel Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Singapore

- 3.7. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Marine Vessel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Submarines Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 5.1.1. Destroyers

- 5.1.2. Frigates

- 5.1.3. Submarines

- 5.1.4. Corvettes

- 5.1.5. Aircraft Carriers

- 5.1.6. Other Vessel Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6. North America Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6.1.1. Destroyers

- 6.1.2. Frigates

- 6.1.3. Submarines

- 6.1.4. Corvettes

- 6.1.5. Aircraft Carriers

- 6.1.6. Other Vessel Types

- 6.1. Market Analysis, Insights and Forecast - by Vessel Type

- 7. Europe Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vessel Type

- 7.1.1. Destroyers

- 7.1.2. Frigates

- 7.1.3. Submarines

- 7.1.4. Corvettes

- 7.1.5. Aircraft Carriers

- 7.1.6. Other Vessel Types

- 7.1. Market Analysis, Insights and Forecast - by Vessel Type

- 8. Asia Pacific Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vessel Type

- 8.1.1. Destroyers

- 8.1.2. Frigates

- 8.1.3. Submarines

- 8.1.4. Corvettes

- 8.1.5. Aircraft Carriers

- 8.1.6. Other Vessel Types

- 8.1. Market Analysis, Insights and Forecast - by Vessel Type

- 9. Latin America Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vessel Type

- 9.1.1. Destroyers

- 9.1.2. Frigates

- 9.1.3. Submarines

- 9.1.4. Corvettes

- 9.1.5. Aircraft Carriers

- 9.1.6. Other Vessel Types

- 9.1. Market Analysis, Insights and Forecast - by Vessel Type

- 10. Middle East and Africa Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vessel Type

- 10.1.1. Destroyers

- 10.1.2. Frigates

- 10.1.3. Submarines

- 10.1.4. Corvettes

- 10.1.5. Aircraft Carriers

- 10.1.6. Other Vessel Types

- 10.1. Market Analysis, Insights and Forecast - by Vessel Type

- 11. North America Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Australia

- 13.1.6 Singapore

- 13.1.7 Rest of Asia Pacific

- 14. Latin America Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Mexico

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Marine Vessel Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Kalashnikov Group

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ThyssenKrupp AG

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 General Dynamics Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Lockheed Martin Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 China State Shipbuilding Corporation Limite

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Fr Lurssen Werft Gmbh & Co KG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Naval Group SA

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 BAE Systems PLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Austal Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Huntington Ingalls Industries Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 EDGE Group PJSC

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 HD Korea Shipbuilding & Offshore Engineering Co Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Navantia SA SME

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Hanwha Ocean (Hanwha Group)

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 FINCANTIERI SpA

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Damen Shipyards Group

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 LARSEN & TOUBRO LIMITED6 3 Other Players

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.18 PT PAL Indonesia

- 16.2.18.1. Overview

- 16.2.18.2. Products

- 16.2.18.3. SWOT Analysis

- 16.2.18.4. Recent Developments

- 16.2.18.5. Financials (Based on Availability)

- 16.2.1 Kalashnikov Group

List of Figures

- Figure 1: Global Marine Vessel Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Marine Vessel Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Marine Vessel Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Marine Vessel Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Marine Vessel Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Marine Vessel Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Marine Vessel Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Marine Vessel Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Marine Vessel Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Marine Vessel Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Marine Vessel Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Marine Vessel Industry Revenue (Million), by Vessel Type 2024 & 2032

- Figure 13: North America Marine Vessel Industry Revenue Share (%), by Vessel Type 2024 & 2032

- Figure 14: North America Marine Vessel Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Marine Vessel Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Marine Vessel Industry Revenue (Million), by Vessel Type 2024 & 2032

- Figure 17: Europe Marine Vessel Industry Revenue Share (%), by Vessel Type 2024 & 2032

- Figure 18: Europe Marine Vessel Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Marine Vessel Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Marine Vessel Industry Revenue (Million), by Vessel Type 2024 & 2032

- Figure 21: Asia Pacific Marine Vessel Industry Revenue Share (%), by Vessel Type 2024 & 2032

- Figure 22: Asia Pacific Marine Vessel Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Marine Vessel Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Marine Vessel Industry Revenue (Million), by Vessel Type 2024 & 2032

- Figure 25: Latin America Marine Vessel Industry Revenue Share (%), by Vessel Type 2024 & 2032

- Figure 26: Latin America Marine Vessel Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Marine Vessel Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Marine Vessel Industry Revenue (Million), by Vessel Type 2024 & 2032

- Figure 29: Middle East and Africa Marine Vessel Industry Revenue Share (%), by Vessel Type 2024 & 2032

- Figure 30: Middle East and Africa Marine Vessel Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Marine Vessel Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Marine Vessel Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Marine Vessel Industry Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 3: Global Marine Vessel Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Marine Vessel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Marine Vessel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Russia Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Marine Vessel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Singapore Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Marine Vessel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Latin America Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Marine Vessel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United Arab Emirates Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Saudi Arabia Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: South Africa Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East and Africa Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Marine Vessel Industry Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 32: Global Marine Vessel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Marine Vessel Industry Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 36: Global Marine Vessel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Russia Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Marine Vessel Industry Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 44: Global Marine Vessel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Australia Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Singapore Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Marine Vessel Industry Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 53: Global Marine Vessel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Brazil Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Mexico Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Latin America Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Marine Vessel Industry Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 58: Global Marine Vessel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: United Arab Emirates Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Saudi Arabia Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Africa Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa Marine Vessel Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Marine Vessel Industry?

The projected CAGR is approximately 6.46%.

2. Which companies are prominent players in the Marine Vessel Industry?

Key companies in the market include Kalashnikov Group, ThyssenKrupp AG, General Dynamics Corporation, Lockheed Martin Corporation, China State Shipbuilding Corporation Limite, Fr Lurssen Werft Gmbh & Co KG, Naval Group SA, BAE Systems PLC, Austal Limited, Huntington Ingalls Industries Inc, EDGE Group PJSC, HD Korea Shipbuilding & Offshore Engineering Co Ltd, Navantia SA SME, Hanwha Ocean (Hanwha Group), FINCANTIERI SpA, Damen Shipyards Group, LARSEN & TOUBRO LIMITED6 3 Other Players, PT PAL Indonesia.

3. What are the main segments of the Marine Vessel Industry?

The market segments include Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.39 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Submarines Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: The UK Ministry of Defence awarded a USD 57 million contract to BAE Systems plc to support communication, command, control, computer, and intelligence (C4I) services for surface vessels. According to the contract, BAE Systems will likely be able to help with C4I services and data deliverables throughout the five phases of shipboard integration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Marine Vessel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Marine Vessel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Marine Vessel Industry?

To stay informed about further developments, trends, and reports in the Marine Vessel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence