Key Insights

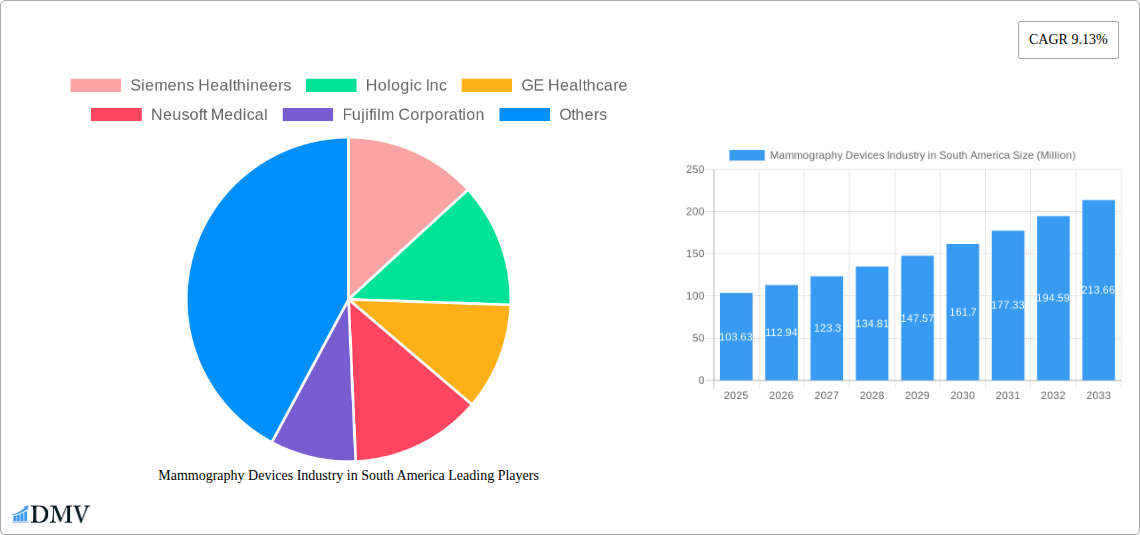

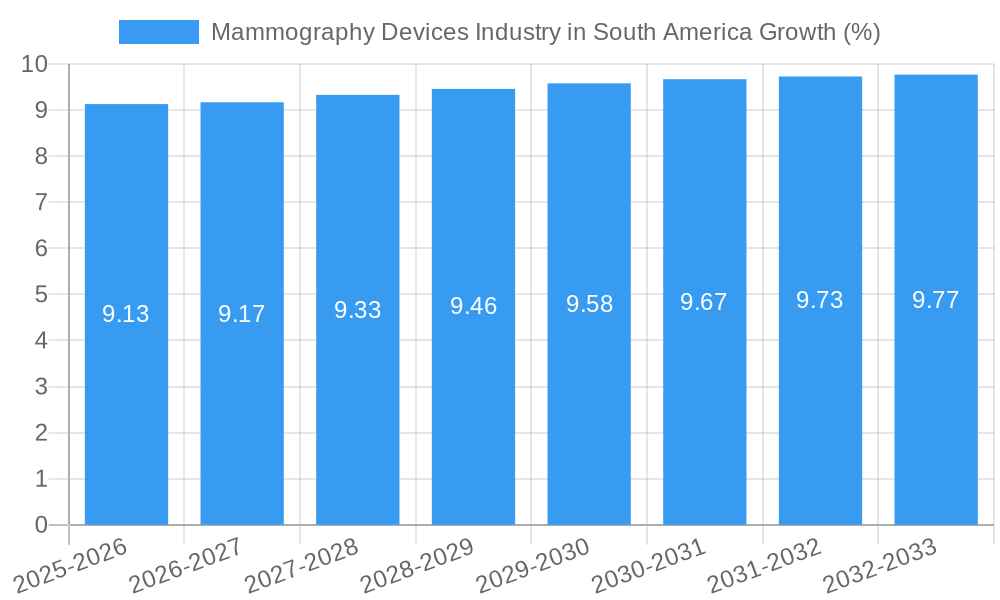

The South American mammography devices market is poised for substantial growth, projected to reach approximately $103.63 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.13% anticipated throughout the forecast period of 2025-2033. This upward trajectory is primarily fueled by increasing awareness surrounding breast cancer, growing demand for early detection, and advancements in diagnostic imaging technology. Digital mammography systems, including tomosynthesis, are leading this expansion, offering superior diagnostic accuracy and patient comfort compared to traditional film-screen methods. The rising incidence of breast cancer in the region, coupled with governmental initiatives to promote cancer screening programs, further underpins the market's strong performance. Hospitals and specialized diagnostic centers are the principal end-users, investing in advanced mammography equipment to enhance their diagnostic capabilities and cater to a growing patient base.

Despite the optimistic outlook, the market faces certain restraints. The high cost of advanced mammography systems and limited healthcare infrastructure in some sub-regions of South America can pose challenges to widespread adoption. Furthermore, the availability of skilled technicians and the reimbursement landscape for mammography services also play a crucial role in market dynamics. However, ongoing technological innovations, such as the development of more affordable digital mammography solutions and increased focus on patient-centric imaging, are expected to mitigate these challenges. Key players like Siemens Healthineers, Hologic Inc., and GE Healthcare are actively investing in research and development and expanding their presence in the region, contributing to market innovation and accessibility. The focus on expanding access to advanced breast cancer screening across Brazil, Argentina, and the rest of South America will continue to drive demand for sophisticated mammography devices.

This in-depth report delves into the dynamic Mammography Devices Market in South America, offering a comprehensive analysis of its current state and future trajectory. Covering the study period from 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this research provides critical insights for stakeholders seeking to understand and capitalize on the South American medical imaging market. We meticulously examine market composition, industry evolution, key regional players, product innovations, growth drivers, obstacles, and future opportunities, all while incorporating high-ranking keywords like digital mammography, breast cancer screening, medical equipment South America, and radiology devices.

Mammography Devices Industry in South America Market Composition & Trends

The South American mammography devices industry exhibits a moderate market concentration, with key players like Siemens Healthineers, Hologic Inc, GE Healthcare, and Fujifilm Corporation dominating the landscape. Innovation is primarily driven by advancements in digital mammography systems and the growing adoption of 3D mammography (Breast Tomosynthesis). Regulatory landscapes vary across countries, with initiatives aimed at improving breast cancer detection rates influencing market access and product approvals. Substitute products, while present in the form of older technologies, are increasingly being phased out in favor of superior digital mammography solutions. End-user profiles reveal a significant reliance on hospitals and diagnostic centers for mammography services, with specialty clinics also playing a crucial role. Mergers and acquisitions are anticipated to shape market dynamics, with potential deal values in the hundreds of millions as companies seek to expand their regional footprint and technological portfolios. The market share distribution is evolving, with digital mammography poised to capture a larger segment from traditional film screen mammography systems.

- Market Share Distribution: Digital Systems are expected to hold the largest share, followed by Breast Tomosynthesis.

- M&A Deal Values: Anticipated to range in the tens to hundreds of millions as market consolidation continues.

- Key Innovation Catalysts: Demand for higher diagnostic accuracy, increased patient comfort, and government-led cancer screening programs.

- Regulatory Influence: Stringent quality standards and the push for early breast cancer diagnosis are shaping product development and market entry.

Mammography Devices Industry in South America Industry Evolution

The mammography devices industry in South America has undergone a significant transformation over the historical period of 2019–2024, driven by a convergence of technological advancements, increasing healthcare expenditure, and a growing awareness of breast cancer screening importance. This evolution is projected to continue at a robust pace through the forecast period of 2025–2033. The shift from analog film screen mammography systems to advanced digital mammography has been a defining feature, offering enhanced image quality, reduced radiation exposure, and improved workflow efficiencies. The market has witnessed substantial growth in the adoption of digital breast tomosynthesis (DBT), also known as 3D mammography, which provides superior detection of abnormalities, particularly in dense breast tissue, a common challenge in South America.

The estimated year of 2025 marks a point where digital technologies are expected to be the standard of care across most of the region. Investment in diagnostic imaging infrastructure, fueled by both public and private sector initiatives, has been a significant growth trajectory. For instance, the increasing prevalence of breast cancer and rising mortality rates have spurred governments and healthcare providers to prioritize early detection. This has led to increased procurement of advanced mammography equipment. The South America medical imaging market is also benefiting from the expansion of healthcare facilities and the increasing demand for specialized diagnostic services. Technological advancements, such as the integration of Artificial Intelligence (AI) for image analysis and the development of more portable and user-friendly mammography units, are further propelling the industry's evolution.

Consumer demand is also playing a vital role. As awareness campaigns about breast cancer awareness gain traction, more women are seeking regular screening. This growing demand, coupled with improved accessibility to healthcare services, particularly in urban centers, is creating a fertile ground for market expansion. The radiology devices market in South America is experiencing a compound annual growth rate (CAGR) in the range of 6% to 8% during the forecast period, indicating a sustained upward trend. The penetration of digital mammography units is expected to exceed 80% by 2030. The development of cost-effective solutions is also crucial for wider adoption, especially in regions with varying economic capacities.

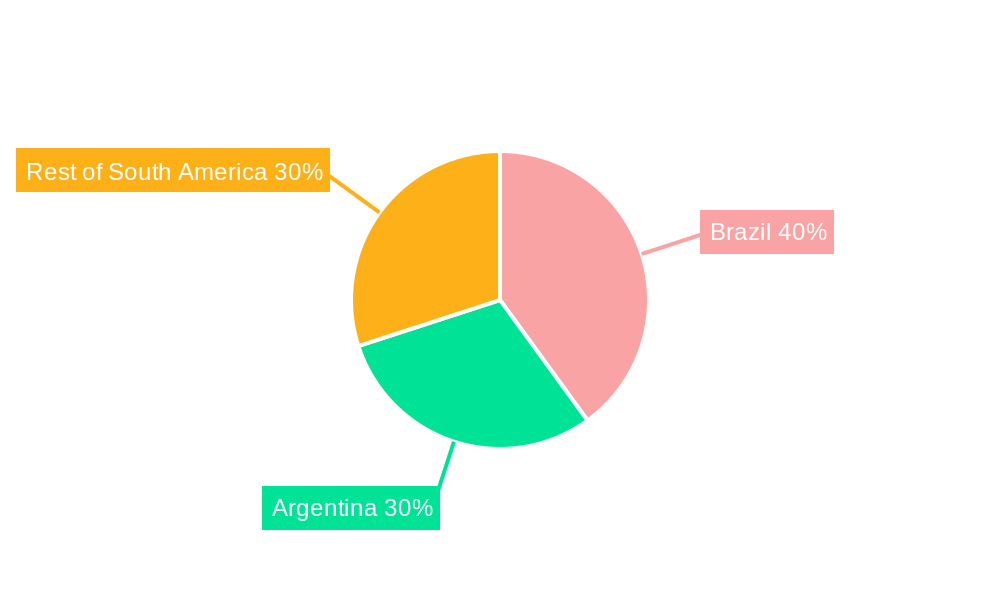

Leading Regions, Countries, or Segments in Mammography Devices Industry in South America

Within the South America mammography devices industry, Brazil stands out as the dominant region, commanding a significant share of the market due to its large population, expanding healthcare infrastructure, and proactive government initiatives for breast cancer screening. The country's robust healthcare system, characterized by a mix of public and private hospitals, coupled with a growing number of specialized diagnostic centers, creates substantial demand for advanced mammography equipment. Furthermore, Brazil has been a frontrunner in adopting new technologies, including digital mammography and breast tomosynthesis, driven by a higher awareness of breast cancer detection and a greater capacity for investment in medical technology.

The Product: Digital Systems segment is also leading the charge across the entire South American medical imaging market. The superior diagnostic capabilities of digital mammography—offering enhanced image clarity, digital storage, and easier manipulation—make it the preferred choice for healthcare providers aiming for accurate and efficient diagnoses. This segment's dominance is further bolstered by the decreasing cost of digital units and the phasing out of older film screen mammography systems.

Dominant Country: Brazil:

- Investment Trends: Significant government and private sector investments in upgrading healthcare facilities and procuring advanced diagnostic equipment.

- Regulatory Support: Favorable policies and programs promoting breast cancer screening and early detection, leading to higher demand for mammography devices.

- Healthcare Infrastructure: Extensive network of hospitals, specialized clinics, and diagnostic centers equipped to handle a large volume of screenings.

- Awareness Campaigns: Effective public health campaigns have increased patient demand for mammography services.

Dominant Product Segment: Digital Systems:

- Technological Superiority: Higher image resolution, reduced radiation dose, and improved diagnostic accuracy compared to analog systems.

- Workflow Efficiency: Digital archiving and networking capabilities streamline radiologist workflows and inter-departmental communication.

- Cost-Effectiveness: Despite higher initial investment, the long-term benefits of digital systems, including reduced film and processing costs, make them economically viable.

- Demand for Advanced Features: Increasing demand for AI-integrated digital mammography for enhanced diagnostic support.

The End User: Hospitals segment also plays a pivotal role in driving market growth, as these institutions are the primary providers of comprehensive diagnostic services and are often at the forefront of adopting new medical technologies. The Rest of South America, encompassing countries like Colombia, Chile, and Peru, also presents significant growth potential, driven by improving healthcare standards and increasing focus on preventative care.

Mammography Devices Industry in South America Product Innovations

Product innovation in the mammography devices industry in South America is sharply focused on enhancing diagnostic accuracy and patient comfort. Digital mammography systems continue to evolve with higher resolution detectors and advanced imaging algorithms that improve the visualization of subtle lesions. The increasing integration of AI-powered image analysis tools is a significant breakthrough, assisting radiologists in identifying potential abnormalities with greater speed and precision. Furthermore, the development of 3D mammography (Breast Tomosynthesis) units offers a substantial leap in breast cancer detection, especially for women with dense breast tissue, providing a more comprehensive view and reducing recall rates. Innovations in ergonomic design and reduced compression force are also key, aiming to improve the patient experience and increase screening compliance.

Propelling Factors for Mammography Devices Industry in South America Growth

Several key factors are propelling the growth of the mammography devices industry in South America. The rising incidence of breast cancer across the region necessitates robust screening programs, thereby driving demand for advanced mammography equipment. Government initiatives and public health campaigns promoting early breast cancer detection are significant drivers. Technological advancements, particularly in digital mammography and 3D mammography, offering improved diagnostic accuracy and patient comfort, are fueling adoption. Furthermore, increasing healthcare expenditure, both public and private, and the expansion of healthcare infrastructure, particularly in underserved areas, are creating new market opportunities. The growing awareness among women about the importance of regular breast cancer screening is also a crucial economic and social influence.

Obstacles in the Mammography Devices Industry in South America Market

Despite the positive outlook, the mammography devices industry in South America faces several obstacles. High acquisition costs for advanced digital mammography systems and 3D mammography units can be a significant barrier, especially for smaller healthcare facilities and in countries with limited healthcare budgets. Limited access to advanced healthcare infrastructure and trained personnel in rural or remote areas restricts the reach of breast cancer screening programs. Fluctuations in currency exchange rates can also impact the affordability of imported medical equipment. Furthermore, varying regulatory frameworks across different South American countries can create complexities for manufacturers and distributors aiming for regional expansion. Supply chain disruptions, as witnessed in recent global events, can also affect the availability of critical components and finished products.

Future Opportunities in Mammography Devices Industry in South America

The future of the mammography devices industry in South America is ripe with opportunities. The growing demand for AI-integrated mammography systems presents a significant avenue for innovation and market penetration, offering enhanced diagnostic capabilities. Expansion into emerging markets within the "Rest of South America" segment, where breast cancer screening rates are gradually increasing, offers substantial growth potential. The development and adoption of more affordable and portable digital mammography solutions can improve access to screening in underserved populations and remote areas. Furthermore, increasing partnerships between manufacturers, healthcare providers, and government organizations can facilitate wider adoption of advanced breast cancer detection technologies and establish comprehensive screening programs. The focus on preventative healthcare and early intervention is a continuous trend that will further bolster the market.

Major Players in the Mammography Devices Industry in South America Ecosystem

- Siemens Healthineers

- Hologic Inc

- GE Healthcare

- Neusoft Medical

- Fujifilm Corporation

- Koninklijke Philips NV

- IMS Giotto SPA

- Canon Medical Systems Corporation

- Planmed Oy

- Konica Minolta

Key Developments in Mammography Devices Industry in South America Industry

- Oct 2022: The Argentinean union Futbolistas Argentinos Agremiados (FAA) purchased a high-tech digital mammography unit that offers free care to its affiliated women's players, enhancing access to crucial breast cancer screening for athletes.

- Feb 2022: The International Atomic Energy Agency (IAEA) installed two new mammography units on Brazilian navy ships, delivering vital health services along South America's biggest waterway and significantly increasing breast cancer screening access in Brazil.

Strategic Mammography Devices Industry in South America Market Forecast

- Oct 2022: The Argentinean union Futbolistas Argentinos Agremiados (FAA) purchased a high-tech digital mammography unit that offers free care to its affiliated women's players, enhancing access to crucial breast cancer screening for athletes.

- Feb 2022: The International Atomic Energy Agency (IAEA) installed two new mammography units on Brazilian navy ships, delivering vital health services along South America's biggest waterway and significantly increasing breast cancer screening access in Brazil.

Strategic Mammography Devices Industry in South America Market Forecast

The mammography devices industry in South America is poised for substantial growth, driven by an increasing emphasis on early breast cancer detection and advancements in medical technology. The projected market expansion is fueled by government-backed screening initiatives, rising healthcare expenditure, and a growing understanding of the importance of regular mammography for women's health. The ongoing transition from traditional film screen mammography systems to sophisticated digital mammography and 3D mammography will remain a key growth catalyst, offering superior diagnostic precision and patient outcomes. Strategic investments in healthcare infrastructure and the increasing adoption of AI-driven diagnostic tools will further solidify the market's upward trajectory. The South America medical imaging market is expected to witness consistent growth throughout the forecast period, presenting lucrative opportunities for stakeholders focused on innovation and accessibility in radiology devices.

Mammography Devices Industry in South America Segmentation

-

1. Product

- 1.1. Digital Systems

- 1.2. Analog Systems

- 1.3. Breast Tomosynthesis

- 1.4. Film Screen Mammography Systems

- 1.5. Other Products

-

2. End User

- 2.1. Hospitals

- 2.2. Specialty Clinics

- 2.3. Diagnostic Centers

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

Mammography Devices Industry in South America Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

Mammography Devices Industry in South America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidences of Breast Cancer; Research and Development in the Field of Breast Cancer Therapies; Increasing Awareness Regarding Breast Cancer and its Screening

- 3.3. Market Restrains

- 3.3.1. Risk of Adverse Effects of Radiation Exposure

- 3.4. Market Trends

- 3.4.1. Digital Mammography Systems Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mammography Devices Industry in South America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Digital Systems

- 5.1.2. Analog Systems

- 5.1.3. Breast Tomosynthesis

- 5.1.4. Film Screen Mammography Systems

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Specialty Clinics

- 5.2.3. Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Brazil Mammography Devices Industry in South America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Digital Systems

- 6.1.2. Analog Systems

- 6.1.3. Breast Tomosynthesis

- 6.1.4. Film Screen Mammography Systems

- 6.1.5. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Specialty Clinics

- 6.2.3. Diagnostic Centers

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Argentina Mammography Devices Industry in South America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Digital Systems

- 7.1.2. Analog Systems

- 7.1.3. Breast Tomosynthesis

- 7.1.4. Film Screen Mammography Systems

- 7.1.5. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Specialty Clinics

- 7.2.3. Diagnostic Centers

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Rest of South America Mammography Devices Industry in South America Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Digital Systems

- 8.1.2. Analog Systems

- 8.1.3. Breast Tomosynthesis

- 8.1.4. Film Screen Mammography Systems

- 8.1.5. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Specialty Clinics

- 8.2.3. Diagnostic Centers

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Brazil Mammography Devices Industry in South America Analysis, Insights and Forecast, 2019-2031

- 10. Argentina Mammography Devices Industry in South America Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America Mammography Devices Industry in South America Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Siemens Healthineers

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Hologic Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 GE Healthcare

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Neusoft Medical

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fujifilm Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Koninklijke Philips NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 IMS Giotto SPA

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Canon Medical Systems Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Planmed Oy

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Konica Minolta*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Siemens Healthineers

List of Figures

- Figure 1: Mammography Devices Industry in South America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mammography Devices Industry in South America Share (%) by Company 2024

List of Tables

- Table 1: Mammography Devices Industry in South America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mammography Devices Industry in South America Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Mammography Devices Industry in South America Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Mammography Devices Industry in South America Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Mammography Devices Industry in South America Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mammography Devices Industry in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Mammography Devices Industry in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Mammography Devices Industry in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America Mammography Devices Industry in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mammography Devices Industry in South America Revenue Million Forecast, by Product 2019 & 2032

- Table 11: Mammography Devices Industry in South America Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Mammography Devices Industry in South America Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Mammography Devices Industry in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Mammography Devices Industry in South America Revenue Million Forecast, by Product 2019 & 2032

- Table 15: Mammography Devices Industry in South America Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Mammography Devices Industry in South America Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Mammography Devices Industry in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Mammography Devices Industry in South America Revenue Million Forecast, by Product 2019 & 2032

- Table 19: Mammography Devices Industry in South America Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Mammography Devices Industry in South America Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Mammography Devices Industry in South America Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mammography Devices Industry in South America?

The projected CAGR is approximately 9.13%.

2. Which companies are prominent players in the Mammography Devices Industry in South America?

Key companies in the market include Siemens Healthineers, Hologic Inc, GE Healthcare, Neusoft Medical, Fujifilm Corporation, Koninklijke Philips NV, IMS Giotto SPA, Canon Medical Systems Corporation, Planmed Oy, Konica Minolta*List Not Exhaustive.

3. What are the main segments of the Mammography Devices Industry in South America?

The market segments include Product, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 103.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidences of Breast Cancer; Research and Development in the Field of Breast Cancer Therapies; Increasing Awareness Regarding Breast Cancer and its Screening.

6. What are the notable trends driving market growth?

Digital Mammography Systems Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk of Adverse Effects of Radiation Exposure.

8. Can you provide examples of recent developments in the market?

Oct 2022, the Argentinean union Futbolistas Argentinos Agremiados (FAA) purchased a high-tech digital mammography unit that offers free care to its affiliated women's players.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mammography Devices Industry in South America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mammography Devices Industry in South America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mammography Devices Industry in South America?

To stay informed about further developments, trends, and reports in the Mammography Devices Industry in South America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence