Key Insights

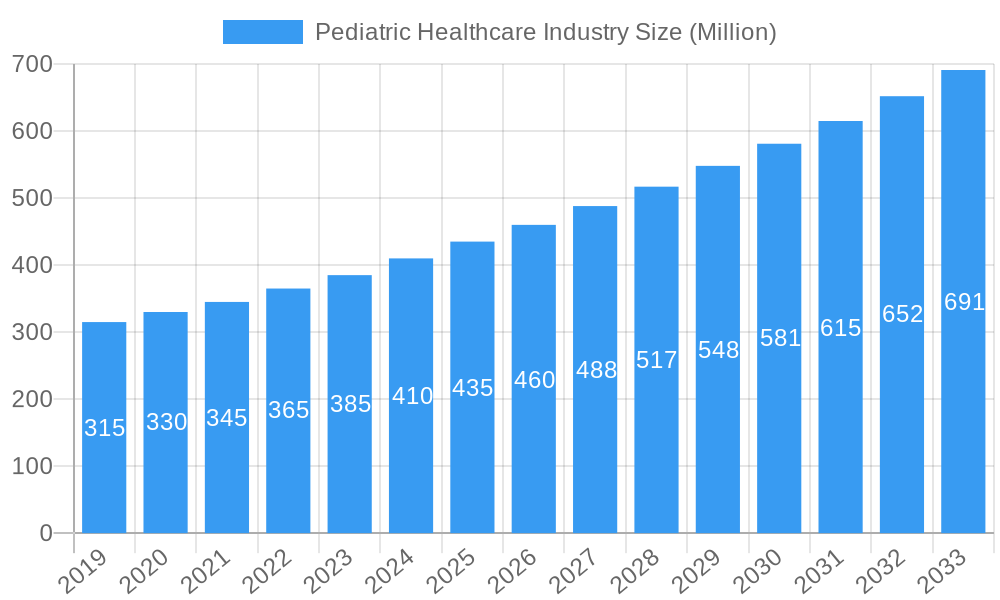

The Pediatric Healthcare Industry is poised for significant expansion, projected to reach an estimated market size of approximately $450 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.35% through 2033. This impressive growth trajectory is propelled by a confluence of factors, including increasing awareness of child-specific health needs, advancements in diagnostic technologies, and the expanding prevalence of both chronic and acute pediatric illnesses. The rising incidence of conditions like asthma, diabetes, and congenital disorders necessitates continuous innovation and investment in specialized treatments, driving market demand for sophisticated healthcare solutions. Furthermore, the growing emphasis on preventative care and the development of novel vaccines to combat childhood diseases are key contributors to this positive market outlook. The industry is characterized by a strong focus on research and development, with pharmaceutical and biotechnology companies actively pursuing innovative drugs and therapies to address unmet medical needs in the pediatric population.

Pediatric Healthcare Industry Market Size (In Million)

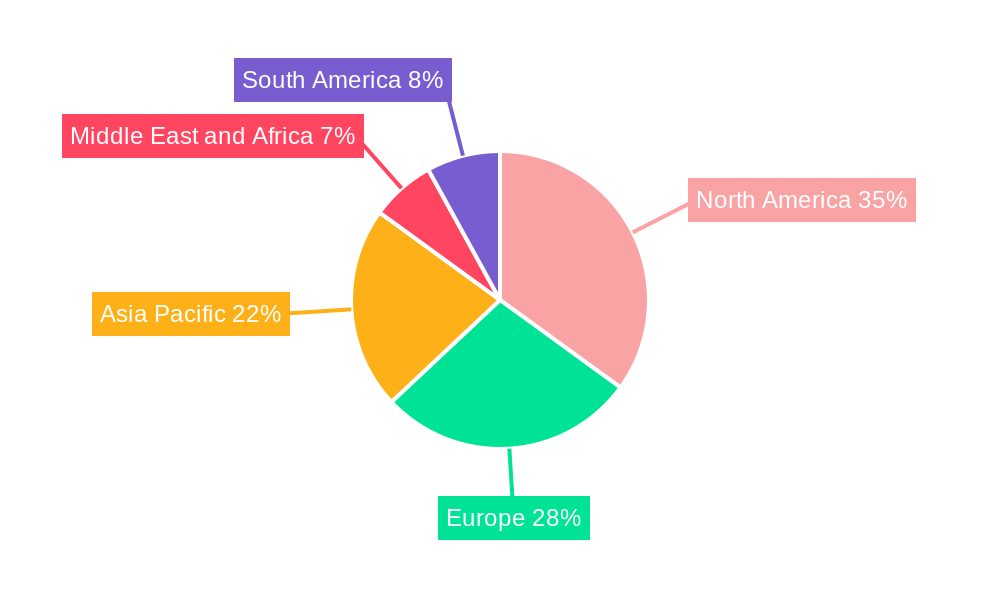

The market's segmentation reveals a balanced demand across various treatment modalities. Vaccines and drugs represent the primary revenue streams, reflecting the ongoing need for infectious disease prevention and the management of existing pediatric conditions. However, the "Others" segment, encompassing advanced diagnostic tools, specialized medical devices, and supportive care services, is also anticipated to witness substantial growth as healthcare providers increasingly adopt a holistic approach to pediatric well-being. Geographically, North America and Europe are expected to maintain their dominance, owing to well-established healthcare infrastructures, high per capita healthcare spending, and a strong regulatory framework supporting pediatric drug development. The Asia Pacific region, however, is emerging as a high-growth market, driven by a large pediatric population, improving healthcare access, and increasing disposable incomes. Key players like Pfizer, Johnson & Johnson, and Novartis are strategically investing in this dynamic market to capitalize on its vast potential.

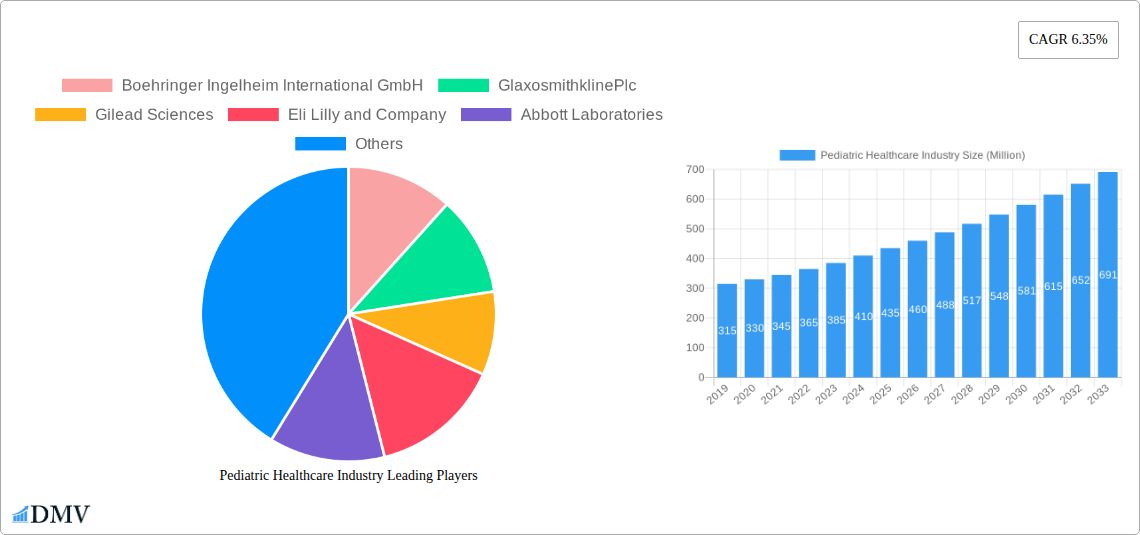

Pediatric Healthcare Industry Company Market Share

Unlocking the Future of Child Health: A Comprehensive Pediatric Healthcare Market Analysis (2019-2033)

This in-depth report delves into the dynamic Pediatric Healthcare Industry, a critical and rapidly evolving sector focused on the well-being of children. Analyze market composition, emerging trends, technological advancements, and strategic forecasts from 2019 to 2033, with a base year of 2025. Understand the competitive landscape, key growth drivers, and pivotal industry developments shaping pediatric medicine. This report is essential for stakeholders including pharmaceutical companies, biotech firms, healthcare providers, investors, and policymakers seeking to navigate and capitalize on this vital market.

Pediatric Healthcare Industry Market Composition & Trends

The pediatric healthcare market is characterized by a dynamic interplay of innovation, regulatory influence, and evolving disease patterns. Market concentration varies across segments, with a notable presence of major global pharmaceutical players. Innovation is primarily driven by the unmet needs in chronic pediatric diseases and the development of novel vaccines and targeted drug therapies. Regulatory bodies play a crucial role in ensuring the safety and efficacy of pediatric treatments, often necessitating extensive clinical trials tailored for young populations. Substitute products, while less prevalent in specialized pediatric care, can emerge in areas like over-the-counter remedies for common acute illnesses. End-user profiles encompass a broad spectrum, from infants and toddlers to adolescents, each with distinct healthcare requirements. Merger and acquisition (M&A) activities are strategic moves to expand product portfolios, enhance research capabilities, and gain market share. Estimated M&A deal values are projected to be in the hundreds of millions of dollars annually within the forecast period. Key market share distribution is concentrated among a few leading companies, with ongoing efforts to penetrate emerging markets and address rare pediatric conditions.

Pediatric Healthcare Industry Industry Evolution

The pediatric healthcare industry has witnessed significant evolution, driven by scientific breakthroughs, a growing understanding of childhood diseases, and an increasing emphasis on preventative care. Over the historical period (2019-2024), the market experienced steady growth, fueled by rising global birth rates and a greater prevalence of both chronic and acute childhood illnesses. Technological advancements have been a cornerstone of this evolution, with the development of more precise diagnostic tools, targeted therapeutic agents, and advanced drug delivery systems specifically designed for children. For instance, the adoption of gene therapies for rare genetic disorders in pediatrics has seen a projected growth rate of over 15% annually in recent years. Furthermore, the demand for vaccines has seen an unprecedented surge, particularly in response to global health crises, leading to a compound annual growth rate (CAGR) of approximately 8% for the pediatric vaccine segment. Shifting consumer demands, driven by greater parental awareness and access to health information, have also influenced market trajectories. Parents are increasingly seeking personalized treatment plans, minimally invasive procedures, and evidence-based, safe, and effective interventions for their children. This has prompted a greater focus on patient-centric care models and the development of medications with improved safety profiles and reduced side effects in pediatric populations. The market has also responded to the growing burden of chronic conditions like asthma, diabetes, and juvenile arthritis, leading to increased investment in research and development for long-term management solutions. The increasing integration of digital health technologies, such as telemedicine and wearable devices for monitoring pediatric patients, is another significant trend that has accelerated market evolution. These innovations not only improve accessibility to healthcare but also enhance the quality of care and patient outcomes. The industry's ability to adapt to these evolving demands and technological landscapes will be crucial for sustained growth and impact in the upcoming forecast period (2025-2033).

Leading Regions, Countries, or Segments in Pediatric Healthcare Industry

The Vaccines segment consistently demonstrates dominance within the pediatric healthcare industry, driven by robust public health initiatives and a growing global commitment to infectious disease prevention. Countries with strong governmental healthcare infrastructure and significant investment in immunization programs, such as the United States, lead this charge. The U.S. market for pediatric vaccines is estimated to be worth over $10 Billion annually.

- Key Drivers for Vaccine Dominance:

- Mandatory Vaccination Policies: Many developed nations have stringent mandatory vaccination schedules for school entry, ensuring consistent demand for a wide range of pediatric vaccines.

- Public Health Investment: Governments worldwide allocate substantial budgets towards national immunization programs, fostering market expansion and accessibility.

- Prevalence of Infectious Diseases: Despite advancements, the ongoing threat of infectious diseases, including newly emerging strains, necessitates continuous vaccine development and uptake.

- Technological Advancements: Continuous research into novel vaccine platforms, such as mRNA technology, offers improved efficacy and safety profiles, further stimulating market growth. The introduction of vaccines for conditions like rotavirus and pneumococcal disease has dramatically reduced childhood morbidity and mortality, solidifying their importance.

While vaccines represent a powerhouse, the Drugs segment, particularly for Chronic Illness, is experiencing substantial growth. This is fueled by the rising incidence of chronic conditions such as pediatric cancers, autoimmune disorders, and rare genetic diseases. Companies are heavily investing in novel drug discovery and development, with a focus on targeted therapies and personalized medicine. The market for pediatric oncology drugs alone is projected to exceed $5 Billion annually by 2028, driven by breakthroughs in precision medicine and immunotherapy.

- Dominance Factors in Chronic Illness Drug Segment:

- Increasing Prevalence: A concerning rise in chronic childhood conditions necessitates long-term and often complex treatment regimens.

- R&D Investments: Pharmaceutical giants are channeling significant resources into research for pediatric-specific chronic disease treatments, leading to a pipeline of innovative therapies.

- Orphan Drug Designations: Incentives for developing treatments for rare pediatric diseases accelerate the drug development process and market entry.

- Advancements in Biomarkers: The identification of specific biomarkers allows for more targeted and effective drug interventions in complex chronic conditions.

The Acute Illness segment, while consistently present, experiences more cyclical demand influenced by seasonal outbreaks and emerging pathogens. However, innovations in antiviral and antibacterial treatments continue to drive its market value. Overall, the synergy between robust vaccine programs and the expanding pipeline of drugs for chronic conditions underscores the multifaceted growth drivers within the pediatric healthcare industry.

Pediatric Healthcare Industry Product Innovations

Product innovations in pediatric healthcare are increasingly focused on enhancing efficacy, safety, and patient compliance. The development of novel drug formulations, such as chewable tablets, liquid suspensions with improved palatability, and extended-release mechanisms, is significantly improving adherence in young patients. Advances in gene therapy and cell-based therapies are revolutionizing the treatment of rare genetic disorders and certain cancers, offering curative potential for previously untreatable conditions. For instance, gene therapies for spinal muscular atrophy have demonstrated remarkable outcomes. Furthermore, the integration of smart drug delivery devices and connected inhalers for respiratory conditions offers real-time monitoring and personalized dosage adjustments, optimizing treatment outcomes and empowering caregivers.

Propelling Factors for Pediatric Healthcare Industry Growth

Several key factors are propelling the growth of the pediatric healthcare industry. Technologically, the rapid advancement of gene editing tools like CRISPR-Cas9 and the widespread adoption of artificial intelligence in drug discovery are accelerating the development of novel and highly targeted therapies for pediatric diseases. Economically, increasing disposable incomes in emerging economies are leading to greater healthcare expenditure on children's well-being, driving demand for advanced treatments and preventative care. Regulatory support, including expedited review pathways for pediatric drugs and orphan drug designations, incentivizes pharmaceutical companies to invest in this crucial market segment, ensuring a robust pipeline of life-saving innovations.

Obstacles in the Pediatric Healthcare Industry Market

Despite its growth, the pediatric healthcare industry faces significant obstacles. Regulatory hurdles, particularly the extensive clinical trials required to ensure the safety and efficacy of drugs in vulnerable pediatric populations, can prolong development timelines and increase costs. Supply chain disruptions, exacerbated by global events, can impact the availability of essential medications and vaccines, leading to shortages that affect patient care. Furthermore, the inherent complexity and often smaller market size for specific pediatric conditions can lead to limited commercial incentives for some rare disease treatments, creating access challenges. Competitive pressures among a growing number of specialized biotechnology firms also necessitate continuous innovation and cost-effectiveness.

Future Opportunities in Pediatric Healthcare Industry

The pediatric healthcare industry is ripe with future opportunities. The burgeoning field of personalized medicine, leveraging genetic profiling to tailor treatments for individual children, presents a significant avenue for growth. The increasing focus on preventative care and early intervention for chronic diseases like obesity and diabetes in children will drive demand for innovative diagnostic tools and lifestyle management solutions. Furthermore, the expansion of telemedicine and digital health platforms offers immense potential to improve access to specialized pediatric care in underserved regions, bridging geographical barriers and enhancing patient monitoring. The development of novel vaccines for emerging infectious diseases and the continued innovation in therapies for rare pediatric cancers and genetic disorders will also be key growth areas.

Major Players in the Pediatric Healthcare Industry Ecosystem

- Boehringer Ingelheim International GmbH

- Glaxosmithkline Plc

- Gilead Sciences

- Eli Lilly and Company

- Abbott Laboratories

- Eisai Co

- Viatris

- The Procter & Gamble Company

- Johnson & Johnson

- Novartis International AG

- Sanofi S A

- Pfizer Inc

Key Developments in Pediatric Healthcare Industry Industry

- April 2022: Gilead opened a pediatric drug development center in Ireland. The new pediatric center will conduct pediatric clinical trials for seven products across 18 countries, significantly bolstering its research capabilities in pediatric therapeutics.

- February 2022: Pfizer Inc., and BioNTech initiated a rolling submission seeking to amend the Emergency Use Authorization (EUA) of the Pfizer-BioNTech COVID-19 Vaccine to include children 6 months through 4 years of age, addressing the urgent public health need in this age group and expanding vaccine accessibility.

Strategic Pediatric Healthcare Industry Market Forecast

The pediatric healthcare industry is poised for robust growth, driven by an increasing focus on child health and significant advancements in medical science. The forecast period (2025–2033) will be characterized by the expanding application of gene and cell therapies for rare pediatric diseases, alongside the continued dominance of vaccine development in combating infectious diseases. Personalized medicine, enabled by genetic insights and AI-driven drug discovery, will revolutionize treatment paradigms. Growing parental awareness and demand for high-quality, accessible pediatric care, especially in emerging markets, will further fuel market expansion, presenting lucrative opportunities for stakeholders committed to innovation and improving child well-being.

Pediatric Healthcare Industry Segmentation

-

1. Type

- 1.1. Chronic Illness

- 1.2. Acute Illness

-

2. Treatment

- 2.1. Vaccines

- 2.2. Drugs

- 2.3. Others

Pediatric Healthcare Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pediatric Healthcare Industry Regional Market Share

Geographic Coverage of Pediatric Healthcare Industry

Pediatric Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Pediatric Diseases; Increased R&D Activities and Awareness of Pediatric Medicine Among Public; Increasing Availability of Advanced Technologies To Provide Continuous Care

- 3.3. Market Restrains

- 3.3.1. Small Size of Study Population and Ethical Issues in Pediatric Research; Complications Associated with the Medicines

- 3.4. Market Trends

- 3.4.1. Chronic Illness Segment Is Expected To Hold The Major Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pediatric Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chronic Illness

- 5.1.2. Acute Illness

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Vaccines

- 5.2.2. Drugs

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Pediatric Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chronic Illness

- 6.1.2. Acute Illness

- 6.2. Market Analysis, Insights and Forecast - by Treatment

- 6.2.1. Vaccines

- 6.2.2. Drugs

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Pediatric Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chronic Illness

- 7.1.2. Acute Illness

- 7.2. Market Analysis, Insights and Forecast - by Treatment

- 7.2.1. Vaccines

- 7.2.2. Drugs

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Pediatric Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chronic Illness

- 8.1.2. Acute Illness

- 8.2. Market Analysis, Insights and Forecast - by Treatment

- 8.2.1. Vaccines

- 8.2.2. Drugs

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Pediatric Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chronic Illness

- 9.1.2. Acute Illness

- 9.2. Market Analysis, Insights and Forecast - by Treatment

- 9.2.1. Vaccines

- 9.2.2. Drugs

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Pediatric Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chronic Illness

- 10.1.2. Acute Illness

- 10.2. Market Analysis, Insights and Forecast - by Treatment

- 10.2.1. Vaccines

- 10.2.2. Drugs

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boehringer Ingelheim International GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GlaxosmithklinePlc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gilead Sciences

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eli Lilly and Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbott Laboratories

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eisai Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Viatris

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Procter & Gamble Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Novartis International AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sanofi S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pfizer Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Boehringer Ingelheim International GmbH

List of Figures

- Figure 1: Global Pediatric Healthcare Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pediatric Healthcare Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Pediatric Healthcare Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Pediatric Healthcare Industry Revenue (Million), by Treatment 2025 & 2033

- Figure 5: North America Pediatric Healthcare Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 6: North America Pediatric Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Pediatric Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pediatric Healthcare Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Pediatric Healthcare Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Pediatric Healthcare Industry Revenue (Million), by Treatment 2025 & 2033

- Figure 11: Europe Pediatric Healthcare Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 12: Europe Pediatric Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Pediatric Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pediatric Healthcare Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Pediatric Healthcare Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Pediatric Healthcare Industry Revenue (Million), by Treatment 2025 & 2033

- Figure 17: Asia Pacific Pediatric Healthcare Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 18: Asia Pacific Pediatric Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Pediatric Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Pediatric Healthcare Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East and Africa Pediatric Healthcare Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Pediatric Healthcare Industry Revenue (Million), by Treatment 2025 & 2033

- Figure 23: Middle East and Africa Pediatric Healthcare Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 24: Middle East and Africa Pediatric Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Pediatric Healthcare Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Pediatric Healthcare Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Pediatric Healthcare Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Pediatric Healthcare Industry Revenue (Million), by Treatment 2025 & 2033

- Figure 29: South America Pediatric Healthcare Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 30: South America Pediatric Healthcare Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Pediatric Healthcare Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pediatric Healthcare Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Pediatric Healthcare Industry Revenue Million Forecast, by Treatment 2020 & 2033

- Table 3: Global Pediatric Healthcare Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Pediatric Healthcare Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Pediatric Healthcare Industry Revenue Million Forecast, by Treatment 2020 & 2033

- Table 6: Global Pediatric Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Pediatric Healthcare Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Pediatric Healthcare Industry Revenue Million Forecast, by Treatment 2020 & 2033

- Table 12: Global Pediatric Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Pediatric Healthcare Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Pediatric Healthcare Industry Revenue Million Forecast, by Treatment 2020 & 2033

- Table 21: Global Pediatric Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Pediatric Healthcare Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Pediatric Healthcare Industry Revenue Million Forecast, by Treatment 2020 & 2033

- Table 30: Global Pediatric Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Pediatric Healthcare Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Pediatric Healthcare Industry Revenue Million Forecast, by Treatment 2020 & 2033

- Table 36: Global Pediatric Healthcare Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Pediatric Healthcare Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pediatric Healthcare Industry?

The projected CAGR is approximately 6.35%.

2. Which companies are prominent players in the Pediatric Healthcare Industry?

Key companies in the market include Boehringer Ingelheim International GmbH, GlaxosmithklinePlc, Gilead Sciences, Eli Lilly and Company, Abbott Laboratories, Eisai Co, Viatris, The Procter & Gamble Company, Johnson & Johnson, Novartis International AG, Sanofi S A, Pfizer Inc.

3. What are the main segments of the Pediatric Healthcare Industry?

The market segments include Type, Treatment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Pediatric Diseases; Increased R&D Activities and Awareness of Pediatric Medicine Among Public; Increasing Availability of Advanced Technologies To Provide Continuous Care.

6. What are the notable trends driving market growth?

Chronic Illness Segment Is Expected To Hold The Major Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Small Size of Study Population and Ethical Issues in Pediatric Research; Complications Associated with the Medicines.

8. Can you provide examples of recent developments in the market?

In April 2022, Gilead opened a pediatric drug development center in Ireland. The new pediatric center out of Ireland will conduct pediatric clinical trials for seven products across 18 countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pediatric Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pediatric Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pediatric Healthcare Industry?

To stay informed about further developments, trends, and reports in the Pediatric Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence