Key Insights

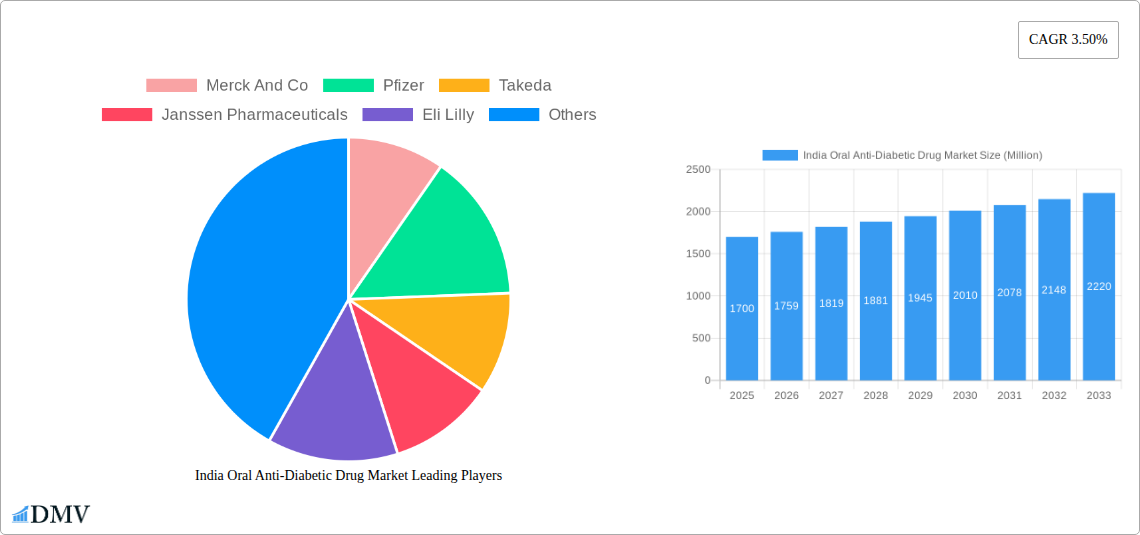

The Indian Oral Anti-Diabetic Drug Market is poised for substantial growth, projected to reach approximately \$1.7 billion with a Compound Annual Growth Rate (CAGR) of 3.50% during the forecast period of 2025-2033. This expansion is primarily fueled by the escalating prevalence of diabetes in India, driven by changing lifestyles, increasing obesity rates, and a growing aging population. The rising awareness regarding diabetes management and the availability of a diverse range of oral anti-diabetic medications, including Biguanides (Metformin), DPP-4 inhibitors, and SGLT-2 inhibitors, are further bolstering market growth. Metformin, a cornerstone therapy, continues to dominate due to its efficacy and affordability. However, newer classes of drugs like SGLT-2 inhibitors and DPP-4 inhibitors are gaining traction owing to their improved safety profiles and added cardiovascular and renal benefits, especially for Type 2 diabetes patients. The increasing healthcare expenditure and supportive government initiatives aimed at improving diabetes care accessibility also contribute to this positive market trajectory.

India Oral Anti-Diabetic Drug Market Market Size (In Billion)

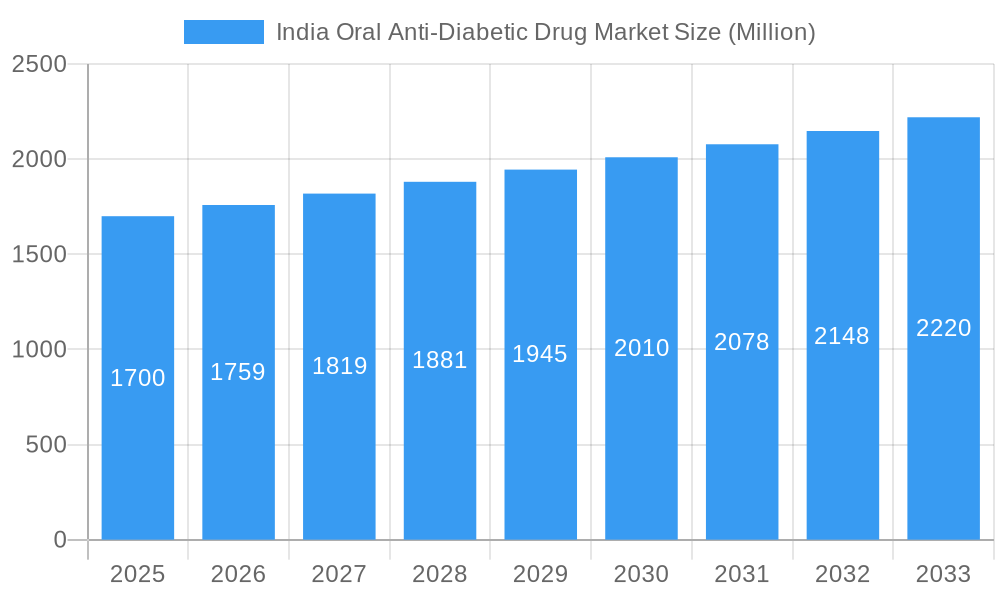

The market segmentation reveals a strong focus on Type 2 diabetes, which accounts for the vast majority of diagnosed cases in India, consequently driving demand for oral anti-diabetic drugs. While Type 1 diabetes requires insulin, the oral anti-diabetic segment remains critical for managing the ever-growing Type 2 population. Key players such as Sanofi, Novo Nordisk, Merck & Co., and Eli Lilly are actively engaged in research and development, introducing innovative formulations and combination therapies to cater to the evolving patient needs. Market restraints include the relatively high cost of some newer generation drugs, which can limit accessibility for a segment of the population, and the persistent reliance on older, less effective therapies in certain regions. Nonetheless, the increasing emphasis on early diagnosis, personalized treatment approaches, and the growing preference for oral medications over injectables for convenience are expected to propel the Indian Oral Anti-Diabetic Drug Market to new heights.

India Oral Anti-Diabetic Drug Market Company Market Share

This in-depth report delivers a granular examination of the India Oral Anti-Diabetic Drug Market, a rapidly expanding sector driven by a surging prevalence of diabetes and increasing healthcare expenditure. Covering the historical period of 2019-2024, base year of 2025, and an extensive forecast period from 2025 to 2033, this analysis provides actionable insights for stakeholders. We dissect market composition, industry evolution, product innovations, leading segments, growth drivers, obstacles, and future opportunities, empowering strategic decision-making. Explore the competitive landscape featuring giants like Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, and Astellas. Dive deep into Oral Anti-Diabetic Drugs categorized by Biguanides (Metformin), Alpha-Glucosidase Inhibitors, Dopamine D2 receptor agonist (Bromocriptin), SGLT-2 inhibitors, DPP-4 inhibitors, Sulfonylureas, and Meglitinides, with a sharp focus on Type 1 Diabetes and Type 2 Diabetes end-users.

India Oral Anti-Diabetic Drug Market Market Composition & Trends

The India Oral Anti-Diabetic Drug Market is characterized by a dynamic interplay of established players and emerging innovators, contributing to a moderate to high concentration. Key innovation catalysts include the relentless pursuit of novel drug formulations, fixed-dose combinations (FDCs), and drugs targeting multiple pathways of glycemic control. The regulatory landscape, overseen by bodies like the CDSCO, plays a pivotal role in drug approvals and market access. Substitute products, including insulin therapies and lifestyle interventions, present a competitive pressure, but the convenience and cost-effectiveness of oral anti-diabetics ensure their sustained demand. End-user profiles are increasingly sophisticated, with a growing demand for patient-centric treatments and drugs addressing comorbid conditions. Mergers and acquisitions (M&A) are expected to shape market consolidation, with potential deal values influencing strategic alliances and market share distribution. The market’s evolution is heavily influenced by R&D investments and strategic collaborations to bring advanced therapies to market.

India Oral Anti-Diabetic Drug Market Industry Evolution

The India Oral Anti-Diabetic Drug Market has witnessed remarkable evolution driven by a confluence of factors, including a rapidly growing diabetic population, increasing health awareness, and advancements in pharmaceutical research. Historically, the market was dominated by older generation drugs like Sulfonylureas and Biguanides, primarily Metformin, due to their affordability and efficacy in managing Type 2 Diabetes. However, over the historical period of 2019-2024, a paradigm shift has occurred with the introduction and widespread adoption of newer drug classes. The rise in metabolic syndrome and lifestyle diseases has significantly propelled the demand for effective and safer anti-diabetic medications. Technological advancements in drug discovery and development have led to the introduction of novel mechanisms of action, such as SGLT-2 inhibitors and DPP-4 inhibitors, which offer improved glycemic control with added benefits like cardiovascular and renal protection. These advancements have not only broadened treatment options but have also addressed the unmet needs of patients with specific complications. The base year of 2025 signifies a mature market where established players are focusing on market penetration and expansion, while new entrants are leveraging innovative molecules. The forecast period of 2025–2033 is projected to witness sustained growth, fueled by the increasing affordability of newer oral anti-diabetic drugs, growing acceptance of combination therapies, and a greater emphasis on personalized medicine. Shifting consumer demands are evident in the preference for drugs that offer a lower risk of hypoglycemia, weight neutrality or loss, and positive cardiovascular outcomes. The market growth trajectory is also influenced by government initiatives aimed at improving diabetes management and access to essential medicines. For instance, increased out-of-pocket spending on healthcare, coupled with the expansion of health insurance coverage, further bolsters the demand for advanced oral anti-diabetic therapies. The penetration of these newer drug classes is expected to accelerate, driven by clinical evidence and physician recommendations, leading to a diversified and sophisticated market landscape by 2033. The continuous introduction of generic versions of innovator drugs also plays a crucial role in expanding market access and affordability, contributing to overall industry growth.

Leading Regions, Countries, or Segments in India Oral Anti-Diabetic Drug Market

Within the India Oral Anti-Diabetic Drug Market, the Type 2 Diabetes segment commands a substantial and continuously growing market share, driven by its overwhelming prevalence across the nation. This dominance is further amplified by the widespread availability and physician preference for Biguanides (Metformin), which remains the first-line therapy for most Type 2 diabetic patients due to its efficacy, safety profile, and affordability. However, the market is witnessing a significant upward trajectory in the adoption of newer segments like DPP-4 inhibitors and SGLT-2 inhibitors. These classes are increasingly being prescribed, especially for patients requiring enhanced glycemic control or those with specific cardiovascular or renal risk factors, reflecting a move towards more targeted and beneficial therapies. The End-User: Type 2 Diabetes segment’s growth is propelled by several key drivers.

- Prevalence of Lifestyle Diseases: India's rapidly urbanizing population and changing lifestyles have led to an epidemic of obesity and sedentary habits, directly contributing to the high incidence of Type 2 Diabetes. This demographic reality ensures a consistent and expanding patient pool.

- Increased Health Awareness and Diagnosis: Growing public awareness about diabetes and its complications, coupled with improved diagnostic capabilities and accessibility of healthcare services, has led to earlier and more frequent diagnoses, further expanding the Type 2 Diabetes market.

- Advancements in Drug Development: The continuous innovation in oral anti-diabetic drug classes, offering improved efficacy, reduced side effects, and added cardiovascular and renal benefits, makes them increasingly attractive treatment options for Type 2 Diabetes management.

- Affordability and Accessibility of Metformin: As the cornerstone of Type 2 Diabetes treatment, Metformin’s low cost and wide availability ensure its continued dominance in the market, making it the foundational segment for many treatment regimens.

- Growing Demand for Combination Therapies: The increasing complexity of diabetes management, especially in Type 2 Diabetes, fuels the demand for fixed-dose combinations (FDCs) that simplify treatment adherence and improve therapeutic outcomes. The recent introduction of triple-FDC by Glenmark Pharmaceuticals underscores this trend.

While Type 1 Diabetes patients predominantly rely on insulin, there is a growing research interest and limited application of specific oral anti-diabetics in certain management strategies. However, the sheer volume of Type 2 Diabetes cases positions it as the undisputed leader in the Indian oral anti-diabetic drug market. The dominance of Biguanides (Metformin) within the Type 2 Diabetes segment is deeply entrenched, but the strategic growth of DPP-4 inhibitors and SGLT-2 inhibitors signifies a maturing market that is embracing newer, evidence-based therapeutic approaches.

India Oral Anti-Diabetic Drug Market Product Innovations

Product innovation in the India Oral Anti-Diabetic Drug Market is primarily focused on enhancing therapeutic efficacy, improving safety profiles, and simplifying patient adherence. Key advancements include the development of novel fixed-dose combinations (FDCs) that consolidate multiple active pharmaceutical ingredients into a single pill, thereby reducing pill burden and improving compliance for patients managing complex glycemic profiles. For instance, the recent launch of a triple-FDC by Glenmark Pharmaceuticals, combining Teneligliptin, Dapagliflozin, and Metformin, exemplifies this trend, targeting patients requiring multifaceted diabetes management. Furthermore, ongoing research is exploring drug molecules with improved pharmacokinetic and pharmacodynamic properties, aiming to reduce side effects like hypoglycemia and gastrointestinal disturbances. The integration of SGLT-2 inhibitors into treatment algorithms, particularly for patients with Type 2 Diabetes and chronic kidney disease, as indicated by AstraZeneca India’s approval for Dapagliflozin, highlights innovation in addressing specific comorbidities. These product innovations are crucial for differentiating offerings and meeting the evolving needs of the Indian diabetic population.

Propelling Factors for India Oral Anti-Diabetic Drug Market Growth

The India Oral Anti-Diabetic Drug Market is propelled by a robust set of factors. A significant driver is the ever-increasing prevalence of diabetes in India, fueled by lifestyle changes, urbanization, and an aging population. This demographic shift directly translates to a larger patient pool requiring therapeutic interventions. Government initiatives and rising healthcare expenditure are also crucial, as they improve access to quality healthcare and medications. Furthermore, advancements in pharmaceutical research and development continuously introduce novel oral anti-diabetic drugs with improved efficacy, safety profiles, and added benefits such as cardiovascular protection, thus expanding treatment options and patient acceptance. The growing awareness among patients and healthcare professionals regarding diabetes management and the availability of advanced oral therapies also plays a vital role. Finally, the cost-effectiveness of oral anti-diabetic drugs compared to certain injectable therapies makes them a preferred choice for a vast segment of the Indian population.

Obstacles in the India Oral Anti-Diabetic Drug Market Market

Despite robust growth, the India Oral Anti-Diabetic Drug Market faces several obstacles. Stringent regulatory pathways and evolving compliance standards can lead to delays in new drug approvals and market entry. Price sensitivity and affordability concerns remain a significant barrier, particularly for newer, high-cost medications, even with the presence of generics. Supply chain disruptions and manufacturing complexities, especially in a vast and diverse country like India, can impact product availability and cost. Furthermore, intense competition from both domestic and international players, including the pressure from generic drug manufacturers, can lead to price erosion and impact profit margins. The limited availability of advanced diagnostic tools and patient education programs in certain regions can also hinder optimal drug selection and adherence.

Future Opportunities in India Oral Anti-Diabetic Drug Market

The India Oral Anti-Diabetic Drug Market presents numerous future opportunities. The increasing demand for combination therapies and fixed-dose combinations (FDCs) offers a significant avenue for market expansion, simplifying treatment regimens and improving patient compliance. The growing focus on personalized medicine and genetic profiling will drive the development of tailored oral anti-diabetic treatments. Furthermore, the untapped potential in rural and semi-urban areas offers substantial growth opportunities, provided access and affordability challenges are addressed. The emergence of novel drug classes with enhanced cardiovascular and renal benefits will cater to the growing awareness of diabetes comorbidities. Finally, strategic partnerships and collaborations between pharmaceutical companies, research institutions, and healthcare providers can accelerate innovation and market penetration, capitalizing on the dynamic Indian healthcare landscape.

Major Players in the India Oral Anti-Diabetic Drug Market Ecosystem

- Merck And Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- Sanofi

- AstraZeneca

- Bristol Myers Squibb

- Novo Nordisk

- Boehringer Ingelheim

- Astellas

Key Developments in India Oral Anti-Diabetic Drug Market Industry

- October 2023: Glenmark Pharmaceuticals announced the release of a new triple-fixed-dose combination (FDC) medication for diabetes treatment, unveiling the blend of Teneligliptin, Dapagliflozin, and Metformin under the brand name Zita.

- January 2022: Novo Nordisk announced the launch of oral semaglutide in India for the treatment of type 2 diabetes.

- November 2022: AstraZeneca India received approval from the Central Drugs Standard Control Organization (CDCSCO) to market its anti-diabetes drug Dapagliflozin, indicated for diabetes patients with chronic kidney disease (CKD).

Strategic India Oral Anti-Diabetic Drug Market Market Forecast

The India Oral Anti-Diabetic Drug Market is poised for sustained and significant growth, projected to expand at a robust CAGR over the forecast period. Key growth catalysts include the escalating burden of diabetes in India, coupled with increased health consciousness and improved access to healthcare. The continuous innovation in drug development, particularly the introduction of newer drug classes with enhanced efficacy and protective benefits against cardiovascular and renal complications, will be a major growth driver. Furthermore, the growing preference for oral medications due to their convenience and cost-effectiveness, alongside the increasing adoption of fixed-dose combinations, will significantly contribute to market expansion. Strategic investments in research and development, coupled with favorable government policies aimed at enhancing diabetes management, will further bolster the market's trajectory, creating substantial opportunities for market players.

India Oral Anti-Diabetic Drug Market Segmentation

-

1. Type

- 1.1. Oral Ant: Biguanides(Metformin)

- 1.2. Alpha-Glucosidase Inhibitors

- 1.3. Dopamine D2 receptor agonist(Bromocriptin)

- 1.4. SGLT-2 inhibitors

- 1.5. DPP-4 inhibitors

- 1.6. Sulfonylureas

- 1.7. Meglitinides

-

2. End-User

- 2.1. Type 1 Diabetes

- 2.2. Type 2 Diabetes

India Oral Anti-Diabetic Drug Market Segmentation By Geography

- 1. India

India Oral Anti-Diabetic Drug Market Regional Market Share

Geographic Coverage of India Oral Anti-Diabetic Drug Market

India Oral Anti-Diabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Sodium-glucose Cotransport-2 (SGLT-2) inhibitor Segment Occupied the Highest Market Share in India Oral Anti-Diabetic Drugs Market in current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Oral Ant: Biguanides(Metformin)

- 5.1.2. Alpha-Glucosidase Inhibitors

- 5.1.3. Dopamine D2 receptor agonist(Bromocriptin)

- 5.1.4. SGLT-2 inhibitors

- 5.1.5. DPP-4 inhibitors

- 5.1.6. Sulfonylureas

- 5.1.7. Meglitinides

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Type 1 Diabetes

- 5.2.2. Type 2 Diabetes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanofi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AstraZeneca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novo Nordisk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Boehringer Ingelheim

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: India Oral Anti-Diabetic Drug Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Oral Anti-Diabetic Drug Market Share (%) by Company 2025

List of Tables

- Table 1: India Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: India Oral Anti-Diabetic Drug Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: India Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: India Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: India Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: India Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: India Oral Anti-Diabetic Drug Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: India Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: India Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Oral Anti-Diabetic Drug Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the India Oral Anti-Diabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Astellas.

3. What are the main segments of the India Oral Anti-Diabetic Drug Market?

The market segments include Type , End-User .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.7 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Sodium-glucose Cotransport-2 (SGLT-2) inhibitor Segment Occupied the Highest Market Share in India Oral Anti-Diabetic Drugs Market in current year.

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

October 2023: Glenmark Pharmaceuticals has announced the release of a new triple-fixed-dose combination (FDC) medication for diabetes treatment. The company, headquartered in Mumbai, has unveiled the blend of Teneligliptin, Dapagliflozin, and Metformin under the brand name Zita.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Oral Anti-Diabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Oral Anti-Diabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Oral Anti-Diabetic Drug Market?

To stay informed about further developments, trends, and reports in the India Oral Anti-Diabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence