Key Insights

The global Sleep Disorder Treatment market is projected to reach $23.34 billion by 2025, demonstrating a Compound Annual Growth Rate (CAGR) of 7.12% through 2033. This growth is propelled by increasing sleep disorder prevalence due to lifestyle factors, rising patient and provider awareness, and significant advancements in pharmaceutical R&D. The growing incidence of insomnia, often linked to stress, irregular schedules, and screen time, is a key driver. Enhanced understanding of long-term health risks associated with untreated sleep apnea and narcolepsy also fuels demand for effective treatments. The market is shifting towards more targeted and safer drug classes. While benzodiazepines were historically dominant, newer treatments like nonbenzodiazepines, orexin antagonists, and melatonin receptor agonists are gaining prominence for their superior efficacy and reduced side effects.

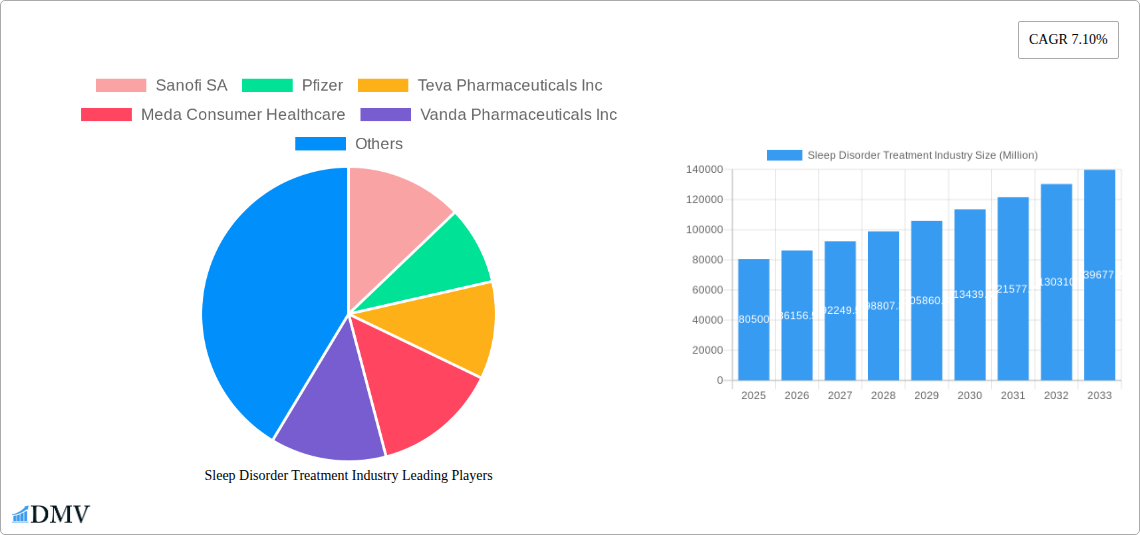

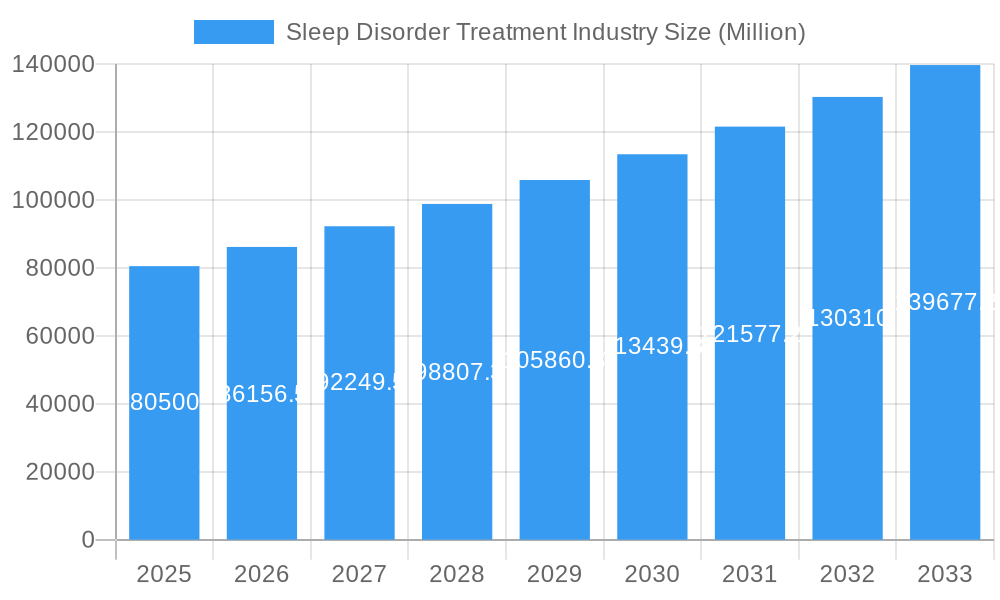

Sleep Disorder Treatment Industry Market Size (In Billion)

The competitive environment features established pharmaceutical companies and innovative biotech firms actively pursuing R&D for novel drug candidates and improved therapies. Key industry players are investing in clinical trials and strategic partnerships. Emerging trends include personalized medicine and the integration of digital health solutions for enhanced patient monitoring and adherence. Market restraints involve stringent regulatory approval processes, potential drug side effects, and a growing preference for non-pharmacological interventions for milder sleep issues. Despite these challenges, the persistent demand for effective sleep disorder management, coupled with continuous innovation, ensures a positive outlook for the sleep disorder treatment industry.

Sleep Disorder Treatment Industry Company Market Share

Unveiling the Future of Rest: A Comprehensive Report on the Sleep Disorder Treatment Industry

This in-depth market intelligence report provides a panoramic view of the burgeoning sleep disorder treatment industry, a critical sector addressing the widespread impact of sleep disturbances. Spanning the historical period of 2019–2024 and projecting to 2033, this analysis delves into market dynamics, technological advancements, and strategic opportunities. With the base year set at 2025, this report leverages extensive research to equip stakeholders with actionable insights for navigating the complex sleep disorder market. Explore the intricacies of insomnia treatment, sleep apnea solutions, narcolepsy therapies, and circadian rhythm disorder management, driven by a growing global awareness of sleep's vital role in overall health. The forecast period of 2025–2033 promises significant expansion, fueled by innovative pharmaceutical drug development and evolving healthcare approaches to sleep wellness.

Sleep Disorder Treatment Industry Market Composition & Trends

The sleep disorder treatment industry exhibits a dynamic market concentration influenced by both established pharmaceutical giants and innovative biotechs. Key players like Sanofi SA, Pfizer, and Teva Pharmaceuticals Inc hold significant market share, while emerging companies are fostering innovation. The market is characterized by a continuous influx of new therapies and diagnostic tools, driven by unmet medical needs and increasing patient demand for effective sleep disorder solutions. Regulatory landscapes, particularly stringent FDA and EMA approvals, shape the introduction of novel treatments, emphasizing safety and efficacy. Substitute products, including lifestyle modifications and non-pharmacological interventions, also play a role, though pharmaceutical solutions remain dominant for severe conditions. End-user profiles are diverse, ranging from individuals experiencing acute insomnia to those managing chronic conditions like sleep apnea and narcolepsy. Mergers and acquisitions (M&A) activities are a notable trend, with deal values in the billions of USD reflecting the industry's high growth potential. For instance, recent M&A activities have focused on acquiring companies with promising pipelines in novel drug classes, aiming to consolidate market position and expand therapeutic portfolios. The market share distribution is expected to see shifts as new orexin antagonists and melatonin antagonists gain traction.

Sleep Disorder Treatment Industry Industry Evolution

The sleep disorder treatment industry has witnessed a profound evolution, transforming from a niche concern to a mainstream healthcare priority. Over the study period of 2019–2033, market growth trajectories have been consistently upward, propelled by a confluence of factors. Technological advancements have revolutionized diagnosis and treatment, enabling more precise identification of sleep abnormalities and the development of targeted therapies. The adoption of wearable sleep trackers and advanced polysomnography techniques has dramatically improved diagnostic accuracy, leading to earlier intervention and personalized treatment plans. Shifting consumer demands underscore a growing public health consciousness regarding sleep, with individuals actively seeking effective solutions for sleep disturbances. This has spurred a surge in demand for a wide array of sleep disorder medications, including benzodiazepines, nonbenzodiazepines, and increasingly, novel agents like orexin antagonists.

The market has also benefited from increased research and development investment, fostering innovation in drug discovery and delivery systems. For example, the development of drugs with improved efficacy and reduced side effect profiles has been a key focus, leading to a gradual shift away from older drug classes where appropriate. Growth rates have been robust, with projections indicating a compound annual growth rate (CAGR) in the tens of billions of USD over the forecast period. Adoption metrics for new classes of drugs are steadily rising as clinical data supporting their benefits becomes more widely disseminated and physician confidence grows. The integration of digital health solutions and telehealth platforms has further expanded access to sleep specialists and treatment, democratizing care and reinforcing the industry's evolutionary path towards comprehensive sleep health management.

Leading Regions, Countries, or Segments in Sleep Disorder Treatment Industry

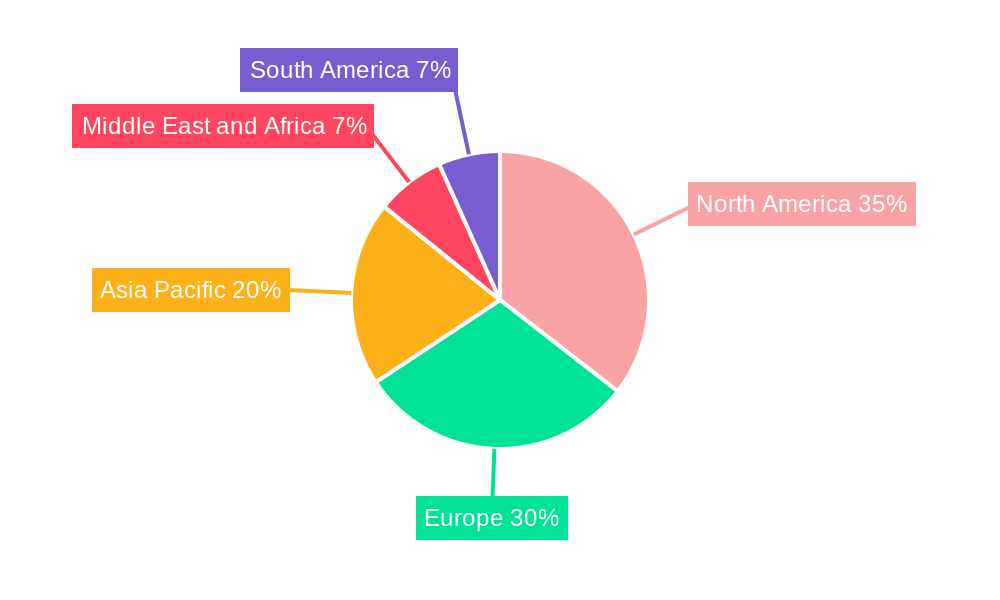

The sleep disorder treatment industry landscape is dominated by a few key regions and specific drug types and applications, reflecting varying healthcare infrastructure, patient demographics, and regulatory environments.

Dominant Regions and Countries:

- North America: This region consistently leads the market, driven by a high prevalence of sleep disorders, a well-established healthcare system, and significant R&D investments by major pharmaceutical companies. The United States, in particular, is a powerhouse in both consumption and innovation within the sleep disorder treatment sector. Government initiatives promoting public health awareness around sleep and robust reimbursement policies further bolster its leadership.

- Europe: With countries like Germany, the UK, and France exhibiting strong market performance, Europe represents another significant market. Favorable regulatory frameworks, an aging population prone to sleep issues, and growing awareness of sleep's impact on chronic diseases contribute to its strong standing. The presence of numerous research institutions and a focus on patient-centric care also plays a crucial role.

- Asia-Pacific: This region is emerging as a high-growth market. Increasing disposable incomes, rising awareness of sleep health, and a growing burden of lifestyle-related sleep disorders are driving demand. Countries like Japan, with its aging population, and China, with its rapidly expanding healthcare sector, are key contributors to this growth.

Dominant Segments:

- Drug Type - Nonbenzodiazepines: While benzodiazepines have historically been prevalent, nonbenzodiazepines are gaining significant traction due to their improved safety profiles and reduced risk of dependence. Their efficacy in treating insomnia makes them a preferred choice for many healthcare providers and patients.

- Drug Type - Orexin Antagonists: This newer class of drugs, targeting the wakefulness-promoting neurotransmitter orexin, represents a significant innovation and a rapidly growing segment, particularly for insomnia and narcolepsy.

- Application - Insomnia: Insomnia remains the most prevalent sleep disorder globally, thus commanding the largest share of the sleep disorder treatment market. The widespread nature of this condition, often exacerbated by stress, lifestyle, and other medical comorbidities, ensures sustained demand for effective treatments.

- Application - Sleep Apnea: With the increasing recognition of sleep apnea as a serious health risk and its strong correlation with cardiovascular diseases, the market for its treatment is experiencing substantial growth. Continuous positive airway pressure (CPAP) devices and pharmacological interventions are key components of this segment.

The dominance in these segments is propelled by factors such as targeted drug development, increasing diagnosis rates, and a growing understanding of the underlying pathophysiology of various sleep disorders.

Sleep Disorder Treatment Industry Product Innovations

Product innovation within the sleep disorder treatment industry is primarily focused on enhancing efficacy, improving safety profiles, and expanding therapeutic options. Key advancements include the development of novel drug types like orexin antagonists (e.g., Idorsia's Quviviq) and melatonin antagonists, which offer targeted mechanisms of action for insomnia and narcolepsy. These innovations aim to reduce the reliance on older drug classes with higher risks of dependence and side effects. Furthermore, advancements in drug delivery systems are improving patient compliance and therapeutic outcomes. The integration of digital health technologies, such as AI-powered diagnostic tools and personalized treatment platforms, is also a significant area of innovation, enabling more precise diagnosis and tailored management of sleep disorders. Performance metrics for these innovations are increasingly being measured by reduction in sleep onset latency, improvement in sleep duration, and a decrease in daytime somnolence, with a focus on minimizing adverse events.

Propelling Factors for Sleep Disorder Treatment Industry Growth

Several key factors are propelling the sleep disorder treatment industry forward. A primary driver is the escalating prevalence of sleep disorders worldwide, stemming from increased stress levels, sedentary lifestyles, and an aging global population. Technological advancements in diagnostics and therapeutics are enabling more effective identification and management of these conditions. Regulatory bodies are also becoming more supportive of innovative treatments for sleep disorders, encouraging research and development. The growing awareness of sleep's critical role in overall health and well-being, fueled by extensive research and public health campaigns, is significantly boosting patient demand for effective sleep disorder solutions. Economic factors, including increasing healthcare expenditure and rising disposable incomes in emerging economies, are further contributing to market expansion.

Obstacles in the Sleep Disorder Treatment Industry Market

Despite its robust growth, the sleep disorder treatment industry faces several obstacles. Stringent regulatory approval processes for new sleep disorder medications can be time-consuming and costly, slowing down market entry. The high cost of advanced diagnostic equipment and novel therapies can limit accessibility, particularly in developing regions. Supply chain disruptions, exacerbated by global events, can impact the availability of essential raw materials and finished drug products. Furthermore, the presence of generic alternatives for older sleep medications creates pricing pressures, especially for established drug types like benzodiazepines and some antidepressants used off-label. Overcoming these barriers is crucial for sustained growth.

Future Opportunities in Sleep Disorder Treatment Industry

The sleep disorder treatment industry is ripe with future opportunities. The development of personalized medicine approaches, leveraging genetic profiling and advanced diagnostics, will unlock new avenues for tailored sleep disorder treatments. The untapped potential in emerging markets, particularly in the Asia-Pacific region, presents a significant growth frontier as awareness and healthcare infrastructure improve. Continued innovation in drug types, such as novel melatonin antagonists and combination therapies, holds promise for addressing complex sleep conditions. The increasing integration of digital health and wearable technologies offers opportunities for remote monitoring, telehealth consultations, and data-driven therapeutic interventions, enhancing patient engagement and treatment adherence.

Major Players in the Sleep Disorder Treatment Industry Ecosystem

- Sanofi SA

- Pfizer

- Teva Pharmaceuticals Inc

- Meda Consumer Healthcare

- Vanda Pharmaceuticals Inc

- Transcept Pharmaceuticals

- Dr Reddy's Laboratory

- Cerêve Inc

- Mylan NV

- Takeda Pharmaceuticals Inc

- Merck & Co

- Zydus Cadila

Key Developments in Sleep Disorder Treatment Industry Industry

- May 2022: Idorsia commercially launched Quviviq, a new drug for insomnia, backed by a robust sales force of 500 representatives and an ambitious Direct-to-Consumer (DTC) advertising campaign, signaling a significant push into the insomnia treatment market.

- April 2022: Oxysleep Max Care launched an exclusive center dedicated to sleep disorders, incorporating advanced rehabilitation facilities. This integrated healthcare model aims to combine modern medical science with holistic approaches for de-stressing and detoxification, offering a comprehensive solution for various sleep-related ailments.

Strategic Sleep Disorder Treatment Industry Market Forecast

The strategic market forecast for the sleep disorder treatment industry indicates robust expansion driven by increasing global prevalence of sleep disturbances and enhanced diagnostic capabilities. Innovations in drug types, particularly orexin antagonists and other novel pharmacological agents, will be key growth catalysts. The growing emphasis on sleep health as a critical component of overall well-being is fostering greater patient and physician engagement. Emerging markets, coupled with advancements in digital health and personalized medicine, present significant untapped potential. Strategic investments in research and development, coupled with a favorable regulatory environment for novel therapies, will pave the way for sustained market growth and improved patient outcomes in the coming years.

Sleep Disorder Treatment Industry Segmentation

-

1. Drug Type

- 1.1. Benzodiazepines

- 1.2. Nonbenzodiazepines

- 1.3. Antidepressants

- 1.4. Orexin Antagonists

- 1.5. Melatonin Antagonists

- 1.6. Other Drug Types

-

2. Application

- 2.1. Insomnia

- 2.2. Sleep Apnea

- 2.3. Narcolepsy

- 2.4. Circadian Disorders

- 2.5. Other Applications

Sleep Disorder Treatment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Sleep Disorder Treatment Industry Regional Market Share

Geographic Coverage of Sleep Disorder Treatment Industry

Sleep Disorder Treatment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness Related to Target Disorders Among the Patient Population; Rising Stress Levels and Changing Dynamics; Presence of Potential Clinical Pipeline Candidates

- 3.3. Market Restrains

- 3.3.1. Lower Diagnosis Rate; Side Effects of Sleep Disorder Drugs

- 3.4. Market Trends

- 3.4.1. Insomnia Holds Notable Share in the Market and is Expected to Continue to Do the Same During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sleep Disorder Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 5.1.1. Benzodiazepines

- 5.1.2. Nonbenzodiazepines

- 5.1.3. Antidepressants

- 5.1.4. Orexin Antagonists

- 5.1.5. Melatonin Antagonists

- 5.1.6. Other Drug Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Insomnia

- 5.2.2. Sleep Apnea

- 5.2.3. Narcolepsy

- 5.2.4. Circadian Disorders

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 6. North America Sleep Disorder Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 6.1.1. Benzodiazepines

- 6.1.2. Nonbenzodiazepines

- 6.1.3. Antidepressants

- 6.1.4. Orexin Antagonists

- 6.1.5. Melatonin Antagonists

- 6.1.6. Other Drug Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Insomnia

- 6.2.2. Sleep Apnea

- 6.2.3. Narcolepsy

- 6.2.4. Circadian Disorders

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 7. Europe Sleep Disorder Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 7.1.1. Benzodiazepines

- 7.1.2. Nonbenzodiazepines

- 7.1.3. Antidepressants

- 7.1.4. Orexin Antagonists

- 7.1.5. Melatonin Antagonists

- 7.1.6. Other Drug Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Insomnia

- 7.2.2. Sleep Apnea

- 7.2.3. Narcolepsy

- 7.2.4. Circadian Disorders

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 8. Asia Pacific Sleep Disorder Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 8.1.1. Benzodiazepines

- 8.1.2. Nonbenzodiazepines

- 8.1.3. Antidepressants

- 8.1.4. Orexin Antagonists

- 8.1.5. Melatonin Antagonists

- 8.1.6. Other Drug Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Insomnia

- 8.2.2. Sleep Apnea

- 8.2.3. Narcolepsy

- 8.2.4. Circadian Disorders

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 9. Middle East and Africa Sleep Disorder Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 9.1.1. Benzodiazepines

- 9.1.2. Nonbenzodiazepines

- 9.1.3. Antidepressants

- 9.1.4. Orexin Antagonists

- 9.1.5. Melatonin Antagonists

- 9.1.6. Other Drug Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Insomnia

- 9.2.2. Sleep Apnea

- 9.2.3. Narcolepsy

- 9.2.4. Circadian Disorders

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 10. South America Sleep Disorder Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 10.1.1. Benzodiazepines

- 10.1.2. Nonbenzodiazepines

- 10.1.3. Antidepressants

- 10.1.4. Orexin Antagonists

- 10.1.5. Melatonin Antagonists

- 10.1.6. Other Drug Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Insomnia

- 10.2.2. Sleep Apnea

- 10.2.3. Narcolepsy

- 10.2.4. Circadian Disorders

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sanofi SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pfizer

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Teva Pharmaceuticals Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Meda Consumer Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vanda Pharmaceuticals Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Transcept Pharmaceuticals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dr Reddy's Laboratory

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cerêve Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mylan NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Takeda Pharmaceuticals Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Merck & Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Zydus Cadila

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Sanofi SA

List of Figures

- Figure 1: Global Sleep Disorder Treatment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Sleep Disorder Treatment Industry Revenue (billion), by Drug Type 2025 & 2033

- Figure 3: North America Sleep Disorder Treatment Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 4: North America Sleep Disorder Treatment Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Sleep Disorder Treatment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Sleep Disorder Treatment Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Sleep Disorder Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Sleep Disorder Treatment Industry Revenue (billion), by Drug Type 2025 & 2033

- Figure 9: Europe Sleep Disorder Treatment Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 10: Europe Sleep Disorder Treatment Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Sleep Disorder Treatment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Sleep Disorder Treatment Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Sleep Disorder Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Sleep Disorder Treatment Industry Revenue (billion), by Drug Type 2025 & 2033

- Figure 15: Asia Pacific Sleep Disorder Treatment Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 16: Asia Pacific Sleep Disorder Treatment Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Sleep Disorder Treatment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Sleep Disorder Treatment Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Sleep Disorder Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Sleep Disorder Treatment Industry Revenue (billion), by Drug Type 2025 & 2033

- Figure 21: Middle East and Africa Sleep Disorder Treatment Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 22: Middle East and Africa Sleep Disorder Treatment Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Middle East and Africa Sleep Disorder Treatment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Sleep Disorder Treatment Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Sleep Disorder Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Sleep Disorder Treatment Industry Revenue (billion), by Drug Type 2025 & 2033

- Figure 27: South America Sleep Disorder Treatment Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 28: South America Sleep Disorder Treatment Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: South America Sleep Disorder Treatment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Sleep Disorder Treatment Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Sleep Disorder Treatment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Drug Type 2020 & 2033

- Table 2: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Drug Type 2020 & 2033

- Table 5: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Drug Type 2020 & 2033

- Table 11: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Drug Type 2020 & 2033

- Table 20: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Drug Type 2020 & 2033

- Table 29: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Drug Type 2020 & 2033

- Table 35: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Sleep Disorder Treatment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Sleep Disorder Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sleep Disorder Treatment Industry?

The projected CAGR is approximately 7.12%.

2. Which companies are prominent players in the Sleep Disorder Treatment Industry?

Key companies in the market include Sanofi SA, Pfizer, Teva Pharmaceuticals Inc, Meda Consumer Healthcare, Vanda Pharmaceuticals Inc, Transcept Pharmaceuticals, Dr Reddy's Laboratory, Cerêve Inc *List Not Exhaustive, Mylan NV, Takeda Pharmaceuticals Inc, Merck & Co, Zydus Cadila.

3. What are the main segments of the Sleep Disorder Treatment Industry?

The market segments include Drug Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness Related to Target Disorders Among the Patient Population; Rising Stress Levels and Changing Dynamics; Presence of Potential Clinical Pipeline Candidates.

6. What are the notable trends driving market growth?

Insomnia Holds Notable Share in the Market and is Expected to Continue to Do the Same During the Forecast Period.

7. Are there any restraints impacting market growth?

Lower Diagnosis Rate; Side Effects of Sleep Disorder Drugs.

8. Can you provide examples of recent developments in the market?

In May 2022, Idorsia commercially launched Quviviq, a drug for insomnia with 500 sales reps and plans for a ' Robust' DTC campaign.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sleep Disorder Treatment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sleep Disorder Treatment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sleep Disorder Treatment Industry?

To stay informed about further developments, trends, and reports in the Sleep Disorder Treatment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence