Key Insights

The global handheld ultrasound devices market is poised for significant expansion, projected to reach a substantial valuation. Driven by increasing demand for portable and point-of-care diagnostic solutions across various medical specialties, the market is expected to witness robust growth. Key factors fueling this upward trajectory include the growing prevalence of chronic diseases, the need for rapid and accurate diagnoses in emergency settings, and the increasing adoption of ultrasound technology in remote and underserved areas. Furthermore, technological advancements leading to miniaturization, improved image quality, and enhanced user-friendliness of handheld devices are contributing to their wider acceptance. The integration of AI and cloud connectivity is also expected to open new avenues for market growth, enabling remote consultations and data analysis, thereby improving patient care and accessibility.

The market's dynamism is further underscored by the diverse applications of handheld ultrasound devices, spanning gynecology, cardiovascular diagnostics, urology, musculoskeletal imaging, and anesthesiology. This broad applicability ensures sustained demand across a wide spectrum of healthcare providers, from large hospitals to small clinics and even in-field medical services. While growth drivers are strong, market restraints such as the high initial cost of advanced devices and the need for specialized training for optimal utilization are present. However, the continuous innovation by leading manufacturers and the increasing focus on cost-effectiveness are mitigating these challenges. Emerging economies, with their expanding healthcare infrastructure and rising disposable incomes, represent significant untapped potential, promising substantial opportunities for market players in the coming years.

Here's the SEO-optimized, insightful report description for the Handheld Ultrasound Devices Industry, meticulously crafted to boost search visibility and captivate stakeholders without any placeholder modifications:

Handheld Ultrasound Devices Industry Market Composition & Trends

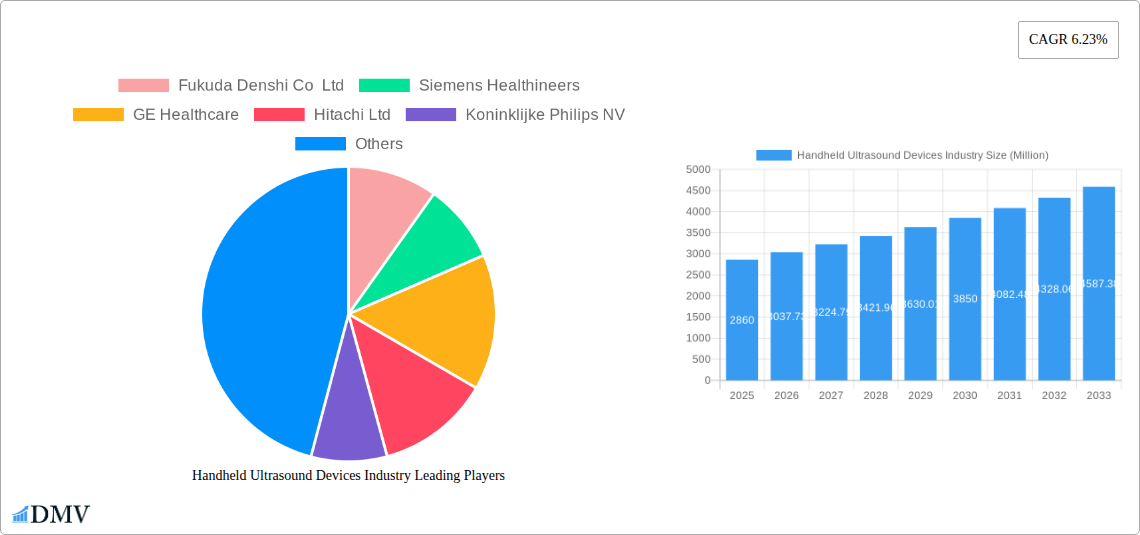

This comprehensive report delves into the intricate market composition and dynamic trends shaping the global Handheld Ultrasound Devices industry. We meticulously analyze market concentration, identifying key players and their respective market share distributions. The study highlights innovation catalysts driving advancements, from miniaturization to AI integration, and scrutinizes the evolving regulatory landscapes across major geographies that influence product approvals and market access. Understanding substitute products and their impact on the handheld ultrasound market is crucial, and this report provides an in-depth assessment. Furthermore, we profile end-user segments, detailing their specific needs and adoption patterns, with a focus on healthcare professionals and emerging point-of-care applications. Mergers and acquisitions (M&A) activities are a significant indicator of market consolidation and strategic growth; the report quantifies M&A deal values, offering insights into strategic investments and partnerships within the Handheld Ultrasound Devices ecosystem.

- Market Concentration Analysis: Identifying dominant players and competitive dynamics within the global Handheld Ultrasound Devices market.

- Innovation Drivers: Examining the impact of technological advancements and research & development on product evolution.

- Regulatory Landscape: Evaluating the influence of governmental policies and approvals on market entry and growth.

- End-User Segmentation: Profiling key user groups and their specific application requirements for handheld ultrasound devices.

- M&A Activities: Quantifying M&A deal values to understand industry consolidation and strategic collaborations, with recent transactions totaling an estimated XX Million.

Handheld Ultrasound Devices Industry Evolution

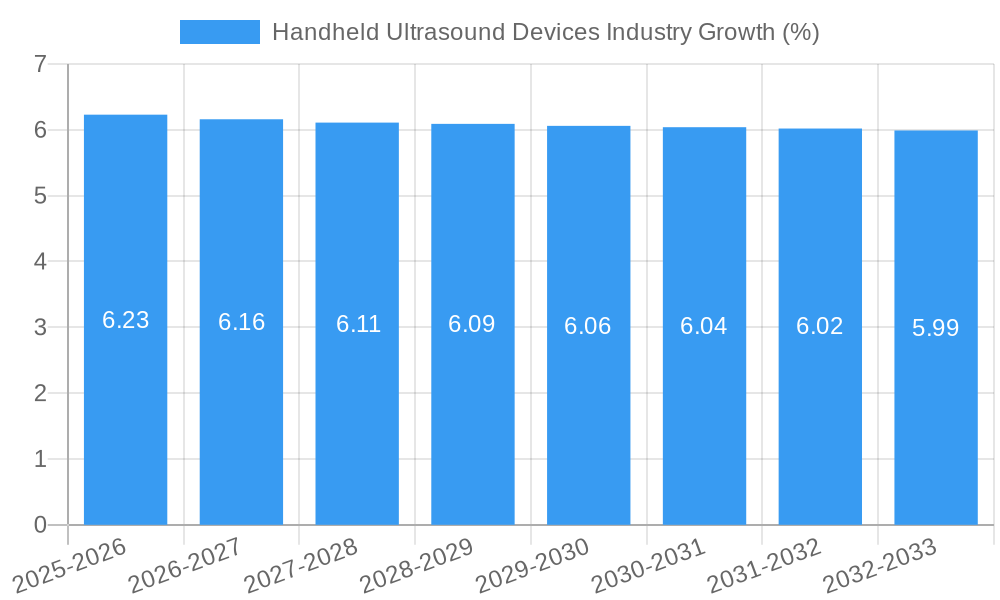

The Handheld Ultrasound Devices industry is undergoing a transformative evolution, driven by relentless technological progress and a growing demand for accessible diagnostic tools. Our analysis spans the historical period from 2019 to 2024, charting the foundational growth and early adoption patterns of these innovative devices. The base year of 2025 serves as a critical pivot point, from which we project the market's trajectory through 2033. This evolution is characterized by significant market growth trajectories, projected to achieve a compound annual growth rate (CAGR) of approximately XX%. Technological advancements are at the forefront, with rapid innovations in probe technology, image processing, artificial intelligence (AI) integration for enhanced diagnostic accuracy, and cloud connectivity for seamless data management. These advancements are fundamentally reshaping how ultrasound diagnostics are performed, moving from centralized imaging departments to the point of care. Shifting consumer demands, particularly from healthcare providers seeking portable, user-friendly, and cost-effective solutions, are further fueling this evolution. The increasing adoption of mobile ultrasound devices and advanced handheld ultrasound devices in diverse clinical settings, including emergency medicine, primary care, and remote health monitoring, underscores this paradigm shift. Growth in key applications like cardiovascular imaging, gynecology, and musculoskeletal assessments demonstrates the expanding utility and acceptance of these devices. The market witnessed a substantial increase in adoption metrics, with handheld ultrasound units experiencing an estimated XX% year-over-year growth in deployments during the historical period. This report provides granular insights into these growth rates and adoption metrics, equipping stakeholders with a clear understanding of the industry's past, present, and future.

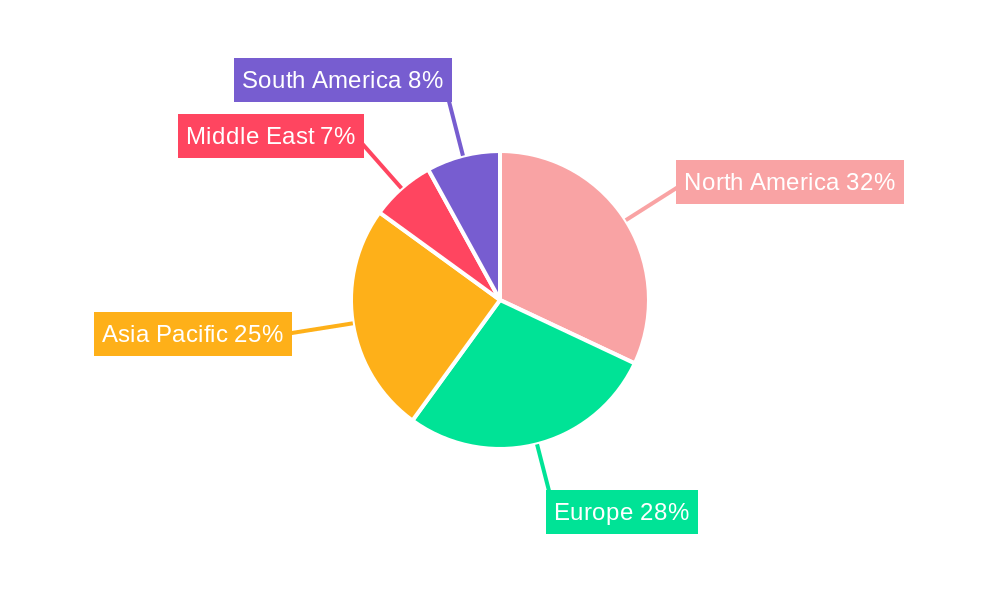

Leading Regions, Countries, or Segments in Handheld Ultrasound Devices Industry

North America is identified as the dominant region within the Handheld Ultrasound Devices industry, driven by robust healthcare infrastructure, high adoption rates of advanced medical technologies, and significant investments in point-of-care ultrasound (POCUS). The United States, in particular, leads due to a well-established reimbursement framework for ultrasound procedures and a strong presence of leading manufacturers. Within the Type of Device segment, the Mobile Ultrasound Device category is currently exhibiting greater market penetration, though the Handheld Ultrasound Device segment is rapidly gaining traction due to its enhanced portability and decreasing price points, projected to capture significant market share by 2028.

In terms of Application, the Cardiovascular segment remains a primary driver of demand, fueled by the increasing prevalence of cardiovascular diseases and the need for rapid, non-invasive diagnostic tools. However, the Gynecology and Urology segments are experiencing substantial growth, attributed to the rising demand for point-of-care diagnostics in women's health and urological assessments, respectively. Anesthesiology and Musculoskeletal applications are also emerging as significant growth areas, with handheld devices proving invaluable for real-time guidance during procedures.

- Dominant Region: North America

- Key Drivers:

- High healthcare expenditure and advanced medical infrastructure.

- Early adoption of POCUS technology by healthcare professionals.

- Favorable reimbursement policies for diagnostic imaging.

- Strong presence of research and development facilities.

- Significant investments from venture capital and private equity firms in MedTech innovation.

- In-depth Analysis: North America's leadership is underpinned by its proactive healthcare system, which readily embraces innovative solutions that improve patient outcomes and operational efficiency. The continuous push for telemedicine and remote patient monitoring further amplifies the demand for portable ultrasound devices. The regulatory environment, while stringent, is also conducive to innovation and market entry for well-vetted technologies.

- Key Drivers:

- Leading Application Segment: Cardiovascular

- Key Drivers:

- Rising global burden of cardiovascular diseases.

- Need for rapid and accessible cardiac diagnostics.

- Advancements in ultrasound technology for cardiac imaging.

- Integration of AI for enhanced cardiac function analysis.

- In-depth Analysis: The cardiovascular segment benefits from the inherent advantages of ultrasound in visualizing heart structures and function. Handheld devices are increasingly used for bedside cardiac assessments, emergency evaluations, and even for remote cardiology consultations, making them indispensable tools for cardiologists and emergency physicians. The projected market value for cardiovascular applications is estimated at $XXX Million by 2028.

- Key Drivers:

- Emerging Segment to Watch: Gynecology

- Key Drivers:

- Growing demand for point-of-care gynecological diagnostics.

- Increased awareness and screening for women's health issues.

- Development of specialized probes for gynecological imaging.

- Utility in primary care settings and resource-limited environments.

- In-depth Analysis: The portability and ease of use of handheld ultrasound devices make them ideal for routine gynecological examinations, offering immediate feedback and reducing the need for specialized imaging centers in many cases. This segment is expected to witness a CAGR of XX% during the forecast period.

- Key Drivers:

Handheld Ultrasound Devices Industry Product Innovations

Product innovations in the Handheld Ultrasound Devices industry are rapidly transforming diagnostic capabilities. Key advancements include the development of ultra-miniaturized probes, enhanced image resolution comparable to traditional cart-based systems, and the integration of AI-powered diagnostic assistance tools for improved accuracy and efficiency. Wireless connectivity, cloud integration for seamless data storage and sharing, and extended battery life are also crucial innovations enhancing user experience and workflow. The incorporation of advanced algorithms for automated measurements and image optimization provides unique selling propositions, making these devices indispensable for point-of-care applications across various medical specialties, from anesthesiology to cardiology.

Propelling Factors for Handheld Ultrasound Devices Industry Growth

The Handheld Ultrasound Devices industry's growth is propelled by several key factors. Technologically, the miniaturization of components, advancements in battery technology, and the integration of AI for image interpretation and workflow automation are crucial. Economically, the increasing demand for cost-effective healthcare solutions and the potential for wider adoption in emerging markets are significant drivers. Regulatory bodies are increasingly recognizing the value of POCUS, leading to supportive policies and expanded reimbursement for certain handheld ultrasound applications. The rising prevalence of chronic diseases also necessitates accessible diagnostic tools, further fueling market expansion.

Obstacles in the Handheld Ultrasound Devices Industry Market

Despite robust growth, the Handheld Ultrasound Devices market faces certain obstacles. Regulatory challenges, including varying approval processes across different countries and the need for continuous validation of AI algorithms, can slow down market entry and adoption. Supply chain disruptions, particularly for specialized electronic components, can impact manufacturing and lead times, potentially increasing costs. Competitive pressures from established players and new entrants offering innovative technologies also necessitate continuous R&D investment. Furthermore, the initial cost of advanced handheld devices, although decreasing, can still be a barrier for some healthcare providers in resource-constrained settings. The market size impacted by these factors is estimated at XX Million annually.

Future Opportunities in Handheld Ultrasound Devices Industry

Emerging opportunities in the Handheld Ultrasound Devices industry are abundant. The expansion of POCUS into primary care and remote patient monitoring presents a significant growth avenue. Advancements in AI and machine learning hold the potential to create highly automated diagnostic tools, further democratizing access to ultrasound. The development of specialized handheld devices for niche applications, such as veterinary medicine and sports medicine, also offers considerable promise. Furthermore, the growing demand for telehealth services is creating a market for integrated handheld ultrasound solutions that can facilitate remote consultations and diagnostics.

Major Players in the Handheld Ultrasound Devices Industry Ecosystem

- Fukuda Denshi Co Ltd

- Siemens Healthineers

- GE Healthcare

- Hitachi Ltd

- Koninklijke Philips NV

- Fujifilm SonoSite Inc

- Canon Medical Systems Corporation

- Shenzhen Mindray

- Samsung Healthcare

Key Developments in Handheld Ultrasound Devices Industry Industry

- 2023: GE Healthcare launches a new AI-powered handheld ultrasound device for critical care, enhancing diagnostic speed and accuracy.

- 2023: Fujifilm SonoSite Inc. announces strategic partnerships to expand its market reach in emerging economies.

- 2024: Siemens Healthineers receives regulatory approval for its advanced handheld ultrasound system, featuring enhanced cardiovascular imaging capabilities.

- 2024: Koninklijke Philips NV unveils a new cloud-connected handheld ultrasound platform, enabling seamless data integration and remote collaboration.

- 2025: Canon Medical Systems Corporation introduces a next-generation handheld ultrasound device with superior image quality and user-friendly interface.

- 2025: Shenzhen Mindray expands its portfolio with a new handheld ultrasound system tailored for point-of-care use in emergency departments.

- 2025: Samsung Healthcare showcases its latest innovations in AI-driven ultrasound diagnostics at major medical conferences.

Strategic Handheld Ultrasound Devices Industry Market Forecast

- 2023: GE Healthcare launches a new AI-powered handheld ultrasound device for critical care, enhancing diagnostic speed and accuracy.

- 2023: Fujifilm SonoSite Inc. announces strategic partnerships to expand its market reach in emerging economies.

- 2024: Siemens Healthineers receives regulatory approval for its advanced handheld ultrasound system, featuring enhanced cardiovascular imaging capabilities.

- 2024: Koninklijke Philips NV unveils a new cloud-connected handheld ultrasound platform, enabling seamless data integration and remote collaboration.

- 2025: Canon Medical Systems Corporation introduces a next-generation handheld ultrasound device with superior image quality and user-friendly interface.

- 2025: Shenzhen Mindray expands its portfolio with a new handheld ultrasound system tailored for point-of-care use in emergency departments.

- 2025: Samsung Healthcare showcases its latest innovations in AI-driven ultrasound diagnostics at major medical conferences.

Strategic Handheld Ultrasound Devices Industry Market Forecast

The strategic Handheld Ultrasound Devices market forecast indicates sustained high growth, driven by the increasing demand for point-of-care diagnostics and the continuous innovation in portable imaging technology. Key growth catalysts include the expanding applications in primary care, emergency medicine, and chronic disease management, coupled with significant advancements in AI integration for enhanced diagnostic accuracy and workflow efficiency. Emerging markets and the growing adoption of telehealth are expected to further fuel market penetration, with a projected market size of $XX Billion by 2033. The industry's potential lies in its ability to democratize advanced imaging, making sophisticated diagnostic tools more accessible and affordable globally.

Handheld Ultrasound Devices Industry Segmentation

-

1. Type of Device

- 1.1. Mobile Ultrasound Device

- 1.2. Handheld Ultrasound Device

-

2. Application

- 2.1. Gynecology

- 2.2. Cardiovascular

- 2.3. Urology

- 2.4. Musculoskeletal

- 2.5. Anesthesiology

- 2.6. Others

Handheld Ultrasound Devices Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Handheld Ultrasound Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Spectrum of Applications of Portable Ultrasound; Rising Advancements in Technology; Increasing Prevalence of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Portable Ultrasound Systems; Lack of Dedicated Training Programs by Companies

- 3.4. Market Trends

- 3.4.1. Mobile Ultrasound Devices is Expected to Grow with High CAGR Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Mobile Ultrasound Device

- 5.1.2. Handheld Ultrasound Device

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gynecology

- 5.2.2. Cardiovascular

- 5.2.3. Urology

- 5.2.4. Musculoskeletal

- 5.2.5. Anesthesiology

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East

- 5.3.5. GCC

- 5.3.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. North America Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Mobile Ultrasound Device

- 6.1.2. Handheld Ultrasound Device

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Gynecology

- 6.2.2. Cardiovascular

- 6.2.3. Urology

- 6.2.4. Musculoskeletal

- 6.2.5. Anesthesiology

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. Europe Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Mobile Ultrasound Device

- 7.1.2. Handheld Ultrasound Device

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Gynecology

- 7.2.2. Cardiovascular

- 7.2.3. Urology

- 7.2.4. Musculoskeletal

- 7.2.5. Anesthesiology

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Asia Pacific Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Mobile Ultrasound Device

- 8.1.2. Handheld Ultrasound Device

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Gynecology

- 8.2.2. Cardiovascular

- 8.2.3. Urology

- 8.2.4. Musculoskeletal

- 8.2.5. Anesthesiology

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Middle East Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 9.1.1. Mobile Ultrasound Device

- 9.1.2. Handheld Ultrasound Device

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Gynecology

- 9.2.2. Cardiovascular

- 9.2.3. Urology

- 9.2.4. Musculoskeletal

- 9.2.5. Anesthesiology

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 10. GCC Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 10.1.1. Mobile Ultrasound Device

- 10.1.2. Handheld Ultrasound Device

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Gynecology

- 10.2.2. Cardiovascular

- 10.2.3. Urology

- 10.2.4. Musculoskeletal

- 10.2.5. Anesthesiology

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 11. South America Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type of Device

- 11.1.1. Mobile Ultrasound Device

- 11.1.2. Handheld Ultrasound Device

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Gynecology

- 11.2.2. Cardiovascular

- 11.2.3. Urology

- 11.2.4. Musculoskeletal

- 11.2.5. Anesthesiology

- 11.2.6. Others

- 11.1. Market Analysis, Insights and Forecast - by Type of Device

- 12. North America Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Italy

- 13.1.5 Spain

- 13.1.6 Rest of Europe

- 14. Asia Pacific Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 Australia

- 14.1.5 South Korea

- 14.1.6 Rest of Asia Pacific

- 15. GCC Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Rest of Middle East

- 16. South America Handheld Ultrasound Devices Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 Brazil

- 16.1.2 Argentina

- 16.1.3 Rest of South America

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Fukuda Denshi Co Ltd

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Siemens Healthineers

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 GE Healthcare

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Hitachi Ltd

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Koninklijke Philips NV

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Fujifilm SonoSite Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Canon Medical Systems Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Shenzhen Mindray

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Samsung Healthcare

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 Fukuda Denshi Co Ltd

List of Figures

- Figure 1: Global Handheld Ultrasound Devices Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Handheld Ultrasound Devices Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: GCC Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: GCC Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: GCC Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: GCC Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: South America Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: South America Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Handheld Ultrasound Devices Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 24: North America Handheld Ultrasound Devices Industry Volume (K Unit), by Type of Device 2024 & 2032

- Figure 25: North America Handheld Ultrasound Devices Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 26: North America Handheld Ultrasound Devices Industry Volume Share (%), by Type of Device 2024 & 2032

- Figure 27: North America Handheld Ultrasound Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 28: North America Handheld Ultrasound Devices Industry Volume (K Unit), by Application 2024 & 2032

- Figure 29: North America Handheld Ultrasound Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: North America Handheld Ultrasound Devices Industry Volume Share (%), by Application 2024 & 2032

- Figure 31: North America Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 32: North America Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 33: North America Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: North America Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe Handheld Ultrasound Devices Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 36: Europe Handheld Ultrasound Devices Industry Volume (K Unit), by Type of Device 2024 & 2032

- Figure 37: Europe Handheld Ultrasound Devices Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 38: Europe Handheld Ultrasound Devices Industry Volume Share (%), by Type of Device 2024 & 2032

- Figure 39: Europe Handheld Ultrasound Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 40: Europe Handheld Ultrasound Devices Industry Volume (K Unit), by Application 2024 & 2032

- Figure 41: Europe Handheld Ultrasound Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Europe Handheld Ultrasound Devices Industry Volume Share (%), by Application 2024 & 2032

- Figure 43: Europe Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 44: Europe Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 45: Europe Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Europe Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

- Figure 47: Asia Pacific Handheld Ultrasound Devices Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 48: Asia Pacific Handheld Ultrasound Devices Industry Volume (K Unit), by Type of Device 2024 & 2032

- Figure 49: Asia Pacific Handheld Ultrasound Devices Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 50: Asia Pacific Handheld Ultrasound Devices Industry Volume Share (%), by Type of Device 2024 & 2032

- Figure 51: Asia Pacific Handheld Ultrasound Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 52: Asia Pacific Handheld Ultrasound Devices Industry Volume (K Unit), by Application 2024 & 2032

- Figure 53: Asia Pacific Handheld Ultrasound Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Handheld Ultrasound Devices Industry Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 56: Asia Pacific Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 57: Asia Pacific Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 58: Asia Pacific Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

- Figure 59: Middle East Handheld Ultrasound Devices Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 60: Middle East Handheld Ultrasound Devices Industry Volume (K Unit), by Type of Device 2024 & 2032

- Figure 61: Middle East Handheld Ultrasound Devices Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 62: Middle East Handheld Ultrasound Devices Industry Volume Share (%), by Type of Device 2024 & 2032

- Figure 63: Middle East Handheld Ultrasound Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 64: Middle East Handheld Ultrasound Devices Industry Volume (K Unit), by Application 2024 & 2032

- Figure 65: Middle East Handheld Ultrasound Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 66: Middle East Handheld Ultrasound Devices Industry Volume Share (%), by Application 2024 & 2032

- Figure 67: Middle East Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 68: Middle East Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 69: Middle East Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 70: Middle East Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

- Figure 71: GCC Handheld Ultrasound Devices Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 72: GCC Handheld Ultrasound Devices Industry Volume (K Unit), by Type of Device 2024 & 2032

- Figure 73: GCC Handheld Ultrasound Devices Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 74: GCC Handheld Ultrasound Devices Industry Volume Share (%), by Type of Device 2024 & 2032

- Figure 75: GCC Handheld Ultrasound Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 76: GCC Handheld Ultrasound Devices Industry Volume (K Unit), by Application 2024 & 2032

- Figure 77: GCC Handheld Ultrasound Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 78: GCC Handheld Ultrasound Devices Industry Volume Share (%), by Application 2024 & 2032

- Figure 79: GCC Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 80: GCC Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 81: GCC Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 82: GCC Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

- Figure 83: South America Handheld Ultrasound Devices Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 84: South America Handheld Ultrasound Devices Industry Volume (K Unit), by Type of Device 2024 & 2032

- Figure 85: South America Handheld Ultrasound Devices Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 86: South America Handheld Ultrasound Devices Industry Volume Share (%), by Type of Device 2024 & 2032

- Figure 87: South America Handheld Ultrasound Devices Industry Revenue (Million), by Application 2024 & 2032

- Figure 88: South America Handheld Ultrasound Devices Industry Volume (K Unit), by Application 2024 & 2032

- Figure 89: South America Handheld Ultrasound Devices Industry Revenue Share (%), by Application 2024 & 2032

- Figure 90: South America Handheld Ultrasound Devices Industry Volume Share (%), by Application 2024 & 2032

- Figure 91: South America Handheld Ultrasound Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 92: South America Handheld Ultrasound Devices Industry Volume (K Unit), by Country 2024 & 2032

- Figure 93: South America Handheld Ultrasound Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 94: South America Handheld Ultrasound Devices Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 4: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 5: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Germany Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: France Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Italy Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Italy Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Spain Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: China Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: China Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Japan Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: India Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Australia Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: South Korea Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Korea Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: South Africa Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 53: Brazil Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Brazil Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Argentina Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Argentina Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Rest of South America Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of South America Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 60: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 61: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 63: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 65: United States Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: United States Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Canada Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Canada Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Mexico Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Mexico Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 72: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 73: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 74: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 75: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 77: Germany Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Germany Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 79: United Kingdom Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: United Kingdom Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: France Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: France Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 83: Italy Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Italy Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: Spain Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Spain Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Rest of Europe Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Rest of Europe Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 90: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 91: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 92: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 93: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 94: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 95: China Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: China Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 97: Japan Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Japan Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: India Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: India Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: Australia Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: Australia Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 103: South Korea Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: South Korea Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 105: Rest of Asia Pacific Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: Rest of Asia Pacific Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 107: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 108: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 109: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 110: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 111: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 112: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 113: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 114: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 115: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 116: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 117: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 118: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 119: South Africa Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 120: South Africa Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 121: Rest of Middle East Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 122: Rest of Middle East Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 123: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 124: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 125: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 126: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 127: Global Handheld Ultrasound Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 128: Global Handheld Ultrasound Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 129: Brazil Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 130: Brazil Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 131: Argentina Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 132: Argentina Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 133: Rest of South America Handheld Ultrasound Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 134: Rest of South America Handheld Ultrasound Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Handheld Ultrasound Devices Industry?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Handheld Ultrasound Devices Industry?

Key companies in the market include Fukuda Denshi Co Ltd, Siemens Healthineers, GE Healthcare, Hitachi Ltd, Koninklijke Philips NV, Fujifilm SonoSite Inc, Canon Medical Systems Corporation, Shenzhen Mindray, Samsung Healthcare.

3. What are the main segments of the Handheld Ultrasound Devices Industry?

The market segments include Type of Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.86 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Spectrum of Applications of Portable Ultrasound; Rising Advancements in Technology; Increasing Prevalence of Chronic Diseases.

6. What are the notable trends driving market growth?

Mobile Ultrasound Devices is Expected to Grow with High CAGR Over the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost of Portable Ultrasound Systems; Lack of Dedicated Training Programs by Companies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Handheld Ultrasound Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Handheld Ultrasound Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Handheld Ultrasound Devices Industry?

To stay informed about further developments, trends, and reports in the Handheld Ultrasound Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence