Key Insights

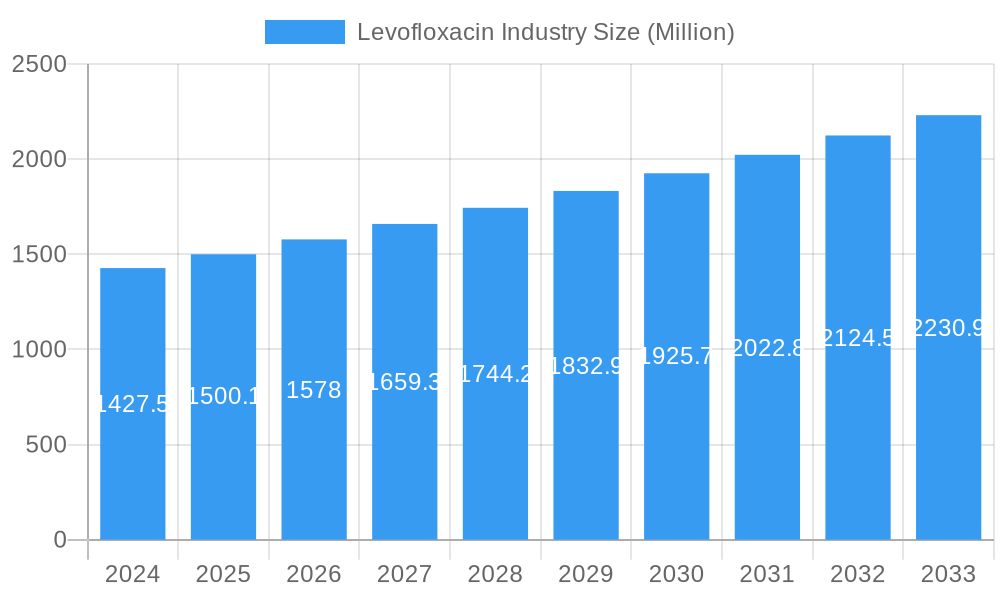

The Levofloxacin market is forecast for significant expansion, projected to reach a market size of $1.83 billion by the base year 2025. This growth trajectory is driven by a robust Compound Annual Growth Rate (CAGR) of 5.5% leading up to 2033. Key catalysts for this sustained expansion include the escalating incidence of bacterial infections, notably respiratory and skin infections, which are primary therapeutic areas for Levofloxacin. An increasing global population and improved healthcare accessibility, particularly in developing regions, further amplify demand. Innovations in pharmaceutical product development, such as the introduction of user-friendly dosage forms including 500 mg and 750 mg tablets, are enhancing patient adherence and market penetration. Factors such as expanding healthcare infrastructure, elevated healthcare expenditure, and heightened awareness among medical professionals and patients regarding Levofloxacin's effectiveness against a wide array of bacterial pathogens are pivotal growth drivers.

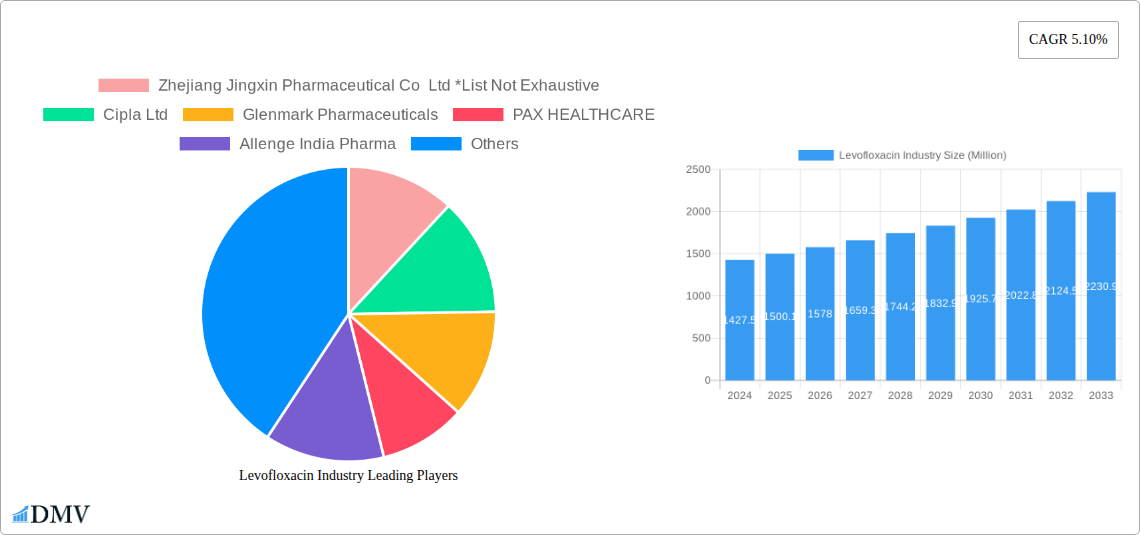

Levofloxacin Industry Market Size (In Billion)

Market dynamics are further influenced by strategic actions from major pharmaceutical entities, including Dr. Reddy's Laboratories, Cipla, and Lupin, who are actively engaged in product innovation, market outreach, and supply chain integrity. Conversely, the market confronts challenges such as the escalating issue of antibiotic resistance, underscoring the importance of responsible prescribing and the pursuit of alternative therapies. Stringent regulatory pathways for novel formulations and generic approvals may also influence the market's growth velocity. Notwithstanding these obstacles, Levofloxacin's increasing preference for treating complex infections, including complicated pneumonia and severe skin and soft tissue infections, is anticipated to maintain its market significance. The distribution network is undergoing evolution, with e-pharmacies emerging as a significant channel alongside conventional hospital and retail pharmacies, thereby improving accessibility and convenience for consumers.

Levofloxacin Industry Company Market Share

Levofloxacin Industry Market: In-depth Analysis and Future Forecast (2019–2033)

This comprehensive Levofloxacin industry report delves deep into the global market dynamics, offering crucial insights for stakeholders seeking to navigate this evolving therapeutic landscape. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report provides a granular analysis of market composition, trends, evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Leveraging high-ranking keywords such as levofloxacin market size, fluoroquinolone antibiotics, antibacterial drug market, pneumonia treatment drugs, and skin infection medications, this report is meticulously crafted to boost search visibility and captivate industry professionals. The analysis incorporates specific data points and real-world developments, ensuring actionable intelligence for pharmaceutical manufacturers, distributors, healthcare providers, and investors.

Levofloxacin Industry Market Composition & Trends

The global levofloxacin market exhibits a moderate concentration, driven by key pharmaceutical giants and a growing number of generic manufacturers. Innovation catalysts include the ongoing need for effective treatments against multi-drug resistant bacteria and the development of novel drug delivery systems. The regulatory landscape, particularly stringent approvals by agencies like the FDA and EMA, plays a pivotal role in market entry and product lifecycle management. Substitute products, primarily other fluoroquinolones and alternative antibiotic classes, present a competitive challenge, though levofloxacin's broad spectrum efficacy maintains its relevance. End-user profiles are diverse, encompassing hospitals, clinics, and retail settings, with an increasing demand from emerging economies. Mergers and acquisition (M&A) activities, though not extensively detailed in public records for this specific drug, contribute to market consolidation and portfolio expansion. Market share distribution is influenced by patent expiries, manufacturing capacities, and regional demand. Projected M&A deal values for related antibacterial segments indicate a significant investment trend.

- Market Share Distribution: Dominated by established players with significant generic penetration.

- Innovation Catalysts: Rising antibiotic resistance, development of combination therapies.

- Regulatory Landscape: Strict approval processes, post-market surveillance.

- Substitute Products: Other fluoroquinolones, carbapenems, cephalosporins.

- End-User Profiles: Hospitals, retail pharmacies, governmental health programs.

- M&A Activities: Strategic acquisitions to expand product portfolios and market reach.

Levofloxacin Industry Industry Evolution

The levofloxacin market evolution has been characterized by steady growth driven by its efficacy in treating a wide range of bacterial infections. From its introduction, levofloxacin quickly established itself as a cornerstone antibiotic due to its potent activity against Gram-positive, Gram-negative, and atypical bacteria. The historical period (2019–2024) witnessed a consistent demand, fueled by rising incidences of respiratory tract infections, urinary tract infections, and skin and soft tissue infections. Technological advancements in pharmaceutical manufacturing have allowed for more efficient and cost-effective production, making levofloxacin formulations more accessible globally. Shifting consumer demands, influenced by increased healthcare awareness and access to medical facilities, have also contributed to market expansion.

The base year (2025) marks a pivotal point where market trends are further shaped by global health initiatives and the ongoing challenge of antimicrobial resistance (AMR). Growth rates have remained robust, with an estimated annual growth rate (CAGR) of approximately 3.5% to 4.5% observed throughout the historical period, projected to continue into the forecast period. Adoption metrics indicate high penetration in developed markets and increasing uptake in developing nations as healthcare infrastructure improves. The shift towards oral formulations and fixed-dose combinations has also played a significant role in enhancing patient compliance and treatment outcomes. Furthermore, the development of newer, more targeted antibiotics, while a competitive factor, has also highlighted the continued importance of broad-spectrum agents like levofloxacin for empiric therapy and situations where specific pathogen identification is delayed. The market's trajectory is closely tied to the global burden of infectious diseases and the development of resistance patterns, necessitating continuous research and development efforts to maintain therapeutic relevance.

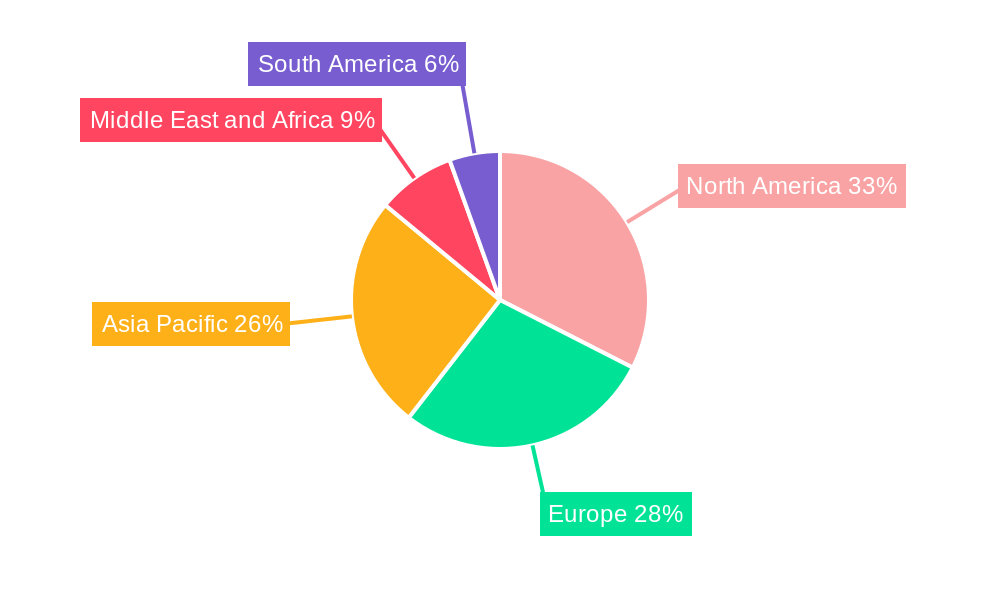

Leading Regions, Countries, or Segments in Levofloxacin Industry

The levofloxacin market landscape is significantly influenced by regional dynamics, with North America and Europe currently leading in terms of market value and adoption. This dominance is attributable to several key factors:

- Advanced Healthcare Infrastructure: Developed regions possess robust healthcare systems, high patient access to quality medical care, and a well-established network of hospitals and pharmacies, facilitating higher prescription volumes for levofloxacin.

- High Incidence of Target Infections: The prevalence of conditions such as pneumonia, complex skin infections, and complicated urinary tract infections, which are primary applications for levofloxacin, remains a significant driver.

- Favorable Reimbursement Policies: Government and private insurance schemes in these regions generally provide good coverage for essential antibiotics, ensuring affordability and accessibility for patients.

- Stringent Regulatory Approvals: While presenting a barrier to entry, the rigorous approval processes by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) ensure the quality and efficacy of levofloxacin products available in these markets, fostering trust among healthcare professionals.

- Investment in R&D: Substantial investments in pharmaceutical research and development lead to the introduction of newer formulations and combination therapies, further solidifying levofloxacin's position.

In terms of product segments, 500 mg tablets represent the most dominant dosage form globally, owing to their versatility in treating a wide range of infections effectively. The pneumonia segment within applications consistently drives significant demand, as levofloxacin is a first-line treatment option for community-acquired pneumonia and other severe respiratory infections. In terms of distribution channels, hospital pharmacies hold a substantial share, reflecting the critical role of levofloxacin in inpatient care, particularly for severe infections requiring intravenous administration or close monitoring. However, the growing presence of online pharmacies and the continued strength of retail pharmacies indicate a diversifying distribution strategy catering to outpatient needs and convenience. The Asia-Pacific region is emerging as a key growth market, driven by increasing healthcare expenditure, a large patient population, and a rise in the incidence of infectious diseases.

Levofloxacin Industry Product Innovations

Product innovations in the levofloxacin pharmaceutical market are primarily focused on enhancing patient convenience and expanding therapeutic utility. While the core molecule remains potent, advancements include the development of fixed-dose combinations designed to improve adherence and broaden the spectrum of activity, as exemplified by the Santen launch of Ducressa for post-cataract surgery. Furthermore, research into novel delivery systems aims to optimize bioavailability and reduce potential side effects, though these are still in early stages of development for levofloxacin. The focus remains on ensuring cost-effectiveness and accessibility of existing formulations, particularly the widely prescribed 500 mg and 750 mg tablets, to combat the global burden of bacterial infections.

Propelling Factors for Levofloxacin Industry Growth

The levofloxacin market growth is propelled by a confluence of factors. Technologically, advancements in manufacturing processes ensure consistent quality and cost-effectiveness of generic levofloxacin, driving wider adoption. Economically, increasing healthcare expenditure in emerging economies is expanding access to essential antibiotics. The persistent and evolving challenge of antimicrobial resistance (AMR) globally necessitates the continued use of broad-spectrum agents like levofloxacin, especially for empirical treatment. Regulatory support, in the form of approvals for generic versions and indications for common infections, further fuels market expansion. The rising incidence of bacterial infections, particularly in vulnerable populations and hospital settings, directly translates to sustained demand for effective treatments.

Obstacles in the Levofloxacin Industry Market

Despite its efficacy, the levofloxacin market faces significant obstacles. Regulatory challenges, including stringent post-market surveillance and evolving guidelines on fluoroquinolone use due to potential side effects, can impact market access and prescription patterns. Supply chain disruptions, exacerbated by geopolitical events and raw material availability, can lead to price volatility and availability issues. Competitive pressures from newer antibiotic classes and the increasing threat of levofloxacin resistance necessitate careful stewardship and monitoring of usage. The potential for adverse events, such as tendonitis and peripheral neuropathy, also prompts a cautious approach by prescribers, leading to its restricted use in certain patient populations.

Future Opportunities in Levofloxacin Industry

The future of the levofloxacin industry lies in exploring new therapeutic niches and optimizing existing applications. Opportunities exist in developing novel combination therapies that target resistant strains or provide synergistic effects. Expanding access in underserved regions with a growing burden of infectious diseases presents a significant market potential. Furthermore, research into localized drug delivery systems for specific infections could minimize systemic exposure and side effects, enhancing patient outcomes and driving innovation. The ongoing global efforts to combat antimicrobial resistance may also lead to renewed interest in well-established broad-spectrum antibiotics when used judiciously.

Major Players in the Levofloxacin Industry Ecosystem

- Zhejiang Jingxin Pharmaceutical Co Ltd

- Cipla Ltd

- Glenmark Pharmaceuticals

- PAX HEALTHCARE

- Allenge India Pharma

- Lupin Limited

- DivineSavior in

- Alna Biotech Private Limited

- Aden Healthcare

- Dr Reddy's Laboratories Ltd

Key Developments in Levofloxacin Industry Industry

- August 2022: Santen launched Ducressa in the United Kingdom and Ireland. The therapy is a fixed-dose combination of levofloxacin and dexamethasone for use after cataract surgery. This is part of a convenient seven-day therapeutic strategy to optimize post-surgery care. This development highlights innovation in combination therapies and expanded applications.

- February 2022: Russia's Binnopharm Group and India's Dr. Reddy's Laboratories announced that they had signed a deal that would allow Binnopharm Group to buy antibacterial medicines from Dr. Reddy's in Russia, Uzbekistan, and Belarus. These medicines are sold under the brand names Ciprolet (ciprofloxacin) and Levolet (levofloxacin). This strategic partnership underscores market expansion efforts and cross-border collaborations within the fluoroquinolone segment.

Strategic Levofloxacin Industry Market Forecast

The strategic forecast for the levofloxacin market indicates continued relevance and moderate growth driven by persistent infectious disease burdens and the ongoing challenge of antimicrobial resistance. Opportunities lie in developing cost-effective generic formulations for emerging markets and exploring novel combination therapies to combat resistant pathogens. Strategic partnerships and market expansion into regions with increasing healthcare access will be crucial. The judicious use of levofloxacin, guided by antimicrobial stewardship principles, will ensure its long-term therapeutic value and market sustainability, projecting a steady demand throughout the forecast period.

Levofloxacin Industry Segmentation

-

1. Type

- 1.1. 250 mg Tablets

- 1.2. 500 mg Tablets

- 1.3. 750 mg Tablets

-

2. Application

- 2.1. Pneumonia

- 2.2. Skin Infection

- 2.3. Kidney Infection

- 2.4. Bladder Infection

- 2.5. Other Applications

-

3. Distribution Channel

- 3.1. Hospital Pharmacies

- 3.2. Retail Pharmacies

- 3.3. Online Pharmacies

Levofloxacin Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Levofloxacin Industry Regional Market Share

Geographic Coverage of Levofloxacin Industry

Levofloxacin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Nosocomial and Community-acquired Pneumonia; Growing Incidence of Bacterial Infections; Easy Availability and Affordable Cost of Drugs

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness about Infectious Diseases; Adverse Reactions Associated with Drugs

- 3.4. Market Trends

- 3.4.1. Pneumonia Segment is Expected to Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Levofloxacin Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. 250 mg Tablets

- 5.1.2. 500 mg Tablets

- 5.1.3. 750 mg Tablets

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pneumonia

- 5.2.2. Skin Infection

- 5.2.3. Kidney Infection

- 5.2.4. Bladder Infection

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospital Pharmacies

- 5.3.2. Retail Pharmacies

- 5.3.3. Online Pharmacies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Levofloxacin Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. 250 mg Tablets

- 6.1.2. 500 mg Tablets

- 6.1.3. 750 mg Tablets

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pneumonia

- 6.2.2. Skin Infection

- 6.2.3. Kidney Infection

- 6.2.4. Bladder Infection

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hospital Pharmacies

- 6.3.2. Retail Pharmacies

- 6.3.3. Online Pharmacies

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Levofloxacin Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. 250 mg Tablets

- 7.1.2. 500 mg Tablets

- 7.1.3. 750 mg Tablets

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pneumonia

- 7.2.2. Skin Infection

- 7.2.3. Kidney Infection

- 7.2.4. Bladder Infection

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hospital Pharmacies

- 7.3.2. Retail Pharmacies

- 7.3.3. Online Pharmacies

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Levofloxacin Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. 250 mg Tablets

- 8.1.2. 500 mg Tablets

- 8.1.3. 750 mg Tablets

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pneumonia

- 8.2.2. Skin Infection

- 8.2.3. Kidney Infection

- 8.2.4. Bladder Infection

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hospital Pharmacies

- 8.3.2. Retail Pharmacies

- 8.3.3. Online Pharmacies

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Levofloxacin Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. 250 mg Tablets

- 9.1.2. 500 mg Tablets

- 9.1.3. 750 mg Tablets

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Pneumonia

- 9.2.2. Skin Infection

- 9.2.3. Kidney Infection

- 9.2.4. Bladder Infection

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hospital Pharmacies

- 9.3.2. Retail Pharmacies

- 9.3.3. Online Pharmacies

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Levofloxacin Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. 250 mg Tablets

- 10.1.2. 500 mg Tablets

- 10.1.3. 750 mg Tablets

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Pneumonia

- 10.2.2. Skin Infection

- 10.2.3. Kidney Infection

- 10.2.4. Bladder Infection

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hospital Pharmacies

- 10.3.2. Retail Pharmacies

- 10.3.3. Online Pharmacies

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zhejiang Jingxin Pharmaceutical Co Ltd *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cipla Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Glenmark Pharmaceuticals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PAX HEALTHCARE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Allenge India Pharma

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lupin Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DivineSavior in

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alna Biotech Private Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aden Healthcare

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dr Reddy's Laboratories Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Zhejiang Jingxin Pharmaceutical Co Ltd *List Not Exhaustive

List of Figures

- Figure 1: Global Levofloxacin Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Levofloxacin Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Levofloxacin Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Levofloxacin Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Levofloxacin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Levofloxacin Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America Levofloxacin Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Levofloxacin Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Levofloxacin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Levofloxacin Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Levofloxacin Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Levofloxacin Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Levofloxacin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Levofloxacin Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: Europe Levofloxacin Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Levofloxacin Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Levofloxacin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Levofloxacin Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Levofloxacin Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Levofloxacin Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Levofloxacin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Levofloxacin Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Levofloxacin Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Levofloxacin Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Levofloxacin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Levofloxacin Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Levofloxacin Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Levofloxacin Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Levofloxacin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Levofloxacin Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: Middle East and Africa Levofloxacin Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East and Africa Levofloxacin Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Levofloxacin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Levofloxacin Industry Revenue (billion), by Type 2025 & 2033

- Figure 35: South America Levofloxacin Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Levofloxacin Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Levofloxacin Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Levofloxacin Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: South America Levofloxacin Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: South America Levofloxacin Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Levofloxacin Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Levofloxacin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Levofloxacin Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Levofloxacin Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Levofloxacin Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Levofloxacin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Levofloxacin Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Levofloxacin Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Levofloxacin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Levofloxacin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Levofloxacin Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Levofloxacin Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Levofloxacin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Levofloxacin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Levofloxacin Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Levofloxacin Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Levofloxacin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Levofloxacin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Levofloxacin Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Levofloxacin Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Levofloxacin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Levofloxacin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 40: Global Levofloxacin Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Levofloxacin Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Levofloxacin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Levofloxacin Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Levofloxacin Industry?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Levofloxacin Industry?

Key companies in the market include Zhejiang Jingxin Pharmaceutical Co Ltd *List Not Exhaustive, Cipla Ltd, Glenmark Pharmaceuticals, PAX HEALTHCARE, Allenge India Pharma, Lupin Limited, DivineSavior in, Alna Biotech Private Limited, Aden Healthcare, Dr Reddy's Laboratories Ltd.

3. What are the main segments of the Levofloxacin Industry?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.83 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Nosocomial and Community-acquired Pneumonia; Growing Incidence of Bacterial Infections; Easy Availability and Affordable Cost of Drugs.

6. What are the notable trends driving market growth?

Pneumonia Segment is Expected to Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Awareness about Infectious Diseases; Adverse Reactions Associated with Drugs.

8. Can you provide examples of recent developments in the market?

August 2022: Santen launched Ducressa in the United Kingdom and Ireland. The therapy is a fixed-dose combination of levofloxacin and dexamethasone for use after cataract surgery. This is part of a convenient seven-day therapeutic strategy to optimize post-surgery care.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Levofloxacin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Levofloxacin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Levofloxacin Industry?

To stay informed about further developments, trends, and reports in the Levofloxacin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence