Key Insights

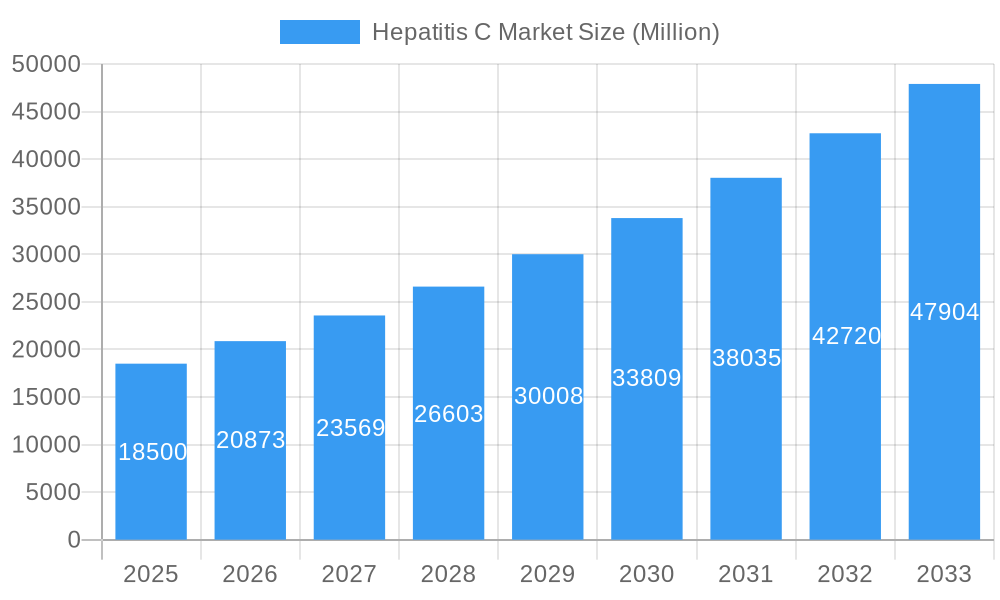

The global Hepatitis C market is poised for significant expansion, projected to reach a substantial market size of approximately USD 18,500 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.82%. This robust growth trajectory is primarily fueled by a confluence of key drivers including advancements in antiviral therapies, increased global screening and diagnosis initiatives, and a growing awareness surrounding the long-term health implications of untreated Hepatitis C. The availability of highly effective Direct-Acting Antivirals (DAAs) has revolutionized treatment, offering shorter durations and higher cure rates, thus bolstering patient outcomes and market demand. Furthermore, public health campaigns and government-led elimination programs in various regions are intensifying efforts to identify and treat infected individuals, thereby expanding the addressable market for diagnostics and therapeutics.

Hepatitis C Market Market Size (In Billion)

The market is segmented across crucial areas of diagnosis and treatment, with both segments demonstrating substantial growth potential. Within diagnostics, advancements in blood tests and the increasing adoption of minimally invasive procedures are driving segment expansion. The treatment landscape is dominated by the demand for potent antiviral drugs, while immune modulator drugs are also gaining traction for specific patient profiles or as adjunct therapies. Hospitals and clinics represent the primary end-users, benefiting from increasing patient influx and the adoption of new treatment protocols. Key industry players like Gilead Sciences, AbbVie, and Bristol-Myers Squibb are at the forefront of innovation, consistently launching novel therapies and expanding their market reach through strategic partnerships and robust R&D investments. Emerging economies, particularly in the Asia Pacific region, are expected to contribute significantly to market growth due to increasing healthcare expenditure and a rising prevalence of the disease, though challenges related to access and affordability persist.

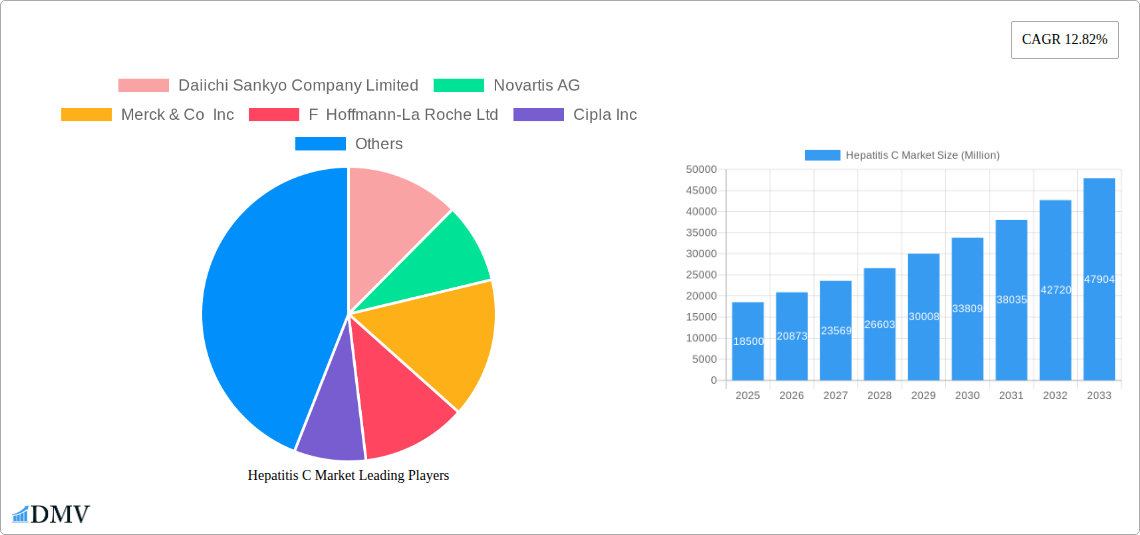

Hepatitis C Market Company Market Share

This comprehensive Hepatitis C Market report provides an in-depth analysis of the global market landscape, offering critical insights for stakeholders, pharmaceutical companies, healthcare providers, and investors. Covering the historical period of 2019–2024 and forecasting through 2033, with a base year of 2025, this study delves into market dynamics, key drivers, emerging opportunities, and the strategic moves of major industry players. Navigate the complex Hepatitis C market with actionable intelligence to drive growth and improve patient outcomes.

Hepatitis C Market Market Composition & Trends

The Hepatitis C Market is characterized by a dynamic interplay of innovation, stringent regulatory frameworks, and evolving treatment paradigms. Market concentration is influenced by the significant R&D investments required for novel antiviral therapies, with leading pharmaceutical giants holding substantial market share. Key innovation catalysts include advancements in direct-acting antiviral (DAA) drug development, leading to higher cure rates and shorter treatment durations. The regulatory landscape plays a crucial role, with agencies like the FDA and EMA continuously evaluating new therapeutic options. Substitute products, while limited in curative treatments, include less effective traditional therapies and preventive measures. End-user profiles range from hospitals and specialized clinics to diagnostic laboratories, all integral to patient diagnosis and management. Mergers and acquisitions (M&A) are notable, driven by the strategic imperative to consolidate market presence and expand product portfolios. For instance, significant M&A deal values are observed as companies aim to acquire promising pipeline assets or gain access to established treatment franchises. The market share distribution is heavily skewed towards innovative DAA treatments, reflecting their superior efficacy.

Hepatitis C Market Industry Evolution

The Hepatitis C Market has undergone a profound transformation over the study period. Initially dominated by interferon-based therapies with significant side effects and lower cure rates, the industry has rapidly shifted towards highly effective Direct-Acting Antivirals (DAAs). This evolution, particularly noticeable from 2019 onwards, has dramatically improved patient outcomes, with cure rates now exceeding 95% for many genotypes. The market growth trajectory has been fueled by increasing awareness, improved diagnostic capabilities, and supportive government initiatives aimed at disease eradication. Technological advancements in drug discovery and formulation have enabled the development of pan-genotypic treatments, simplifying treatment regimens and expanding access. Shifting consumer demands are increasingly focused on shorter treatment durations, fewer side effects, and improved quality of life post-treatment. The adoption of DAAs has seen a steep upward curve, displacing older treatment modalities. For example, the market experienced a Compound Annual Growth Rate (CAGR) of approximately 8-10% in the early years of DAA dominance, with growth moderating as the market matures and treatment accessibility widens. The estimated market size for Hepatitis C therapeutics is projected to reach xx Million by 2025, with significant contributions from key markets in North America and Europe. The ongoing research into novel combination therapies and potential cure strategies continues to shape the industry's future.

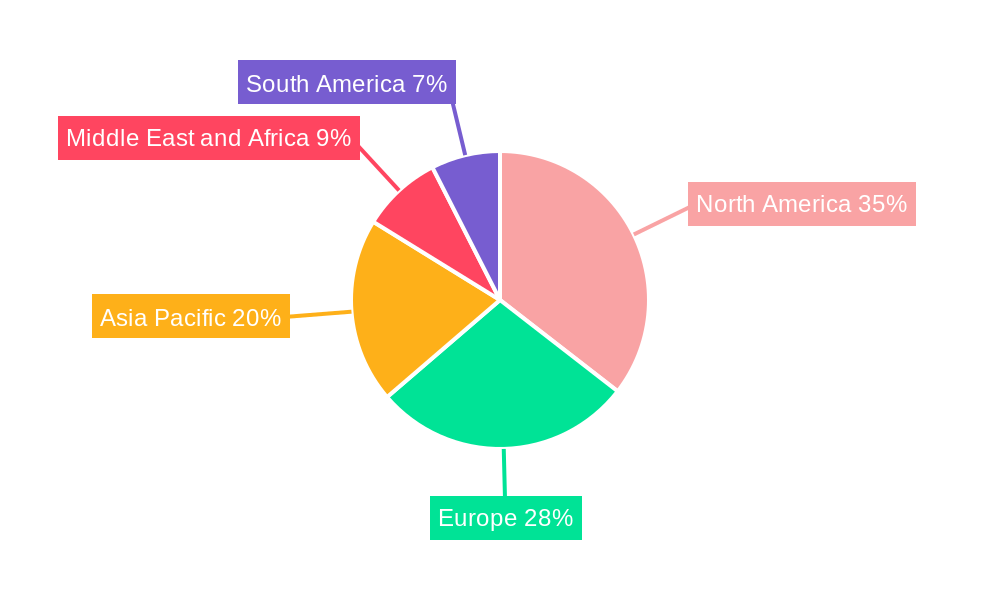

Leading Regions, Countries, or Segments in Hepatitis C Market

The Hepatitis C Market's dominance is multifaceted, with significant contributions stemming from key therapeutic segments and major geographical regions.

Treatment Segment Dominance:

- Antiviral Drugs: This segment unequivocally leads the Hepatitis C market. The advent and widespread adoption of Direct-Acting Antivirals (DAAs) have revolutionized Hepatitis C treatment, offering high cure rates and significantly reduced side effects compared to older therapies. The market is driven by continuous innovation in DAA combinations and pan-genotypic regimens.

- Immune Modulator Drugs: While historically important, immune modulator drugs have largely been superseded by DAAs for primary treatment. They may still find niche applications in specific patient populations or combination therapies, but their market share is considerably smaller.

- Other Treatments: This category encompasses supportive care and management of complications, playing a vital role in overall patient well-being but not directly contributing to viral eradication in the same magnitude as antiviral drugs.

Regional Dominance:

- North America: This region consistently exhibits strong market performance due to advanced healthcare infrastructure, high per capita income, robust reimbursement policies, and significant investments in R&D by leading pharmaceutical companies. The presence of a large patient pool and proactive public health initiatives to screen and treat Hepatitis C contribute to its leadership.

- Europe: Similar to North America, Europe benefits from well-established healthcare systems, widespread access to advanced treatments, and strong governmental support for Hepatitis C elimination programs. Major European countries often align with North American market trends, driving demand for innovative therapies.

- Asia Pacific: This region presents a significant growth opportunity, with increasing awareness, improving healthcare access, and a large undiagnosed population. Government initiatives and the increasing affordability of generic DAAs are key drivers of market expansion.

End-User Landscape:

- Hospitals and Clinics: These remain the primary settings for Hepatitis C diagnosis and treatment, leveraging specialized medical expertise and comprehensive diagnostic facilities.

- Diagnostic Laboratories: Essential for accurate diagnosis, genotyping, and monitoring treatment efficacy, diagnostic laboratories play a critical role in the patient care pathway.

Hepatitis C Market Product Innovations

Product innovation in the Hepatitis C Market is intensely focused on enhancing treatment efficacy, simplifying regimens, and broadening accessibility. The development of pan-genotypic direct-acting antiviral (DAA) combinations has been a landmark achievement, offering effective treatment across all major Hepatitis C genotypes with a single regimen. These innovations have led to shorter treatment durations, often as short as 8-12 weeks, compared to the months-long therapies of the past. Unique selling propositions include significantly improved patient compliance due to once-daily oral administration and a favorable safety profile with minimal side effects. Technological advancements are also exploring novel drug delivery systems and potentially curative therapies, aiming for even greater patient benefit and disease eradication.

Propelling Factors for Hepatitis C Market Growth

Several key factors are propelling the growth of the Hepatitis C Market. The widespread adoption of highly effective Direct-Acting Antivirals (DAAs) with high cure rates and favorable safety profiles is a primary driver. Increased government initiatives and public health campaigns focused on screening, diagnosis, and treatment are expanding the patient pool seeking care. Advancements in diagnostic technologies allow for earlier and more accurate identification of infections. Furthermore, expanding reimbursement policies in both developed and emerging economies are improving patient access to these life-saving treatments. The continuous pipeline of innovative therapies by major pharmaceutical companies further fuels market expansion.

Obstacles in the Hepatitis C Market Market

Despite significant progress, the Hepatitis C Market faces several obstacles. High treatment costs associated with novel DAAs remain a significant barrier, particularly in low- and middle-income countries, limiting access for a large segment of the global patient population. Complex diagnostic pathways and a lack of widespread screening programs in certain regions contribute to a substantial undiagnosed population. Regulatory hurdles and lengthy approval processes for new therapies can delay market entry. Furthermore, drug resistance, though less common with DAAs, remains a concern, necessitating careful treatment selection. Supply chain disruptions and manufacturing challenges can also impact the availability of essential medications.

Future Opportunities in Hepatitis C Market

The Hepatitis C Market is poised for continued growth driven by emerging opportunities. Expanding access to affordable generic DAAs in emerging economies presents a vast untapped market. The development of ultra-short treatment regimens and potentially curative therapies, such as those targeting viral reservoirs or utilizing immunotherapy, represent significant future advancements. Increased focus on Hepatitis C elimination programs worldwide will drive demand for comprehensive diagnostic and treatment solutions. Furthermore, advancements in digital health and telemedicine can improve patient monitoring and adherence, especially in remote areas. The potential for co-infection treatment strategies, addressing Hepatitis C in conjunction with other viral infections like HIV, also offers new avenues for market penetration.

Major Players in the Hepatitis C Market Ecosystem

- Daiichi Sankyo Company Limited

- Novartis AG

- Merck & Co Inc

- F Hoffmann-La Roche Ltd

- Cipla Inc

- GlaxoSmithKline plc

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- AbbVie Inc

- Johnson & Johnson

- Astellas Pharma Inc

- Gilead Sciences Inc

- Bristol-Myers Squibb Company

Key Developments in Hepatitis C Market Industry

- January 2023: HIVMA created guidance for treating patients with COVID-19 with nirmatrelvir-ritonavir (Paxlovid) who have HIV or hepatitis C. The guidance includes a link to IDSA's clinical guidance for using nirmatrelvir- ritonavir and potential drug interactions. This development underscores the increasing focus on managing co-infections and the complex drug interactions associated with Hepatitis C treatment.

- September 2022: Texas Medicaid designated MAVYRET medication as the primary preferred direct-acting antiviral (DAA) drug option for treating a hepatitis C infection. This decision highlights the ongoing evaluation and preference for specific DAA therapies by large healthcare payers, influencing market dynamics and prescribing patterns.

Strategic Hepatitis C Market Market Forecast

The Hepatitis C Market is set for sustained growth driven by the increasing global focus on Hepatitis C elimination. The forecast period (2025–2033) will be characterized by the continued dominance of direct-acting antivirals (DAAs), with an emphasis on pan-genotypic regimens and shorter treatment durations. Expanding access to affordable generic treatments in emerging markets will be a significant growth catalyst. Strategic partnerships between pharmaceutical companies and public health organizations will be crucial for widespread screening and treatment initiatives. The development of novel, potentially curative therapies, along with advancements in diagnostics, will further shape market evolution, promising a future where Hepatitis C is increasingly preventable and treatable on a global scale.

Hepatitis C Market Segmentation

-

1. Type

-

1.1. Diagnosis

- 1.1.1. Liver Biopsy

- 1.1.2. Blood Tests

- 1.1.3. Other Diagnoses

-

1.2. Treatment

- 1.2.1. Antiviral Drugs

- 1.2.2. Immune Modulator Drugs

- 1.2.3. Other Treatments

-

1.1. Diagnosis

-

2. End-User

- 2.1. Hospitals and Clinics

- 2.2. Diagnostic Laboratory

- 2.3. Other End-Users

Hepatitis C Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Hepatitis C Market Regional Market Share

Geographic Coverage of Hepatitis C Market

Hepatitis C Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Disease Burden of Hepatitis C; Increasing Awareness and Advances in Diagnosis; Surge In Availability of Advanced Therapeutic Products

- 3.3. Market Restrains

- 3.3.1. High Cost of Treatment; Social Stigma and Undiagnosed Cases

- 3.4. Market Trends

- 3.4.1. Antiviral Drugs Segment is Expected to Hold a Major Share in the Hepatitis C Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hepatitis C Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Diagnosis

- 5.1.1.1. Liver Biopsy

- 5.1.1.2. Blood Tests

- 5.1.1.3. Other Diagnoses

- 5.1.2. Treatment

- 5.1.2.1. Antiviral Drugs

- 5.1.2.2. Immune Modulator Drugs

- 5.1.2.3. Other Treatments

- 5.1.1. Diagnosis

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Hospitals and Clinics

- 5.2.2. Diagnostic Laboratory

- 5.2.3. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hepatitis C Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Diagnosis

- 6.1.1.1. Liver Biopsy

- 6.1.1.2. Blood Tests

- 6.1.1.3. Other Diagnoses

- 6.1.2. Treatment

- 6.1.2.1. Antiviral Drugs

- 6.1.2.2. Immune Modulator Drugs

- 6.1.2.3. Other Treatments

- 6.1.1. Diagnosis

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Hospitals and Clinics

- 6.2.2. Diagnostic Laboratory

- 6.2.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Hepatitis C Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Diagnosis

- 7.1.1.1. Liver Biopsy

- 7.1.1.2. Blood Tests

- 7.1.1.3. Other Diagnoses

- 7.1.2. Treatment

- 7.1.2.1. Antiviral Drugs

- 7.1.2.2. Immune Modulator Drugs

- 7.1.2.3. Other Treatments

- 7.1.1. Diagnosis

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Hospitals and Clinics

- 7.2.2. Diagnostic Laboratory

- 7.2.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Hepatitis C Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Diagnosis

- 8.1.1.1. Liver Biopsy

- 8.1.1.2. Blood Tests

- 8.1.1.3. Other Diagnoses

- 8.1.2. Treatment

- 8.1.2.1. Antiviral Drugs

- 8.1.2.2. Immune Modulator Drugs

- 8.1.2.3. Other Treatments

- 8.1.1. Diagnosis

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Hospitals and Clinics

- 8.2.2. Diagnostic Laboratory

- 8.2.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Hepatitis C Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Diagnosis

- 9.1.1.1. Liver Biopsy

- 9.1.1.2. Blood Tests

- 9.1.1.3. Other Diagnoses

- 9.1.2. Treatment

- 9.1.2.1. Antiviral Drugs

- 9.1.2.2. Immune Modulator Drugs

- 9.1.2.3. Other Treatments

- 9.1.1. Diagnosis

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Hospitals and Clinics

- 9.2.2. Diagnostic Laboratory

- 9.2.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Hepatitis C Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Diagnosis

- 10.1.1.1. Liver Biopsy

- 10.1.1.2. Blood Tests

- 10.1.1.3. Other Diagnoses

- 10.1.2. Treatment

- 10.1.2.1. Antiviral Drugs

- 10.1.2.2. Immune Modulator Drugs

- 10.1.2.3. Other Treatments

- 10.1.1. Diagnosis

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Hospitals and Clinics

- 10.2.2. Diagnostic Laboratory

- 10.2.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Daiichi Sankyo Company Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novartis AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck & Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Hoffmann-La Roche Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cipla Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GlaxoSmithKline plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Takeda Pharmaceutical Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eli Lilly and Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AbbVie Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Johnson & Johnson

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Astellas Pharma Inc *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Gilead Sciences Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bristol-Myers Squibb Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Daiichi Sankyo Company Limited

List of Figures

- Figure 1: Global Hepatitis C Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Hepatitis C Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Hepatitis C Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hepatitis C Market Revenue (undefined), by End-User 2025 & 2033

- Figure 5: North America Hepatitis C Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Hepatitis C Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Hepatitis C Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Hepatitis C Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Hepatitis C Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Hepatitis C Market Revenue (undefined), by End-User 2025 & 2033

- Figure 11: Europe Hepatitis C Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Hepatitis C Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Hepatitis C Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Hepatitis C Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Hepatitis C Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Hepatitis C Market Revenue (undefined), by End-User 2025 & 2033

- Figure 17: Asia Pacific Hepatitis C Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Hepatitis C Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Hepatitis C Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Hepatitis C Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East and Africa Hepatitis C Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Hepatitis C Market Revenue (undefined), by End-User 2025 & 2033

- Figure 23: Middle East and Africa Hepatitis C Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Middle East and Africa Hepatitis C Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Hepatitis C Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Hepatitis C Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: South America Hepatitis C Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Hepatitis C Market Revenue (undefined), by End-User 2025 & 2033

- Figure 29: South America Hepatitis C Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: South America Hepatitis C Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Hepatitis C Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hepatitis C Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Hepatitis C Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 3: Global Hepatitis C Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Hepatitis C Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Hepatitis C Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 6: Global Hepatitis C Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Hepatitis C Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Hepatitis C Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 12: Global Hepatitis C Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Hepatitis C Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Hepatitis C Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 21: Global Hepatitis C Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Hepatitis C Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global Hepatitis C Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 30: Global Hepatitis C Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Hepatitis C Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 35: Global Hepatitis C Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 36: Global Hepatitis C Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Hepatitis C Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hepatitis C Market?

The projected CAGR is approximately 15.1%.

2. Which companies are prominent players in the Hepatitis C Market?

Key companies in the market include Daiichi Sankyo Company Limited, Novartis AG, Merck & Co Inc, F Hoffmann-La Roche Ltd, Cipla Inc, GlaxoSmithKline plc, Takeda Pharmaceutical Company Limited, Eli Lilly and Company, AbbVie Inc, Johnson & Johnson, Astellas Pharma Inc *List Not Exhaustive, Gilead Sciences Inc, Bristol-Myers Squibb Company.

3. What are the main segments of the Hepatitis C Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Disease Burden of Hepatitis C; Increasing Awareness and Advances in Diagnosis; Surge In Availability of Advanced Therapeutic Products.

6. What are the notable trends driving market growth?

Antiviral Drugs Segment is Expected to Hold a Major Share in the Hepatitis C Market.

7. Are there any restraints impacting market growth?

High Cost of Treatment; Social Stigma and Undiagnosed Cases.

8. Can you provide examples of recent developments in the market?

January 2023: HIVMA created guidance for treating patients with COVID-19 with nirmatrelvir-ritonavir (Paxlovid) who have HIV or hepatitis C. The guidance includes a link to IDSA's clinical guidance for using nirmatrelvir- ritonavir and potential drug interactions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hepatitis C Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hepatitis C Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hepatitis C Market?

To stay informed about further developments, trends, and reports in the Hepatitis C Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence