Key Insights

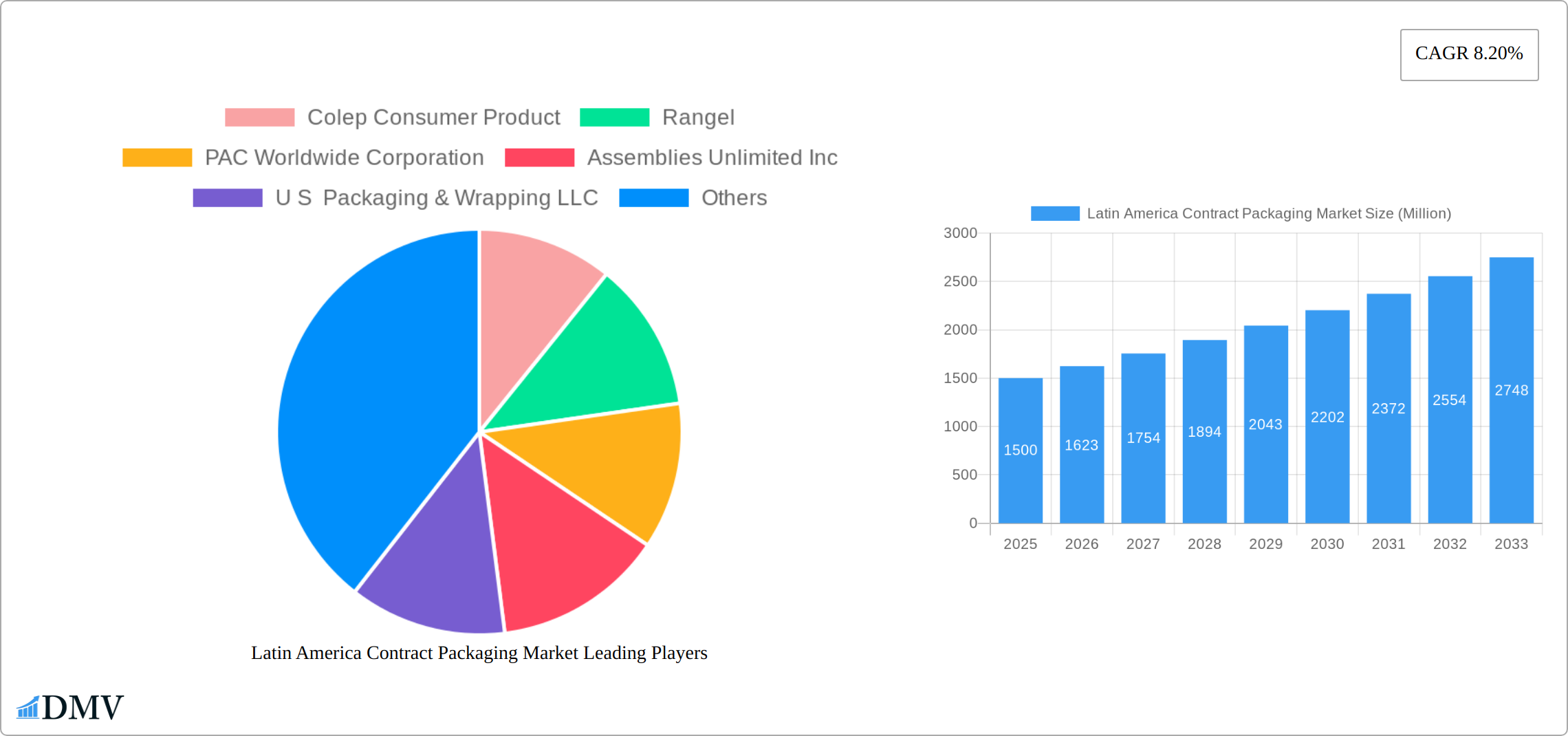

The Latin American contract packaging market, valued at approximately $XX million in 2025, is poised for robust growth, exhibiting a compound annual growth rate (CAGR) of 8.20% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector in the region, coupled with increasing demand for pharmaceutical products and a rising focus on efficient supply chains, are driving significant demand for contract packaging services. Furthermore, the growth of e-commerce and the rising popularity of personalized products necessitate flexible and scalable packaging solutions, further bolstering the market. Brazil, Mexico, and Argentina constitute the largest market segments, contributing significantly to the overall growth. The increasing adoption of sustainable packaging practices and technological advancements in automation and packaging design are also shaping market trends. While challenges such as fluctuating raw material prices and economic volatility in certain regions exist, the overall outlook for the Latin American contract packaging market remains positive, with significant opportunities for growth across all segments—primary, secondary, and tertiary packaging—and end-user industries.

Latin America Contract Packaging Market Market Size (In Billion)

Growth is expected to be particularly strong in the food and beverage and pharmaceutical segments, driven by stringent regulatory requirements and the need for sophisticated packaging solutions. The increasing focus on convenience and on-the-go consumption patterns also contributes to growth, particularly in secondary packaging solutions for single-serve portions or ready-to-eat meals. The rising middle class in Latin America and increasing disposable incomes are fueling demand for packaged goods across all categories. Furthermore, the presence of established contract packaging companies and the entry of new players are creating a competitive landscape, encouraging innovation and efficiency improvements. This competitive environment is likely to further propel growth within the forecast period. Companies are also increasingly adopting advanced technologies like automation to increase efficiency and reduce costs, contributing to market expansion.

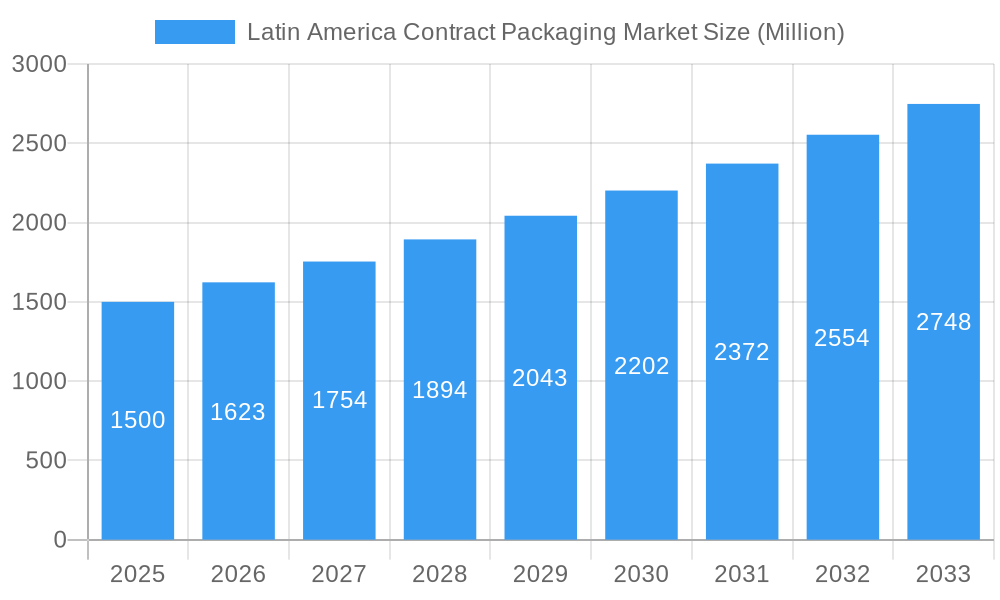

Latin America Contract Packaging Market Company Market Share

Latin America Contract Packaging Market: A Comprehensive Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Latin America contract packaging market, providing crucial data and forecasts for informed strategic decision-making. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's dynamics, key players, and future trajectory. Valued at xx Million in 2025, the market is poised for significant growth, presenting lucrative opportunities for businesses across the packaging value chain.

Latin America Contract Packaging Market Composition & Trends

This section meticulously examines the Latin America contract packaging market's structure and evolution. We analyze market concentration, revealing the share held by leading players like Colep Consumer Product, Rangel, PAC Worldwide Corporation, Assemblies Unlimited Inc, U S Packaging & Wrapping LLC, TricorBraun, and VMA LOGDIST. The report delves into innovation catalysts, such as sustainable packaging solutions and technological advancements in automation, and assesses the impact of evolving regulatory landscapes on market participants. Furthermore, it explores the influence of substitute products and profiles end-user industries, including Food, Beverages, Pharmaceutical, Household and Personal Care, and Other End-user Industries. A detailed analysis of recent mergers and acquisitions (M&A) activity, including deal values and their implications for market share distribution (e.g., TricorBraun's acquisition of Merlot Packaging), is also provided. The report also incorporates an in-depth examination of the competitive landscape, highlighting key partnerships and collaborations. The market share distribution among the major players is estimated to be: Colep Consumer Product (xx%), Rangel (xx%), PAC Worldwide Corporation (xx%), Assemblies Unlimited Inc (xx%), U S Packaging & Wrapping LLC (xx%), TricorBraun (xx%), and VMA LOGDIST (xx%). The total value of M&A deals in the period 2019-2024 is estimated at xx Million.

Latin America Contract Packaging Market Industry Evolution

This section offers a comprehensive analysis of the Latin America contract packaging market's evolution from 2019 to 2033. We delve into historical data (2019-2024) and project future growth (2025-2033), identifying pivotal milestones and shifts in market dynamics. The impact of technological advancements, including automation, robotics, and the integration of Industry 4.0 principles, on production efficiency, cost optimization, and overall supply chain agility is thoroughly examined. The report explores the evolving consumer landscape, focusing on the increasing demand for sustainable and innovative packaging solutions – such as recyclable, compostable, and reusable options – and their effect on market demand. Detailed data points, including precise annual growth rates (AGRs) and adoption rates for key technologies, provide a granular understanding of market trajectory. Furthermore, the analysis incorporates a macroeconomic assessment, considering factors like fluctuating currency exchange rates, inflation, and regional economic growth, alongside shifts in consumer behavior and purchasing power, to create a robust and nuanced forecast. The report projects a Compound Annual Growth Rate (CAGR) of [Insert Projected CAGR]% during the forecast period (2025-2033), supported by detailed market segmentation and analysis of key influencing factors.

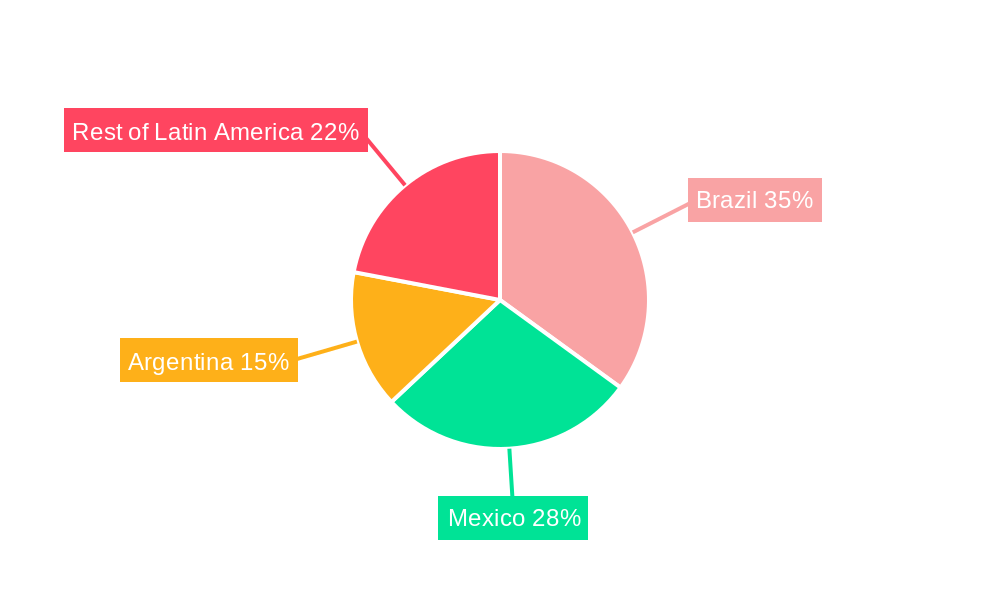

Leading Regions, Countries, or Segments in Latin America Contract Packaging Market

This section identifies the dominant regions, countries, and segments within the Latin America contract packaging market. The report meticulously analyzes market share distribution across Brazil, Mexico, Argentina, and other countries, examining the factors driving their prominence. It also explores the leading end-user industries (Food, Beverages, Pharmaceutical, Household and Personal Care, Other End-user Industries) and packaging services (Primary, Secondary, and Tertiary Packaging), highlighting key drivers and dominance factors for each.

- Key Drivers for Brazil: Strong domestic consumption, robust industrial base, favorable government policies.

- Key Drivers for Mexico: Growing foreign investment, proximity to the US market, increasing demand for packaged goods.

- Key Drivers for the Pharmaceutical Segment: Strict regulatory compliance needs, growing demand for specialized packaging solutions.

- Key Drivers for Primary Packaging: High demand driven by product protection and branding requirements.

Brazil is identified as the largest market due to its considerable population and established manufacturing sector. Mexico’s proximity to the US market also contributes to its significant market share. The pharmaceutical segment is experiencing the highest growth rate due to stringent regulatory requirements and rising healthcare spending.

Latin America Contract Packaging Market Product Innovations

This section showcases recent and emerging innovations within the Latin American contract packaging market. It highlights the proliferation of sustainable packaging materials (e.g., biodegradable plastics, recycled content, plant-based alternatives), advanced packaging technologies (e.g., active and intelligent packaging, tamper-evident seals, serialization technologies for enhanced product traceability), and innovative packaging designs aimed at enhancing product appeal, extending shelf life, and improving the overall consumer experience. The report analyzes the unique selling propositions (USPs) of these new products and their impact on key performance indicators (KPIs), including cost efficiency, environmental footprint reduction, brand differentiation, consumer satisfaction, and supply chain resilience.

Propelling Factors for Latin America Contract Packaging Market Growth

The growth of the Latin America contract packaging market is fueled by a confluence of factors. The expanding middle class and rising disposable incomes are driving increased consumption of packaged goods across various sectors, creating significant market opportunities. Technological advancements in automation, materials science, and digitalization are enhancing production efficiency, reducing costs, improving quality control, and enabling the creation of increasingly sophisticated and sustainable packaging solutions. Furthermore, favorable government regulations promoting domestic manufacturing, attracting foreign direct investment (FDI), and encouraging sustainable practices are providing a supportive regulatory environment for market expansion. The growing e-commerce sector is further stimulating demand for specialized packaging solutions designed for online delivery and protecting products during transit.

Obstacles in the Latin America Contract Packaging Market

Despite significant growth potential, several obstacles hinder the Latin America contract packaging market. Regulatory complexities and inconsistencies across different countries create challenges for businesses seeking to expand their operations regionally. Supply chain disruptions, particularly exacerbated by recent global events, pose risks to production and delivery timelines. Intense competition among established and emerging players further intensifies the pressure on profit margins. These factors, alongside fluctuating raw material prices, significantly impact market dynamics.

Future Opportunities in Latin America Contract Packaging Market

The Latin America contract packaging market presents substantial future opportunities. The continued expansion of e-commerce necessitates innovative and protective packaging solutions for online delivery, presenting a significant growth area. The growing awareness of environmental concerns and the increasing adoption of circular economy principles are driving demand for eco-friendly and sustainable packaging alternatives, creating opportunities for companies offering compostable, recyclable, and reusable packaging solutions. Moreover, untapped markets in less developed regions of Latin America offer considerable potential for market penetration and expansion. Furthermore, the increasing focus on brand personalization and customized packaging solutions represents another avenue for growth within the market.

Major Players in the Latin America Contract Packaging Market Ecosystem

- Colep Consumer Products

- Rangel

- PAC Worldwide Corporation

- Assemblies Unlimited Inc

- U.S. Packaging & Wrapping LLC

- TricorBraun

- VMA LOGDIST

- [Add other relevant major players]

Key Developments in Latin America Contract Packaging Market Industry

- November 2022: TricorBraun acquired Vancouver-based Merlot Packaging, expanding its presence in the North American nutraceutical packaging market.

- March 2022: Aptar Food + Beverage partnered with Chacauhaa Brazil, launching an innovative inverted packaging solution for honey.

Strategic Latin America Contract Packaging Market Forecast

The Latin America contract packaging market is poised for continued growth driven by increasing consumer demand, technological advancements, and favorable economic conditions. The market's future potential is substantial, particularly in segments focused on sustainability and e-commerce. Strategic investments in automation and innovation will be crucial for businesses seeking to capitalize on the market's expansive opportunities.

Latin America Contract Packaging Market Segmentation

-

1. Service

- 1.1. Primary Packaging

- 1.2. Secondary Packaging

- 1.3. Tertiary Packaging

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverages

- 2.3. Pharmaceutical

- 2.4. Household and Personal Care

- 2.5. Other End-user Industries

Latin America Contract Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Contract Packaging Market Regional Market Share

Geographic Coverage of Latin America Contract Packaging Market

Latin America Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from E-commerce Industry; Development in the Retail Chain

- 3.3. Market Restrains

- 3.3.1. Competition from In-house packaging

- 3.4. Market Trends

- 3.4.1. Increasing Demand from E-commerce Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Primary Packaging

- 5.1.2. Secondary Packaging

- 5.1.3. Tertiary Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverages

- 5.2.3. Pharmaceutical

- 5.2.4. Household and Personal Care

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Colep Consumer Product

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rangel

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PAC Worldwide Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Assemblies Unlimited Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 U S Packaging & Wrapping LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TricorBraun

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VMA LOGDIST

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Colep Consumer Product

List of Figures

- Figure 1: Latin America Contract Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Contract Packaging Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Latin America Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Latin America Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Contract Packaging Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Latin America Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Latin America Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Contract Packaging Market?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the Latin America Contract Packaging Market?

Key companies in the market include Colep Consumer Product, Rangel, PAC Worldwide Corporation, Assemblies Unlimited Inc, U S Packaging & Wrapping LLC, TricorBraun, VMA LOGDIST.

3. What are the main segments of the Latin America Contract Packaging Market?

The market segments include Service, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from E-commerce Industry; Development in the Retail Chain.

6. What are the notable trends driving market growth?

Increasing Demand from E-commerce Industry.

7. Are there any restraints impacting market growth?

Competition from In-house packaging.

8. Can you provide examples of recent developments in the market?

November 2022: TricorBraun acquired Vancouver-based Merlot Packaging, a rigid packaging distributor specializing in high-quality closures, serving customers in the nutraceutical segment to further expand its presence in Canada. The company is focusing on combining the expertise of TricorBraun and Merlot to serve nutraceutical customers across North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence