Key Insights

The Latin American Active and Intelligent Packaging market is poised for substantial expansion, driven by escalating consumer demand for extended shelf life, enhanced product safety, and superior brand experience. With a projected compound annual growth rate (CAGR) of 9.4% from a base year of 2025, the market size is estimated to reach $29 billion. This growth is significantly influenced by the food and beverage sector, which is actively seeking innovative packaging solutions to preserve freshness and mitigate waste across diverse climatic conditions and infrastructural challenges within the region. The healthcare industry also contributes considerably, adopting active packaging for pharmaceuticals and medical devices to guarantee product integrity and patient safety. Brazil and Mexico lead market growth due to their large populations, strong economies, and expanding food processing capabilities. Evolving consumer preferences for convenient, tamper-evident packaging, coupled with heightened awareness of food safety and hygiene, further propel market expansion. While initial investment costs for new technologies and potential regulatory complexities present challenges, sustained growth in e-commerce, a burgeoning middle class, and a strategic focus on supply chain efficiency are set to fuel continued market development through 2033. Segment analysis reveals intelligent packaging is outpacing active packaging technologies, indicating a clear industry and consumer preference for advanced functionalities. The competitive landscape is characterized by dynamic engagement between global and regional players.

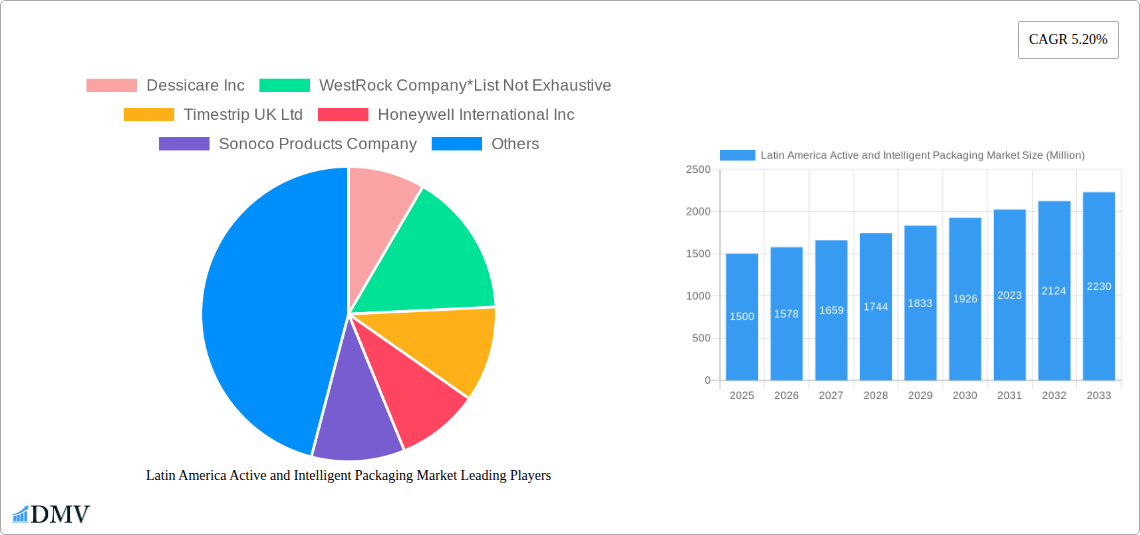

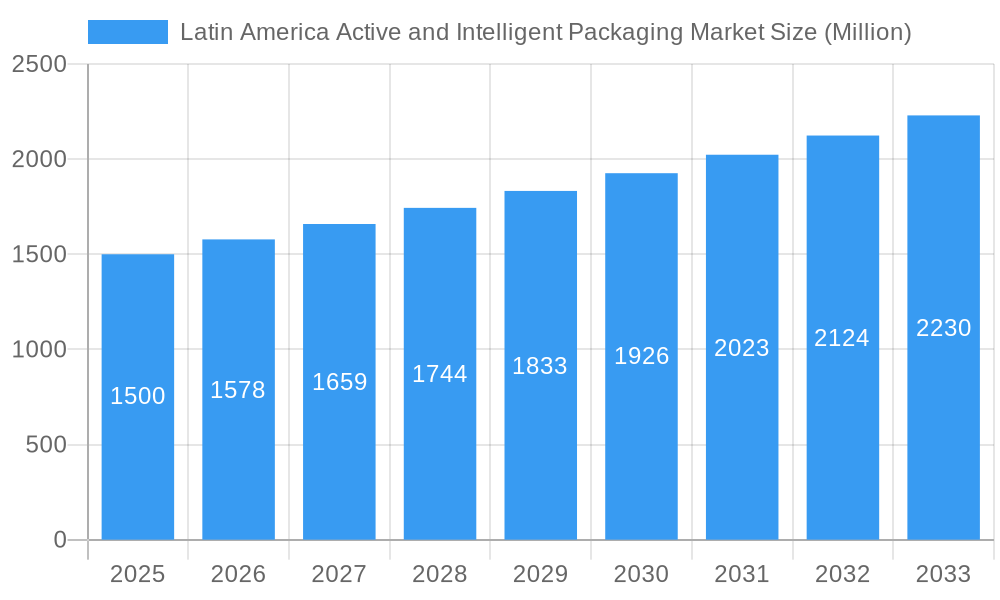

Latin America Active and Intelligent Packaging Market Market Size (In Billion)

Looking ahead, the market's trajectory from 2025 through 2033 will be shaped by the introduction of novel packaging materials, advancements in sensor technology and data analytics integrated into packaging, and supportive government regulations promoting sustainable and eco-friendly packaging practices. Strategic collaborations and partnerships are key initiatives for companies aiming to refine product portfolios and broaden market reach. Ultimately, the ability of packaging manufacturers to effectively address the specific demands and challenges of the Latin American market, particularly concerning affordability, accessibility, and sustainability, will define future growth opportunities.

Latin America Active and Intelligent Packaging Market Company Market Share

Latin America Active and Intelligent Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Latin America active and intelligent packaging market, encompassing historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). It delves into market trends, competitive dynamics, technological advancements, and growth opportunities, offering invaluable insights for stakeholders across the value chain. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Latin America Active and Intelligent Packaging Market Market Composition & Trends

The competitive landscape of the Latin America Active and Intelligent Packaging market is characterized by a dynamic interplay of established industry leaders and emerging innovators. Key players such as Dessicare Inc, WestRock Company, Timestrip UK Ltd, Honeywell International Inc, Sonoco Products Company, Landec Corporation, Ball Corporation, Crown Holdings Inc, Bemis Company Inc, BASF SE, Graphic Packaging International LLC, Sealed Air Corporation, and Amcor Ltd are actively shaping market dynamics. The market's trajectory is influenced by a confluence of factors including relentless innovation in material science and digital integration, evolving regulatory frameworks, particularly stringent food safety standards that mandate advanced traceability and spoilage detection, the persistent challenge posed by cost-effective traditional packaging alternatives, and a growing sophistication in end-user preferences demanding convenience, extended shelf-life, and enhanced product transparency. Strategic mergers and acquisitions (M&A) continue to be a significant driver, with substantial deal values impacting market concentration and fostering consolidation. Projections for 2025 indicate a market share distribution where Amcor Ltd (xx%), Sealed Air Corporation (xx%), and a diverse array of other players (xx%) will command significant presence. Over the past five years, the M&A landscape has been particularly active, with aggregate deal values surpassing xx Million, signaling a strong trend towards strategic consolidation and expansion.

- Market Concentration: The market exhibits moderate concentration, with a select group of prominent players holding substantial market share, indicating opportunities for both established entities and agile new entrants.

- Innovation Catalysts: A primary driver for innovation is the escalating consumer demand for products with extended shelf-life, heightened product safety assurances, and an enriched, interactive brand experience facilitated by smart packaging features.

- Regulatory Landscape: The region's robust and increasingly stringent food safety and traceability regulations are compelling manufacturers to adopt advanced active and intelligent packaging solutions to ensure compliance and consumer confidence.

- Substitute Products: While traditional packaging materials continue to offer a cost-effective alternative, the superior performance attributes of active and intelligent packaging, such as enhanced spoilage prevention and real-time monitoring, are increasingly outweighing cost considerations for premium applications.

- End-User Profiles: The food and beverage sector remains the dominant consumer of active and intelligent packaging, closely followed by the rapidly expanding healthcare and personal care industries, both of which prioritize product integrity and consumer safety.

- M&A Activities: The market is witnessing a clear trend of consolidation through strategic acquisitions and collaborations, aimed at expanding product portfolios, geographical reach, and technological capabilities, thereby intensifying market concentration.

Latin America Active and Intelligent Packaging Market Industry Evolution

This section analyzes the historical and projected growth trajectories of the Latin America active and intelligent packaging market. It explores the influence of technological advancements such as RFID, sensors, and time-temperature indicators, as well as the changing consumer preferences towards sustainable and convenient packaging. The market experienced a growth rate of xx% from 2019 to 2024, driven primarily by the increasing demand for food preservation and improved supply chain management. Adoption of intelligent packaging is expected to increase significantly over the forecast period, fueled by technological advancements and rising consumer awareness. By 2033, the penetration rate of intelligent packaging is anticipated to reach xx%.

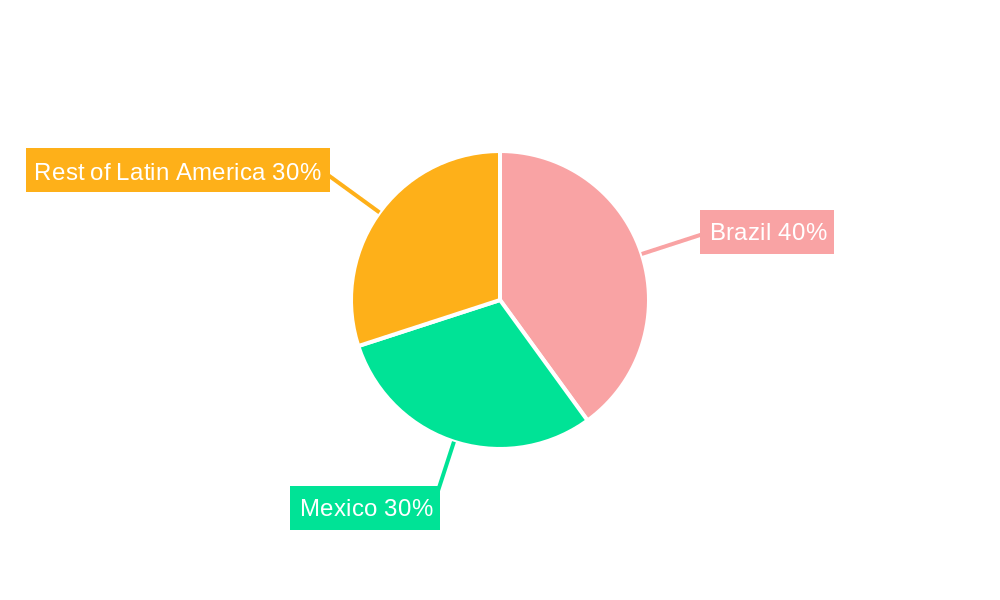

Leading Regions, Countries, or Segments in Latin America Active and Intelligent Packaging Market

Brazil and Mexico represent the largest markets within Latin America for active and intelligent packaging, driven by robust economic growth, expanding food and beverage sectors, and increasing healthcare expenditure. The "Rest of Latin America" region shows significant growth potential.

Key Drivers:

- Brazil: Significant investments in infrastructure and expanding middle class contribute to increased demand.

- Mexico: Growing food processing industry and export-oriented economy boost market growth.

- Food & Beverage: The largest segment, driven by increasing demand for extended shelf life and enhanced product safety.

- Healthcare: Growing demand for pharmaceutical packaging solutions with enhanced security and tamper evidence.

Dominance Factors:

The dominance of Brazil and Mexico stems from their larger economies, advanced infrastructure, and established food and beverage industries. The Food & Beverage segment leads due to its size and the specific needs of extending product shelf-life and preventing spoilage.

Latin America Active and Intelligent Packaging Market Product Innovations

Recent innovations in active and intelligent packaging include the development of biodegradable and compostable materials, improved sensor technologies for real-time monitoring, and the integration of RFID for enhanced supply chain traceability. These innovations are enhancing product safety, reducing food waste, and improving consumer experience through better product information and brand engagement. The unique selling propositions include improved shelf life, enhanced product traceability, and enhanced consumer convenience.

Propelling Factors for Latin America Active and Intelligent Packaging Market Growth

The growth of the Latin America active and intelligent packaging market is propelled by several factors. Increased consumer demand for extended shelf-life products reduces food waste and enhances convenience. Stringent government regulations on food safety mandate the adoption of advanced packaging solutions. Technological advancements continue to improve the functionality and affordability of active and intelligent packaging. Furthermore, the expanding e-commerce sector fuels the demand for tamper-evident and trackable packaging.

Obstacles in the Latin America Active and Intelligent Packaging Market Market

The market faces challenges including high initial investment costs for adopting advanced technologies, supply chain disruptions affecting raw material availability, and the competitive pressure from traditional packaging materials. Regulatory complexities and variations across different Latin American countries also pose a significant barrier to entry. These factors can lead to price volatility and limit market expansion.

Future Opportunities in Latin America Active and Intelligent Packaging Market

The Latin America Active and Intelligent Packaging market is ripe with burgeoning opportunities. A significant growth avenue lies in the increasing global and regional demand for sustainable and eco-friendly packaging solutions, prompting the development of biodegradable active components and recyclable intelligent sensors. Expansion into underserved yet high-potential markets, such as the sophisticated personal care and cosmetics sectors, presents a substantial opportunity for tailored active and intelligent packaging solutions that enhance product appeal and shelf-life. Furthermore, the seamless integration of smart packaging technologies with burgeoning digital platforms, including IoT devices and mobile applications, offers unprecedented potential for enhanced consumer engagement, personalized product information delivery, and streamlined supply chain management. Continuous advancements in material science, particularly in the development of novel active ingredients and miniaturized, cost-effective sensors, coupled with sophisticated data analytics capabilities, are poised to unlock new functionalities and drive significant market expansion.

Major Players in the Latin America Active and Intelligent Packaging Market Ecosystem

- Dessicare Inc

- WestRock Company

- Timestrip UK Ltd

- Honeywell International Inc

- Sonoco Products Company

- Landec Corporation

- Ball Corporation

- Crown Holdings Inc

- Bemis Company Inc

- BASF SE

- Graphic Packaging International LLC

- Sealed Air Corporation

- Amcor Ltd

Key Developments in Latin America Active and Intelligent Packaging Market Industry

- September 2021: A notable strategic investment of USD 150 Million was announced by an undisclosed leading packaging firm to significantly bolster RFID production capacity within Brazil. This expansion is specifically targeted towards serving the growing demands of the food, healthcare, and personal care product sectors. With operations slated to commence by the end of 2022 and an ambitious plan to achieve a 30% increase in production capacity through further technological integration and upgrades, this development underscores a strong commitment to meeting the escalating market demand for advanced traceability and authentication solutions.

Strategic Latin America Active and Intelligent Packaging Market Market Forecast

The Latin America active and intelligent packaging market is on a trajectory for robust and sustained growth throughout the forecast period. This expansion will be underpinned by a combination of favorable macroeconomic trends, including steady economic development across key nations, a burgeoning middle class with increasing disposable income, and a corresponding rise in consumer demand for higher quality, safer, and more convenient products. Technological innovation will remain a critical cornerstone, driving advancements in sustainable material formulations, the miniaturization and cost-effectiveness of sensor technologies, and the seamless integration of smart packaging with emerging digital ecosystems and big data analytics platforms. The paramount importance of enhancing supply chain efficiency, minimizing product spoilage and waste, and meeting stringent regulatory requirements will further accelerate the adoption and market penetration of active and intelligent packaging solutions. Consequently, the market is expected to witness significant growth, driven by both supply-side innovations and escalating demand from a diverse range of end-use industries.

Latin America Active and Intelligent Packaging Market Segmentation

-

1. Type

-

1.1. Active Packaging

- 1.1.1. Gas Scavengers/Emitters

- 1.1.2. Moisture Scavenger

- 1.1.3. Microwave Susceptors

- 1.1.4. Other Active Packaging Technologies

-

1.2. Intelligent Packaging

- 1.2.1. Coding and Markings

- 1.2.2. Antenna (RFID and NFC)

- 1.2.3. Sensors and Output Devices

- 1.2.4. Other Intelligent Packaging Technologies

-

1.1. Active Packaging

-

2. End-user Vertical

- 2.1. Food

- 2.2. Beverage

- 2.3. Healthcare

- 2.4. Personal Care

- 2.5. Other End-user Verticals

Latin America Active and Intelligent Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Active and Intelligent Packaging Market Regional Market Share

Geographic Coverage of Latin America Active and Intelligent Packaging Market

Latin America Active and Intelligent Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Longer Shelf Life and Changing Consumer Lifestyle; Growing Demand for Fresh and Quality Food Products

- 3.3. Market Restrains

- 3.3.1. ; High Initial Cost for Research Activities

- 3.4. Market Trends

- 3.4.1. Longer Shelf Life and Changing Consumer Lifestyle is expected to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Active and Intelligent Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Active Packaging

- 5.1.1.1. Gas Scavengers/Emitters

- 5.1.1.2. Moisture Scavenger

- 5.1.1.3. Microwave Susceptors

- 5.1.1.4. Other Active Packaging Technologies

- 5.1.2. Intelligent Packaging

- 5.1.2.1. Coding and Markings

- 5.1.2.2. Antenna (RFID and NFC)

- 5.1.2.3. Sensors and Output Devices

- 5.1.2.4. Other Intelligent Packaging Technologies

- 5.1.1. Active Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Healthcare

- 5.2.4. Personal Care

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dessicare Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WestRock Company*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Timestrip UK Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Landec Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ball Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Crown Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bemis Company Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Graphic Packaging International LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sealed Air Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Amcor Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Dessicare Inc

List of Figures

- Figure 1: Latin America Active and Intelligent Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Active and Intelligent Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 3: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 6: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Active and Intelligent Packaging Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the Latin America Active and Intelligent Packaging Market?

Key companies in the market include Dessicare Inc, WestRock Company*List Not Exhaustive, Timestrip UK Ltd, Honeywell International Inc, Sonoco Products Company, Landec Corporation, Ball Corporation, Crown Holdings Inc, Bemis Company Inc, BASF SE, Graphic Packaging International LLC, Sealed Air Corporation, Amcor Ltd.

3. What are the main segments of the Latin America Active and Intelligent Packaging Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 29 billion as of 2022.

5. What are some drivers contributing to market growth?

Longer Shelf Life and Changing Consumer Lifestyle; Growing Demand for Fresh and Quality Food Products.

6. What are the notable trends driving market growth?

Longer Shelf Life and Changing Consumer Lifestyle is expected to drive the market.

7. Are there any restraints impacting market growth?

; High Initial Cost for Research Activities.

8. Can you provide examples of recent developments in the market?

September 2021 - The company has long announced the investment of USD 150 million to expand the radio-frequency identification (RFID) production capacity in Brazil for food, healthcare, and personal care products amid the increased demand. However, in 2021 the company announced that it would start operations by the end of 2022 with additional investments in technology to increase the production capacity by 30%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Active and Intelligent Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Active and Intelligent Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Active and Intelligent Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Active and Intelligent Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence