Key Insights

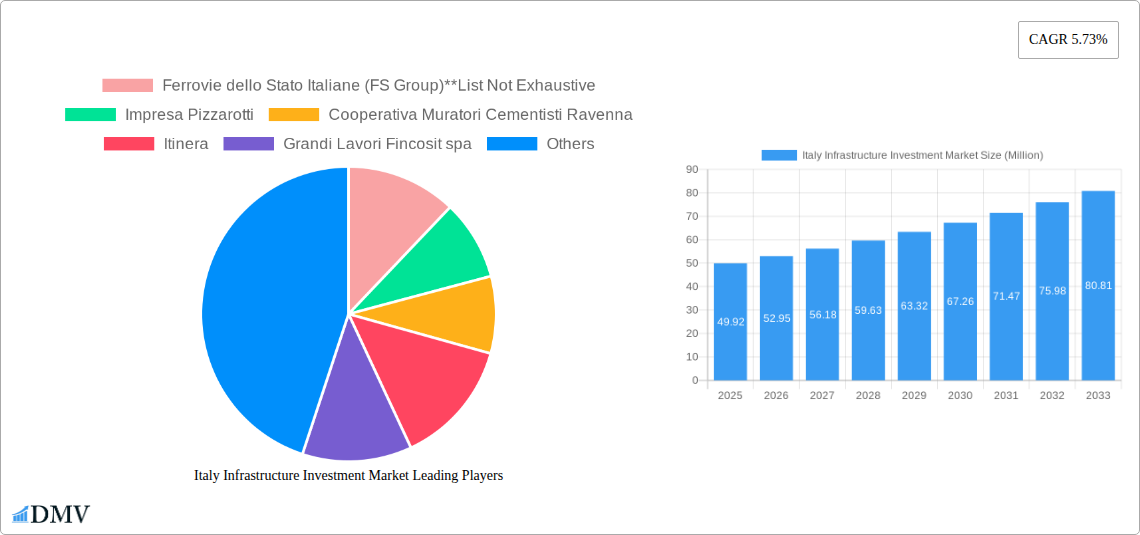

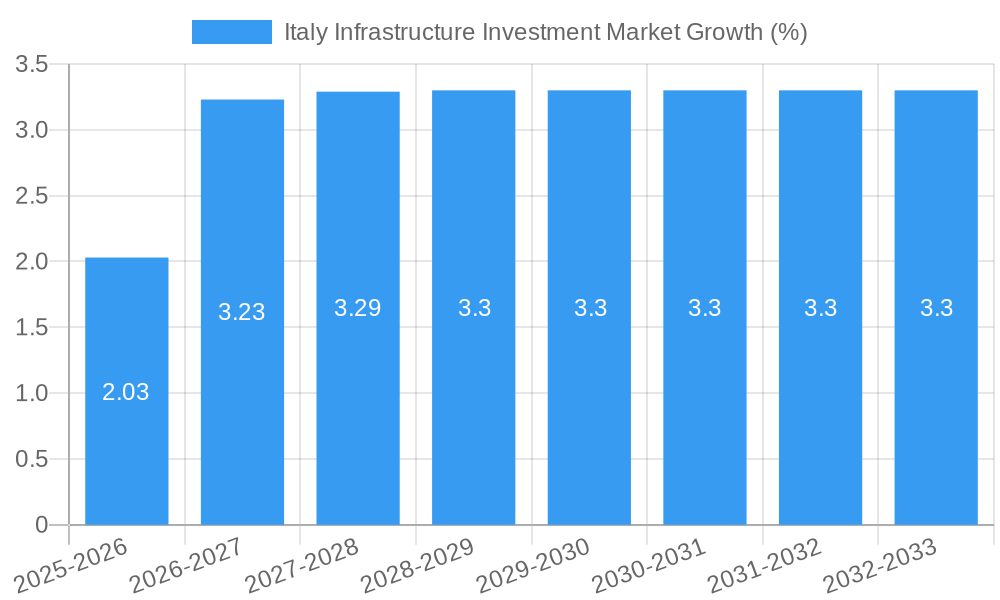

The Italy Infrastructure Investment Market is poised for substantial growth, projected to be worth €49.92 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 5.73% from 2025 to 2033. This expansion is driven by several key factors. Increased government spending on transportation infrastructure modernization, particularly within the road, rail, and port sectors, is a significant catalyst. Italy's commitment to improving its logistics network to enhance international trade and boost economic competitiveness fuels this investment. Furthermore, the ongoing development of sustainable infrastructure solutions, such as eco-friendly transportation systems and energy-efficient building designs, is attracting both public and private investment. The market is segmented by mode of transportation (roadways, railways, airways, ports and waterways), reflecting the diverse nature of infrastructure projects underway. Major players like Ferrovie dello Stato Italiane (FS Group), Impresa Pizzarotti, and WeBuild are actively shaping this market, driving innovation and competition.

Growth in the Italy Infrastructure Investment Market will likely be influenced by several trends. The increasing adoption of digital technologies, including smart city initiatives and the implementation of advanced monitoring systems, will significantly influence infrastructure development. This will lead to more efficient project management and improved asset utilization. Further, the European Union's focus on sustainable development goals and its financial support for environmentally friendly infrastructure projects will provide additional impetus. However, potential restraints such as bureaucratic hurdles, fluctuating material costs, and skilled labor shortages could moderate the market's overall growth. Despite these challenges, the long-term outlook for the Italian infrastructure investment market remains positive, with significant opportunities for expansion across all segments throughout the forecast period. Projected growth indicates a substantial increase in market value by 2033, surpassing the 2025 figure significantly.

Italy Infrastructure Investment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Italy Infrastructure Investment Market, covering the period from 2019 to 2033. With a focus on market trends, key players, and future growth opportunities, this report is an essential resource for stakeholders across the infrastructure sector. The study incorporates detailed market segmentation by mode (Roadways, Railways, Airways, Ports and Waterways), offering granular insights into investment patterns and growth trajectories. The report’s base year is 2025, with forecasts extending to 2033, providing a long-term perspective on market evolution.

Italy Infrastructure Investment Market Composition & Trends

This section delves into the intricacies of the Italian infrastructure investment market, analyzing market concentration, innovation drivers, and regulatory dynamics. We assess the competitive landscape, highlighting market share distribution amongst key players. The report also examines the impact of mergers and acquisitions (M&A) activities, evaluating deal values and their influence on market consolidation. Substitute products and their potential impact on market share are also analyzed. Finally, we profile the key end-users driving demand within the Italian infrastructure sector.

- Market Concentration: The Italian infrastructure market exhibits a moderately concentrated structure with a few dominant players capturing significant market share. We estimate the top 5 players hold approximately XX% of the market share in 2025.

- Innovation Catalysts: Government initiatives promoting sustainable infrastructure and technological advancements in construction methods act as primary catalysts for innovation.

- Regulatory Landscape: Stringent environmental regulations and EU directives shape investment decisions and project timelines.

- Substitute Products: Limited substitute products exist within certain segments, making the market relatively resilient to substitution.

- End-User Profiles: Public sector entities (national and regional governments) constitute a major portion of the end-user base, with private sector involvement increasing gradually.

- M&A Activities: The market has witnessed considerable M&A activity in recent years, with deal values totaling approximately USD xx Million in the period 2019-2024. This consolidation trend is expected to continue.

Italy Infrastructure Investment Market Industry Evolution

This section provides a comprehensive analysis of the market’s evolutionary trajectory, examining historical growth trends, projected future growth rates, and the influence of technological advancements. We analyze the impact of shifting consumer demands, focusing on the growing emphasis on sustainability and resilience in infrastructure projects. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033). This growth is attributed to several factors, including increasing government investment in infrastructure modernization, technological advancements leading to increased efficiency and reduced project costs, and a growing focus on sustainable infrastructure development. Specific examples of technological advancements such as the adoption of BIM (Building Information Modeling) and the use of advanced materials are highlighted along with their associated adoption rates.

Leading Regions, Countries, or Segments in Italy Infrastructure Investment Market

This section identifies the dominant segments within the Italian infrastructure investment market, focusing on the "By Mode" classification: Roadways, Railways, Airways, Ports and Waterways. A detailed analysis of the factors contributing to the dominance of each segment is provided.

- Dominant Segment: The Railways segment is projected to be the leading segment throughout the forecast period, driven by significant government investment in high-speed rail expansion and modernization projects.

Key Drivers for Railway Segment Dominance:

- Significant government funding allocated to high-speed rail projects.

- Increased demand for improved commuter rail networks in major urban areas.

- Favorable regulatory environment promoting railway infrastructure development.

In-depth Analysis: The prominence of the railway segment stems from Italy’s commitment to improving its national rail network. This includes expansion of high-speed lines and upgrades to existing infrastructure, significantly bolstering investment in this sector. Furthermore, government initiatives focused on improving inter-city and regional connectivity have fueled this growth.

Italy Infrastructure Investment Market Product Innovations

This section highlights recent product innovations within the Italian infrastructure investment market. These innovations encompass advanced materials, construction technologies, and project management techniques aimed at improving project efficiency, reducing costs, and enhancing sustainability. For example, the adoption of prefabricated components and modular construction methods has gained traction, streamlining construction processes and minimizing on-site work. Furthermore, innovative financing models, such as Public-Private Partnerships (PPPs), are being increasingly utilized to attract private sector investment.

Propelling Factors for Italy Infrastructure Investment Market Growth

Several factors contribute to the growth of the Italy Infrastructure Investment Market. Significant government investment in infrastructure development, driven by the need to modernize aging infrastructure and improve connectivity, is a primary driver. Furthermore, technological advancements and the increasing focus on sustainable infrastructure contribute significantly to market expansion. Finally, supportive regulatory frameworks and favorable economic conditions play a crucial role in fostering investment.

Obstacles in the Italy Infrastructure Investment Market

Despite promising growth prospects, certain obstacles hinder market expansion. Bureaucratic processes and permitting delays can prolong project timelines and increase costs. Supply chain disruptions, particularly in the procurement of specialized materials, can lead to project delays and cost overruns. Finally, intense competition among contractors and fluctuating material prices add further challenges to market growth.

Future Opportunities in Italy Infrastructure Investment Market

The future presents several exciting opportunities. The growing adoption of smart city technologies, such as intelligent transportation systems and smart grids, offers substantial potential for investment. Furthermore, the increasing focus on sustainable and resilient infrastructure development creates a significant demand for environmentally friendly solutions. Expanding into new market segments, such as renewable energy infrastructure, also presents promising opportunities.

Major Players in the Italy Infrastructure Investment Market Ecosystem

- Ferrovie dello Stato Italiane (FS Group)

- Impresa Pizzarotti

- Cooperativa Muratori Cementisti Ravenna

- Itinera

- Grandi Lavori Fincosit spa

- Rizzani de Eccher

- Salecf Group

- WeBuild

- Astaldi

- Colas Rail Italia SpA

- Gleisfrei Srl Costruzioni Ferroviarie

Key Developments in Italy Infrastructure Investment Market Industry

- May 2023: WeBuild secured a USD 300.88 Million contract for a 15km highway section in Piedmont, demonstrating significant private sector involvement in road infrastructure development.

- August 2023: A consortium, including Itinera, won a USD 179.57 Million contract for a railway extension near Naples, highlighting the ongoing investments in public transportation.

Strategic Italy Infrastructure Investment Market Forecast

The Italian infrastructure investment market is poised for robust growth over the forecast period. Continued government investment, coupled with technological advancements and a growing emphasis on sustainable infrastructure, will drive market expansion. The projected CAGR underscores the significant investment potential and market opportunities within the Italian infrastructure sector.

Italy Infrastructure Investment Market Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airways

- 1.4. Ports and Waterways

Italy Infrastructure Investment Market Segmentation By Geography

- 1. Italy

Italy Infrastructure Investment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment Plan Towards Urban Rail Development

- 3.3. Market Restrains

- 3.3.1. Italy’s Fragmented Approach to Tenders

- 3.4. Market Trends

- 3.4.1. Increasing Demand For Trolleybus in Italy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Infrastructure Investment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Ports and Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ferrovie dello Stato Italiane (FS Group)**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Impresa Pizzarotti

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cooperativa Muratori Cementisti Ravenna

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Itinera

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grandi Lavori Fincosit spa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rizzani de Eccher

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Salecf Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WeBuild

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Astaldi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Colas Rail Italia SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gleisfrei Srl Costruzioni Ferroviarie

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Ferrovie dello Stato Italiane (FS Group)**List Not Exhaustive

List of Figures

- Figure 1: Italy Infrastructure Investment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Infrastructure Investment Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Infrastructure Investment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Infrastructure Investment Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 3: Italy Infrastructure Investment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Italy Infrastructure Investment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Italy Infrastructure Investment Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 6: Italy Infrastructure Investment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Infrastructure Investment Market?

The projected CAGR is approximately 5.73%.

2. Which companies are prominent players in the Italy Infrastructure Investment Market?

Key companies in the market include Ferrovie dello Stato Italiane (FS Group)**List Not Exhaustive, Impresa Pizzarotti, Cooperativa Muratori Cementisti Ravenna, Itinera, Grandi Lavori Fincosit spa, Rizzani de Eccher, Salecf Group, WeBuild, Astaldi, Colas Rail Italia SpA, Gleisfrei Srl Costruzioni Ferroviarie.

3. What are the main segments of the Italy Infrastructure Investment Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Investment Plan Towards Urban Rail Development.

6. What are the notable trends driving market growth?

Increasing Demand For Trolleybus in Italy.

7. Are there any restraints impacting market growth?

Italy’s Fragmented Approach to Tenders.

8. Can you provide examples of recent developments in the market?

May 2023: Italian contractor Webuild has won a EUR 284 million (USD 300.88 million) contract to build a 15 km section of the Pedemontana Piemontese highway in Piedmont. Working on behalf of Italy’s state railway company, Webuild and its subsidiary Cossi Costruzioni will design and build parts one and two of the highway’s first lot, connecting the towns of Masserano and Ghemme. The two-lane road will pass over six viaducts and six overpasses, together measuring 1.5 km.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Infrastructure Investment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Infrastructure Investment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Infrastructure Investment Market?

To stay informed about further developments, trends, and reports in the Italy Infrastructure Investment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence