Key Insights

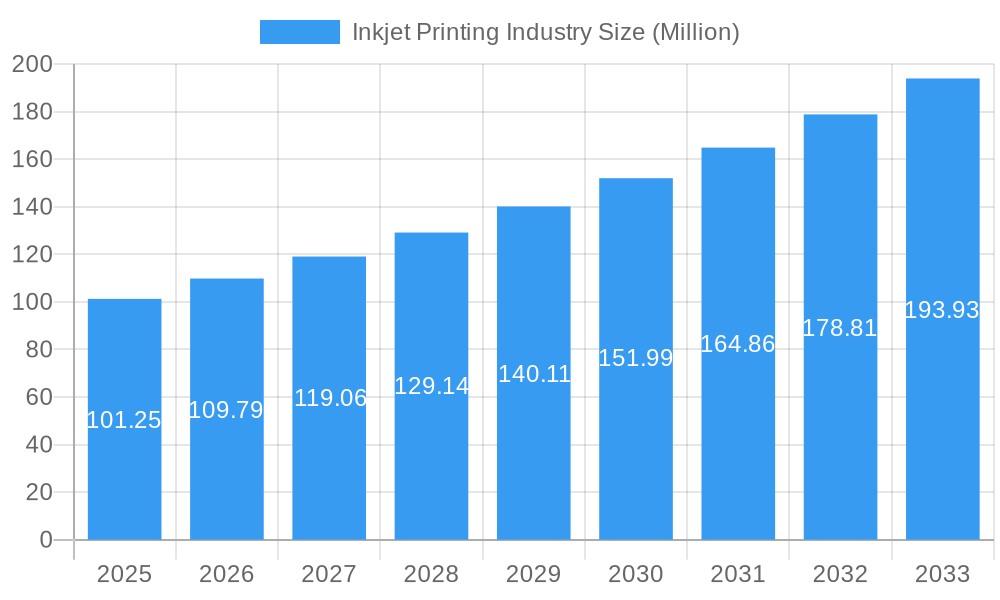

The inkjet printing industry, valued at $101.25 million in 2025, is projected to experience robust growth, driven by increasing demand across diverse applications. The compound annual growth rate (CAGR) of 8.32% from 2025 to 2033 signifies a significant expansion, fueled by several key factors. The rise of e-commerce and personalized marketing strategies significantly boosts the demand for high-quality, on-demand printing in areas like labels, packaging, and advertising. Technological advancements, such as improved printhead technology leading to higher resolution and faster speeds, are further enhancing the appeal of inkjet printing. The expanding adoption of inkjet printing in commercial print applications, fueled by its cost-effectiveness and versatility, contributes substantially to market growth. Furthermore, the increasing demand for customized books and publications also serves as a significant driver. While certain constraints, such as the potentially higher initial investment costs compared to other printing technologies and the need for specialized inks, might pose challenges, the overall market outlook remains positive, driven by innovation and expanding applications.

Inkjet Printing Industry Market Size (In Million)

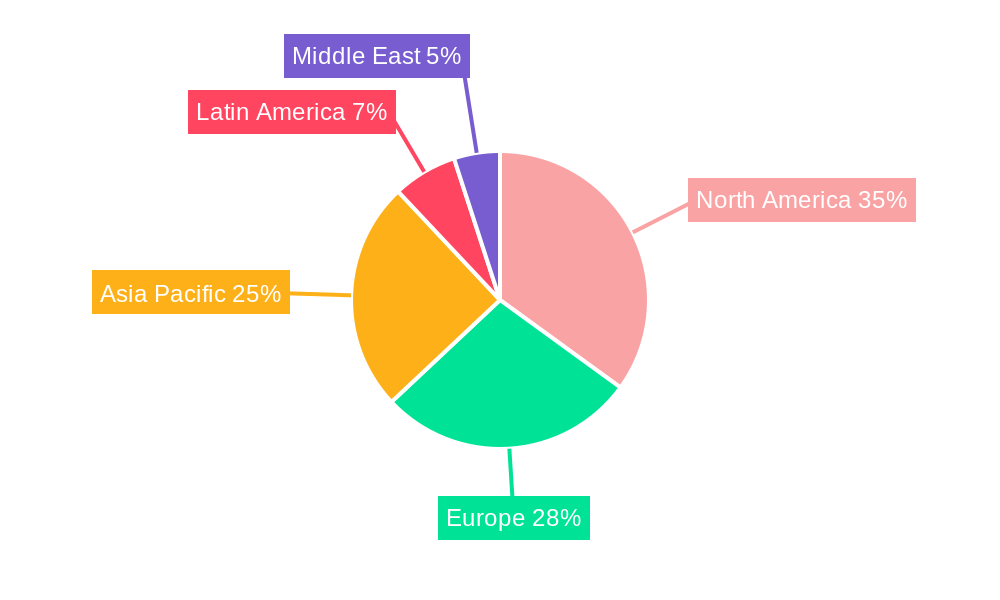

The segmentation of the inkjet printing market reveals a diversified landscape. While precise data for individual application segments isn't provided, it's reasonable to project substantial growth across all segments. The books/publishing segment will likely benefit from the ongoing digital transformation and self-publishing trends, while commercial print will continue its expansion due to its suitability for on-demand printing and variable data printing. The advertising segment is poised for growth due to its suitability for direct mail and personalized marketing initiatives. The transaction and labeling segments will see consistent demand due to their crucial role in various industries. Packaging applications will experience a surge due to the rising demand for high-quality packaging with varied designs and enhanced branding opportunities. The geographical distribution of the market is likely to show strong growth in regions with expanding economies and rising disposable incomes, particularly in the Asia-Pacific region. Companies like Jet Inks Private Limited, Fujifilm Holdings Corporation, Canon Inc., and others, are key players actively shaping this dynamic market landscape through continuous innovation and strategic expansions.

Inkjet Printing Industry Company Market Share

Inkjet Printing Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the inkjet printing industry, encompassing market trends, technological advancements, key players, and future growth projections from 2019 to 2033. With a focus on market segmentation by application (Books/Publishing, Commercial Print, Advertising, Transaction, Labels, Packaging, and Other Applications), this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The base year for this report is 2025, with estimations for 2025 and a forecast period spanning 2025-2033. The historical period covered is 2019-2024. The global inkjet printing market is estimated to be worth xx Million in 2025, projected to reach xx Million by 2033.

Inkjet Printing Industry Market Composition & Trends

The inkjet printing market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the emergence of innovative smaller companies is challenging the established order. Market share distribution is dynamic, influenced by technological breakthroughs, strategic partnerships, and mergers & acquisitions (M&A) activity. The estimated total M&A deal value within the inkjet printing industry during the study period (2019-2024) was approximately xx Million. Regulatory landscapes vary globally, impacting material usage and environmental compliance. Substitute technologies, such as laser printing, pose ongoing competitive pressure, while the demand for high-quality, cost-effective printing solutions drives industry innovation. End-user profiles are diverse, ranging from individual consumers and small businesses to large corporations and industrial manufacturers.

- Market Share Distribution (2024 Estimate): HP: xx%, Canon: xx%, Epson: xx%, Others: xx%

- Key Innovation Catalysts: Demand for high-resolution printing, sustainable ink technologies, and integration with digital workflows.

- Significant M&A Activities (2019-2024): [List 3-5 significant M&A deals with brief descriptions and estimated values].

- Regulatory Landscape: Focus on reducing environmental impact, increasing ink efficiency and compliance with waste regulations.

Inkjet Printing Industry Industry Evolution

The inkjet printing industry has witnessed a remarkable evolution, driven by technological advancements and evolving consumer demands. From the early adoption of inkjet technology for home printing to its expansion into high-volume commercial and industrial applications, the market has experienced substantial growth. The historical period (2019-2024) saw a Compound Annual Growth Rate (CAGR) of approximately xx%, primarily fueled by increased adoption in the packaging and labeling segments. Technological advancements such as the development of higher-resolution print heads, faster printing speeds, and more durable inks have broadened the applications of inkjet technology. Shifting consumer demands towards personalized and on-demand printing further propelled market growth. The forecast period (2025-2033) is projected to see a CAGR of approximately xx%, with significant growth anticipated in industrial applications, particularly within the packaging sector, propelled by increased demand for customized packaging and product labeling. Adoption of inkjet technology in sectors like commercial printing and advertising is expected to maintain steady growth.

Leading Regions, Countries, or Segments in Inkjet Printing Industry

The Packaging segment currently dominates the inkjet printing market. North America and Western Europe remain key regions, while the Asia-Pacific region exhibits rapid growth potential.

- Key Drivers for Packaging Segment Dominance:

- Rising demand for customized packaging solutions.

- Increased adoption of digital printing technologies for flexible packaging.

- Growth in e-commerce and related packaging needs.

- Key Drivers for North America and Western Europe:

- Established printing infrastructure and high adoption rates.

- Strong presence of major inkjet printing manufacturers.

- High investment in R&D and technological advancements.

- Key Drivers for Asia-Pacific Growth:

- Expanding manufacturing sector and burgeoning consumer markets.

- Increased government support and investment in infrastructure.

- Rising demand for high-quality printing across various sectors.

Inkjet Printing Industry Product Innovations

Recent years have seen significant advancements in inkjet printing technology, including the development of high-resolution print heads, wider color gamuts, and eco-friendly inks. These innovations cater to diverse applications, from high-volume commercial printing to personalized packaging and point-of-sale displays. Key innovations focus on improving print speed, reducing ink consumption, and enhancing print quality. Unique selling propositions include enhanced print durability, variable data printing capabilities, and streamlined workflow integration.

Propelling Factors for Inkjet Printing Industry Growth

The inkjet printing industry's growth is propelled by several factors. Technological advancements like improved print quality, speed, and cost-effectiveness are primary drivers. The growing demand for personalized and on-demand printing across various applications further fuels expansion. Favorable economic conditions and increasing disposable incomes in developing economies also contribute to market growth. Furthermore, government initiatives promoting sustainability and reducing reliance on traditional printing methods create additional opportunities.

Obstacles in the Inkjet Printing Industry Market

Despite its growth potential, the inkjet printing industry faces several challenges. Supply chain disruptions can lead to increased production costs and delays. Intense competition from established players and emerging technologies creates pricing pressure. Furthermore, stringent environmental regulations related to ink disposal and resource consumption present compliance hurdles.

Future Opportunities in Inkjet Printing Industry

Future opportunities lie in expanding into new markets and exploring emerging technologies. The increasing demand for personalized and sustainable packaging presents significant growth potential. Advancements in ink technology, such as eco-friendly and high-performance inks, will continue to drive innovation. Expansion into new applications, like 3D printing and textile printing, opens new avenues for growth.

Major Players in the Inkjet Printing Industry Ecosystem

Key Developments in Inkjet Printing Industry Industry

- November 2021: Canon India launched the PIXMA E4570 inkjet multifunction printer, enhancing productivity and efficiency.

- September 2021: Lexmark introduced the Lexmark Optra IoT Platform, a cloud-based solution for data management.

- June 2021: Fujifilm entered the flexible packaging market with the Jet Press FP 790 water-based inkjet digital press.

Strategic Inkjet Printing Industry Market Forecast

The inkjet printing market is poised for continued growth, driven by technological advancements, expanding applications, and increasing demand for personalized and sustainable printing solutions. The forecast period will likely witness significant expansion in the packaging and labeling segments, along with steady growth in other applications. Emerging technologies and market trends will shape future growth trajectories, presenting lucrative opportunities for key players.

Inkjet Printing Industry Segmentation

-

1. Application

- 1.1. Books/Publishing

- 1.2. Commercial Print

- 1.3. Advertising

- 1.4. Transaction

- 1.5. Labels

- 1.6. Packaging

- 1.7. Other Applications

Inkjet Printing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Inkjet Printing Industry Regional Market Share

Geographic Coverage of Inkjet Printing Industry

Inkjet Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Big Data

- 3.2.2 IoT

- 3.2.3 and Digitalization of Print Processing and Packaging; Smart Production

- 3.2.4 Speed

- 3.2.5 Flexibility

- 3.2.6 and Cost Control

- 3.3. Market Restrains

- 3.3.1. Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Advertisement is Anticipated to Hold a Dominant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Books/Publishing

- 5.1.2. Commercial Print

- 5.1.3. Advertising

- 5.1.4. Transaction

- 5.1.5. Labels

- 5.1.6. Packaging

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Books/Publishing

- 6.1.2. Commercial Print

- 6.1.3. Advertising

- 6.1.4. Transaction

- 6.1.5. Labels

- 6.1.6. Packaging

- 6.1.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Books/Publishing

- 7.1.2. Commercial Print

- 7.1.3. Advertising

- 7.1.4. Transaction

- 7.1.5. Labels

- 7.1.6. Packaging

- 7.1.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Books/Publishing

- 8.1.2. Commercial Print

- 8.1.3. Advertising

- 8.1.4. Transaction

- 8.1.5. Labels

- 8.1.6. Packaging

- 8.1.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Books/Publishing

- 9.1.2. Commercial Print

- 9.1.3. Advertising

- 9.1.4. Transaction

- 9.1.5. Labels

- 9.1.6. Packaging

- 9.1.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Books/Publishing

- 10.1.2. Commercial Print

- 10.1.3. Advertising

- 10.1.4. Transaction

- 10.1.5. Labels

- 10.1.6. Packaging

- 10.1.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jet Inks Private Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fujifilm Holdings Corporation*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Canon Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Videojet Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xerox Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HP Development Company LP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lexmark International Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hitachi Industrial Equipment Systems Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inkjet Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Brother Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Jet Inks Private Limited

List of Figures

- Figure 1: Global Inkjet Printing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Inkjet Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Inkjet Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Inkjet Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Inkjet Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Inkjet Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Inkjet Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Inkjet Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Inkjet Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Inkjet Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Inkjet Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Inkjet Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Inkjet Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Inkjet Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Latin America Inkjet Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Inkjet Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Inkjet Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Inkjet Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Inkjet Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Inkjet Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Inkjet Printing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Inkjet Printing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Inkjet Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Inkjet Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Inkjet Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Inkjet Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Inkjet Printing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inkjet Printing Industry?

The projected CAGR is approximately 8.32%.

2. Which companies are prominent players in the Inkjet Printing Industry?

Key companies in the market include Jet Inks Private Limited, Fujifilm Holdings Corporation*List Not Exhaustive, Canon Inc, Videojet Technologies Inc, Xerox Corporation, HP Development Company LP, Lexmark International Inc, Hitachi Industrial Equipment Systems Co Ltd, Inkjet Inc, Brother Industries Ltd.

3. What are the main segments of the Inkjet Printing Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 101.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Big Data. IoT. and Digitalization of Print Processing and Packaging; Smart Production. Speed. Flexibility. and Cost Control.

6. What are the notable trends driving market growth?

Advertisement is Anticipated to Hold a Dominant Share of the Market.

7. Are there any restraints impacting market growth?

Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

November 2021 - Canon India launched the all-new PIXMA E4570 inkjet multifunction printer. This is innovated to increase productivity and efficiency at work. The all-new PIXMA E4570 provides a suite of productivity features, combined with high print yields and low-cost printing, making it essential for students, home offices, and even small offices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inkjet Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inkjet Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inkjet Printing Industry?

To stay informed about further developments, trends, and reports in the Inkjet Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence