Key Insights

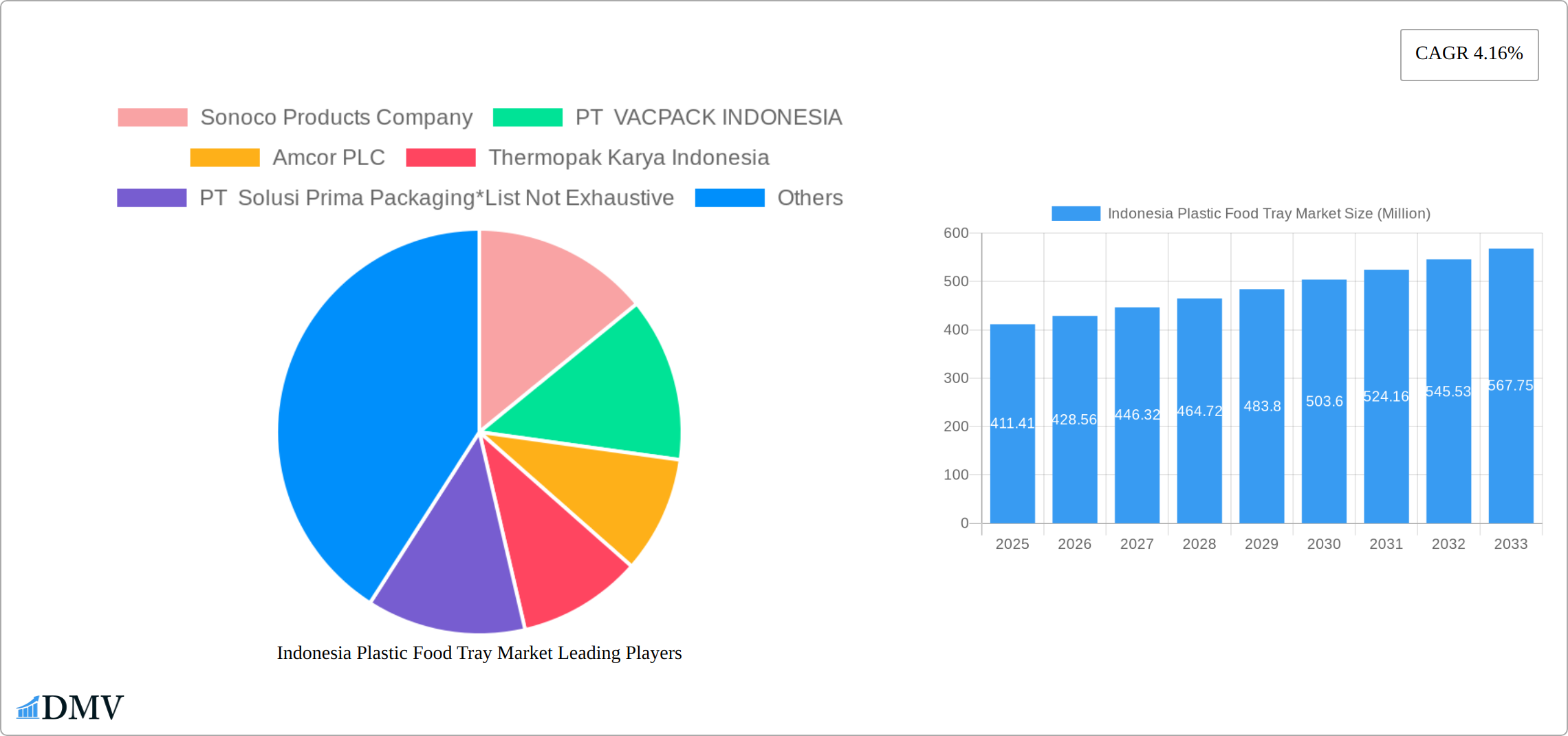

The Indonesia plastic food tray market, valued at $411.41 million in 2025, is projected to experience robust growth, driven by a rising population, increasing urbanization, and a surge in demand for convenient and affordable food packaging solutions. The convenience offered by plastic food trays, particularly in a rapidly developing economy like Indonesia, is a significant factor contributing to market expansion. Growth is further fueled by the flourishing food service industry, including restaurants, cafes, and street food vendors, all reliant on efficient and cost-effective packaging. Key segments within the market include PET, PVC, and PP resin types, each catering to specific needs in terms of durability, cost, and recyclability. While environmental concerns regarding plastic waste pose a potential restraint, the market is witnessing a gradual shift toward more sustainable materials and improved recycling infrastructure, mitigating this challenge. Competition among established players like Sonoco Products Company and Amcor PLC, alongside local manufacturers, fosters innovation and drives price competitiveness, making plastic food trays a viable option for a broad range of consumers. The forecast period (2025-2033) anticipates continued growth, although the pace might be influenced by factors such as fluctuations in raw material prices and government regulations related to plastic waste management.

Indonesia Plastic Food Tray Market Market Size (In Million)

The projected Compound Annual Growth Rate (CAGR) of 4.16% indicates a steady expansion of the Indonesia plastic food tray market throughout the forecast period. This growth is expected to be driven by continuous improvements in food processing and packaging technologies, enhancing the shelf life and appeal of packaged food items. Furthermore, the increasing adoption of ready-to-eat meals and packaged snacks aligns perfectly with the convenience offered by plastic food trays. The market segmentation by resin type highlights the diversity of material choices available, each offering unique properties that address the specific needs of different food products and packaging applications. While challenges exist in terms of environmental sustainability, innovative solutions such as biodegradable plastics and improved recycling initiatives are likely to play a vital role in shaping the long-term trajectory of the market, ensuring its growth remains responsible and environmentally conscious.

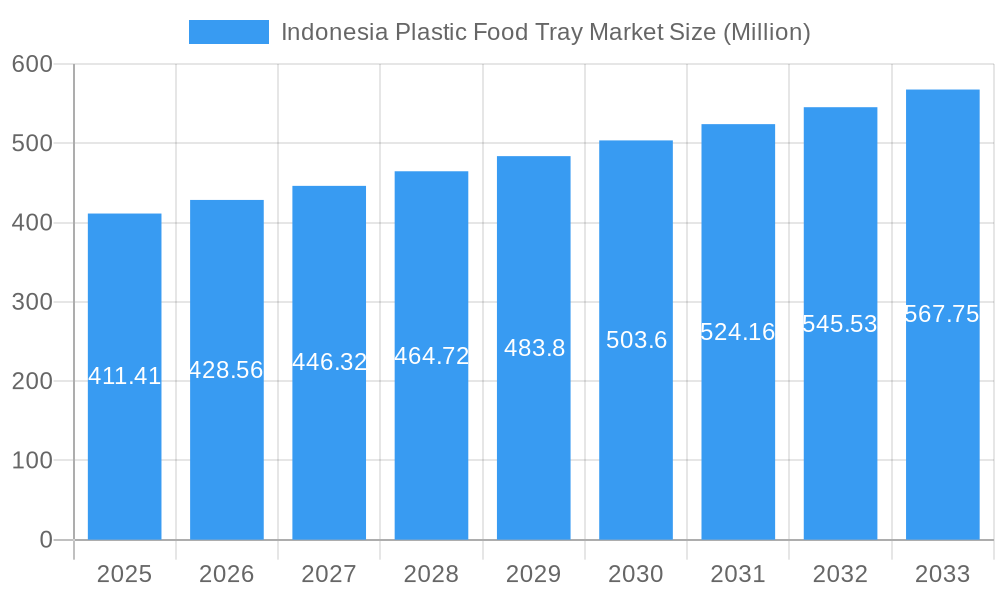

Indonesia Plastic Food Tray Market Company Market Share

Indonesia Plastic Food Tray Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Indonesia plastic food tray market, offering a detailed overview of market trends, competitive dynamics, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for stakeholders including manufacturers, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The market is projected to reach xx Million by 2033.

Indonesia Plastic Food Tray Market Composition & Trends

This section delves into the intricate landscape of the Indonesian plastic food tray market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market is characterized by a moderately concentrated structure, with key players such as Sonoco Products Company, PT VACPACK INDONESIA, Amcor PLC, and others holding significant market shares. However, the presence of numerous smaller players indicates a competitive environment.

- Market Share Distribution (2024): Amcor PLC holds an estimated xx% market share, followed by Sonoco Products Company at xx%, and PT VACPACK INDONESIA at xx%. The remaining share is distributed among other players.

- Innovation Catalysts: Growing demand for convenient and eco-friendly packaging solutions is driving innovation in materials and designs. This includes the development of biodegradable and compostable trays.

- Regulatory Landscape: Indonesia's environmental regulations are increasingly impacting the plastic food tray industry, promoting the adoption of sustainable alternatives.

- Substitute Products: Paper-based and biodegradable alternatives are emerging as substitutes, posing a challenge to traditional plastic trays.

- End-User Profiles: The primary end-users are quick-service restaurants (QSRs), supermarkets, and food manufacturers.

- M&A Activities (2019-2024): The reported M&A deal value during this period totaled approximately xx Million, driven primarily by strategic acquisitions aimed at expanding market reach and product portfolios. Several smaller acquisitions contributed to this total.

Indonesia Plastic Food Tray Market Industry Evolution

This section provides a detailed analysis of the Indonesian plastic food tray market's growth trajectory, technological advancements, and evolving consumer preferences. Between 2019 and 2024, the market experienced a significant Compound Annual Growth Rate (CAGR) of approximately XX%, propelled by the robust expansion of the food service sector, a burgeoning middle class, and increasing disposable incomes. Technological advancements in material science are continuously enabling the development of lighter, more durable, and aesthetically pleasing trays, enhancing both functionality and visual appeal. Concurrently, consumers' growing preference for convenience and a heightened awareness of sustainability are actively shaping market trends, leading to a discernible demand for eco-friendly and recyclable options. The projected CAGR for the period of 2025-2033 is estimated at XX%, indicating sustained and accelerated market expansion. Furthermore, the pervasive shift towards online food delivery services has emerged as a substantial catalyst, significantly contributing to the overall growth of the plastic food tray market.

Leading Regions, Countries, or Segments in Indonesia Plastic Food Tray Market

This section identifies the dominant resin types shaping the Indonesian plastic food tray market. While precise market share data for individual resin types is dynamic, the analysis strongly suggests that PP (Polypropylene) commands a significant market share. This dominance is attributed to its inherent versatility, exceptional cost-effectiveness, and broad suitability for a wide array of food applications, making it the preferred choice for many manufacturers and food businesses.

- Key Drivers for PP Dominance:

- Cost-effectiveness: PP resin typically presents a more economical option compared to alternatives like PET or PVC, making it attractive for high-volume production.

- Versatility: PP's inherent malleability allows it to be easily molded into diverse shapes, sizes, and designs, effectively catering to the varied and evolving needs of the food tray market.

- High Demand from QSRs: The escalating popularity and expansion of Quick-Service Restaurants (QSRs) directly fuel the demand for PP trays, owing to their affordability and suitability for efficient mass production.

- Other Resin Types: While PET (Polyethylene Terephthalate) and PVC (Polyvinyl Chloride) are also utilized in the market, they generally hold smaller market shares. Factors contributing to this include higher production costs for PET and growing environmental concerns associated with PVC, leading to a preference for more sustainable alternatives where possible.

Indonesia Plastic Food Tray Market Product Innovations

Recent innovations include the introduction of trays with improved barrier properties to extend shelf life, microwavable trays for added convenience, and trays incorporating sustainable materials like PLA (Polylactic Acid) or recycled content. These advancements aim to improve product functionality and address growing sustainability concerns, enhancing the value proposition for consumers and meeting stringent regulations. Specific performance metrics such as improved oxygen barrier or enhanced heat resistance are key selling points for new product developments.

Propelling Factors for Indonesia Plastic Food Tray Market Growth

Several factors contribute to the growth of the Indonesian plastic food tray market. The expansion of the food service industry, particularly quick-service restaurants, is a major driver, coupled with rising disposable incomes leading to increased food consumption. Furthermore, technological advancements enabling the production of more efficient and sustainable packaging contribute significantly. Government initiatives promoting the use of food-safe packaging also support market growth.

Obstacles in the Indonesia Plastic Food Tray Market

The Indonesian plastic food tray market navigates several significant challenges. Fluctuating raw material prices, particularly for petrochemical-based resins, can impact manufacturing costs and profitability. Evolving environmental regulations, which increasingly scrutinize and sometimes restrict the use of certain plastic types, present a continuous obstacle, necessitating adaptation and innovation. The market also contends with intense competition among manufacturers, driving price pressures and the need for differentiation. Furthermore, global supply chain disruptions, often exacerbated by geopolitical events or unforeseen crises, can directly affect production timelines, raw material availability, and overall market stability. Compounding these issues, growing environmental consciousness among consumers is actively influencing purchasing decisions, fostering a demand for more sustainable packaging solutions and placing pressure on the industry to innovate with recyclable, biodegradable, or compostable alternatives.

Future Opportunities in Indonesia Plastic Food Tray Market

The future of the Indonesian plastic food tray market is intrinsically linked to the burgeoning demand for environmentally responsible and sustainable packaging solutions. The accelerating growth of online food delivery services continues to be a significant market expansion opportunity, creating an ongoing need for reliable and convenient food tray options. Innovations in material science and design, particularly those that incorporate recycled content and explore biodegradable or compostable materials, will be paramount for continued market growth. This focus on sustainability is further amplified by the anticipation of stricter environmental regulations in the coming years, creating a fertile ground for companies that can offer compliant and forward-thinking packaging solutions. The development of novel, high-performance bioplastics and the optimization of recycling infrastructure will also play a crucial role in unlocking new avenues for growth and market leadership.

Major Players in the Indonesia Plastic Food Tray Market Ecosystem

- Sonoco Products Company (Sonoco Products Company)

- PT VACPACK INDONESIA

- Amcor PLC (Amcor PLC)

- Thermopak Karya Indonesia

- PT Solusi Prima Packaging

- PT Gosyen Pacific Sukses Makmur

Key Developments in Indonesia Plastic Food Tray Market Industry

- December 2022: The highly anticipated launch of Popeyes in Indonesia by Restaurants Brands Asia (RBA) is poised to significantly escalate the demand for food trays in the coming years. The ambitious plan for expansion to 300 stores across the archipelago represents a substantial and promising market opportunity for plastic food tray manufacturers and suppliers.

- March 2022: Sonoco Products Company announced a price adjustment, implementing a 9% increase on its thermoformed CPET trays. This adjustment was primarily a reflection of escalating raw material costs within the industry, signaling a broader trend that impacts overall market pricing and necessitates strategic cost management by other players in the sector.

Strategic Indonesia Plastic Food Tray Market Forecast

The Indonesian plastic food tray market is poised for sustained growth, driven by continued expansion in the food service sector, rising consumer incomes, and the adoption of innovative, sustainable packaging solutions. While challenges exist in terms of regulation and material costs, the long-term outlook remains positive, with significant potential for market expansion, particularly for manufacturers who can adapt to evolving consumer preferences and environmental concerns.

Indonesia Plastic Food Tray Market Segmentation

-

1. Resin Type

- 1.1. PET

- 1.2. PVC

- 1.3. PP

- 1.4. Other Resin Types

Indonesia Plastic Food Tray Market Segmentation By Geography

- 1. Indonesia

Indonesia Plastic Food Tray Market Regional Market Share

Geographic Coverage of Indonesia Plastic Food Tray Market

Indonesia Plastic Food Tray Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Ready-to-Eat and Online Food Delivery; Surge in Number of Cafes and Quick Service Restaurants

- 3.3. Market Restrains

- 3.3.1. Shift Toward Green Solutions such as Bagasse Trays

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Ready-to-eat Food and Online Food Delivery Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Plastic Food Tray Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. PET

- 5.1.2. PVC

- 5.1.3. PP

- 5.1.4. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT VACPACK INDONESIA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thermopak Karya Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Solusi Prima Packaging*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Gosyen Pacific Sukses Makmur

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: Indonesia Plastic Food Tray Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Plastic Food Tray Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Plastic Food Tray Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Indonesia Plastic Food Tray Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Indonesia Plastic Food Tray Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 4: Indonesia Plastic Food Tray Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Plastic Food Tray Market?

The projected CAGR is approximately 4.16%.

2. Which companies are prominent players in the Indonesia Plastic Food Tray Market?

Key companies in the market include Sonoco Products Company, PT VACPACK INDONESIA, Amcor PLC, Thermopak Karya Indonesia, PT Solusi Prima Packaging*List Not Exhaustive, PT Gosyen Pacific Sukses Makmur.

3. What are the main segments of the Indonesia Plastic Food Tray Market?

The market segments include Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 411.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Ready-to-Eat and Online Food Delivery; Surge in Number of Cafes and Quick Service Restaurants.

6. What are the notable trends driving market growth?

Increasing Demand for Ready-to-eat Food and Online Food Delivery Drives the Market.

7. Are there any restraints impacting market growth?

Shift Toward Green Solutions such as Bagasse Trays.

8. Can you provide examples of recent developments in the market?

December 2022: Quick-service restaurants are partnering and investing in Indonesia. Such collaborations may increase the demand for food tray packaging. For instance, in December 2022, Restaurants Brands Asia's (RBA) step-down subsidiary PT Sari Chicken is set to launch the Popeyes restaurant brand in Indonesia. The first store was scheduled to open in Margo City in December 2022 and aims to open 300 stores in the next few years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Plastic Food Tray Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Plastic Food Tray Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Plastic Food Tray Market?

To stay informed about further developments, trends, and reports in the Indonesia Plastic Food Tray Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence