Key Insights

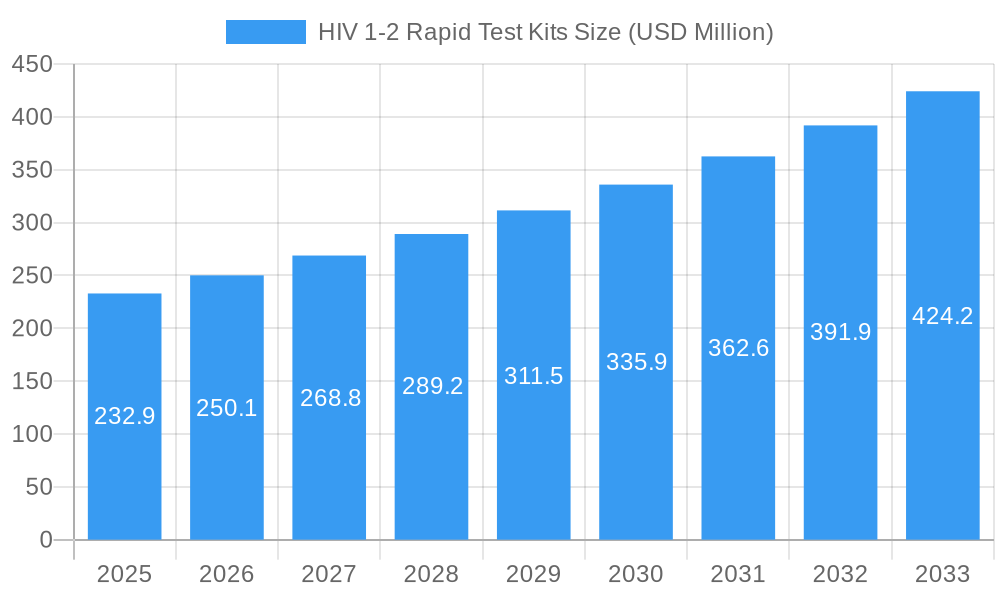

The global market for HIV 1-2 rapid test kits is experiencing robust growth, driven by increasing awareness of HIV/AIDS, expanding diagnostic accessibility, and government initiatives aimed at early detection and treatment. The market is projected to reach USD 232.9 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025-2033. This significant expansion is fueled by the rising prevalence of HIV in certain regions and the ongoing efforts to curb its spread through widespread testing. The demand for convenient, quick, and accurate diagnostic solutions at the point of care is a primary catalyst, enabling faster intervention and improved patient outcomes.

HIV 1-2 Rapid Test Kits Market Size (In Million)

The market segmentation reveals a dynamic landscape, with 'Offline Sales' currently holding a dominant share due to established healthcare infrastructure and accessibility in many regions. However, 'Online Sales' are poised for substantial growth, driven by the increasing digitalization of healthcare and the convenience of direct-to-consumer models, particularly for discreet testing. In terms of types, 'Blood' and 'Oral Fluid' based tests are the most prevalent due to their established efficacy and widespread adoption. The market is characterized by the presence of numerous key players, fostering innovation and competitive pricing, which further stimulates market expansion. Geographically, North America and Europe are significant markets, while the Asia Pacific region presents immense growth potential due to its large population and increasing healthcare expenditure.

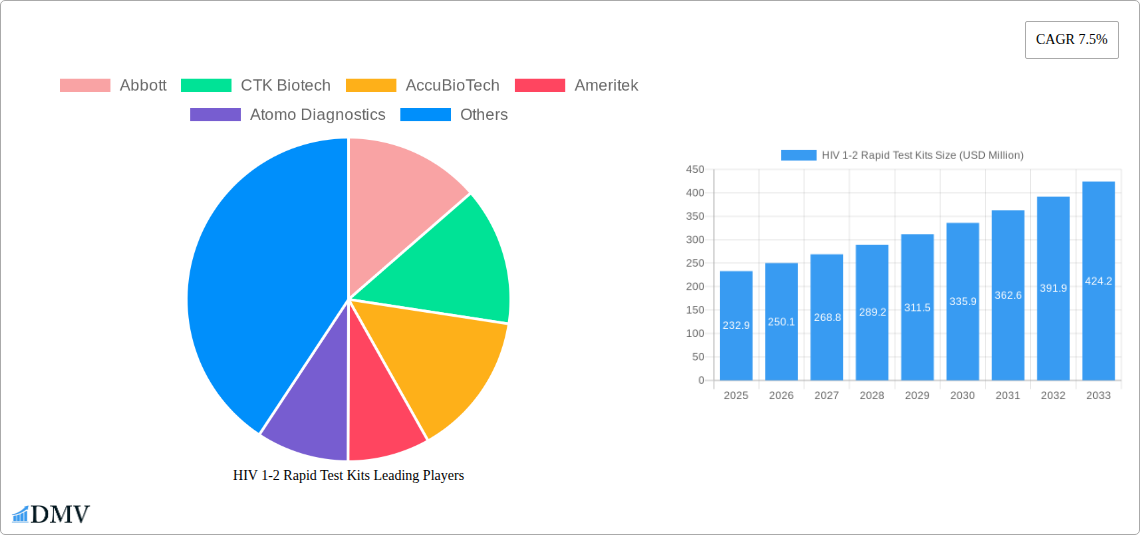

HIV 1-2 Rapid Test Kits Company Market Share

HIV 1-2 Rapid Test Kits Market Composition & Trends

The HIV 1-2 rapid test kits market is characterized by a dynamic competitive landscape, with key players like Abbott, SD Biosensor, and Wondfo holding substantial market share, estimated to be in the hundreds of millions. Innovation remains a primary catalyst for growth, driven by the constant pursuit of higher sensitivity, faster turnaround times, and improved user-friendliness. Regulatory bodies worldwide are also playing a crucial role, with stringent approval processes ensuring the quality and reliability of diagnostic tools, and influencing market entry for new products. Substitute products, while present, are generally less convenient or accurate, positioning rapid test kits as the preferred choice for immediate screening. End-user profiles are diverse, encompassing healthcare professionals in clinics and hospitals, public health organizations, and increasingly, individuals seeking at-home testing solutions, reflecting a growing awareness and proactive approach to health management. Mergers and acquisitions (M&A) are a significant aspect of market consolidation, with numerous deals valued in the tens to hundreds of millions of dollars occurring as larger entities seek to expand their portfolios and geographic reach. The market share distribution reveals a moderate to high concentration, with the top five companies likely accounting for over seventy-five percent of the global market value.

- Market Share Distribution: Top 5 Companies estimated to hold over $500 million in market share.

- M&A Deal Values: Significant transactions often range from $50 million to $500 million, indicating strategic consolidation.

- Innovation Catalysts: Focus on sensitivity, specificity, and point-of-care convenience.

- Regulatory Landscape: FDA, CE, and WHO prequalification are critical for market access, impacting launch timelines and investments by millions.

- Substitute Products: Traditional laboratory tests and molecular assays offer higher diagnostic certainty but lack immediate results.

- End-User Profiles: Healthcare facilities, NGOs, blood banks, and direct-to-consumer segments driving demand in the millions.

HIV 1-2 Rapid Test Kits Industry Evolution

The HIV 1-2 rapid test kits industry has witnessed remarkable evolution driven by technological advancements, shifting healthcare paradigms, and increasing global health consciousness. Over the historical period (2019-2024), the market experienced consistent growth, with an estimated compound annual growth rate (CAGR) of approximately 7.5%, reaching a market valuation in the low billions by 2024. This growth was propelled by heightened awareness campaigns, increased accessibility to diagnostic tools, and government initiatives focused on HIV prevention and control. The base year, 2025, stands as a pivotal point with an estimated market size of approximately $2.5 billion. The study period (2019-2033) encompasses a transformative phase where technological innovations have significantly improved the accuracy, speed, and ease of use of HIV 1-2 rapid test kits.

Early in the historical period, lateral flow assays were the dominant technology, offering qualitative results with rapid turnaround times. However, advancements have led to the development of more sophisticated technologies, including enzyme-linked immunosorbent assays (ELISA) based rapid tests and even some point-of-care molecular diagnostic platforms offering higher sensitivity and quantitative or semi-quantitative results. The adoption metrics have seen a substantial increase, with an estimated 60% of initial HIV screenings globally now utilizing rapid test kits, a figure projected to climb to over 80% by the end of the forecast period.

Consumer demand has also played a crucial role in shaping the industry. The increasing desire for privacy, convenience, and immediate results has fueled the growth of self-testing kits and over-the-counter sales. This trend is particularly pronounced in developed economies but is rapidly gaining traction in low and middle-income countries due to the decentralization of healthcare services. The COVID-19 pandemic, while disruptive in some aspects, also accelerated the acceptance of rapid diagnostic testing and at-home testing solutions, further bolstering the market for HIV 1-2 rapid test kits.

Looking ahead to the forecast period (2025-2033), the market is poised for continued robust expansion, with an anticipated CAGR of around 8.2%, projecting a market valuation exceeding $5 billion by 2033. This growth will be driven by ongoing technological innovations such as the integration of multiplexing capabilities to detect co-infections, the development of smartphone-integrated diagnostic devices for easier data management and telemedicine connectivity, and the expansion of testing into non-traditional settings. Furthermore, the persistent global burden of HIV, coupled with efforts to achieve UNAIDS 95-95-95 targets, will continue to create a sustained demand for accessible and reliable diagnostic tools. The increasing focus on early diagnosis and linkage to care will also ensure that rapid test kits remain at the forefront of HIV management strategies worldwide, with investments in research and development by major players projected to be in the hundreds of millions. The market's trajectory is therefore one of consistent growth, innovation, and increasing impact on global public health.

Leading Regions, Countries, or Segments in HIV 1-2 Rapid Test Kits

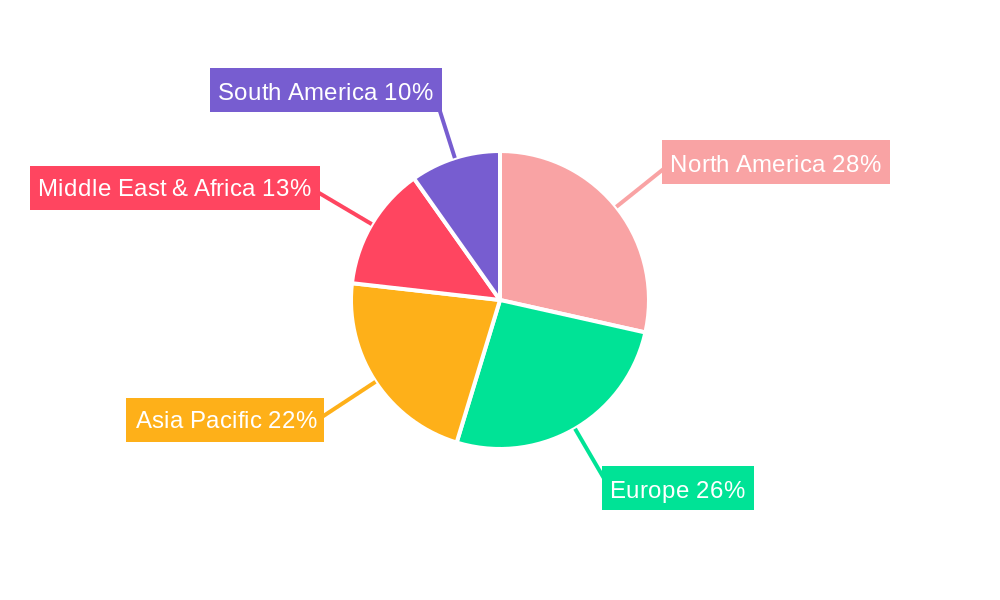

The global HIV 1-2 rapid test kits market exhibits distinct regional dominance and segment preferences, with North America and Europe currently leading due to robust healthcare infrastructure, high disease awareness, and significant government investment in public health initiatives, estimated in the hundreds of millions. These regions benefit from established regulatory frameworks that facilitate the adoption of advanced diagnostic technologies, coupled with a strong emphasis on preventive healthcare and early detection, leading to an estimated market share of over thirty percent for each. The United States, in particular, stands out as a major market, driven by a large patient population, widespread availability of healthcare services, and strong demand for both professional and self-testing solutions, contributing billions in annual sales.

In terms of application segments, Offline Sales currently dominate the market, accounting for an estimated seventy-five percent of the total revenue. This is primarily due to the extensive use of rapid test kits in clinical settings such as hospitals, diagnostic laboratories, blood banks, and public health clinics. Healthcare professionals' reliance on these kits for immediate patient screening and diagnosis underpins the strength of the offline segment. However, Online Sales are experiencing a significant surge, projected to grow at a CAGR of over 10% during the forecast period, driven by the increasing consumer preference for convenience, privacy, and direct access to healthcare products. E-commerce platforms and direct-to-consumer sales channels are expanding rapidly, making HIV 1-2 rapid test kits more accessible to individuals who prefer to test at home. This growing trend is expected to capture a substantial market share in the coming years, potentially reaching twenty-five percent of the total market.

Regarding types of samples tested, Blood-based HIV 1-2 rapid test kits represent the largest segment, holding an estimated sixty-five percent of the market share. These kits are widely accepted and have a long history of reliable performance, making them a standard in clinical settings. Oral Fluid-based test kits are gaining popularity due to their non-invasive nature and ease of use, particularly for self-testing and in situations where blood collection may be challenging. This segment is projected to grow at a robust CAGR of approximately 9.5%, driven by its user-friendliness and increasing adoption for public health screening programs, with an estimated market value in the hundreds of millions. Urine-based test kits, while less prevalent than blood or oral fluid, also cater to specific niche applications and are expected to see steady growth, albeit at a slower pace.

- Dominant Regions: North America and Europe, with combined market share estimated at over sixty percent, driven by strong healthcare infrastructure and government initiatives amounting to hundreds of millions in investment.

- Leading Country: United States, a significant contributor to global sales, with an estimated market value in the low billions.

- Application Segment (Dominant): Offline Sales, accounting for approximately seventy-five percent of the market, reflecting widespread use in healthcare facilities.

- Application Segment (Growing): Online Sales, projected to grow significantly due to convenience and privacy, with an estimated market share of twenty-five percent by the end of the forecast period.

- Type Segment (Dominant): Blood, representing approximately sixty-five percent of the market, due to its established reliability and extensive clinical use, with an estimated market value in the billions.

- Type Segment (Growing): Oral Fluid, driven by non-invasive nature and ease of self-testing, with a projected CAGR of 9.5% and an estimated market value in the hundreds of millions.

- Key Drivers (Regional): Government funding for public health programs (hundreds of millions), high diagnostic rates, and advanced healthcare reimbursement policies.

- Key Drivers (Application): Increasing demand for point-of-care diagnostics (offline), and growing preference for at-home testing and telemedicine (online).

- Key Drivers (Type): Established clinical validation (blood), and demand for non-invasive and convenient testing (oral fluid).

HIV 1-2 Rapid Test Kits Product Innovations

Product innovation in HIV 1-2 rapid test kits is continuously enhancing performance and accessibility. Recent advancements include the development of highly sensitive immunoassay platforms that can detect HIV-1 p24 antigen along with antibodies, leading to earlier diagnosis. These next-generation kits offer reduced window periods, a critical factor in preventing transmission. Furthermore, researchers are exploring multiplexing capabilities to simultaneously detect multiple viral infections or biomarkers from a single sample, thereby increasing efficiency and reducing costs for healthcare providers, with development investments in the tens of millions. The integration of digital technologies, such as smartphone connectivity for data analysis and secure sharing with healthcare professionals, is also a significant trend, improving patient engagement and enabling better follow-up care, with potential market penetration in the millions. User-friendly designs, including finger-prick blood sampling and saliva collection methods, continue to be refined for at-home use, making testing more approachable for the general population. The overall aim is to provide rapid, accurate, and convenient diagnostic solutions that contribute significantly to global HIV control efforts, with a focus on lowering the cost per test in the billions.

Propelling Factors for HIV 1-2 Rapid Test Kits Growth

Several key factors are propelling the growth of the HIV 1-2 rapid test kits market. The increasing global prevalence of HIV, coupled with sustained public health efforts to promote early diagnosis and treatment, remains a primary driver, impacting millions of lives annually. Technological advancements have led to the development of more accurate, sensitive, and user-friendly rapid test kits, expanding their application in point-of-care settings and for self-testing, with research and development investments in the hundreds of millions. Government initiatives and funding programs aimed at HIV prevention and control in low and middle-income countries are significantly boosting demand for affordable and accessible diagnostic tools. The growing awareness among individuals about the importance of regular HIV testing and the availability of discreet testing options further contribute to market expansion, with consumer spending in the billions. Furthermore, the push towards achieving UNAIDS' 95-95-95 targets necessitates widespread and rapid testing, creating a sustained demand for these kits.

Obstacles in the HIV 1-2 Rapid Test Kits Market

Despite the robust growth, the HIV 1-2 rapid test kits market faces several obstacles. Stringent regulatory approval processes in various countries can lead to prolonged market entry timelines and significant investment costs, potentially in the tens of millions. Fluctuations in raw material prices and supply chain disruptions, as witnessed during global health crises, can impact manufacturing costs and product availability, affecting market stability. The availability of less expensive, albeit sometimes less accurate, diagnostic alternatives in certain regions can also pose a competitive challenge. Moreover, misinformation and stigma surrounding HIV testing can deter individuals from seeking diagnosis, hindering widespread adoption, with potential for millions of undiagnosed cases. Ensuring the quality and reliability of tests, particularly in resource-limited settings, remains a continuous challenge requiring ongoing oversight and stringent quality control measures.

Future Opportunities in HIV 1-2 Rapid Test Kits

Emerging opportunities in the HIV 1-2 rapid test kits market are abundant. The expansion of self-testing and direct-to-consumer sales channels, driven by technological integration like smartphone connectivity and telemedicine, presents a significant growth avenue, projected to impact billions in sales. The development of point-of-care devices capable of detecting co-infections or resistance markers alongside HIV will enhance diagnostic capabilities and open new market segments, attracting tens of millions in development. Expanding into underserved regions and low-income countries through cost-effective solutions and public-private partnerships offers substantial potential. Furthermore, innovations in lab-on-a-chip technologies and microfluidics promise to create even more compact, sensitive, and rapid testing platforms, with ongoing investments in the hundreds of millions. The increasing focus on personalized medicine and proactive health management will also fuel the demand for frequent and accessible HIV screening.

Major Players in the HIV 1-2 Rapid Test Kits Ecosystem

Abbott CTK Biotech AccuBioTech Ameritek Atomo Diagnostics Autobio Diagnostics Beckman Coulter Bioneer bioLytical Laboratories Biosynex Testsea Cupid Limited DIALAB HUMAN INTEC J. Mitra & Co Meril Life Sciences MP Biomedicals Medsource Ozone Biomedicals Nanjing Synthgene Medical Technology Premier Medical SD Biosensor KHB (Shanghai Kehua Bio-Engineering) Türklab A.S. Trinity Biotech Wantai BioPharma Wondfo

Key Developments in HIV 1-2 Rapid Test Kits Industry

- 2023: Launch of next-generation rapid HIV tests with enhanced sensitivity and reduced window periods by several leading manufacturers, impacting millions of potential diagnoses.

- 2022: Increased regulatory approvals for self-testing kits in major markets, facilitating greater accessibility and personal health management, with a market impact in the hundreds of millions.

- 2021: Significant investment in R&D for digital integration of rapid test kits, enabling data sharing and telemedicine applications, a trend valued in the tens of millions.

- 2020: Enhanced focus on supply chain resilience for rapid diagnostic tests in response to global health challenges, ensuring availability for millions.

- 2019: Introduction of oral fluid-based rapid HIV tests with improved accuracy and user experience, contributing to a growing segment worth hundreds of millions.

Strategic HIV 1-2 Rapid Test Kits Market Forecast

The strategic forecast for the HIV 1-2 rapid test kits market is exceptionally positive, driven by persistent global health needs and continuous technological innovation. Growth catalysts include the expanding demand for point-of-care diagnostics and the significant rise in self-testing facilitated by user-friendly designs and online accessibility, collectively influencing billions in market value. Government-led public health initiatives, particularly in developing nations aiming to achieve ambitious HIV control targets, will continue to be a substantial market driver, with projected spending in the hundreds of millions. Furthermore, the integration of digital health technologies and the development of multiplex diagnostic platforms are poised to unlock new market segments and enhance the value proposition of rapid testing. The market is expected to witness sustained growth, solidifying its crucial role in global HIV prevention and management strategies, with an estimated market value exceeding $5 billion by 2033.

HIV 1-2 Rapid Test Kits Segmentation

-

1. Application

- 1.1. Offline Sales

- 1.2. Online Sales

-

2. Types

- 2.1. Blood

- 2.2. Oral Fluid

- 2.3. Urine

HIV 1-2 Rapid Test Kits Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

HIV 1-2 Rapid Test Kits Regional Market Share

Geographic Coverage of HIV 1-2 Rapid Test Kits

HIV 1-2 Rapid Test Kits REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global HIV 1-2 Rapid Test Kits Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Offline Sales

- 5.1.2. Online Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Blood

- 5.2.2. Oral Fluid

- 5.2.3. Urine

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America HIV 1-2 Rapid Test Kits Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Offline Sales

- 6.1.2. Online Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Blood

- 6.2.2. Oral Fluid

- 6.2.3. Urine

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America HIV 1-2 Rapid Test Kits Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Offline Sales

- 7.1.2. Online Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Blood

- 7.2.2. Oral Fluid

- 7.2.3. Urine

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe HIV 1-2 Rapid Test Kits Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Offline Sales

- 8.1.2. Online Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Blood

- 8.2.2. Oral Fluid

- 8.2.3. Urine

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa HIV 1-2 Rapid Test Kits Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Offline Sales

- 9.1.2. Online Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Blood

- 9.2.2. Oral Fluid

- 9.2.3. Urine

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific HIV 1-2 Rapid Test Kits Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Offline Sales

- 10.1.2. Online Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Blood

- 10.2.2. Oral Fluid

- 10.2.3. Urine

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Abbott

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CTK Biotech

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AccuBioTech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ameritek

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Atomo Diagnostics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Autobio Diagnostics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Beckman Coulter

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bioneer

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 bioLytical Laboratories

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Biosynex

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Testsea

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cupid Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 DIALAB

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HUMAN

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 INTEC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 J. Mitra & Co

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Meril Life Sciences

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 MP Biomedicals

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Medsource Ozone Biomedicals

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Nanjing Synthgene Medical Technology

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Premier Medical

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 SD Biosensor

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 KHB (Shanghai Kehua Bio-Engineering

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Türklab A.S.

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Trinity Biotech

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Wantai BioPharma

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Wondfo

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.1 Abbott

List of Figures

- Figure 1: Global HIV 1-2 Rapid Test Kits Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America HIV 1-2 Rapid Test Kits Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America HIV 1-2 Rapid Test Kits Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America HIV 1-2 Rapid Test Kits Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America HIV 1-2 Rapid Test Kits Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America HIV 1-2 Rapid Test Kits Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America HIV 1-2 Rapid Test Kits Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America HIV 1-2 Rapid Test Kits Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America HIV 1-2 Rapid Test Kits Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America HIV 1-2 Rapid Test Kits Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America HIV 1-2 Rapid Test Kits Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America HIV 1-2 Rapid Test Kits Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America HIV 1-2 Rapid Test Kits Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe HIV 1-2 Rapid Test Kits Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe HIV 1-2 Rapid Test Kits Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe HIV 1-2 Rapid Test Kits Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe HIV 1-2 Rapid Test Kits Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe HIV 1-2 Rapid Test Kits Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe HIV 1-2 Rapid Test Kits Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa HIV 1-2 Rapid Test Kits Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa HIV 1-2 Rapid Test Kits Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa HIV 1-2 Rapid Test Kits Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa HIV 1-2 Rapid Test Kits Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa HIV 1-2 Rapid Test Kits Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa HIV 1-2 Rapid Test Kits Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific HIV 1-2 Rapid Test Kits Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific HIV 1-2 Rapid Test Kits Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific HIV 1-2 Rapid Test Kits Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific HIV 1-2 Rapid Test Kits Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific HIV 1-2 Rapid Test Kits Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific HIV 1-2 Rapid Test Kits Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global HIV 1-2 Rapid Test Kits Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific HIV 1-2 Rapid Test Kits Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HIV 1-2 Rapid Test Kits?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the HIV 1-2 Rapid Test Kits?

Key companies in the market include Abbott, CTK Biotech, AccuBioTech, Ameritek, Atomo Diagnostics, Autobio Diagnostics, Beckman Coulter, Bioneer, bioLytical Laboratories, Biosynex, Testsea, Cupid Limited, DIALAB, HUMAN, INTEC, J. Mitra & Co, Meril Life Sciences, MP Biomedicals, Medsource Ozone Biomedicals, Nanjing Synthgene Medical Technology, Premier Medical, SD Biosensor, KHB (Shanghai Kehua Bio-Engineering, Türklab A.S., Trinity Biotech, Wantai BioPharma, Wondfo.

3. What are the main segments of the HIV 1-2 Rapid Test Kits?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HIV 1-2 Rapid Test Kits," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HIV 1-2 Rapid Test Kits report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HIV 1-2 Rapid Test Kits?

To stay informed about further developments, trends, and reports in the HIV 1-2 Rapid Test Kits, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence