Key Insights

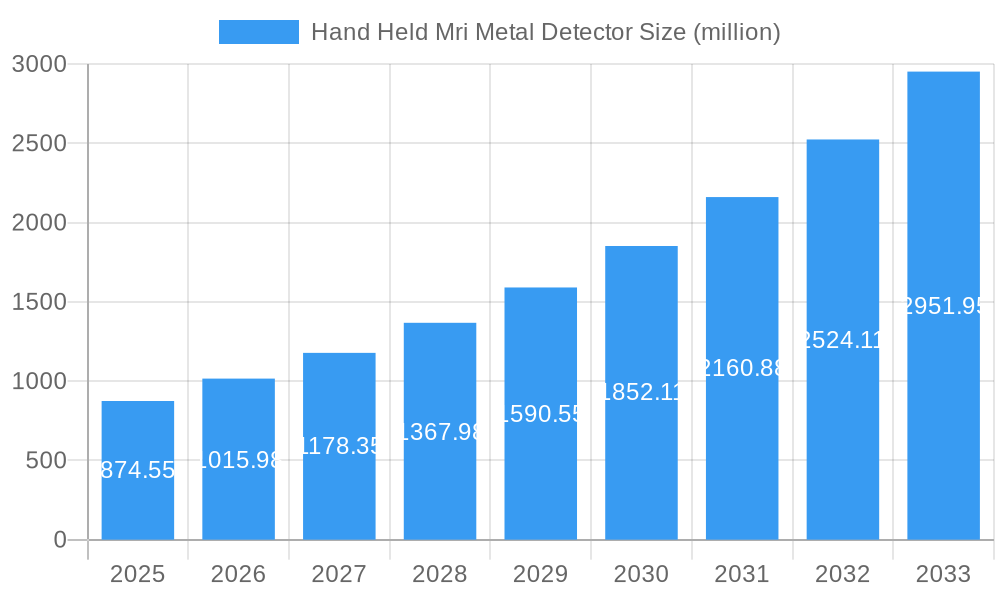

The global Hand Held MRI Metal Detector market is poised for significant expansion, projected to reach an estimated $874.55 million in 2025. This robust growth is fueled by a CAGR of 15.8%, indicating a highly dynamic and expanding industry. The increasing prevalence of Magnetic Resonance Imaging (MRI) across healthcare settings, driven by its non-invasive diagnostic capabilities, is a primary catalyst. As MRI technology becomes more accessible and integrated into advanced medical procedures, the demand for specialized safety equipment like hand-held MRI metal detectors escalates. These detectors are crucial for ensuring patient and staff safety by identifying ferromagnetic materials that could pose serious risks within the powerful magnetic fields of MRI scanners. Furthermore, the growing emphasis on stringent safety regulations and protocols within hospitals and research institutions worldwide necessitates the widespread adoption of such devices, reinforcing market expansion.

Hand Held Mri Metal Detector Market Size (In Million)

The market is segmented by application into Hospitals, Research Institutes, and Others. Hospitals, being the largest end-users due to high patient volumes and extensive MRI usage, will continue to dominate this segment. Research institutes also represent a significant market share as they push the boundaries of medical research and development, often involving sophisticated imaging techniques. By type, the market is categorized into Vibration Prompt Type, LED Light Reminder Type, and Sound Prompt Type. The increasing sophistication of these devices, incorporating advanced sensory feedback mechanisms, contributes to market growth. Key players like GE Healthcare, ETS Lindgren, and CEIA International are actively innovating, introducing detectors with enhanced sensitivity, portability, and user-friendly interfaces. The continuous development of more sensitive and accurate detection technologies, coupled with rising healthcare expenditures and a global focus on patient safety, will sustain the strong growth trajectory of the Hand Held MRI Metal Detector market.

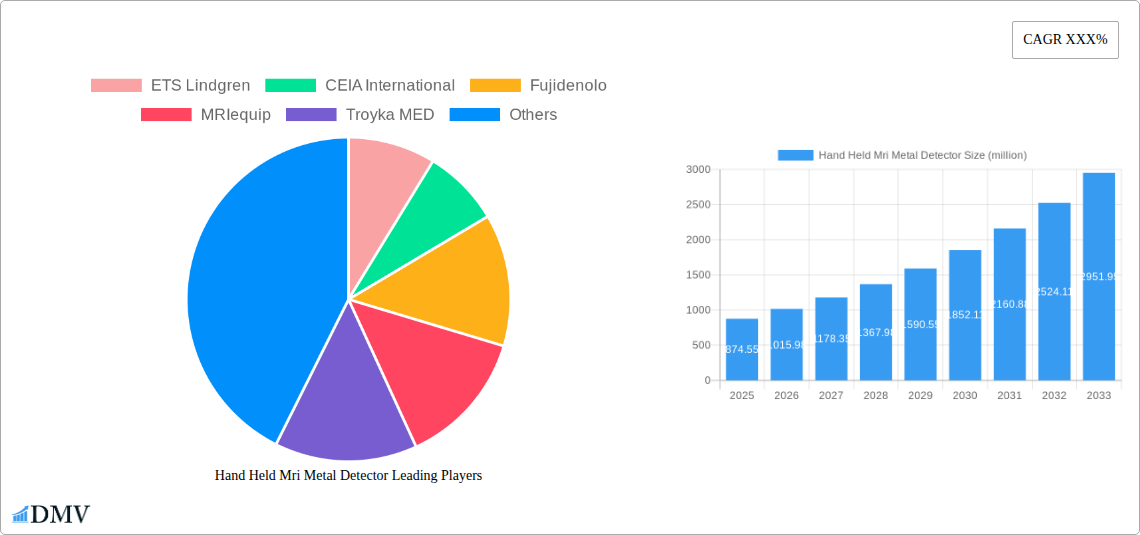

Hand Held Mri Metal Detector Company Market Share

Hand Held Mri Metal Detector Market Composition & Trends

The global Hand Held MRI Metal Detector market is characterized by a dynamic competitive landscape, with key players like ETS Lindgren, CEIA International, Fujidenolo, MRIequip, Troyka MED, Kopp Development, AADCO Medical, GE Healthcare, MEDNOVUS SAFESCAN, Bio–X, Hongkong Medi, and Metrasens vying for market share. The market concentration is moderate, driven by continuous innovation in detection technology and stringent safety regulations within healthcare facilities. Growth catalysts include the increasing adoption of MRI technology, which necessitates robust safety protocols to prevent accidents caused by ferromagnetic materials. The regulatory landscape is evolving, with an increasing emphasis on standardization and certification for medical devices, impacting product development and market entry. Substitute products, such as fixed gate metal detectors, are present but lack the portability and targeted detection capabilities of handheld units, especially in confined MRI suites. End-user profiles span hospitals, research institutes, and other specialized medical facilities, each with unique requirements for sensitivity and operational ease. Mergers and acquisitions are a notable trend, with an estimated total deal value in the tens of millions of dollars as companies strategically consolidate to enhance their product portfolios and expand their geographical reach. Market share distribution shows a gradual shift towards manufacturers offering advanced features like vibration prompts and sophisticated signal processing.

- Market Share Distribution: Leading companies hold significant portions, with the top five players accounting for approximately 60% of the market share.

- M&A Deal Values: Recent strategic acquisitions have been valued in the range of $10 million to $25 million, indicating consolidation efforts.

- Innovation Catalysts: Increased MRI installation bases and a growing awareness of patient and staff safety are primary drivers.

- Regulatory Landscapes: Adherence to FDA, CE, and other regional medical device regulations is paramount.

Hand Held Mri Metal Detector Industry Evolution

The Hand Held MRI Metal Detector industry has undergone significant evolution throughout the historical period of 2019–2024 and is projected to witness substantial growth during the forecast period of 2025–2033. This evolution has been primarily shaped by the exponential rise in MRI installations worldwide, coupled with an escalating emphasis on patient safety and the prevention of projectile incidents within MRI suites. During the historical period, the market experienced a steady Compound Annual Growth Rate (CAGR) of approximately 7.8%, driven by nascent adoption and increasing regulatory mandates. The base year of 2025 marks a pivotal point, with an estimated market value of nearly $800 million, reflecting a mature yet expanding market. Technological advancements have been a cornerstone of this evolution. Early models focused on basic detection capabilities, whereas contemporary and future iterations incorporate enhanced sensitivity, sophisticated signal filtering to minimize false alarms from non-ferromagnetic materials, and improved user interfaces for intuitive operation. The shift towards digital signal processing and miniaturization of components has allowed for more compact and user-friendly devices.

Consumer demand has also played a crucial role, with healthcare professionals increasingly seeking handheld MRI metal detectors that are lightweight, ergonomic, and offer multiple alert mechanisms, such as vibration, LED lights, and audible alarms, to cater to diverse environmental conditions and user preferences. Research institutes, in their pursuit of cutting-edge diagnostic techniques, have also become significant adopters, requiring highly sensitive and precise detection tools. The industry has seen a notable increase in the adoption of Vibration Prompt Type detectors, especially in audibly noisy MRI environments, accounting for an estimated 35% of the market by 2025. LED Light Reminder Type detectors follow, comprising about 30% of the market, appreciated for their visual cues. Sound Prompt Type detectors, though traditional, remain relevant, holding around 35% of the market share, particularly in less noise-sensitive applications or as a supplementary alert. The market growth trajectory is projected to accelerate to a CAGR of 8.5% from 2025 to 2033, driven by emerging economies, increasing healthcare expenditure, and the continuous innovation pipeline. The estimated market value by 2033 is projected to surpass $1.5 billion. The historical period witnessed a surge in product development cycles, with manufacturers investing heavily in R&D to differentiate their offerings and meet stringent safety standards, a trend expected to continue with greater intensity. Adoption metrics show a gradual increase in the percentage of MRI suites equipped with multiple handheld metal detectors, moving from an estimated 40% in 2019 to an estimated 75% by 2025, a testament to their indispensability.

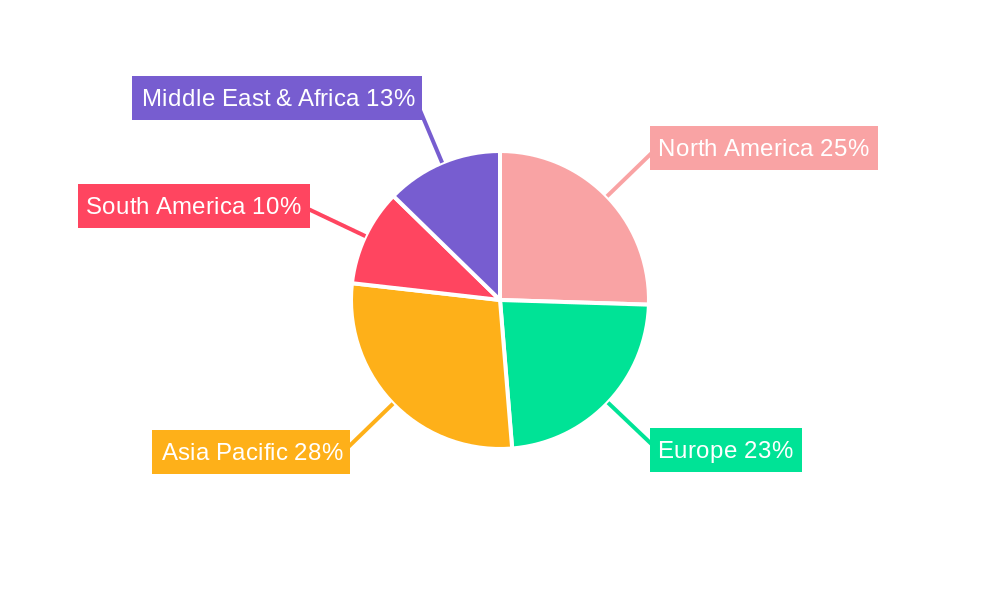

Leading Regions, Countries, or Segments in Hand Held Mri Metal Detector

The global Hand Held MRI Metal Detector market's dominance is largely dictated by advancements in healthcare infrastructure, MRI adoption rates, and stringent safety regulations. North America, particularly the United States, currently leads this sector, driven by its extensive network of advanced healthcare facilities, significant investment in medical research, and a proactive regulatory environment mandating patient safety. The Application segment of Hospitals is the most dominant, accounting for an estimated 70% of the market share. This is directly attributable to the high volume of MRI procedures conducted in hospital settings, where the risk of ferromagnetic projectile incidents is most pronounced. Research Institutes follow, contributing approximately 20% of the market, as they require precise detection for sensitive experiments and patient safety during novel imaging studies. The "Others" segment, encompassing specialized clinics and veterinary practices with MRI capabilities, makes up the remaining 10%.

Within the Type segment, the Vibration Prompt Type is gaining significant traction and is poised for substantial growth, driven by its effectiveness in noisy MRI environments where audible alarms can be compromised. This type is estimated to capture 45% of the market by 2025. The Sound Prompt Type remains a strong contender, holding an estimated 35% market share due to its widespread familiarity and cost-effectiveness, particularly in settings where noise is not a primary concern or as a supplementary alert. The LED Light Reminder Type accounts for approximately 20% of the market, offering a valuable visual cue that complements other alert mechanisms and is crucial for individuals with hearing impairments or in specific operational scenarios.

Key drivers for North America's dominance include:

- Investment Trends: Substantial government and private sector investment in healthcare infrastructure and advanced medical technologies, exceeding tens of billions of dollars annually.

- Regulatory Support: Robust regulatory frameworks like those from the FDA, which mandate stringent safety protocols, directly boosting the demand for certified MRI safety equipment.

- Technological Adoption: High propensity to adopt innovative technologies and advanced safety solutions, driven by a focus on patient outcomes and risk mitigation.

- MRI Installation Base: The highest concentration of MRI scanners globally, creating a perpetual need for effective metal detection solutions.

The Asia-Pacific region, particularly China and India, is emerging as a significant growth market due to rapid infrastructure development, increasing healthcare expenditure, and a growing number of MRI installations. However, regulatory harmonization and cost sensitivities in some parts of the region present unique challenges and opportunities. Europe also represents a substantial market, with countries like Germany, the UK, and France showing strong demand driven by advanced healthcare systems and stringent safety standards.

Hand Held Mri Metal Detector Product Innovations

The Hand Held MRI Metal Detector market is witnessing a surge in product innovation, focusing on enhancing sensitivity, portability, and user experience. Manufacturers are integrating advanced digital signal processing to distinguish between ferromagnetic and non-ferromagnetic materials with greater accuracy, thereby reducing false alarms. Innovations include the development of ergonomic designs for extended use and improved battery life, allowing for continuous operation throughout demanding shifts. Furthermore, the integration of multiple alert systems, such as distinct vibration patterns, bright LED indicators, and adjustable sound frequencies, caters to diverse operational needs and environments. Some advanced models are also incorporating connectivity features for data logging and system integration, offering valuable insights into metal detection patterns and potential safety concerns within MRI suites. These product advancements are crucial for meeting the evolving safety standards and operational efficiencies demanded by healthcare providers.

Propelling Factors for Hand Held Mri Metal Detector Growth

The growth of the Hand Held MRI Metal Detector market is propelled by several interconnected factors. Foremost is the escalating global installation of MRI machines, a trend supported by increased healthcare expenditure and the growing recognition of MRI's diagnostic capabilities, estimated to grow by approximately 5% annually. This expanding installed base directly translates into a higher demand for essential safety equipment. Furthermore, stringent regulatory mandates from bodies like the FDA and European regulatory agencies, focusing on patient and staff safety within MRI environments, are compelling healthcare providers to invest in reliable metal detection solutions. The increasing awareness among healthcare professionals and administrators regarding the severe risks associated with ferromagnetic projectiles in MRI suites – ranging from patient injury to equipment damage – acts as a significant catalyst. Finally, continuous technological advancements in detector sensitivity, signal processing, and user interface design, leading to more efficient and user-friendly devices, are fostering market expansion, with R&D investments in this sector reaching hundreds of millions of dollars annually.

Obstacles in the Hand Held Mri Metal Detector Market

Despite robust growth, the Hand Held MRI Metal Detector market faces several obstacles. Regulatory Hurdles and Standardization: While regulations drive demand, the lack of complete global standardization in testing and certification can create complexities for manufacturers aiming for international market penetration, potentially adding millions in compliance costs per product line. High Cost of Advanced Technology: The integration of sophisticated features like advanced digital signal processing and multi-modal alerts can lead to higher manufacturing costs, making premium devices less accessible for smaller healthcare facilities or those in budget-constrained regions. Supply Chain Disruptions: As with many electronic components, the market remains susceptible to global supply chain disruptions, which can impact production timelines and increase raw material costs, potentially affecting the availability and pricing of finished goods. Intense Competition and Price Sensitivity: The presence of numerous established and emerging players can lead to intense price competition, especially for basic models, squeezing profit margins and challenging smaller manufacturers.

Future Opportunities in Hand Held Mri Metal Detector

The future of the Hand Held MRI Metal Detector market is ripe with opportunities. The burgeoning adoption of MRI technology in emerging economies presents a vast untapped market, promising significant growth in the coming years. Advancements in wearable technology could lead to integrated solutions where metal detection capabilities are embedded within staff uniforms or other personal protective equipment, enhancing convenience and real-time monitoring. The development of AI-powered algorithms for even more sophisticated threat identification and false alarm reduction holds immense potential, leading to highly intelligent detection systems. Furthermore, the growing demand for specialized detectors tailored for specific MRI field strengths or particular types of ferromagnetic materials could open niche market segments. Expanding product offerings to include integrated cybersecurity features for connected devices also represents a forward-looking opportunity.

Major Players in the Hand Held Mri Metal Detector Ecosystem

- ETS Lindgren

- CEIA International

- Fujidenolo

- MRIequip

- Troyka MED

- Kopp Development

- AADCO Medical

- GE Healthcare

- MEDNOVUS SAFESCAN

- Bio–X

- Hongkong Medi

- Metrasens

Key Developments in Hand Held Mri Metal Detector Industry

- 2023/08: Metrasens launches its new generation of handheld MRI detectors, featuring enhanced sensitivity and extended battery life.

- 2023/05: CEIA International expands its product line with a focus on integrated solutions for MRI suites.

- 2022/11: ETS Lindgren announces strategic partnerships to enhance its distribution network in emerging markets.

- 2022/06: FDA releases updated guidelines for MRI safety equipment, spurring demand for compliant devices.

- 2021/10: AADCO Medical acquires a smaller competitor to strengthen its market position in North America.

Strategic Hand Held Mri Metal Detector Market Forecast

The strategic forecast for the Hand Held MRI Metal Detector market indicates a robust growth trajectory, driven by the increasing global installation of MRI scanners, which is projected to reach millions of units by 2033. The unwavering emphasis on patient and staff safety within magnetic resonance imaging environments, bolstered by evolving regulatory frameworks, will continue to be a primary growth catalyst. Manufacturers are expected to focus on developing more intelligent, portable, and user-friendly devices, incorporating advanced signal processing and multi-modal alert systems. The expansion of healthcare infrastructure in emerging economies and the continuous drive for technological innovation will further propel market expansion, with projected market values reaching well over a billion dollars. Strategic collaborations and product portfolio expansions will be key for companies aiming to capture a significant share of this dynamic and essential market.

Hand Held Mri Metal Detector Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Research Institute

- 1.3. Others

-

2. Type

- 2.1. Vibration Prompt Type

- 2.2. LED Light Reminder Type

- 2.3. Sound Prompt Type

Hand Held Mri Metal Detector Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hand Held Mri Metal Detector Regional Market Share

Geographic Coverage of Hand Held Mri Metal Detector

Hand Held Mri Metal Detector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hand Held Mri Metal Detector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Research Institute

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Vibration Prompt Type

- 5.2.2. LED Light Reminder Type

- 5.2.3. Sound Prompt Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Hand Held Mri Metal Detector Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Research Institute

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Vibration Prompt Type

- 6.2.2. LED Light Reminder Type

- 6.2.3. Sound Prompt Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Hand Held Mri Metal Detector Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Research Institute

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Vibration Prompt Type

- 7.2.2. LED Light Reminder Type

- 7.2.3. Sound Prompt Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Hand Held Mri Metal Detector Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Research Institute

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Vibration Prompt Type

- 8.2.2. LED Light Reminder Type

- 8.2.3. Sound Prompt Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Hand Held Mri Metal Detector Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Research Institute

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Vibration Prompt Type

- 9.2.2. LED Light Reminder Type

- 9.2.3. Sound Prompt Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Hand Held Mri Metal Detector Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Research Institute

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Vibration Prompt Type

- 10.2.2. LED Light Reminder Type

- 10.2.3. Sound Prompt Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ETS Lindgren

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CEIA International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fujidenolo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MRIequip

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Troyka MED

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kopp Development

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AADCO Medical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GE Healthcare

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MEDNOVUS SAFESCAN

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bio–X

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hongkong Medi

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Metrasens

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ETS Lindgren

List of Figures

- Figure 1: Global Hand Held Mri Metal Detector Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Hand Held Mri Metal Detector Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America Hand Held Mri Metal Detector Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America Hand Held Mri Metal Detector Volume (K), by Application 2025 & 2033

- Figure 5: North America Hand Held Mri Metal Detector Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Hand Held Mri Metal Detector Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Hand Held Mri Metal Detector Revenue (undefined), by Type 2025 & 2033

- Figure 8: North America Hand Held Mri Metal Detector Volume (K), by Type 2025 & 2033

- Figure 9: North America Hand Held Mri Metal Detector Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Hand Held Mri Metal Detector Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Hand Held Mri Metal Detector Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Hand Held Mri Metal Detector Volume (K), by Country 2025 & 2033

- Figure 13: North America Hand Held Mri Metal Detector Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Hand Held Mri Metal Detector Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Hand Held Mri Metal Detector Revenue (undefined), by Application 2025 & 2033

- Figure 16: South America Hand Held Mri Metal Detector Volume (K), by Application 2025 & 2033

- Figure 17: South America Hand Held Mri Metal Detector Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America Hand Held Mri Metal Detector Volume Share (%), by Application 2025 & 2033

- Figure 19: South America Hand Held Mri Metal Detector Revenue (undefined), by Type 2025 & 2033

- Figure 20: South America Hand Held Mri Metal Detector Volume (K), by Type 2025 & 2033

- Figure 21: South America Hand Held Mri Metal Detector Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Hand Held Mri Metal Detector Volume Share (%), by Type 2025 & 2033

- Figure 23: South America Hand Held Mri Metal Detector Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America Hand Held Mri Metal Detector Volume (K), by Country 2025 & 2033

- Figure 25: South America Hand Held Mri Metal Detector Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Hand Held Mri Metal Detector Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Hand Held Mri Metal Detector Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe Hand Held Mri Metal Detector Volume (K), by Application 2025 & 2033

- Figure 29: Europe Hand Held Mri Metal Detector Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Hand Held Mri Metal Detector Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Hand Held Mri Metal Detector Revenue (undefined), by Type 2025 & 2033

- Figure 32: Europe Hand Held Mri Metal Detector Volume (K), by Type 2025 & 2033

- Figure 33: Europe Hand Held Mri Metal Detector Revenue Share (%), by Type 2025 & 2033

- Figure 34: Europe Hand Held Mri Metal Detector Volume Share (%), by Type 2025 & 2033

- Figure 35: Europe Hand Held Mri Metal Detector Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Hand Held Mri Metal Detector Volume (K), by Country 2025 & 2033

- Figure 37: Europe Hand Held Mri Metal Detector Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Hand Held Mri Metal Detector Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Hand Held Mri Metal Detector Revenue (undefined), by Application 2025 & 2033

- Figure 40: Middle East & Africa Hand Held Mri Metal Detector Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa Hand Held Mri Metal Detector Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa Hand Held Mri Metal Detector Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa Hand Held Mri Metal Detector Revenue (undefined), by Type 2025 & 2033

- Figure 44: Middle East & Africa Hand Held Mri Metal Detector Volume (K), by Type 2025 & 2033

- Figure 45: Middle East & Africa Hand Held Mri Metal Detector Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East & Africa Hand Held Mri Metal Detector Volume Share (%), by Type 2025 & 2033

- Figure 47: Middle East & Africa Hand Held Mri Metal Detector Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa Hand Held Mri Metal Detector Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa Hand Held Mri Metal Detector Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Hand Held Mri Metal Detector Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Hand Held Mri Metal Detector Revenue (undefined), by Application 2025 & 2033

- Figure 52: Asia Pacific Hand Held Mri Metal Detector Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific Hand Held Mri Metal Detector Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Hand Held Mri Metal Detector Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Hand Held Mri Metal Detector Revenue (undefined), by Type 2025 & 2033

- Figure 56: Asia Pacific Hand Held Mri Metal Detector Volume (K), by Type 2025 & 2033

- Figure 57: Asia Pacific Hand Held Mri Metal Detector Revenue Share (%), by Type 2025 & 2033

- Figure 58: Asia Pacific Hand Held Mri Metal Detector Volume Share (%), by Type 2025 & 2033

- Figure 59: Asia Pacific Hand Held Mri Metal Detector Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific Hand Held Mri Metal Detector Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific Hand Held Mri Metal Detector Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Hand Held Mri Metal Detector Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Hand Held Mri Metal Detector Volume K Forecast, by Application 2020 & 2033

- Table 3: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Hand Held Mri Metal Detector Volume K Forecast, by Type 2020 & 2033

- Table 5: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Hand Held Mri Metal Detector Volume K Forecast, by Region 2020 & 2033

- Table 7: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Hand Held Mri Metal Detector Volume K Forecast, by Application 2020 & 2033

- Table 9: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Hand Held Mri Metal Detector Volume K Forecast, by Type 2020 & 2033

- Table 11: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Hand Held Mri Metal Detector Volume K Forecast, by Country 2020 & 2033

- Table 13: United States Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Hand Held Mri Metal Detector Volume K Forecast, by Application 2020 & 2033

- Table 21: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Hand Held Mri Metal Detector Volume K Forecast, by Type 2020 & 2033

- Table 23: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Hand Held Mri Metal Detector Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: Global Hand Held Mri Metal Detector Volume K Forecast, by Application 2020 & 2033

- Table 33: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global Hand Held Mri Metal Detector Volume K Forecast, by Type 2020 & 2033

- Table 35: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Hand Held Mri Metal Detector Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Application 2020 & 2033

- Table 56: Global Hand Held Mri Metal Detector Volume K Forecast, by Application 2020 & 2033

- Table 57: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Type 2020 & 2033

- Table 58: Global Hand Held Mri Metal Detector Volume K Forecast, by Type 2020 & 2033

- Table 59: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Hand Held Mri Metal Detector Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Application 2020 & 2033

- Table 74: Global Hand Held Mri Metal Detector Volume K Forecast, by Application 2020 & 2033

- Table 75: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Type 2020 & 2033

- Table 76: Global Hand Held Mri Metal Detector Volume K Forecast, by Type 2020 & 2033

- Table 77: Global Hand Held Mri Metal Detector Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global Hand Held Mri Metal Detector Volume K Forecast, by Country 2020 & 2033

- Table 79: China Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Hand Held Mri Metal Detector Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Hand Held Mri Metal Detector Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hand Held Mri Metal Detector?

The projected CAGR is approximately 15.8%.

2. Which companies are prominent players in the Hand Held Mri Metal Detector?

Key companies in the market include ETS Lindgren, CEIA International, Fujidenolo, MRIequip, Troyka MED, Kopp Development, AADCO Medical, GE Healthcare, MEDNOVUS SAFESCAN, Bio–X, Hongkong Medi, Metrasens.

3. What are the main segments of the Hand Held Mri Metal Detector?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hand Held Mri Metal Detector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hand Held Mri Metal Detector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hand Held Mri Metal Detector?

To stay informed about further developments, trends, and reports in the Hand Held Mri Metal Detector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence