Key Insights

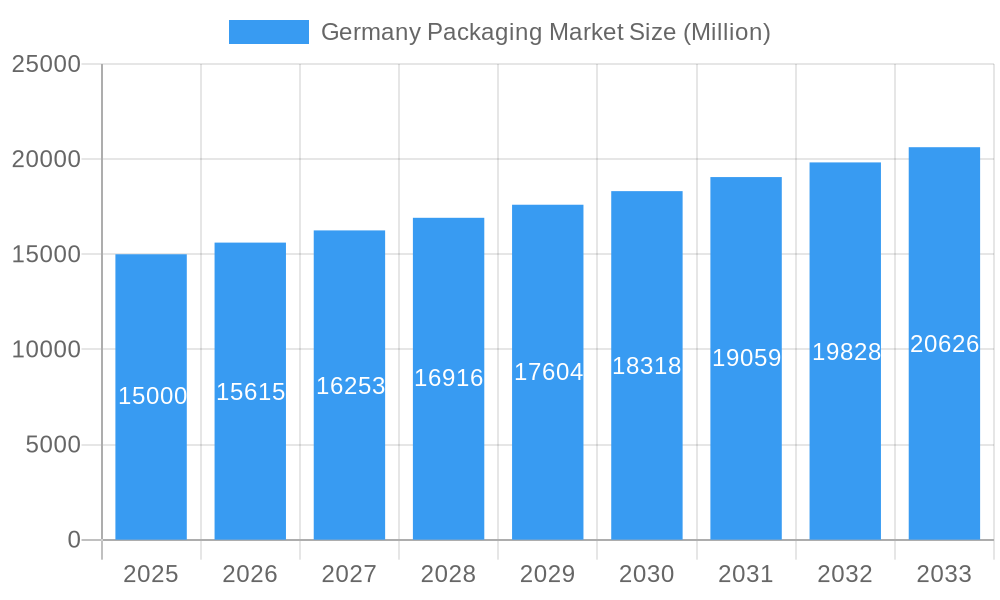

The German packaging market, projected to reach €14.65 billion in 2025, is anticipated to grow at a CAGR of 4.25% between 2025 and 2033. This expansion is propelled by the surge in e-commerce, demanding enhanced packaging for secure product delivery. Growing consumer preference for convenience and extended product shelf life further drives the adoption of advanced packaging materials and technologies. Additionally, stringent regulations concerning food safety and sustainability are encouraging the uptake of eco-friendly packaging solutions. The market is segmented by material (glass, plastic, metal, other), packaging type (rigid, flexible), and end-user sector (food, beverage, pharmaceutical, household & personal care). Plastic packaging is expected to maintain its lead, though a gradual transition to sustainable alternatives like biodegradable materials is forecast, influenced by heightened environmental consciousness and regulatory mandates. Leading companies such as Reynolds Group Holdings, Ball Corporation, and Amcor PLC are prioritizing R&D to address these evolving market dynamics and sustain competitive advantage.

Germany Packaging Market Market Size (In Billion)

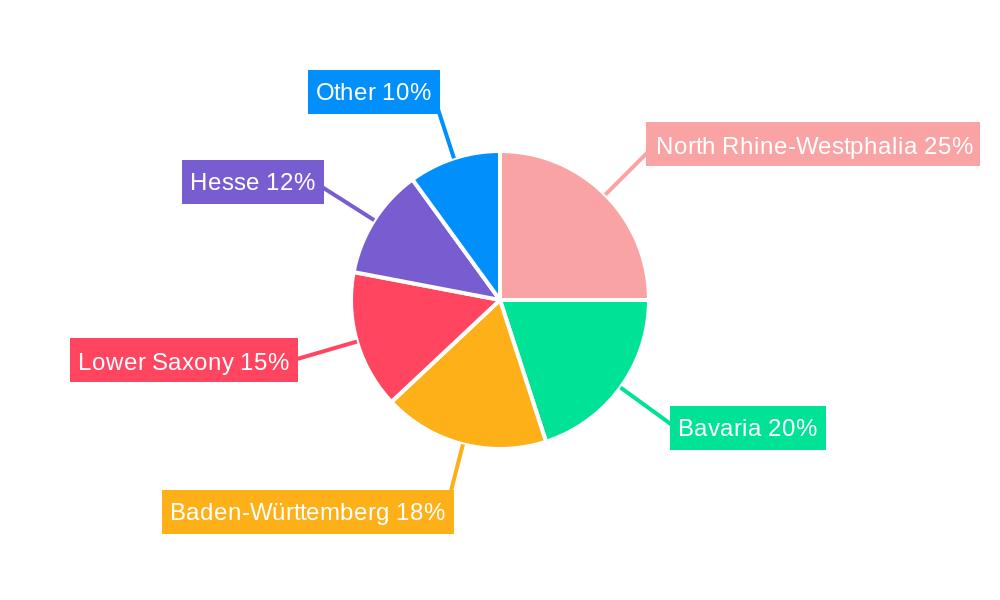

Regional economic disparities within Germany are reflected in packaging market growth patterns. North Rhine-Westphalia and Bavaria are poised for significant expansion, supported by higher population density and strong industrial output. Nonetheless, all major regions are expected to contribute to the market's overall growth trajectory. While escalating raw material costs present a challenge, the long-term outlook for the German packaging market remains optimistic, underpinned by sustained e-commerce expansion, a steadfast commitment to sustainability, and continuous innovation in packaging materials and technologies. The competitive environment features a blend of large global enterprises and niche specialized firms, fostering a vibrant and innovative marketplace.

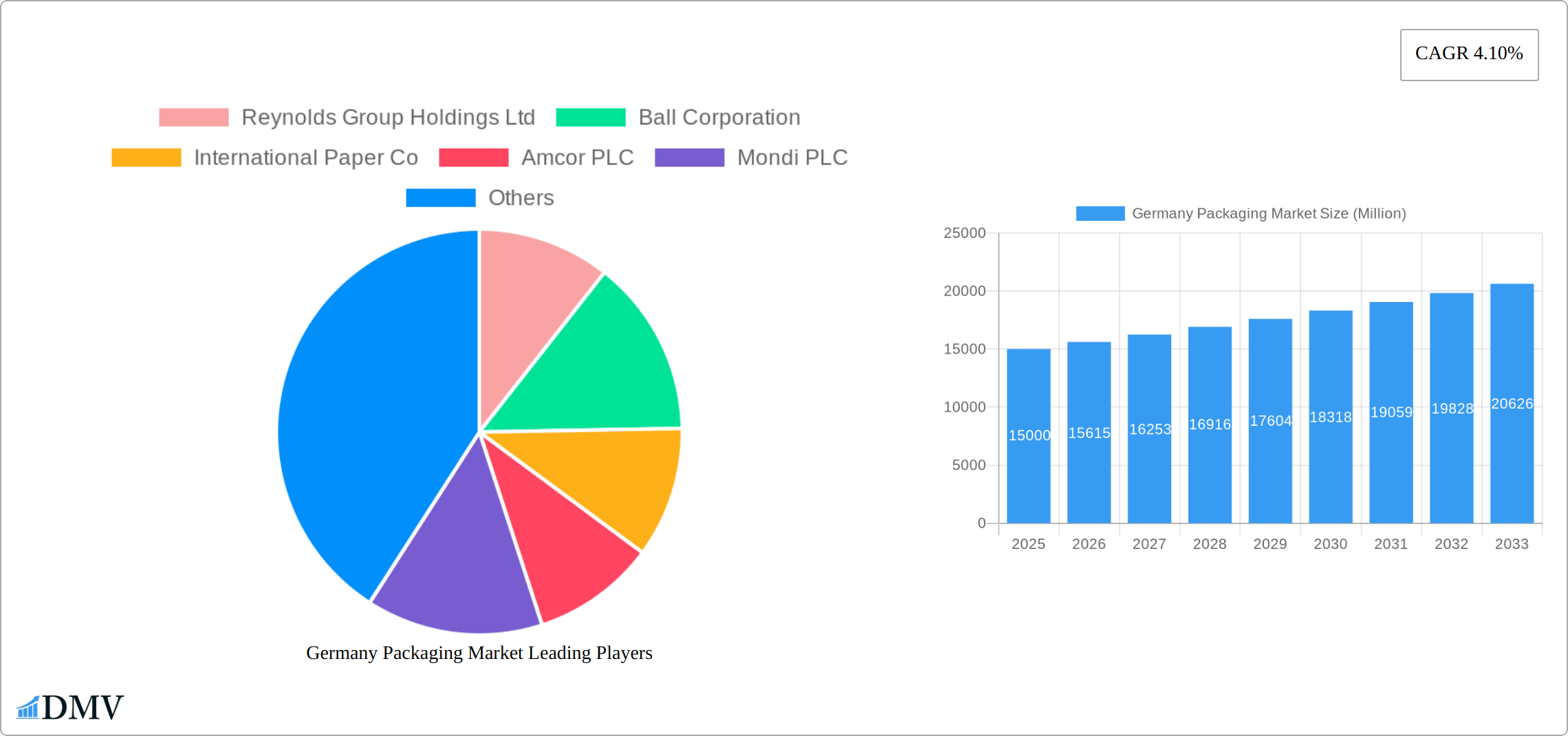

Germany Packaging Market Company Market Share

Germany Packaging Market Market Composition & Trends

The German packaging market is a dynamic landscape shaped by intense competition, groundbreaking innovations, and a constantly evolving regulatory framework. Several key players dominate the market, including Reynolds Group Holdings Ltd, Ball Corporation, and International Paper Co, alongside other significant contributors such as Amcor PLC, Mondi PLC, and Crown Holdings Incorporated. While precise market share figures fluctuate, projections for 2025 suggest a competitive distribution, with Reynolds Group Holdings Ltd potentially holding around 15%, Ball Corporation approximately 12%, and International Paper Co around 10%. The remaining market share is divided amongst numerous other companies.

Driving innovation is the paramount need for sustainable packaging solutions. Companies are investing heavily in research and development, focusing on biodegradable and compostable materials, as well as smart packaging technologies that enhance traceability and consumer engagement. This push towards sustainability is significantly influenced by Germany's stringent environmental regulations, particularly the Packaging Act (Verpackungsgesetz), which mandates ambitious recycling quotas and incentivizes the adoption of eco-friendly packaging materials and designs.

The market is also witnessing the rise of substitute products like reusable packaging and bulk dispensers, particularly within the food and beverage sector, reflecting growing consumer awareness and a shift towards reducing waste. The end-user base is diverse, spanning from large multinational corporations to small and medium-sized enterprises (SMEs), each presenting unique packaging requirements. The sector has seen significant merger and acquisition (M&A) activity in recent years, with deal values exceeding $2 billion since 2019. A notable example is Smurfit Kappa Group PLC's acquisition of a German packaging firm in 2023 for $500 million, a strategic move to expand its presence in the German market.

Estimated Market Share Distribution (2025):

Reynolds Group Holdings Ltd: ~15%

Ball Corporation: ~12%

International Paper Co: ~10%

Others: ~63%

M&A Deal Values (2019-2024): >$2 Billion

Key Acquisition: Smurfit Kappa Group PLC acquisition of a local firm for $500 Million in 2023

Germany Packaging Market Industry Evolution

The Germany Packaging Market has undergone significant evolution over the study period from 2019 to 2033. The market has witnessed a steady growth trajectory, with a compound annual growth rate (CAGR) of approximately 3.5% during the historical period of 2019-2024. This growth is attributed to the increasing demand for packaged goods across various end-user verticals, including food, beverage, pharmaceutical, and household and personal care products.

Technological advancements have played a pivotal role in shaping the market. The adoption of smart packaging solutions, such as RFID tags and QR codes, has surged, with adoption rates increasing by 20% annually since 2020. These technologies enhance product traceability and consumer engagement, driving demand for innovative packaging solutions.

Consumer demands have shifted towards sustainability, with a growing preference for eco-friendly packaging materials. This shift is evident in the increasing market share of biodegradable plastics and recycled materials, which now constitute over 25% of the total packaging material used in Germany. The market is also witnessing a rise in the use of lightweight materials to reduce carbon footprints, with lightweight packaging solutions growing at a CAGR of 5% during the forecast period of 2025-2033.

The food and beverage sector remains the largest end-user vertical, accounting for 40% of the total market in 2025. However, the pharmaceutical sector is expected to experience the highest growth rate, projected at 6% CAGR, driven by the need for secure and tamper-evident packaging solutions.

Leading Regions, Countries, or Segments in Germany Packaging Market

In the Germany Packaging Market, the Plastic segment holds the dominant position, accounting for approximately 45% of the market share in 2025. This dominance is driven by the versatility and cost-effectiveness of plastic materials, which cater to a wide range of packaging needs across various end-user verticals.

- Key Drivers for Plastic Segment:

- Investment in R&D for sustainable plastic alternatives

- High demand from the food and beverage industry

- Regulatory support for lightweight packaging solutions

The Rigid packaging type is another leading segment, with a market share of 55% in 2025. Rigid packaging offers durability and protection, making it a preferred choice for pharmaceuticals and high-value consumer goods. The growth of this segment is fueled by the need for secure packaging solutions that ensure product integrity.

- Key Drivers for Rigid Packaging:

- Increasing demand for tamper-evident packaging

- Growth in the pharmaceutical sector

- Technological advancements in material strength and design

The Food end-user vertical is the most dominant, commanding a 40% market share in 2025. This dominance is driven by the high consumption of packaged food products in Germany, coupled with the need for innovative and sustainable packaging solutions to meet consumer demands.

- Key Drivers for Food Vertical:

- Rising demand for convenience foods

- Consumer preference for sustainable packaging

- Regulatory push for reduced food waste

The dominance of these segments is also influenced by regional factors, with the southern regions of Germany showing higher adoption rates for sustainable packaging solutions due to a more environmentally conscious consumer base. The northern regions, on the other hand, have a higher concentration of manufacturing facilities, contributing to the demand for industrial packaging solutions.

Germany Packaging Market Product Innovations

Innovations in the Germany Packaging Market are centered around sustainability and functionality. Companies like Amcor PLC and Mondi PLC have introduced biodegradable packaging solutions that decompose within months, reducing environmental impact. Smart packaging technologies, such as temperature-sensitive labels and NFC-enabled packaging, are gaining traction, offering consumers real-time information about product freshness and authenticity. These innovations not only enhance product appeal but also align with Germany's stringent environmental regulations.

Propelling Factors for Germany Packaging Market Growth

Several factors are propelling the growth of the Germany Packaging Market. Technological advancements, such as the development of smart packaging solutions, are enhancing product traceability and consumer engagement. Economically, the rise in disposable income and urbanization is driving demand for packaged goods. Regulatory influences, particularly the push for sustainable packaging, are compelling companies to innovate and adopt eco-friendly materials. For instance, the Packaging Act has led to a 30% increase in the use of recycled materials since its implementation.

Obstacles in the Germany Packaging Market Market

The Germany Packaging Market faces several obstacles that could hinder its growth. Regulatory challenges, such as stringent environmental regulations, increase the cost of compliance for packaging companies. Supply chain disruptions, particularly those caused by global events, can lead to delays and increased costs. Competitive pressures are intense, with companies like Reynolds Group Holdings Ltd and Ball Corporation constantly vying for market share. These obstacles have led to a 5% reduction in profit margins for some players in the market over the past year.

Future Opportunities in Germany Packaging Market

The Germany Packaging Market presents numerous future opportunities. Emerging markets for sustainable packaging solutions are expanding, driven by consumer demand for eco-friendly products. Technological advancements, such as the integration of IoT in packaging, offer new avenues for product differentiation. Shifting consumer trends towards convenience and health-conscious packaging are also creating opportunities for innovation and market growth.

Major Players in the Germany Packaging Market Ecosystem

- Reynolds Group Holdings Ltd

- Ball Corporation

- International Paper Co

- Amcor PLC

- Mondi PLC

- Crown Holdings Incorporated

- Smurfit Kappa Group PLC

- Berry Plastics GmbH*List Not Exhaustive

- Sealed Air Corporation

- WestRock Co

- Owens-Illinois Inc

Key Developments in Germany Packaging Market Industry

- January 2023: Amcor PLC launched a new line of biodegradable packaging solutions, enhancing its market position in sustainable packaging.

- March 2024: Ball Corporation acquired a local packaging firm for $300 Million, expanding its footprint in the German market.

- June 2025: Mondi PLC introduced smart packaging with NFC technology, allowing consumers to access product information via smartphones.

- September 2026: Smurfit Kappa Group PLC partnered with a technology firm to develop IoT-enabled packaging solutions, aiming to improve supply chain efficiency.

Strategic Germany Packaging Market Market Forecast

The strategic forecast for the Germany Packaging Market indicates robust growth potential through 2033. The market is expected to benefit from continued technological innovations, particularly in smart and sustainable packaging solutions. Regulatory support for eco-friendly packaging will further drive market expansion. The increasing demand for convenience and health-conscious packaging across various end-user verticals will create new opportunities for market players. With a projected CAGR of 4% during the forecast period of 2025-2033, the Germany Packaging Market is poised for significant growth, driven by these key catalysts.

Germany Packaging Market Segmentation

-

1. Material

- 1.1. Glass

- 1.2. Plastic

- 1.3. Metal

- 1.4. Other Materials

-

2. Packaging Type

- 2.1. Rigid

- 2.2. Flexible

-

3. End-user Vertical

- 3.1. Food

- 3.2. Beverage

- 3.3. Pharmaceutical

- 3.4. Household and Personal Care

- 3.5. Other End-user Verticalss

Germany Packaging Market Segmentation By Geography

- 1. Germany

Germany Packaging Market Regional Market Share

Geographic Coverage of Germany Packaging Market

Germany Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Demand for Convenient Packaging; Increased Emphasis for Product Differentiation

- 3.3. Market Restrains

- 3.3.1. ; Increasing Stringent Regulations Regarding Non-biodegradable Materials

- 3.4. Market Trends

- 3.4.1. Plastic Packaging to Hold Dominant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Glass

- 5.1.2. Plastic

- 5.1.3. Metal

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Rigid

- 5.2.2. Flexible

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Pharmaceutical

- 5.3.4. Household and Personal Care

- 5.3.5. Other End-user Verticalss

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reynolds Group Holdings Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ball Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 International Paper Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mondi PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crown Holdings Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Smurfit Kappa Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berry Plastics GmbH*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sealed Air Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WestRock Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Owens-Illinois Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Reynolds Group Holdings Ltd

List of Figures

- Figure 1: Germany Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Germany Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Germany Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Germany Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Germany Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Germany Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: Germany Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Germany Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Packaging Market?

The projected CAGR is approximately 4.25%.

2. Which companies are prominent players in the Germany Packaging Market?

Key companies in the market include Reynolds Group Holdings Ltd, Ball Corporation, International Paper Co, Amcor PLC, Mondi PLC, Crown Holdings Incorporated, Smurfit Kappa Group PLC, Berry Plastics GmbH*List Not Exhaustive, Sealed Air Corporation, WestRock Co, Owens-Illinois Inc.

3. What are the main segments of the Germany Packaging Market?

The market segments include Material, Packaging Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.65 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increased Demand for Convenient Packaging; Increased Emphasis for Product Differentiation.

6. What are the notable trends driving market growth?

Plastic Packaging to Hold Dominant Share.

7. Are there any restraints impacting market growth?

; Increasing Stringent Regulations Regarding Non-biodegradable Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Packaging Market?

To stay informed about further developments, trends, and reports in the Germany Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence