Key Insights

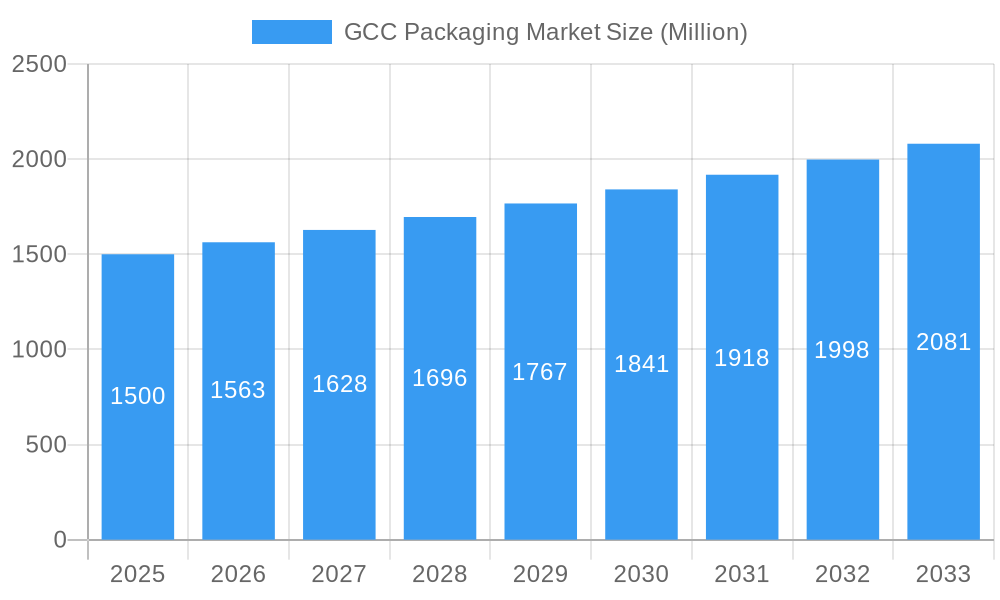

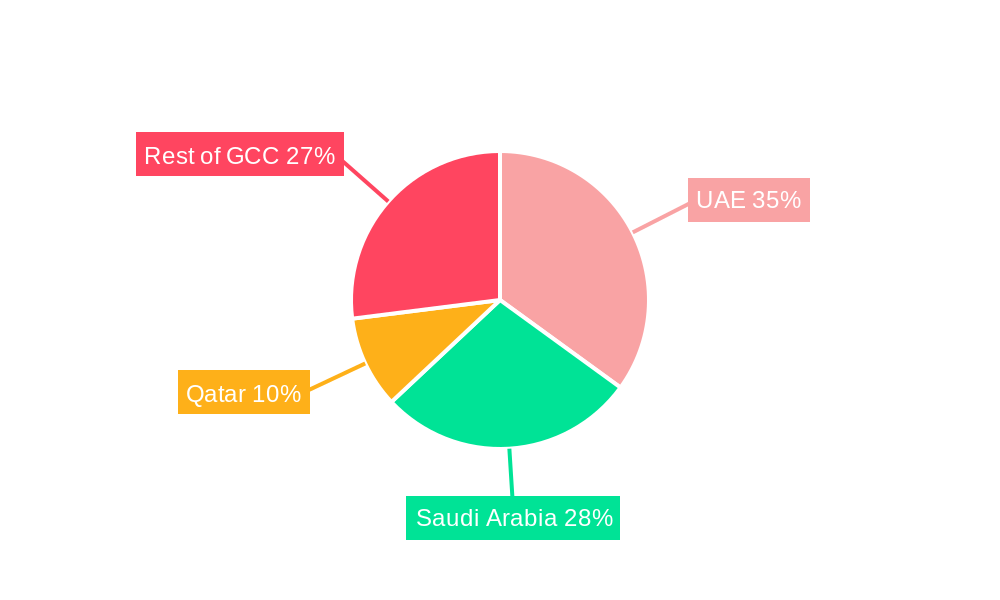

The GCC packaging market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.20% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning food and beverage sector, coupled with a rising population and increasing disposable incomes across the GCC nations, significantly boosts demand for diverse packaging solutions. Furthermore, the region's thriving e-commerce landscape necessitates innovative and efficient packaging for safe and timely delivery of goods. Growth is also supported by the increasing adoption of sustainable packaging materials, driven by environmental concerns and government regulations promoting eco-friendly practices. However, the market faces certain constraints, including fluctuating oil prices which can impact raw material costs, and the competitive landscape with both local and international players vying for market share. Segmentation analysis reveals that plastic packaging currently holds the largest market share due to its versatility and cost-effectiveness, although this is expected to gradually shift towards more sustainable alternatives like paper and paperboard in the coming years, driven by consumer preferences and regulatory pressures. The rigid packaging segment also holds a significant share, particularly in the food and beverage industry. Amongst the end-user industries, food and beverage dominates, followed by pharmaceuticals and personal/homecare products. The UAE and Saudi Arabia constitute the largest national markets within the GCC region.

GCC Packaging Market Market Size (In Billion)

The competitive landscape is dynamic, with a mix of multinational corporations like Tetra Pak and Aptar Group, alongside established local players like Hotpack Packaging and Arabian Packaging. These companies are strategically focusing on product innovation, expansion into new markets, and adoption of sustainable practices to maintain competitiveness. The forecast period suggests continued growth, driven by sustained economic development, increasing consumerism, and a shift towards e-commerce and sophisticated packaging requirements, including enhanced product protection and branding opportunities. This presents significant opportunities for both established players and new entrants in the market to capitalize on the ongoing growth trend. However, understanding and addressing the market constraints regarding raw material costs and competition remains crucial for success. The market's future trajectory is strongly linked to the overall economic performance of the GCC and evolving consumer behavior.

GCC Packaging Market Company Market Share

GCC Packaging Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the GCC packaging market, offering a comprehensive overview of its current state, future trends, and growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the dynamic GCC packaging landscape. The market is projected to reach xx Million by 2033, exhibiting robust growth driven by key factors detailed within.

GCC Packaging Market Composition & Trends

The GCC packaging market is characterized by a moderately concentrated landscape, with several large players alongside numerous smaller, regional companies. Market share distribution is dynamic, with larger multinational corporations holding significant shares, particularly in the plastic and paperboard segments. Innovation is driven by consumer demand for sustainable and convenient packaging solutions, alongside stringent regulatory frameworks promoting eco-friendly materials. Substitute products, such as biodegradable plastics, are gaining traction, while mergers and acquisitions (M&A) activities continue to reshape the competitive landscape. Deal values for recent M&A transactions in the GCC packaging sector averaged approximately xx Million, reflecting significant investment in market consolidation and expansion.

- Market Concentration: Moderately concentrated, with a mix of large multinational and smaller regional players.

- Innovation Catalysts: Growing consumer preference for sustainable packaging, coupled with stricter environmental regulations.

- Regulatory Landscape: Increasing focus on sustainability and recyclability standards impacting material choices.

- Substitute Products: Biodegradable plastics and alternative materials are emerging as competitive options.

- End-User Profiles: Diverse across food & beverage, pharmaceuticals, personal care, and other industries.

- M&A Activities: Significant M&A activity observed, with average deal values reaching xx Million.

GCC Packaging Market Industry Evolution

The GCC packaging market has witnessed significant evolution, driven by rapid economic growth, urbanization, and changing consumer preferences. The market has expanded considerably, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is expected to continue at a CAGR of xx% during the forecast period (2025-2033). Technological advancements in packaging materials, such as the rise of lightweight and flexible packaging, have played a crucial role in shaping market trends. Simultaneously, increasing consumer awareness of environmental issues is driving demand for sustainable and eco-friendly packaging solutions. Adoption of recycled materials and biodegradable options is steadily increasing, reaching an estimated xx% market penetration in 2025. This shift is largely influenced by governmental initiatives promoting sustainable practices and consumer preference for environmentally responsible products. The rise of e-commerce has further spurred demand for specialized packaging solutions to protect products during transit.

Leading Regions, Countries, or Segments in GCC Packaging Market

The UAE currently holds the largest market share within the GCC, driven by a robust economy, high population density, and a significant presence of multinational companies within its food & beverage and pharmaceutical sectors. Saudi Arabia follows closely behind as a key market, exhibiting strong potential due to its sizeable population and expanding industrial sectors. In terms of material types, plastic remains dominant due to its versatility and affordability, although paper and paperboard segments are experiencing substantial growth fueled by sustainability initiatives. Similarly, the flexible packaging type commands a larger share than rigid packaging due to its cost-effectiveness and suitability for diverse applications. The food and beverage industry forms the largest end-user segment, followed by the pharmaceutical and personal care industries.

- Key Drivers (UAE): Strong economic growth, high population density, significant foreign investment, and a favorable regulatory environment.

- Key Drivers (Saudi Arabia): Large population, expanding industrial base, and government support for economic diversification.

- Key Drivers (Plastic): Versatility, affordability, and widespread use across various sectors.

- Key Drivers (Flexible Packaging): Cost-effectiveness, suitability for various products, and increasing demand from the food & beverage industry.

- Key Drivers (Food & Beverage): High consumption of packaged foods and beverages, and increasing demand for convenient packaging options.

GCC Packaging Market Product Innovations

Recent innovations include the development of lightweight, recyclable, and biodegradable packaging materials to address growing environmental concerns. Advancements in printing technologies enable more sophisticated and visually appealing packaging designs. Smart packaging solutions incorporating sensors and RFID technology are gaining traction, enhancing product traceability and consumer experience. These innovations offer enhanced product protection, extended shelf life, and improved consumer engagement. Key performance metrics for these innovative solutions include reduced environmental impact, improved product safety, and increased brand loyalty.

Propelling Factors for GCC Packaging Market Growth

The GCC packaging market is experiencing robust expansion, driven by a confluence of powerful economic and societal shifts. A rapidly growing population, coupled with increasing disposable incomes, is directly translating into a heightened consumer demand for a wider array of packaged goods, spanning food and beverages to personal care and household items. Simultaneously, the burgeoning e-commerce sector is a significant catalyst, creating an imperative for sophisticated and highly protective packaging solutions designed to withstand the rigors of transit and ensure product integrity. Furthermore, a growing global consciousness towards environmental preservation is echoed in the GCC, with stringent government regulations increasingly promoting sustainable packaging practices. These regulations, which include the phasing out of single-use plastics and the incentivization of recycled content, are actively steering the market towards eco-friendly materials and innovative, circular economy-aligned solutions.

Obstacles in the GCC Packaging Market

Despite its promising trajectory, the GCC packaging market navigates a landscape of significant challenges. Volatility in the prices of key raw materials, particularly crude oil derivatives for plastics and pulp for paper, poses a persistent threat to production costs and profit margins, necessitating agile procurement strategies and hedging mechanisms. Geopolitical factors and global economic uncertainties can trigger supply chain disruptions, leading to potential delays in material availability and unexpected shortages that impact manufacturing timelines. The competitive intensity within the GCC packaging sector is formidable, with both established multinational corporations and agile local players vying for market share. This necessitates a constant drive for innovation in both product design and operational efficiency, alongside meticulous cost management, to maintain a competitive edge and ensure sustained profitability.

Future Opportunities in GCC Packaging Market

The GCC packaging market is ripe with substantial future opportunities, particularly for forward-thinking enterprises. The escalating demand for sustainable and environmentally responsible packaging solutions represents a paramount avenue for innovation. Companies that can offer advanced bio-degradable, compostable, or high-recycled content packaging will find a receptive market. The relentless growth of e-commerce continues to fuel the need for specialized, high-performance protective packaging that not only safeguards products but also enhances the unboxing experience. Strategic diversification into high-value niche segments, such as advanced medical and pharmaceutical packaging, which demand sterile, tamper-evident, and precisely engineered solutions, presents significant growth potential. Moreover, the integration of smart packaging technologies offers exciting prospects for enhanced product traceability, authentication, and interactive consumer engagement through QR codes, RFID tags, and embedded sensors.

Major Players in the GCC Packaging Market Ecosystem

- Aptar Group Inc

- Can-pack SA

- Hotpack Packaging Industries LLC

- Arabian Packaging LLC

- Huhtamaki Flexibles UAE (Huhtamaki OYJ)

- Amber Packaging Industries LLC

- Tetra Pak International

- Integrated Plastics Packaging LLC

- Mondi PLC

- Najmuddin Packaging & Refilling Industry Llc

- Napco National

- Unipack Containers & Carton Products LLC

- Rotopacking Materials Ind Co LLC

- Al Rumanah Packaging

- Express Pack Print

- Tarboosh Packaging Co LLC

- Corys Packaging LLC

- Gulf East Paper and Plastic Industries LLC

- Green Packaging Boxes Ind LLC

- Emirates Printing Press (LLC)

Key Developments in GCC Packaging Market Industry

- March 2023: Al Ain Water has championed sustainability with the introduction of a new water container crafted from recycled PET (rPET). This innovative move is projected to slash energy consumption and carbon emissions by an impressive 75% when compared to the production of virgin PET, demonstrating a significant step towards a circular economy within the beverage sector.

- September 2022: KeryasPaper Industry LLC has signaled its commitment to expanding its production capabilities with a substantial USD 40 Million investment in a new Kraft liner project. Slated for the UAE, this facility will boast a significant production capacity of 200,000 Metric Tonnes Per Annum (MTPA), addressing the growing regional demand for high-quality paper-based packaging materials.

- August 2022: Symphony Environmental Solutions Plc has forged a strategic partnership with EcobatchPlastic Factory in the UAE. This collaboration is focused on the localized production of their innovative biodegradable d2w masterbatch, specifically designed for rigid plastic packaging applications across the GCC, thereby offering a more environmentally conscious alternative to conventional plastics.

Strategic GCC Packaging Market Forecast

The GCC packaging market is poised for sustained growth driven by several key factors. Continued economic expansion, population growth, and the increasing adoption of sustainable packaging practices will fuel market expansion. Furthermore, technological advancements in packaging materials and smart packaging solutions will create new opportunities for market players. The projected market value growth indicates a positive outlook for investors and businesses operating within this dynamic sector.

GCC Packaging Market Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Glass

- 1.4. Paper and Paperboard

-

2. Packaging Type

- 2.1. Rigid

- 2.2. Flexible

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Pharmaceutical

- 3.4. Personal/Homecare

- 3.5. Other End-user Industries

GCC Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Packaging Market Regional Market Share

Geographic Coverage of GCC Packaging Market

GCC Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Environmentally Sustainable Packaging Products and Scope for Printing Innovations; Anticipating Growth in Demand for Packaged Food Sales

- 3.3. Market Restrains

- 3.3.1. Increased Costs of Raw Materials

- 3.4. Market Trends

- 3.4.1. Increase Demand for Packaging in Food and Beverage Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Glass

- 5.1.4. Paper and Paperboard

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Rigid

- 5.2.2. Flexible

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Pharmaceutical

- 5.3.4. Personal/Homecare

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America GCC Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.2. Metal

- 6.1.3. Glass

- 6.1.4. Paper and Paperboard

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Rigid

- 6.2.2. Flexible

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Pharmaceutical

- 6.3.4. Personal/Homecare

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America GCC Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.2. Metal

- 7.1.3. Glass

- 7.1.4. Paper and Paperboard

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Rigid

- 7.2.2. Flexible

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Pharmaceutical

- 7.3.4. Personal/Homecare

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe GCC Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.2. Metal

- 8.1.3. Glass

- 8.1.4. Paper and Paperboard

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Rigid

- 8.2.2. Flexible

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Pharmaceutical

- 8.3.4. Personal/Homecare

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa GCC Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.2. Metal

- 9.1.3. Glass

- 9.1.4. Paper and Paperboard

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Rigid

- 9.2.2. Flexible

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Pharmaceutical

- 9.3.4. Personal/Homecare

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific GCC Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.2. Metal

- 10.1.3. Glass

- 10.1.4. Paper and Paperboard

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Rigid

- 10.2.2. Flexible

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Pharmaceutical

- 10.3.4. Personal/Homecare

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aptar Group Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Can-pack SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hotpack Packaging Industries LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Arabian Packaging LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Huhtamaki Flexibles UAE (Huhtamaki OYJ)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amber Packaging Industries LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tetra Pak International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Integrated Plastics Packaging LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mondi PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Najmuddin Packaging & Refilling Industry Llc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Napco National

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Unipack Containers & Carton Products LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rotopacking Materials Ind Co LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Al Rumanah Packaging*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Express Pack Print

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Tarboosh Packaging Co LLC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Corys Packaging LLC

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Gulf East Paper and Plastic Industries LLC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Green Packaging Boxes Ind LLC

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Emirates Printing Press (LLC)

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Aptar Group Inc

List of Figures

- Figure 1: Global GCC Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America GCC Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America GCC Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 5: North America GCC Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America GCC Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America GCC Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America GCC Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America GCC Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America GCC Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 11: South America GCC Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America GCC Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 13: South America GCC Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 14: South America GCC Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America GCC Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America GCC Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America GCC Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe GCC Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe GCC Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe GCC Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 21: Europe GCC Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Europe GCC Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe GCC Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe GCC Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe GCC Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa GCC Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East & Africa GCC Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa GCC Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 29: Middle East & Africa GCC Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 30: Middle East & Africa GCC Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa GCC Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa GCC Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa GCC Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific GCC Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 35: Asia Pacific GCC Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific GCC Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 37: Asia Pacific GCC Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 38: Asia Pacific GCC Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific GCC Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific GCC Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific GCC Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global GCC Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Global GCC Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global GCC Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global GCC Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global GCC Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 7: Global GCC Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global GCC Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global GCC Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global GCC Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 14: Global GCC Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global GCC Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global GCC Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global GCC Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 21: Global GCC Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global GCC Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global GCC Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 33: Global GCC Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 34: Global GCC Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global GCC Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global GCC Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 43: Global GCC Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 44: Global GCC Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global GCC Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific GCC Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Packaging Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the GCC Packaging Market?

Key companies in the market include Aptar Group Inc, Can-pack SA, Hotpack Packaging Industries LLC, Arabian Packaging LLC, Huhtamaki Flexibles UAE (Huhtamaki OYJ), Amber Packaging Industries LLC, Tetra Pak International, Integrated Plastics Packaging LLC, Mondi PLC, Najmuddin Packaging & Refilling Industry Llc, Napco National, Unipack Containers & Carton Products LLC, Rotopacking Materials Ind Co LLC, Al Rumanah Packaging*List Not Exhaustive, Express Pack Print, Tarboosh Packaging Co LLC, Corys Packaging LLC, Gulf East Paper and Plastic Industries LLC, Green Packaging Boxes Ind LLC, Emirates Printing Press (LLC).

3. What are the main segments of the GCC Packaging Market?

The market segments include Material, Packaging Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Environmentally Sustainable Packaging Products and Scope for Printing Innovations; Anticipating Growth in Demand for Packaged Food Sales.

6. What are the notable trends driving market growth?

Increase Demand for Packaging in Food and Beverage Sector.

7. Are there any restraints impacting market growth?

Increased Costs of Raw Materials.

8. Can you provide examples of recent developments in the market?

March 2023- Al Ain Water, a major water provider in the United Arab Emirates, created a new water container made of recycled polyethylene terephthalate (rPET). Because it requires 75% less energy to produce than virgin PET and emits 75% less carbon dioxide during manufacture, recycled PET has a better ecological balance than glass and single-use aluminum cans.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Packaging Market?

To stay informed about further developments, trends, and reports in the GCC Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence