Key Insights

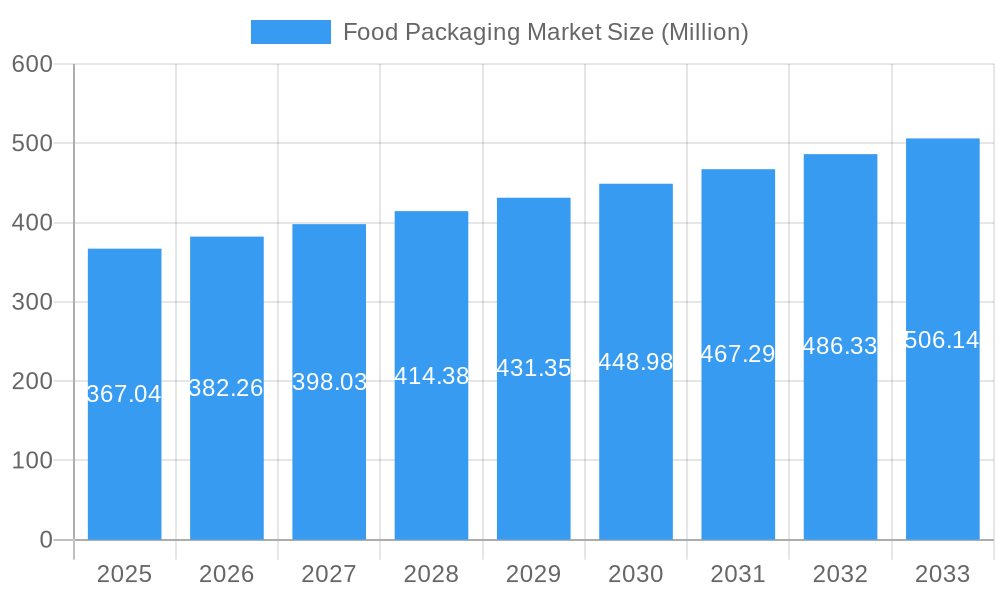

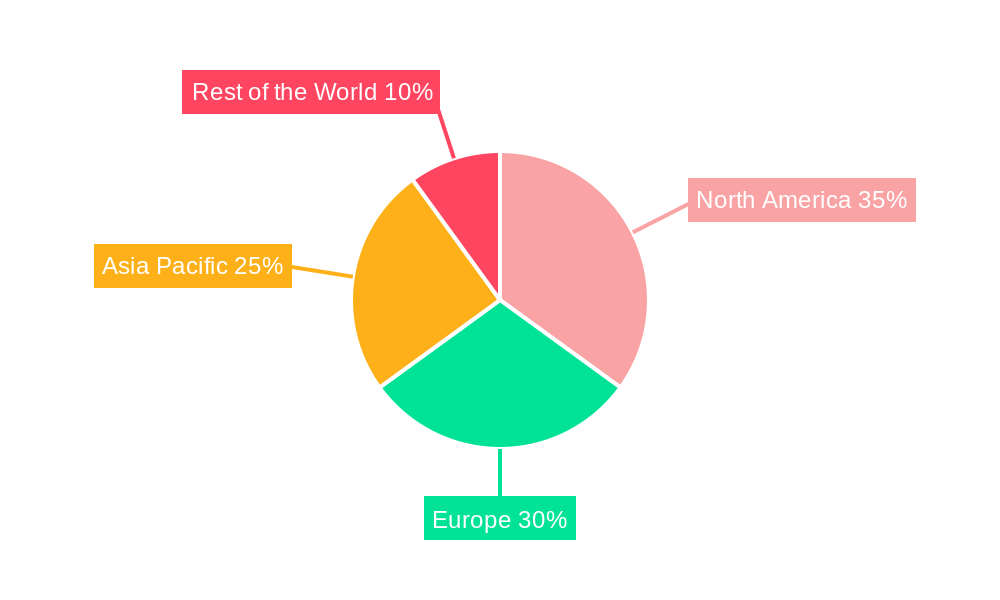

The global food packaging market, valued at $367.04 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for convenient and ready-to-eat meals, coupled with the rising global population and changing consumer lifestyles, fuels the need for effective and safe food packaging solutions. Furthermore, technological advancements in packaging materials, such as the development of sustainable and eco-friendly options like biodegradable plastics and improved recyclable materials, are significantly impacting market growth. The diverse application across various food categories, including dairy, meat, fruits, vegetables, bakery, and confectionery products, further contributes to market expansion. Growth is also fueled by the increasing focus on extending shelf life and maintaining food quality during transportation and storage. Regional variations exist, with North America and Europe currently holding significant market shares, while Asia-Pacific is poised for substantial growth due to its expanding middle class and rising disposable incomes. Competitive pressures amongst major players like Smurfit Kappa, WestRock, and Amcor are driving innovation and efficiency improvements within the industry.

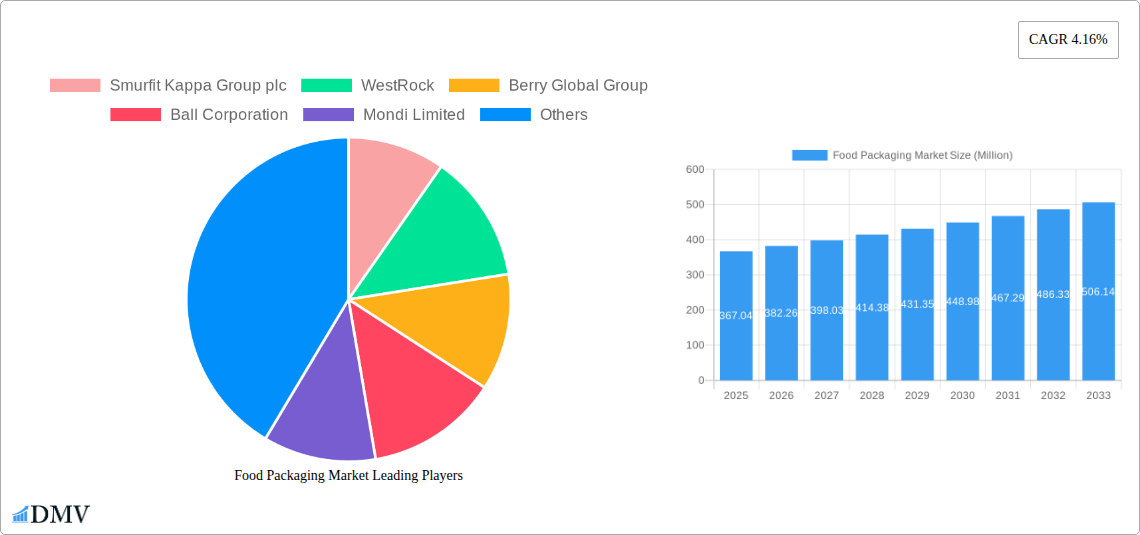

Food Packaging Market Market Size (In Million)

However, the market also faces certain challenges. Fluctuations in raw material prices, particularly for plastics and paper, can significantly impact production costs and profitability. Furthermore, stringent government regulations regarding food safety and environmental sustainability are requiring companies to invest in compliant packaging solutions. This necessitates ongoing research and development to create more eco-friendly and cost-effective alternatives. The need for sophisticated supply chain management to ensure timely delivery of packaging materials to food producers adds another layer of complexity. Despite these restraints, the long-term outlook for the food packaging market remains positive, driven by the fundamental need for safe and efficient food preservation and distribution across the globe. The continuous evolution of packaging materials and technologies will play a crucial role in shaping the market's future trajectory, emphasizing sustainability and consumer convenience.

Food Packaging Market Company Market Share

Food Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Food Packaging Market, offering a comprehensive overview of market dynamics, growth trajectories, key players, and future opportunities. Spanning the period from 2019 to 2033, with 2025 as the base year, this report is an essential resource for stakeholders seeking to understand and capitalize on this dynamic market. The market is projected to reach xx Million by 2033, showcasing substantial growth potential.

Food Packaging Market Market Composition & Trends

The Food Packaging Market is characterized by a moderately concentrated landscape, with key players like Smurfit Kappa Group plc, WestRock, Berry Global Group, and Amcor Plc holding significant market share. However, the presence of numerous smaller players fosters competition and innovation. Market share distribution fluctuates based on product type, material, and geographic location. For instance, plastic packaging currently dominates, but growing environmental concerns and regulatory changes are driving a shift towards sustainable alternatives like paper and paperboard. Innovation is primarily driven by advancements in materials science, barrier technologies, and packaging designs to improve shelf life and reduce food waste. The regulatory landscape is increasingly stringent, pushing manufacturers towards eco-friendly and compliant solutions. Substitute products, such as reusable containers and bulk purchasing options, pose a challenge to traditional packaging but represent a niche segment. End-users encompass food producers, processors, retailers, and consumers, each with unique packaging requirements. Mergers and acquisitions (M&A) activity is significant, with recent deals like SIG’s acquisition of Scholle IPN in June 2022, valued at USD 1.53 Billion, reflecting consolidation and expansion strategies within the industry.

- Market Concentration: Moderately concentrated, with top players holding significant, but not dominant, shares.

- Innovation Catalysts: Advancements in materials science, barrier technologies, and sustainable packaging.

- Regulatory Landscape: Increasingly stringent regulations focusing on sustainability and food safety.

- Substitute Products: Reusable containers and bulk purchasing represent a growing but niche segment.

- M&A Activity: Significant activity reflects industry consolidation and expansion strategies (e.g., SIG's acquisition of Scholle IPN).

- Market Share Distribution: Varies significantly across material type, packaging type, and geographic region (Plastic currently leading).

- M&A Deal Values: Significant deals exceeding USD 1 Billion are becoming more frequent.

Food Packaging Market Industry Evolution

The Food Packaging Market has experienced substantial growth over the historical period (2019-2024), driven by factors such as rising food consumption, changing consumer preferences (e.g., convenience and on-the-go consumption), and expansion of organized retail. This trend is projected to continue during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. Technological advancements like active and intelligent packaging, which extend shelf life and improve food safety, are gaining traction. Consumer demand for sustainable and eco-friendly packaging is a major influence, leading to increased adoption of biodegradable, compostable, and recyclable materials. This shift necessitates innovation in material science and packaging design. The rise of e-commerce further contributes to market growth, demanding protective and convenient packaging solutions for online food delivery. Moreover, stringent food safety regulations are driving demand for high-barrier packaging to maintain product quality and prevent contamination.

Leading Regions, Countries, or Segments in Food Packaging Market

The Food Packaging Market exhibits regional variations in growth and dominance. While precise figures aren't available without conducting a full market analysis, certain factors significantly influence regional dominance.

- By Type of Material: Plastic currently dominates globally due to its cost-effectiveness and versatility, followed by paper and paperboard. However, Metal and Glass hold substantial shares in specific segments and regions.

- By Packaging Type: Flexible packaging enjoys significant growth, spurred by convenience and cost savings. Rigid packaging holds its position, driven by products requiring high protection.

- By Product Type: Cans remain a staple across various food types. Converted Roll Stock, Gusseted Boxes, and Corrugated Boxes are widely used based on application-specific needs.

- By Application: Dairy products and poultry & meat products constitute major applications due to their high volume and packaging requirements. Fruits & vegetables and Bakery & Confectionery are also significant segments.

- Key Drivers (Examples): Investment in sustainable packaging solutions; supportive government policies promoting eco-friendly materials; strong consumer demand for convenient packaging; regulatory frameworks ensuring food safety.

North America and Europe currently hold a significant share, but rapidly developing economies in Asia-Pacific demonstrate high growth potential, driving market expansion.

Food Packaging Market Product Innovations

Recent innovations encompass eco-friendly materials, such as plant-based plastics and recycled content, and improved barrier technologies to extend shelf life and reduce food waste. Active and intelligent packaging systems provide real-time information on product freshness and condition. Innovations in design focus on convenience, reduced material usage, and enhanced recyclability. These innovations directly address consumer demands for sustainability and improved product quality. Companies are increasingly differentiating their offerings through unique selling propositions, such as sustainable sourcing and reduced carbon footprints.

Propelling Factors for Food Packaging Market Growth

Several factors propel market growth:

- Technological Advancements: Innovations in materials, barrier technologies, and printing techniques.

- Economic Growth: Rising disposable incomes and increased food consumption in developing economies.

- Regulatory Changes: Stringent regulations pushing for sustainable and safe packaging solutions. Examples include mandates for recycled content and reduced plastic usage.

Obstacles in the Food Packaging Market Market

Challenges hindering market growth include:

- Regulatory Hurdles: Strict environmental regulations and compliance costs associated with sustainable packaging.

- Supply Chain Disruptions: Fluctuations in raw material prices and logistical complexities impacting production.

- Competitive Pressures: Intense competition among established players and emerging entrants.

Future Opportunities in Food Packaging Market

Future opportunities include:

- Expansion in Emerging Markets: Untapped potential in developing economies with growing food consumption.

- Technological Innovation: Advancements in bio-based materials, active and intelligent packaging.

- Sustainable Packaging Solutions: Increased demand for eco-friendly, recyclable, and compostable packaging.

Major Players in the Food Packaging Market Ecosystem

- Smurfit Kappa Group plc (Smurfit Kappa)

- WestRock (WestRock)

- Berry Global Group (Berry Global)

- Ball Corporation (Ball Corporation)

- Mondi Limited (Mondi)

- Tetra Pak (Tetra Pak)

- Amcor Plc (Amcor)

- Crown Holdings Inc (Crown Holdings)

- Schur Flexibles Group

- International Papers (International Paper)

- Sealed Air Corp (Sealed Air)

- Anchor Packaging Inc

- Graham Packaging Company Inc

Key Developments in Food Packaging Market Industry

- June 2022: SIG completed the acquisition of Scholle IPN, a flexible packaging solution provider, for USD 1.53 Billion. This significantly expands SIG's offerings in sustainable packaging solutions.

- August 2022: Seal Packaging launched new eco-friendly packaging options, including plastic-free paper cups and compostable bowls, reflecting the growing demand for sustainable alternatives.

Strategic Food Packaging Market Market Forecast

The Food Packaging Market is poised for continued growth driven by increasing food consumption, evolving consumer preferences, and advancements in sustainable packaging solutions. The focus on eco-friendly materials and innovative packaging technologies will shape the market's trajectory in the coming years. The market is expected to witness significant expansion, particularly in emerging economies, presenting lucrative opportunities for both established players and new entrants. The emphasis on sustainability and technological innovation will further drive market growth and reshape the competitive landscape.

Food Packaging Market Segmentation

-

1. Type of Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Glass

- 1.4. Paper and Paperboard

-

2. Packaging Type

- 2.1. Rigid

- 2.2. Semi Rigid

- 2.3. Flexible

-

3. Product Type

- 3.1. Cans

- 3.2. Converted Roll Stock

- 3.3. Gusseted Box

- 3.4. Corrugated Box

- 3.5. Boxboard

- 3.6. Other Packaging Types (Pouches and bottles)

-

4. Application

- 4.1. Dairy Products

- 4.2. Poultry and Meat Products

- 4.3. Fruits & Vegetables

- 4.4. Bakery & Confectionery

- 4.5. Other Ap

Food Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Spain

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Food Packaging Market Regional Market Share

Geographic Coverage of Food Packaging Market

Food Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenience Foods in Developing Economies; Increasing Demand for Shelf-Life Extension of Foods Accelerating the Food Packaging Market; Trend of Small Households

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations Pertaining to Food Packaging

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Shelf-Life Extension of Foods Accelerating the Food Packaging Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Glass

- 5.1.4. Paper and Paperboard

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Rigid

- 5.2.2. Semi Rigid

- 5.2.3. Flexible

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Cans

- 5.3.2. Converted Roll Stock

- 5.3.3. Gusseted Box

- 5.3.4. Corrugated Box

- 5.3.5. Boxboard

- 5.3.6. Other Packaging Types (Pouches and bottles)

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Dairy Products

- 5.4.2. Poultry and Meat Products

- 5.4.3. Fruits & Vegetables

- 5.4.4. Bakery & Confectionery

- 5.4.5. Other Ap

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type of Material

- 6. North America Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Material

- 6.1.1. Plastic

- 6.1.2. Metal

- 6.1.3. Glass

- 6.1.4. Paper and Paperboard

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Rigid

- 6.2.2. Semi Rigid

- 6.2.3. Flexible

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Cans

- 6.3.2. Converted Roll Stock

- 6.3.3. Gusseted Box

- 6.3.4. Corrugated Box

- 6.3.5. Boxboard

- 6.3.6. Other Packaging Types (Pouches and bottles)

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Dairy Products

- 6.4.2. Poultry and Meat Products

- 6.4.3. Fruits & Vegetables

- 6.4.4. Bakery & Confectionery

- 6.4.5. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Type of Material

- 7. Europe Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Material

- 7.1.1. Plastic

- 7.1.2. Metal

- 7.1.3. Glass

- 7.1.4. Paper and Paperboard

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Rigid

- 7.2.2. Semi Rigid

- 7.2.3. Flexible

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Cans

- 7.3.2. Converted Roll Stock

- 7.3.3. Gusseted Box

- 7.3.4. Corrugated Box

- 7.3.5. Boxboard

- 7.3.6. Other Packaging Types (Pouches and bottles)

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Dairy Products

- 7.4.2. Poultry and Meat Products

- 7.4.3. Fruits & Vegetables

- 7.4.4. Bakery & Confectionery

- 7.4.5. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Type of Material

- 8. Asia Pacific Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Material

- 8.1.1. Plastic

- 8.1.2. Metal

- 8.1.3. Glass

- 8.1.4. Paper and Paperboard

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Rigid

- 8.2.2. Semi Rigid

- 8.2.3. Flexible

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Cans

- 8.3.2. Converted Roll Stock

- 8.3.3. Gusseted Box

- 8.3.4. Corrugated Box

- 8.3.5. Boxboard

- 8.3.6. Other Packaging Types (Pouches and bottles)

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Dairy Products

- 8.4.2. Poultry and Meat Products

- 8.4.3. Fruits & Vegetables

- 8.4.4. Bakery & Confectionery

- 8.4.5. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Type of Material

- 9. Rest of the World Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Material

- 9.1.1. Plastic

- 9.1.2. Metal

- 9.1.3. Glass

- 9.1.4. Paper and Paperboard

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Rigid

- 9.2.2. Semi Rigid

- 9.2.3. Flexible

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Cans

- 9.3.2. Converted Roll Stock

- 9.3.3. Gusseted Box

- 9.3.4. Corrugated Box

- 9.3.5. Boxboard

- 9.3.6. Other Packaging Types (Pouches and bottles)

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Dairy Products

- 9.4.2. Poultry and Meat Products

- 9.4.3. Fruits & Vegetables

- 9.4.4. Bakery & Confectionery

- 9.4.5. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Type of Material

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Smurfit Kappa Group plc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 WestRock

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Berry Global Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ball Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mondi Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tetra Pak

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Amcor Plc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Crown Holdings Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schur Flexibles Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 International Papers

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sealed Air Corp

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Anchor Packaging Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Graham Packaging Company Inc *List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Smurfit Kappa Group plc

List of Figures

- Figure 1: Global Food Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Food Packaging Market Revenue (Million), by Type of Material 2025 & 2033

- Figure 3: North America Food Packaging Market Revenue Share (%), by Type of Material 2025 & 2033

- Figure 4: North America Food Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 5: North America Food Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America Food Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 7: North America Food Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: North America Food Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 9: North America Food Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Food Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Food Packaging Market Revenue (Million), by Type of Material 2025 & 2033

- Figure 13: Europe Food Packaging Market Revenue Share (%), by Type of Material 2025 & 2033

- Figure 14: Europe Food Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 15: Europe Food Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 16: Europe Food Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Europe Food Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Food Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Food Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Food Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Food Packaging Market Revenue (Million), by Type of Material 2025 & 2033

- Figure 23: Asia Pacific Food Packaging Market Revenue Share (%), by Type of Material 2025 & 2033

- Figure 24: Asia Pacific Food Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 25: Asia Pacific Food Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 26: Asia Pacific Food Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Food Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Food Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific Food Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Food Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Food Packaging Market Revenue (Million), by Type of Material 2025 & 2033

- Figure 33: Rest of the World Food Packaging Market Revenue Share (%), by Type of Material 2025 & 2033

- Figure 34: Rest of the World Food Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 35: Rest of the World Food Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 36: Rest of the World Food Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Rest of the World Food Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Rest of the World Food Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Rest of the World Food Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Rest of the World Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Food Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Food Packaging Market Revenue Million Forecast, by Type of Material 2020 & 2033

- Table 2: Global Food Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Global Food Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Global Food Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Food Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Food Packaging Market Revenue Million Forecast, by Type of Material 2020 & 2033

- Table 7: Global Food Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 8: Global Food Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Food Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Food Packaging Market Revenue Million Forecast, by Type of Material 2020 & 2033

- Table 14: Global Food Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 15: Global Food Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 16: Global Food Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Germany Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Spain Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Food Packaging Market Revenue Million Forecast, by Type of Material 2020 & 2033

- Table 25: Global Food Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 26: Global Food Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Global Food Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: China Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: India Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Australia Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Food Packaging Market Revenue Million Forecast, by Type of Material 2020 & 2033

- Table 35: Global Food Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 36: Global Food Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 37: Global Food Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Packaging Market?

The projected CAGR is approximately 4.16%.

2. Which companies are prominent players in the Food Packaging Market?

Key companies in the market include Smurfit Kappa Group plc, WestRock, Berry Global Group, Ball Corporation, Mondi Limited, Tetra Pak, Amcor Plc, Crown Holdings Inc, Schur Flexibles Group, International Papers, Sealed Air Corp, Anchor Packaging Inc, Graham Packaging Company Inc *List Not Exhaustive.

3. What are the main segments of the Food Packaging Market?

The market segments include Type of Material, Packaging Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 367.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenience Foods in Developing Economies; Increasing Demand for Shelf-Life Extension of Foods Accelerating the Food Packaging Market; Trend of Small Households.

6. What are the notable trends driving market growth?

Increasing Demand for Shelf-Life Extension of Foods Accelerating the Food Packaging Market.

7. Are there any restraints impacting market growth?

Stringent Regulations Pertaining to Food Packaging.

8. Can you provide examples of recent developments in the market?

August 2022: Seal Packaging introduced fresh eco-friendly packaging options. The first UKCA-marked plastic-free paper cups, the It's Not Paper bag collection, a workable and ecological replacement for conventional paper bags, and the Compostabowl are just a few of the new, creative goods now being introduced.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Packaging Market?

To stay informed about further developments, trends, and reports in the Food Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence