Key Insights

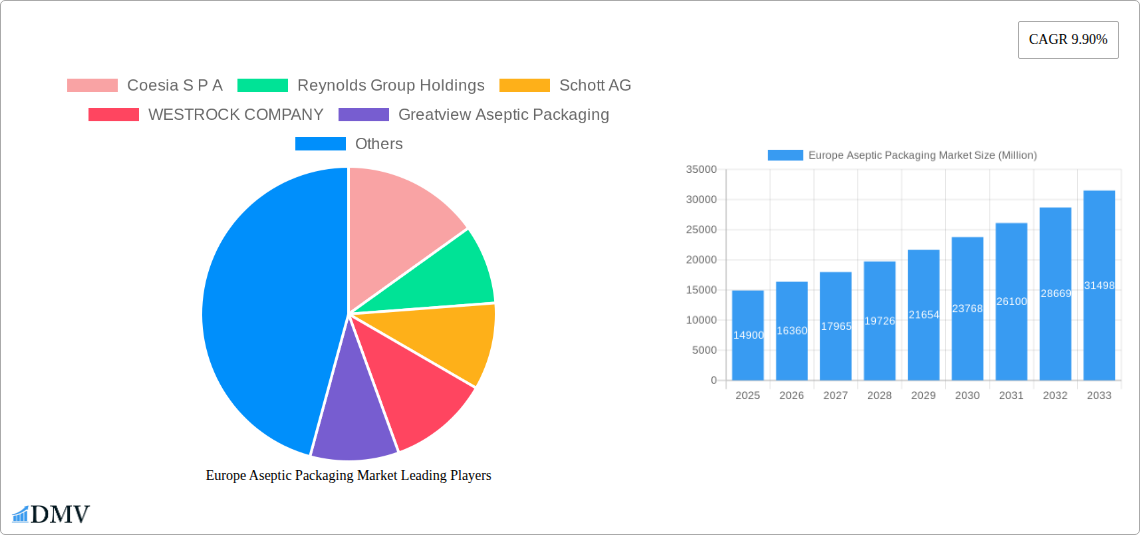

The European aseptic packaging market, valued at €14.9 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 9.9% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for convenient, shelf-stable food and beverages, particularly in the burgeoning e-commerce grocery sector, is a significant driver. Consumers are increasingly prioritizing longer shelf life and reduced food waste, further boosting the adoption of aseptic packaging. Furthermore, the pharmaceutical and medical industries' reliance on aseptic packaging for sterile product delivery contributes to market growth. The preference for sustainable and eco-friendly packaging solutions is also shaping industry trends, with manufacturers actively developing recyclable and biodegradable aseptic packaging materials. While potential economic downturns could present a restraint, the overall market outlook remains positive, fueled by innovation in packaging materials (like paper-based alternatives) and continuous advancements in aseptic filling technologies.

Europe Aseptic Packaging Market Market Size (In Billion)

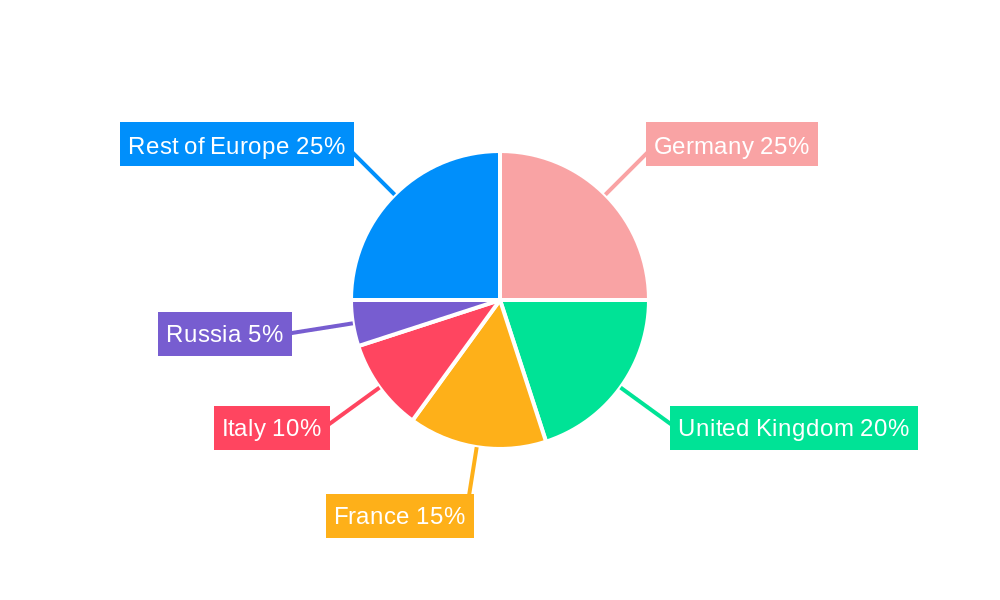

Germany, the United Kingdom, and France are leading the European market, accounting for a significant share of the total revenue. However, other countries like Italy and Russia are exhibiting substantial growth potential, contributing to the overall market expansion. The diverse segments within the market—including carton boxes, bags and pouches, bottles and jars, and various materials such as metal, glass, paper, and plastics—provide ample opportunities for specialized players. Leading companies like Coesia S.P.A., Reynolds Group Holdings, and Amcor PLC are investing heavily in R&D to develop innovative and sustainable packaging solutions, further intensifying competition and driving market expansion. The ongoing trend toward convenient single-serve portions and the rising adoption of aseptic packaging in emerging food and beverage categories will ensure sustained growth throughout the forecast period.

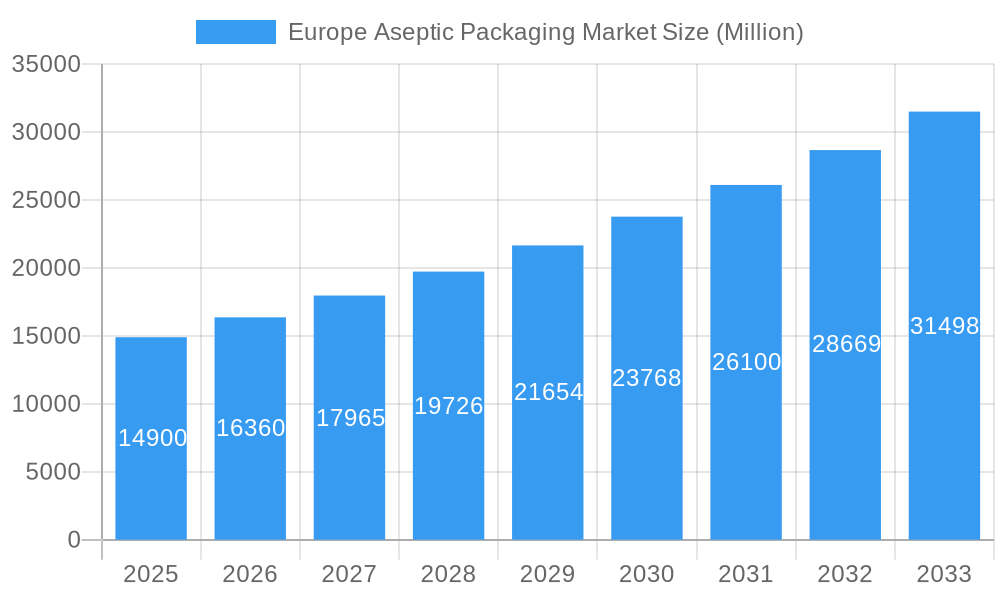

Europe Aseptic Packaging Market Company Market Share

Europe Aseptic Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Europe aseptic packaging market, offering invaluable data and projections for stakeholders across the value chain. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils key trends, competitive landscapes, and future growth opportunities within this dynamic sector. The market is expected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Europe Aseptic Packaging Market Composition & Trends

This section delves into the intricate structure of the European aseptic packaging market, analyzing market concentration, innovation drivers, regulatory impacts, substitute product analysis, end-user segmentation, and mergers & acquisitions (M&A) activities. The market is moderately fragmented, with key players holding significant but not dominant shares. The top five players collectively account for approximately xx% of the market share in 2025. M&A activities have been relatively moderate, with xx Million in deal value recorded between 2019 and 2024. Innovation is primarily driven by sustainability concerns and evolving consumer preferences towards convenient, shelf-stable products. Stringent regulations regarding food safety and material recyclability are shaping the market landscape. Substitute packaging materials constantly challenge the aseptic market, while increasing demand for extended shelf life foods from food & beverage and pharmaceutical sectors are primary drivers for the overall growth of the market.

- Market Share Distribution (2025): Top 5 players: xx%; Others: xx%

- M&A Deal Value (2019-2024): xx Million

- Key Innovation Catalysts: Sustainability, Convenience, Extended Shelf Life

- Regulatory Landscape: Stringent food safety & recyclability standards

- Substitute Products: Traditional packaging materials (glass, plastic)

Europe Aseptic Packaging Market Industry Evolution

The European aseptic packaging market has experienced significant growth over the past five years, fueled by technological advancements and shifting consumer demands. The historical period (2019-2024) witnessed a CAGR of xx%, primarily driven by the increasing adoption of aseptic packaging across the food and beverage industry. Technological innovations like improved barrier materials, lightweighting solutions, and eco-friendly designs are pushing the industry forward. Consumer preference for convenient, ready-to-consume products and the growth of e-commerce are further contributing to the upward trajectory. The forecast period (2025-2033) is projected to maintain a strong growth trajectory, with a CAGR of xx%, primarily driven by continued technological innovation and increased demand from emerging markets within Europe. The shift towards sustainable packaging materials is expected to become a major factor influencing market growth.

Leading Regions, Countries, or Segments in Europe Aseptic Packaging Market

Germany, the United Kingdom, and France represent the largest aseptic packaging markets in Europe, driven by robust food and beverage sectors and advanced packaging infrastructure. Carton boxes remain the dominant packaging type, accounting for over xx% of the market share in 2025, followed by bags and pouches. The food and beverage industry remains the largest end-user segment, while the pharmaceutical and medical sector is experiencing considerable growth. Paper and plastic are the primary packaging materials used, reflecting the balance between cost-effectiveness and sustainability concerns.

- Key Drivers (Germany): Strong domestic food & beverage industry, advanced manufacturing capabilities

- Key Drivers (UK): Large retail sector, high consumer demand for convenient food

- Key Drivers (France): Significant wine production, growing demand for sustainable packaging

- Dominant Packaging Type: Carton Boxes (xx% market share in 2025)

- Dominant End-User Industry: Food & Beverage

Europe Aseptic Packaging Market Product Innovations

Recent innovations focus on enhanced sustainability, improved barrier properties, and enhanced convenience. The introduction of Elopak's Pure-Pak esense and SIG's paper u-bend straw exemplify the industry's commitment to eco-friendly and consumer-centric designs. These innovations offer reduced carbon footprints, improved recyclability, and enhanced user experience, leading to significant market acceptance. Further advancements in material science and manufacturing processes are anticipated to further propel market growth.

Propelling Factors for Europe Aseptic Packaging Market Growth

Several key factors are driving the growth of the European aseptic packaging market: increasing demand for shelf-stable food and beverages, growing concerns over food safety and hygiene, advancements in aseptic packaging technologies, rising consumer preference for convenience, and increasing investments in research and development. Furthermore, stringent regulations promoting sustainable packaging and recyclability act as strong drivers.

Obstacles in the Europe Aseptic Packaging Market

The Europe aseptic packaging market faces challenges including fluctuations in raw material prices, increasing concerns regarding plastic waste and environmental impact, stringent regulations impacting packaging design, and intense competition from substitute packaging materials. Supply chain disruptions caused by geopolitical instability can further add complexities and increase market volatility. The combined impact of these factors can influence market growth and profitability.

Future Opportunities in Europe Aseptic Packaging Market

Future opportunities lie in developing sustainable and eco-friendly packaging solutions, expanding into new market segments like the ready-to-eat meals sector, and leveraging advancements in digital printing and smart packaging technologies. The increasing demand for personalized packaging and functional barrier materials also presents a significant avenue for market expansion.

Major Players in the Europe Aseptic Packaging Market Ecosystem

Key Developments in Europe Aseptic Packaging Market Industry

- August 2021: Elopak announced the Pure-Pak esense product line, a recyclable aseptic carton reducing carbon footprint by 28%.

- April 2021: SIG launched a paper u-bend straw for aseptic cartons in partnership with CAPSA Food's Central Lechera Asturiana.

Strategic Europe Aseptic Packaging Market Forecast

The European aseptic packaging market is poised for sustained growth, driven by continuous innovation in sustainable materials, increasing demand for convenient food and beverages, and the growing adoption of aseptic packaging across diverse sectors. The market's future is bright, with opportunities for significant expansion and consolidation among key players. The focus on sustainability and enhanced consumer experience will continue to shape the industry's trajectory over the forecast period.

Europe Aseptic Packaging Market Segmentation

-

1. Packaging Material

- 1.1. Metal

- 1.2. Glass

- 1.3. Paper

- 1.4. Plastics

- 1.5. Others

-

2. Packaging Type

- 2.1. Carton Boxes

- 2.2. Bags and Pouches

- 2.3. Cups and Trays

- 2.4. Bottles and Jars

- 2.5. Metal Cans

- 2.6. Plastic Cans

- 2.7. Composite Cans

- 2.8. Others

-

3. End-User Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Pharmaceutical & Medical

- 3.4. Others

Europe Aseptic Packaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Aseptic Packaging Market Regional Market Share

Geographic Coverage of Europe Aseptic Packaging Market

Europe Aseptic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand to Reduce Cost of Cold Chain Logistics; Increasing Demand for Longer Shelf Life of Products

- 3.3. Market Restrains

- 3.3.1. Lack of Supply of Bio-plastics and Related Materials

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Longer Shelf Life of Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Aseptic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 5.1.1. Metal

- 5.1.2. Glass

- 5.1.3. Paper

- 5.1.4. Plastics

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Carton Boxes

- 5.2.2. Bags and Pouches

- 5.2.3. Cups and Trays

- 5.2.4. Bottles and Jars

- 5.2.5. Metal Cans

- 5.2.6. Plastic Cans

- 5.2.7. Composite Cans

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Pharmaceutical & Medical

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Coesia S P A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Reynolds Group Holdings

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schott AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WESTROCK COMPANY

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Greatview Aseptic Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amcor PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CFT S P A *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SIG Combibloc Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DS SMITH PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ecolean Packaging

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Krones Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sealed Air Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Tetra Pal International SA

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Coesia S P A

List of Figures

- Figure 1: Europe Aseptic Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Aseptic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Aseptic Packaging Market Revenue Million Forecast, by Packaging Material 2020 & 2033

- Table 2: Europe Aseptic Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Europe Aseptic Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Europe Aseptic Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Aseptic Packaging Market Revenue Million Forecast, by Packaging Material 2020 & 2033

- Table 6: Europe Aseptic Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 7: Europe Aseptic Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Europe Aseptic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Aseptic Packaging Market?

The projected CAGR is approximately 9.90%.

2. Which companies are prominent players in the Europe Aseptic Packaging Market?

Key companies in the market include Coesia S P A, Reynolds Group Holdings, Schott AG, WESTROCK COMPANY, Greatview Aseptic Packaging, Amcor PLC, Mondi PLC, CFT S P A *List Not Exhaustive, SIG Combibloc Group, DS SMITH PLC, Ecolean Packaging, Krones Inc, Sealed Air Corporation, Tetra Pal International SA.

3. What are the main segments of the Europe Aseptic Packaging Market?

The market segments include Packaging Material, Packaging Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand to Reduce Cost of Cold Chain Logistics; Increasing Demand for Longer Shelf Life of Products.

6. What are the notable trends driving market growth?

Increasing Demand for Longer Shelf Life of Products.

7. Are there any restraints impacting market growth?

Lack of Supply of Bio-plastics and Related Materials.

8. Can you provide examples of recent developments in the market?

August 2021 - Elopak announced Pure-Pak esense product line, which is an aseptic carton layered with aluminum that allows the manufacturer to reduce the carbon footprint by 28%. The package also facilitates full recyclability. Moreover, the package has been introduced for beverages such as fruit juices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Aseptic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Aseptic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Aseptic Packaging Market?

To stay informed about further developments, trends, and reports in the Europe Aseptic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence