Key Insights

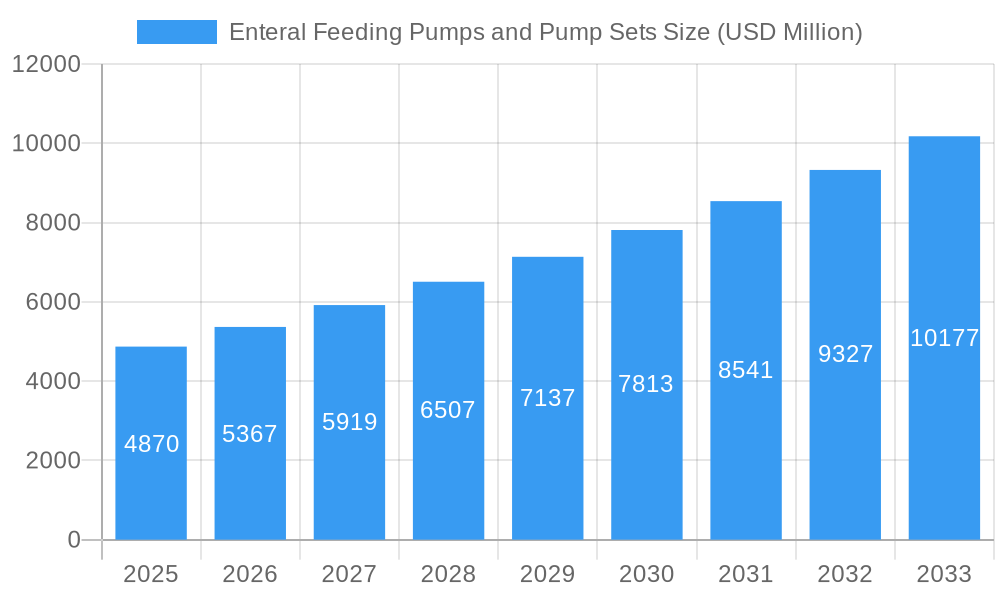

The global Enteral Feeding Pumps and Pump Sets market is poised for significant expansion, projected to reach an estimated USD 4.87 billion in 2025. This robust growth is fueled by a CAGR of 10.2%, indicating a dynamic and thriving industry. The increasing prevalence of chronic diseases, including cancer, gastrointestinal disorders, and neurological conditions, is a primary driver, necessitating long-term nutritional support. Furthermore, the aging global population, with its higher susceptibility to malnutrition and dysphagia, contributes substantially to the demand for enteral feeding solutions. Advances in pump technology, offering enhanced portability, accuracy, and user-friendliness, are also playing a crucial role in market acceleration. The growing emphasis on home healthcare and the shift of medical treatments from hospitals to home settings further amplify the market's potential, as enteral feeding devices provide a convenient and cost-effective alternative for patients requiring ongoing nutritional management.

Enteral Feeding Pumps and Pump Sets Market Size (In Billion)

The market's growth trajectory is further shaped by evolving trends such as the development of smart feeding pumps with integrated monitoring and data logging capabilities, catering to personalized patient care. The rising adoption of these advanced devices in both hospital and home care settings underscores the industry's commitment to innovation and improved patient outcomes. While the market enjoys substantial growth, certain restraints, such as the high initial cost of some advanced pump systems and the potential for device-related infections if not maintained properly, warrant attention. However, the strong upward momentum, driven by increasing patient populations requiring nutritional support and continuous technological advancements, is expected to outweigh these challenges, solidifying a promising future for the enteral feeding pumps and pump sets market.

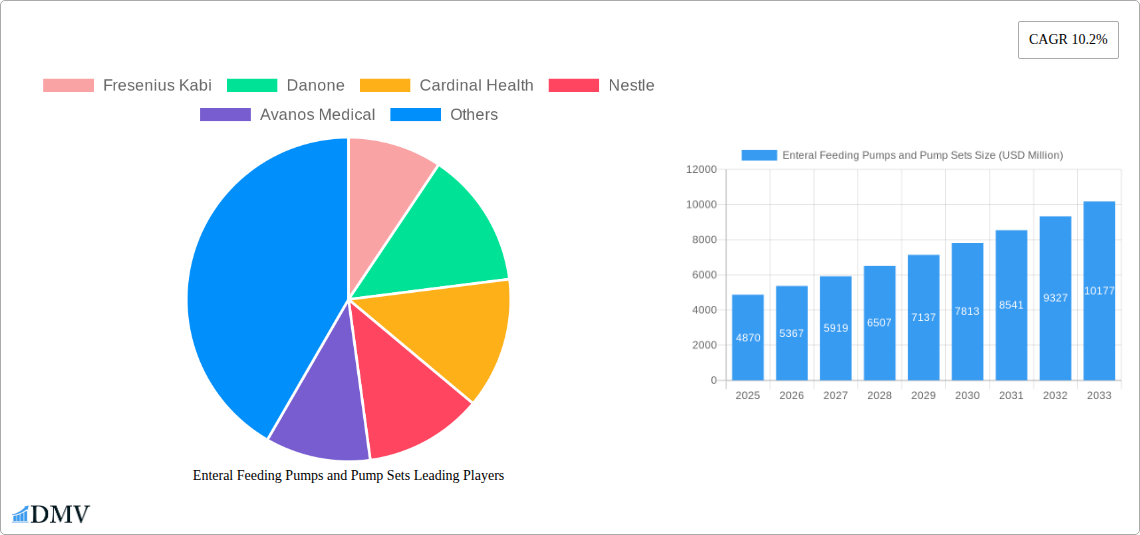

Enteral Feeding Pumps and Pump Sets Company Market Share

This comprehensive market research report offers an in-depth analysis of the global Enteral Feeding Pumps and Pump Sets market, providing critical insights for stakeholders across the healthcare and medical device industries. Spanning the study period of 2019–2033, with a base year of 2025, the report delivers precise market valuations and forecasts, projecting a market size in the billions of USD. Our expert analysis covers market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, future opportunities, and the strategic landscape of major players.

Enteral Feeding Pumps and Pump Sets Market Composition & Trends

The Enteral Feeding Pumps and Pump Sets market exhibits a moderate to highly concentrated structure, characterized by the strategic presence of key players such as Fresenius Kabi, Danone, Cardinal Health, Nestle, Avanos Medical, B. Braun, Abbott, Moog, Applied Medical Technology, Cook Medical, Boston Scientific, and Oso Home Care, Inc. Innovation catalysts are primarily driven by advancements in smart pump technology, enhanced patient safety features, and the development of user-friendly, portable devices catering to both hospital and home care settings. The regulatory landscape, overseen by bodies like the FDA and EMA, emphasizes stringent quality control and device efficacy, influencing product development and market entry strategies. Substitute products, while present in the form of alternative nutrition delivery methods, are generally less effective for long-term or complex enteral feeding regimens. End-user profiles range from pediatric to geriatric patients with conditions like dysphagia, gastrointestinal disorders, and critical illnesses, requiring consistent and controlled nutritional support. Mergers and acquisitions (M&A) activities have played a significant role in market consolidation, with deal values estimated to be in the hundreds of millions to billions of USD, reflecting strategic expansions and portfolio enhancements. The market share distribution is dynamic, with leading companies holding substantial portions, driven by their extensive product portfolios and global reach.

Enteral Feeding Pumps and Pump Sets Industry Evolution

The global Enteral Feeding Pumps and Pump Sets market has witnessed a significant and consistent growth trajectory over the historical period of 2019–2024, a trend projected to accelerate through the forecast period of 2025–2033. This evolution is underpinned by a confluence of factors, most notably the increasing global prevalence of chronic diseases and malnutrition, which directly fuels the demand for reliable and advanced enteral nutrition solutions. Technological advancements have been a primary engine of change, transforming basic infusion devices into sophisticated, programmable pumps offering enhanced accuracy, patient safety features like occlusion alarms and dosage error prevention, and connectivity for remote monitoring. The adoption of smart pumps with integrated data logging and wireless capabilities has surged, particularly in hospital settings, enabling better clinical decision-making and workflow efficiency. Concurrently, the market has observed a pronounced shift towards home care solutions. This is driven by factors such as the aging global population, a preference for personalized and comfortable care, and increasing healthcare cost containment initiatives that encourage shorter hospital stays. The development of portable, lightweight, and user-friendly enteral feeding pumps and pump sets has been instrumental in facilitating this transition, empowering patients to manage their nutrition independently and improving their quality of life.

Furthermore, the expansion of reimbursement policies and insurance coverage for enteral feeding therapies in various regions has significantly lowered the financial barrier for patients, thereby boosting market penetration. Innovations in pump set designs, focusing on reducing set changes, improving biocompatibility, and minimizing the risk of contamination, have also contributed to the market's sustained growth. The COVID-19 pandemic, while posing some initial supply chain challenges, also inadvertently highlighted the critical role of enteral nutrition in managing critically ill patients, leading to increased awareness and adoption of these devices. The market's growth rate, estimated to be in the high single digits annually, is indicative of its robust health and ongoing expansion. Specific data points reveal a CAGR of approximately XX% during the historical period and a projected CAGR of XX% for the forecast period, reflecting sustained demand and innovation. The adoption metrics for advanced enteral feeding pumps in acute care settings have risen by an estimated XX%, while the penetration of home care enteral feeding devices has seen a similar upward trend, underscoring the market's dynamic evolution and its critical role in modern healthcare.

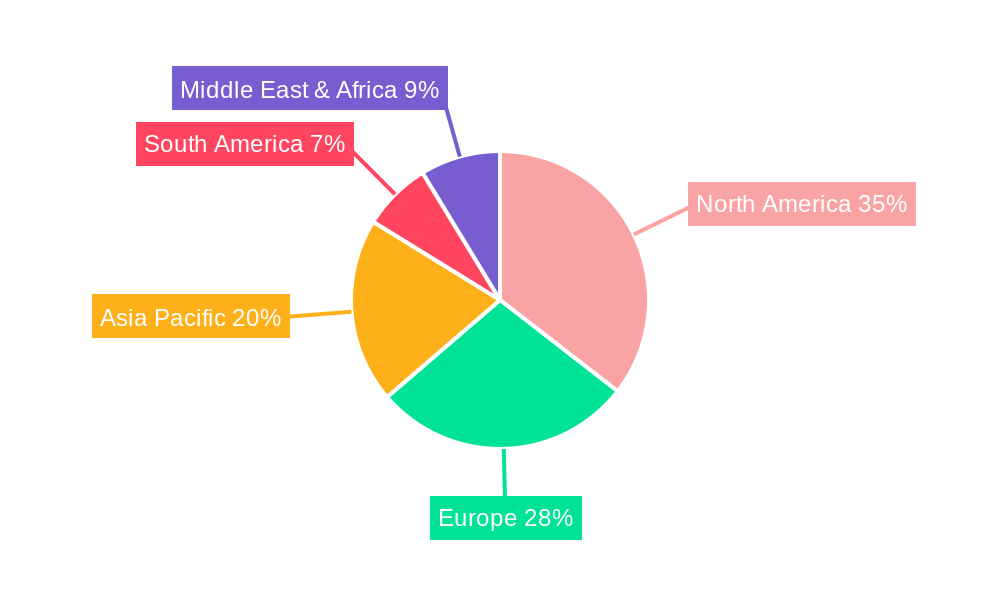

Leading Regions, Countries, or Segments in Enteral Feeding Pumps and Pump Sets

The global Enteral Feeding Pumps and Pump Sets market is characterized by the strong dominance of North America as a leading region, driven by a robust healthcare infrastructure, high disposable incomes, and a significant prevalence of chronic diseases requiring nutritional support. Within this region, the United States stands out as a primary market, consistently demonstrating substantial market share due to advanced healthcare expenditure and early adoption of innovative medical technologies.

Key Drivers of Dominance in North America:

- High Healthcare Spending and Reimbursement: Extensive insurance coverage and government reimbursement policies for enteral feeding therapies provide a strong financial impetus for both institutional and home care adoption. The Centers for Medicare & Medicaid Services (CMS) plays a pivotal role in shaping reimbursement landscapes, ensuring access to essential medical devices.

- Technological Advancement and Innovation Adoption: North America is a hotbed for medical device innovation. Leading companies like Abbott, Fresenius Kabi, and Cardinal Health continually introduce advanced enteral feeding pumps with enhanced features, driving market growth. The early adoption of smart pump technologies and connected devices for remote patient monitoring further solidifies its leadership.

- Prevalence of Target Patient Populations: The region exhibits a high incidence of conditions necessitating enteral feeding, including obesity, diabetes, gastrointestinal disorders, neurological conditions (e.g., stroke, ALS), and cancer. This creates a large and sustained patient pool requiring these devices.

- Well-Established Distribution Networks: An efficient and widespread network of medical distributors, healthcare providers, and home care agencies ensures easy access to enteral feeding pumps and pump sets across the region.

- Strong Regulatory Framework: While stringent, the FDA's regulatory framework also fosters innovation by providing clear guidelines for device approval, encouraging manufacturers to invest in research and development.

Among the Application segments, Hospitals historically represent the largest market share due to their role in managing acute care patients requiring intensive nutritional support. However, the Home Care segment is experiencing the most rapid growth. This surge is propelled by factors such as the aging population, a preference for decentralized patient care, the development of portable and user-friendly devices, and cost-containment strategies encouraging earlier discharge. In terms of Types, Continuous Feeding pumps command a significant share due to their suitability for patients requiring consistent and precise nutritional intake over extended periods, particularly in critical care and long-term care settings. However, Intermittent Feeding pumps are gaining traction in home care scenarios, offering greater flexibility and patient autonomy. The growth in home care is closely linked to the increasing adoption of intermittent feeding pumps that cater to a more personalized and lifestyle-accommodating approach to nutrition delivery. The interplay between these segments highlights a market that is not only expanding but also evolving to meet diverse patient needs and care delivery models, with North America consistently leading the charge in embracing these advancements.

Enteral Feeding Pumps and Pump Sets Product Innovations

Recent product innovations in the Enteral Feeding Pumps and Pump Sets market are centered on enhancing patient safety, user convenience, and therapeutic efficacy. Manufacturers are increasingly integrating wireless connectivity and data analytics capabilities into their pumps, enabling real-time monitoring, remote adjustments, and detailed reporting for healthcare providers. Advances in disposable pump sets focus on reducing priming volumes, improving occlusion detection, and incorporating antimicrobial properties to minimize infection risks. Furthermore, the development of highly portable and battery-efficient pumps is a key trend, empowering patients with greater mobility and enabling seamless transitions between hospital and home care environments. These innovations are crucial for improving patient outcomes and reducing the overall burden of care.

Propelling Factors for Enteral Feeding Pumps and Pump Sets Growth

The global Enteral Feeding Pumps and Pump Sets market is propelled by several key factors. The rising global prevalence of chronic diseases, including cancer, diabetes, and gastrointestinal disorders, directly increases the demand for enteral nutrition. Technological advancements in smart pump technology, offering enhanced precision, safety features, and connectivity, are driving adoption in both hospital and home care settings. The aging global population also contributes significantly, as older individuals are more susceptible to malnutrition and require nutritional support. Furthermore, favorable reimbursement policies and increasing healthcare expenditure in emerging economies are expanding market access. The growing trend towards home-based healthcare solutions and patient preference for comfort and independence further fuels the demand for portable and user-friendly enteral feeding devices.

Obstacles in the Enteral Feeding Pumps and Pump Sets Market

Despite robust growth, the Enteral Feeding Pumps and Pump Sets market faces several obstacles. Stringent regulatory requirements for device approval and market entry can lead to lengthy development cycles and increased costs for manufacturers. Supply chain disruptions, as evidenced during recent global events, can impact the availability of raw materials and finished products. High initial costs of advanced enteral feeding pumps can be a barrier for some healthcare facilities and patients, particularly in resource-limited settings. Limited awareness and understanding of the benefits of enteral nutrition in certain demographics and regions can also hinder market penetration. Finally, competition from alternative nutritional support methods and the need for consistent user training and maintenance present ongoing challenges.

Future Opportunities in Enteral Feeding Pumps and Pump Sets

The Enteral Feeding Pumps and Pump Sets market is poised for significant future opportunities. The burgeoning home care segment presents a vast untapped potential, driven by aging populations and the demand for personalized, convenient care. Emerging economies in Asia-Pacific and Latin America represent significant growth markets due to increasing healthcare investments and a rising middle class. The development of AI-powered feeding pumps capable of personalized nutrition delivery and predictive analytics offers a transformative opportunity. Furthermore, the focus on reducing healthcare-associated infections will drive innovation in pump sets with enhanced antimicrobial properties. Opportunities also lie in developing more affordable and accessible enteral feeding solutions to cater to a wider patient demographic.

Major Players in the Enteral Feeding Pumps and Pump Sets Ecosystem

- Fresenius Kabi

- Danone

- Cardinal Health

- Nestle

- Avanos Medical

- B. Braun

- Abbott

- Moog

- Applied Medical Technology

- Cook Medical

- Boston Scientific

- Oso Home Care, Inc.

Key Developments in Enteral Feeding Pumps and Pump Sets Industry

- 2023: Fresenius Kabi launches its latest generation of integrated enteral feeding systems, focusing on enhanced patient safety and user interface improvements.

- 2022: Avanos Medical acquires a new company specializing in advanced enteral nutrition formulations, aiming to offer a more comprehensive solution to patients.

- 2021: Abbott receives regulatory approval for its next-generation smart enteral feeding pump, featuring advanced connectivity and data management capabilities.

- 2020: B. Braun introduces a novel pump set designed to minimize the risk of bacterial contamination and prolong set usage.

- 2019: Cardinal Health expands its enteral nutrition portfolio with the integration of innovative pump technologies to cater to the growing home care market.

Strategic Enteral Feeding Pumps and Pump Sets Market Forecast

The strategic enteral feeding pumps and pump sets market forecast indicates continued robust growth driven by an aging global population and the increasing incidence of chronic diseases necessitating nutritional support. Innovations in smart pump technology, remote patient monitoring, and user-centric designs will be pivotal in expanding the home care segment and improving patient outcomes. Emerging markets in Asia-Pacific and Latin America are expected to witness significant expansion, offering substantial opportunities for both established and new market entrants. The focus on cost-effectiveness and patient convenience will continue to shape product development and market strategies, ensuring sustained demand for these critical medical devices in the coming years.

Enteral Feeding Pumps and Pump Sets Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Home Care

-

2. Types

- 2.1. Continuous Feeding

- 2.2. Intermittent Feeding

Enteral Feeding Pumps and Pump Sets Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Enteral Feeding Pumps and Pump Sets Regional Market Share

Geographic Coverage of Enteral Feeding Pumps and Pump Sets

Enteral Feeding Pumps and Pump Sets REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enteral Feeding Pumps and Pump Sets Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Home Care

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Continuous Feeding

- 5.2.2. Intermittent Feeding

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Enteral Feeding Pumps and Pump Sets Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Home Care

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Continuous Feeding

- 6.2.2. Intermittent Feeding

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Enteral Feeding Pumps and Pump Sets Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Home Care

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Continuous Feeding

- 7.2.2. Intermittent Feeding

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Enteral Feeding Pumps and Pump Sets Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Home Care

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Continuous Feeding

- 8.2.2. Intermittent Feeding

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Enteral Feeding Pumps and Pump Sets Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Home Care

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Continuous Feeding

- 9.2.2. Intermittent Feeding

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Enteral Feeding Pumps and Pump Sets Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Home Care

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Continuous Feeding

- 10.2.2. Intermittent Feeding

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Fresenius Kabi

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Danone

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cardinal Health

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nestle

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Avanos Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 B. Braun

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abbott

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Moog

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Applied Medical Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cook Medical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Boston Scientific

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Oso Home Care

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Inc.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Fresenius Kabi

List of Figures

- Figure 1: Global Enteral Feeding Pumps and Pump Sets Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Enteral Feeding Pumps and Pump Sets Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Enteral Feeding Pumps and Pump Sets Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Enteral Feeding Pumps and Pump Sets Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Enteral Feeding Pumps and Pump Sets Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enteral Feeding Pumps and Pump Sets?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the Enteral Feeding Pumps and Pump Sets?

Key companies in the market include Fresenius Kabi, Danone, Cardinal Health, Nestle, Avanos Medical, B. Braun, Abbott, Moog, Applied Medical Technology, Cook Medical, Boston Scientific, Oso Home Care, Inc..

3. What are the main segments of the Enteral Feeding Pumps and Pump Sets?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enteral Feeding Pumps and Pump Sets," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enteral Feeding Pumps and Pump Sets report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enteral Feeding Pumps and Pump Sets?

To stay informed about further developments, trends, and reports in the Enteral Feeding Pumps and Pump Sets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence