Key Insights

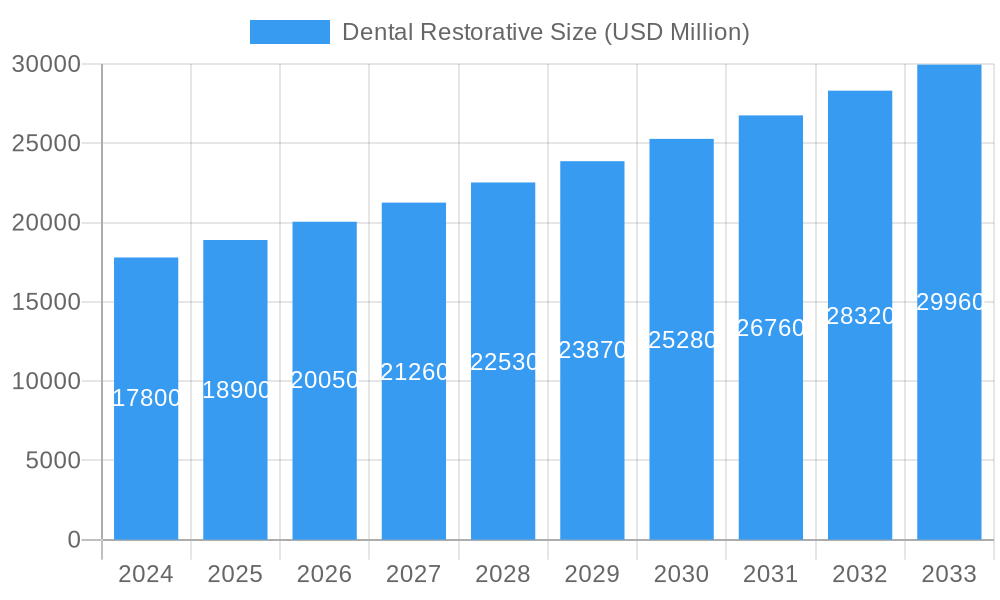

The global Dental Restorative market is poised for robust expansion, with an estimated market size of $17.8 billion in 2024. This growth is driven by a confluence of factors, including the increasing prevalence of dental caries and periodontal diseases, a growing emphasis on aesthetic dentistry, and advancements in material science leading to more durable and biocompatible restorative solutions. An estimated 6.2% CAGR between 2025 and 2033 signifies sustained momentum in this sector. Key applications such as impression materials and denture materials are expected to witness significant demand, fueled by an aging global population and rising disposable incomes in emerging economies. Furthermore, the continuous development of innovative materials, including advanced ceramics and composite resins, is enhancing treatment outcomes and patient satisfaction, further propelling market growth. The market's trajectory is also influenced by an increasing awareness among consumers regarding oral hygiene and the availability of sophisticated dental treatments.

Dental Restorative Market Size (In Billion)

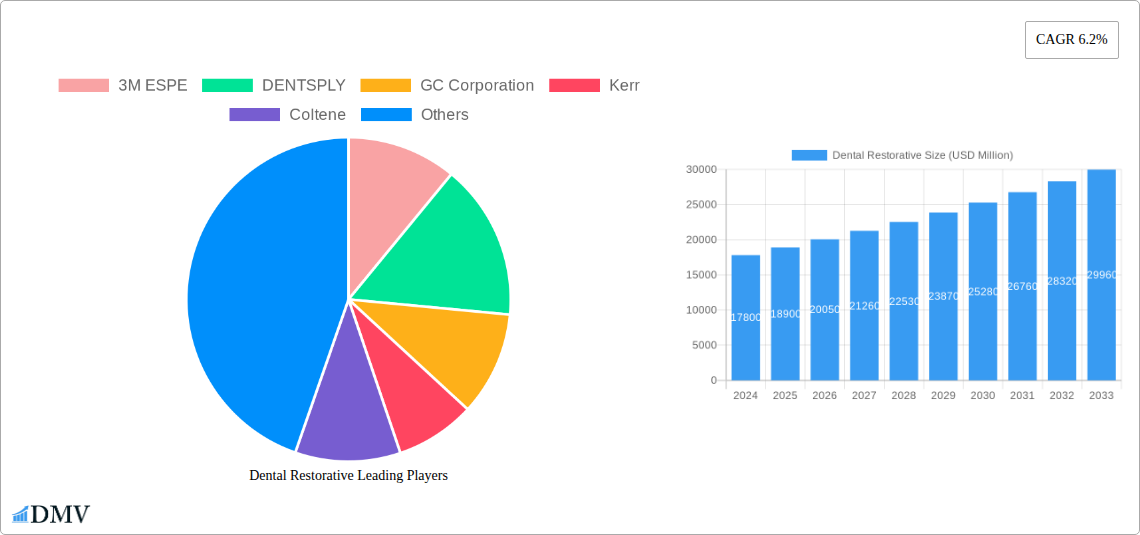

The dental restorative landscape is characterized by a dynamic interplay of technological innovation and evolving patient needs. While the market benefits from strong growth drivers, certain restraints may influence its pace. These include the high cost of advanced dental procedures and materials, potentially limiting accessibility in certain regions, and stringent regulatory approvals for new products. Nevertheless, the overall outlook remains exceptionally positive. The market is segmented into diverse product types, including metals and alloys, ceramics, and composite materials, each catering to specific clinical requirements and patient preferences. Companies like 3M ESPE, DENTSPLY, and GC Corporation are at the forefront, investing heavily in research and development to introduce cutting-edge solutions. Strategic collaborations and acquisitions are also expected to play a crucial role in shaping the competitive landscape, enabling companies to expand their product portfolios and market reach across key regions such as North America, Europe, and the Asia Pacific.

Dental Restorative Company Market Share

Embark on a comprehensive exploration of the global dental restorative market, a sector poised for significant expansion. This in-depth report analyzes the market from 2019 to 2033, providing a detailed outlook for the base year of 2025 and a robust forecast period from 2025 to 2033. With historical data spanning 2019–2024, gain unparalleled insights into market composition, emerging trends, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. We cover key segments including Impression Material, Expendable Pattern Materials, Denture Materials, Adhesive Material, and Other Applications, alongside product types such as Metals and Alloys, Ceramics, Composite Materials, and Other. Discover the strategic initiatives of industry leaders like 3M ESPE, DENTSPLY, GC Corporation, Kerr, Coltene, Ivoclar Vivadent, Heraeus Kulzer, DenMat Holdings, DMG, Kuraray Noritake, Pentron, Premier, Shofu, and VOCO.

Dental Restorative Market Composition & Trends

The dental restorative market exhibits a dynamic landscape characterized by moderate to high concentration, driven by continuous innovation and stringent regulatory oversight. Key catalysts include the development of biocompatible materials, advancements in digital dentistry, and a growing demand for aesthetically pleasing solutions. Substitutes such as direct restorations and temporary materials play a role, but the market's focus remains on durable and advanced restorative options. End-user profiles span dental practitioners, dental laboratories, and increasingly, direct-to-consumer channels for certain product categories. Mergers and acquisitions are strategic maneuvers to consolidate market share and acquire cutting-edge technologies. For instance, M&A deal values are projected to reach billions of dollars, reflecting intense competitive interest. Market share distribution shows a gradual shift towards companies with strong R&D pipelines and established distribution networks, aiming for a combined market value exceeding USD 20 billion by the forecast period.

- Market Concentration: Dominated by a few key players but with increasing fragmentation due to specialized product development.

- Innovation Catalysts: Biocompatibility, aesthetics, digital integration, and minimally invasive techniques.

- Regulatory Landscapes: Strict FDA, CE, and other regional body approvals influence product development and market entry, impacting USD 5 billion in potential new product launches annually.

- Substitute Products: While direct restorations offer alternatives, advanced materials maintain dominance in complex procedures.

- End-User Profiles: Dental professionals, dental labs, and growing direct patient engagement.

- M&A Activities: Strategic acquisitions to gain technological edge and market access, with deal values potentially exceeding USD 3 billion in the historical period.

Dental Restorative Industry Evolution

The dental restorative industry has witnessed a profound evolution, driven by a confluence of technological breakthroughs and shifting consumer expectations for enhanced oral health and aesthetics. Market growth trajectories have been consistently upward, fueled by an aging global population, increased prevalence of dental caries and periodontal diseases, and a rising disposable income in emerging economies, contributing to an estimated market value of USD 15 billion in the base year. Technological advancements, particularly in the realm of dental composites, ceramics, and adhesive materials, have revolutionized restorative procedures. Innovations such as CAD/CAM technology, 3D printing for dental prosthetics, and the development of bioactive restorative materials have significantly improved treatment outcomes, durability, and patient comfort. Adoption metrics for these advanced technologies are climbing, with a projected 15% year-on-year growth in the adoption of digital dental workflows. Shifting consumer demands have moved beyond mere functional restoration to a strong emphasis on cosmetic appeal, natural tooth appearance, and minimally invasive treatment options. This has spurred the development of tooth-colored restorative materials that closely mimic natural enamel and dentin. The global dental restorative market size is projected to reach USD 30 billion by the end of the forecast period, reflecting an average annual growth rate (CAGR) of 6%. The demand for dental implant materials and dental crown and bridge materials is particularly robust. Furthermore, the increasing acceptance of aesthetic dentistry and preventative care contributes to sustained market expansion. The integration of artificial intelligence in diagnosing and planning restorative treatments is an emerging trend that will further shape the industry's future. The impact of these advancements is evident in the improved longevity of restorations and a reduction in post-operative complications, further solidifying the market's growth potential.

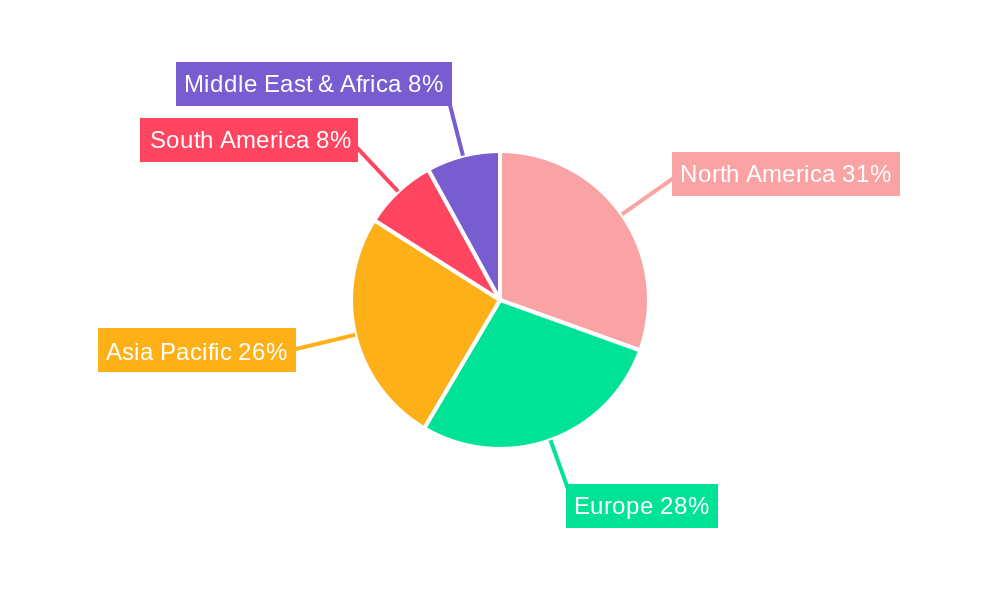

Leading Regions, Countries, or Segments in Dental Restorative

The dental restorative market sees North America emerge as a dominant region, propelled by robust healthcare infrastructure, high patient awareness regarding oral health, and substantial disposable income. Within North America, the United States leads due to its advanced dental technology adoption, favorable reimbursement policies, and a high concentration of dental professionals and clinics. Investment trends in dental research and development are particularly strong here, estimated to be in the billions of dollars annually. Regulatory support from bodies like the FDA streamlines the approval process for innovative dental materials and devices, fostering market growth.

- Dominant Region: North America, with the United States as the leading country.

- Key Drivers: High patient awareness, strong economic conditions, advanced healthcare infrastructure, and significant R&D investments.

- Investment Trends: Billions invested annually in dental research, technology, and practice expansion.

- Regulatory Support: Streamlined approval processes for innovative materials and devices.

- Market Value Contribution: Estimated to contribute over 35% of the global dental restorative market revenue in the base year.

In terms of application segments, Adhesive Material holds a significant position. The development of universal adhesives and advancements in bonding technologies have made them indispensable in various restorative procedures, from direct composite restorations to cementation of indirect restorations. The market for adhesive materials alone is projected to exceed USD 7 billion by 2033.

- Dominant Application Segment: Adhesive Material.

- Significance: Essential for bonding restorative materials to tooth structure, enabling durable and aesthetic outcomes.

- Growth Factors: Advancements in bonding agents, increasing demand for minimally invasive dentistry, and their role in both direct and indirect restorations.

- Market Value: Expected to represent a substantial portion of the overall market, with projected growth exceeding 8% CAGR.

Among product types, Composite Materials continue to dominate due to their excellent aesthetic properties, versatility, and biocompatibility. The continuous improvement in resin matrix technology, filler particles, and curing mechanisms ensures their widespread adoption across various clinical scenarios, contributing an estimated USD 10 billion to the market.

- Dominant Product Type: Composite Materials.

- Versatility: Widely used for direct restorations, veneers, inlays, and onlays.

- Technological Advancements: Innovations in nano-composites, self-etching systems, and aesthetic layering techniques.

- Market Share: Consistently holds the largest share, projected to maintain its lead through the forecast period.

Dental Restorative Product Innovations

The dental restorative market is abuzz with product innovations that are redefining patient care. Self-healing composites that can repair micro-cracks, bioactive restorative materials that stimulate remineralization, and highly aesthetic ceramic materials offering superior translucency are transforming the field. Innovations in impression material technologies, such as digital intraoral scanners, are reducing the need for traditional physical impressions. Advanced denture materials offer enhanced strength, fit, and aesthetics, providing a more comfortable and natural feel. The integration of nanotechnology in metals and alloys is leading to stronger, more biocompatible implants and prosthetics. These advancements collectively enhance the longevity, functionality, and aesthetic appeal of dental restorations.

Propelling Factors for Dental Restorative Growth

Several key factors are propelling the dental restorative market forward. The growing global prevalence of dental caries, periodontal diseases, and tooth loss due to aging populations necessitates advanced restorative solutions. Technological advancements in materials science and digital dentistry, including CAD/CAM and 3D printing, are enhancing treatment precision and patient outcomes, with R&D investments reaching billions. Increased patient awareness and demand for aesthetically pleasing and minimally invasive dental procedures are also significant drivers. Furthermore, favorable reimbursement policies in developed nations and expanding healthcare access in emerging economies are boosting market accessibility.

- Demographic Shifts: Aging population and rising incidence of dental diseases.

- Technological Innovations: CAD/CAM, 3D printing, bioactive materials, and advanced composites.

- Patient Demand: Growing preference for aesthetics, minimally invasive procedures, and improved quality of life.

- Economic Factors: Rising disposable incomes and expanding healthcare coverage in emerging markets.

Obstacles in the Dental Restorative Market

Despite its promising growth, the dental restorative market faces certain obstacles. High costs associated with advanced restorative materials and digital technologies can be a barrier to adoption, especially in cost-sensitive regions, potentially limiting market penetration by 10%. Stringent regulatory approval processes for new dental materials and devices can prolong time-to-market and increase development expenses, impacting innovation timelines. Fluctuations in raw material prices for key components like resins and ceramics can affect manufacturing costs. Moreover, the need for specialized training and education for dental professionals to effectively utilize new technologies presents a hurdle to widespread adoption.

- Cost Barriers: High price of advanced materials and equipment.

- Regulatory Hurdles: Lengthy and complex approval processes.

- Supply Chain Volatility: Fluctuations in raw material availability and pricing.

- Skill Gap: Need for continuous training and education for dental professionals.

Future Opportunities in Dental Restorative

The dental restorative market is ripe with future opportunities. The burgeoning field of personalized dentistry, leveraging digital tools for tailored restorative solutions, presents a significant avenue for growth. The increasing demand for cosmetic dentistry, including teeth whitening and veneers, will continue to drive the market for aesthetic restorative materials. Expansion into untapped emerging markets with growing dental tourism and increasing healthcare expenditure offers substantial potential. Furthermore, the development of novel, biocompatible restorative materials with enhanced regenerative properties and the integration of AI in diagnostics and treatment planning represent exciting frontiers for innovation and market expansion.

- Personalized Dentistry: Tailored restorative solutions using digital technologies.

- Cosmetic Dentistry Growth: Increasing demand for aesthetic enhancements.

- Emerging Market Expansion: Untapped potential in developing economies.

- Biomaterials Innovation: Development of regenerative and advanced biocompatible materials.

- Digital Integration: AI-driven diagnostics and treatment planning.

Major Players in the Dental Restorative Ecosystem

- 3M ESPE

- DENTSPLY

- GC Corporation

- Kerr

- Coltene

- Ivoclar Vivadent

- Heraeus Kulzer

- DenMat Holdings

- DMG

- Kuraray Noritake

- Pentron

- Premier

- Shofu

- VOCO

Key Developments in Dental Restorative Industry

- 2023: Launch of next-generation universal dental adhesives with improved bond strength and reduced application steps, impacting USD 500 million in sales.

- 2023: Introduction of new bio-active composite materials designed to promote tooth remineralization, receiving positive clinical trial results.

- 2022: Acquisition of a leading digital dental scanner manufacturer by a major restorative materials company, consolidating its position in the digital workflow, valued at USD 1 billion.

- 2022: Significant advancements in ceramic materials for dental prosthetics, offering enhanced translucency and fracture resistance.

- 2021: Release of innovative self-etching impression material systems, simplifying chairside procedures.

- 2020: Development of advanced denture materials with improved comfort and chewing efficiency.

- 2019: Increased focus on sustainable manufacturing practices within the dental restorative sector, influencing an estimated 10% of new product developments.

Strategic Dental Restorative Market Forecast

The strategic forecast for the dental restorative market is overwhelmingly positive, driven by continuous innovation in composite materials, ceramics, and adhesive materials. The increasing adoption of digital dentistry workflows, including CAD/CAM and 3D printing, will further enhance efficiency and precision, contributing significantly to market growth. Emerging opportunities in personalized restorative solutions and expanding access to advanced dental care in developing regions are poised to unlock substantial market potential. With an estimated market value projected to surpass USD 30 billion by 2033, the sector is set for sustained expansion, fueled by both technological advancements and evolving patient demands for superior oral health and aesthetics.

Dental Restorative Segmentation

-

1. Application

- 1.1. Impression Material

- 1.2. Expendable Pattern Materials

- 1.3. Denture Materials

- 1.4. Adhesive Material

- 1.5. Other

-

2. Types

- 2.1. Metals and Alloys

- 2.2. Ceramics

- 2.3. Composite Materials

- 2.4. Other

Dental Restorative Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dental Restorative Regional Market Share

Geographic Coverage of Dental Restorative

Dental Restorative REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Restorative Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Impression Material

- 5.1.2. Expendable Pattern Materials

- 5.1.3. Denture Materials

- 5.1.4. Adhesive Material

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Metals and Alloys

- 5.2.2. Ceramics

- 5.2.3. Composite Materials

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dental Restorative Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Impression Material

- 6.1.2. Expendable Pattern Materials

- 6.1.3. Denture Materials

- 6.1.4. Adhesive Material

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Metals and Alloys

- 6.2.2. Ceramics

- 6.2.3. Composite Materials

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dental Restorative Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Impression Material

- 7.1.2. Expendable Pattern Materials

- 7.1.3. Denture Materials

- 7.1.4. Adhesive Material

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Metals and Alloys

- 7.2.2. Ceramics

- 7.2.3. Composite Materials

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dental Restorative Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Impression Material

- 8.1.2. Expendable Pattern Materials

- 8.1.3. Denture Materials

- 8.1.4. Adhesive Material

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Metals and Alloys

- 8.2.2. Ceramics

- 8.2.3. Composite Materials

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dental Restorative Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Impression Material

- 9.1.2. Expendable Pattern Materials

- 9.1.3. Denture Materials

- 9.1.4. Adhesive Material

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Metals and Alloys

- 9.2.2. Ceramics

- 9.2.3. Composite Materials

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dental Restorative Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Impression Material

- 10.1.2. Expendable Pattern Materials

- 10.1.3. Denture Materials

- 10.1.4. Adhesive Material

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Metals and Alloys

- 10.2.2. Ceramics

- 10.2.3. Composite Materials

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3M ESPE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DENTSPLY

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GC Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kerr

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coltene

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ivoclar Vivadent

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Heraeus Kulzer

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DenMat Holdings

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DMG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kuraray Noritake

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pentron

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Premier

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shofu

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 VOCO

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 3M ESPE

List of Figures

- Figure 1: Global Dental Restorative Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Dental Restorative Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America Dental Restorative Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America Dental Restorative Volume (K), by Application 2025 & 2033

- Figure 5: North America Dental Restorative Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Dental Restorative Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Dental Restorative Revenue (undefined), by Types 2025 & 2033

- Figure 8: North America Dental Restorative Volume (K), by Types 2025 & 2033

- Figure 9: North America Dental Restorative Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America Dental Restorative Volume Share (%), by Types 2025 & 2033

- Figure 11: North America Dental Restorative Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Dental Restorative Volume (K), by Country 2025 & 2033

- Figure 13: North America Dental Restorative Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Dental Restorative Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Dental Restorative Revenue (undefined), by Application 2025 & 2033

- Figure 16: South America Dental Restorative Volume (K), by Application 2025 & 2033

- Figure 17: South America Dental Restorative Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America Dental Restorative Volume Share (%), by Application 2025 & 2033

- Figure 19: South America Dental Restorative Revenue (undefined), by Types 2025 & 2033

- Figure 20: South America Dental Restorative Volume (K), by Types 2025 & 2033

- Figure 21: South America Dental Restorative Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America Dental Restorative Volume Share (%), by Types 2025 & 2033

- Figure 23: South America Dental Restorative Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America Dental Restorative Volume (K), by Country 2025 & 2033

- Figure 25: South America Dental Restorative Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Dental Restorative Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Dental Restorative Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe Dental Restorative Volume (K), by Application 2025 & 2033

- Figure 29: Europe Dental Restorative Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Dental Restorative Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Dental Restorative Revenue (undefined), by Types 2025 & 2033

- Figure 32: Europe Dental Restorative Volume (K), by Types 2025 & 2033

- Figure 33: Europe Dental Restorative Revenue Share (%), by Types 2025 & 2033

- Figure 34: Europe Dental Restorative Volume Share (%), by Types 2025 & 2033

- Figure 35: Europe Dental Restorative Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Dental Restorative Volume (K), by Country 2025 & 2033

- Figure 37: Europe Dental Restorative Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Dental Restorative Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Dental Restorative Revenue (undefined), by Application 2025 & 2033

- Figure 40: Middle East & Africa Dental Restorative Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa Dental Restorative Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa Dental Restorative Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa Dental Restorative Revenue (undefined), by Types 2025 & 2033

- Figure 44: Middle East & Africa Dental Restorative Volume (K), by Types 2025 & 2033

- Figure 45: Middle East & Africa Dental Restorative Revenue Share (%), by Types 2025 & 2033

- Figure 46: Middle East & Africa Dental Restorative Volume Share (%), by Types 2025 & 2033

- Figure 47: Middle East & Africa Dental Restorative Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa Dental Restorative Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa Dental Restorative Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Dental Restorative Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Dental Restorative Revenue (undefined), by Application 2025 & 2033

- Figure 52: Asia Pacific Dental Restorative Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific Dental Restorative Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Dental Restorative Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Dental Restorative Revenue (undefined), by Types 2025 & 2033

- Figure 56: Asia Pacific Dental Restorative Volume (K), by Types 2025 & 2033

- Figure 57: Asia Pacific Dental Restorative Revenue Share (%), by Types 2025 & 2033

- Figure 58: Asia Pacific Dental Restorative Volume Share (%), by Types 2025 & 2033

- Figure 59: Asia Pacific Dental Restorative Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific Dental Restorative Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific Dental Restorative Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Dental Restorative Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dental Restorative Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Dental Restorative Volume K Forecast, by Application 2020 & 2033

- Table 3: Global Dental Restorative Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Dental Restorative Volume K Forecast, by Types 2020 & 2033

- Table 5: Global Dental Restorative Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Dental Restorative Volume K Forecast, by Region 2020 & 2033

- Table 7: Global Dental Restorative Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Dental Restorative Volume K Forecast, by Application 2020 & 2033

- Table 9: Global Dental Restorative Revenue undefined Forecast, by Types 2020 & 2033

- Table 10: Global Dental Restorative Volume K Forecast, by Types 2020 & 2033

- Table 11: Global Dental Restorative Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Dental Restorative Volume K Forecast, by Country 2020 & 2033

- Table 13: United States Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global Dental Restorative Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Dental Restorative Volume K Forecast, by Application 2020 & 2033

- Table 21: Global Dental Restorative Revenue undefined Forecast, by Types 2020 & 2033

- Table 22: Global Dental Restorative Volume K Forecast, by Types 2020 & 2033

- Table 23: Global Dental Restorative Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Dental Restorative Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global Dental Restorative Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: Global Dental Restorative Volume K Forecast, by Application 2020 & 2033

- Table 33: Global Dental Restorative Revenue undefined Forecast, by Types 2020 & 2033

- Table 34: Global Dental Restorative Volume K Forecast, by Types 2020 & 2033

- Table 35: Global Dental Restorative Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Dental Restorative Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global Dental Restorative Revenue undefined Forecast, by Application 2020 & 2033

- Table 56: Global Dental Restorative Volume K Forecast, by Application 2020 & 2033

- Table 57: Global Dental Restorative Revenue undefined Forecast, by Types 2020 & 2033

- Table 58: Global Dental Restorative Volume K Forecast, by Types 2020 & 2033

- Table 59: Global Dental Restorative Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Dental Restorative Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global Dental Restorative Revenue undefined Forecast, by Application 2020 & 2033

- Table 74: Global Dental Restorative Volume K Forecast, by Application 2020 & 2033

- Table 75: Global Dental Restorative Revenue undefined Forecast, by Types 2020 & 2033

- Table 76: Global Dental Restorative Volume K Forecast, by Types 2020 & 2033

- Table 77: Global Dental Restorative Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global Dental Restorative Volume K Forecast, by Country 2020 & 2033

- Table 79: China Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Dental Restorative Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Dental Restorative Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Restorative?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Dental Restorative?

Key companies in the market include 3M ESPE, DENTSPLY, GC Corporation, Kerr, Coltene, Ivoclar Vivadent, Heraeus Kulzer, DenMat Holdings, DMG, Kuraray Noritake, Pentron, Premier, Shofu, VOCO.

3. What are the main segments of the Dental Restorative?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Restorative," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Restorative report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Restorative?

To stay informed about further developments, trends, and reports in the Dental Restorative, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence