Key Insights

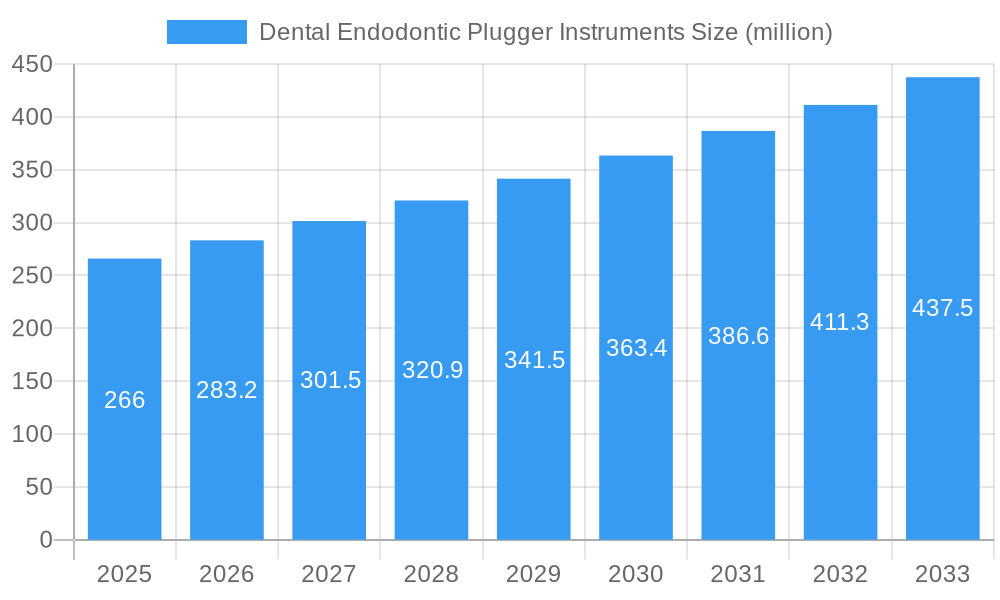

The global Dental Endodontic Plugger Instruments market is poised for significant expansion, projected to reach an estimated $266 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% anticipated throughout the forecast period of 2025-2033. This upward trajectory is primarily propelled by a confluence of escalating global dental health awareness, a growing prevalence of dental caries and endodontic issues, and the increasing adoption of advanced endodontic procedures. The rising demand for minimally invasive treatments and the continuous innovation in material science, particularly with Nickel-Titanium (NiTi) alloys offering enhanced flexibility and durability, are further acting as strong market drivers. Furthermore, the expanding dental tourism sector in developing economies is also contributing to the increased consumption of endodontic instruments, fueling market growth.

Dental Endodontic Plugger Instruments Market Size (In Million)

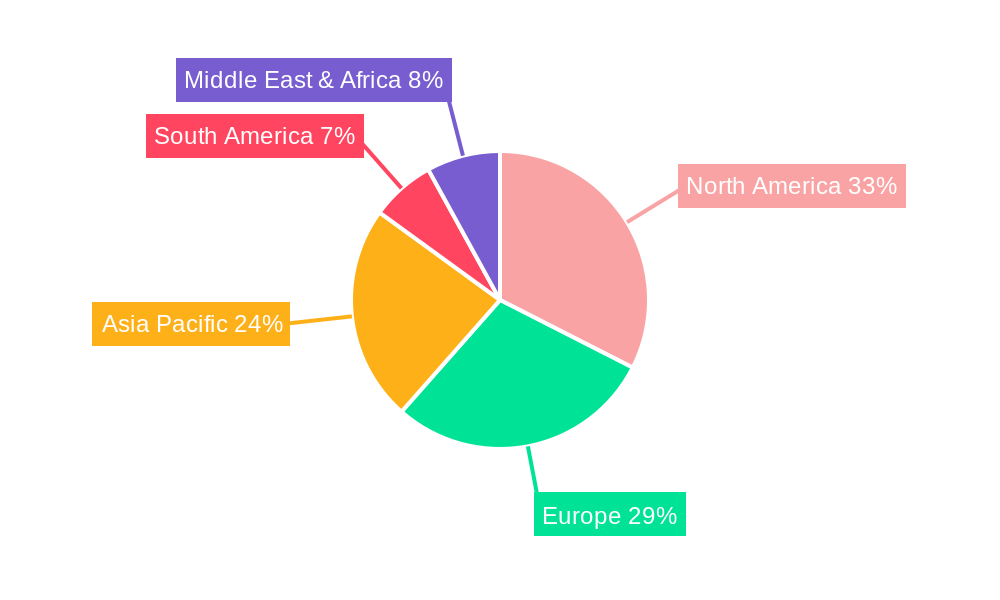

The market landscape is characterized by several key trends, including the development of ergonomic plugger designs that reduce clinician fatigue and improve procedural efficiency, and the integration of antimicrobial properties in instrument materials to enhance patient safety. The dominance of NiTi instruments is expected to continue due to their superior performance characteristics, although stainless steel remains a viable option for specific applications and cost-conscious markets. Hospitals and specialized dental clinics represent the primary application segments, driven by higher patient volumes and access to advanced dental technologies. Geographically, North America and Europe are expected to maintain their leading positions owing to well-established healthcare infrastructures and high disposable incomes. However, the Asia Pacific region, particularly China and India, is projected to witness the fastest growth, fueled by a burgeoning middle class, increasing dental insurance penetration, and government initiatives to improve oral healthcare access. Despite the positive outlook, factors such as the high cost of advanced endodontic instruments and the need for specialized training for their effective utilization could pose moderate restraints to market expansion.

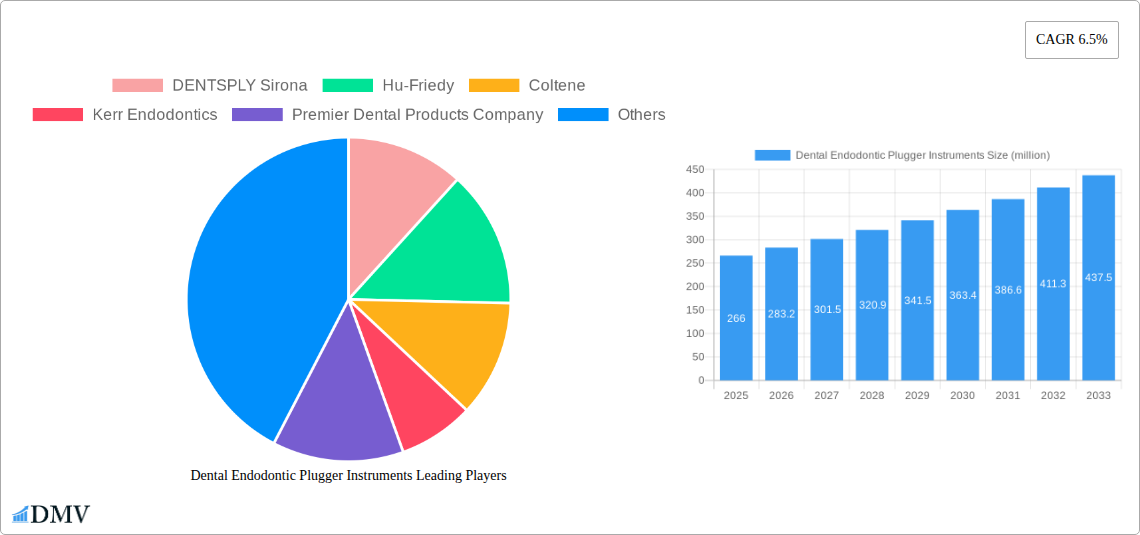

Dental Endodontic Plugger Instruments Company Market Share

Dental Endodontic Plugger Instruments Market Composition & Trends

The global dental endodontic plugger instruments market is characterized by a moderate to high concentration, with key players like DENTSPLY Sirona, Hu-Friedy, Coltene, Kerr Endodontics, and Mani, Inc. commanding significant market share. Innovation remains a primary catalyst, driven by the demand for minimally invasive procedures and improved patient outcomes. The regulatory landscape, overseen by bodies such as the FDA and EMA, emphasizes product safety and efficacy, influencing product development cycles. Substitute products, while present in the broader dental instrumentation sphere, offer limited direct competition to specialized endodontic pluggers. End-user profiles range from individual practitioners in dental clinics to larger hospital departments, each with distinct purchasing behaviors and volume requirements. Mergers and acquisitions (M&A) are a recurring theme, with strategic consolidations aiming to expand product portfolios and market reach. Recent M&A activities, such as the acquisition of smaller innovative firms by larger corporations, have been valued in the tens of millions. The market share distribution indicates that NiTi instruments are increasingly capturing a larger portion of the market due to their superior flexibility and handling properties.

- Market Concentration: Moderate to High

- Innovation Catalysts: Minimally invasive dentistry, enhanced patient comfort, improved treatment efficacy.

- Regulatory Landscape: Strict adherence to ISO standards, FDA and EMA guidelines.

- Substitute Products: Limited direct substitutes for specialized endodontic plugger functions.

- End-User Profiles: Dental Clinics (primary), Hospitals (secondary), Dental Schools/Research Institutions.

- M&A Deal Values: Estimated range of $10 million to $50 million for strategic acquisitions.

- Market Share Distribution: NiTi instruments projected to grow by an estimated 15% over the forecast period.

Dental Endodontic Plugger Instruments Industry Evolution

The dental endodontic plugger instruments industry has witnessed a robust growth trajectory throughout the historical period (2019-2024) and is poised for continued expansion through the forecast period (2025-2033). This evolution is underpinned by several interconnected factors, including increasing global awareness of oral health, a rising prevalence of dental caries and root canal treatments, and significant advancements in dental technology. During the historical period, the market experienced an average annual growth rate (AAGR) of approximately 5.8%, driven by a surge in demand for root canal therapies. This demand was further amplified by an aging global population and a greater emphasis on preserving natural teeth.

Technological advancements have been a cornerstone of this industry's evolution. The transition from traditional stainless steel pluggers to Nickel-Titanium (NiTi) instruments has been a defining trend. NiTi pluggers offer superior flexibility, shape memory, and non-cutting tips, allowing for more precise manipulation within the complex anatomy of root canals, thereby reducing the risk of procedural errors and improving treatment outcomes. This adoption metric for NiTi instruments has risen from an estimated 40% in 2019 to over 65% by 2024, with further growth anticipated. The development of advanced coating technologies and ergonomic designs for plugger handles has also contributed to enhanced clinician comfort and operational efficiency, leading to increased adoption rates.

Shifting consumer demands play a crucial role. Patients are increasingly seeking less invasive and more comfortable dental procedures. Endodontic pluggers, integral to the success of root canal treatments, directly contribute to achieving these patient-centric goals. The growing disposable income in emerging economies has also led to increased accessibility to advanced dental care, further fueling market expansion. The global dental endodontic plugger instruments market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, reaching an estimated market value of over $500 million by the end of the forecast period. This sustained growth is indicative of the indispensable role of these instruments in modern endodontics and the continuous innovation driving their development.

Leading Regions, Countries, or Segments in Dental Endodontic Plugger Instruments

The dental endodontic plugger instruments market exhibits significant regional variations, with North America currently leading in terms of market size and adoption. Within the Application segment, Dental Clinics represent the dominant end-user, accounting for an estimated 60% of the total market share. This dominance is attributed to the high volume of endodontic procedures performed in private practices and specialized endodontic centers. Hospitals, while significant, represent a secondary market, focusing on more complex cases and trauma-related endodontic treatments.

In terms of Type, NiTi pluggers are rapidly gaining traction and are projected to become the leading segment by the end of the forecast period, driven by their inherent advantages. However, stainless steel pluggers still hold a substantial market share, particularly in cost-sensitive markets and for specific procedural applications where their rigidity is preferred. The projected market share for NiTi instruments is expected to reach 75% by 2033, while stainless steel will likely stabilize around 23%, with 'Others' encompassing emerging materials and specialized designs.

Dominant Application Segment: Dental Clinics

- Key Drivers: High volume of routine endodontic procedures, preference for specialized treatments in private settings, growing patient awareness.

- Investment Trends: Significant investment by dental practitioners in advanced instrumentation for improved patient care and practice efficiency.

- Regulatory Support: Favorable regulatory environments in North America and Europe encourage the adoption of high-quality dental instruments.

- End-User Profiles: General dentists, endodontists, dental hygienists involved in post-operative care.

Dominant Instrument Type: NiTi Pluggers (projected)

- Key Drivers: Superior flexibility, corrosion resistance, biocompatibility, and shape memory allowing for better adaptation to root canal anatomy.

- Adoption Metrics: Increased demand due to a reduction in procedural complications and improved success rates of endodontic treatments.

- Technological Advancements: Continuous innovation in NiTi alloys and manufacturing processes enhancing performance and durability.

- Market Penetration: Expected to penetrate over 75% of the market by 2033, with continued research into enhanced NiTi properties.

North America's leadership is fueled by high per capita healthcare spending, advanced dental infrastructure, and a strong emphasis on research and development. The United States and Canada are key contributors, with a large patient pool and a high rate of adoption for new dental technologies. Europe follows closely, with countries like Germany, the UK, and France demonstrating substantial market share due to robust healthcare systems and an aging population requiring extensive dental care. Emerging economies in Asia-Pacific and Latin America are expected to witness the fastest growth rates, driven by increasing healthcare investments, improving access to dental education, and a growing middle class.

Dental Endodontic Plugger Instruments Product Innovations

Recent product innovations in dental endodontic plugger instruments focus on enhancing precision, patient comfort, and procedural efficiency. Manufacturers are developing pluggers with advanced NiTi alloys that offer superior flexibility and cyclic fatigue resistance, allowing for repeated use and reduced risk of breakage. Innovations include ergonomic handle designs for improved grip and control, minimizing clinician fatigue during prolonged procedures. Furthermore, specialized plugger tip geometries are being engineered to facilitate better condensation of obturating materials in challenging canal anatomies. Antimicrobial coatings are also being explored to further enhance patient safety and treatment outcomes, representing a significant unique selling proposition.

Propelling Factors for Dental Endodontic Plugger Instruments Growth

Several interconnected factors are propelling the growth of the dental endodontic plugger instruments market.

- Increasing Prevalence of Dental Caries and Root Canal Treatments: A growing global incidence of dental issues necessitates more endodontic interventions.

- Technological Advancements: The shift towards NiTi instruments and advanced manufacturing techniques improves treatment outcomes and clinician experience.

- Rising Oral Healthcare Awareness: Greater public understanding of oral hygiene and the importance of preserving natural teeth drives demand for root canal therapies.

- Aging Global Population: Older individuals are more susceptible to dental problems, leading to a higher demand for endodontic procedures.

- Favorable Reimbursement Policies: Expanding insurance coverage for dental treatments, including root canals, enhances accessibility.

Obstacles in the Dental Endodontic Plugger Instruments Market

Despite robust growth, the dental endodontic plugger instruments market faces certain obstacles.

- High Cost of Advanced Instruments: NiTi pluggers, while superior, can be significantly more expensive than traditional stainless steel options, limiting adoption in cost-sensitive regions or for smaller practices.

- Stringent Regulatory Approvals: Obtaining necessary approvals from regulatory bodies can be a lengthy and resource-intensive process, slowing down market entry for new products.

- Availability of Skilled Professionals: The effective use of advanced endodontic pluggers requires specialized training, and a shortage of highly skilled endodontists can limit procedural volume.

- Counterfeit Products: The presence of counterfeit or substandard instruments in the market can erode trust and pose risks to patient safety, impacting the perceived value of genuine products.

Future Opportunities in Dental Endodontic Plugger Instruments

The future of the dental endodontic plugger instruments market is ripe with opportunities.

- Emerging Markets: Significant growth potential exists in developing economies in Asia-Pacific, Latin America, and Africa as access to dental care improves.

- Minimally Invasive Endodontics: Continued research into less invasive techniques will drive demand for specialized, highly precise plugger designs.

- Integration with Digital Dentistry: Opportunities exist for pluggers compatible with advanced digital imaging and navigation systems.

- Biomaterials and Coatings: Development of pluggers with enhanced biocompatibility and antimicrobial properties will offer a competitive edge.

- Customization and Personalization: Tailored plugger designs for specific anatomical challenges or procedural preferences could emerge.

Major Players in the Dental Endodontic Plugger Instruments Ecosystem

- DENTSPLY Sirona

- Hu-Friedy

- Coltene

- Kerr Endodontics

- Premier Dental Products Company

- Mani, Inc.

- PDT, Inc.

- Kerr Corporation

- Integra lifesciences

- American Eagle Instruments

- Dentsply Maillefer

- Charles B. Schwed

Key Developments in Dental Endodontic Plugger Instruments Industry

- 2023 March: Hu-Friedy launches an enhanced line of NiTi endodontic pluggers featuring improved ergonomic designs and material properties.

- 2022 December: Coltene introduces a new generation of self-adapting pluggers designed for efficient condensation of bioceramic sealers.

- 2022 August: DENTSPLY Sirona expands its endodontic portfolio with the acquisition of a prominent NiTi instrument manufacturer, strengthening its market position.

- 2021 November: Kerr Endodontics unveils a novel plugger with a micro-textured tip for enhanced grip and material handling.

- 2021 May: Mani, Inc. announces the expansion of its global distribution network, increasing accessibility to its range of endodontic pluggers.

- 2020 September: Premier Dental Products Company receives regulatory approval for its innovative stainless steel plugger with a proprietary heat-treatment process.

- 2019 January: Integra LifeSciences acquires a company specializing in advanced dental materials, signaling a potential expansion into related instrumentation.

Strategic Dental Endodontic Plugger Instruments Market Forecast

The strategic forecast for the dental endodontic plugger instruments market is exceptionally positive, driven by a confluence of escalating demand for endodontic treatments, continuous technological innovation, and a growing global emphasis on oral health preservation. The market is projected to witness robust growth, fueled by the increasing adoption of advanced NiTi instruments, which offer superior performance and patient outcomes. Emerging economies present significant untapped potential, while established markets will continue to be driven by the need for sophisticated instrumentation. Strategic initiatives by major players, including product development and potential mergers, will further shape the market landscape, ensuring sustained expansion and a consistent demand for high-quality endodontic pluggers in the coming years.

Dental Endodontic Plugger Instruments Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Dental Clinics

- 1.3. Others

-

2. Type

- 2.1. NiTi

- 2.2. Stainless Steel

- 2.3. Others

Dental Endodontic Plugger Instruments Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dental Endodontic Plugger Instruments Regional Market Share

Geographic Coverage of Dental Endodontic Plugger Instruments

Dental Endodontic Plugger Instruments REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Endodontic Plugger Instruments Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Dental Clinics

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. NiTi

- 5.2.2. Stainless Steel

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dental Endodontic Plugger Instruments Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Dental Clinics

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. NiTi

- 6.2.2. Stainless Steel

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dental Endodontic Plugger Instruments Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Dental Clinics

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. NiTi

- 7.2.2. Stainless Steel

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dental Endodontic Plugger Instruments Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Dental Clinics

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. NiTi

- 8.2.2. Stainless Steel

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dental Endodontic Plugger Instruments Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Dental Clinics

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. NiTi

- 9.2.2. Stainless Steel

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dental Endodontic Plugger Instruments Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Dental Clinics

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. NiTi

- 10.2.2. Stainless Steel

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DENTSPLY Sirona

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hu-Friedy

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Coltene

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kerr Endodontics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Premier Dental Products Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mani Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PDT Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kerr Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Integra lifesciences

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 American Eagle Instruments

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dentsply Maillefer

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Charles B. Schwed

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 DENTSPLY Sirona

List of Figures

- Figure 1: Global Dental Endodontic Plugger Instruments Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Dental Endodontic Plugger Instruments Revenue (million), by Application 2025 & 2033

- Figure 3: North America Dental Endodontic Plugger Instruments Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Dental Endodontic Plugger Instruments Revenue (million), by Type 2025 & 2033

- Figure 5: North America Dental Endodontic Plugger Instruments Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Dental Endodontic Plugger Instruments Revenue (million), by Country 2025 & 2033

- Figure 7: North America Dental Endodontic Plugger Instruments Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Dental Endodontic Plugger Instruments Revenue (million), by Application 2025 & 2033

- Figure 9: South America Dental Endodontic Plugger Instruments Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Dental Endodontic Plugger Instruments Revenue (million), by Type 2025 & 2033

- Figure 11: South America Dental Endodontic Plugger Instruments Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Dental Endodontic Plugger Instruments Revenue (million), by Country 2025 & 2033

- Figure 13: South America Dental Endodontic Plugger Instruments Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Dental Endodontic Plugger Instruments Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Dental Endodontic Plugger Instruments Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Dental Endodontic Plugger Instruments Revenue (million), by Type 2025 & 2033

- Figure 17: Europe Dental Endodontic Plugger Instruments Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Dental Endodontic Plugger Instruments Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Dental Endodontic Plugger Instruments Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Dental Endodontic Plugger Instruments Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Dental Endodontic Plugger Instruments Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Dental Endodontic Plugger Instruments Revenue (million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Dental Endodontic Plugger Instruments Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Dental Endodontic Plugger Instruments Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Dental Endodontic Plugger Instruments Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Dental Endodontic Plugger Instruments Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Dental Endodontic Plugger Instruments Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Dental Endodontic Plugger Instruments Revenue (million), by Type 2025 & 2033

- Figure 29: Asia Pacific Dental Endodontic Plugger Instruments Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Dental Endodontic Plugger Instruments Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Dental Endodontic Plugger Instruments Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Type 2020 & 2033

- Table 3: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Type 2020 & 2033

- Table 12: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Type 2020 & 2033

- Table 18: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Type 2020 & 2033

- Table 30: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Type 2020 & 2033

- Table 39: Global Dental Endodontic Plugger Instruments Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Dental Endodontic Plugger Instruments Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Endodontic Plugger Instruments?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Dental Endodontic Plugger Instruments?

Key companies in the market include DENTSPLY Sirona, Hu-Friedy, Coltene, Kerr Endodontics, Premier Dental Products Company, Mani, Inc., PDT, Inc., Kerr Corporation, Integra lifesciences, American Eagle Instruments, Dentsply Maillefer, Charles B. Schwed.

3. What are the main segments of the Dental Endodontic Plugger Instruments?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 266 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Endodontic Plugger Instruments," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Endodontic Plugger Instruments report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Endodontic Plugger Instruments?

To stay informed about further developments, trends, and reports in the Dental Endodontic Plugger Instruments, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence