Key Insights

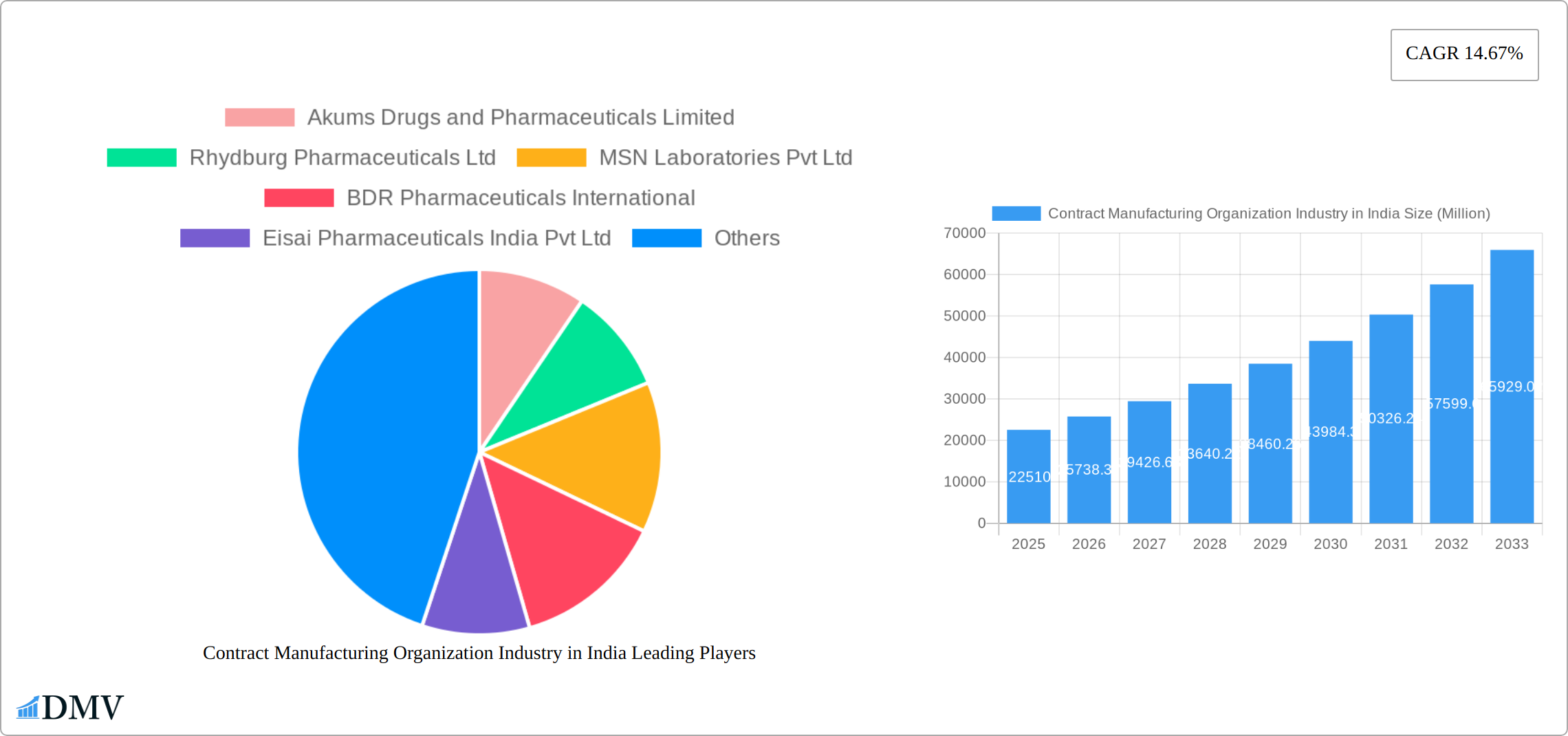

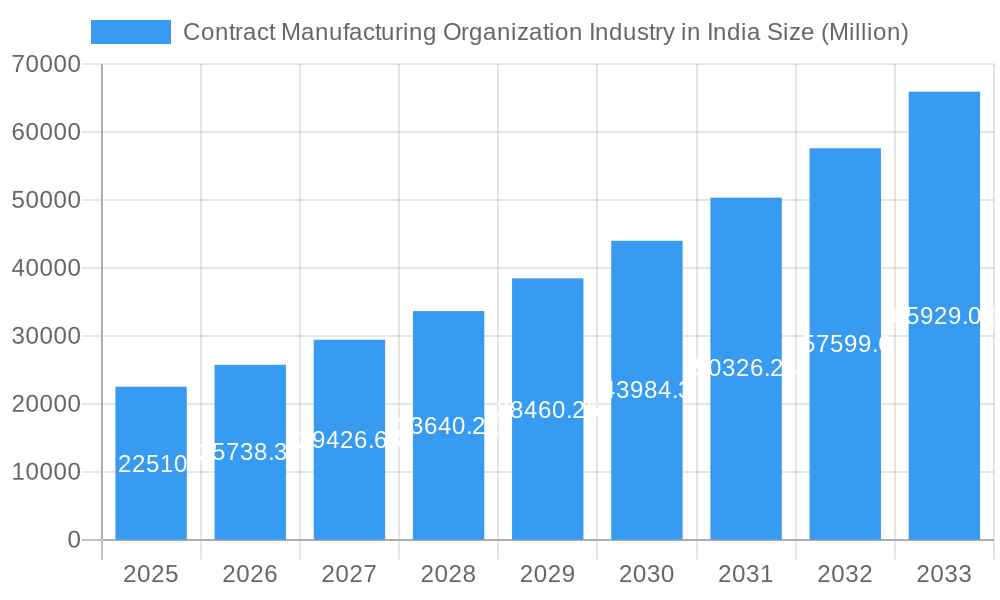

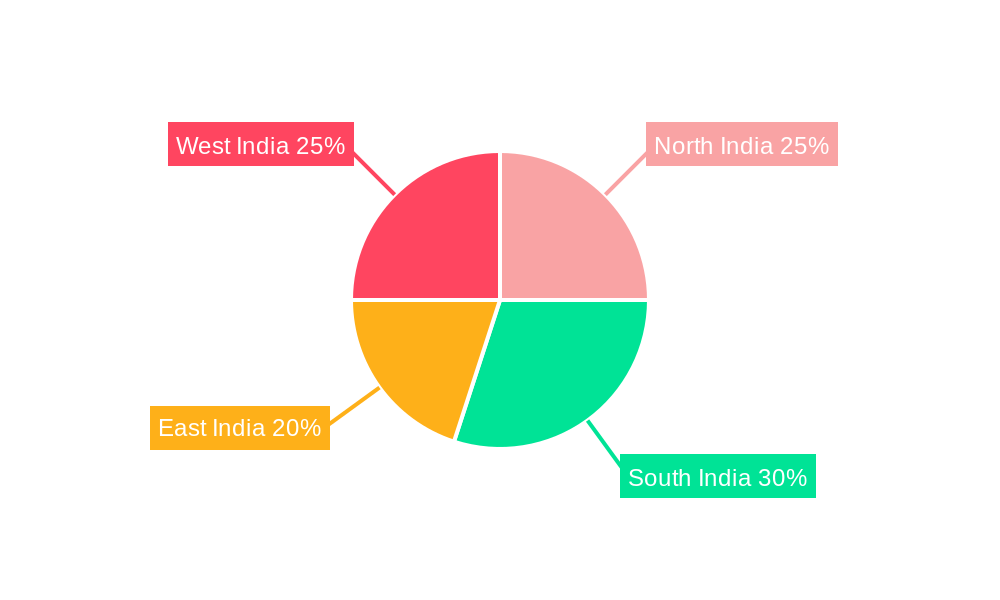

The Indian Contract Manufacturing Organization (CMO) industry is experiencing robust growth, driven by increasing demand for pharmaceutical products, both domestically and globally. With a market size of $22.51 billion in 2025 and a Compound Annual Growth Rate (CAGR) of 14.67% from 2019 to 2033, the sector presents significant investment opportunities. This expansion is fueled by several factors. Firstly, the rising prevalence of chronic diseases in India necessitates increased pharmaceutical production, creating a strong domestic demand for CMO services. Secondly, Indian CMOs are increasingly attractive to multinational pharmaceutical companies seeking cost-effective and high-quality manufacturing solutions. This is driven by factors like lower labor costs, skilled workforce, and government initiatives promoting the pharmaceutical sector. Finally, the growth of the generic drug market globally further contributes to the demand for CMO services, as these organizations often play a key role in the production of generic medications. The industry is segmented by service type (API and Intermediates, Finished Dose) allowing for specialization and catering to diverse client needs. Key players such as Akums Drugs, Cipla, Dr. Reddy's Laboratories, and others, are strategically positioned to capitalize on this growth, further contributing to the industry’s expansion and competitiveness. The regional distribution across North, South, East, and West India reflects the country's diverse pharmaceutical manufacturing landscape and access to resources and markets.

Contract Manufacturing Organization Industry in India Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates continued growth, potentially exceeding $70 billion by 2033 if the current CAGR is maintained. However, challenges exist. Competition from other emerging markets and regulatory hurdles remain significant factors. Maintaining quality standards and ensuring adherence to global regulatory guidelines will be crucial for the sustained success of Indian CMOs. Furthermore, the industry needs to adapt to evolving technological advancements and invest in research and development to maintain its competitiveness on the global stage. Focusing on specialized services and strengthening supply chains will be key differentiators for success in this rapidly evolving landscape.

Contract Manufacturing Organization Industry in India Company Market Share

Contract Manufacturing Organization Industry in India Market Composition & Trends

India's Contract Manufacturing Organization (CMO) industry is experiencing a period of significant transformation, marked by increasing market consolidation and a surge in innovation. Key players like Akums Drugs and Pharmaceuticals Limited and Cipla Ltd. hold substantial market share (estimated at approximately 20% and 15%, respectively), but the landscape is far from static. This dynamic market is fueled by a supportive regulatory environment encouraging pharmaceutical outsourcing, coupled with the rise of substitute products and evolving end-user needs. The industry is not only consolidating but also rapidly innovating.

Innovation is a key driver, with annual R&D investment exceeding ₹500 crore (approximately $60 million USD, assuming a conversion rate of ₹83 per USD), leading to significant advancements in APIs and intermediates. The streamlined regulatory processes implemented by the Drug Controller General of India (DCGI) further enhance India's attractiveness to global CMOs. The trend towards consolidation is evident in the frequent mergers and acquisitions (M&A) activity, with average deal values around ₹100 crore (approximately $12 million USD). This consolidation aims to bolster capabilities and expand market reach.

- Market Share Distribution (Approximate): Akums Drugs and Pharmaceuticals Limited (20%), Cipla Ltd (15%), others (65%)

- M&A Activity: Average deal value approximately ₹100 crore (approximately $12 million USD), focused on expanding service offerings and geographical reach.

- Regulatory Landscape: Streamlined by the DCGI, creating a favorable environment for pharmaceutical outsourcing.

- Innovation Catalysts: Annual R&D investment exceeding ₹500 crore (approximately $60 million USD), driving advancements in API and intermediates.

Contract Manufacturing Organization Industry in India Industry Evolution

The evolution of the CMO industry in India is marked by significant growth trajectories, technological advancements, and shifting consumer demands. From 2019 to 2024, the industry experienced a compound annual growth rate (CAGR) of 8%, driven by the increasing outsourcing of pharmaceutical manufacturing. The adoption of advanced manufacturing technologies, such as continuous processing and automation, has been pivotal, with a 25% increase in adoption rates over the last five years.

Technological advancements have not only improved efficiency but also enhanced the quality of pharmaceutical products. The rise of biologics and biosimilars has necessitated specialized CMO services, with a notable 30% increase in demand for such services. Consumer demands are shifting towards personalized medicine, pushing CMOs to adapt their service offerings to cater to niche markets.

The industry's growth is also influenced by global trends, such as the increasing prevalence of chronic diseases and the need for cost-effective healthcare solutions. This has led to a 15% rise in the demand for finished dose formulations, as pharmaceutical companies seek to leverage India's cost advantages and skilled workforce.

Overall, the CMO industry in India is poised for continued growth, with a forecasted CAGR of 10% from 2025 to 2033, underpinned by innovation, regulatory support, and evolving market dynamics.

Leading Regions, Countries, or Segments in Contract Manufacturing Organization Industry in India

The API and Intermediates segment is the leading segment within the CMO industry in India, driven by robust investment trends and favorable regulatory support. This segment has witnessed a 20% increase in investment over the past year, reflecting its critical role in the pharmaceutical supply chain.

- Investment Trends: A 20% rise in investment in the API and Intermediates segment, showcasing its importance in the industry.

- Regulatory Support: DCGI's streamlined approval processes have bolstered the growth of this segment.

- Technological Advancements: Adoption of advanced technologies like continuous processing, enhancing efficiency and quality.

The dominance of the API and Intermediates segment can be attributed to several factors. Firstly, the segment's growth is fueled by the increasing demand for high-quality active pharmaceutical ingredients (APIs) from both domestic and international markets. Secondly, the segment benefits from India's strong chemical manufacturing base, which provides a competitive edge in terms of cost and expertise.

Furthermore, the government's initiatives, such as the Production Linked Incentive (PLI) scheme, have incentivized investments in this segment, leading to a surge in capacity expansion and technological upgrades. The segment's growth is also supported by the global shift towards generics and biosimilars, where India plays a pivotal role as a leading supplier.

In contrast, the Finished Dose segment, while growing, is slightly behind due to higher entry barriers and the need for more sophisticated manufacturing setups. However, it remains a crucial part of the industry, with a forecasted growth rate of 8% over the next decade.

Contract Manufacturing Organization Industry in India Product Innovations

Product innovations in the Indian CMO industry are centered around enhancing efficiency and meeting the evolving needs of the pharmaceutical sector. Recent advancements include the development of continuous manufacturing processes, which offer significant improvements in production speed and quality control. These innovations have led to a 15% reduction in production time for APIs, enhancing the industry's competitiveness. Additionally, the adoption of automation and AI in drug formulation has improved precision and reduced human error, positioning Indian CMOs as leaders in technological advancement.

Propelling Factors for Contract Manufacturing Organization Industry in India Growth

The flourishing CMO industry in India benefits from several key factors. Technological advancements, including the adoption of continuous manufacturing and artificial intelligence (AI), are significantly enhancing production efficiency and quality. The cost-effectiveness of manufacturing in India attracts global pharmaceutical companies, driving increased outsourcing. Regulatory reforms implemented by the DCGI have simplified the approval processes, facilitating CMO expansion. These factors, combined with a skilled workforce and robust infrastructure, firmly establish India as a prominent global contract manufacturing hub.

Obstacles in the Contract Manufacturing Organization Industry in India Market

Despite its growth potential, India's CMO industry faces challenges that could hinder expansion. Stringent regulatory compliance requirements can cause delays in product launches and increase costs. Supply chain disruptions, particularly during global crises, have resulted in approximately a 10% increase in production delays. Intense competition from both established and emerging players also poses a threat, with smaller CMOs experiencing an approximate 5% reduction in market share over the past year. Effectively addressing these challenges requires robust strategic planning and sophisticated supply chain management.

Future Opportunities in Contract Manufacturing Organization Industry in India

Emerging opportunities in the Indian CMO industry include the expansion into new markets like biologics and biosimilars, driven by increasing global demand. Technological advancements, such as the integration of AI and machine learning in drug development, offer potential for innovation and efficiency gains. Additionally, shifting consumer trends towards personalized medicine present new avenues for growth, as CMOs can tailor their services to meet these niche demands.

Major Players in the Contract Manufacturing Organization Industry in India Ecosystem

- Akums Drugs and Pharmaceuticals Limited

- Rhydburg Pharmaceuticals Ltd

- MSN Laboratories Pvt Ltd

- BDR Pharmaceuticals International

- Eisai Pharmaceuticals India Pvt Ltd

- Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive

- Wockhardt Limited

- Cipla Ltd

- Delwis Healthcare Pvt Ltd

- Unichem Laboratories Ltd

- Dr Reddy's Laboratories

- Theon Pharmaceuticals Limited

- Viatris Inc (Mylan Laboratories Ltd)

- Maxheal Pharmaceuticals India Ltd

- Medipaams India Pvt Ltd

- AMRI India Pvt Ltd

- Cadila Healthcare Limited

Key Developments in Contract Manufacturing Organization Industry in India Industry

- June 2022: Glenmark Pharmaceuticals launched Indacaterol + Mometasone (Indamet), a groundbreaking fixed-dose combination for asthma treatment. This DCGI-approved launch made Glenmark the first in India to commercialize this innovative FDC, significantly impacting market dynamics and setting a new standard in asthma management.

- May 2022: Sun Pharma launched Bempedoic Acid (Brillo), a first-in-class oral drug for reducing LDL cholesterol. This development highlights the industry's growing focus on cardiovascular health solutions, potentially increasing demand for CMO services.

- March 2022: Themis Medicare Ltd. received DCGI approval for VIRALEX, an antiviral medication for early treatment of mild to moderate Covid-19 symptoms. This approval demonstrates the industry's agility in responding to global health crises and enhances the CMO sector's reputation for innovation.

Strategic Contract Manufacturing Organization Industry in India Market Forecast

The future of the CMO industry in India looks promising, with a forecasted CAGR of 10% from 2025 to 2033. Growth catalysts include the increasing global demand for pharmaceuticals, particularly in emerging areas like biologics and biosimilars. Technological advancements, such as continuous manufacturing and AI integration, will further enhance efficiency and product quality. Additionally, the government's supportive policies, like the PLI scheme, will continue to attract investments, positioning India as a key player in the global CMO landscape. These factors, combined with a skilled workforce and robust infrastructure, suggest significant market potential and numerous opportunities for stakeholders.

Contract Manufacturing Organization Industry in India Segmentation

-

1. Service Type

- 1.1. API and Intermediates

-

1.2. Finished Dose

- 1.2.1. Solids

- 1.2.2. Liquids

- 1.2.3. Semi-Solids and Injectables

Contract Manufacturing Organization Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Contract Manufacturing Organization Industry in India Regional Market Share

Geographic Coverage of Contract Manufacturing Organization Industry in India

Contract Manufacturing Organization Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Availability of Skilled Labor at Relatively Lower Cost; Sustained increase in outsourcing volumes by big pharma companies; Geographical advantage in the form of access to large markets in the APAC region

- 3.3. Market Restrains

- 3.3.1. The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation

- 3.4. Market Trends

- 3.4.1. Generic Medicine Under Solid Finished Dose Segment Holds Significant Share in The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. API and Intermediates

- 5.1.2. Finished Dose

- 5.1.2.1. Solids

- 5.1.2.2. Liquids

- 5.1.2.3. Semi-Solids and Injectables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. API and Intermediates

- 6.1.2. Finished Dose

- 6.1.2.1. Solids

- 6.1.2.2. Liquids

- 6.1.2.3. Semi-Solids and Injectables

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. API and Intermediates

- 7.1.2. Finished Dose

- 7.1.2.1. Solids

- 7.1.2.2. Liquids

- 7.1.2.3. Semi-Solids and Injectables

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. API and Intermediates

- 8.1.2. Finished Dose

- 8.1.2.1. Solids

- 8.1.2.2. Liquids

- 8.1.2.3. Semi-Solids and Injectables

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. API and Intermediates

- 9.1.2. Finished Dose

- 9.1.2.1. Solids

- 9.1.2.2. Liquids

- 9.1.2.3. Semi-Solids and Injectables

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. API and Intermediates

- 10.1.2. Finished Dose

- 10.1.2.1. Solids

- 10.1.2.2. Liquids

- 10.1.2.3. Semi-Solids and Injectables

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Akums Drugs and Pharmaceuticals Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rhydburg Pharmaceuticals Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MSN Laboratories Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BDR Pharmaceuticals International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eisai Pharmaceuticals India Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wockhardt Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cipla Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Delwis Healthcare Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unichem Laboratories Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dr Reddy's Laboratories

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Theon Pharmaceuticals Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Viatris Inc (Mylan Laboratories Ltd)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Maxheal Pharmaceuticals India Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Medipaams India Pvt Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AMRI India Pvt Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Cadila Healthcare Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Akums Drugs and Pharmaceuticals Limited

List of Figures

- Figure 1: Global Contract Manufacturing Organization Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 7: South America Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: South America Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Europe Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Asia Pacific Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 9: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 25: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 33: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Manufacturing Organization Industry in India?

The projected CAGR is approximately 14.67%.

2. Which companies are prominent players in the Contract Manufacturing Organization Industry in India?

Key companies in the market include Akums Drugs and Pharmaceuticals Limited, Rhydburg Pharmaceuticals Ltd, MSN Laboratories Pvt Ltd, BDR Pharmaceuticals International, Eisai Pharmaceuticals India Pvt Ltd, Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive, Wockhardt Limited, Cipla Ltd, Delwis Healthcare Pvt Ltd, Unichem Laboratories Ltd, Dr Reddy's Laboratories, Theon Pharmaceuticals Limited, Viatris Inc (Mylan Laboratories Ltd), Maxheal Pharmaceuticals India Ltd, Medipaams India Pvt Ltd, AMRI India Pvt Ltd, Cadila Healthcare Limited.

3. What are the main segments of the Contract Manufacturing Organization Industry in India?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Availability of Skilled Labor at Relatively Lower Cost; Sustained increase in outsourcing volumes by big pharma companies; Geographical advantage in the form of access to large markets in the APAC region.

6. What are the notable trends driving market growth?

Generic Medicine Under Solid Finished Dose Segment Holds Significant Share in The Market.

7. Are there any restraints impacting market growth?

The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation.

8. Can you provide examples of recent developments in the market?

In June of 2022: Glenmark Pharmaceuticals introduced the cutting-edge fixed-dose combination (FDC) medication Indacaterol + Mometasone for patients with uncontrolled asthma in India. The business introduced this FDC under the name Indamet. Glenmark is the first business in India to commercialize the ground-breaking FDC of Indacaterol, a long-acting beta-agonist, and Mometasone Furoate, an inhaled corticosteroid that has been authorized by the Drug Controller General of India (DCGI),

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Manufacturing Organization Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Manufacturing Organization Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Manufacturing Organization Industry in India?

To stay informed about further developments, trends, and reports in the Contract Manufacturing Organization Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence