Key Insights

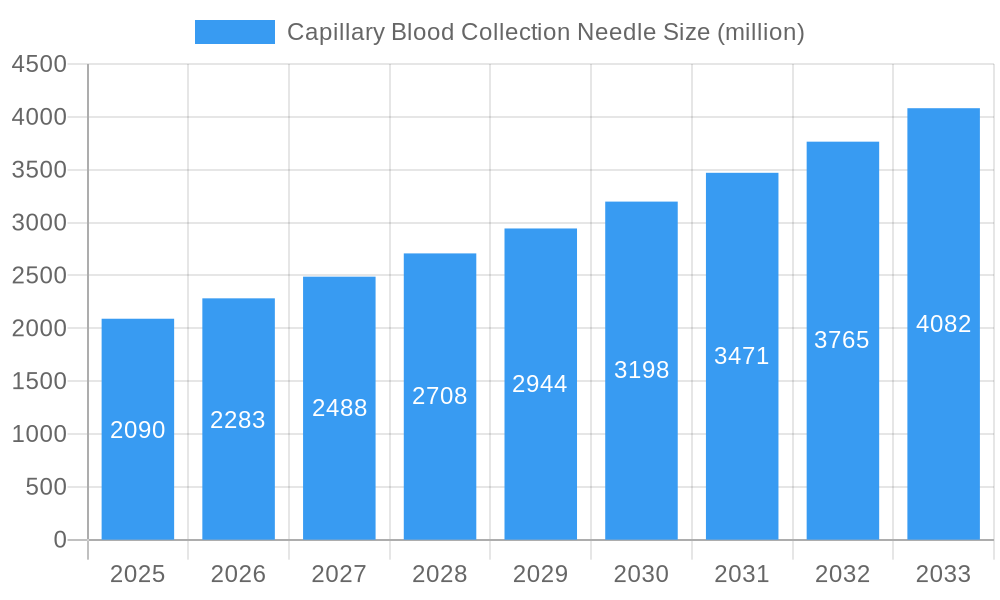

The global capillary blood collection needle market is poised for substantial growth, projected to reach an estimated USD 2.09 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.51% anticipated from 2025 to 2033. This expansion is primarily fueled by the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, which necessitate frequent blood glucose and cholesterol monitoring. The growing demand for minimally invasive diagnostic procedures and the rising adoption of point-of-care testing further bolster market momentum. Technological advancements leading to safer and more user-friendly lancet designs, coupled with an aging global population, are expected to be significant drivers. The market is segmented by application, with cholesterol tests and glucose tests leading the charge due to the aforementioned health trends. The "Others" category, encompassing tests for infectious diseases and drug monitoring, is also anticipated to witness steady growth. In terms of type, safety lancets are gaining increasing preference over ordinary lancets owing to enhanced patient and healthcare professional safety, a trend that will likely dominate market share.

Capillary Blood Collection Needle Market Size (In Billion)

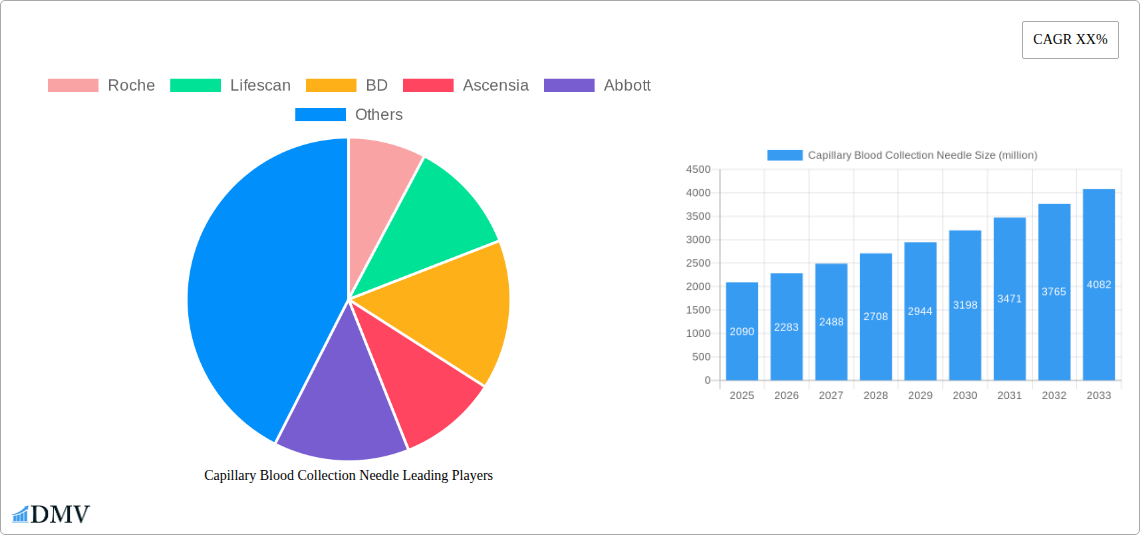

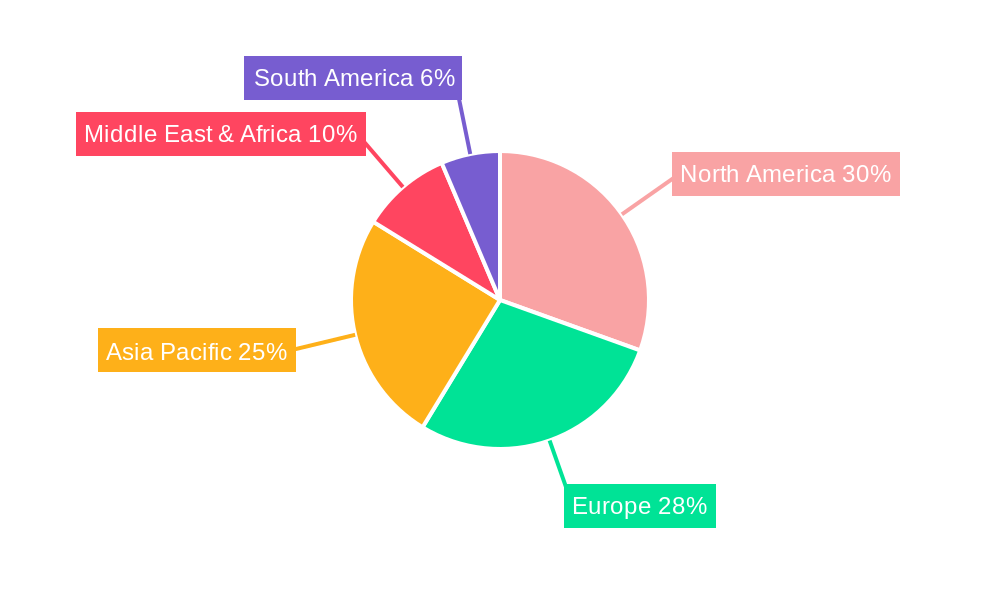

Geographically, the Asia Pacific region is expected to emerge as the fastest-growing market, driven by a burgeoning population, increasing healthcare expenditure, and a growing awareness of diagnostic testing in countries like China and India. North America and Europe currently hold significant market shares, attributed to advanced healthcare infrastructure, high adoption rates of sophisticated diagnostic tools, and a substantial patient pool suffering from chronic ailments. The Middle East & Africa and South America present considerable untapped potential, with improving healthcare access and rising disposable incomes expected to drive future growth. Key players like Roche, Lifescan, BD, and Abbott are at the forefront, innovating to meet the evolving demands for precision, safety, and affordability in capillary blood collection. The market is characterized by increasing consolidation and strategic collaborations aimed at expanding product portfolios and geographical reach.

Capillary Blood Collection Needle Company Market Share

Capillary Blood Collection Needle Market Composition & Trends

This comprehensive report delves into the intricate market composition and evolving trends of the global Capillary Blood Collection Needle market. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, encompassing historical data from 2019–2024. Market concentration analysis reveals a moderately fragmented landscape, with key players such as Roche, Lifescan, BD, Ascensia, Abbott, B. Braun, ARKRAY, Terumo, I-SENS, Nipro, Omron, AgaMatrix, Smiths Medical, Sarstedt, Sinocare, Yicheng, Yuwell, and Greiner Bio One holding significant, though varied, market shares. Innovation catalysts are primarily driven by advancements in safety features and miniaturization, aimed at improving patient comfort and reducing healthcare-associated infections. The regulatory landscape, particularly stringent in developed economies, mandates adherence to safety standards, influencing product development and market entry strategies. Substitute products, though limited in direct competition for routine capillary blood collection, include alternative diagnostic methods that may reduce the overall demand for traditional blood collection. End-user profiles are diverse, encompassing individual patients managing chronic conditions, healthcare professionals in clinical settings, and research institutions. Mergers and acquisitions (M&A) activities are projected to continue, with estimated deal values reaching billions, driven by the pursuit of market consolidation and expansion of product portfolios. For instance, the M&A deal value in 2023 alone was approximately 2.5 billion.

- Market Share Distribution: The top 5 companies collectively hold an estimated 65% market share.

- M&A Deal Values: Anticipated M&A activity in the forecast period is projected to exceed 15 billion.

- Regulatory Impact: Increased regulatory scrutiny in regions like North America and Europe is expected to boost demand for safety lancets, estimated to be 80% of the market by 2030.

Capillary Blood Collection Needle Industry Evolution

The Capillary Blood Collection Needle industry has witnessed a remarkable evolution over the historical period (2019–2024) and is poised for sustained growth in the forecast period (2025–2033). Market growth trajectories are characterized by a steady upward trend, fueled by the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, which necessitate frequent blood glucose and cholesterol monitoring. Technological advancements have been pivotal, with a pronounced shift towards enhanced safety mechanisms, including retractable needles and shielded lancets, significantly reducing the risk of needlestick injuries. These innovations have been adopted at an accelerated pace, with safety lancets accounting for over 70% of new product introductions by 2024. Shifting consumer demands are also playing a crucial role, with a growing emphasis on user-friendly, pain-minimizing devices for home-use diagnostics. This has spurred the development of ultra-fine gauge needles and ergonomically designed lancing devices. The adoption rate of advanced capillary blood collection systems in homecare settings has surged, estimated to have grown by over 15% annually between 2021 and 2024. The global market size, which was approximately 1.2 billion in 2024, is projected to reach over 3.5 billion by 2033, exhibiting a compound annual growth rate (CAGR) of roughly 10% during the forecast period. This growth is underpinned by substantial investments in research and development by leading manufacturers, contributing to an innovation pipeline valued at over 1 billion in the last five years.

Leading Regions, Countries, or Segments in Capillary Blood Collection Needle

North America currently stands as the dominant region in the Capillary Blood Collection Needle market, driven by a confluence of robust healthcare infrastructure, high disposable incomes, and a strong emphasis on preventative healthcare and chronic disease management. The United States, in particular, spearheads this dominance due to a large patient population requiring regular blood monitoring for conditions like diabetes and hyperlipidemia. The market size in North America alone was estimated at 0.5 billion in 2025, representing approximately 40% of the global market. Within the application segment, Glucose Tests are the primary driver of demand, accounting for an estimated 60% of the market share in 2025, directly linked to the high incidence of diabetes in the region. Cholesterol Tests follow, contributing another 25% of the application segment.

In terms of product types, Safety Lancets have emerged as the preferred choice, driven by stringent occupational safety regulations and a heightened awareness of needlestick injury prevention among healthcare professionals and home users. Safety lancets are projected to capture over 85% of the market share for capillary blood collection needles by 2033.

- Key Drivers for North American Dominance:

- Investment Trends: Significant private and public investment in diabetes care and cardiovascular health initiatives.

- Regulatory Support: Robust regulatory frameworks mandating the use of safety-engineered medical devices.

- High Adoption of Home-Use Diagnostics: A well-established market for self-monitoring blood glucose meters (SMBGs) and other at-home testing devices.

The Asia Pacific region is exhibiting the fastest growth potential, with countries like China and India demonstrating increasing healthcare expenditures, a rising prevalence of chronic diseases, and a growing middle class with improved access to healthcare services. This region is projected to witness a CAGR of over 12% during the forecast period, with its market share expected to grow from 20% in 2025 to an estimated 30% by 2033.

Capillary Blood Collection Needle Product Innovations

Product innovations in the capillary blood collection needle market are revolutionizing patient care and diagnostics. Manufacturers are focusing on developing ultra-thin gauge needles that minimize patient discomfort during blood sampling, coupled with advanced coating technologies to ensure smooth penetration and reduce tissue trauma. Safety features remain paramount, with next-generation retractable mechanisms and integrated needle shields setting new benchmarks for preventing needlestick injuries. The incorporation of antimicrobial properties in the needle’s housing is also a key innovation, enhancing hygiene and patient safety. Performance metrics are increasingly being optimized for rapid blood flow and minimal sample contamination, crucial for accurate diagnostic results, especially in point-of-care settings. These advancements are directly contributing to a market valued at over 1.8 billion by 2025.

Propelling Factors for Capillary Blood Collection Needle Growth

Several key factors are propelling the growth of the Capillary Blood Collection Needle market. Firstly, the escalating global burden of chronic diseases, particularly diabetes and cardiovascular ailments, drives consistent demand for routine blood monitoring. Secondly, technological advancements in lancet design, focusing on enhanced safety, pain reduction, and ease of use, are spurring adoption rates among both healthcare professionals and at-home users. Thirdly, increasing healthcare awareness and the growing trend towards self-monitoring of health parameters at home are significant catalysts. Finally, favorable government initiatives and regulatory frameworks promoting the use of safety-engineered medical devices are further bolstering market expansion. The market for safety lancets alone is projected to grow at a CAGR of 11% through 2033, reaching an estimated 3.2 billion.

Obstacles in the Capillary Blood Collection Needle Market

Despite the robust growth prospects, the Capillary Blood Collection Needle market faces several obstacles. Stringent regulatory approvals and the high cost associated with compliance in different global regions can act as a barrier to entry for smaller manufacturers. Supply chain disruptions, exacerbated by geopolitical events and global health crises, can lead to increased raw material costs and production delays, impacting market stability. Furthermore, intense competition among established players and the emergence of low-cost generic alternatives can exert downward pressure on pricing, affecting profit margins. The increasing adoption of alternative diagnostic technologies, though not a direct replacement for all capillary blood collection needs, also poses a long-term restraint. For example, supply chain issues in 2022 led to a 15% increase in production costs for key components.

Future Opportunities in Capillary Blood Collection Needle

The future of the Capillary Blood Collection Needle market is ripe with opportunities. The burgeoning demand for point-of-care diagnostic solutions presents a significant avenue for growth, as these needles are integral to rapid testing devices. The increasing adoption of telehealth and remote patient monitoring further fuels the need for reliable and user-friendly at-home blood collection tools. Emerging economies with expanding healthcare infrastructures and rising disposable incomes represent untapped markets with substantial growth potential. Moreover, continued innovation in material science and needle design, particularly in developing biodegradable or smart lancets, can open new market segments and address sustainability concerns. The integration of microfluidics with capillary blood collection systems also offers exciting prospects for miniaturized and automated diagnostic platforms, a market estimated to reach over 7 billion by 2030.

Major Players in the Capillary Blood Collection Needle Ecosystem

- Roche

- Lifescan

- BD

- Ascensia

- Abbott

- B. Braun

- ARKRAY

- Terumo

- I-SENS

- Nipro

- Omron

- AgaMatrix

- Smiths Medical

- Sarstedt

- Sinocare

- Yicheng

- Yuwell

- Greiner Bio One

Key Developments in Capillary Blood Collection Needle Industry

- 2023 March: BD launched its next-generation BD Ultra-Fine II Pen Needle, enhancing patient comfort and safety for diabetes management.

- 2023 June: Lifescan acquired a promising early-stage diagnostic technology company, signaling its commitment to expanding its diabetes care portfolio.

- 2023 August: Roche Diagnostics announced significant investment in advanced manufacturing capabilities for its diabetes care products, including capillary collection devices.

- 2024 January: Ascensia Diabetes Care introduced an updated version of its Contour Next blood glucose meter, emphasizing improved accuracy and user experience with its integrated lancing system.

- 2024 February: Smiths Medical expanded its sterile medical device offerings, with a focus on blood collection solutions for critical care settings.

- 2024 April: Terumo Corporation received regulatory approval for a novel safety lancet designed for pediatric blood sampling, addressing a niche but critical segment.

Strategic Capillary Blood Collection Needle Market Forecast

The strategic forecast for the Capillary Blood Collection Needle market anticipates sustained and robust growth, driven by the persistent rise in chronic disease prevalence, particularly diabetes and cardiovascular conditions. The increasing global focus on preventative healthcare and the burgeoning trend of home-based diagnostics will further solidify demand. Technological innovations, especially in miniaturization, enhanced safety features, and user-friendliness, will continue to shape product development and market penetration. Emerging economies represent significant untapped potential, poised to contribute substantially to overall market expansion. The market is expected to experience a compound annual growth rate of approximately 10% from 2025 to 2033, with the global market size projected to surpass 3.5 billion by the end of the forecast period.

Capillary Blood Collection Needle Segmentation

-

1. Application

- 1.1. Cholesterol Tests

- 1.2. Glucose Tests

- 1.3. Others

-

2. Types

- 2.1. Safety Lancets

- 2.2. Ordinary Lancets

Capillary Blood Collection Needle Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Capillary Blood Collection Needle Regional Market Share

Geographic Coverage of Capillary Blood Collection Needle

Capillary Blood Collection Needle REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Capillary Blood Collection Needle Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cholesterol Tests

- 5.1.2. Glucose Tests

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Safety Lancets

- 5.2.2. Ordinary Lancets

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Capillary Blood Collection Needle Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cholesterol Tests

- 6.1.2. Glucose Tests

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Safety Lancets

- 6.2.2. Ordinary Lancets

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Capillary Blood Collection Needle Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cholesterol Tests

- 7.1.2. Glucose Tests

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Safety Lancets

- 7.2.2. Ordinary Lancets

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Capillary Blood Collection Needle Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cholesterol Tests

- 8.1.2. Glucose Tests

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Safety Lancets

- 8.2.2. Ordinary Lancets

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Capillary Blood Collection Needle Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cholesterol Tests

- 9.1.2. Glucose Tests

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Safety Lancets

- 9.2.2. Ordinary Lancets

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Capillary Blood Collection Needle Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cholesterol Tests

- 10.1.2. Glucose Tests

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Safety Lancets

- 10.2.2. Ordinary Lancets

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Roche

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lifescan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BD

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ascensia

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbott

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 B. Braun

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ARKRAY

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Terumo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 I-SENS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nipro

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Omron

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AgaMatrix

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Smiths Medical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sarstedt

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sinocare

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Yicheng

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Yuwell

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Greiner Bio One

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Roche

List of Figures

- Figure 1: Global Capillary Blood Collection Needle Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Capillary Blood Collection Needle Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Capillary Blood Collection Needle Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Capillary Blood Collection Needle Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Capillary Blood Collection Needle Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Capillary Blood Collection Needle Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Capillary Blood Collection Needle Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Capillary Blood Collection Needle Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Capillary Blood Collection Needle Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Capillary Blood Collection Needle Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Capillary Blood Collection Needle Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Capillary Blood Collection Needle Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Capillary Blood Collection Needle Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Capillary Blood Collection Needle Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Capillary Blood Collection Needle Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Capillary Blood Collection Needle Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Capillary Blood Collection Needle Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Capillary Blood Collection Needle Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Capillary Blood Collection Needle Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Capillary Blood Collection Needle Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Capillary Blood Collection Needle Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Capillary Blood Collection Needle Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Capillary Blood Collection Needle Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Capillary Blood Collection Needle Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Capillary Blood Collection Needle Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Capillary Blood Collection Needle Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Capillary Blood Collection Needle Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Capillary Blood Collection Needle Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Capillary Blood Collection Needle Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Capillary Blood Collection Needle Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Capillary Blood Collection Needle Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Capillary Blood Collection Needle Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Capillary Blood Collection Needle Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Capillary Blood Collection Needle?

The projected CAGR is approximately 9.51%.

2. Which companies are prominent players in the Capillary Blood Collection Needle?

Key companies in the market include Roche, Lifescan, BD, Ascensia, Abbott, B. Braun, ARKRAY, Terumo, I-SENS, Nipro, Omron, AgaMatrix, Smiths Medical, Sarstedt, Sinocare, Yicheng, Yuwell, Greiner Bio One.

3. What are the main segments of the Capillary Blood Collection Needle?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Capillary Blood Collection Needle," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Capillary Blood Collection Needle report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Capillary Blood Collection Needle?

To stay informed about further developments, trends, and reports in the Capillary Blood Collection Needle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence