Key Insights

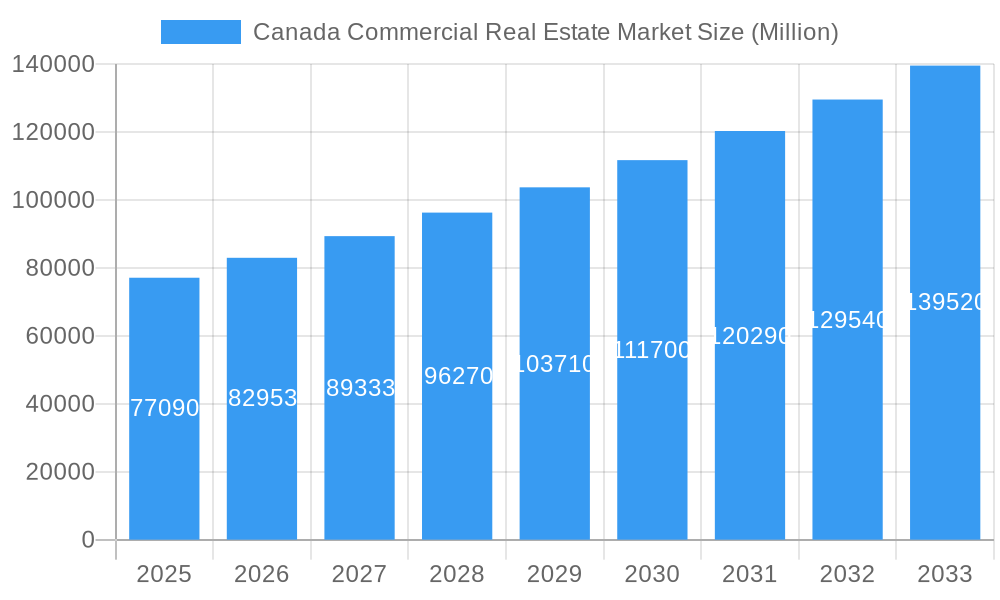

The Canadian commercial real estate market, valued at $77.09 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.59% from 2025 to 2033. This expansion is fueled by several key factors. Strong population growth, particularly in major cities like Toronto and Vancouver, is increasing demand for office, retail, and residential spaces. Furthermore, ongoing investments in infrastructure and a generally positive economic outlook contribute to a favorable investment climate. The market is segmented by property type (office, retail, industrial, multi-family, hospitality) and key cities, with Toronto, Vancouver, and Calgary representing significant portions of the market. Competition among developers, REITs (like Cominar REIT, Allied REIT, and Dream Office REIT), and real estate brokerage firms is intense, reflecting the market's attractiveness. However, challenges such as rising interest rates, potential economic slowdowns, and increasing construction costs could act as constraints on future growth. The market's performance will likely be influenced by shifts in government policies, technological advancements within the real estate sector (e.g., proptech), and global economic conditions.

Canada Commercial Real Estate Market Market Size (In Billion)

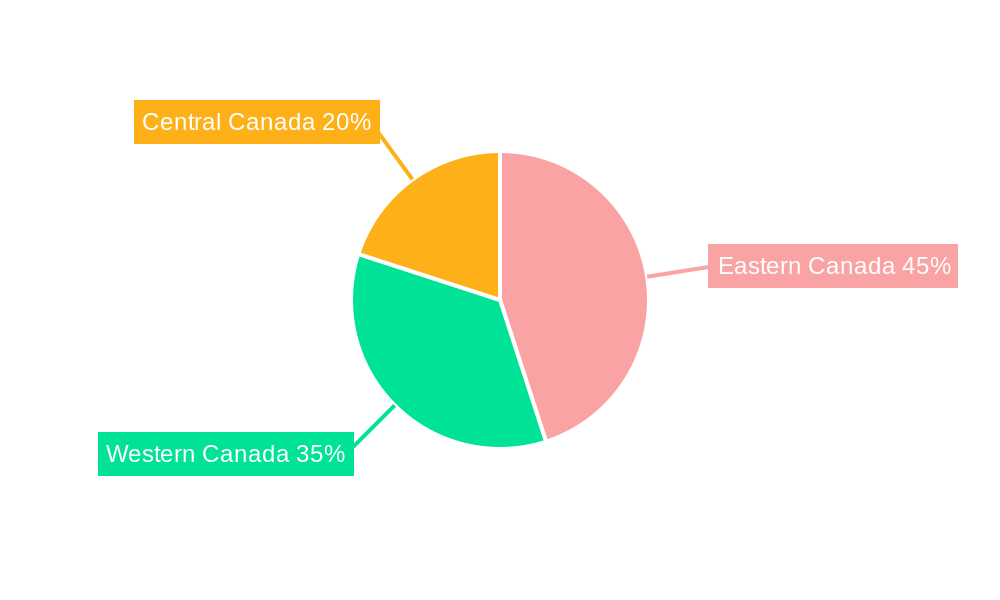

The forecast period of 2025-2033 anticipates continued growth, although at a potentially moderated pace compared to the initial years. The distribution across different property types will likely evolve based on evolving economic priorities and urban development plans. Industrial real estate, driven by e-commerce growth and supply chain optimization, is anticipated to show strong performance. The multi-family segment will also be significant, influenced by factors such as urbanization and changing demographic trends. Regional variations will exist, with western Canada, specifically British Columbia and Alberta, potentially experiencing higher growth rates driven by resource extraction and technological innovation. The eastern Canadian markets, notably Ontario and Quebec, are expected to remain significant contributors, driven by established economic hubs. Careful monitoring of macroeconomic conditions, government regulations, and the evolving needs of businesses and individuals is crucial for accurate projections of the market's trajectory.

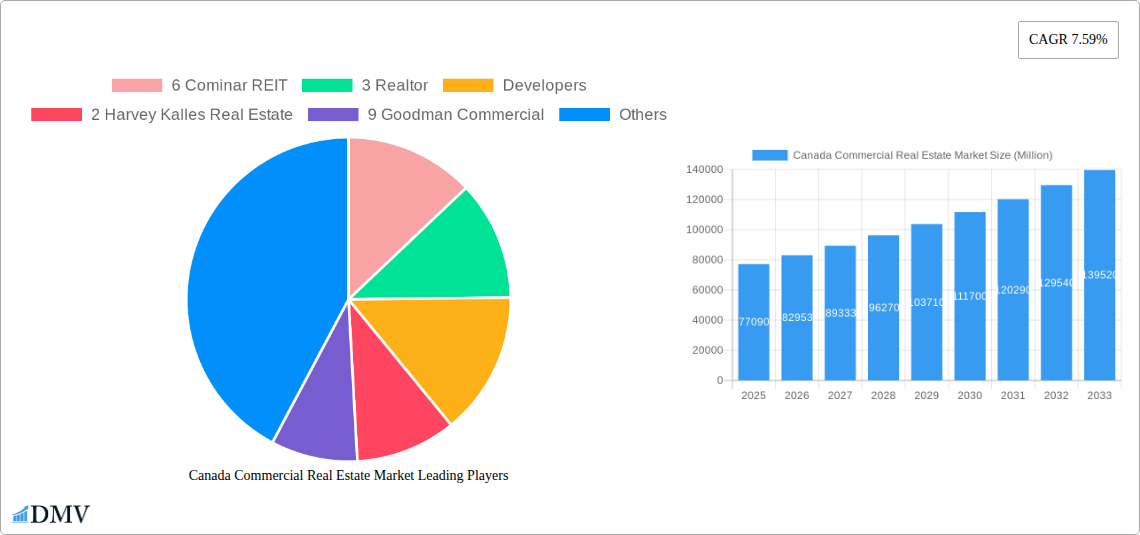

Canada Commercial Real Estate Market Company Market Share

Canada Commercial Real Estate Market: A Comprehensive Report (2019-2033)

This insightful report delivers a detailed analysis of the Canadian commercial real estate market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base and estimated year of 2025, and a forecast period of 2025-2033, this report provides a robust historical perspective (2019-2024) and future outlook. We delve deep into market trends, key players, and emerging opportunities, providing the data-driven intelligence needed to make informed strategic decisions. The report covers key segments including Office, Retail, Industrial, Multi-family, and Hospitality across major cities such as Toronto, Vancouver, Calgary, Ottawa, Montreal, Edmonton, and the Rest of Canada. Expect detailed analysis of M&A activity, market share distribution, and projected growth trajectories impacting companies like Cominar REIT, Goodman Commercial, Brookfield Global Integrated Solutions, and many more.

Canada Commercial Real Estate Market Composition & Trends

This section provides a comprehensive overview of the Canadian commercial real estate market's composition and prevailing trends. We analyze market concentration, identifying key players and their respective market share distribution. Innovation catalysts, including technological advancements and evolving consumer preferences, are thoroughly examined. The regulatory landscape, including its impact on market activity and investment decisions, is also assessed. Further analysis explores substitute products and their influence on market dynamics, and comprehensive end-user profiles are developed to understand the diverse demands shaping this market. Finally, a dedicated segment explores M&A activities, including the value and frequency of significant deals.

- Market Concentration: The Canadian commercial real estate market exhibits a moderately concentrated structure, with a few large players holding significant market share. For example, Goodman Commercial holds approximately 9% of the market, while Cominar REIT holds approximately 6%. However, a large number of smaller players and regional firms contribute significantly to the market's overall dynamism.

- M&A Activity: The analysis reveals a significant volume of M&A transactions during the historical period, with deal values reaching approximately xx Million CAD annually, driven largely by strategic acquisitions and consolidation efforts. Notable examples include recent acquisitions by both Prologis and VICI Properties Inc (detailed in the Key Developments section).

- Innovation Catalysts: Technological advancements like PropTech, BIM, and data analytics are transforming market operations, improving efficiency, and enhancing decision-making. This is particularly evident in the rise of online property platforms and the use of AI-driven valuation models.

- Regulatory Landscape: The regulatory environment significantly impacts development and investment decisions. Our analysis covers key regulations impacting zoning, building codes, and environmental concerns.

Canada Commercial Real Estate Market Industry Evolution

This section traces the evolution of the Canadian commercial real estate market, examining market growth trajectories across various segments. We analyze the impact of technological advancements, identifying how innovations are reshaping operational efficiency, investment strategies, and consumer behavior. The study also explores the influence of shifting consumer demands, from preferences for sustainable buildings to the growing popularity of co-working spaces.

(600-word detailed analysis of market growth trajectories, technological advancements, and changing consumer demands would be included here, incorporating data points on growth rates and adoption metrics. Examples include the increasing adoption of smart building technologies, the rise of e-commerce impacting retail real estate, and changing work-from-home trends affecting office space demand.)

Leading Regions, Countries, or Segments in Canada Commercial Real Estate Market

This analysis identifies the dominant regions, countries, and segments within the Canadian commercial real estate market. Toronto, Vancouver, and Montreal consistently rank as leading cities, driven by robust economies, strong population growth, and significant investment activity.

- Key Drivers for Toronto's Dominance: Strong economic activity, diverse industry base, high population density, and substantial foreign investment.

- Key Drivers for Vancouver's Dominance: Rapid population growth, high demand for residential and commercial space, and proximity to the Asia-Pacific market.

- Key Drivers for Montreal's Dominance: A thriving tech sector, growing tourism industry, and increasing foreign investment.

- Segment Analysis: The Industrial segment is experiencing robust growth, fueled by e-commerce expansion and supply chain changes. The Multi-family segment is also showing strong performance, reflecting increasing urbanization and population growth. The Office segment is seeing some shifts due to hybrid work models, requiring more flexible and adaptable spaces.

(600-word detailed analysis of dominance factors, including investment trends, regulatory support, and economic conditions for each leading region and segment would be included here.)

Canada Commercial Real Estate Market Product Innovations

(100-150 words detailing product innovations, applications, and performance metrics. This would include examples of new building designs emphasizing sustainability, the integration of smart building technologies, and the rise of flexible office spaces.)

Propelling Factors for Canada Commercial Real Estate Market Growth

(150 words identifying key growth drivers, including technological advancements (e.g., PropTech), economic factors (e.g., increasing urbanization and population growth), and supportive government policies.)

Obstacles in the Canada Commercial Real Estate Market Market

(150 words discussing barriers and restraints such as regulatory hurdles, supply chain disruptions, rising construction costs, and increasing interest rates, quantifying their impact where possible.)

Future Opportunities in Canada Commercial Real Estate Market

(150 words highlighting emerging opportunities like the growth of sustainable real estate, the development of innovative building technologies, and expansion into new markets, such as secondary cities.)

Major Players in the Canada Commercial Real Estate Market Ecosystem

- 6 Cominar REIT

- 3 Realtor, Developers

- 2 Harvey Kalles Real Estate

- 9 Goodman Commercial

- 3 Amacon

- 4 Pinnacle International

- 1 Brookfield Global Integrated Solutions

- Real Estate Brokerage Firms

- 1 Manulife Real Estate

- 10 Redev Properties*

- 7 Allied REIT**List Not Exhaustive

- 2 WestBank Corp

- 1 Onni Group

- 6 Knights Bridge Development Corp

- 5 Dream Office REIT

- Other Companies (startups associations etc )

- 2 Relogix

- 8 TAG Developments

- 7 Chard Development

- 4 Hausway

- 3 Maxwell Realty*

- 5 Anthem Properties Group Limited

Key Developments in Canada Commercial Real Estate Market Industry

- June 2023: Prologis, Inc. acquired nearly 14 Million square feet of industrial properties from Blackstone for USD 3.1 Billion, representing a 4% cap rate in the first year and a 5.75% cap rate adjusted for current market rents. This signifies significant investment in the industrial sector.

- May 2023: VICI Properties Inc. purchased Century Casinos' real estate assets in Calgary and Edmonton for USD 164.7 Million, demonstrating confidence in the Canadian gaming industry.

Strategic Canada Commercial Real Estate Market Market Forecast

(150 words summarizing growth catalysts, focusing on future opportunities and market potential, such as projections for growth in specific segments or regions and potential returns on investment.)

Canada Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Office

- 1.2. Retail

- 1.3. Industrial

- 1.4. Multi-family

- 1.5. Hospitality

-

2. Key Cities

- 2.1. Toronto

- 2.2. Vancouver

- 2.3. Calgary

- 2.4. Ottawa

- 2.5. Montreal

- 2.6. Edmonton

- 2.7. Rest of Canada

Canada Commercial Real Estate Market Segmentation By Geography

- 1. Canada

Canada Commercial Real Estate Market Regional Market Share

Geographic Coverage of Canada Commercial Real Estate Market

Canada Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of retail sector driving the market; Office spaces in Toronto and Vancouver are increasing

- 3.3. Market Restrains

- 3.3.1. High interest rates tend to slowdown business growth; Increasing cost of real estate affecting the growth of the market

- 3.4. Market Trends

- 3.4.1. Evolution of retail sector driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Multi-family

- 5.1.5. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Toronto

- 5.2.2. Vancouver

- 5.2.3. Calgary

- 5.2.4. Ottawa

- 5.2.5. Montreal

- 5.2.6. Edmonton

- 5.2.7. Rest of Canada

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 6 Cominar REIT

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3 Realtor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Developers

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Harvey Kalles Real Estate

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 9 Goodman Commercial

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 3 Amacon

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 4 Pinnacle International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1 Brookfield Global Integrated Solutions

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Real Estate Brokerage Firms

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 1 Manulife Real Estate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 10 Redev Properties*

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 7 Allied REIT**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 2 WestBank Corp

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 1 Onni Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 6 Knights Bridge Development Corp

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 5 Dream Office REIT

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Other Companies (startups associations etc )

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 2 Relogix

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 8 TAG Developments

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 7 Chard Development

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 4 Hausway

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 3 Maxwell Realty*

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 5 Anthem Properties Group Limited

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.1 6 Cominar REIT

List of Figures

- Figure 1: Canada Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Commercial Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Canada Commercial Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Canada Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Canada Commercial Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Commercial Real Estate Market?

The projected CAGR is approximately 7.59%.

2. Which companies are prominent players in the Canada Commercial Real Estate Market?

Key companies in the market include 6 Cominar REIT, 3 Realtor, Developers, 2 Harvey Kalles Real Estate, 9 Goodman Commercial, 3 Amacon, 4 Pinnacle International, 1 Brookfield Global Integrated Solutions, Real Estate Brokerage Firms, 1 Manulife Real Estate, 10 Redev Properties*, 7 Allied REIT**List Not Exhaustive, 2 WestBank Corp, 1 Onni Group, 6 Knights Bridge Development Corp, 5 Dream Office REIT, Other Companies (startups associations etc ), 2 Relogix, 8 TAG Developments, 7 Chard Development, 4 Hausway, 3 Maxwell Realty*, 5 Anthem Properties Group Limited.

3. What are the main segments of the Canada Commercial Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 77.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of retail sector driving the market; Office spaces in Toronto and Vancouver are increasing.

6. What are the notable trends driving market growth?

Evolution of retail sector driving the market.

7. Are there any restraints impacting market growth?

High interest rates tend to slowdown business growth; Increasing cost of real estate affecting the growth of the market.

8. Can you provide examples of recent developments in the market?

June 2023: Prologis, Inc. and Blackstone announced a definitive agreement for Prologis to acquire nearly 14 million square feet of industrial properties from opportunistic real estate funds affiliated with Blackstone for USD 3.1 billion, funded by cash. The acquisition price represents an approximately 4% cap rate in the first year and a 5.75% cap rate when adjusting to today's market rents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the Canada Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence