Key Insights

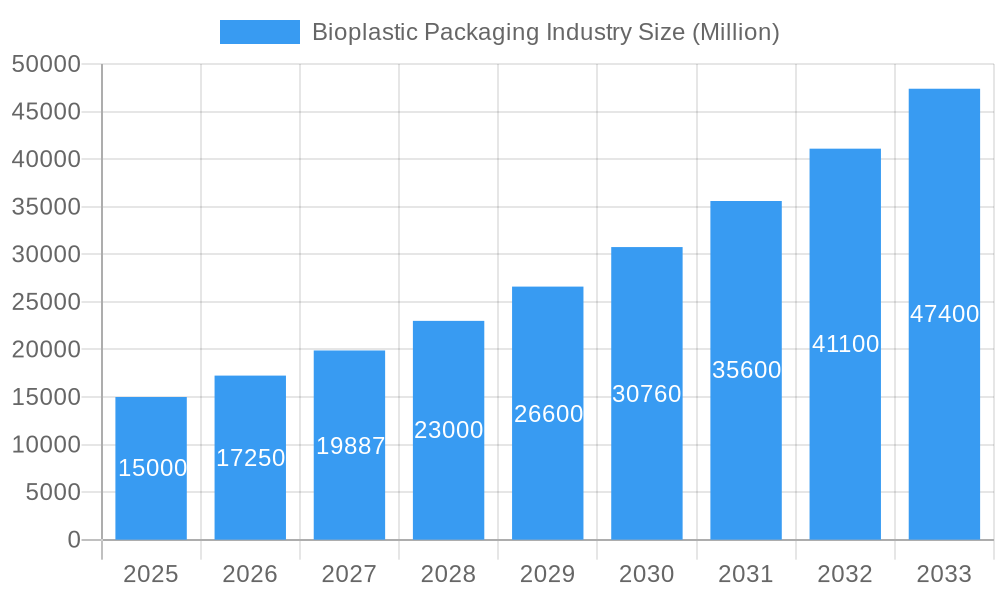

The bioplastic packaging market is experiencing significant expansion, driven by escalating consumer preference for sustainable and eco-friendly alternatives to conventional petroleum-based plastics. A projected compound annual growth rate (CAGR) of 17.2% from a base year of 2025 indicates robust market growth. This surge is propelled by stringent environmental regulations targeting plastic waste reduction, heightened consumer environmental consciousness, and the growing availability of high-performance bio-based polymers. Key material segments like PLA, PBAT, and PHA are gaining prominence due to their biodegradability and compostability. Diverse product types, including rigid and flexible packaging, serve critical end-user industries such as food & beverage, pharmaceuticals, and personal care. While cost considerations and application limitations persist, continuous technological advancements and increasing economies of scale are mitigating these challenges. Geographically, North America and Europe currently dominate, with the Asia-Pacific region anticipated to witness substantial growth fueled by industrialization and rising disposable incomes.

Bioplastic Packaging Industry Market Size (In Billion)

Leading bioplastic packaging market participants are actively pursuing research and development, expanding production, and forming strategic alliances to leverage market opportunities. The competitive environment is characterized by innovation and strategic maneuvering among established chemical firms and specialized bioplastic producers. Future expansion hinges on sustained material innovation, enhanced processing technologies, and the establishment of efficient collection and composting infrastructure. Evolving consumer behavior, supportive government policies, and the development of scalable, cost-effective bioplastic solutions will shape the market's trajectory. While detailed regional segmentation requires further analysis, current trends signal widespread opportunities for sustained market growth. The market is projected to reach a size of 24.71 billion by 2033.

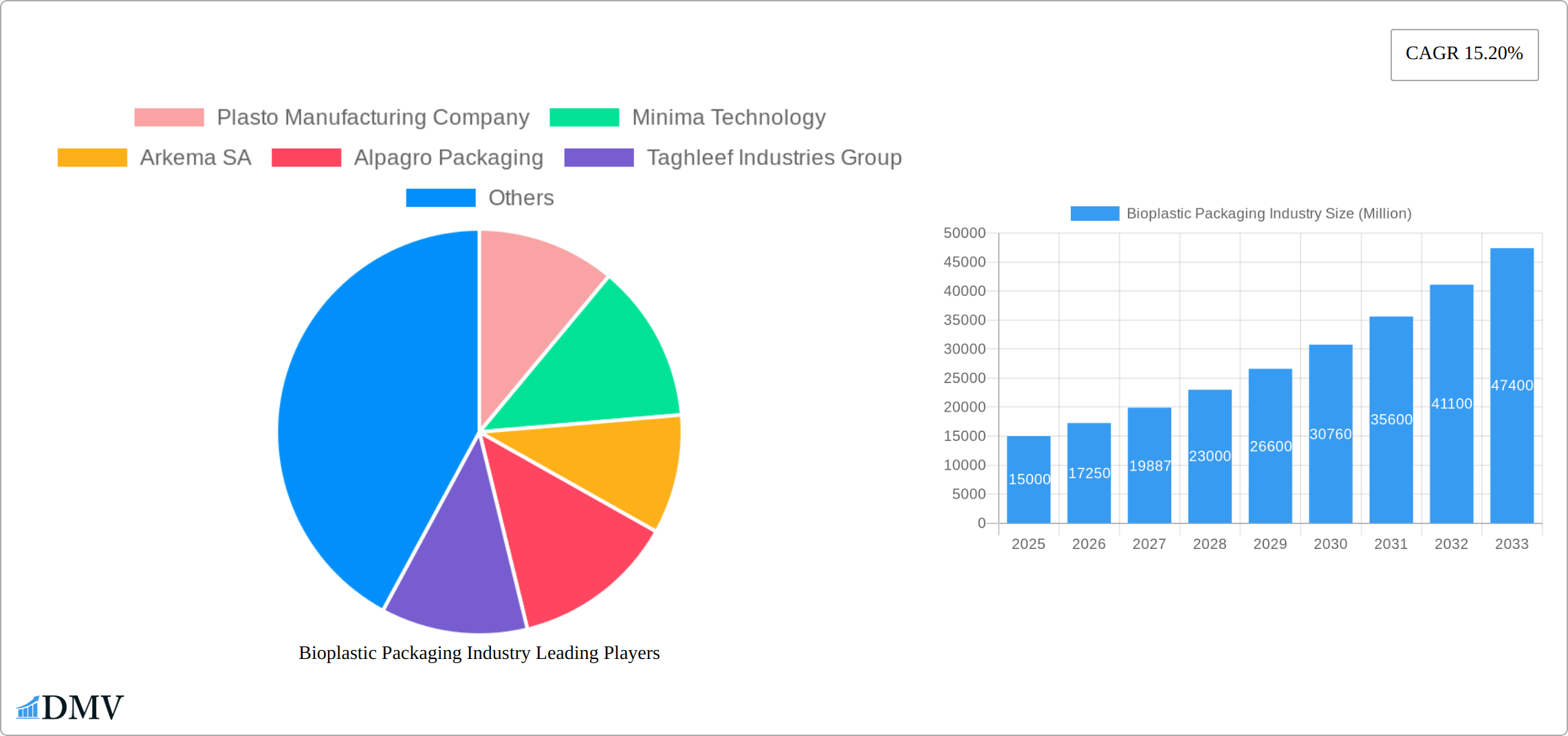

Bioplastic Packaging Industry Company Market Share

Bioplastic Packaging Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Bioplastic Packaging Industry, offering a comprehensive overview of market dynamics, growth drivers, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on this rapidly evolving market. The global bioplastic packaging market is projected to reach xx Million by 2033, exhibiting substantial growth driven by increasing environmental concerns and stringent regulations.

Bioplastic Packaging Industry Market Composition & Trends

The bioplastic packaging market presents a moderately fragmented landscape with numerous key players vying for market share. Market dynamics are significantly shaped by technological advancements, evolving regulatory frameworks, and the burgeoning demand for eco-friendly packaging solutions. Innovation acts as a crucial catalyst, with companies continuously developing novel bio-based materials and packaging formats to align with shifting consumer preferences and stringent environmental standards. The regulatory environment plays a pivotal role, with governments increasingly enacting policies that promote biodegradable and compostable materials. While competition from conventional plastics remains a considerable challenge, the escalating awareness of environmental sustainability is steadily driving a transition towards bioplastic alternatives. Furthermore, mergers and acquisitions (M&A) activities are reshaping the market landscape, with larger corporations acquiring smaller companies to expand their product portfolios and broaden their market reach. The substantial increase in M&A deal values in recent years underscores the industry's significant growth potential.

- Market Share Distribution (2025 Projection): The top five players are projected to hold approximately [Insert Percentage]% of the market share, indicating a [Describe the level of concentration - e.g., moderately concentrated, highly fragmented] market structure.

- M&A Deal Values: Total M&A deal values surpassed [Insert Amount] Million in 2024 and are anticipated to reach [Insert Amount] Million in 2025, reflecting [Describe the trend - e.g., robust growth, steady increase] in investment activity.

- Key End-User Profiles: The food and beverage, personal care and household goods, and pharmaceutical sectors represent the primary end-users, driving demand for bioplastic packaging solutions tailored to their specific needs.

Bioplastic Packaging Industry Evolution

The bioplastic packaging industry has witnessed remarkable growth over the past few years, driven by rising consumer awareness of environmental issues and government regulations promoting sustainable packaging. The market has evolved from a niche sector to a significant segment within the broader packaging industry. Technological advancements, including the development of new bio-based polymers and improved manufacturing processes, have significantly enhanced the performance and cost-effectiveness of bioplastic packaging. Consumer demand for eco-friendly alternatives to conventional plastics has also fueled the industry's growth. This shift is evident in the increasing adoption of bioplastic packaging across various sectors. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). The adoption rate of bioplastic packaging is expected to increase significantly in the coming years, driven by factors such as increasing environmental concerns and stringent government regulations. Specific adoption metrics like the percentage of bioplastic packaging used in various end-user industries are analyzed in detail within the report.

Leading Regions, Countries, or Segments in Bioplastic Packaging Industry

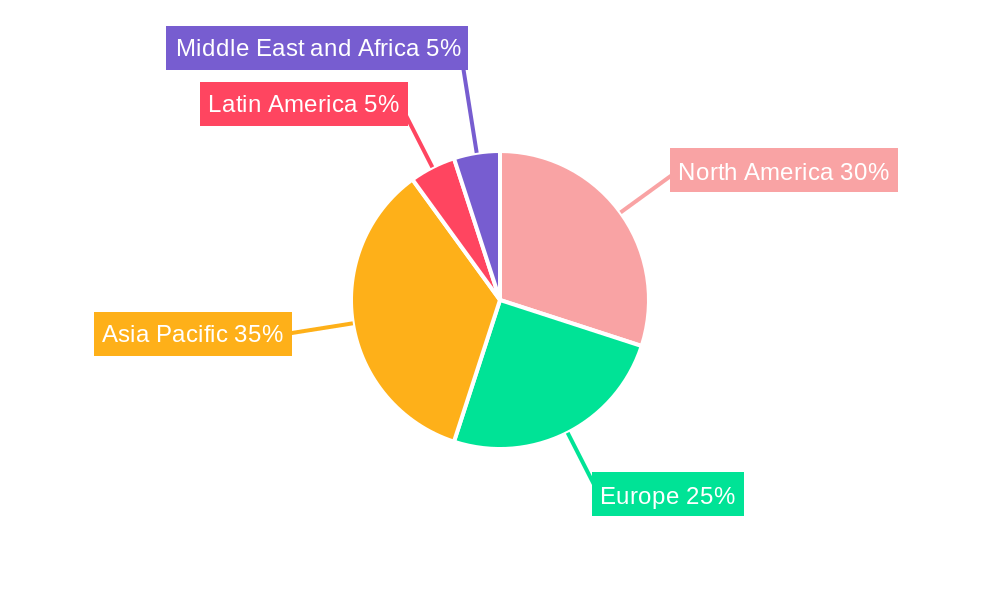

The bioplastic packaging market exhibits significant geographical diversity, with notable variations in growth trajectories and adoption rates across different regions and countries. Specific market segments also display varying degrees of dominance.

Dominant Regions: North America and Europe currently lead the market, driven by high consumer demand for sustainable products and stringent environmental regulations. However, the Asia-Pacific region is poised for substantial growth in the coming years, fueled by [Mention specific factors driving growth in Asia-Pacific, e.g., rising disposable incomes, increasing environmental awareness].

Key Drivers by Segment:

- By Material Type: PLA and PBAT remain dominant bioplastic materials due to their biodegradability, cost-effectiveness, and suitability across a wide range of applications. However, [Mention emerging materials and their potential impact].

- By Product Type: Flexible packaging (pouches and films) maintains a larger market share than rigid packaging (bottles and trays) owing to its versatility and widespread use across diverse end-user industries. Nevertheless, advancements in [Mention specific areas of rigid packaging innovation] are expected to alter this dynamic.

- By End-user Industry: The food and beverage industry continues to be the largest consumer of bioplastic packaging due to the immense volume of food products requiring packaging. Growth in other sectors like [Mention other high-growth sectors] is also contributing significantly.

Factors Driving Dominance:

- Investment Trends: Robust investment in research and development is fueling innovation and expanding the availability of diverse bioplastic packaging solutions, leading to [Mention specific outcomes of this investment, e.g., improved material properties, wider range of applications].

- Regulatory Support: Governments worldwide are actively implementing policies and regulations to incentivize the adoption of sustainable packaging alternatives, creating a favorable environment for market growth.

Bioplastic Packaging Industry Product Innovations

Recent innovations in bioplastic packaging include the development of advanced bio-based polymers with improved barrier properties, strength, and compostability. These advancements allow bioplastic packaging to compete effectively with conventional plastic alternatives in terms of performance and functionality. Companies are also focusing on developing innovative packaging formats and designs to meet the specific requirements of different end-user industries. Unique selling propositions, such as enhanced compostability, recyclability, and reduced environmental impact, are attracting significant consumer interest. The incorporation of smart packaging technologies, such as sensors and traceability systems, is further enhancing the appeal of bioplastic packaging.

Propelling Factors for Bioplastic Packaging Industry Growth

Several factors contribute to the growth of the bioplastic packaging industry. Technological advancements, such as the development of new bio-based polymers with improved properties, are driving innovation and expanding the range of applications. Economic factors, including increasing consumer demand for sustainable products and the rising cost of conventional plastics, are also boosting market growth. Stringent government regulations and policies promoting the use of sustainable packaging are further accelerating the adoption of bioplastic packaging. For example, the EU's Single-Use Plastics Directive is driving the demand for compostable packaging solutions.

Obstacles in the Bioplastic Packaging Industry Market

The bioplastic packaging industry faces several challenges that impede its growth trajectory. Inconsistencies in regulatory frameworks and varying standards across different regions create complexities for manufacturers. Supply chain vulnerabilities can lead to price fluctuations and disruptions in production. Intense competition from conventional plastics and other sustainable alternatives poses a significant hurdle. The comparatively higher cost of bioplastic packaging compared to conventional plastics remains a key barrier to widespread adoption, demanding cost-effective production methods and innovative solutions. Addressing these challenges effectively is crucial to unlocking the industry's full growth potential.

Future Opportunities in Bioplastic Packaging Industry

The bioplastic packaging market presents promising opportunities for future growth. Emerging markets in developing countries present significant potential for expansion, while advancements in biodegradable and compostable technologies continue to drive innovation. Consumer trends toward sustainable and ethical consumption patterns further enhance the industry's prospects. New applications, such as in the electronics and medical device industries, are also opening up new avenues for growth.

Major Players in the Bioplastic Packaging Industry Ecosystem

- Plasto Manufacturing Company

- Minima Technology

- Arkema SA

- Alpagro Packaging

- Taghleef Industries Group

- BASF SE

- Plastic Suppliers Inc

- Mondi PLC

- Mitsubishi Chemicals Corporation

- Element Packaging Ltd

- Eastman Chemical Company

- Treemera GmbH

- Tipa-corp Ltd

- FKuR Ploymers GmbH

- COMPOSTPACK SAS

- Biogreen Packaging Pvt Ltd

- Tetra Pak International SA

- Biome Bioplastics Limited

- Amcor Limited

- Raepak Ltd

Key Developments in Bioplastic Packaging Industry Industry

- August 2022: LG Chem Ltd. partnered with Archer Daniels Midland Co. (ADM) to build two biodegradable plastic manufacturing plants in Illinois, USA, focusing on food packaging. This significantly expands capacity and strengthens the supply chain for bioplastics in the food sector.

- January 2022: Vikas Ecotech Limited announced plans to invest in Polyhydroxyalkanoates (PHA) technology through a potential joint venture with Aurapha Private Ltd., aiming to produce biodegradable plastics. This investment signals a growing interest in alternative biodegradable materials beyond PLA and PBAT.

Strategic Bioplastic Packaging Industry Market Forecast

The bioplastic packaging market is projected to experience substantial growth, driven by a confluence of factors including heightened environmental awareness, stricter regulations governing conventional plastics, and continuous technological advancements in bio-based materials. The emergence of new market entrants and strategic collaborations is expected to further stimulate market expansion. The forecast indicates a significant surge in demand across various end-use sectors, especially in the food and beverage, cosmetics, and healthcare industries. This growth will be propelled by both rising consumer demand for sustainable products and proactive government policies promoting eco-friendly practices. The market is poised to witness a decisive shift towards more sustainable and innovative packaging solutions in the years to come. [Include specific quantitative projections if available, e.g., Expected CAGR, market size by year X].

Bioplastic Packaging Industry Segmentation

-

1. Material Type

- 1.1. BIO - PET

- 1.2. BIO - PE

- 1.3. BIO - PA

- 1.4. Other Bio-Based/Non-Biodegradable Materials

- 1.5. Starch Blends

- 1.6. PLA

- 1.7. PBAT

- 1.8. PHA

- 1.9. Other Biodegradable Materials

-

2. Product Type

- 2.1. Rigid Pl

- 2.2. Flexible

-

3. End-user Industries

- 3.1. Food

- 3.2. Beverage

- 3.3. Pharmaceuticals

- 3.4. Personal Care & Household Care

- 3.5. Other End-user Applications

Bioplastic Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Bioplastic Packaging Industry Regional Market Share

Geographic Coverage of Bioplastic Packaging Industry

Bioplastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Stringent Government Regulations against the Use of Conventional Plastics; Increased Usage of Green Products

- 3.2.2 Sustainability

- 3.2.3 and Inclination toward Environment Protection

- 3.3. Market Restrains

- 3.3.1. Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Rigid Packaging to Hold Dominant Position in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. BIO - PET

- 5.1.2. BIO - PE

- 5.1.3. BIO - PA

- 5.1.4. Other Bio-Based/Non-Biodegradable Materials

- 5.1.5. Starch Blends

- 5.1.6. PLA

- 5.1.7. PBAT

- 5.1.8. PHA

- 5.1.9. Other Biodegradable Materials

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Rigid Pl

- 5.2.2. Flexible

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Pharmaceuticals

- 5.3.4. Personal Care & Household Care

- 5.3.5. Other End-user Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. BIO - PET

- 6.1.2. BIO - PE

- 6.1.3. BIO - PA

- 6.1.4. Other Bio-Based/Non-Biodegradable Materials

- 6.1.5. Starch Blends

- 6.1.6. PLA

- 6.1.7. PBAT

- 6.1.8. PHA

- 6.1.9. Other Biodegradable Materials

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Rigid Pl

- 6.2.2. Flexible

- 6.3. Market Analysis, Insights and Forecast - by End-user Industries

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Pharmaceuticals

- 6.3.4. Personal Care & Household Care

- 6.3.5. Other End-user Applications

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. BIO - PET

- 7.1.2. BIO - PE

- 7.1.3. BIO - PA

- 7.1.4. Other Bio-Based/Non-Biodegradable Materials

- 7.1.5. Starch Blends

- 7.1.6. PLA

- 7.1.7. PBAT

- 7.1.8. PHA

- 7.1.9. Other Biodegradable Materials

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Rigid Pl

- 7.2.2. Flexible

- 7.3. Market Analysis, Insights and Forecast - by End-user Industries

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Pharmaceuticals

- 7.3.4. Personal Care & Household Care

- 7.3.5. Other End-user Applications

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. BIO - PET

- 8.1.2. BIO - PE

- 8.1.3. BIO - PA

- 8.1.4. Other Bio-Based/Non-Biodegradable Materials

- 8.1.5. Starch Blends

- 8.1.6. PLA

- 8.1.7. PBAT

- 8.1.8. PHA

- 8.1.9. Other Biodegradable Materials

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Rigid Pl

- 8.2.2. Flexible

- 8.3. Market Analysis, Insights and Forecast - by End-user Industries

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Pharmaceuticals

- 8.3.4. Personal Care & Household Care

- 8.3.5. Other End-user Applications

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. BIO - PET

- 9.1.2. BIO - PE

- 9.1.3. BIO - PA

- 9.1.4. Other Bio-Based/Non-Biodegradable Materials

- 9.1.5. Starch Blends

- 9.1.6. PLA

- 9.1.7. PBAT

- 9.1.8. PHA

- 9.1.9. Other Biodegradable Materials

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Rigid Pl

- 9.2.2. Flexible

- 9.3. Market Analysis, Insights and Forecast - by End-user Industries

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Pharmaceuticals

- 9.3.4. Personal Care & Household Care

- 9.3.5. Other End-user Applications

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. BIO - PET

- 10.1.2. BIO - PE

- 10.1.3. BIO - PA

- 10.1.4. Other Bio-Based/Non-Biodegradable Materials

- 10.1.5. Starch Blends

- 10.1.6. PLA

- 10.1.7. PBAT

- 10.1.8. PHA

- 10.1.9. Other Biodegradable Materials

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Rigid Pl

- 10.2.2. Flexible

- 10.3. Market Analysis, Insights and Forecast - by End-user Industries

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Pharmaceuticals

- 10.3.4. Personal Care & Household Care

- 10.3.5. Other End-user Applications

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Plasto Manufacturing Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Minima Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Arkema SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alpagro Packaging

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Taghleef Industries Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Plastic Suppliers Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mondi PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi Chemicals Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Element Packaging Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Eastman Chemical Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Treemera GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Tipa-corp Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 FKuR Ploymers GmbH

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 COMPOSTPACK SAS

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Biogreen Packaging Pvt Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Tetra Pak International SA*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Biome Bioplastics Limited

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Amcor Limited

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Raepak Ltd

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Plasto Manufacturing Company

List of Figures

- Figure 1: Global Bioplastic Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Bioplastic Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 3: North America Bioplastic Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Bioplastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America Bioplastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Bioplastic Packaging Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 7: North America Bioplastic Packaging Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 8: North America Bioplastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Bioplastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Bioplastic Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 11: Europe Bioplastic Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Bioplastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: Europe Bioplastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Bioplastic Packaging Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 15: Europe Bioplastic Packaging Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 16: Europe Bioplastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Bioplastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Bioplastic Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 19: Asia Pacific Bioplastic Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Asia Pacific Bioplastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Asia Pacific Bioplastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Pacific Bioplastic Packaging Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 23: Asia Pacific Bioplastic Packaging Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 24: Asia Pacific Bioplastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Bioplastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Bioplastic Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Latin America Bioplastic Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Latin America Bioplastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Latin America Bioplastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Latin America Bioplastic Packaging Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 31: Latin America Bioplastic Packaging Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 32: Latin America Bioplastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Bioplastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Bioplastic Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 35: Middle East and Africa Bioplastic Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Middle East and Africa Bioplastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 37: Middle East and Africa Bioplastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Middle East and Africa Bioplastic Packaging Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 39: Middle East and Africa Bioplastic Packaging Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 40: Middle East and Africa Bioplastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Bioplastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 4: Global Bioplastic Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 8: Global Bioplastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 10: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 12: Global Bioplastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 14: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 15: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 16: Global Bioplastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 19: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 20: Global Bioplastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 22: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 24: Global Bioplastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bioplastic Packaging Industry?

The projected CAGR is approximately 17.2%.

2. Which companies are prominent players in the Bioplastic Packaging Industry?

Key companies in the market include Plasto Manufacturing Company, Minima Technology, Arkema SA, Alpagro Packaging, Taghleef Industries Group, BASF SE, Plastic Suppliers Inc, Mondi PLC, Mitsubishi Chemicals Corporation, Element Packaging Ltd, Eastman Chemical Company, Treemera GmbH, Tipa-corp Ltd, FKuR Ploymers GmbH, COMPOSTPACK SAS, Biogreen Packaging Pvt Ltd, Tetra Pak International SA*List Not Exhaustive, Biome Bioplastics Limited, Amcor Limited, Raepak Ltd.

3. What are the main segments of the Bioplastic Packaging Industry?

The market segments include Material Type, Product Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations against the Use of Conventional Plastics; Increased Usage of Green Products. Sustainability. and Inclination toward Environment Protection.

6. What are the notable trends driving market growth?

Rigid Packaging to Hold Dominant Position in the Market.

7. Are there any restraints impacting market growth?

Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

August 2022: LG Chem Ltd., the largest Korean chemical firm, announced a partnership with the US-based food processing organization Archer Daniels Midland Co. (ADM) to build two manufacturing plants in Illinois, US. The production facilities will be manufacturing biodegradable plastics that are extensively used in food packaging applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bioplastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bioplastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bioplastic Packaging Industry?

To stay informed about further developments, trends, and reports in the Bioplastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence