Key Insights

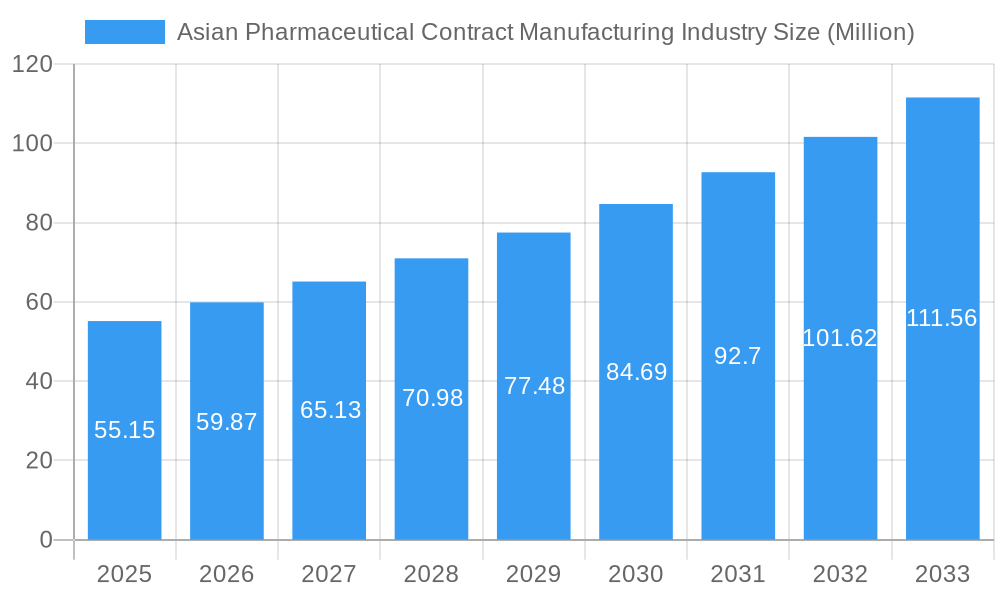

The Asian pharmaceutical contract manufacturing market, valued at $55.15 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.74% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases and a rising geriatric population across the region are driving demand for pharmaceuticals. Secondly, the burgeoning generic drug market, particularly in India and China, necessitates efficient and cost-effective contract manufacturing solutions. Furthermore, stringent regulatory requirements and a growing focus on quality control are pushing pharmaceutical companies to outsource manufacturing to specialized contract manufacturers, leveraging their expertise and infrastructure. The market segmentation reveals significant opportunities across various service types. Injectable dose formulations, particularly secondary packaging, hold substantial potential. High-potency API (HPAPI) development and finished dosage formulation (FDF) manufacturing represent specialized segments with substantial growth prospects. The dominance of countries like China, India, and Japan, with their established pharmaceutical industries and large populations, significantly shapes market dynamics. However, competition from established players and emerging regional manufacturers will intensify.

Asian Pharmaceutical Contract Manufacturing Industry Market Size (In Million)

The competitive landscape is characterized by both global and regional players. Established international contract manufacturers like Lonza Group, Thermo Fisher Scientific (Patheon), and Catalent Inc. compete alongside strong regional players such as Jubilant Life Sciences Ltd and Famar SA. The increasing adoption of advanced technologies and automation in pharmaceutical manufacturing, coupled with the growing focus on personalized medicine and biologics, will redefine the industry landscape over the next decade. The Asia Pacific region, with its diverse markets and growth opportunities, constitutes a significant segment within this market. Successful players will need to navigate regulatory complexities, manage supply chain challenges, and adapt to evolving technological demands to maintain a competitive edge and capitalize on the tremendous growth opportunities within the Asian pharmaceutical contract manufacturing sector.

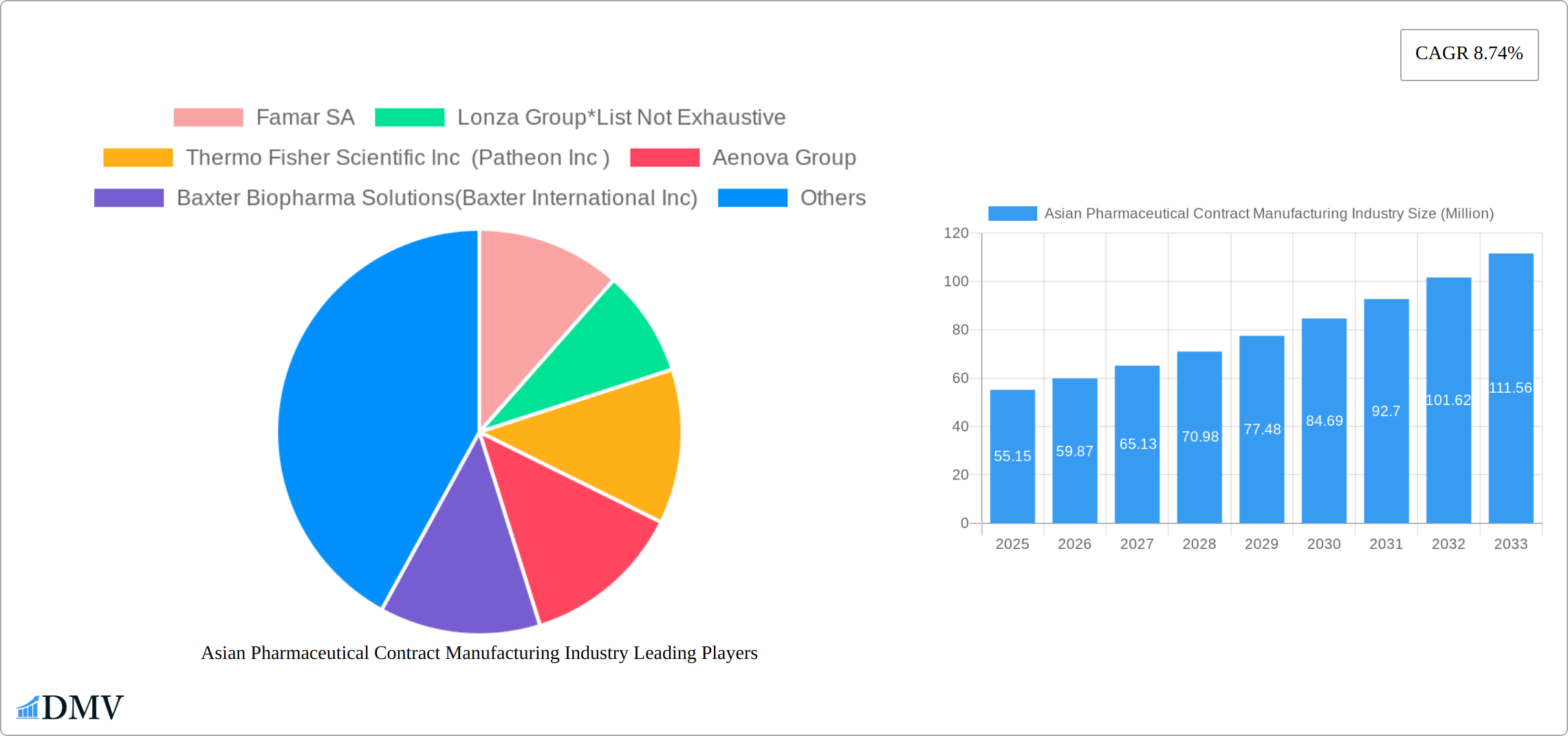

Asian Pharmaceutical Contract Manufacturing Industry Company Market Share

Asian Pharmaceutical Contract Manufacturing Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Asian pharmaceutical contract manufacturing industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to navigate this dynamic sector. The report leverages extensive data analysis to provide accurate predictions and valuable strategic insights. The market size for 2025 is estimated at $XX Million.

Asian Pharmaceutical Contract Manufacturing Industry Market Composition & Trends

This section provides a comprehensive analysis of the Asian pharmaceutical contract manufacturing market, delving into its structure, key drivers of innovation, the prevailing regulatory environment, the influence of substitute products, the profiles of end-users, and significant merger & acquisition (M&A) activities. The market is characterized by a dynamic mix of participants, with some entities commanding substantial market influence. We meticulously examine the distribution of market share among prominent players, including Famar SA, Lonza Group, Thermo Fisher Scientific Inc (Patheon Inc), Aenova Group, Baxter Biopharma Solutions (Baxter International Inc), Pfizer CentreSource (Pfizer Inc), Jubilant Life Sciences Ltd, Catalent Inc, Boehringer Ingelheim Group, and Recipharm AB. It is important to note that this enumeration is illustrative and not exhaustive.

-

Market Concentration: The market presents a moderately concentrated landscape, wherein a select number of major players hold a significant portion of the market share, while a multitude of smaller enterprises cater to specialized niche segments. Estimated market share percentages for key companies for the year 2025 are as follows: Famar SA (XX%), Lonza Group (XX%), Thermo Fisher Scientific (XX%), and so forth. The residual market share is distributed among a broader spectrum of smaller entities.

-

Innovation Catalysts: Transformative technological advancements in Active Pharmaceutical Ingredient (API) manufacturing, with a particular emphasis on High Potency APIs (HPAPIs), coupled with the escalating demand for sophisticated dosage forms, are the primary catalysts driving innovation across the industry.

-

Regulatory Landscape: The rigorous and often complex regulatory frameworks prevalent across diverse Asian nations, including but not limited to China, India, Japan, and Australia, profoundly shape manufacturing methodologies and compliance standards. Disparities in these regulatory dictates across different jurisdictions present both intricate challenges and lucrative opportunities for market participants.

-

M&A Activity: The pharmaceutical contract manufacturing sector has experienced a notable surge in M&A transactions in recent years. The aggregate value of M&A deals executed within the Asian region between 2019 and 2024 is estimated at $XX Million, with an average deal valuation of $XX Million. These strategic consolidations are typically motivated by objectives such as expanding geographical footprints, augmenting technological proficiencies, and diversifying service portfolios.

-

Substitute Products: The pervasive availability of generic pharmaceuticals and the ongoing development of alternative manufacturing technologies introduce considerable competitive pressures within this dynamic market.

Asian Pharmaceutical Contract Manufacturing Industry Industry Evolution

This section analyzes the evolution of the Asian pharmaceutical contract manufacturing industry, focusing on market growth trajectories, technological advancements, and shifting consumer demands. The industry has experienced considerable growth driven by factors such as rising healthcare expenditure, an aging population, and the increasing prevalence of chronic diseases. The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) was approximately XX%, while the projected CAGR for the forecast period (2025-2033) is estimated at XX%.

Technological advancements, including automation, process optimization, and the implementation of advanced analytical techniques, have significantly enhanced efficiency and product quality. The adoption rate of advanced technologies like AI and machine learning in manufacturing processes is increasing steadily, with approximately XX% of leading companies implementing these technologies by 2025. Consumer demand is also driving innovation, with an increasing focus on personalized medicine and specialized drug delivery systems. This is reflected in the growth of segments such as HPAPI manufacturing and specialized dosage forms.

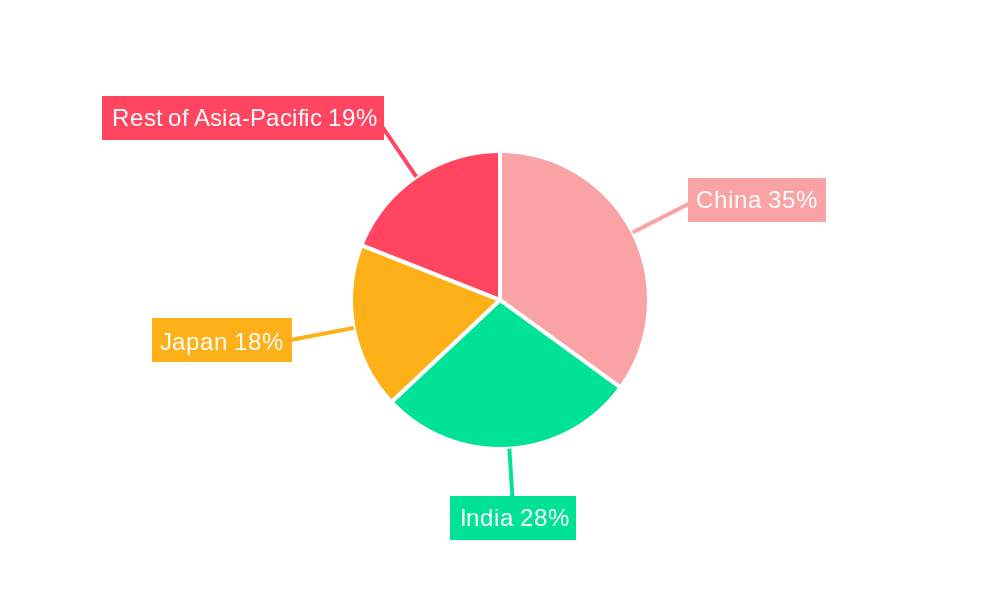

Leading Regions, Countries, or Segments in Asian Pharmaceutical Contract Manufacturing Industry

This section identifies the leading regions, countries, and segments within the Asian pharmaceutical contract manufacturing industry.

Dominant Regions/Countries: China and India are currently the leading markets, driven by their large and growing pharmaceutical industries, favorable government policies, and a large pool of skilled labor. Japan maintains a strong position due to its advanced technological capabilities and stringent regulatory standards. Other countries such as Australia and the Rest of Asia-Pacific are also contributing to the overall market growth, though at a comparatively slower pace.

Key Drivers:

China: Significant government investment in the pharmaceutical sector, favorable regulatory policies for foreign investment, and a robust domestic market drive China's dominance.

India: Lower manufacturing costs, a skilled workforce, and a growing generic drug industry contribute to India's prominent position.

Japan: Advanced technology, stringent regulatory compliance, and a focus on high-quality manufacturing make Japan a significant player.

Dominant Segments: The Active Pharmaceutical Ingredient (API) manufacturing segment and Injectable Dose Formulation (including secondary packaging) are currently the largest segments. High Potency API (HPAPI) manufacturing and Finished Dosage Formulation (FDF) development are rapidly growing segments due to increasing demand for complex and potent drugs.

Asian Pharmaceutical Contract Manufacturing Industry Product Innovations

Recent product innovations include advanced drug delivery systems (e.g., liposomal formulations, nanoparticles), improvements in API synthesis and purification, and the development of novel dosage forms designed for enhanced patient compliance and efficacy. These innovations are driven by the need for more effective and targeted drug therapies, improving patient outcomes and addressing unmet medical needs. The adoption of these technologies is contributing to improved performance metrics, such as reduced manufacturing costs, increased production efficiency, and higher product quality.

Propelling Factors for Asian Pharmaceutical Contract Manufacturing Industry Growth

The expansion of the Asian pharmaceutical contract manufacturing industry is being propelled by a confluence of powerful factors. Technological breakthroughs, including the widespread adoption of automation and AI-driven process optimization, are significantly enhancing operational efficiency and driving down costs. Concurrently, supportive government policies and regulatory incentives, particularly within rapidly developing economies, are actively encouraging investments in this vital sector. The escalating healthcare expenditure and the demographic shift towards an aging population across numerous Asian countries are directly contributing to a heightened demand for pharmaceutical products, thereby stimulating the need for comprehensive contract manufacturing services.

Obstacles in the Asian Pharmaceutical Contract Manufacturing Industry Market

The industry is not without its impediments. Stringent adherence to regulatory compliance requirements can inadvertently escalate operational costs and extend production timelines. Furthermore, vulnerabilities within the global supply chain, often amplified by geopolitical instabilities and unforeseen natural calamities, pose significant risks to production continuity and timely product delivery. The intense competitive landscape, characterized by the presence of both formidable domestic and international contenders, mandates a perpetual pursuit of innovation and cost-effectiveness. Navigating these challenges effectively requires companies to implement robust risk management and mitigation strategies to ensure sustained market presence and profitability.

Future Opportunities in Asian Pharmaceutical Contract Manufacturing Industry

Future opportunities lie in the expansion of services into new therapeutic areas, such as personalized medicine and biologics. Advances in technology, including 3D printing and continuous manufacturing, offer potential for increased efficiency and reduced production costs. The growing demand for specialized drug delivery systems presents a significant opportunity for contract manufacturers to offer value-added services and capture market share. Moreover, exploring new markets in the Asia-Pacific region will provide substantial growth potential.

Major Players in the Asian Pharmaceutical Contract Manufacturing Industry Ecosystem

Key Developments in Asian Pharmaceutical Contract Manufacturing Industry Industry

- 2022-Q4: Lonza Group announced a substantial investment aimed at bolstering its High Potency API (HPAPI) manufacturing capabilities in Singapore, underscoring its commitment to advanced manufacturing in the region.

- 2023-Q1: Catalent Inc. unveiled a groundbreaking advanced drug delivery platform designed to facilitate the development and personalization of medicines, signaling a move towards more tailored therapeutic solutions.

- 2023-Q2: A significant strategic merger between two mid-sized contract manufacturers based in India resulted in the formation of a more formidable and competitive entity within the market. (Specific details regarding the merger participants and financial terms remain confidential). It is anticipated that similar consolidation activities will continue to shape the market landscape throughout the forecast period.

Strategic Asian Pharmaceutical Contract Manufacturing Industry Market Forecast

The Asian pharmaceutical contract manufacturing market is on track for sustained and robust growth over the projected forecast period. This upward trajectory is underpinned by the continuous evolution of technological frontiers, the ever-increasing global healthcare spending, and the ongoing refinement of favorable regulatory environments across key markets. Emerging opportunities, particularly in the burgeoning fields of personalized medicine, advanced drug delivery systems, and novel therapeutic modalities, are expected to be significant drivers of market expansion. The future prosperity of the industry will be largely contingent on the agility of companies to adapt to evolving regulatory landscapes, embrace cutting-edge technologies, and adeptly manage intricate and often globalized supply chains. Projections indicate that the market is poised to reach $XX Million by 2033, reflecting substantial and promising growth potential.

Asian Pharmaceutical Contract Manufacturing Industry Segmentation

-

1. Service Type

-

1.1. Active P

- 1.1.1. Small Molecule

- 1.1.2. Large Molecule

- 1.1.3. High Potency API (HPAPI)

-

1.2. Finished

- 1.2.1. Solid Dose Formulation

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

- 1.3. Secondary Packaging

-

1.1. Active P

Asian Pharmaceutical Contract Manufacturing Industry Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asian Pharmaceutical Contract Manufacturing Industry Regional Market Share

Geographic Coverage of Asian Pharmaceutical Contract Manufacturing Industry

Asian Pharmaceutical Contract Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Outsourcing Volume by Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. ; Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs

- 3.4. Market Trends

- 3.4.1. Injectable Dose Formulations Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Pharmaceutical Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Active P

- 5.1.1.1. Small Molecule

- 5.1.1.2. Large Molecule

- 5.1.1.3. High Potency API (HPAPI)

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.3. Secondary Packaging

- 5.1.1. Active P

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Famar SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lonza Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Thermo Fisher Scientific Inc (Patheon Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aenova Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Baxter Biopharma Solutions(Baxter International Inc)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pfizer CentreSource (Pfizer Inc)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jubilant Life Sciences Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Catalent Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boehringer Ingelheim Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Recipharm AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Famar SA

List of Figures

- Figure 1: Asian Pharmaceutical Contract Manufacturing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asian Pharmaceutical Contract Manufacturing Industry Share (%) by Company 2025

List of Tables

- Table 1: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Japan Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Indonesia Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Malaysia Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Singapore Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Thailand Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Vietnam Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Philippines Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bangladesh Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Pakistan Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Pharmaceutical Contract Manufacturing Industry?

The projected CAGR is approximately 8.74%.

2. Which companies are prominent players in the Asian Pharmaceutical Contract Manufacturing Industry?

Key companies in the market include Famar SA, Lonza Group*List Not Exhaustive, Thermo Fisher Scientific Inc (Patheon Inc ), Aenova Group, Baxter Biopharma Solutions(Baxter International Inc), Pfizer CentreSource (Pfizer Inc), Jubilant Life Sciences Ltd, Catalent Inc, Boehringer Ingelheim Group, Recipharm AB.

3. What are the main segments of the Asian Pharmaceutical Contract Manufacturing Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.15 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Outsourcing Volume by Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Injectable Dose Formulations Holds Significant Market Share.

7. Are there any restraints impacting market growth?

; Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Pharmaceutical Contract Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Pharmaceutical Contract Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Pharmaceutical Contract Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Asian Pharmaceutical Contract Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence