Key Insights

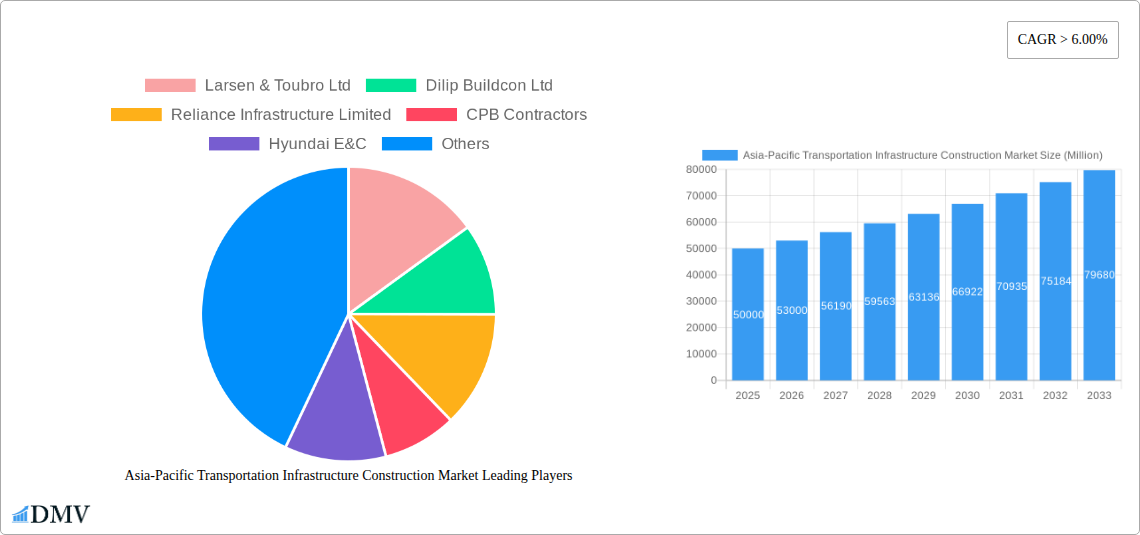

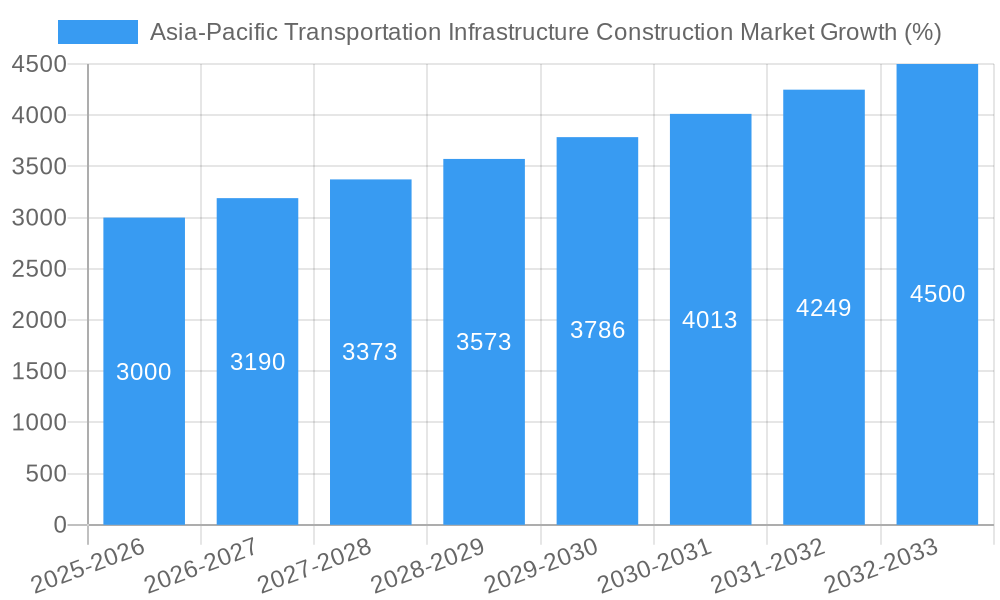

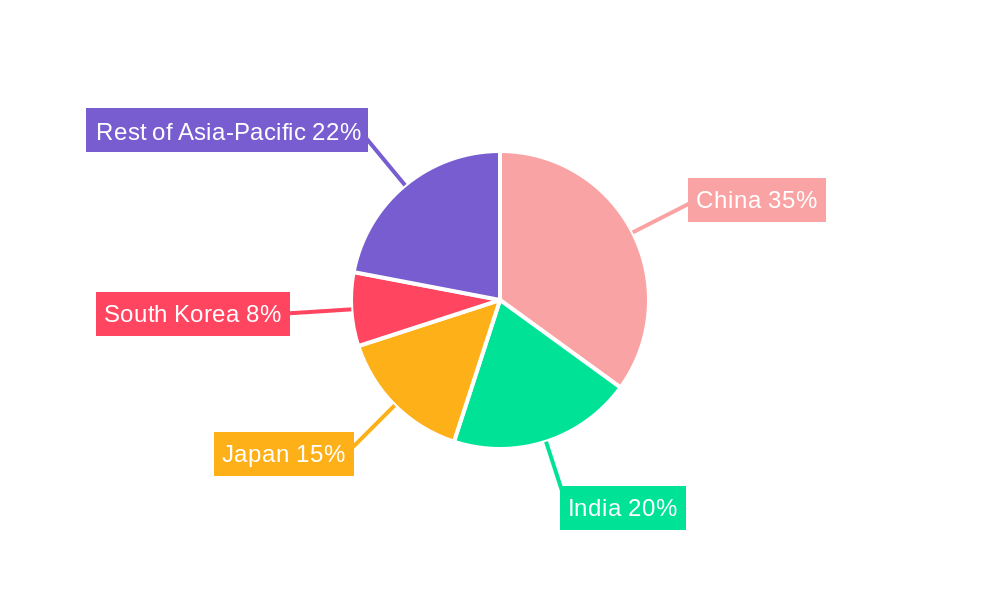

The Asia-Pacific transportation infrastructure construction market is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, and government initiatives promoting connectivity and economic development across the region. A CAGR exceeding 6% indicates a significant expansion, with the market size projected to reach substantial figures by 2033. Key drivers include the need for improved road networks to support burgeoning logistics and e-commerce, the expansion of high-speed rail systems to connect major cities, and the development of modern air and seaports to facilitate international trade. China, India, and other Southeast Asian nations are leading this growth, fueled by massive infrastructure investments and ambitious national development plans. While challenges exist, such as land acquisition complexities and environmental concerns, the overall outlook remains positive. The market is segmented by modes of transportation (roads, railways, airways, waterways) and geographically, with China, India, Japan, and South Korea representing significant market shares. The presence of major international and domestic construction companies further underscores the market's vitality and potential for further growth. This market dynamism presents lucrative opportunities for investors and contractors alike, particularly those specializing in sustainable and technologically advanced infrastructure solutions.

The competitive landscape is characterized by both multinational giants and regional players. Larsen & Toubro, Dilip Buildcon, and Reliance Infrastructure are prominent examples of Indian firms, while CPB Contractors and Hyundai E&C represent the significant international presence. Chinese firms like China State Construction Engineering and China Communications Construction Company dominate through sheer scale and government support. Japanese companies like Obayashi Corporation are also significant players, often working on large-scale projects. The diverse range of companies indicates a market capable of supporting a broad spectrum of expertise and project sizes, ranging from large-scale national infrastructure projects to smaller, localized initiatives. Continued technological advancements, particularly in sustainable building materials and construction techniques, are anticipated to further shape the market landscape. This includes increased adoption of automation, improved project management systems, and emphasis on environmentally friendly practices.

Asia-Pacific Transportation Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific transportation infrastructure construction market, offering a comprehensive overview of its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market valued at xx Million in 2025.

Asia-Pacific Transportation Infrastructure Construction Market Composition & Trends

This section delves into the market's competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, and the impact of substitute products. We examine end-user profiles and the significant role of mergers and acquisitions (M&A) activity. The report meticulously dissects market share distribution among key players and provides insights into the value of completed M&A deals. The analysis considers factors such as government policies promoting sustainable transportation, technological advancements like intelligent transportation systems (ITS), and the increasing demand for efficient and resilient infrastructure across the region. The intricate interplay of these factors shapes the market dynamics, influencing investment patterns and the overall growth trajectory. Specific data points, such as market share percentages for leading players and cumulative values of M&A transactions in the past five years (xx Million), are provided to enrich the analysis.

- Market Concentration: High concentration with a few dominant players controlling a significant market share.

- Innovation Catalysts: Government initiatives promoting sustainable infrastructure, technological advancements in construction materials and techniques.

- Regulatory Landscape: Varying regulatory frameworks across countries, impacting project timelines and costs.

- Substitute Products: Limited direct substitutes, but alternative modes of transport pose indirect competition.

- End-User Profiles: Government agencies, private companies, and joint ventures constitute the primary end-users.

- M&A Activities: Consolidation through strategic acquisitions, aiming to expand market reach and enhance capabilities.

Asia-Pacific Transportation Infrastructure Construction Market Industry Evolution

This section meticulously analyzes the market's growth trajectory, highlighting technological progress and shifts in consumer preferences influencing the sector's evolution. Detailed examination reveals trends like increasing urbanization, rising disposable incomes, and the growing focus on sustainable transportation, all contributing to the market's expansion. The report quantifies this growth using data points like compound annual growth rates (CAGR) for various segments during the historical period (2019-2024) and projected CAGR during the forecast period (2025-2033). Adoption rates of new technologies, like ITS and green construction materials, are also quantified to provide insights into the market's technological transformation. Moreover, the analysis incorporates shifting consumer preferences, such as a growing preference for efficient public transport systems and environmentally friendly infrastructure solutions. The section also delves into the impact of geopolitical factors and economic fluctuations on market growth, offering a holistic perspective on industry evolution. The estimated market size in 2033 is predicted to be xx Million.

Leading Regions, Countries, or Segments in Asia-Pacific Transportation Infrastructure Construction Market

This section identifies the dominant regions, countries, and modes of transport within the Asia-Pacific transportation infrastructure construction market. A detailed analysis pinpoints the key drivers behind this dominance, including significant government investments, supportive regulatory frameworks, and unique market characteristics.

Key Drivers:

- China: Massive infrastructure projects, government spending on transportation initiatives, and a strong domestic construction industry.

- India: Rapid urbanization, rising disposable incomes, and government focus on infrastructure development.

- Roads: Highest market share due to extensive road networks and ongoing expansion projects.

- Railways: Significant investments in high-speed rail projects and expansion of existing networks drive growth.

Dominance Factors:

China's dominance stems from massive government investment in infrastructure, particularly in high-speed rail and road networks. India's rapid economic growth and expanding urbanization fuel its strong performance, emphasizing road and railway infrastructure. The roads segment's dominance reflects the importance of road networks for freight and passenger transportation across the region.

Asia-Pacific Transportation Infrastructure Construction Market Product Innovations

The market showcases continuous innovation in construction materials, technologies, and project management techniques. Advances in sustainable construction materials like recycled aggregates, along with the implementation of Building Information Modeling (BIM) for efficient project planning and management, are key examples. Furthermore, the integration of intelligent transportation systems (ITS), including traffic management systems and smart parking solutions, enhances efficiency and sustainability. These innovations deliver improved project performance, reduced environmental impact, and enhanced user experience.

Propelling Factors for Asia-Pacific Transportation Infrastructure Construction Market Growth

Several factors fuel the growth of this market. Firstly, substantial government investments in infrastructure projects across the region are paramount. Secondly, rapid urbanization and population growth significantly increase demand for transportation solutions. Thirdly, technological advancements in construction methods and materials enhance efficiency and sustainability, further stimulating the market. Lastly, supportive government regulations and policies fostering private sector participation significantly contribute to market expansion.

Obstacles in the Asia-Pacific Transportation Infrastructure Construction Market

The market faces challenges like regulatory complexities and bureaucratic hurdles delaying project approvals and execution. Supply chain disruptions, particularly in procuring construction materials, occasionally impact project timelines and budgets. Furthermore, intense competition among construction firms can lead to price wars and reduced profit margins. These factors, when combined, can exert a quantifiable negative impact on market growth, estimated to be xx% in the past year.

Future Opportunities in Asia-Pacific Transportation Infrastructure Construction Market

Emerging opportunities include the expansion of high-speed rail networks, the development of smart cities with integrated transportation systems, and the increasing adoption of sustainable construction practices. The growing focus on improving last-mile connectivity and the development of multimodal transportation systems also present significant growth avenues.

Major Players in the Asia-Pacific Transportation Infrastructure Construction Market Ecosystem

- Larsen & Toubro Ltd

- Dilip Buildcon Ltd

- Reliance Infrastructure Limited

- CPB Contractors

- Hyundai E&C

- China State Construction Engineering

- China Communications Construction Company

- Obayashi Corporation

- Italian Thai (ITD)

- China Railway Construction Corporation

Key Developments in Asia-Pacific Transportation Infrastructure Construction Market Industry

- January 2023: The Indo-Japan Joint Working Group (JWG) initiated collaboration on road infrastructure development in India, focusing on sustainable and digitally enabled solutions. This signifies a shift towards smart and sustainable infrastructure.

- January 2023: China's CRRC Corporation Ltd. launched Asia's first hydrogen urban train, showcasing advancements in green transportation technology and signifying a potential shift in the railway sector towards emission reduction. This development underscores a trend towards sustainable and technologically advanced solutions.

Strategic Asia-Pacific Transportation Infrastructure Construction Market Forecast

The Asia-Pacific transportation infrastructure construction market is poised for robust growth, driven by sustained government investment, technological advancements, and the increasing demand for efficient and sustainable transportation solutions. The market's future trajectory is bright, fueled by ongoing urbanization, rising incomes, and a commitment to sustainable development across the region. The forecast suggests a significant expansion in market size, projected to reach xx Million by 2033.

Asia-Pacific Transportation Infrastructure Construction Market Segmentation

-

1. Modes

- 1.1. Roads

- 1.2. Railways

- 1.3. Airways

- 1.4. Waterways

Asia-Pacific Transportation Infrastructure Construction Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population

- 3.2.2 along with a rising middle class

- 3.3. Market Restrains

- 3.3.1. Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs

- 3.4. Market Trends

- 3.4.1. Government initiatives driving transport infrastructure market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Modes

- 5.1.1. Roads

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Modes

- 6. China Asia-Pacific Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Larsen & Toubro Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Dilip Buildcon Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Reliance Infrastructure Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 CPB Contractors

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hyundai E&C

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 China State Construction Engineering

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 China Communications Construction Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Obayashi Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Italian Thai (ITD)**List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 China Railway Construction Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Larsen & Toubro Ltd

List of Figures

- Figure 1: Asia-Pacific Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Transportation Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Transportation Infrastructure Construction Market Revenue Million Forecast, by Modes 2019 & 2032

- Table 3: Asia-Pacific Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Asia-Pacific Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Asia-Pacific Transportation Infrastructure Construction Market Revenue Million Forecast, by Modes 2019 & 2032

- Table 13: Asia-Pacific Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: New Zealand Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia-Pacific Transportation Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Transportation Infrastructure Construction Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Asia-Pacific Transportation Infrastructure Construction Market?

Key companies in the market include Larsen & Toubro Ltd, Dilip Buildcon Ltd, Reliance Infrastructure Limited, CPB Contractors, Hyundai E&C, China State Construction Engineering, China Communications Construction Company, Obayashi Corporation, Italian Thai (ITD)**List Not Exhaustive, China Railway Construction Corporation.

3. What are the main segments of the Asia-Pacific Transportation Infrastructure Construction Market?

The market segments include Modes.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population. along with a rising middle class.

6. What are the notable trends driving market growth?

Government initiatives driving transport infrastructure market in India.

7. Are there any restraints impacting market growth?

Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs.

8. Can you provide examples of recent developments in the market?

January 2023: The Indo-Japan Joint Working Group (JWG) will work together to provide the best road infrastructure for commuters and freight movement while also assisting India in meeting its sustainable transportation goals. The collaborative projects will lead to a massive digital transformation in the areas of intelligent transportation systems (ITS) and environmentally friendly mobility. India's strong commitment to collaboration with Japan in the areas of highway development, administration, and monitoring through the implementation of digitally enabled ITS services

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence