Key Insights

The global anti-counterfeit packaging market is poised for substantial expansion, driven by escalating concerns surrounding product authenticity and brand integrity across multiple industries. The market, valued at $204.08 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.4% from 2025 to 2033. Key growth catalysts include the widespread prevalence of counterfeit goods, stringent governmental regulations to combat illicit trade, and increasing consumer demand for genuine products. Advancements in technologies, such as integrated trace and track systems, tamper-evident seals, and covert forensic markers, are further accelerating market growth. The food & beverage and healthcare & pharmaceuticals sectors represent the primary end-user segments, underscoring the critical need for authenticity and safety verification in these areas. While cost and integration complexities present potential challenges, the overall market outlook remains robust, fueled by consistent demand for innovative anti-counterfeit solutions.

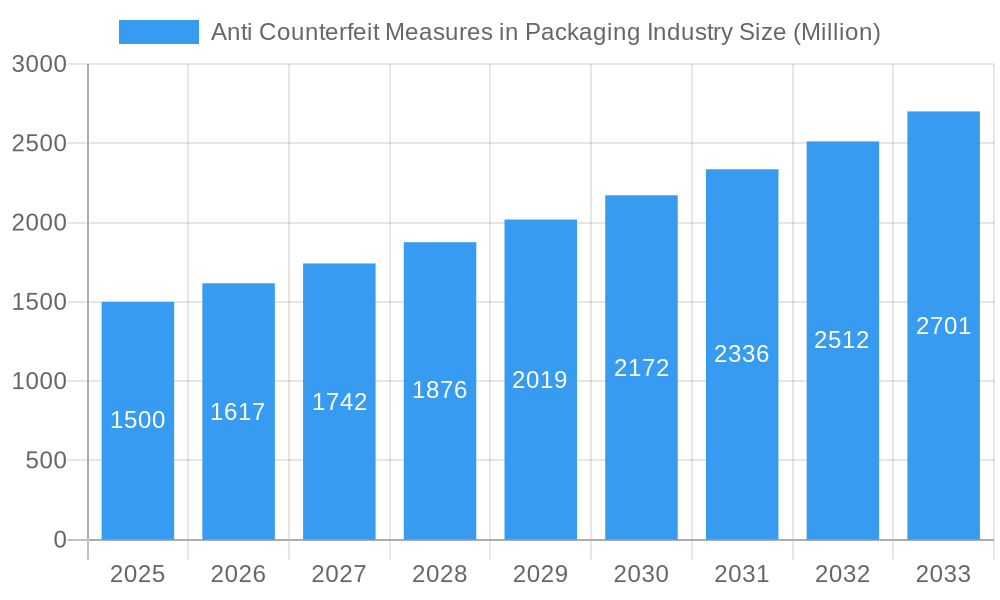

Anti Counterfeit Measures in Packaging Industry Market Size (In Billion)

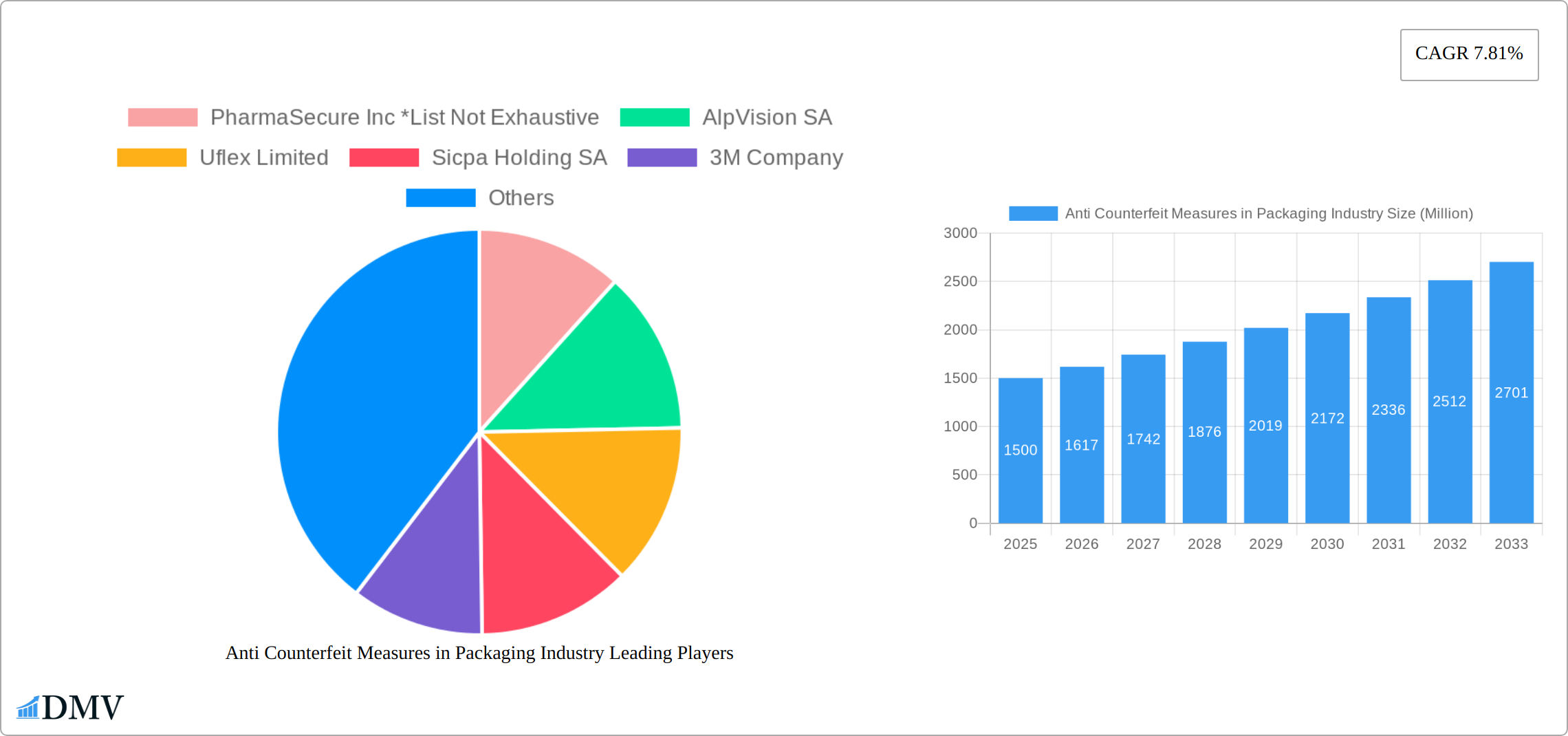

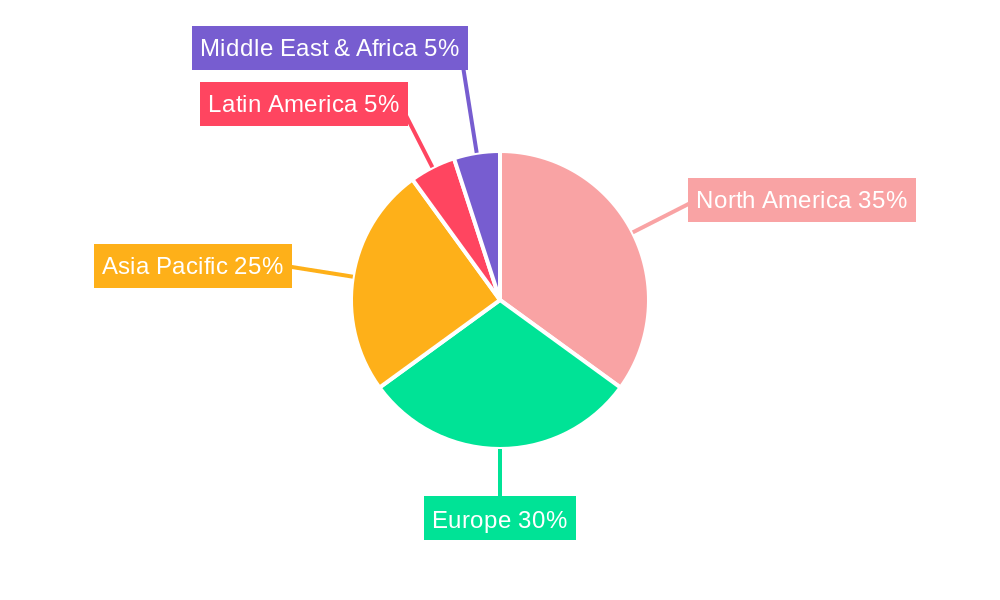

Market segmentation highlights the diverse range of solutions. Trace and track technologies are gaining prominence for their ability to provide granular product journey data, enhancing supply chain transparency. Tamper-evident packaging offers immediate visual confirmation of product integrity, while covert and forensic markers provide advanced authentication methods, often imperceptible to counterfeiters. Geographically, North America and Europe currently dominate market share, supported by established regulatory frameworks and high consumer awareness. However, the Asia-Pacific region is anticipated to witness significant growth, driven by rapid economic development and rising consumer expenditure. Leading companies such as PharmaSecure, AlpVision, Uflex, and Sicpa are actively influencing market trends through continuous innovation and strategic alliances, contributing to the global proliferation of anti-counterfeit solutions. Future market success hinges on ongoing development of cutting-edge technologies, collaborative supply chain efforts, and effective regulatory enforcement.

Anti Counterfeit Measures in Packaging Industry Company Market Share

Anti Counterfeit Measures in Packaging Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Anti Counterfeit Measures in Packaging Industry, projecting a market valued at USD xx Million by 2033. It delves into market dynamics, technological advancements, and key players shaping this crucial sector, offering invaluable insights for stakeholders across the value chain. The study period covers 2019-2033, with a base and estimated year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024.

Anti Counterfeit Measures in Packaging Industry Market Composition & Trends

The global anti-counterfeit measures market is experiencing robust growth, driven by escalating concerns over product authenticity and brand protection. Market concentration is moderate, with several key players holding significant shares, but a fragmented landscape also exists, particularly among smaller specialized firms. Innovation is fueled by advancements in digital technologies, including blockchain, AI, and RFID, enabling more sophisticated and secure packaging solutions. Stringent regulations, particularly in the pharmaceutical and food & beverage sectors, are further propelling market expansion. Substitute products, such as traditional security seals, are gradually being replaced by more technologically advanced solutions. End-users are increasingly demanding robust anti-counterfeit measures, reflecting growing consumer awareness and trust in brands. The market has witnessed notable M&A activity, exemplified by the USD 1.45 Billion acquisition of Vestcom by Avery Dennison Corporation in August 2021.

- Market Share Distribution (2024): Top 5 players account for approximately 35% of the market; remaining share distributed amongst numerous smaller players.

- M&A Deal Values (2019-2024): Total value exceeding USD xx Million, indicating a consolidation trend within the sector.

- Innovation Catalysts: Advancements in digital technologies (Blockchain, AI, RFID) and increased regulatory scrutiny.

- Regulatory Landscape: Stringent regulations in key regions (e.g., EU, US, China) mandating anti-counterfeit measures.

Anti Counterfeit Measures in Packaging Industry Industry Evolution

The anti-counterfeit packaging industry has undergone a significant transformation in recent years. Market growth trajectories show a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024, with projections exceeding xx% during the forecast period. This rapid expansion is primarily driven by technological advancements, including the incorporation of sophisticated authentication technologies like covert and forensic markers, and the rise of traceability and track-and-trace systems. Consumer demand for authentic products has also significantly increased, particularly among health-conscious individuals and those seeking premium brands, further driving adoption of advanced anti-counterfeit solutions. This evolving landscape compels companies to continuously innovate, leading to the development of more secure and cost-effective solutions. The shift towards digitalization also plays a significant role in boosting market expansion, allowing for real-time tracking and authentication of products throughout the supply chain. The market's evolution is also characterized by a growing focus on sustainability, with manufacturers developing eco-friendly anti-counterfeit measures.

Leading Regions, Countries, or Segments in Anti Counterfeit Measures in Packaging Industry

North America currently commands the largest market share in anti-counterfeit packaging measures. This dominance stems from the region's high adoption rate of advanced technologies, particularly "Trace and Track" solutions, and its stringent regulatory frameworks, especially within the healthcare and pharmaceutical sectors. The strong emphasis on supply chain visibility and product provenance fuels the demand for these advanced technologies. The healthcare and pharmaceuticals segment displays the highest demand due to escalating concerns surrounding drug counterfeiting and patient safety.

- Key Drivers (North America):

- Substantial investments in anti-counterfeiting infrastructure and R&D.

- Robust regulatory support, including clear compliance mandates and penalties for non-compliance.

- High consumer awareness and demand for authentic products, driving purchasing decisions.

- A well-established ecosystem of technology providers and integrators.

- Key Drivers (Healthcare & Pharmaceuticals):

- Stringent regulatory requirements for drug traceability and serialization.

- Heightened consumer concerns regarding counterfeit medications and their potential health risks.

- The high value of pharmaceutical products makes them prime targets for counterfeiting.

- Increased pressure from regulatory bodies and insurance providers.

- Dominance Factors: A confluence of stringent regulations, high consumer awareness, rapid technological advancements, significant private and public investments, and a robust infrastructure contribute to North America's leading position.

Anti Counterfeit Measures in Packaging Industry Product Innovations

Recent innovations are significantly enhancing packaging security. This includes the integration of advanced materials like nano-structures and metamaterials, creating sophisticated overt and covert security features. These features range from micro-printing and holograms to specialized inks with unique chemical compositions. Digital technologies such as QR codes, NFC tags, and RFID are also increasingly integrated, offering enhanced traceability and authentication capabilities. Product performance is measured by ease of implementation, cost-effectiveness, and the overall level of security provided. These innovations offer significantly greater protection against counterfeiting, ensuring product authenticity and complete traceability throughout the entire supply chain.

Propelling Factors for Anti Counterfeit Measures in Packaging Industry Growth

The anti-counterfeit packaging market is experiencing robust growth, propelled by several key factors. Technological advancements, such as blockchain technology for immutable record-keeping, AI-powered authentication systems for real-time verification, and the development of advanced, tamper-evident materials, are at the forefront. The rising incidence of counterfeiting across various sectors, coupled with growing consumer awareness and demand for product authenticity, is putting immense pressure on manufacturers to adopt robust anti-counterfeiting measures. Stringent government regulations across industries, particularly pharmaceuticals, food and beverages, are mandating the implementation of these technologies, further accelerating market growth.

Obstacles in the Anti Counterfeit Measures in Packaging Industry Market

Despite the significant growth potential, several obstacles hinder widespread adoption of anti-counterfeit measures. High initial investment costs associated with implementing advanced technologies pose a significant barrier for smaller businesses and emerging markets. Complex and often fragile supply chains can impede the seamless implementation and management of these solutions. Intense competition amongst technology providers leads to pricing pressures, necessitating continuous innovation to maintain a competitive edge. Furthermore, inconsistencies in regulations across different regions create compliance hurdles and hinder market standardization, making global deployment challenging.

Future Opportunities in Anti Counterfeit Measures in Packaging Industry

The expanding adoption of Internet of Things (IoT) devices and advanced analytics will offer opportunities for enhanced product traceability and monitoring. The integration of blockchain technology and AI will provide more robust and secure authentication mechanisms. Emerging markets in developing countries with high counterfeiting rates represent significant growth potential. The development of sustainable and eco-friendly anti-counterfeit solutions caters to rising environmental concerns.

Major Players in the Anti Counterfeit Measures in Packaging Industry Ecosystem

- PharmaSecure Inc

- AlpVision SA

- Uflex Limited

- Sicpa Holding SA

- 3M Company

- CCL Industries Inc

- Avery Dennison Corporation

- Applied DNA Sciences Inc

- Authentix Inc

- Zebra Technologies Corporation

- E I Du Pont De Nemours and Company

- Ampacet Corporation

Key Developments in Anti Counterfeit Measures in Packaging Industry Industry

- August 2021: Avery Dennison Corporation acquired Vestcom for USD 1.45 Billion, expanding its branded labeling offerings. This significantly strengthened Avery Dennison's position in the market and broadened its reach within the retail and consumer packaged goods industries.

Strategic Anti Counterfeit Measures in Packaging Industry Market Forecast

The anti-counterfeit measures market is projected to experience substantial growth in the coming years, driven by the persistent demand for secure and reliable packaging solutions. Technological innovation, increasingly stringent regulations, and heightened consumer awareness of counterfeiting will continue to fuel this expansion. Emerging markets represent significant growth opportunities, particularly as economies develop and consumer demand for branded goods increases. The widespread adoption of advanced technologies like AI and blockchain will unlock further opportunities. Finally, a growing focus on sustainable and environmentally friendly anti-counterfeiting solutions will further enhance the long-term growth prospects of this dynamic market.

Anti Counterfeit Measures in Packaging Industry Segmentation

-

1. Technology

- 1.1. Trace and Track

- 1.2. Tamper-evident

- 1.3. Covert

- 1.4. Overt

- 1.5. Forensic Markers

-

2. End User

- 2.1. Food and Beverage

- 2.2. Healthcare and Pharmaceuticals

- 2.3. Industrial and Automotive

- 2.4. Consumer Electronics

- 2.5. Other End Users

Anti Counterfeit Measures in Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

- 5. Middle East

-

6. South Africa

- 6.1. United Arab Emirates

- 6.2. Rest of Middle East

Anti Counterfeit Measures in Packaging Industry Regional Market Share

Geographic Coverage of Anti Counterfeit Measures in Packaging Industry

Anti Counterfeit Measures in Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Booming E-commerce Industry; Increasing Focus of Manufacturers on Brand Protection

- 3.3. Market Restrains

- 3.3.1. High-initial Costs

- 3.4. Market Trends

- 3.4.1. Pharmaceuticals and Healthcare to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Trace and Track

- 5.1.2. Tamper-evident

- 5.1.3. Covert

- 5.1.4. Overt

- 5.1.5. Forensic Markers

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food and Beverage

- 5.2.2. Healthcare and Pharmaceuticals

- 5.2.3. Industrial and Automotive

- 5.2.4. Consumer Electronics

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Trace and Track

- 6.1.2. Tamper-evident

- 6.1.3. Covert

- 6.1.4. Overt

- 6.1.5. Forensic Markers

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Food and Beverage

- 6.2.2. Healthcare and Pharmaceuticals

- 6.2.3. Industrial and Automotive

- 6.2.4. Consumer Electronics

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Trace and Track

- 7.1.2. Tamper-evident

- 7.1.3. Covert

- 7.1.4. Overt

- 7.1.5. Forensic Markers

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Food and Beverage

- 7.2.2. Healthcare and Pharmaceuticals

- 7.2.3. Industrial and Automotive

- 7.2.4. Consumer Electronics

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Trace and Track

- 8.1.2. Tamper-evident

- 8.1.3. Covert

- 8.1.4. Overt

- 8.1.5. Forensic Markers

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Food and Beverage

- 8.2.2. Healthcare and Pharmaceuticals

- 8.2.3. Industrial and Automotive

- 8.2.4. Consumer Electronics

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Trace and Track

- 9.1.2. Tamper-evident

- 9.1.3. Covert

- 9.1.4. Overt

- 9.1.5. Forensic Markers

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Food and Beverage

- 9.2.2. Healthcare and Pharmaceuticals

- 9.2.3. Industrial and Automotive

- 9.2.4. Consumer Electronics

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Trace and Track

- 10.1.2. Tamper-evident

- 10.1.3. Covert

- 10.1.4. Overt

- 10.1.5. Forensic Markers

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Food and Beverage

- 10.2.2. Healthcare and Pharmaceuticals

- 10.2.3. Industrial and Automotive

- 10.2.4. Consumer Electronics

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. South Africa Anti Counterfeit Measures in Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Trace and Track

- 11.1.2. Tamper-evident

- 11.1.3. Covert

- 11.1.4. Overt

- 11.1.5. Forensic Markers

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Food and Beverage

- 11.2.2. Healthcare and Pharmaceuticals

- 11.2.3. Industrial and Automotive

- 11.2.4. Consumer Electronics

- 11.2.5. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PharmaSecure Inc *List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 AlpVision SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Uflex Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Sicpa Holding SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 3M Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 CCL Industries Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Avery Dennison Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Applied Dna Sciences Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Authentix Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Zebra Technologies Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 E I Du Pont De Nemours and Company

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Ampacet Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 PharmaSecure Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Anti Counterfeit Measures in Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 9: Europe Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 15: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 21: Latin America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Latin America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Latin America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 27: Middle East Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 29: Middle East Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Africa Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Technology 2025 & 2033

- Figure 33: South Africa Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 34: South Africa Anti Counterfeit Measures in Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 35: South Africa Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: South Africa Anti Counterfeit Measures in Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: South Africa Anti Counterfeit Measures in Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 11: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Spain Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 20: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: China Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Australia Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 27: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Latin America Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 33: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 34: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 36: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 37: Global Anti Counterfeit Measures in Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East Anti Counterfeit Measures in Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Counterfeit Measures in Packaging Industry?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the Anti Counterfeit Measures in Packaging Industry?

Key companies in the market include PharmaSecure Inc *List Not Exhaustive, AlpVision SA, Uflex Limited, Sicpa Holding SA, 3M Company, CCL Industries Inc, Avery Dennison Corporation, Applied Dna Sciences Inc, Authentix Inc, Zebra Technologies Corporation, E I Du Pont De Nemours and Company, Ampacet Corporation.

3. What are the main segments of the Anti Counterfeit Measures in Packaging Industry?

The market segments include Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Booming E-commerce Industry; Increasing Focus of Manufacturers on Brand Protection.

6. What are the notable trends driving market growth?

Pharmaceuticals and Healthcare to Drive the Market Demand.

7. Are there any restraints impacting market growth?

High-initial Costs.

8. Can you provide examples of recent developments in the market?

In August 2021, - Avery Dennison Corporation acquired Vestcom for an investment of USD 1.45 billion. The acquisition will help the company expand its branded labeling offerings for retail and consumer packaged goods industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti Counterfeit Measures in Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti Counterfeit Measures in Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti Counterfeit Measures in Packaging Industry?

To stay informed about further developments, trends, and reports in the Anti Counterfeit Measures in Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence