Key Insights

The Americas plastic bag market, covering North and South America, is driven by robust growth. The market, valued at $27.31 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.6% through the forecast period (2025-2033). Key growth drivers include the expanding e-commerce sector, rising consumerism, and sustained demand across consumer retail, institutional (hospitality, healthcare), and industrial applications. The preference for convenient packaging solutions significantly fuels market expansion. However, increasing environmental concerns and regulations on plastic waste pose restraints. The market is witnessing a trend towards biodegradable and compostable alternatives like PLA and PHA, although non-biodegradable options still hold a larger share. Mexico and Brazil are pivotal markets within the Americas, showing substantial growth potential due to their expanding populations and economic development.

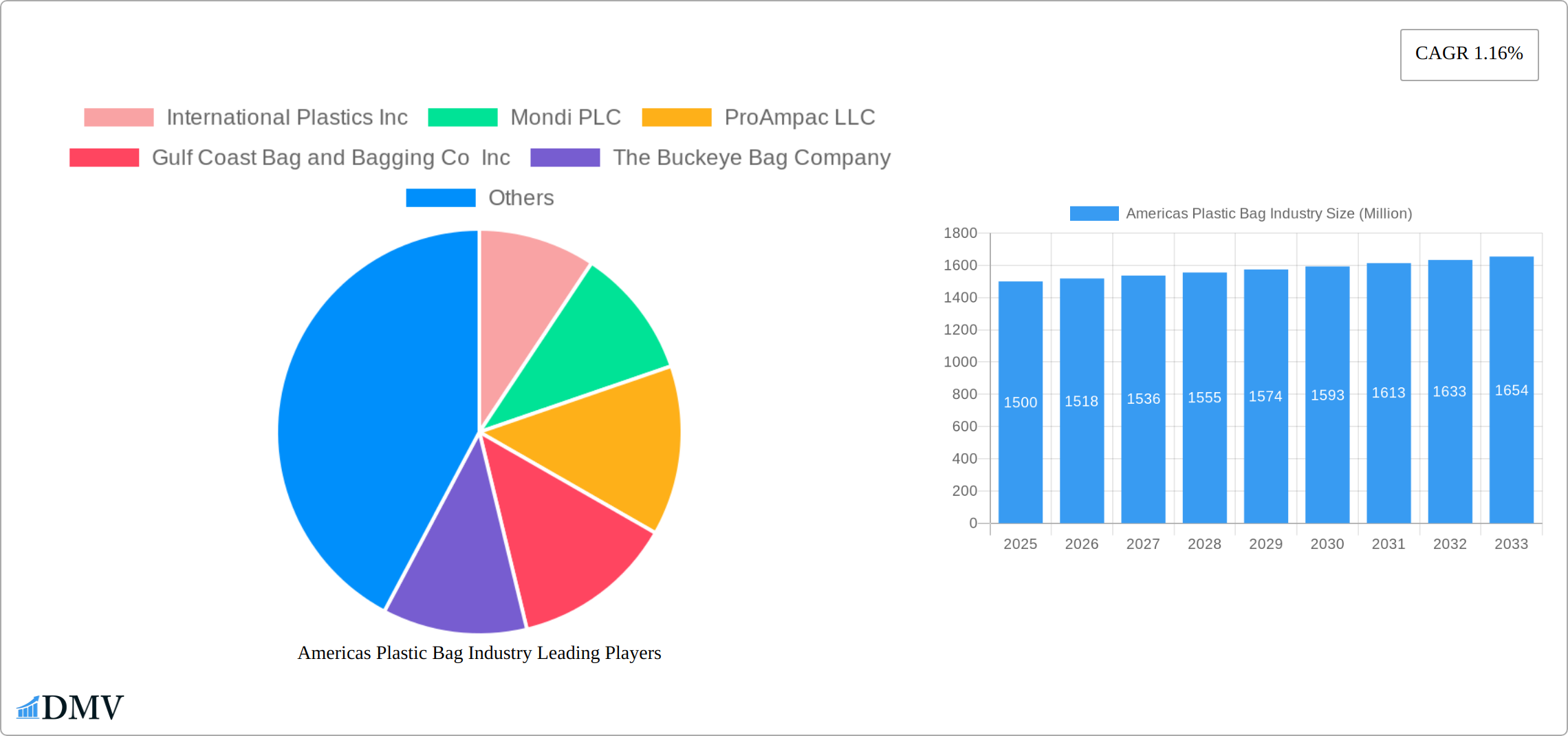

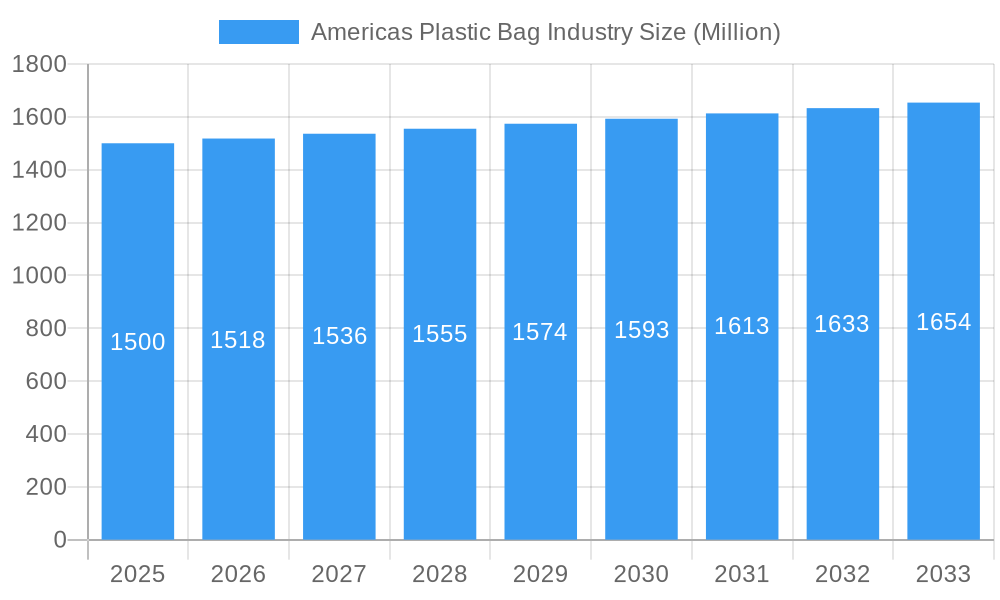

Americas Plastic Bag Industry Market Size (In Billion)

Market segmentation reveals that while the consumer and retail sector currently leads, institutional and industrial segments are also experiencing significant growth. Major players such as International Plastics Inc, Mondi PLC, and Berry Global Inc are competing through product diversification, geographic expansion, and strategic partnerships. The market's future will be shaped by the integration of sustainable materials, manufacturing technology advancements, and the enforcement of environmental regulations across the Americas, potentially accelerating the adoption of eco-friendly alternatives and reshaping industry competition.

Americas Plastic Bag Industry Company Market Share

Americas Plastic Bag Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Americas plastic bag industry, encompassing market size, trends, growth drivers, challenges, and future opportunities from 2019 to 2033. The study covers key segments, leading players, and recent developments, offering valuable insights for stakeholders across the value chain. With a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for strategic decision-making. The market size is projected to reach xx Million by 2033, presenting significant growth potential.

Americas Plastic Bag Industry Market Composition & Trends

The Americas plastic bag industry presents a dynamic landscape shaped by competitive pressures, evolving consumer preferences, and stringent environmental regulations. This section analyzes the market's structure, key players, innovation drivers, and the impact of external forces on its trajectory. We examine market concentration, mergers and acquisitions (M&A) activity, and the influence of substitute products and evolving end-user demands.

- Market Structure & Concentration: The market exhibits a moderately concentrated structure, with leading players like Novolex Holdings and Berry Global Inc. holding significant market share. However, regional players and smaller specialized businesses also contribute to the overall market dynamics. A detailed analysis of market share distribution across key players, including an estimated percentage for the top five in 2025, provides a clearer understanding of the competitive landscape.

- Innovation in Materials & Processes: The industry is witnessing a surge in innovation driven by the growing demand for sustainable packaging. This includes the development and adoption of biodegradable materials such as PLA and PHA, as well as advancements in recyclable polyethylene films, exemplified by ProAmpac's ProActive Recyclable R-2000F. These innovations are crucial for addressing environmental concerns and meeting evolving consumer expectations.

- Regulatory Landscape & Compliance: Increasingly stringent environmental regulations focused on plastic waste management are reshaping industry strategies. Companies are adapting to these regulations through the adoption of eco-friendly alternatives, investments in recycling infrastructure, and the implementation of sustainable manufacturing processes. Understanding these regulations and their impact is vital for assessing market trends and opportunities.

- Competitive Pressures from Substitute Products: The plastic bag industry faces competition from various substitute products, including paper bags, reusable bags, and other innovative packaging solutions. This competitive pressure necessitates continuous innovation in material science, design, and cost-effectiveness to maintain market share and appeal to environmentally conscious consumers.

- End-User Segmentation & Demand Analysis: The report analyzes consumption patterns across key end-use segments: consumer & retail, institutional, and industrial. Understanding the specific needs and preferences of each segment is crucial for tailoring product offerings and marketing strategies. This analysis includes variations in material preferences, desired bag functionalities, and overall volume consumption.

- Mergers & Acquisitions (M&A) Activity: M&A activity within the Americas plastic bag industry reflects strategic efforts to expand market reach, diversify product portfolios, and enhance operational efficiencies. Analysis of recent deal values (e.g., average deal values during 2019-2024) and their impact on market share distribution provides insight into the industry's consolidation trends.

Americas Plastic Bag Industry Industry Evolution

This section analyzes the historical (2019-2024) and projected (2025-2033) growth trajectories of the Americas plastic bag market. We explore the influence of technological advancements, shifting consumer preferences (e.g., growing preference for sustainable options), and regulatory changes on market dynamics. The overall market is expected to experience a compound annual growth rate (CAGR) of xx% during the forecast period. This growth is influenced by:

- Technological Advancements: Innovations in film extrusion, printing technologies, and material science are enhancing bag performance (strength, durability, aesthetics), leading to increased adoption in various applications.

- Consumer Demands: Growing environmental awareness and demand for sustainable products are driving the market shift towards biodegradable and recyclable bags.

- Market Growth Trajectories: The consumer and retail segment is expected to be the largest contributor to overall market growth, driven by the expanding e-commerce sector and increased consumption of packaged goods. The industrial segment is also projected to show substantial growth, particularly in sectors like food and agriculture.

Leading Regions, Countries, or Segments in Americas Plastic Bag Industry

This section identifies the dominant regions, countries, and segments within the Americas plastic bag market. The analysis focuses on market share, growth drivers, and key factors contributing to regional dominance.

By Material Type:

- Non-Biodegradable: This segment holds the largest market share, driven by lower cost and established infrastructure. However, growing environmental concerns are challenging its dominance.

- Biodegradable (PLA, PHA, etc.): This segment exhibits the highest growth potential, driven by increasing regulatory pressures, consumer demand for sustainable options, and continuous innovation in material science.

By Application Type:

- Consumer and Retail: This segment remains the largest, driven by the high volume of packaged goods sold through retail channels. The growth is fueled by expanding e-commerce and the associated need for efficient packaging.

- Institutional: This segment is expected to experience steady growth, primarily due to increased demand in the healthcare and hospitality sectors.

- Industrial: The industrial segment shows growth driven by the packaging needs of various industries, including agriculture and manufacturing. Increased demand for customized packaging solutions drives market growth in this sector.

Key Drivers (Across Segments):

- Increased investment in sustainable packaging solutions: Major players are investing heavily in research and development of biodegradable and recyclable alternatives.

- Stringent environmental regulations: Government regulations are promoting the use of eco-friendly packaging materials and reducing plastic waste.

- Consumer preference for sustainable products: Growing consumer awareness about the environmental impact of plastic bags is driving demand for sustainable alternatives.

Americas Plastic Bag Industry Product Innovations

Recent product innovations have focused on enhanced sustainability and performance. ProAmpac LLC's launch of ProActive Recyclable R-2000F exemplifies the trend towards high-performance recyclable polyethylene-based films, designed to meet the demands of cold-temperature applications while minimizing environmental impact. These innovations showcase improved stiffness, scuff-resistance, and freezer display characteristics compared to standard films, providing a clear competitive advantage. Other innovations involve the integration of recycled content and the development of advanced barrier technologies for extended product shelf life.

Propelling Factors for Americas Plastic Bag Industry Growth

The growth of the Americas plastic bag market is driven by a confluence of factors, including: advancements in material science leading to more sustainable and durable bags; the explosive growth of e-commerce, increasing demand for packaging; supportive government policies promoting responsible packaging; and the continued expansion of the consumer goods and retail sectors. Technological advancements in manufacturing processes also enhance efficiency and reduce production costs, contributing to overall market expansion.

Obstacles in the Americas Plastic Bag Industry Market

Despite significant growth potential, the Americas plastic bag industry faces notable challenges. Stringent environmental regulations, often resulting in increased production costs and limitations on specific bag types, are a primary concern. Supply chain disruptions, especially regarding raw material sourcing, can impact production capacity and profitability. Furthermore, intense competition from substitute products, coupled with fluctuating consumer preferences, pose ongoing threats to market share and margins. These factors can collectively impact projected market growth rates.

Future Opportunities in Americas Plastic Bag Industry

The future holds promising opportunities for the Americas plastic bag market. The growing demand for sustainable and eco-friendly packaging presents a significant growth opportunity for companies focusing on biodegradable and compostable options. Moreover, exploring new markets and applications (e.g., specialized industrial packaging) alongside advancements in recycling technologies are key to unlocking growth potential. Innovative partnerships with waste management companies can further capitalize on the sustainability trend.

Major Players in the Americas Plastic Bag Industry Ecosystem

- International Plastics Inc

- Mondi PLC

- ProAmpac LLC

- Gulf Coast Bag and Bagging Co Inc

- The Buckeye Bag Company

- Novolex Holdings

- Berry Global Inc

- List Not Exhaustive

Key Developments in Americas Plastic Bag Industry Industry

- July 2020: Walmart, Target, and CVS Health joined the Consortium to Reinvent the Retail Plastic Bag, aiming to test alternatives to single-use plastic shopping bags. This initiative reflects a significant shift towards sustainable packaging solutions within the retail sector.

- February 2021: ProAmpac LLC launched ProActive Recyclable R-2000F, a recyclable polyethylene-based film. This launch signifies innovation in sustainable packaging, meeting demands for cold-temperature applications with improved performance and eco-friendliness.

Strategic Americas Plastic Bag Industry Market Forecast

The Americas plastic bag market is projected to experience continued growth throughout the forecast period (2025-2033). This growth will be significantly influenced by the increasing demand for sustainable packaging options, fueled by both consumer preference and governmental regulations. Technological advancements in biodegradable and recyclable materials, coupled with a focus on circular economy models and improved recycling infrastructure, will play a pivotal role in shaping the industry's future trajectory. The report will provide a detailed quantitative forecast, outlining projected growth rates and market size for the period.

Americas Plastic Bag Industry Segmentation

-

1. Material Type

-

1.1. Non-Biodegradable

- 1.1.1. High Density Polyethylene (HDPE)

- 1.1.2. Polystyrene (PS)

- 1.1.3. Low Density Polyethylene (LDPE)

- 1.1.4. Others

- 1.2. Bio-degradable (PLA, PHA, etc.)

-

1.1. Non-Biodegradable

-

2. Application Type

- 2.1. Consumer

- 2.2. Institut

- 2.3. Industrial (includes sacks, etc.)

- 2.4. Other Applications

-

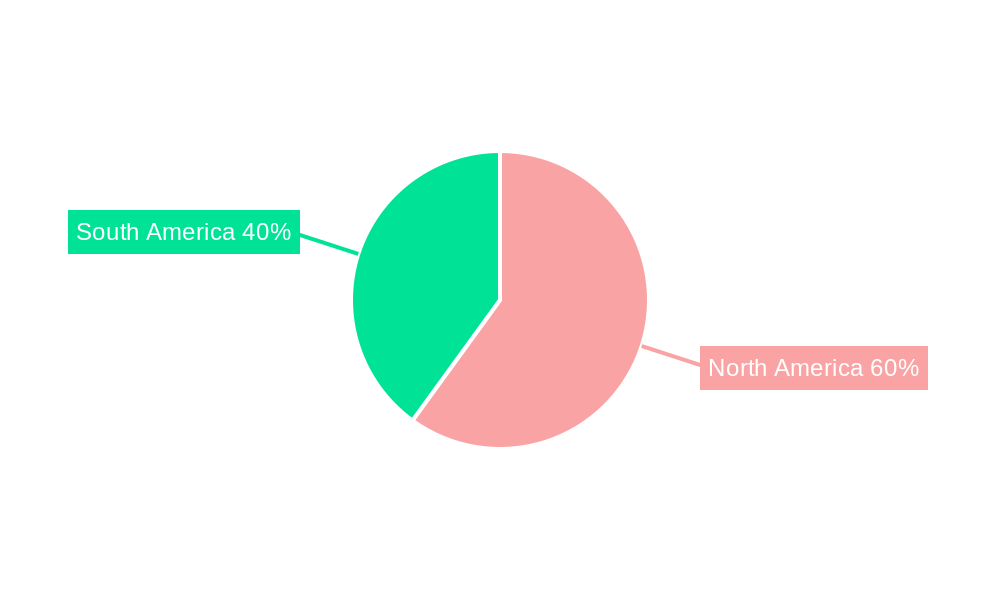

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.2. Latin America

-

3.1. North America

Americas Plastic Bag Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 2. Latin America

Americas Plastic Bag Industry Regional Market Share

Geographic Coverage of Americas Plastic Bag Industry

Americas Plastic Bag Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Unit Sales in Key End-user Markets; Advancements in Printing Industry has Enabling Firms to Use Plastic Bags to Promote their Brands

- 3.3. Market Restrains

- 3.3.1. ; Government Regulations and Interventions

- 3.4. Market Trends

- 3.4.1. Consumer and Retail Accounts for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Plastic Bag Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Non-Biodegradable

- 5.1.1.1. High Density Polyethylene (HDPE)

- 5.1.1.2. Polystyrene (PS)

- 5.1.1.3. Low Density Polyethylene (LDPE)

- 5.1.1.4. Others

- 5.1.2. Bio-degradable (PLA, PHA, etc.)

- 5.1.1. Non-Biodegradable

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Consumer

- 5.2.2. Institut

- 5.2.3. Industrial (includes sacks, etc.)

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.2. Latin America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Americas Plastic Bag Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Non-Biodegradable

- 6.1.1.1. High Density Polyethylene (HDPE)

- 6.1.1.2. Polystyrene (PS)

- 6.1.1.3. Low Density Polyethylene (LDPE)

- 6.1.1.4. Others

- 6.1.2. Bio-degradable (PLA, PHA, etc.)

- 6.1.1. Non-Biodegradable

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Consumer

- 6.2.2. Institut

- 6.2.3. Industrial (includes sacks, etc.)

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. North America

- 6.3.1.1. United States

- 6.3.1.2. Canada

- 6.3.2. Latin America

- 6.3.1. North America

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Latin America Americas Plastic Bag Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Non-Biodegradable

- 7.1.1.1. High Density Polyethylene (HDPE)

- 7.1.1.2. Polystyrene (PS)

- 7.1.1.3. Low Density Polyethylene (LDPE)

- 7.1.1.4. Others

- 7.1.2. Bio-degradable (PLA, PHA, etc.)

- 7.1.1. Non-Biodegradable

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Consumer

- 7.2.2. Institut

- 7.2.3. Industrial (includes sacks, etc.)

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. North America

- 7.3.1.1. United States

- 7.3.1.2. Canada

- 7.3.2. Latin America

- 7.3.1. North America

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 International Plastics Inc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Mondi PLC

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 ProAmpac LLC

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Gulf Coast Bag and Bagging Co Inc

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 The Buckeye Bag Company

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Novolex Holdings

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Berry Global Inc *List Not Exhaustive

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.1 International Plastics Inc

List of Figures

- Figure 1: Americas Plastic Bag Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Americas Plastic Bag Industry Share (%) by Company 2025

List of Tables

- Table 1: Americas Plastic Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Americas Plastic Bag Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Americas Plastic Bag Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Americas Plastic Bag Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Americas Plastic Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Americas Plastic Bag Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 7: Americas Plastic Bag Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Americas Plastic Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Americas Plastic Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Americas Plastic Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Americas Plastic Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 12: Americas Plastic Bag Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 13: Americas Plastic Bag Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Americas Plastic Bag Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Plastic Bag Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Americas Plastic Bag Industry?

Key companies in the market include International Plastics Inc, Mondi PLC, ProAmpac LLC, Gulf Coast Bag and Bagging Co Inc, The Buckeye Bag Company, Novolex Holdings, Berry Global Inc *List Not Exhaustive.

3. What are the main segments of the Americas Plastic Bag Industry?

The market segments include Material Type, Application Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Unit Sales in Key End-user Markets; Advancements in Printing Industry has Enabling Firms to Use Plastic Bags to Promote their Brands.

6. What are the notable trends driving market growth?

Consumer and Retail Accounts for the Largest Market Share.

7. Are there any restraints impacting market growth?

; Government Regulations and Interventions.

8. Can you provide examples of recent developments in the market?

February 2021 - ProAmpac LLC has launched ProActive Recyclable R-2000F, a polyethylene-based laminated structure that offers excellent performance in cold temperature conditions. The product was designed with enhanced stiffness and scuff-resistance compared to standard surface printed films and showed outstanding display characteristics in the freezer case.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Plastic Bag Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Plastic Bag Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Plastic Bag Industry?

To stay informed about further developments, trends, and reports in the Americas Plastic Bag Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence