Key Insights

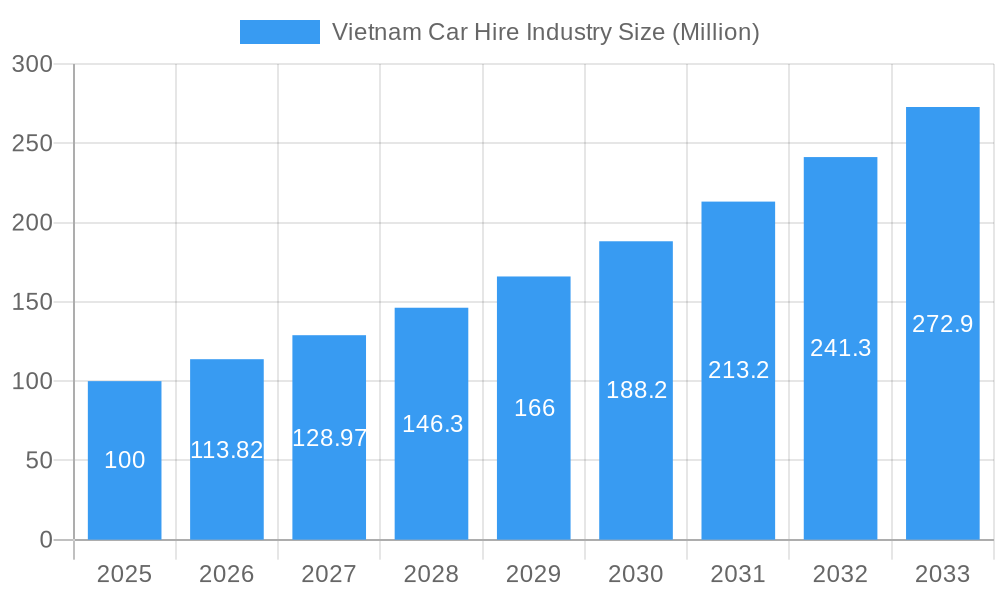

The Vietnam car hire market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 13.82% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, a burgeoning tourism sector, attracting millions of international and domestic visitors annually, significantly increases demand for car rental services for exploring the country's diverse landscapes. Secondly, rising disposable incomes and a growing middle class are enabling more Vietnamese citizens to utilize car hire for both leisure and business purposes. Finally, the increasing availability of online booking platforms simplifies the rental process, contributing to higher adoption rates. The market segments reveal a dynamic landscape; online bookings are likely outpacing offline methods due to convenience, while short-term rentals dominate the market. However, the long-term rental segment is also witnessing growth, driven by both business needs and individuals seeking alternative transportation options. While specific data on the proportional size of each segment is unavailable, market trends suggest a substantial share for short-term tourism-related bookings. Competition is fierce, with both international players like Avis and Hertz, and local companies like Vina Rent A Car and Mai Linh Group vying for market share. The presence of ride-hailing giants like Grab and Gojek further influences the market dynamics, offering alternative transportation modes and impacting pricing strategies.

Vietnam Car Hire Industry Market Size (In Million)

Growth in the Vietnam car hire market is expected to continue throughout the forecast period, albeit possibly with some moderation towards the later years as market saturation and competitive pressures intensify. Factors such as infrastructure development, government regulations concerning the transportation sector, and fuel price fluctuations will significantly affect market trajectory. While challenges exist, such as the need for improved infrastructure in certain regions and potential environmental concerns, the overall growth outlook remains optimistic, driven by the aforementioned factors and the continued expansion of Vietnam's economy and tourism sector. The industry's future will largely depend on the ability of companies to adapt to evolving consumer preferences, leverage technology for improved service delivery, and navigate regulatory changes effectively. A key trend to watch is the integration of technology into the rental process, including mobile apps, automated check-in/check-out systems, and potentially autonomous vehicles in the future.

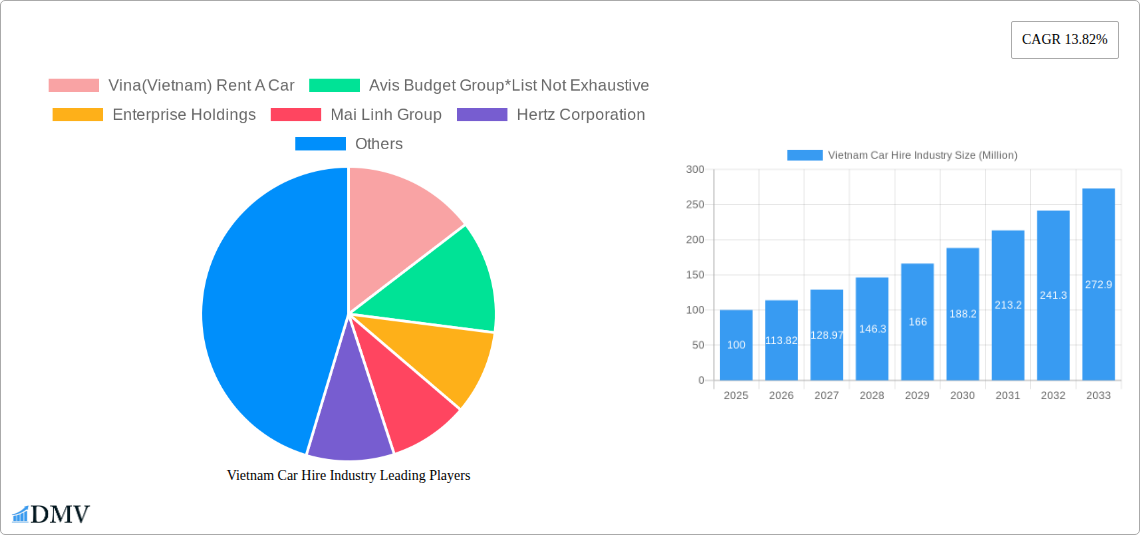

Vietnam Car Hire Industry Company Market Share

Vietnam Car Hire Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Vietnam car hire industry, encompassing its current market dynamics, future growth projections, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. The report projects a market value of xx Million USD by 2033, driven by factors detailed within.

Vietnam Car Hire Industry Market Composition & Trends

This section delves into the competitive landscape of the Vietnam car hire market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute offerings, and end-user demographics. We examine the impact of mergers and acquisitions (M&A) activity, quantifying deal values where possible, and providing a comprehensive overview of market share distribution among key players. The market is characterized by a mix of international giants and local operators, leading to a dynamic competitive landscape.

- Market Concentration: The Vietnam car hire market exhibits a moderately concentrated structure, with several major players holding significant market share. However, the presence of numerous smaller operators indicates opportunities for both organic growth and consolidation.

- Innovation Catalysts: Technological advancements, such as mobile booking apps and online platforms, are driving innovation, enhancing customer experience, and improving operational efficiency.

- Regulatory Landscape: Government regulations regarding licensing, insurance, and vehicle standards significantly influence market operations and growth. The report analyzes the current regulatory framework and its potential impact on future market dynamics.

- Substitute Products: Alternative transportation options, such as ride-hailing services (Grab, Gojek) and public transport, exert competitive pressure on the car rental market. The report assesses the competitive intensity and market share captured by substitute products.

- End-User Profiles: The report segments the market based on user demographics, including tourists, business travelers, and local residents, highlighting their distinct rental preferences and needs.

- M&A Activities: Significant M&A activity in the industry is analyzed, with deal values estimated at xx Million USD over the historical period. This analysis provides insights into market consolidation trends and potential future acquisitions. Examples include potential strategic partnerships aiming to leverage technology and expand market reach.

Vietnam Car Hire Industry Industry Evolution

This section traces the evolution of the Vietnam car hire industry, showcasing growth trajectories, technological progress, and evolving customer preferences. We examine the historical period (2019-2024), the base year (2025), and forecast the market's growth to 2033. Data points include annual growth rates (CAGR) and adoption rates for various technologies. The industry experienced significant growth fueled by Vietnam’s burgeoning tourism sector and rising disposable incomes. The rise of online booking platforms transformed customer access to rental services, improving convenience and efficiency. Advancements in fleet management technology, such as telematics and GPS tracking, have streamlined operations and enhanced safety. The increasing preference for self-drive rentals over chauffeur-driven services reflects changing consumer behavior. Moreover, the integration of innovative technologies such as electric and hybrid vehicles is expected to shape future industry developments. The report predicts a CAGR of xx% during the forecast period (2025-2033).

Leading Regions, Countries, or Segments in Vietnam Car Hire Industry

This section identifies the dominant segments within the Vietnam car hire market, focusing on booking type (online vs. offline), rental duration (short-term vs. long-term), and application type (tourism vs. commuting).

Key Drivers:

- Online Booking: The increasing popularity of online bookings is driven by convenience, ease of price comparison, and wider availability of vehicles.

- Short-Term Rentals: The short-term rental segment dominates due to the high volume of tourist traffic and business travel.

- Tourism Applications: Tourism is a significant driver of growth, with international and domestic tourists relying heavily on car hire services for exploring the country.

Dominance Factors: The online booking segment exhibits faster growth compared to offline channels. This is attributable to increased internet and smartphone penetration, improved digital literacy, and the convenience offered by online platforms. Short-term rentals dominate the market due to the prevalence of tourist and business travel, whereas long-term rentals cater to a niche market. Tourism continues to be the largest application segment, though the commuting segment is demonstrating promising growth potential.

Vietnam Car Hire Industry Product Innovations

Recent product innovations include the introduction of mobile apps for streamlined booking and management, integration of GPS navigation and telematics systems for enhanced safety and efficiency, and expansion of fleet offerings to include eco-friendly vehicles. These innovations are aimed at improving the customer experience, enhancing operational efficiency, and addressing growing environmental concerns. Unique selling propositions focus on providing personalized service, competitive pricing, and a diverse range of vehicles to cater to various customer needs.

Propelling Factors for Vietnam Car Hire Industry Growth

Several factors contribute to the growth of the Vietnam car hire industry. These include the expanding tourism sector, rising disposable incomes leading to increased leisure travel, government initiatives promoting infrastructure development, and the increasing adoption of technology for enhancing operational efficiency and customer experience. The growth of e-commerce and digital payments further facilitates online bookings and transactions.

Obstacles in the Vietnam Car Hire Industry Market

Challenges include intense competition from ride-hailing services, fluctuating fuel prices, traffic congestion in urban areas, and regulatory complexities relating to licensing and insurance. Supply chain disruptions impacting vehicle availability and maintenance costs also pose significant hurdles. These factors can lead to reduced profitability and operational inefficiencies.

Future Opportunities in Vietnam Car Hire Industry

Future opportunities lie in expanding into underserved markets, particularly in rural areas, leveraging technology to offer personalized services and enhance customer engagement, and capitalizing on the growing demand for sustainable and eco-friendly vehicles. Strategic partnerships with hotels, travel agencies, and other businesses can further broaden market reach and distribution channels.

Major Players in the Vietnam Car Hire Industry Ecosystem

- Vina(Vietnam) Rent A Car

- Avis Budget Group

- Enterprise Holdings

- Mai Linh Group

- Hertz Corporation

- Vietnam Sun Corporation (Vinasun)

- PT Gojek

- Grab Holdings Inc

Key Developments in Vietnam Car Hire Industry Industry

- September 2021: Zoomcar launches operations in Vietnam, introducing approximately 1,000 vehicles to the market.

- May 2022: Zoomcar partners with PJICO to offer comprehensive insurance packages for both car owners and renters, a first in Vietnam.

- June 2022: Avis opens a new branch in Phu Quoc, expanding its presence in a key tourist destination.

Strategic Vietnam Car Hire Industry Market Forecast

The Vietnam car hire market is poised for robust growth, driven by the increasing popularity of domestic and international tourism, the rising middle class, and technological advancements. Opportunities exist in expanding into new markets, diversifying service offerings, and adopting sustainable practices. The market is expected to witness significant consolidation as larger players seek to acquire smaller operators and strengthen their market position. The report's forecast indicates substantial growth potential in the coming years.

Vietnam Car Hire Industry Segmentation

-

1. Booking Type

- 1.1. Online

- 1.2. Offline

-

2. Rental Duration

- 2.1. Short-term

- 2.2. Long-term

-

3. Application Type

- 3.1. Tourism

- 3.2. Commuting

Vietnam Car Hire Industry Segmentation By Geography

- 1. Vietnam

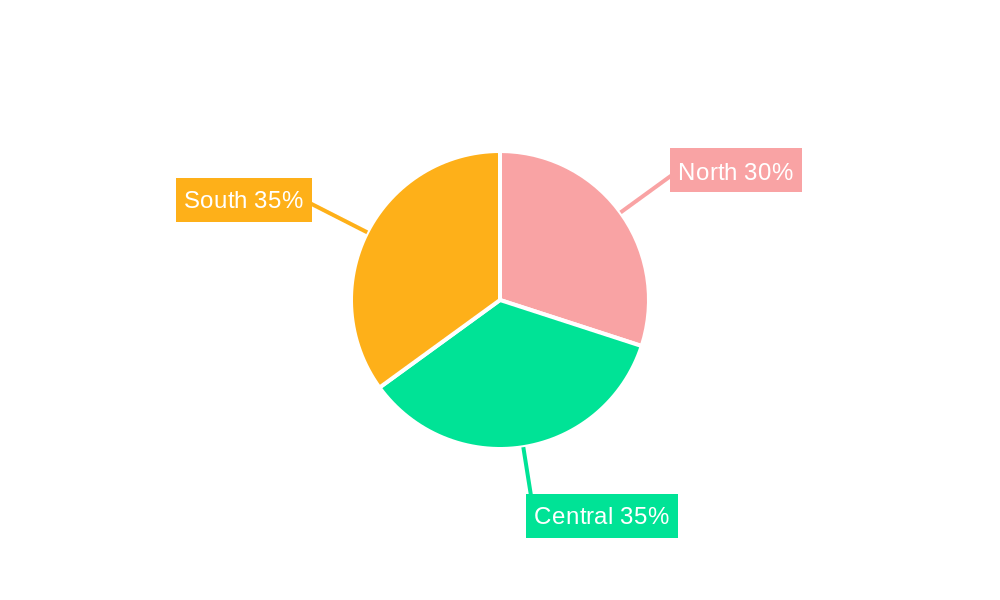

Vietnam Car Hire Industry Regional Market Share

Geographic Coverage of Vietnam Car Hire Industry

Vietnam Car Hire Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Increasing Investments by Foreign Players is Pushing Demand for Car Rentals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Car Hire Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration

- 5.2.1. Short-term

- 5.2.2. Long-term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Tourism

- 5.3.2. Commuting

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vina(Vietnam) Rent A Car

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Avis Budget Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enterprise Holdings

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mai Linh Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hertz Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vietnam Sun Corporation (Vinasun)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Gojek

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grab Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Vina(Vietnam) Rent A Car

List of Figures

- Figure 1: Vietnam Car Hire Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Vietnam Car Hire Industry Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Car Hire Industry Revenue undefined Forecast, by Booking Type 2020 & 2033

- Table 2: Vietnam Car Hire Industry Revenue undefined Forecast, by Rental Duration 2020 & 2033

- Table 3: Vietnam Car Hire Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 4: Vietnam Car Hire Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Vietnam Car Hire Industry Revenue undefined Forecast, by Booking Type 2020 & 2033

- Table 6: Vietnam Car Hire Industry Revenue undefined Forecast, by Rental Duration 2020 & 2033

- Table 7: Vietnam Car Hire Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 8: Vietnam Car Hire Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Car Hire Industry?

The projected CAGR is approximately 12.19%.

2. Which companies are prominent players in the Vietnam Car Hire Industry?

Key companies in the market include Vina(Vietnam) Rent A Car, Avis Budget Group*List Not Exhaustive, Enterprise Holdings, Mai Linh Group, Hertz Corporation, Vietnam Sun Corporation (Vinasun), PT Gojek, Grab Holdings Inc.

3. What are the main segments of the Vietnam Car Hire Industry?

The market segments include Booking Type, Rental Duration, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Increasing Investments by Foreign Players is Pushing Demand for Car Rentals.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

In June 2022, Avis opened a new branch in Duong To hamlet, Duong To commune, Phu Quoc city - about 2km from Phu Quoc airport. The car rental services start at prices of 600,000 VND per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Car Hire Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Car Hire Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Car Hire Industry?

To stay informed about further developments, trends, and reports in the Vietnam Car Hire Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence