Key Insights

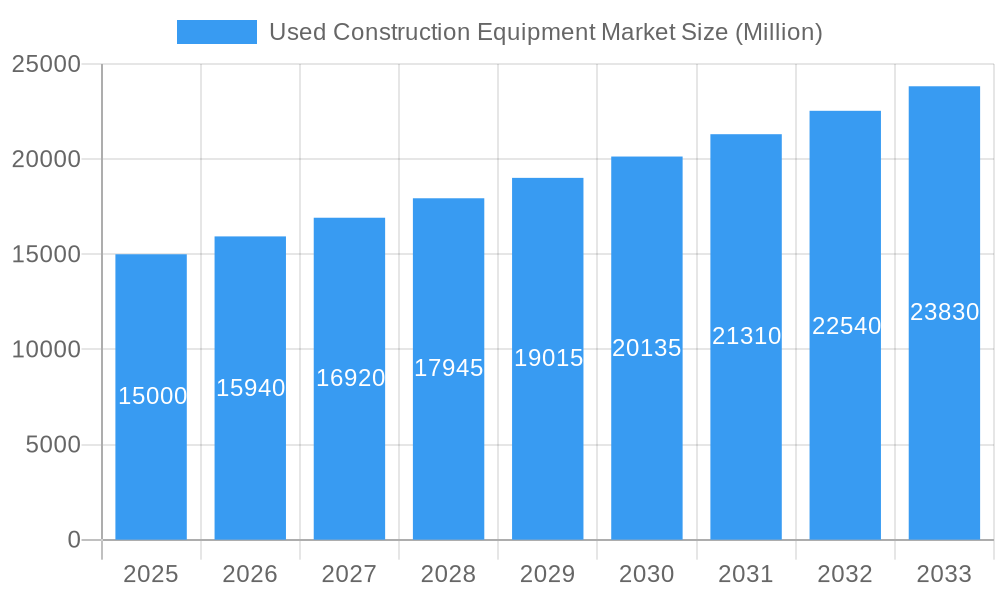

The global used construction equipment market is projected for significant expansion through 2033, building on a recent Compound Annual Growth Rate (CAGR) of 5.13%. Robust demand is driven by escalating global infrastructure development, particularly in rapidly urbanizing emerging economies. Cost-effective, pre-owned machinery remains a key preference. Excavators, loaders, backhoes, and telescopic handlers are leading segments due to their broad application. While internal combustion engines still dominate, electric and hybrid options are gaining traction, supported by environmental consciousness and regulatory support for sustainability. Major manufacturers like Caterpillar, Komatsu, and Volvo CE are enhancing their used equipment portfolios and after-sales services. Despite challenges from commodity price volatility and economic fluctuations, consistent demand from SMEs for affordable solutions ensures a positive market outlook.

Used Construction Equipment Market Market Size (In Billion)

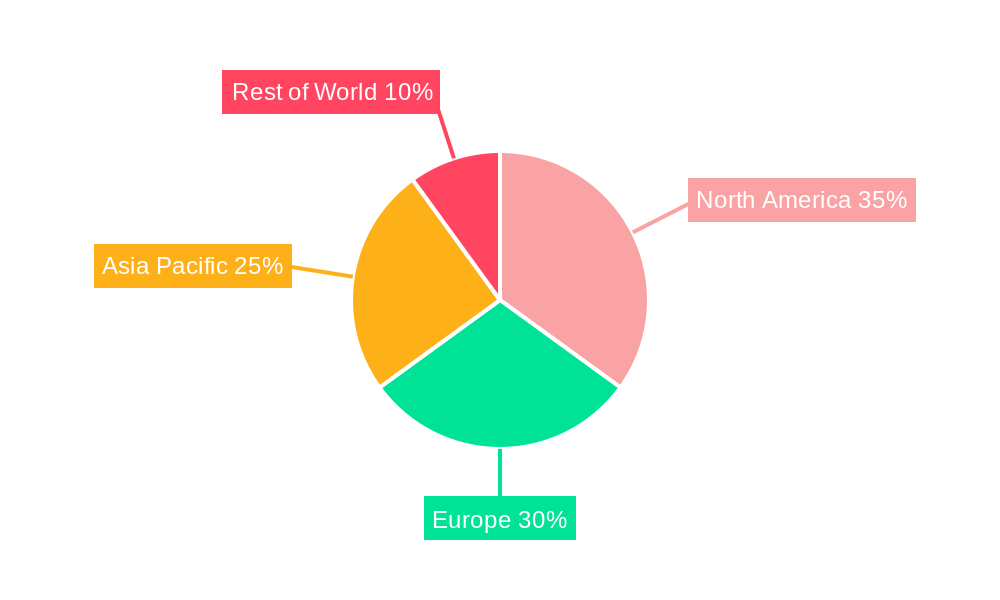

Geographically, North America and Europe currently lead in market share, owing to mature construction sectors and infrastructure revitalization. However, the Asia-Pacific region is expected to experience the most rapid growth, fueled by extensive infrastructure projects and industrialization in China and India. The integration of advanced technologies such as telematics and remote diagnostics in used equipment is improving its appeal and operational efficiency, further stimulating market growth. Intense competition centers on delivering reliable, well-maintained used equipment, coupled with competitive financing and leasing. This fosters an innovative market landscape with advancements in refurbishment and a growing network of specialized dealers and rental firms.

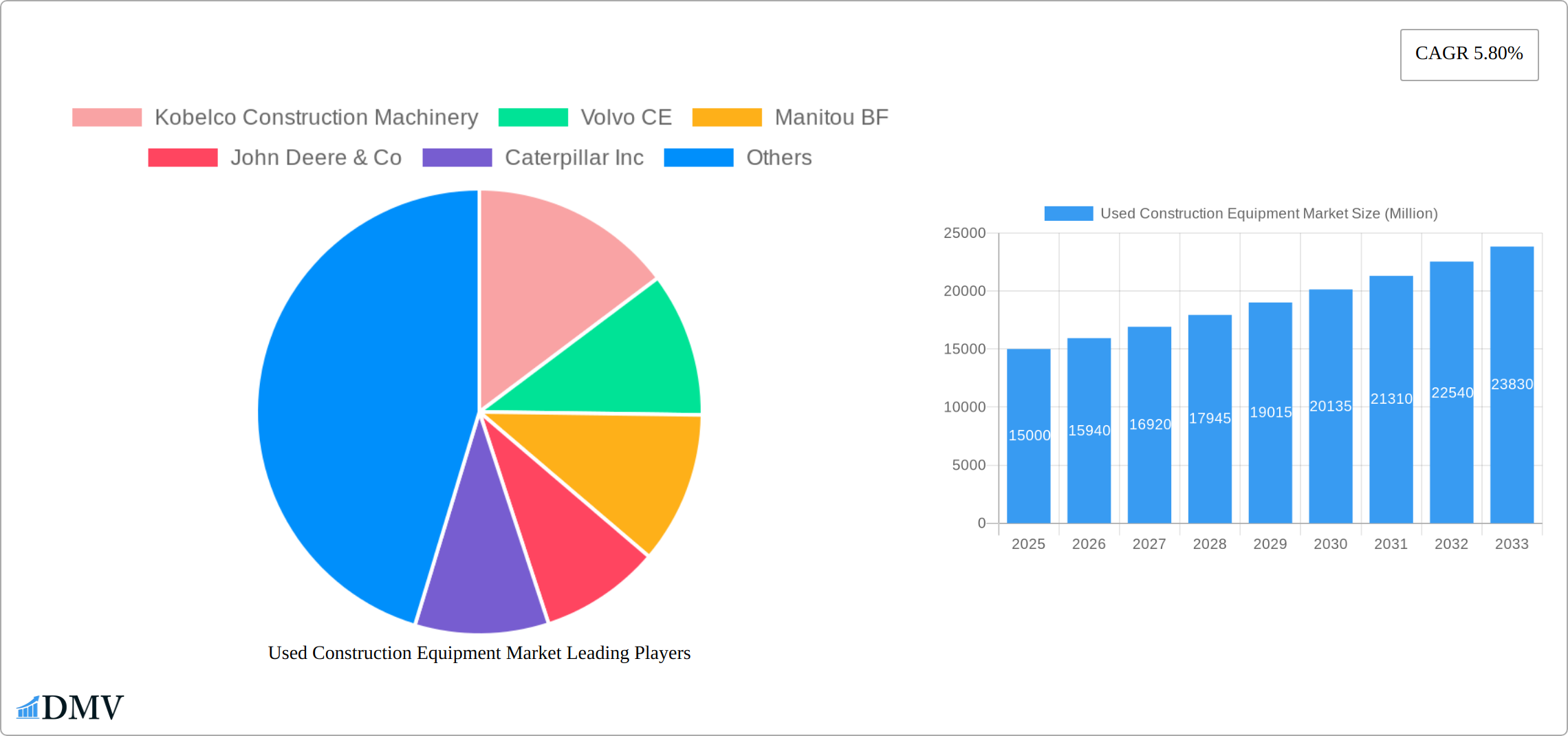

Used Construction Equipment Market Company Market Share

Used Construction Equipment Market Analysis: Size, Trends, and Forecast (2024-2033)

This comprehensive market report offers an in-depth analysis of the global used construction equipment market, detailing trends, growth drivers, challenges, and future opportunities. Spanning 2019-2033, with a base year of 2024 and a forecast period of 2025-2033, this report is vital for stakeholders navigating this dynamic sector. The market is anticipated to reach 131.38 billion by 2033.

Used Construction Equipment Market Composition & Trends

This section delves into the intricate composition of the used construction equipment market, analyzing its concentration, innovative forces, regulatory environment, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity. The market exhibits a moderately concentrated landscape, with key players such as Caterpillar Inc., Komatsu, and Volvo CE holding significant market share. However, a growing number of smaller players are emerging, particularly in the online used equipment sales space. Market share distribution in 2025 is estimated as follows: Caterpillar Inc. (20%), Komatsu (18%), Volvo CE (15%), and others (47%).

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Catalysts: Technological advancements in equipment design, digital platforms for sales and rentals, and the increasing adoption of data analytics for equipment management.

- Regulatory Landscape: Varying regulations across different geographies impact equipment lifespan and disposal methods, influencing the used equipment market.

- Substitute Products: Limited direct substitutes, but alternative construction techniques and rental services influence demand.

- End-User Profiles: Construction companies, demolition contractors, rental businesses, and individual buyers constitute the primary end-users.

- M&A Activities: Increased M&A activity in recent years, with deal values exceeding xx Million in the past five years, reflecting consolidation and expansion strategies. Examples include [insert specific M&A examples with values if available, otherwise state "Specific examples of M&A activity are detailed within the report"].

Used Construction Equipment Market Industry Evolution

The used construction equipment market has experienced significant growth from 2019 to 2024, fueled by factors such as large-scale infrastructure projects, rapid urbanization globally, and the increasing preference for cost-effective equipment solutions among construction firms. This trend is projected to continue, with a Compound Annual Growth Rate (CAGR) of xx% anticipated from 2025 to 2033. The market's evolution is marked by several key aspects: Firstly, technological advancements, including the integration of telematics for remote monitoring and diagnostics, are enhancing equipment management and operational efficiency. Secondly, the rise of digital marketplaces and online platforms is streamlining the buying and selling process, increasing transparency and accessibility for buyers and sellers. Finally, the adoption of more sustainable equipment, such as electric and hybrid drive systems, is steadily increasing, driven by environmental concerns and long-term cost savings. A detailed analysis of adoption rates across different drive types is available in the full report.

Leading Regions, Countries, or Segments in Used Construction Equipment Market

North America currently dominates the used construction equipment market, primarily due to substantial infrastructure investments and a robust construction sector. Europe and the Asia-Pacific region also represent significant markets, with growth trajectories influenced by regional economic conditions and government policies supporting infrastructure development and sustainable construction practices. Analyzing the product type segment, Excavators and Loaders/Backhoes maintain a leading market share due to their versatility and widespread application across various construction projects. While Internal Combustion Engines (ICE) currently hold the largest share of the drive type segment, the market is witnessing a gradual shift towards alternative drive systems, reflecting growing environmental concerns and technological advancements.

Key Market Drivers:

- North America: High levels of construction activity, favorable economic conditions, and a large existing fleet of construction equipment requiring replacement or upgrades.

- Europe: Significant investments in infrastructure renewal projects, government incentives promoting sustainable construction methods, and a thriving equipment rental market.

- Asia-Pacific: Rapid urbanization, substantial infrastructure investments driven by economic growth in emerging economies, and increasing demand for construction equipment across diverse projects.

- Product Type: Excavators & Loaders/Backhoes: High and consistent demand driven by their versatility across a wide range of construction tasks and project sizes.

- Drive Type: Internal Combustion Engine (ICE): Established technology, widespread fuel availability, and a large existing fleet of ICE-powered equipment. However, the market share is expected to decline gradually as alternative drive types gain traction.

Used Construction Equipment Market Product Innovations

Recent innovations are transforming the used construction equipment market. The integration of advanced telematics systems provides real-time equipment monitoring, predictive maintenance capabilities, and improved operational efficiency. Developments in fuel-efficient engines and the introduction of electric and hybrid drive systems are reducing environmental impact and operating costs. The ongoing digitalization of the market, particularly through online marketplaces and digital platforms, is enhancing transparency, streamlining transactions, and improving overall market efficiency. This facilitates easier access to equipment information, pricing, and sales/rental options.

Propelling Factors for Used Construction Equipment Market Growth

The growth of the used construction equipment market is driven by several key factors: the significantly lower cost of used equipment compared to new machinery makes it an attractive option for budget-conscious construction companies; globally robust infrastructure development projects constantly generate substantial demand for both new and used equipment; and finally, ongoing technological advancements such as improved fuel efficiency, telematics integration, and the emergence of alternative drive systems enhance the appeal and functionality of used equipment, making them increasingly competitive.

Obstacles in the Used Construction Equipment Market

The used construction equipment market faces certain challenges. Supply chain disruptions can affect the availability of parts and equipment. Fluctuations in fuel prices and stricter environmental regulations also impact the market. Moreover, intense competition among sellers and the risk of buying faulty equipment are significant obstacles.

Future Opportunities in Used Construction Equipment Market

Future opportunities lie in expanding into emerging markets, particularly in developing economies experiencing rapid infrastructure development. The increasing adoption of electric and hybrid drive types presents significant growth potential. Furthermore, the development of innovative financing and leasing options can significantly improve market access and accessibility.

Major Players in the Used Construction Equipment Market Ecosystem

Key Developments in Used Construction Equipment Market Industry

- January 2021: Kobelco Cranes launched the Kobelco Used Crane Finder service, enhancing market transparency.

- November 2022: Maxim Crane Works L.P. launched Maxim Marketplace™, a digital platform for used equipment sales.

- December 2022: MyCrane, a Dubai-based online crane rental service, opened a US branch, further digitalizing the market.

Strategic Used Construction Equipment Market Forecast

The used construction equipment market is poised for continued growth, driven by increasing demand from emerging markets, technological advancements, and a growing preference for cost-effective equipment solutions. The market is expected to benefit from ongoing infrastructure development and the increasing adoption of digital platforms for equipment sales and rentals. The shift towards sustainable construction practices and the adoption of electric and hybrid drive types are expected to further shape market dynamics in the coming years.

Used Construction Equipment Market Segmentation

-

1. Product Type

- 1.1. Crane

- 1.2. Telescopic Handler

- 1.3. Excavator

- 1.4. Material Handling Equipment

- 1.5. Loader and Backhoe

- 1.6. Others

-

2. Drive Type

- 2.1. Internal Combustion Engine

- 2.2. Electric

- 2.3. Hybrid

Used Construction Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of World

Used Construction Equipment Market Regional Market Share

Geographic Coverage of Used Construction Equipment Market

Used Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Forklift; Others

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption; Others

- 3.4. Market Trends

- 3.4.1. High Cost of New Construction Equipment is driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Crane

- 5.1.2. Telescopic Handler

- 5.1.3. Excavator

- 5.1.4. Material Handling Equipment

- 5.1.5. Loader and Backhoe

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Crane

- 6.1.2. Telescopic Handler

- 6.1.3. Excavator

- 6.1.4. Material Handling Equipment

- 6.1.5. Loader and Backhoe

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. Internal Combustion Engine

- 6.2.2. Electric

- 6.2.3. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Crane

- 7.1.2. Telescopic Handler

- 7.1.3. Excavator

- 7.1.4. Material Handling Equipment

- 7.1.5. Loader and Backhoe

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. Internal Combustion Engine

- 7.2.2. Electric

- 7.2.3. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Crane

- 8.1.2. Telescopic Handler

- 8.1.3. Excavator

- 8.1.4. Material Handling Equipment

- 8.1.5. Loader and Backhoe

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. Internal Combustion Engine

- 8.2.2. Electric

- 8.2.3. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of World Used Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Crane

- 9.1.2. Telescopic Handler

- 9.1.3. Excavator

- 9.1.4. Material Handling Equipment

- 9.1.5. Loader and Backhoe

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. Internal Combustion Engine

- 9.2.2. Electric

- 9.2.3. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kobelco Construction Machinery

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Volvo CE

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Manitou BF

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 John Deere & Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Caterpillar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Construction Machiner

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Komatsu

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Liebherr International

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mitsubishi heavy Industries Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Terex Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: Global Used Construction Equipment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 5: North America Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 11: Europe Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: Europe Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 17: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Asia Pacific Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of World Used Construction Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Rest of World Used Construction Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of World Used Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 23: Rest of World Used Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: Rest of World Used Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of World Used Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Global Used Construction Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 6: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 9: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 12: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Used Construction Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Used Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 15: Global Used Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Construction Equipment Market?

The projected CAGR is approximately 5.13%.

2. Which companies are prominent players in the Used Construction Equipment Market?

Key companies in the market include Kobelco Construction Machinery, Volvo CE, Manitou BF, John Deere & Co, Caterpillar Inc, Hitachi Construction Machiner, Komatsu, Liebherr International, Mitsubishi heavy Industries Ltd, Terex Corporation.

3. What are the main segments of the Used Construction Equipment Market?

The market segments include Product Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 131.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Forklift; Others.

6. What are the notable trends driving market growth?

High Cost of New Construction Equipment is driving the growth of the market.

7. Are there any restraints impacting market growth?

Supply Chain Disruption; Others.

8. Can you provide examples of recent developments in the market?

December 2022: MyCrane, a Dubai-based online crane rental service, has opened a branch in the United States. It is a new digital platform launched to disrupt and streamline the crane rental procurement process. It also provides the option to buy and sell cranes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Used Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence