Key Insights

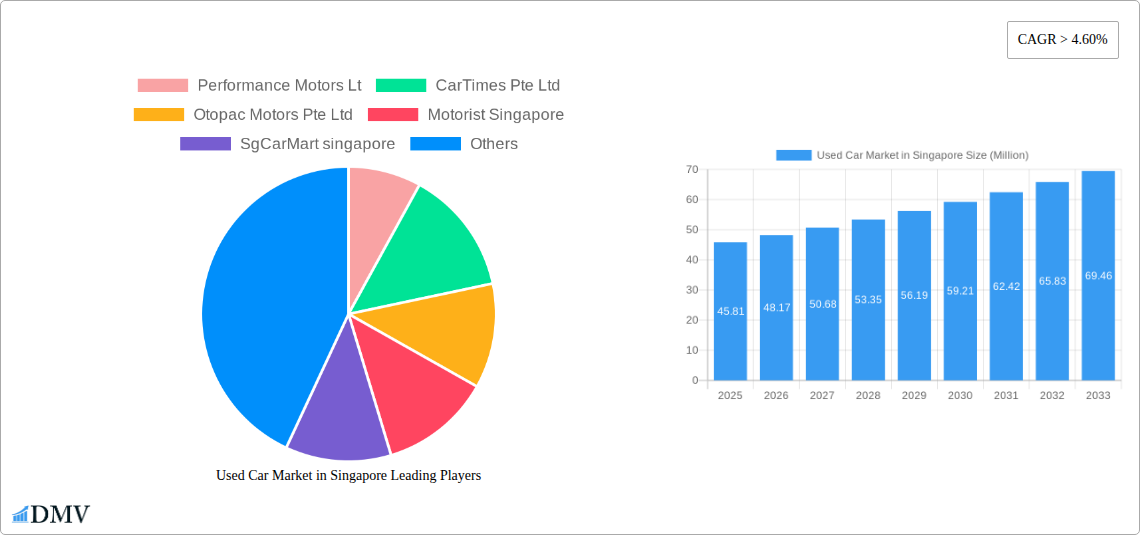

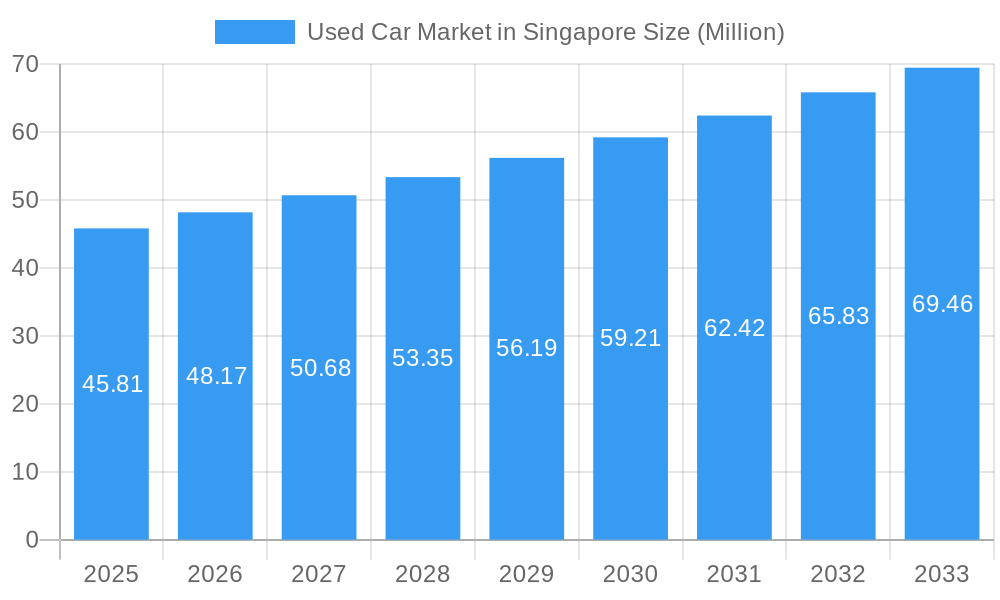

The Singaporean used car market, valued at $45.81 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 4.60% from 2025 to 2033. This growth is fueled by several key factors. Increasing vehicle ownership, particularly among younger demographics, coupled with a preference for more affordable transportation options compared to new cars, significantly boosts demand. The rise of online car marketplaces like SgCarMart and Carsome Singapore streamlines the buying process, enhancing accessibility and convenience for consumers. Furthermore, the diverse range of vehicle types available, from hatchbacks and sedans to SUVs and MPVs, caters to a broad spectrum of consumer needs and preferences. The organized sector, comprising dealerships and established online platforms, is progressively gaining market share over the unorganized sector, driven by consumer preference for transparency and reliable after-sales service. However, fluctuating fuel prices and government regulations regarding vehicle ownership and emissions could potentially act as restraints on market growth in the coming years. The market segmentation reveals significant opportunities for players catering to specific vehicle types, booking preferences (online versus offline), and fuel types.

Used Car Market in Singapore Market Size (In Million)

The competitive landscape is characterized by a mix of established players like Performance Motors and Eurokars Group, alongside emerging online platforms such as Carro and Carsome. These companies leverage their respective strengths—whether it be extensive inventory, robust online platforms, or established brand recognition—to capture market share. The continued growth of the market depends on several factors, including maintaining a balance between affordability and stringent emission standards, and fostering consumer confidence through transparent and reliable transaction methods. Successful players will need to adapt to changing consumer preferences and technological advancements, offering innovative services and leveraging data analytics to improve the overall customer experience. This market presents a significant opportunity for investment and strategic partnerships in the coming decade.

Used Car Market in Singapore Company Market Share

Used Car Market in Singapore Market Composition & Trends

This comprehensive report provides an in-depth analysis of the Singapore used car market, covering the period 2019-2033. The study meticulously examines market composition, revealing key trends and dynamics shaping this vibrant sector. We delve into the competitive landscape, analyzing market share distribution among major players like Carro, Carsome, and sgCarMart, and assessing the impact of mergers and acquisitions (M&A) activity. The report also investigates the influence of regulatory frameworks, technological innovations, evolving consumer preferences, and the presence of substitute products. Understanding these factors is crucial for stakeholders seeking to navigate the complexities of the Singaporean used car market.

- Market Concentration: The Singapore used car market exhibits a moderately concentrated structure, with a few major players commanding significant market share. Precise market share figures for each player are available in the full report.

- Innovation Catalysts: Technological advancements such as online platforms and digital inspection tools are driving significant innovation within the market.

- Regulatory Landscape: Government regulations pertaining to vehicle inspections, emissions standards, and licensing play a pivotal role in shaping market dynamics. The report details these regulations and their impact.

- Substitute Products: The availability of public transport and ride-hailing services exerts some competitive pressure on the used car market.

- End-User Profiles: The report segments consumers based on demographics, income levels, and vehicle preferences to provide a clear picture of the target audience.

- M&A Activity: Significant M&A activity, including the USD 150 Million acquisition of sgCarMart in February 2022, reflects the increasing consolidation within the market. The report details the financial implications and strategic motivations behind these deals.

Used Car Market in Singapore Industry Evolution

This section charts the evolution of Singapore's used car market from 2019 to 2033, highlighting key growth trajectories, technological disruptions, and evolving consumer preferences. We analyze historical data (2019-2024) and project future trends (2025-2033) with a base year of 2025 and an estimated year of 2025. The report includes detailed data on market size (in Millions of SGD), growth rates, and adoption metrics for various technological advancements. The shift towards online platforms, the growing popularity of specific vehicle types (SUVs, for example), and the impact of government policies are all thoroughly examined. The increasing integration of technology, such as AI-powered valuation tools and online marketplaces, is reshaping the customer experience and driving industry efficiency. We explore how these changes are affecting both established players and new entrants, leading to a more dynamic and competitive market landscape. The report further analyzes the influence of macroeconomic factors, such as economic growth and consumer sentiment, on market demand. This section provides actionable insights into the long-term growth potential of the used car market in Singapore.

Leading Regions, Countries, or Segments in Used Car Market in Singapore

This section identifies and analyzes the leading segments within the Singapore used car market. While Singapore is a city-state and regional distinctions are minimal, the report provides a deep dive into the dominant segments across various classifications:

By Vehicle Type: SUVs consistently demonstrate strong demand, driven by factors such as family needs and a preference for higher ground clearance. Sedans maintain a significant share, while Hatchbacks and MPVs cater to specific consumer preferences. The precise market share for each vehicle type is detailed in the report.

By Vendor Type: The organized sector, encompassing established dealerships and online platforms, holds a larger market share compared to the unorganized sector. This disparity is attributed to factors such as consumer trust, transparency, and warranty offerings. The report quantifies the market share held by each sector.

By Booking Type: Online bookings are steadily gaining traction, reflecting the growing preference for digital convenience and broader access to inventory. However, offline channels remain a substantial part of the market. The report quantifies the growth of online booking compared to offline.

By Fuel Type: Gasoline-powered vehicles continue to dominate the market due to their widespread availability and affordability. However, a gradual increase in the adoption of other fuel types is anticipated, although the market share for diesel and alternative fuels remains comparatively smaller. Precise market share figures are provided in the report.

Key Drivers:

- Investment Trends: Significant investments in both online platforms and established dealerships contribute to market growth and innovation.

- Regulatory Support: Government initiatives aimed at promoting transparency and consumer protection have further boosted market development.

Used Car Market in Singapore Product Innovations

Recent years have witnessed a surge in product innovations within the Singapore used car market. This includes the adoption of online platforms offering transparent pricing and detailed vehicle history reports, as well as the development of sophisticated vehicle inspection and valuation tools leveraging AI and machine learning. These innovations enhance the customer experience and increase market efficiency. Further innovation in financing options and extended warranties are also contributing to increased consumer confidence and sales. The unique selling propositions of leading players are analyzed in detail in the report.

Propelling Factors for Used Car Market in Singapore Growth

Several factors contribute to the growth trajectory of the used car market in Singapore. Technological advancements, such as online marketplaces and digital inspection tools, improve efficiency and transparency. Economic conditions, including consumer spending habits and credit availability, play a significant role in shaping demand. Favorable government policies promoting sustainable transportation options also have a positive influence.

Obstacles in the Used Car Market in Singapore Market

Despite strong growth potential, the Singapore used car market faces certain challenges. Regulatory hurdles related to vehicle import and licensing can increase costs and complexity. Supply chain disruptions from global events impact the availability of certain vehicles. Intense competition from both established players and new entrants creates pressure on pricing and profitability.

Future Opportunities in Used Car Market in Singapore

The future holds significant opportunities for the Singapore used car market. Expansion into new vehicle segments, adoption of innovative technologies such as electric vehicle (EV) sales and servicing, and catering to evolving consumer preferences for sustainability are key areas of growth. Furthermore, personalized financing solutions and enhanced customer service models can lead to increased market penetration and consumer satisfaction.

Major Players in the Used Car Market in Singapore Ecosystem

- Performance Motors Ltd

- CarTimes Pte Ltd

- Otopac Motors Pte Ltd

- Motorist Singapore

- SgCarMart Singapore

- Directcars Pte Ltd

- Trusty Cars Pte Ltd (Carro)

- Cosmo Automobiles Pte Ltd

- Carsome Singapore Pte Ltd

- Eurokars Group of Companies

- Vincar Pte Ltd

Key Developments in Used Car Market in Singapore Industry

- February 2022: A consortium led by Toyota Financial Services Singapore purchased sgCarMart for USD 150 Million. This acquisition significantly reshaped the market landscape.

- March 2022: Carsome acquired a 51% stake in CarTimes Group, intensifying competition in the online used car platform segment.

- May 2022: The formation of Porsche Singapore Pte Ltd by Eurokars Group and Porsche signaled a shift towards innovative automotive retail concepts.

Strategic Used Car Market in Singapore Market Forecast

The Singapore used car market is poised for continued growth, driven by increasing demand, technological advancements, and evolving consumer preferences. The market is expected to experience significant expansion in the coming years, particularly in online sales and the adoption of innovative financing solutions. The sustained growth in the overall economy and the increasing affordability of used vehicles will also contribute to market expansion. The report provides detailed forecasts for market size and segment-specific growth rates.

Used Car Market in Singapore Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. UnOrganized

-

3. Booking Type

- 3.1. Online

- 3.2. Offline

-

4. Fuel Type

- 4.1. Gasoline

- 4.2. Diesel

- 4.3. Other Fuel Types

Used Car Market in Singapore Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Market in Singapore Regional Market Share

Geographic Coverage of Used Car Market in Singapore

Used Car Market in Singapore REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Use of Online Platforms

- 3.3. Market Restrains

- 3.3.1. Stringent Governmental Regulations and Import Taxes

- 3.4. Market Trends

- 3.4.1. Organized Segment Expected to Hold Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. UnOrganized

- 5.3. Market Analysis, Insights and Forecast - by Booking Type

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Fuel Type

- 5.4.1. Gasoline

- 5.4.2. Diesel

- 5.4.3. Other Fuel Types

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. Sports U

- 6.2. Market Analysis, Insights and Forecast - by Vendor Type

- 6.2.1. Organized

- 6.2.2. UnOrganized

- 6.3. Market Analysis, Insights and Forecast - by Booking Type

- 6.3.1. Online

- 6.3.2. Offline

- 6.4. Market Analysis, Insights and Forecast - by Fuel Type

- 6.4.1. Gasoline

- 6.4.2. Diesel

- 6.4.3. Other Fuel Types

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Car Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. Sports U

- 7.2. Market Analysis, Insights and Forecast - by Vendor Type

- 7.2.1. Organized

- 7.2.2. UnOrganized

- 7.3. Market Analysis, Insights and Forecast - by Booking Type

- 7.3.1. Online

- 7.3.2. Offline

- 7.4. Market Analysis, Insights and Forecast - by Fuel Type

- 7.4.1. Gasoline

- 7.4.2. Diesel

- 7.4.3. Other Fuel Types

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Car Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. Sports U

- 8.2. Market Analysis, Insights and Forecast - by Vendor Type

- 8.2.1. Organized

- 8.2.2. UnOrganized

- 8.3. Market Analysis, Insights and Forecast - by Booking Type

- 8.3.1. Online

- 8.3.2. Offline

- 8.4. Market Analysis, Insights and Forecast - by Fuel Type

- 8.4.1. Gasoline

- 8.4.2. Diesel

- 8.4.3. Other Fuel Types

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Car Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. Sports U

- 9.2. Market Analysis, Insights and Forecast - by Vendor Type

- 9.2.1. Organized

- 9.2.2. UnOrganized

- 9.3. Market Analysis, Insights and Forecast - by Booking Type

- 9.3.1. Online

- 9.3.2. Offline

- 9.4. Market Analysis, Insights and Forecast - by Fuel Type

- 9.4.1. Gasoline

- 9.4.2. Diesel

- 9.4.3. Other Fuel Types

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Car Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. Sports U

- 10.2. Market Analysis, Insights and Forecast - by Vendor Type

- 10.2.1. Organized

- 10.2.2. UnOrganized

- 10.3. Market Analysis, Insights and Forecast - by Booking Type

- 10.3.1. Online

- 10.3.2. Offline

- 10.4. Market Analysis, Insights and Forecast - by Fuel Type

- 10.4.1. Gasoline

- 10.4.2. Diesel

- 10.4.3. Other Fuel Types

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Performance Motors Lt

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CarTimes Pte Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Otopac Motors Pte Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Motorist Singapore

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SgCarMart singapore

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Directcars Pte Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trusty Cars Pte Ltd (Carro)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Merchant logo Cosmo Automobiles Pte Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Carsome Singapore Pte Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eurokars Group of Companies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Vincar Pte Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Performance Motors Lt

List of Figures

- Figure 1: Global Used Car Market in Singapore Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Used Car Market in Singapore Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Used Car Market in Singapore Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Used Car Market in Singapore Revenue (Million), by Vendor Type 2025 & 2033

- Figure 5: North America Used Car Market in Singapore Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 6: North America Used Car Market in Singapore Revenue (Million), by Booking Type 2025 & 2033

- Figure 7: North America Used Car Market in Singapore Revenue Share (%), by Booking Type 2025 & 2033

- Figure 8: North America Used Car Market in Singapore Revenue (Million), by Fuel Type 2025 & 2033

- Figure 9: North America Used Car Market in Singapore Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 10: North America Used Car Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Used Car Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Used Car Market in Singapore Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: South America Used Car Market in Singapore Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: South America Used Car Market in Singapore Revenue (Million), by Vendor Type 2025 & 2033

- Figure 15: South America Used Car Market in Singapore Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 16: South America Used Car Market in Singapore Revenue (Million), by Booking Type 2025 & 2033

- Figure 17: South America Used Car Market in Singapore Revenue Share (%), by Booking Type 2025 & 2033

- Figure 18: South America Used Car Market in Singapore Revenue (Million), by Fuel Type 2025 & 2033

- Figure 19: South America Used Car Market in Singapore Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 20: South America Used Car Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Used Car Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Used Car Market in Singapore Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Europe Used Car Market in Singapore Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Europe Used Car Market in Singapore Revenue (Million), by Vendor Type 2025 & 2033

- Figure 25: Europe Used Car Market in Singapore Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 26: Europe Used Car Market in Singapore Revenue (Million), by Booking Type 2025 & 2033

- Figure 27: Europe Used Car Market in Singapore Revenue Share (%), by Booking Type 2025 & 2033

- Figure 28: Europe Used Car Market in Singapore Revenue (Million), by Fuel Type 2025 & 2033

- Figure 29: Europe Used Car Market in Singapore Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 30: Europe Used Car Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Used Car Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Used Car Market in Singapore Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 33: Middle East & Africa Used Car Market in Singapore Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 34: Middle East & Africa Used Car Market in Singapore Revenue (Million), by Vendor Type 2025 & 2033

- Figure 35: Middle East & Africa Used Car Market in Singapore Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 36: Middle East & Africa Used Car Market in Singapore Revenue (Million), by Booking Type 2025 & 2033

- Figure 37: Middle East & Africa Used Car Market in Singapore Revenue Share (%), by Booking Type 2025 & 2033

- Figure 38: Middle East & Africa Used Car Market in Singapore Revenue (Million), by Fuel Type 2025 & 2033

- Figure 39: Middle East & Africa Used Car Market in Singapore Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 40: Middle East & Africa Used Car Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa Used Car Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Used Car Market in Singapore Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 43: Asia Pacific Used Car Market in Singapore Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 44: Asia Pacific Used Car Market in Singapore Revenue (Million), by Vendor Type 2025 & 2033

- Figure 45: Asia Pacific Used Car Market in Singapore Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 46: Asia Pacific Used Car Market in Singapore Revenue (Million), by Booking Type 2025 & 2033

- Figure 47: Asia Pacific Used Car Market in Singapore Revenue Share (%), by Booking Type 2025 & 2033

- Figure 48: Asia Pacific Used Car Market in Singapore Revenue (Million), by Fuel Type 2025 & 2033

- Figure 49: Asia Pacific Used Car Market in Singapore Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 50: Asia Pacific Used Car Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific Used Car Market in Singapore Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 4: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 5: Global Used Car Market in Singapore Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 8: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 9: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 10: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 16: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 17: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 18: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 24: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 25: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 26: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 37: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 38: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 39: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 40: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global Used Car Market in Singapore Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 48: Global Used Car Market in Singapore Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 49: Global Used Car Market in Singapore Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 50: Global Used Car Market in Singapore Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 51: Global Used Car Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Used Car Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Market in Singapore?

The projected CAGR is approximately > 4.60%.

2. Which companies are prominent players in the Used Car Market in Singapore?

Key companies in the market include Performance Motors Lt, CarTimes Pte Ltd, Otopac Motors Pte Ltd, Motorist Singapore, SgCarMart singapore, Directcars Pte Ltd, Trusty Cars Pte Ltd (Carro), Merchant logo Cosmo Automobiles Pte Ltd, Carsome Singapore Pte Ltd, Eurokars Group of Companies, Vincar Pte Ltd.

3. What are the main segments of the Used Car Market in Singapore?

The market segments include Vehicle Type, Vendor Type, Booking Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.81 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Use of Online Platforms.

6. What are the notable trends driving market growth?

Organized Segment Expected to Hold Significant Share in the Market.

7. Are there any restraints impacting market growth?

Stringent Governmental Regulations and Import Taxes.

8. Can you provide examples of recent developments in the market?

May 2022: Eurokars Group and Porsche announced the formation of Porsche Singapore Pte Ltd, a new venture with a focus to explore emerging automotive retail concepts that will continue to create customer-centric experiences in Singapore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Market in Singapore," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Market in Singapore report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Market in Singapore?

To stay informed about further developments, trends, and reports in the Used Car Market in Singapore, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence