Key Insights

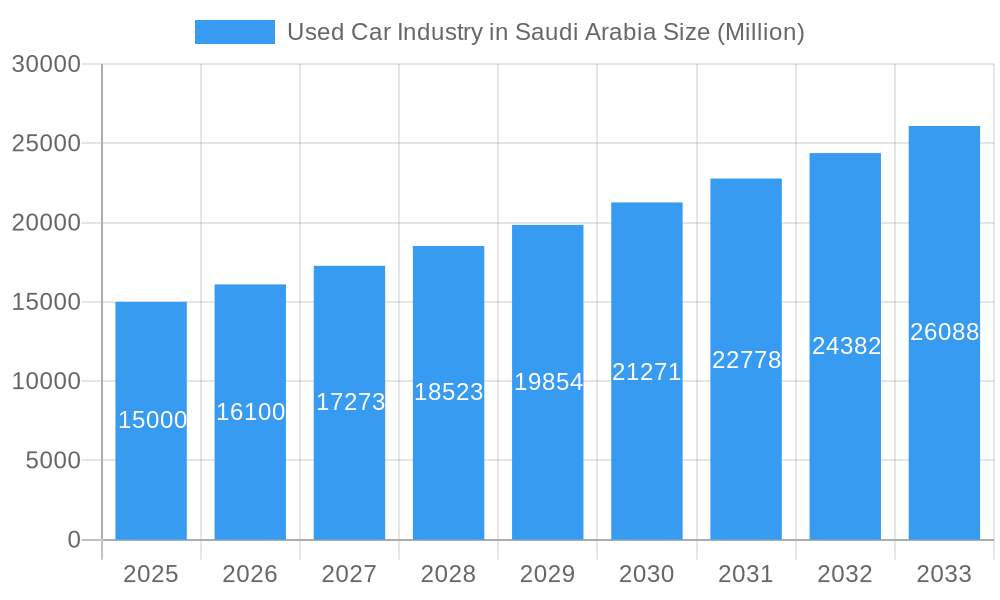

The Saudi Arabian used car market, exhibiting a robust CAGR of 7.36% between 2019 and 2024, is poised for continued growth through 2033. This expansion is driven by several factors. Firstly, the increasing affordability of used vehicles compared to new cars makes them attractive to a larger segment of the population, particularly younger buyers and those on tighter budgets. Secondly, a growing preference for online car marketplaces like Yalla Motors and Dubizzle Motors LLC is streamlining the buying process and boosting transparency. This digital shift is complemented by the expansion of organized vendors, offering greater trust and improved after-sales service, gradually displacing the unorganized sector. Regional variations exist, with potentially higher demand in urban centers like Riyadh and Jeddah compared to less populated regions. The market segmentation, encompassing various vehicle types (Hatchbacks, Sedans, MUVs, SUVs) and sales channels, presents significant opportunities for targeted marketing strategies. The presence of established players such as Abdul Latif Jameel Motors and Al-Futtaim Group ensures competition and fosters innovation within the market.

Used Car Industry in Saudi Arabia Market Size (In Billion)

However, challenges remain. Fluctuations in fuel prices and economic conditions can influence consumer spending on automobiles. Furthermore, the prevalence of counterfeit vehicle parts and potential issues with vehicle history transparency could dampen growth if not addressed effectively. Regulatory changes related to vehicle imports and emissions standards will also play a significant role in shaping the market's future trajectory. Addressing these challenges through robust quality control mechanisms and increased consumer awareness campaigns will be crucial for sustained market expansion. The current presence of diverse sales channels, including online platforms and traditional dealerships, offers diverse opportunities for both buyers and sellers. Future growth will depend on adapting to evolving consumer preferences and technological advancements within the automotive sector.

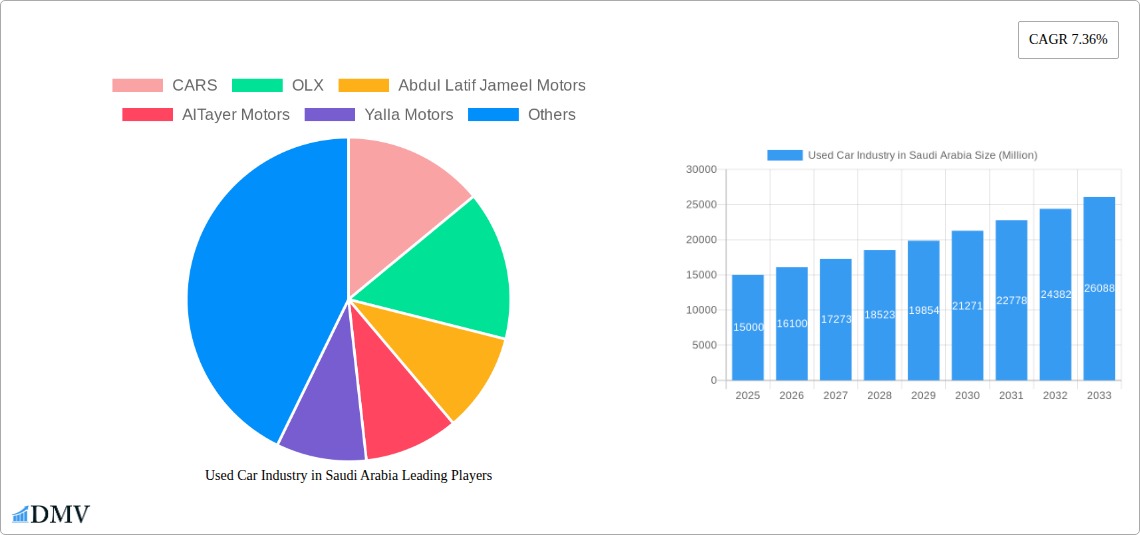

Used Car Industry in Saudi Arabia Company Market Share

Used Car Industry in Saudi Arabia: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning used car industry in Saudi Arabia, projecting a market valued at SAR xx Million by 2033. The study meticulously examines market composition, trends, leading players, and future growth prospects, offering invaluable insights for stakeholders across the automotive ecosystem. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is essential for strategic decision-making and investment planning.

Used Car Industry in Saudi Arabia Market Composition & Trends

This section delves into the intricate dynamics of the Saudi Arabian used car market, analyzing market concentration, innovative drivers, regulatory landscapes, substitute products, and end-user profiles. The report also investigates significant M&A activities, providing a detailed understanding of market share distribution and the financial value of these transactions. We examine the competitive landscape, highlighting the strategies employed by major players like CARS, OLX, Abdul Latif Jameel Motors, AlTayyar Motors, Yalla Motors, Dubizzle Motors LLC, Al-Futtaim Group, Arabian Auto Agency, Al Nabooda Automobiles LLC, and others.

- Market Concentration: The market exhibits a [Describe level of concentration - e.g., moderately concentrated] structure, with the top 5 players holding an estimated [xx]% market share in 2025.

- Innovation Catalysts: The rise of online platforms and digitalization is a significant driver, alongside evolving consumer preferences for pre-owned vehicles.

- Regulatory Landscape: Government regulations regarding vehicle imports, inspections, and emissions standards significantly influence market operations.

- Substitute Products: The public transportation sector and ride-hailing services represent key substitutes for used car purchases.

- End-User Profiles: The report profiles various consumer segments based on demographics, income levels, and vehicle preferences.

- M&A Activities: The report analyzes completed and projected M&A deals, detailing the financial value (estimated at SAR xx Million for the period 2019-2024) and their impact on market consolidation.

Used Car Industry in Saudi Arabia Industry Evolution

This section traces the evolution of the Saudi Arabian used car market, showcasing growth trajectories, technological advancements, and shifting consumer preferences. The analysis incorporates specific data points such as compound annual growth rates (CAGR) and adoption metrics for online sales channels and digital inspection technologies. The report details the significant shift from traditional offline dealerships to a growing presence of online platforms, driving increased transparency and convenience. The market is expected to exhibit a CAGR of [xx]% during the forecast period (2025-2033), driven by factors such as increasing vehicle ownership, rising disposable incomes, and government initiatives promoting sustainable transportation. Detailed analyses of sales data from 2019-2024 inform this projection.

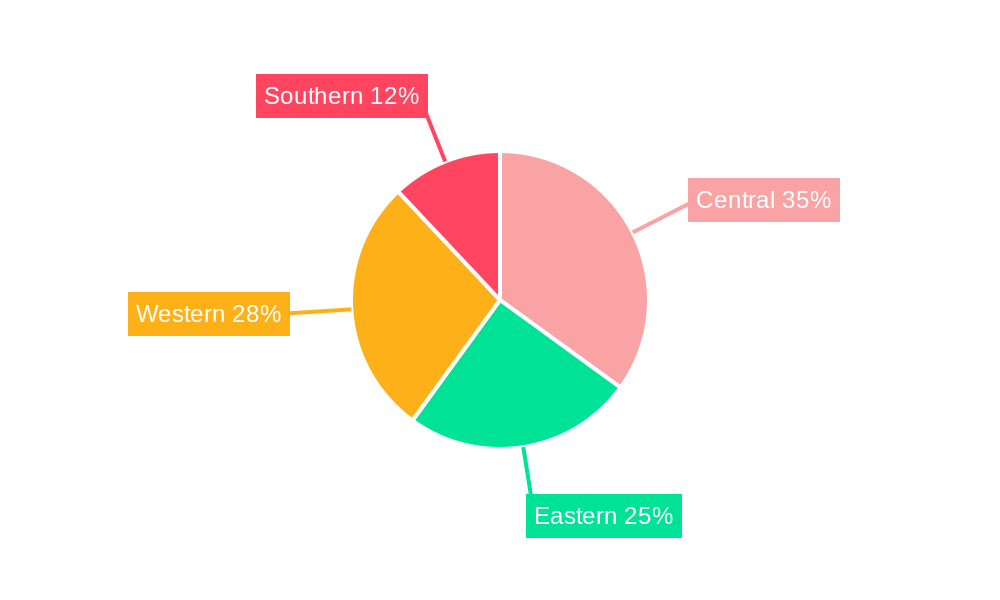

Leading Regions, Countries, or Segments in Used Car Industry in Saudi Arabia

This section identifies the leading regions, countries, or segments within the Saudi Arabian used car market, providing a detailed analysis of the factors driving their dominance.

- Vehicle Type: SUVs and Sedans are projected to constitute the largest segments by 2025, reflecting consumer preferences. The Hatchback and MUV segments hold a smaller, but significant share of the market.

- Sales Channel: Online sales channels are experiencing rapid growth, attributed to increased internet penetration and consumer familiarity with e-commerce.

- Vendor Type: Organized vendors (dealerships and established online platforms) hold a larger market share than unorganized vendors (individual sellers), reflecting consumer preference for reliable sources.

Key Drivers:

- Investment Trends: Significant investments in online marketplaces and digital infrastructure are fueling market growth.

- Regulatory Support: Government initiatives aimed at streamlining the used car market contribute to its expansion.

Used Car Industry in Saudi Arabia Product Innovations

The Saudi Arabian used car market is witnessing an influx of innovative products and services aimed at enhancing consumer experience. This includes advancements in vehicle inspection technologies, online financing options, and warranty programs offered by organized vendors. These innovations are improving transparency and trust in the market, which in turn boosts consumer confidence and transaction volumes.

Propelling Factors for Used Car Industry in Saudi Arabia Growth

Several factors are driving the growth of the Saudi Arabian used car market. These include rising disposable incomes, increasing urbanization leading to higher vehicle ownership, and the convenience of online platforms. Government initiatives promoting sustainable mobility also indirectly contribute to the growth of the used car market.

Obstacles in the Used Car Industry in Saudi Arabia Market

The Saudi Arabian used car market faces challenges such as concerns about vehicle history and quality, the prevalence of fraudulent activities, and the lack of standardized inspection processes across all vendors. Addressing these challenges would require stringent regulatory oversight and increased consumer education.

Future Opportunities in Used Car Industry in Saudi Arabia

Future opportunities in the Saudi Arabian used car market lie in the expansion of online platforms, the integration of advanced technologies like AI-powered valuation tools, and the development of comprehensive warranty and financing solutions. Further diversification into niche markets, such as electric vehicles, also presents a lucrative avenue for growth.

Major Players in the Used Car Industry in Saudi Arabia Ecosystem

- CARS

- OLX

- Abdul Latif Jameel Motors

- AlTayyar Motors

- Yalla Motors

- Dubizzle Motors LLC

- Al-Futtaim Group

- Arabian Auto Agency

- Al Nabooda Automobiles LLC

Key Developments in Used Car Industry in Saudi Arabia Industry

- [Month, Year]: Launch of a new online platform offering comprehensive vehicle history reports.

- [Month, Year]: Introduction of stricter regulations regarding vehicle inspections and emissions standards.

- [Month, Year]: Merger between two major used car dealerships. (Add more bullet points as needed.)

Strategic Used Car Industry in Saudi Arabia Market Forecast

The Saudi Arabian used car market is poised for sustained growth in the coming years, driven by factors such as increasing vehicle ownership, the expansion of online platforms, and the introduction of innovative services. The market is projected to experience robust growth, exceeding SAR xx Million in revenue by 2033, offering considerable opportunities for investment and market expansion for both domestic and international players.

Used Car Industry in Saudi Arabia Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. SUVs and MUVs

-

2. Sales Channel

- 2.1. Online

- 2.2. Offline

-

3. Vendor Type

- 3.1. Organized

- 3.2. Unorganized

Used Car Industry in Saudi Arabia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Industry in Saudi Arabia Regional Market Share

Geographic Coverage of Used Car Industry in Saudi Arabia

Used Car Industry in Saudi Arabia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Demand for Luxury Cars is Anticipated to Boost the Market

- 3.3. Market Restrains

- 3.3.1. Comparatively Limited Market Transparency May Hinder the Market

- 3.4. Market Trends

- 3.4.1. Hatchback Segmented to Gain Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. SUVs and MUVs

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Vendor Type

- 5.3.1. Organized

- 5.3.2. Unorganized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. SUVs and MUVs

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by Vendor Type

- 6.3.1. Organized

- 6.3.2. Unorganized

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. SUVs and MUVs

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by Vendor Type

- 7.3.1. Organized

- 7.3.2. Unorganized

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. SUVs and MUVs

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by Vendor Type

- 8.3.1. Organized

- 8.3.2. Unorganized

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. SUVs and MUVs

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by Vendor Type

- 9.3.1. Organized

- 9.3.2. Unorganized

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Car Industry in Saudi Arabia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. SUVs and MUVs

- 10.2. Market Analysis, Insights and Forecast - by Sales Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.3. Market Analysis, Insights and Forecast - by Vendor Type

- 10.3.1. Organized

- 10.3.2. Unorganized

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CARS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 OLX

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Abdul Latif Jameel Motors

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AlTayer Motors

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yalla Motors

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dubizzle Motors LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Al-Futtaim Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arabian Auto Agency*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al Nabooda Automobiles LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 CARS

List of Figures

- Figure 1: Global Used Car Industry in Saudi Arabia Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Used Car Industry in Saudi Arabia Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Used Car Industry in Saudi Arabia Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Used Car Industry in Saudi Arabia Revenue (Million), by Sales Channel 2025 & 2033

- Figure 5: North America Used Car Industry in Saudi Arabia Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 6: North America Used Car Industry in Saudi Arabia Revenue (Million), by Vendor Type 2025 & 2033

- Figure 7: North America Used Car Industry in Saudi Arabia Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 8: North America Used Car Industry in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Used Car Industry in Saudi Arabia Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: South America Used Car Industry in Saudi Arabia Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: South America Used Car Industry in Saudi Arabia Revenue (Million), by Sales Channel 2025 & 2033

- Figure 13: South America Used Car Industry in Saudi Arabia Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 14: South America Used Car Industry in Saudi Arabia Revenue (Million), by Vendor Type 2025 & 2033

- Figure 15: South America Used Car Industry in Saudi Arabia Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 16: South America Used Car Industry in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Used Car Industry in Saudi Arabia Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Europe Used Car Industry in Saudi Arabia Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe Used Car Industry in Saudi Arabia Revenue (Million), by Sales Channel 2025 & 2033

- Figure 21: Europe Used Car Industry in Saudi Arabia Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 22: Europe Used Car Industry in Saudi Arabia Revenue (Million), by Vendor Type 2025 & 2033

- Figure 23: Europe Used Car Industry in Saudi Arabia Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 24: Europe Used Car Industry in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Used Car Industry in Saudi Arabia Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East & Africa Used Car Industry in Saudi Arabia Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East & Africa Used Car Industry in Saudi Arabia Revenue (Million), by Sales Channel 2025 & 2033

- Figure 29: Middle East & Africa Used Car Industry in Saudi Arabia Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 30: Middle East & Africa Used Car Industry in Saudi Arabia Revenue (Million), by Vendor Type 2025 & 2033

- Figure 31: Middle East & Africa Used Car Industry in Saudi Arabia Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 32: Middle East & Africa Used Car Industry in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Used Car Industry in Saudi Arabia Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 35: Asia Pacific Used Car Industry in Saudi Arabia Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Asia Pacific Used Car Industry in Saudi Arabia Revenue (Million), by Sales Channel 2025 & 2033

- Figure 37: Asia Pacific Used Car Industry in Saudi Arabia Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 38: Asia Pacific Used Car Industry in Saudi Arabia Revenue (Million), by Vendor Type 2025 & 2033

- Figure 39: Asia Pacific Used Car Industry in Saudi Arabia Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 40: Asia Pacific Used Car Industry in Saudi Arabia Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Used Car Industry in Saudi Arabia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 3: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 4: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 7: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 8: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 14: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 15: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 21: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 22: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 34: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 35: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 43: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 44: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 45: Global Used Car Industry in Saudi Arabia Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Used Car Industry in Saudi Arabia Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Industry in Saudi Arabia?

The projected CAGR is approximately 7.36%.

2. Which companies are prominent players in the Used Car Industry in Saudi Arabia?

Key companies in the market include CARS, OLX, Abdul Latif Jameel Motors, AlTayer Motors, Yalla Motors, Dubizzle Motors LLC, Al-Futtaim Group, Arabian Auto Agency*List Not Exhaustive, Al Nabooda Automobiles LLC.

3. What are the main segments of the Used Car Industry in Saudi Arabia?

The market segments include Vehicle Type, Sales Channel, Vendor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Demand for Luxury Cars is Anticipated to Boost the Market.

6. What are the notable trends driving market growth?

Hatchback Segmented to Gain Momentum.

7. Are there any restraints impacting market growth?

Comparatively Limited Market Transparency May Hinder the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Industry in Saudi Arabia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Industry in Saudi Arabia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Industry in Saudi Arabia?

To stay informed about further developments, trends, and reports in the Used Car Industry in Saudi Arabia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence