Key Insights

The used car financing market is poised for significant expansion, driven by the increasing affordability of pre-owned vehicles and the sustained demand for personal mobility. Innovations in digital lending platforms and enhanced credit assessment methodologies are democratizing access to financing. Emerging subscription-based vehicle models are also amplifying the need for flexible financing solutions. The market is segmented by vehicle type and financier, presenting a dynamic landscape.

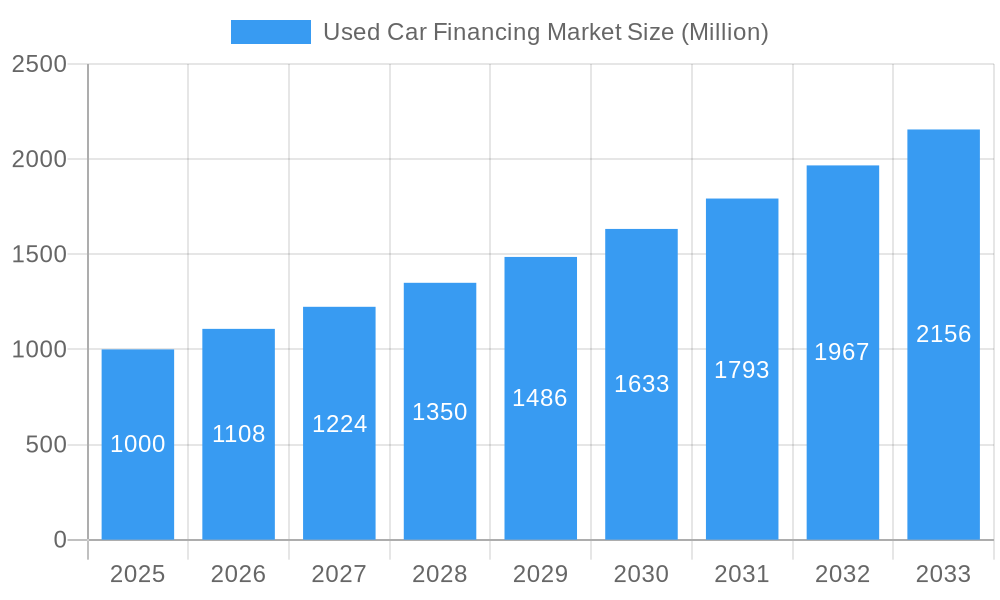

Used Car Financing Market Market Size (In Billion)

The market is projected to reach a size of $47.9 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.41% through 2033. Growth is anticipated to be most pronounced in developing economies with expanding middle classes and increasing urbanization, particularly in the Asia-Pacific and South American regions. Intensifying competition among financiers is fostering innovation in product offerings and pricing strategies, ultimately benefiting consumers and driving market growth.

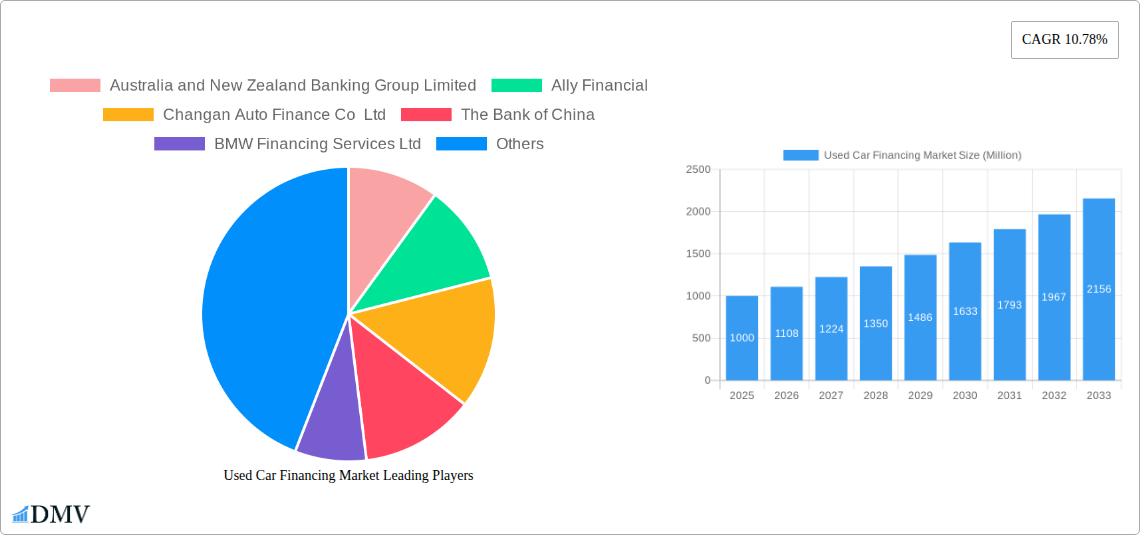

Used Car Financing Market Company Market Share

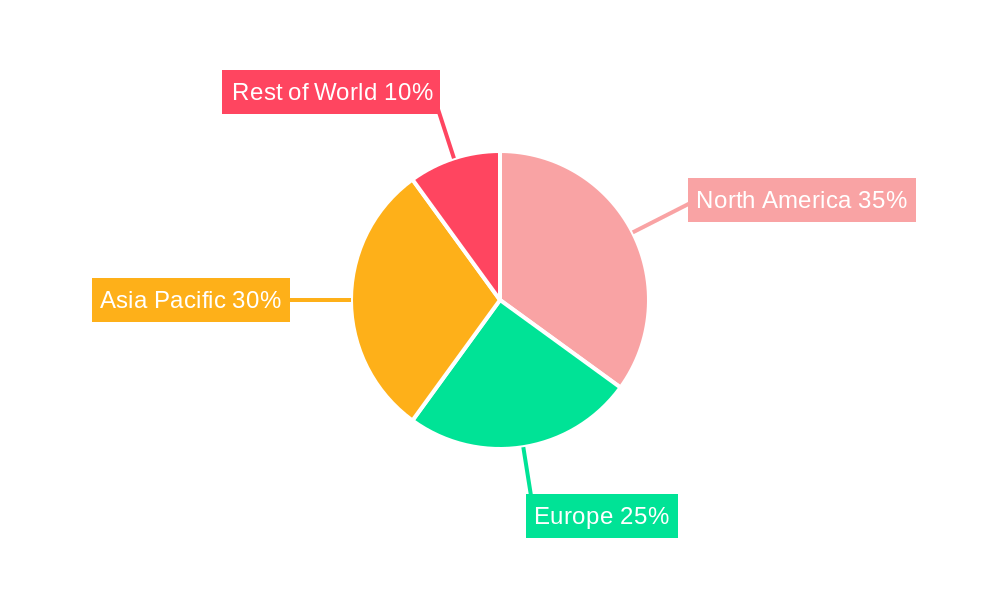

Geographically, North America commands a significant market share due to its mature automotive and financial sectors. However, the Asia-Pacific region is projected to be the fastest-growing market, propelled by rising vehicle ownership and robust economic development in countries such as India and China. Europe represents a substantial market with more moderate growth prospects. Strategic collaborations between lenders and auto dealerships are becoming pivotal for seamless consumer financing. Advancements in digital lending, refined credit risk management, and a greater emphasis on responsible borrowing practices are contributing to a more transparent and sustainable market.

Used Car Financing Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Used Car Financing Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. The market is estimated to be valued at $XX Million in 2025 and is projected to reach $XX Million by 2033.

Used Car Financing Market Composition & Trends

This section delves into the intricate composition of the used car financing market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and merger and acquisition (M&A) activities. We analyze the market share distribution among key players, revealing the competitive landscape and identifying dominant forces. Furthermore, we evaluate the influence of regulatory frameworks, technological advancements, and evolving consumer preferences on market dynamics. Our analysis includes a detailed examination of recent M&A activities, including deal values and their impact on market consolidation. The market exhibits a moderately concentrated structure, with top 5 players holding approximately XX% of the market share in 2024.

Market Share Distribution (2024):

- Top 5 Players: XX%

- Others: XX%

M&A Activity (2019-2024): Total deal value estimated at $XX Million, with an average deal size of $XX Million. Key deals included [Insert 2-3 examples of significant M&A activity with brief descriptions].

Innovation Catalysts: Fintech advancements, digital lending platforms, and improved credit scoring models are driving market innovation.

Regulatory Landscape: Varying regulations across geographies impact lending practices and consumer protection.

Substitute Products: Peer-to-peer lending platforms and alternative financing options pose a competitive challenge.

Used Car Financing Market Industry Evolution

This section offers a granular analysis of the used car financing market's evolution, exploring growth trajectories, technological advancements, and the shift in consumer demands. We present specific data points, such as growth rates and adoption metrics, to illustrate the market's dynamic nature. The market witnessed a CAGR of XX% during the historical period (2019-2024), driven primarily by the increasing popularity of used cars and the rise of digital lending platforms. Technological advancements like AI-powered credit scoring and online loan processing are streamlining the financing process and enhancing customer experience. The shift towards online used car platforms has also significantly influenced market growth. Growing demand for SUVs and MPVs has fuelled segment-specific growth within the used car market, impacting financing needs accordingly. Furthermore, evolving consumer preferences for flexible financing options, such as balloon payments and lease-to-own programs, are reshaping the market landscape.

Leading Regions, Countries, or Segments in Used Car Financing Market

This section identifies the dominant regions, countries, and segments within the used car financing market. We analyze factors contributing to their dominance, such as investment trends and regulatory support. We also consider the impact of car type (Hatchback, Sedan, SUV, MPV) and financier type (OEM, Banks, NBFCs).

Dominant Region: North America [or specify based on data]

Key Drivers:

- High Used Car Sales: Strong demand for used vehicles fuels the need for financing.

- Favorable Regulatory Environment: Supportive policies encourage lending activities.

- Robust Financial Infrastructure: Well-established banking and financial institutions facilitate financing.

By Car Type: SUVs and MPVs are showing the highest growth due to rising consumer preference for larger vehicles. Sedans and Hatchbacks maintain steady demand.

By Financier: Banks continue to dominate the market, followed by OEMs and NBFCs, which are gaining traction. NBFC's are gaining traction due to their flexibility and ability to serve niche segments.

Used Car Financing Market Product Innovations

Recent innovations include AI-driven credit scoring algorithms that assess risk more accurately and efficiently, reducing processing times and improving approval rates. Digital lending platforms offer streamlined online applications and instant loan approvals, enhancing customer experience. The integration of blockchain technology offers the potential for increased security and transparency in loan processing. These advancements enhance customer experience and reduce administrative overheads for lenders.

Propelling Factors for Used Car Financing Market Growth

Several factors drive growth in the used car financing market. Increased affordability of used cars compared to new vehicles is a major driver. The rise of online used car marketplaces makes the process convenient for buyers, further boosting demand. Supportive government policies and incentives also contribute to market expansion. Technological advancements like AI-powered credit scoring systems streamline loan processing, allowing for faster approvals and access to credit for a wider range of customers.

Obstacles in the Used Car Financing Market

The used car financing market faces challenges, including stringent regulatory compliance requirements and the risk of defaults. Fluctuations in used car prices and economic uncertainty can impact consumer demand and lender profitability. Competitive pressures from both established players and new entrants also pose a challenge. Supply chain disruptions in the automotive industry can influence the availability of vehicles, affecting the overall market.

Future Opportunities in Used Car Financing Market

Expansion into emerging markets with growing economies presents significant opportunities. Innovative financing products catering to specific consumer needs, such as flexible repayment options or lease-to-own programs, can unlock further growth. Technological advancements, such as AI-powered risk assessment and blockchain-based transaction security, will further reshape the market.

Major Players in the Used Car Financing Market Ecosystem

- Australia and New Zealand Banking Group Limited

- Ally Financial

- Changan Auto Finance Co Ltd

- The Bank of China

- BMW Financing Services Ltd

- Ford Motor Credit Company

- JPMorgan Chase & Co

- The Bank of America Corporation

- HSBC Holdings PLC

- Standard Bank Group Ltd

- Toyota Motor Corporation

- BYD Auto Finance Company Limited

Key Developments in Used Car Financing Market Industry

- December 2021: Car24 partnered with Bajaj Finance Ltd for used car financing, expanding access to credit.

- May 2022: CarTrade Tech partnered with Cholamandalam Investment and Finance Co. to offer used car financing, increasing competition in the market.

Strategic Used Car Financing Market Forecast

The used car financing market is poised for continued growth, driven by increasing demand for used vehicles, technological advancements, and supportive regulatory environments. The market's expansion will be influenced by the penetration of online platforms and innovative financing solutions. The forecast period anticipates significant growth, driven by strong consumer demand and the ongoing digital transformation of the automotive finance sector.

Used Car Financing Market Segmentation

-

1. Car Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sports Utility Vehicle

- 1.4. Multi-purpose Vehicle

-

2. Financier

- 2.1. OEM

- 2.2. Banks

- 2.3. Non-Banking Financial Company

Used Car Financing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Argentina

- 4.3. United Arab Emirates

- 4.4. Saudi Arabia

- 4.5. Other Countries

Used Car Financing Market Regional Market Share

Geographic Coverage of Used Car Financing Market

Used Car Financing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. OEM Based Financing to Provide Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Financing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Car Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicle

- 5.1.4. Multi-purpose Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Financier

- 5.2.1. OEM

- 5.2.2. Banks

- 5.2.3. Non-Banking Financial Company

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Car Type

- 6. North America Used Car Financing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Car Type

- 6.1.1. Hatchback

- 6.1.2. Sedan

- 6.1.3. Sports Utility Vehicle

- 6.1.4. Multi-purpose Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Financier

- 6.2.1. OEM

- 6.2.2. Banks

- 6.2.3. Non-Banking Financial Company

- 6.1. Market Analysis, Insights and Forecast - by Car Type

- 7. Europe Used Car Financing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Car Type

- 7.1.1. Hatchback

- 7.1.2. Sedan

- 7.1.3. Sports Utility Vehicle

- 7.1.4. Multi-purpose Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Financier

- 7.2.1. OEM

- 7.2.2. Banks

- 7.2.3. Non-Banking Financial Company

- 7.1. Market Analysis, Insights and Forecast - by Car Type

- 8. Asia Pacific Used Car Financing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Car Type

- 8.1.1. Hatchback

- 8.1.2. Sedan

- 8.1.3. Sports Utility Vehicle

- 8.1.4. Multi-purpose Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Financier

- 8.2.1. OEM

- 8.2.2. Banks

- 8.2.3. Non-Banking Financial Company

- 8.1. Market Analysis, Insights and Forecast - by Car Type

- 9. Rest of the World Used Car Financing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Car Type

- 9.1.1. Hatchback

- 9.1.2. Sedan

- 9.1.3. Sports Utility Vehicle

- 9.1.4. Multi-purpose Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Financier

- 9.2.1. OEM

- 9.2.2. Banks

- 9.2.3. Non-Banking Financial Company

- 9.1. Market Analysis, Insights and Forecast - by Car Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Australia and New Zealand Banking Group Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ally Financial

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Changan Auto Finance Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Bank of China

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BMW Financing Services Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ford Motor Credit Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JPMorgan Chase & Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The Bank of America Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 HSBC Holdings PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Standard Bank Group Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Toyota Motor Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 BYD Auto Finance Company Limited

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Australia and New Zealand Banking Group Limited

List of Figures

- Figure 1: Global Used Car Financing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Used Car Financing Market Revenue (billion), by Car Type 2025 & 2033

- Figure 3: North America Used Car Financing Market Revenue Share (%), by Car Type 2025 & 2033

- Figure 4: North America Used Car Financing Market Revenue (billion), by Financier 2025 & 2033

- Figure 5: North America Used Car Financing Market Revenue Share (%), by Financier 2025 & 2033

- Figure 6: North America Used Car Financing Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Used Car Financing Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Used Car Financing Market Revenue (billion), by Car Type 2025 & 2033

- Figure 9: Europe Used Car Financing Market Revenue Share (%), by Car Type 2025 & 2033

- Figure 10: Europe Used Car Financing Market Revenue (billion), by Financier 2025 & 2033

- Figure 11: Europe Used Car Financing Market Revenue Share (%), by Financier 2025 & 2033

- Figure 12: Europe Used Car Financing Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Used Car Financing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Used Car Financing Market Revenue (billion), by Car Type 2025 & 2033

- Figure 15: Asia Pacific Used Car Financing Market Revenue Share (%), by Car Type 2025 & 2033

- Figure 16: Asia Pacific Used Car Financing Market Revenue (billion), by Financier 2025 & 2033

- Figure 17: Asia Pacific Used Car Financing Market Revenue Share (%), by Financier 2025 & 2033

- Figure 18: Asia Pacific Used Car Financing Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Used Car Financing Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Used Car Financing Market Revenue (billion), by Car Type 2025 & 2033

- Figure 21: Rest of the World Used Car Financing Market Revenue Share (%), by Car Type 2025 & 2033

- Figure 22: Rest of the World Used Car Financing Market Revenue (billion), by Financier 2025 & 2033

- Figure 23: Rest of the World Used Car Financing Market Revenue Share (%), by Financier 2025 & 2033

- Figure 24: Rest of the World Used Car Financing Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Used Car Financing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Car Financing Market Revenue billion Forecast, by Car Type 2020 & 2033

- Table 2: Global Used Car Financing Market Revenue billion Forecast, by Financier 2020 & 2033

- Table 3: Global Used Car Financing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Used Car Financing Market Revenue billion Forecast, by Car Type 2020 & 2033

- Table 5: Global Used Car Financing Market Revenue billion Forecast, by Financier 2020 & 2033

- Table 6: Global Used Car Financing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Used Car Financing Market Revenue billion Forecast, by Car Type 2020 & 2033

- Table 12: Global Used Car Financing Market Revenue billion Forecast, by Financier 2020 & 2033

- Table 13: Global Used Car Financing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Germany Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Spain Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Used Car Financing Market Revenue billion Forecast, by Car Type 2020 & 2033

- Table 21: Global Used Car Financing Market Revenue billion Forecast, by Financier 2020 & 2033

- Table 22: Global Used Car Financing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: India Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: China Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Used Car Financing Market Revenue billion Forecast, by Car Type 2020 & 2033

- Table 29: Global Used Car Financing Market Revenue billion Forecast, by Financier 2020 & 2033

- Table 30: Global Used Car Financing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: United Arab Emirates Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Other Countries Used Car Financing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Financing Market?

The projected CAGR is approximately 2.41%.

2. Which companies are prominent players in the Used Car Financing Market?

Key companies in the market include Australia and New Zealand Banking Group Limited, Ally Financial, Changan Auto Finance Co Ltd, The Bank of China, BMW Financing Services Ltd, Ford Motor Credit Company, JPMorgan Chase & Co, The Bank of America Corporation, HSBC Holdings PLC, Standard Bank Group Ltd, Toyota Motor Corporation, BYD Auto Finance Company Limited.

3. What are the main segments of the Used Car Financing Market?

The market segments include Car Type, Financier.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

OEM Based Financing to Provide Momentum.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

May 2022: CarTrade Tech, which is a platform that offers consumers to sell and buy automobiles, entered a partnership with Cholamandalam Investment and Finance Coto in order to offer finance for used cars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Financing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Financing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Financing Market?

To stay informed about further developments, trends, and reports in the Used Car Financing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence