Key Insights

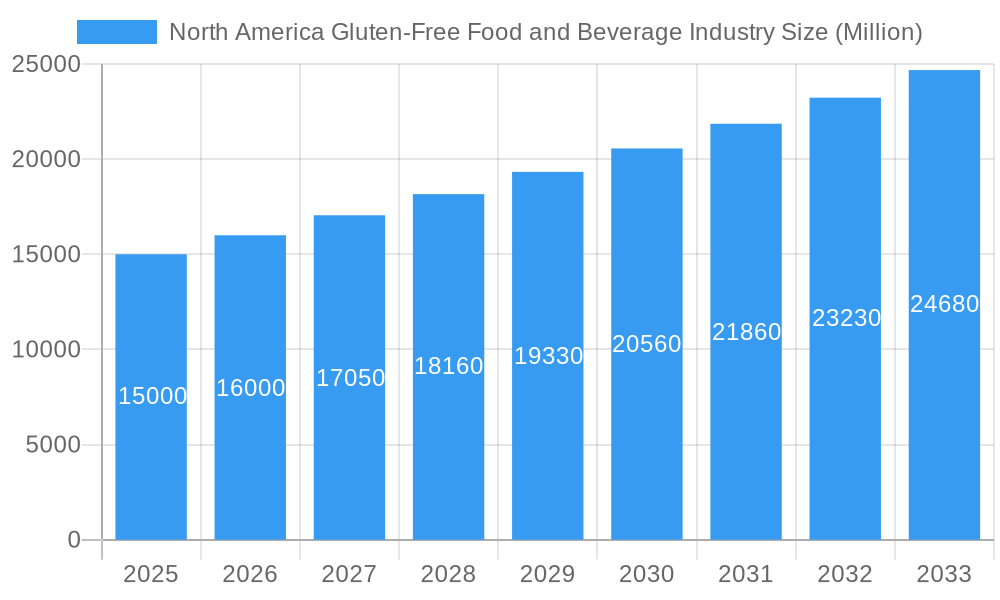

The North American gluten-free food and beverage sector is experiencing significant expansion. This growth is propelled by heightened awareness of celiac disease and gluten sensitivities, alongside increasing consumer preference for healthier, specialized dietary choices. The market, valued at $6.28 billion in the base year of 2025, is forecasted to achieve a Compound Annual Growth Rate (CAGR) of 7% between 2025 and 2033. Key drivers include a rising incidence of diagnosed celiac disease and gluten intolerance, greater consumer understanding of the health advantages of gluten-free diets (such as weight management and improved digestion), and the expanding availability of a wide array of palatable gluten-free products across numerous food categories. Leading companies like Nestlé, Unilever, and PepsiCo are actively investing in research and development, product innovation, and broadening their gluten-free offerings to capitalize on this market opportunity. Notably, gluten-free bread products, cookies and snacks, and beverages are exhibiting the strongest growth, indicating a consumer trend towards convenient, flavorful options that cater to dietary requirements without compromising taste.

North America Gluten-Free Food and Beverage Industry Market Size (In Billion)

Despite the positive outlook, the market faces certain obstacles. Elevated pricing remains a considerable restraint, as gluten-free products frequently carry a premium over conventional alternatives. Maintaining product quality, taste, and texture comparable to traditional items is an ongoing focus for manufacturers. Additionally, addressing potential consumer perceptions of limited variety and taste compared to conventional foods is vital for sustained market penetration. Nevertheless, continuous research and development, coupled with effective marketing strategies emphasizing health and lifestyle benefits, position the North American gluten-free food and beverage market for substantial future growth. Regional differences within North America, such as higher consumption in the United States compared to Canada and Mexico, will continue to influence market dynamics and strategic decisions for industry participants.

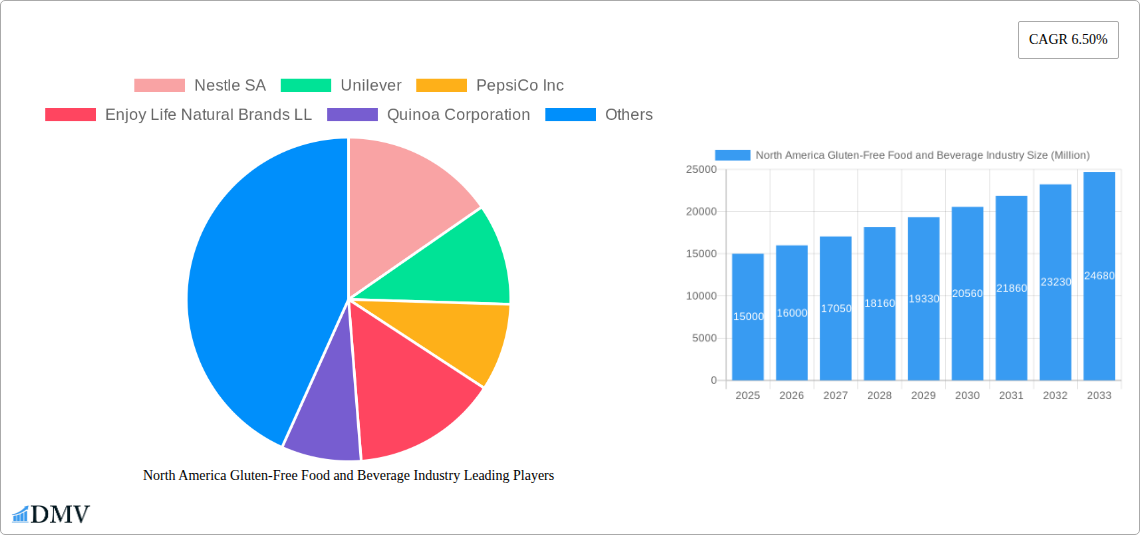

North America Gluten-Free Food and Beverage Industry Company Market Share

North America Gluten-Free Food and Beverage Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America gluten-free food and beverage market, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market trends, growth drivers, and future opportunities within this rapidly expanding sector. The report forecasts a market valued at xx Million by 2033, presenting a detailed breakdown across various segments and key players, including Nestle SA, Unilever, PepsiCo Inc, Enjoy Life Natural Brands LL, Quinoa Corporation, Hain Celestial Group Inc, Amy's Kitchen Inc, and Raisio PLC.

North America Gluten-Free Food and Beverage Industry Market Composition & Trends

This section analyzes the competitive landscape of the North American gluten-free food and beverage market, examining market concentration, innovation, regulatory factors, substitute products, and M&A activity. The report details the market share distribution among leading players, revealing a moderately consolidated market with key players holding significant shares. M&A activity is analyzed, considering deal values and their impact on market dynamics. For example, the consolidation of smaller gluten-free brands by larger food companies is highlighted, along with an assessment of the implications for innovation and competition. The evolving regulatory landscape concerning gluten-free labeling and standards is also explored, impacting both market access and consumer confidence. The increasing availability of substitute products in other dietary categories, such as vegan or plant-based options, is also assessed in terms of their influence on market growth. End-user profiles are segmented by demographics and dietary preferences to illustrate market demand.

- Market Concentration: xx% market share held by top 5 players in 2025.

- M&A Activity (2019-2024): xx Million in total deal value across xx transactions.

- Regulatory Landscape: Analysis of FDA regulations and their impact on market growth.

- Substitute Products: Assessment of competition from vegan/plant-based alternatives.

North America Gluten-Free Food and Beverage Industry Industry Evolution

This section meticulously charts the evolution of the North American gluten-free food and beverage industry from 2019 to 2033. We examine market growth trajectories, pinpointing key inflection points and assessing the impact of technological advancements on production efficiency and product innovation. The report delves into changing consumer demands, analyzing the factors driving the rise in gluten-free consumption, such as increased awareness of celiac disease and rising health consciousness. Specific data points, including compound annual growth rates (CAGR) for different segments and adoption rates of gluten-free products across various demographic groups, are provided. This section also explores the increasing sophistication of gluten-free products to meet demands for improved taste, texture, and nutritional profiles. The impact of lifestyle trends and evolving dietary preferences will also be examined to assess the long-term viability of this market.

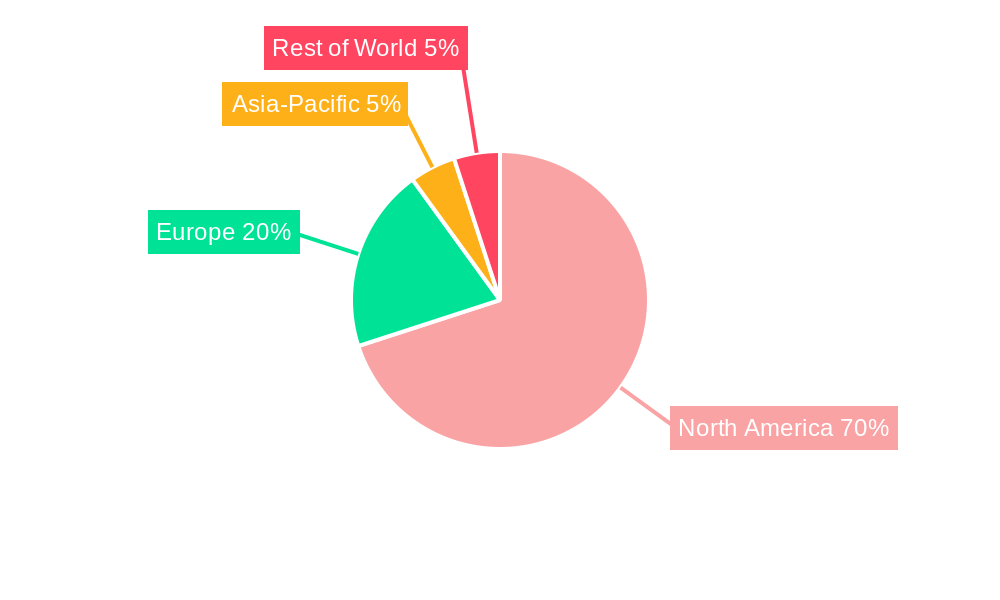

Leading Regions, Countries, or Segments in North America Gluten-Free Food and Beverage Industry

This section identifies the leading regions, countries, and product segments within the North American gluten-free food and beverage market. The analysis considers factors driving the dominance of specific segments, including investment trends, regulatory support, and consumer preferences. The report delves into the reasons behind the leading segment's success and forecasts its future growth trajectory.

- Dominant Segment: xx (e.g., Cookies and Snacks) is expected to hold the largest market share in 2025, driven by xx.

- Key Drivers:

- Increased consumer awareness: Growing understanding of gluten intolerance and health benefits of gluten-free diets.

- Product innovation: Introduction of tastier, more convenient, and nutritionally enhanced products.

- Retail expansion: Wider availability of gluten-free products in supermarkets and specialty stores.

- Government support: Regulatory measures promoting the growth of the industry.

North America Gluten-Free Food and Beverage Industry Product Innovations

This section showcases recent product innovations within the North American gluten-free food and beverage industry. The report highlights unique selling propositions (USPs) of new products, focusing on factors such as improved taste, texture, and nutritional content. Technological advancements contributing to improved production efficiency and enhanced product attributes are also discussed, emphasizing the use of novel ingredients and processing techniques.

Propelling Factors for North America Gluten-Free Food and Beverage Industry Growth

Several key factors are driving the growth of the North American gluten-free food and beverage market. These include rising consumer awareness of gluten-related health issues, increased demand for healthier food options, and technological advancements leading to improved product quality and availability. Government support and favorable regulations are further bolstering the industry's expansion. The increasing availability of gluten-free products across various retail channels also contributes to this growth.

Obstacles in the North America Gluten-Free Food and Beverage Industry Market

Despite the significant growth potential, the North American gluten-free food and beverage market faces several challenges. These include maintaining consistent product quality, managing supply chain complexities, and navigating fluctuating raw material prices. Furthermore, intense competition from established food manufacturers and the emergence of new players pose a challenge to market participants. Regulatory hurdles and the potential for increased scrutiny over labeling claims could further impact industry growth.

Future Opportunities in North America Gluten-Free Food and Beverage Industry

The North American gluten-free food and beverage market presents numerous future opportunities. The expansion into new markets, such as functional foods and personalized nutrition, offers significant potential for growth. Technological advancements in gluten-free food processing and the development of innovative products will also shape the industry's trajectory. Capitalizing on evolving consumer preferences for sustainable and ethically sourced ingredients will further create avenues for expansion.

Major Players in the North America Gluten-Free Food and Beverage Industry Ecosystem

- Nestle SA

- Unilever

- PepsiCo Inc

- Enjoy Life Natural Brands LL

- Quinoa Corporation

- Hain Celestial Group Inc

- Amy's Kitchen Inc

- Raisio PLC

Key Developments in North America Gluten-Free Food and Beverage Industry Industry

- 2023 Q3: Launch of a new line of gluten-free snacks by a major food manufacturer.

- 2022 Q4: Acquisition of a smaller gluten-free bakery by a larger food company.

- 2021 Q2: Introduction of new gluten-free labeling regulations in a key market.

Strategic North America Gluten-Free Food and Beverage Industry Market Forecast

The North America gluten-free food and beverage market is poised for continued growth, driven by several factors. Rising health consciousness, increased consumer awareness of gluten-related disorders, and the ongoing innovation in gluten-free products will propel market expansion. The increasing availability of gluten-free options in various foodservice and retail channels further contributes to the optimistic outlook. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), reaching a projected value of xx Million by 2033.

North America Gluten-Free Food and Beverage Industry Segmentation

-

1. Product Type

- 1.1. Beverages

- 1.2. Bread Products

- 1.3. Cookies and Snacks

- 1.4. Condiments, Seasonings, and Spreads

- 1.5. Dairy/Dairy Substitutes

- 1.6. Meat/Meat Substitutes

- 1.7. Other Gluten-free Products

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

North America Gluten-Free Food and Beverage Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Gluten-Free Food and Beverage Industry Regional Market Share

Geographic Coverage of North America Gluten-Free Food and Beverage Industry

North America Gluten-Free Food and Beverage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Gluten-free Food and Beverage Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gluten-Free Food and Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beverages

- 5.1.2. Bread Products

- 5.1.3. Cookies and Snacks

- 5.1.4. Condiments, Seasonings, and Spreads

- 5.1.5. Dairy/Dairy Substitutes

- 5.1.6. Meat/Meat Substitutes

- 5.1.7. Other Gluten-free Products

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.2.4. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Gluten-Free Food and Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beverages

- 6.1.2. Bread Products

- 6.1.3. Cookies and Snacks

- 6.1.4. Condiments, Seasonings, and Spreads

- 6.1.5. Dairy/Dairy Substitutes

- 6.1.6. Meat/Meat Substitutes

- 6.1.7. Other Gluten-free Products

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.2.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Gluten-Free Food and Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beverages

- 7.1.2. Bread Products

- 7.1.3. Cookies and Snacks

- 7.1.4. Condiments, Seasonings, and Spreads

- 7.1.5. Dairy/Dairy Substitutes

- 7.1.6. Meat/Meat Substitutes

- 7.1.7. Other Gluten-free Products

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.2.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Gluten-Free Food and Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beverages

- 8.1.2. Bread Products

- 8.1.3. Cookies and Snacks

- 8.1.4. Condiments, Seasonings, and Spreads

- 8.1.5. Dairy/Dairy Substitutes

- 8.1.6. Meat/Meat Substitutes

- 8.1.7. Other Gluten-free Products

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.2.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Gluten-Free Food and Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Beverages

- 9.1.2. Bread Products

- 9.1.3. Cookies and Snacks

- 9.1.4. Condiments, Seasonings, and Spreads

- 9.1.5. Dairy/Dairy Substitutes

- 9.1.6. Meat/Meat Substitutes

- 9.1.7. Other Gluten-free Products

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United States

- 9.2.2. Canada

- 9.2.3. Mexico

- 9.2.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nestle SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Unilever

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 PepsiCo Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Enjoy Life Natural Brands LL

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Quinoa Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hain Celestial Group Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Amy's Kitchen Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Raisio PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Nestle SA

List of Figures

- Figure 1: North America Gluten-Free Food and Beverage Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Gluten-Free Food and Beverage Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 3: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Geography 2020 & 2033

- Table 5: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Region 2020 & 2033

- Table 7: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 9: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Geography 2020 & 2033

- Table 11: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Country 2020 & 2033

- Table 13: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 15: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Geography 2020 & 2033

- Table 17: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Country 2020 & 2033

- Table 19: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 21: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Geography 2020 & 2033

- Table 23: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Country 2020 & 2033

- Table 25: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 27: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Geography 2020 & 2033

- Table 29: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gluten-Free Food and Beverage Industry?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the North America Gluten-Free Food and Beverage Industry?

Key companies in the market include Nestle SA, Unilever, PepsiCo Inc, Enjoy Life Natural Brands LL, Quinoa Corporation, Hain Celestial Group Inc, Amy's Kitchen Inc, Raisio PLC.

3. What are the main segments of the North America Gluten-Free Food and Beverage Industry?

The market segments include Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Increasing Demand for Gluten-free Food and Beverage Products.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Ton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gluten-Free Food and Beverage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gluten-Free Food and Beverage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gluten-Free Food and Beverage Industry?

To stay informed about further developments, trends, and reports in the North America Gluten-Free Food and Beverage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence