Key Insights

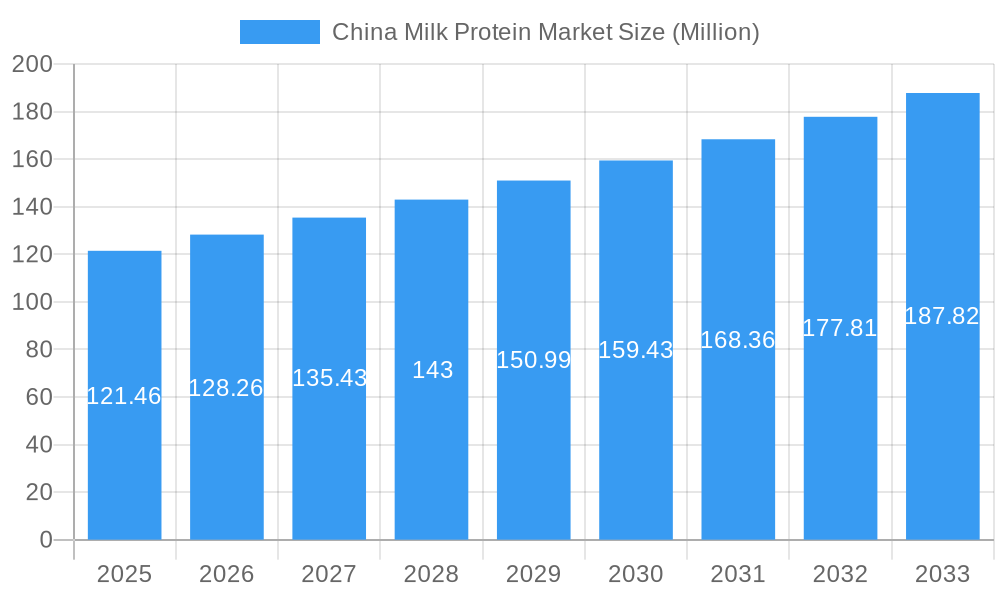

The China milk protein market is forecast for substantial growth, projected to reach 23.9 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033. This expansion is fueled by escalating consumer demand for protein-enriched foods and beverages, heightened health consciousness, and the increasing application of milk protein in functional foods and dietary supplements. Key growth catalysts include the pervasive health and wellness trends, driving higher consumption of protein-fortified products across diverse sectors. The dynamic food and beverage industry, especially in ready-to-drink protein shakes and dairy alternatives, significantly contributes to this growth. Furthermore, the animal feed sector, a substantial consumer of milk protein concentrates and hydrolysates, benefits from advancements in livestock farming and a greater emphasis on animal nutrition.

China Milk Protein Market Market Size (In Billion)

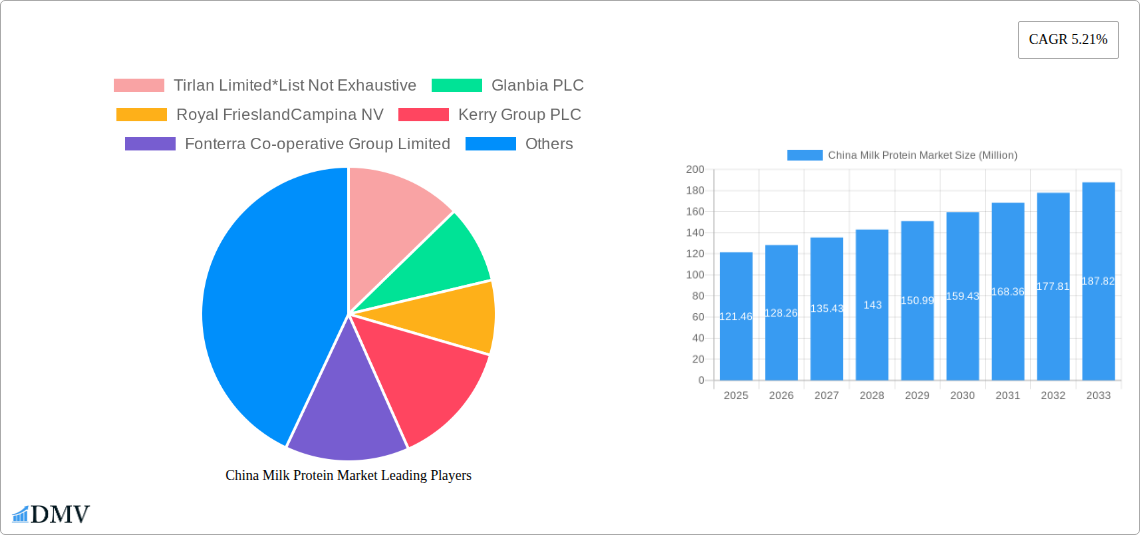

While challenges such as milk price volatility and potential supply chain disruptions exist, the overall positive market trajectory is expected to persist. The availability of various milk protein forms—concentrates, hydrolysates, and isolates—addresses the specific needs of multiple industries, fostering opportunities for market segmentation and customized product development. Leading industry players, including Tirlan Limited, Glanbia PLC, and Fonterra Co-operative Group Limited, are instrumental in driving innovation and broadening market accessibility.

China Milk Protein Market Company Market Share

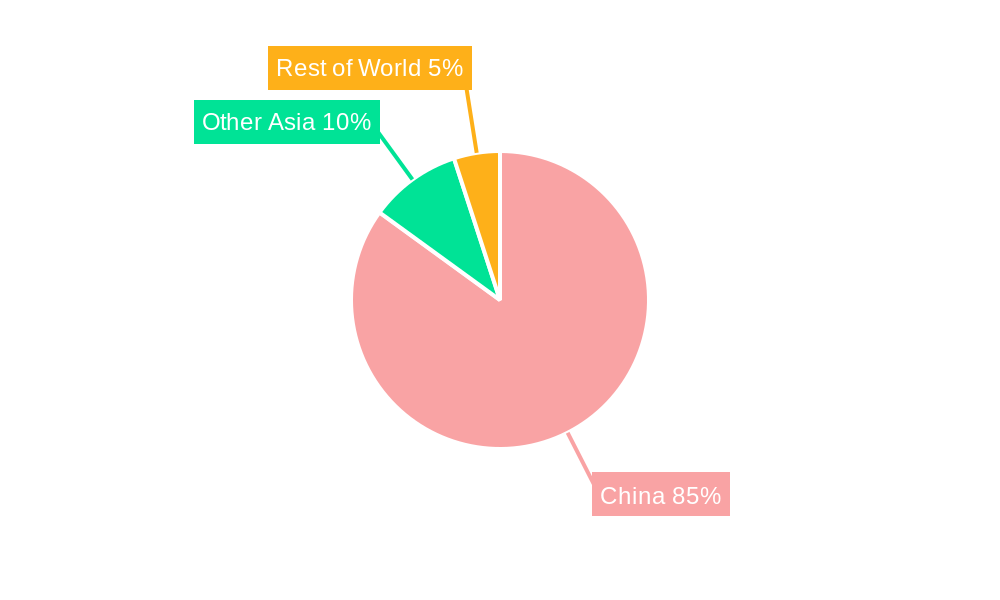

China is anticipated to maintain its leading position within the regional market. The nation's extensive population, expanding middle class, and rising disposable incomes are key drivers of market expansion. Each market segment—concentrates, hydrolysates, and isolates, spanning animal feed, personal care, food & beverages, and supplements—presents distinct growth opportunities. Concentrates are expected to retain a significant market share due to their cost-effectiveness, while the demand for hydrolysates and isolates is projected to rise owing to their superior functionalities and nutritional advantages. Market analysis indicates a high degree of consolidation, characterized by the dominance of large multinational corporations, alongside the presence of smaller, specialized firms offering niche solutions. The projected market growth is underpinned by the ongoing health and wellness movement, with a pronounced focus on protein-enhanced products, signaling sustained expansion for the China milk protein market.

China Milk Protein Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning China milk protein market, offering invaluable data and projections for stakeholders. With a focus on market trends, competitive landscape, and future opportunities, this report is essential for businesses seeking to navigate this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The market is segmented by form (concentrates, hydrolyzed, isolates) and end-user (animal feed, personal care and cosmetics, food and beverages, supplements). The market is projected to reach xx Million by 2033.

China Milk Protein Market Composition & Trends

This section delves into the intricacies of the China milk protein market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user dynamics, and mergers & acquisitions (M&A) activity. The market exhibits a moderately concentrated structure, with key players holding significant market share. Innovation is propelled by increasing consumer demand for high-protein products and the development of novel applications across various sectors. Stringent regulatory standards govern food safety and quality, influencing product development and market entry strategies. Plant-based protein alternatives represent a key competitive threat, while the prevalence of M&A activity signifies ongoing consolidation within the industry.

- Market Share Distribution: Key players such as Glanbia PLC and Fonterra Co-operative Group Limited hold a substantial share, with the top 5 companies accounting for approximately xx% of the total market.

- M&A Deal Values: Total M&A deal value in the period 2019-2024 reached approximately xx Million, highlighting significant investment and consolidation in the sector.

- End-User Analysis: The food and beverage segment dominates, followed by animal feed and the personal care industry. Growth in the supplement sector is expected to accelerate in the forecast period.

China Milk Protein Market Industry Evolution

The China milk protein market has experienced robust growth during the historical period (2019-2024), driven by factors such as rising disposable incomes, changing dietary habits, and increasing health consciousness. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. Technological advancements, including improved processing techniques and the development of novel protein formulations, are further fueling market expansion. Consumer preferences are shifting towards organic and functional milk proteins, creating new opportunities for innovation and product differentiation. The increasing adoption of convenient and ready-to-consume protein products is also driving market growth. Specific data points regarding precise growth rates and adoption metrics will be provided in the full report.

Leading Regions, Countries, or Segments in China Milk Protein Market

The report identifies key regions, countries, and segments driving the China milk protein market. While precise data is available in the full report, we can anticipate that the coastal regions of China (e.g., Guangdong, Jiangsu, Zhejiang) will exhibit the strongest growth due to higher consumer spending and established food processing industries. The Food & Beverage segment is expected to remain dominant, driven by its diverse applications.

Key Drivers:

- Investment Trends: Significant foreign direct investment (FDI) in food processing and dairy industries boosts production and market expansion.

- Regulatory Support: Favorable government policies promoting the development of the dairy industry further accelerate market growth.

Dominance Factors: High population density, developed infrastructure, and robust consumer demand contribute to the dominance of specific regions and segments.

China Milk Protein Market Product Innovations

Recent years have witnessed a surge in product innovation, with companies launching a wide array of milk protein-based products tailored to specific consumer needs. These innovations encompass novel protein formulations optimized for various applications, organic options, and functional ingredients with added health benefits. Technological advancements, including advanced protein extraction and purification techniques, enhance product quality and performance, leading to the development of superior products with enhanced functionality. Companies are increasingly focusing on products with extended shelf life and improved organoleptic properties, addressing consumer concerns regarding convenience and sensory appeal.

Propelling Factors for China Milk Protein Market Growth

Several factors are driving the expansion of the China milk protein market. Firstly, the rising disposable incomes and urbanization are boosting consumer spending on premium food products, including high-protein options. Secondly, changing dietary preferences and increasing health consciousness among consumers are leading to greater demand for milk proteins as dietary supplements and functional food ingredients. Finally, supportive government policies encouraging the development of the dairy industry provide a favorable environment for market growth.

Obstacles in the China Milk Protein Market

The China milk protein market faces several challenges. Stringent regulatory compliance requirements add complexity and cost to product development and market entry. Supply chain disruptions, particularly concerning raw material sourcing and logistics, can impact production efficiency and product availability. Furthermore, increasing competition from domestic and international players, as well as the emergence of plant-based protein alternatives, poses a threat to market share. These challenges together negatively affect profit margins, estimated at xx% during 2024.

Future Opportunities in China Milk Protein Market

Emerging opportunities exist in the China milk protein market. The growing demand for organic and functional food products, coupled with increasing interest in personalized nutrition, creates new opportunities for product differentiation and innovation. The expansion of e-commerce channels offers opportunities for improved market reach and direct-to-consumer sales. Finally, the development of novel applications in areas such as sports nutrition and specialized infant formulas presents significant growth potential.

Major Players in the China Milk Protein Market Ecosystem

- Tirlan Limited

- Glanbia PLC (Glanbia PLC)

- Royal FrieslandCampina NV (FrieslandCampina)

- Kerry Group PLC (Kerry Group PLC)

- Fonterra Co-operative Group Limited (Fonterra Co-operative Group Limited)

- Morinaga Milk Industry Co Ltd (Morinaga Milk Industry Co Ltd)

- Groupe Lactalis (Groupe Lactalis)

- Arla Foods AmbA (Arla Foods)

- Danone S.A. (Danone S.A.)

- FrieslandCampina

Key Developments in China Milk Protein Market Industry

- February 2021: Arla Foods amba launched a pioneering dry-blend protein for infant formula manufacturers, reducing production costs without compromising safety and quality.

- March 2022: Arla Foods Ingredients introduced new organic offerings for early-life nutrition and various organic food concepts for the Chinese market, showcased at Food Ingredients China 2022.

- July 2022: Arla Foods Ingredients unveiled 'cast cheese,' an organic solution using Nutrilac Organic milk proteins, emphasizing its use in organic product creation and enhancing flavor.

Strategic China Milk Protein Market Forecast

The China milk protein market is poised for substantial growth, fueled by several factors including increasing consumer demand for protein-rich foods, innovative product development, and supportive government policies. This growth is anticipated to continue throughout the forecast period, leading to significant market expansion and presenting lucrative opportunities for businesses operating in this dynamic sector. The market is expected to witness further consolidation, with strategic alliances and mergers likely to reshape the competitive landscape.

China Milk Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Hydrolyzed

- 1.3. Isolates

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Dairy and Dairy Alternative Products

- 2.3.5. RTE/RTC Food Products

- 2.3.6. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

China Milk Protein Market Segmentation By Geography

- 1. China

China Milk Protein Market Regional Market Share

Geographic Coverage of China Milk Protein Market

China Milk Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Nutritious Food; Functional and Processing Benefits of Milk Protein

- 3.3. Market Restrains

- 3.3.1. Rising Demand and Popularity of Plant-based Proteins

- 3.4. Market Trends

- 3.4.1. Increasing Consumer Demand for Nutritious Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Milk Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Hydrolyzed

- 5.1.3. Isolates

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Dairy and Dairy Alternative Products

- 5.2.3.5. RTE/RTC Food Products

- 5.2.3.6. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tirlan Limited*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Glanbia PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Royal FrieslandCampina NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kerry Group PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fonterra Co-operative Group Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Morinaga Milk Industry Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Groupe Lactalis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arla Foods AmbA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Danone S.A.

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 FrieslandCampina

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tirlan Limited*List Not Exhaustive

List of Figures

- Figure 1: China Milk Protein Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Milk Protein Market Share (%) by Company 2025

List of Tables

- Table 1: China Milk Protein Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: China Milk Protein Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 3: China Milk Protein Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: China Milk Protein Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 5: China Milk Protein Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Milk Protein Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: China Milk Protein Market Revenue billion Forecast, by Form 2020 & 2033

- Table 8: China Milk Protein Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 9: China Milk Protein Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: China Milk Protein Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 11: China Milk Protein Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: China Milk Protein Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Milk Protein Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the China Milk Protein Market?

Key companies in the market include Tirlan Limited*List Not Exhaustive, Glanbia PLC, Royal FrieslandCampina NV, Kerry Group PLC, Fonterra Co-operative Group Limited, Morinaga Milk Industry Co Ltd, Groupe Lactalis, Arla Foods AmbA, Danone S.A. , FrieslandCampina.

3. What are the main segments of the China Milk Protein Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Nutritious Food; Functional and Processing Benefits of Milk Protein.

6. What are the notable trends driving market growth?

Increasing Consumer Demand for Nutritious Food.

7. Are there any restraints impacting market growth?

Rising Demand and Popularity of Plant-based Proteins.

8. Can you provide examples of recent developments in the market?

July 2022: Arla Foods Ingredients intensified its focus on the Chinese market by introducing a range of innovative whey protein-based ingredient concepts. A highlight of their efforts was the unveiling of 'cast cheese,' an inventive organic solution crafted from Nutrilac Organic milk proteins. Arla Foods asserts that these proteins not only facilitate the creation of organic products but also enrich the cheese with a delightful milky and mild flavor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Milk Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Milk Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Milk Protein Market?

To stay informed about further developments, trends, and reports in the China Milk Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence