Key Insights

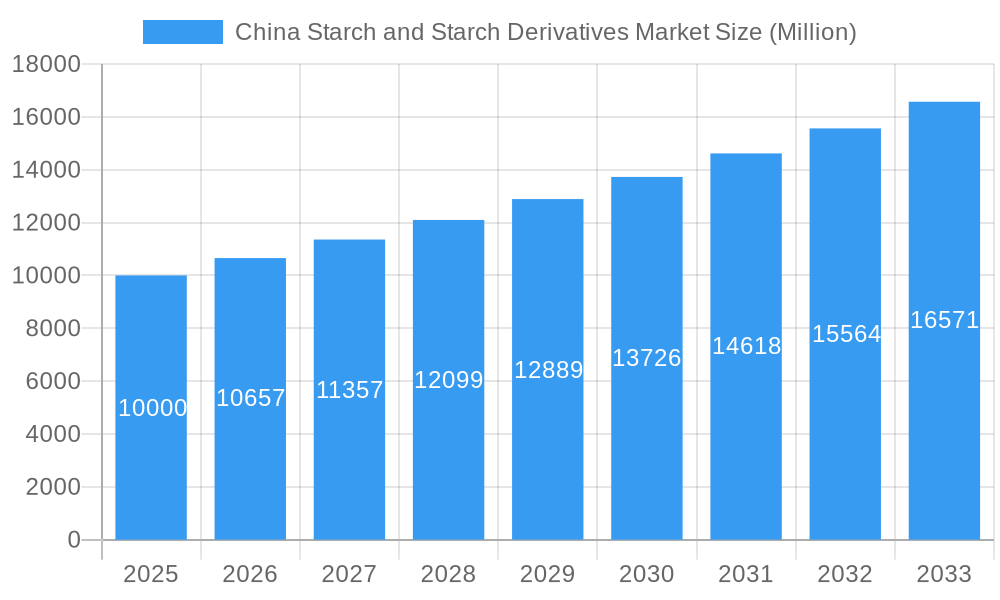

The China starch and starch derivatives market is projected for significant expansion, with an estimated market size of $25.9 billion in 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% from 2025 to 2033. This growth is primarily driven by the expanding food and beverage sector in China, which requires starch-based ingredients for sweeteners, thickeners, and stabilizers. The pharmaceutical and personal care industries also contribute to demand, utilizing starch derivatives in applications like tablet binders and cosmetic thickeners. A key trend is the increasing adoption of modified starches for their superior functional properties, alongside a rising consumer preference for clean-label and sustainably sourced ingredients. However, market growth may be constrained by raw material price volatility and potential supply chain disruptions. The market is segmented by product type (native, modified), raw material (corn, cassava, potato, wheat, others), and application (food & beverage, pharmaceuticals, personal care, animal feed, others). Key industry players are focusing on distribution networks and technological innovation to maintain a competitive position.

China Starch and Starch Derivatives Market Market Size (In Billion)

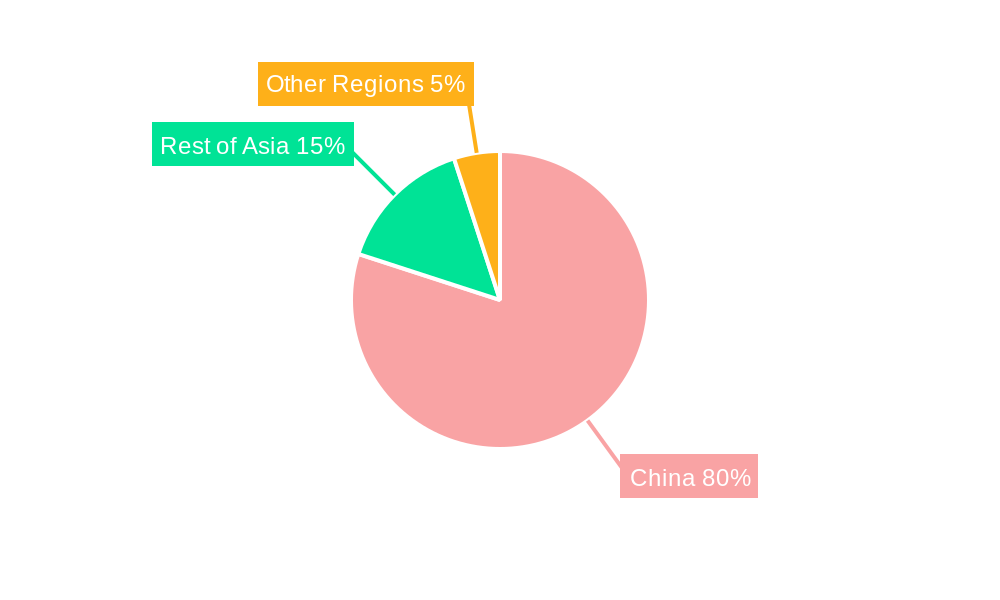

China holds a dominant position in the Asian starch market, driven by its extensive agricultural base and large consumer population. Market competition is influenced by product differentiation, pricing, technological advancements, and brand recognition. Future growth will be propelled by the expansion of downstream industries, innovations in starch modification, and supportive government policies. Navigating raw material price fluctuations and ensuring consistent supply of high-quality products will be crucial. Sustainable and eco-friendly production practices will also shape the market's future trajectory.

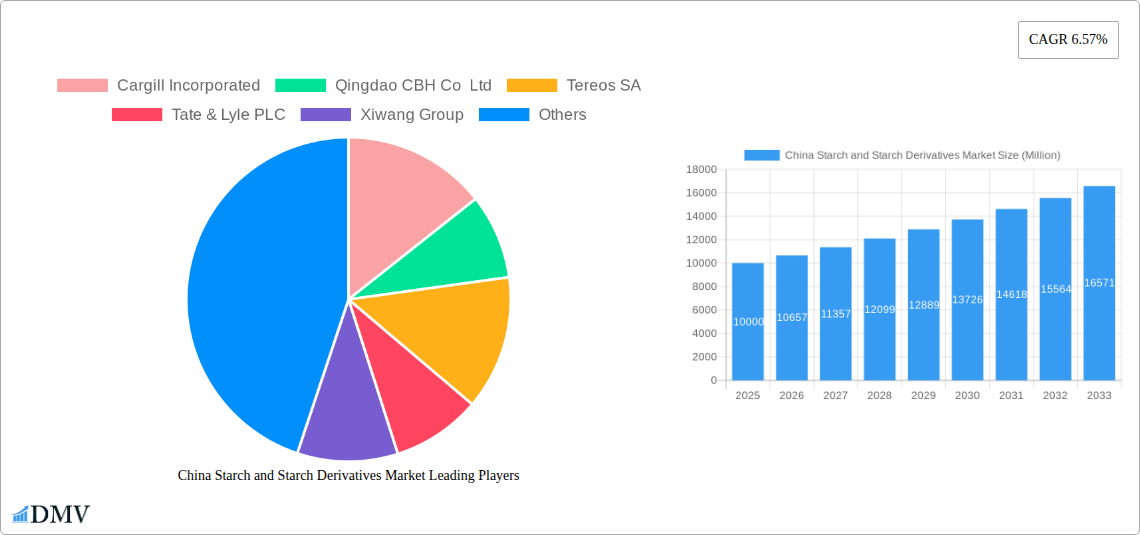

China Starch and Starch Derivatives Market Company Market Share

China Starch and Starch Derivatives Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the China starch and starch derivatives market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. With a detailed examination of market trends, competitive dynamics, and future growth prospects, this report is an indispensable resource for businesses, investors, and researchers alike. Covering the period from 2019 to 2033, with a base year of 2025, this report leverages extensive data analysis to offer accurate forecasts and strategic recommendations. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx%.

China Starch and Starch Derivatives Market Market Composition & Trends

The China starch and starch derivatives market is characterized by a moderately concentrated landscape, with key players like Cargill Incorporated, Ingredion Incorporated, and Tate & Lyle PLC holding significant market share. However, the presence of numerous smaller domestic players fosters competition. Market innovation is driven by consumer demand for novel food and beverage products, leading to the development of functional starches with enhanced properties. Stringent food safety regulations in China significantly impact market operations, encouraging the adoption of advanced processing technologies. Substitute products, such as cellulose-based thickeners, pose a moderate competitive threat. The market is segmented across various end-use industries, including food and beverage (the largest segment), pharmaceuticals, personal care, and animal feed. M&A activities are relatively frequent, with recent deals reflecting a push towards consolidation and expansion into new market segments. For example, the acquisition of Jiangsu Haian Starch Co Ltd by Tereos significantly bolstered its market presence. Estimated M&A deal values for the period 2019-2024 totaled approximately xx Million.

- Market Share Distribution (2025): Cargill (xx%), Ingredion (xx%), Tate & Lyle (xx%), Others (xx%)

- Key Innovation Catalysts: Consumer demand for functional foods, stringent food safety regulations

- Regulatory Landscape: Stringent quality and safety standards for food and pharmaceutical applications.

- Substitute Products: Cellulose-based thickeners, modified celluloses.

- M&A Activity: High level of consolidation and expansion in recent years.

China Starch and Starch Derivatives Market Industry Evolution

The China starch and starch derivatives market has witnessed significant growth driven by factors such as rising disposable incomes, changing dietary habits, and the increasing demand for processed foods. The market expanded at a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a strong growth trajectory in the forecast period (2025-2033). Technological advancements, particularly in starch modification techniques, have enabled the production of specialized starches with tailored properties for specific applications. This has led to an increase in the adoption of modified starches in various industries, driving market expansion. Consumer preferences are shifting towards healthier and more convenient food products, which has fueled the demand for functional starches with improved nutritional and processing characteristics. The adoption of advanced technologies like enzyme technology and precision fermentation is projected to increase at a rate of xx% annually. Moreover, the growing awareness of health and wellness is driving demand for natural and organic starches.

Leading Regions, Countries, or Segments in China Starch and Starch Derivatives Market

The food and beverage sector accounts for the largest share of starch consumption in China, fueled by the country’s large and growing population, rapid urbanization, and increasing consumption of processed foods. Corn is the dominant raw material for starch production, followed by cassava and potato. Within product types, modified starches are witnessing faster growth rates than native starches due to their enhanced functionalities. Geographically, coastal regions with robust industrial activity and significant population density showcase higher starch consumption.

- Key Drivers (Food & Beverage Segment): Rising disposable incomes, increasing demand for processed foods, urbanization.

- Key Drivers (Modified Starch): Functional properties, versatility across applications.

- Dominance Factors: Large and growing population, high demand for processed foods, well-established supply chains, favorable government policies.

China Starch and Starch Derivatives Market Product Innovations

Recent innovations focus on developing starches with improved functionalities, such as enhanced viscosity, texture, and freeze-thaw stability. This includes the introduction of novel modified starches tailored to specific applications in the food, pharmaceutical, and personal care industries. Technological advancements in enzyme technology and precision fermentation are enabling the creation of more sustainable and efficient starch production processes. Unique selling propositions often center around enhanced performance characteristics, cost-effectiveness, and improved sustainability.

Propelling Factors for China Starch and Starch Derivatives Market Growth

Several factors contribute to the market's growth. Technological advancements in starch modification lead to specialized starches for diverse applications. Economic expansion and rising disposable incomes fuel demand for processed foods. Favorable government policies, such as investments in agricultural infrastructure, support the industry.

Obstacles in the China Starch and Starch Derivatives Market Market

Challenges include fluctuations in raw material prices and supply chain disruptions. Stringent regulations concerning food safety and environmental protection increase production costs. Intense competition among domestic and international players impacts profitability. These factors create pricing pressure and constrain margin expansion.

Future Opportunities in China Starch and Starch Derivatives Market

Emerging opportunities exist in the development of novel starch-based biomaterials and biodegradable plastics. Growing demand for healthy and sustainable ingredients drives interest in organic and functional starches. Expansion into new markets such as pharmaceuticals and cosmetics offers significant potential.

Major Players in the China Starch and Starch Derivatives Market Ecosystem

- Cargill Incorporated

- Qingdao CBH Co Ltd

- Tereos SA

- Tate & Lyle PLC

- Xiwang Group

- Ingredion Incorporated

- Roquette Freres

- ROYAL AVEBE UA

Key Developments in China Starch and Starch Derivatives Market Industry

- 2022: Cargill announced a major investment in its starch production facility in China.

- 2021: Tereos acquired the starch business of Jiangsu Haian Starch Co Ltd.

- 2019: Tate & Lyle entered into a strategic partnership with COFCO.

Strategic China Starch and Starch Derivatives Market Market Forecast

The China starch and starch derivatives market is poised for continued growth, driven by rising consumer demand, technological innovation, and supportive government policies. Expanding applications in diverse industries and increasing focus on sustainability will further propel market expansion, presenting significant opportunities for industry participants.

China Starch and Starch Derivatives Market Segmentation

-

1. Product Type

- 1.1. Native Starch

-

1.2. Modified Starch

- 1.2.1. Dextrose

- 1.2.2. Maltodextrin

- 1.2.3. Other Product Types

-

2. Beverage Type

- 2.1. Corn

- 2.2. Cassava

- 2.3. Potato

- 2.4. Wheat

- 2.5. Other Raw Materials

-

3. Application

-

3.1. Food and Beverage

- 3.1.1. Confectionery

- 3.1.2. Bakery

- 3.1.3. Dairy

- 3.1.4. Beverages

- 3.1.5. Other Food and Beverage Applications

- 3.2. Pharmaceuticals

- 3.3. Personal Care

- 3.4. Animal Feed

- 3.5. Other Applications

-

3.1. Food and Beverage

China Starch and Starch Derivatives Market Segmentation By Geography

- 1. China

China Starch and Starch Derivatives Market Regional Market Share

Geographic Coverage of China Starch and Starch Derivatives Market

China Starch and Starch Derivatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Rise In The Price Of White Sugar Is Boosting The Demand For Starch Sugar As Cheaper Alternative Of Sweetener

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Starch and Starch Derivatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Native Starch

- 5.1.2. Modified Starch

- 5.1.2.1. Dextrose

- 5.1.2.2. Maltodextrin

- 5.1.2.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Beverage Type

- 5.2.1. Corn

- 5.2.2. Cassava

- 5.2.3. Potato

- 5.2.4. Wheat

- 5.2.5. Other Raw Materials

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverage

- 5.3.1.1. Confectionery

- 5.3.1.2. Bakery

- 5.3.1.3. Dairy

- 5.3.1.4. Beverages

- 5.3.1.5. Other Food and Beverage Applications

- 5.3.2. Pharmaceuticals

- 5.3.3. Personal Care

- 5.3.4. Animal Feed

- 5.3.5. Other Applications

- 5.3.1. Food and Beverage

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Qingdao CBH Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tereos SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tate & Lyle PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xiwang Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ingredion Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Roquette Freres

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ROYAL AVEBE UA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: China Starch and Starch Derivatives Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Starch and Starch Derivatives Market Share (%) by Company 2025

List of Tables

- Table 1: China Starch and Starch Derivatives Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: China Starch and Starch Derivatives Market Revenue billion Forecast, by Beverage Type 2020 & 2033

- Table 3: China Starch and Starch Derivatives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: China Starch and Starch Derivatives Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: China Starch and Starch Derivatives Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: China Starch and Starch Derivatives Market Revenue billion Forecast, by Beverage Type 2020 & 2033

- Table 7: China Starch and Starch Derivatives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: China Starch and Starch Derivatives Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Starch and Starch Derivatives Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the China Starch and Starch Derivatives Market?

Key companies in the market include Cargill Incorporated, Qingdao CBH Co Ltd, Tereos SA, Tate & Lyle PLC, Xiwang Group, Ingredion Incorporated, Roquette Freres, ROYAL AVEBE UA.

3. What are the main segments of the China Starch and Starch Derivatives Market?

The market segments include Product Type, Beverage Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Rise In The Price Of White Sugar Is Boosting The Demand For Starch Sugar As Cheaper Alternative Of Sweetener.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. In 2022, Cargill announced a major investment in its starch production facility in China, expanding its production capacity to meet growing demand. 2. Tereos acquired the starch business of Jiangsu Haian Starch Co Ltd in 2021, strengthening its position in the Chinese market. 3. In 2019, Tate & Lyle entered into a strategic partnership with COFCO to develop and market a range of starch-based ingredients in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Starch and Starch Derivatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Starch and Starch Derivatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Starch and Starch Derivatives Market?

To stay informed about further developments, trends, and reports in the China Starch and Starch Derivatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence