Key Insights

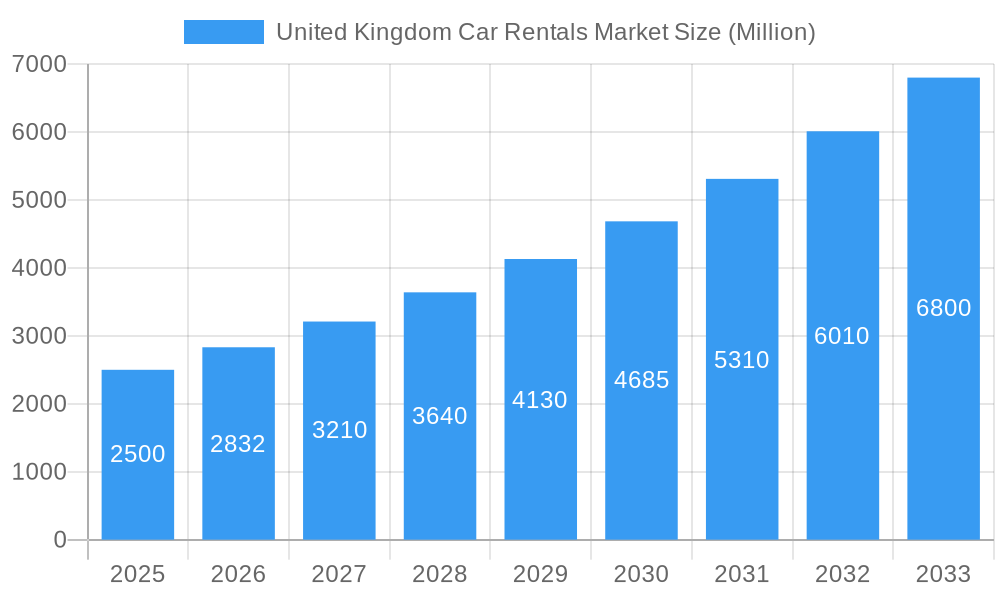

The United Kingdom car rental market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 13.70%, presents a compelling investment opportunity. Driven by increasing tourism, business travel, and the growing preference for flexible transportation solutions, the market is poised for significant expansion throughout the forecast period (2025-2033). The short-term rental segment is expected to dominate, fueled by the popularity of weekend getaways and spontaneous travel plans. Online booking platforms are rapidly gaining traction, offering convenience and competitive pricing, contributing significantly to the market's growth. Premium/Luxury vehicle rentals are also experiencing increased demand, reflecting a rise in disposable incomes and a preference for higher-end travel experiences. While Brexit initially posed some challenges, the market has demonstrated resilience, adapting to new regulations and leveraging opportunities presented by the evolving travel landscape. Major players such as Europcar, Hertz, Enterprise, Sixt, and Avis are fiercely competing, investing heavily in technology and expanding their fleets to cater to evolving customer needs. The market segmentation by vehicle type (Budget/Economy, Premium/Luxury), booking type (Online, Offline), and application type (Leisure/Tourism, Business) provides valuable insights into specific market trends and growth potential within each niche.

United Kingdom Car Rentals Market Market Size (In Billion)

The long-term rental segment, although smaller than short-term rentals, is also experiencing steady growth, driven by increasing demand from businesses and individuals seeking cost-effective long-term transportation solutions. Factors such as improving infrastructure, government initiatives promoting tourism, and the rise of the sharing economy are expected to further stimulate market growth. However, challenges such as fluctuating fuel prices, stringent environmental regulations, and potential economic downturns could present headwinds. To mitigate these risks, rental companies are focusing on fuel-efficient vehicles, implementing sustainable practices, and offering flexible pricing models to maintain competitiveness and attract a broader customer base. Analyzing regional variations within the UK market, including the impact of local economic conditions and tourism patterns, will be critical for effective market penetration and sustainable growth for rental companies. The market's future trajectory hinges on adapting to these challenges while capitalizing on the expanding opportunities within the UK’s dynamic travel sector.

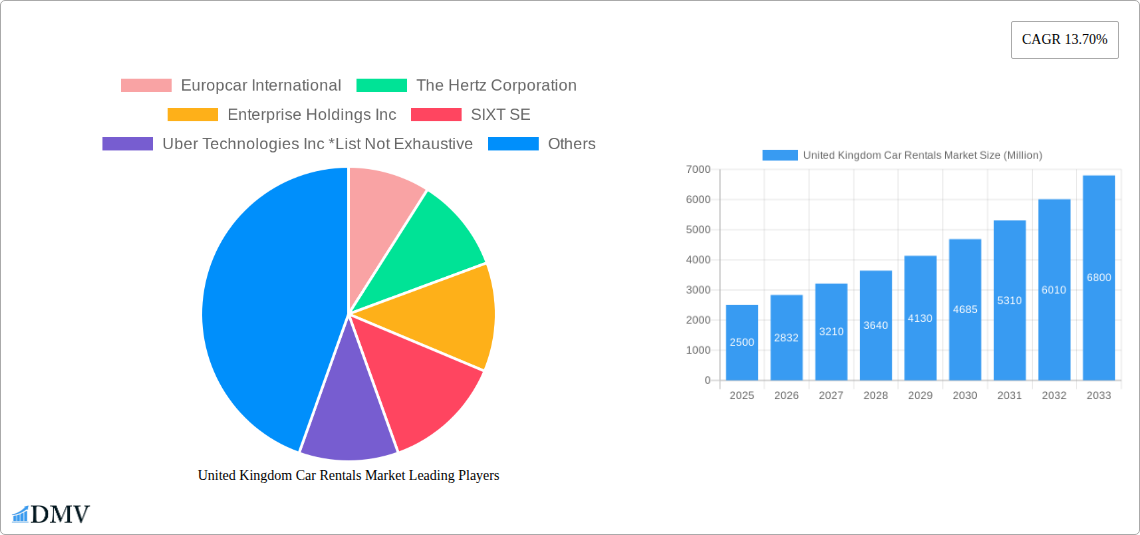

United Kingdom Car Rentals Market Company Market Share

United Kingdom Car Rentals Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United Kingdom car rentals market, offering a comprehensive overview of its current state, future trends, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this study delivers invaluable insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market size is predicted to reach £XX Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

United Kingdom Car Rentals Market Composition & Trends

This section meticulously analyzes the competitive landscape of the UK car rental market, evaluating market concentration, innovation catalysts, regulatory frameworks, substitute products, and end-user profiles. It delves into the impact of mergers and acquisitions (M&A) activities, providing a granular view of market share distribution amongst key players. The report examines the strategic implications of these M&A deals, with estimated values exceeding £XX Million in the period from 2019-2024.

- Market Concentration: The UK car rental market exhibits a moderately concentrated structure, with major players like Europcar International, The Hertz Corporation, Enterprise Holdings Inc, SIXT SE, and Avis Budget Group Inc holding significant market shares. Uber Technologies Inc.'s entry has further intensified competition, particularly in the short-term rental segment.

- Innovation Catalysts: Technological advancements such as mobile booking apps, automated check-in/check-out kiosks, and the rise of electric vehicle rental fleets are reshaping the industry landscape.

- Regulatory Landscape: The report scrutinizes the impact of government regulations on vehicle emissions, licensing requirements, and consumer protection laws.

- Substitute Products: The report assesses the competitive pressure from alternative transportation modes, such as ride-hailing services and public transportation, and their impact on market demand.

- End-User Profiles: A detailed analysis of different end-user segments (business travelers, leisure tourists, etc.) and their rental preferences is included, alongside insights into the shifting demographics of the market.

- M&A Activity: A comprehensive overview of significant mergers and acquisitions within the UK car rental sector is presented, including deal values and strategic rationales.

United Kingdom Car Rentals Market Industry Evolution

This section offers a comprehensive analysis of the UK car rental market's growth trajectory, technological advancements, and shifting consumer preferences from 2019 to 2033. The evolution of the industry is detailed, encompassing the impact of various factors on market growth, including technological innovation and changes in consumer behavior. Detailed data points on growth rates and adoption metrics for new technologies are provided. The report analyzes the changing preferences of consumers regarding vehicle types and rental durations, providing insights into the shift from traditional offline booking methods to the growing popularity of online platforms. Market growth is forecast to accelerate due to increased tourism, business travel, and the expanding adoption of mobile technology. Detailed analysis of market size and CAGR growth throughout the study period is also included.

Leading Regions, Countries, or Segments in United Kingdom Car Rentals Market

This section identifies the dominant regions, countries, and segments within the UK car rental market, based on rental duration (short-term and long-term), booking type (online and offline), application type (leisure/tourism and business), and vehicle type (budget/economy and premium/luxury). Each segment's key drivers are explored in detail.

- Rental Duration: Short-term rentals dominate the market, driven by leisure travel and business trips. Long-term rentals show potential growth, particularly for relocation or temporary housing solutions.

- Booking Type: Online bookings have experienced exponential growth, driven by the ease of access and competitive pricing provided by online platforms.

- Application Type: The leisure/tourism segment is the largest, with fluctuating business travel impacting the market's seasonality.

- Vehicle Type: The demand for budget/economy vehicles dominates due to price sensitivity, while the premium/luxury segment offers opportunities for higher profit margins.

- Key Drivers:

- Increased investment in technological infrastructure and fleet modernization.

- Government initiatives promoting sustainable tourism and business travel.

United Kingdom Car Rentals Market Product Innovations

This section highlights significant product innovations, applications, and performance metrics in the UK car rental market. The focus is on unique selling propositions (USPs) offered by rental companies, such as innovative loyalty programs, flexible rental options, and improved customer service features via mobile applications. Technological advancements, such as the integration of telematics and the introduction of electric and hybrid vehicle fleets, are also examined, along with their impact on the operational efficiency and environmental sustainability of car rental businesses.

Propelling Factors for United Kingdom Car Rentals Market Growth

Several factors are driving the growth of the UK car rental market. Technological advancements, such as mobile booking apps and online platforms, have improved accessibility and convenience for customers. Economic growth, including increases in disposable income and tourism, has also fueled demand. Furthermore, supportive government regulations and initiatives to encourage sustainable transport are contributing to market expansion.

Obstacles in the United Kingdom Car Rentals Market Market

The UK car rental market faces several challenges. Fluctuations in fuel prices and economic downturns can impact demand. Intense competition from ride-hailing services and public transportation poses a threat. Supply chain disruptions and vehicle shortages can also hinder operations. Moreover, regulatory changes, such as stricter emission standards, can impact operational costs and investment strategies.

Future Opportunities in United Kingdom Car Rentals Market

The future of the UK car rental market holds significant potential. The growing popularity of electric vehicles creates opportunities for eco-friendly rental options. Expansion into underserved regions and the development of specialized rental services (e.g., for campervans or luxury vehicles) offer new avenues for growth. Increased adoption of innovative technologies and strategic partnerships can further enhance the customer experience and competitive advantage.

Major Players in the United Kingdom Car Rentals Market Ecosystem

- Europcar International

- The Hertz Corporation (Hertz)

- Enterprise Holdings Inc (Enterprise)

- SIXT SE (SIXT)

- Uber Technologies Inc (Uber)

- Avis Budget Group Inc (Avis Budget Group)

Key Developments in United Kingdom Car Rentals Market Industry

- January 2023: Avis Budget Group announces a significant investment in electric vehicle fleet expansion.

- March 2022: Hertz launches a new mobile app with enhanced features.

- June 2021: Europcar and SIXT enter into a strategic partnership for fleet sharing.

- (Further developments will be added in the full report)

Strategic United Kingdom Car Rentals Market Market Forecast

The UK car rental market is poised for continued growth, driven by technological innovation, economic expansion, and evolving consumer preferences. The increasing popularity of online bookings, the rise of electric vehicles, and the development of innovative rental models will shape the market's future trajectory. Strategic partnerships and investments in technology will be critical for players to maintain a competitive edge in this dynamic market. The predicted market size in 2033 suggests substantial growth opportunities for both existing and new market entrants.

United Kingdom Car Rentals Market Segmentation

-

1. Rental Duration

- 1.1. Short Term

- 1.2. Long Term

-

2. Booking Type

- 2.1. Online

- 2.2. Offline

-

3. Application Type

- 3.1. Leisure/Tourism

- 3.2. Business

-

4. Vehicle Type

- 4.1. Budget/Economy

- 4.2. Premium/Luxury

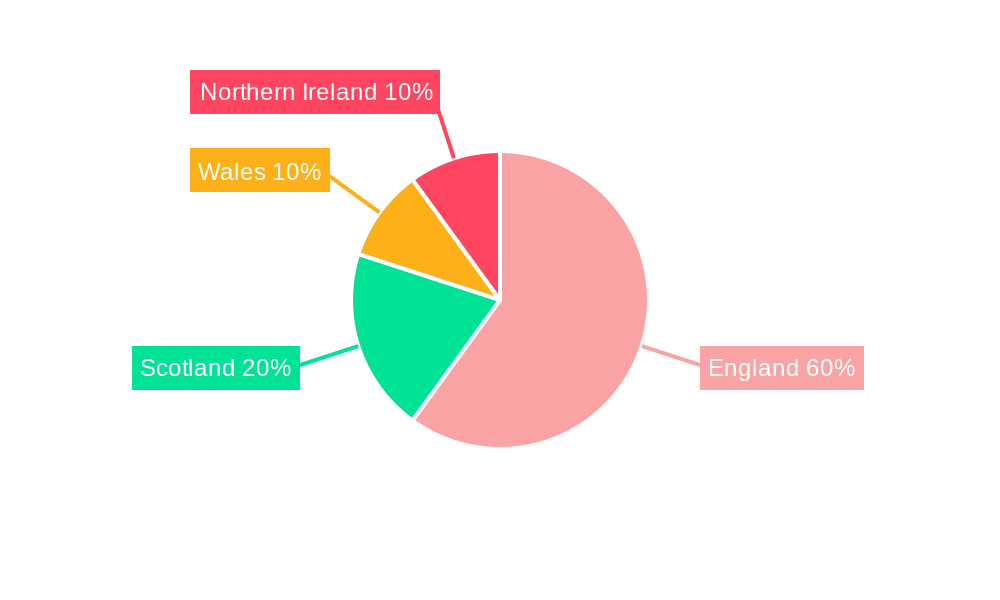

United Kingdom Car Rentals Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Car Rentals Market Regional Market Share

Geographic Coverage of United Kingdom Car Rentals Market

United Kingdom Car Rentals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for ADAS likely Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Growing Demand for Tour and Travel Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Car Rentals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rental Duration

- 5.1.1. Short Term

- 5.1.2. Long Term

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Leisure/Tourism

- 5.3.2. Business

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Budget/Economy

- 5.4.2. Premium/Luxury

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Rental Duration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Europcar International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Hertz Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enterprise Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SIXT SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Uber Technologies Inc *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Avis Budget Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Europcar International

List of Figures

- Figure 1: United Kingdom Car Rentals Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United Kingdom Car Rentals Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Car Rentals Market Revenue undefined Forecast, by Rental Duration 2020 & 2033

- Table 2: United Kingdom Car Rentals Market Revenue undefined Forecast, by Booking Type 2020 & 2033

- Table 3: United Kingdom Car Rentals Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 4: United Kingdom Car Rentals Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 5: United Kingdom Car Rentals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: United Kingdom Car Rentals Market Revenue undefined Forecast, by Rental Duration 2020 & 2033

- Table 7: United Kingdom Car Rentals Market Revenue undefined Forecast, by Booking Type 2020 & 2033

- Table 8: United Kingdom Car Rentals Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 9: United Kingdom Car Rentals Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 10: United Kingdom Car Rentals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Car Rentals Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the United Kingdom Car Rentals Market?

Key companies in the market include Europcar International, The Hertz Corporation, Enterprise Holdings Inc, SIXT SE, Uber Technologies Inc *List Not Exhaustive, Avis Budget Group Inc.

3. What are the main segments of the United Kingdom Car Rentals Market?

The market segments include Rental Duration, Booking Type, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for ADAS likely Drive the Market.

6. What are the notable trends driving market growth?

Growing Demand for Tour and Travel Activities.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Car Rentals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Car Rentals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Car Rentals Market?

To stay informed about further developments, trends, and reports in the United Kingdom Car Rentals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence