Key Insights

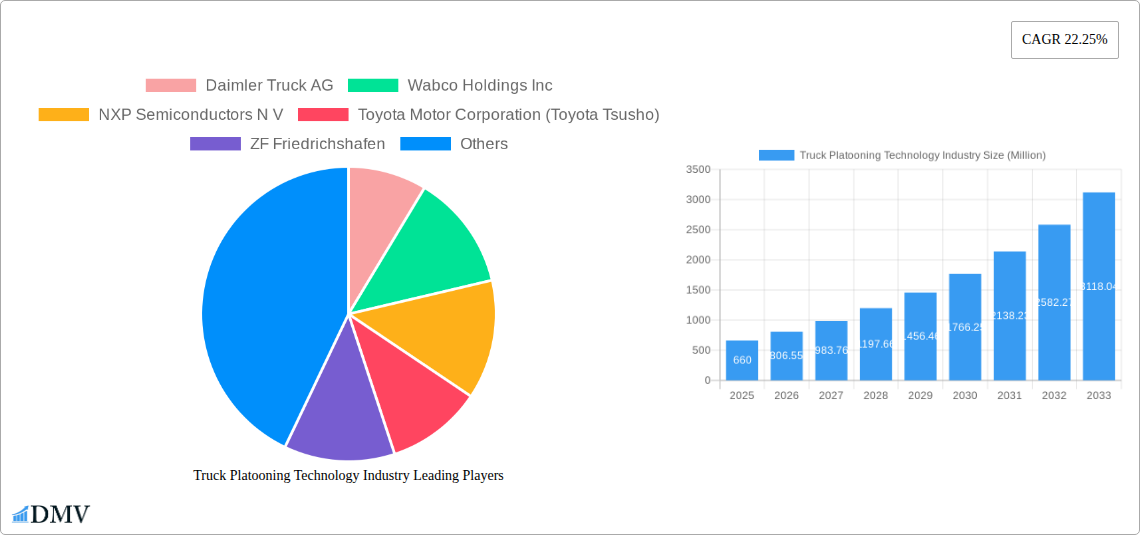

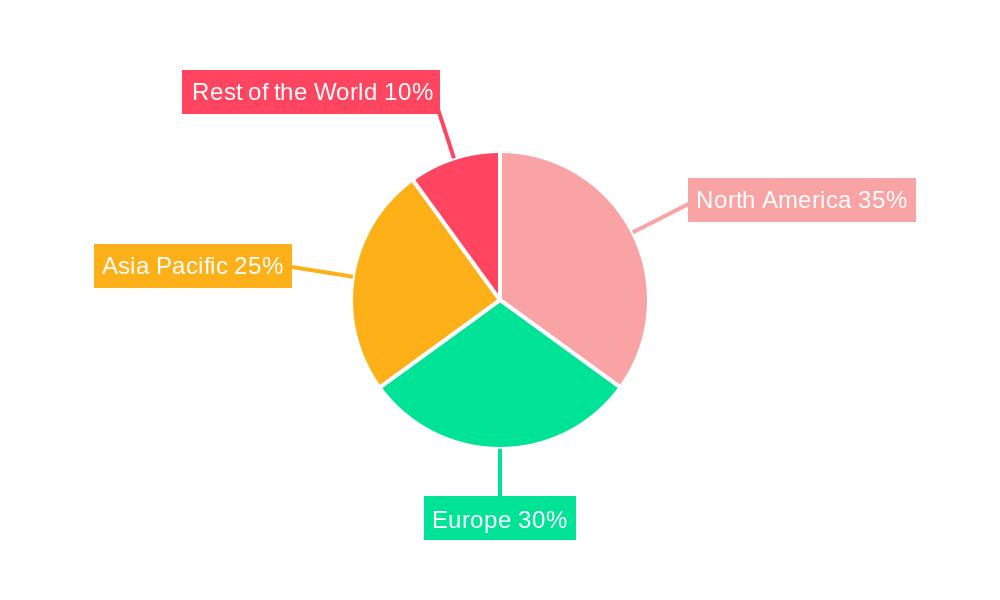

The Truck Platooning Technology market is experiencing robust growth, projected to reach a significant size by 2033. The 22.25% Compound Annual Growth Rate (CAGR) from 2025 to 2033 reflects the increasing adoption of fuel-efficient and safer transportation solutions by the trucking industry globally. Key drivers include stringent fuel efficiency regulations, rising fuel costs, and the need to enhance road safety. Technological advancements in areas such as Adaptive Cruise Control, Automated Emergency Braking, and Vehicle-to-Vehicle (V2V) communication are further accelerating market expansion. The market is segmented by platooning type (Driver-Assistive and Autonomous), technology type (various driver-assistance systems), and infrastructure type (V2V, V2I, GPS). Autonomous truck platooning, while still nascent, holds immense potential for future growth due to its promise of maximized efficiency and reduced labor costs. The substantial investment from major players like Daimler, Volvo, and Bosch indicates a strong belief in the technology’s long-term viability. Regional variations exist, with North America and Europe currently leading the market, fueled by advanced infrastructure and supportive regulatory frameworks. However, the Asia-Pacific region, particularly China and India, is poised for substantial growth due to expanding logistics networks and a focus on improving transportation efficiency. Challenges include high initial investment costs, the need for robust communication infrastructure, and concerns around regulatory hurdles and cybersecurity. Despite these hurdles, the long-term outlook for the Truck Platooning Technology market remains highly optimistic, driven by continued technological advancements and the inherent benefits of improved fuel economy, safety, and efficiency.

Truck Platooning Technology Industry Market Size (In Million)

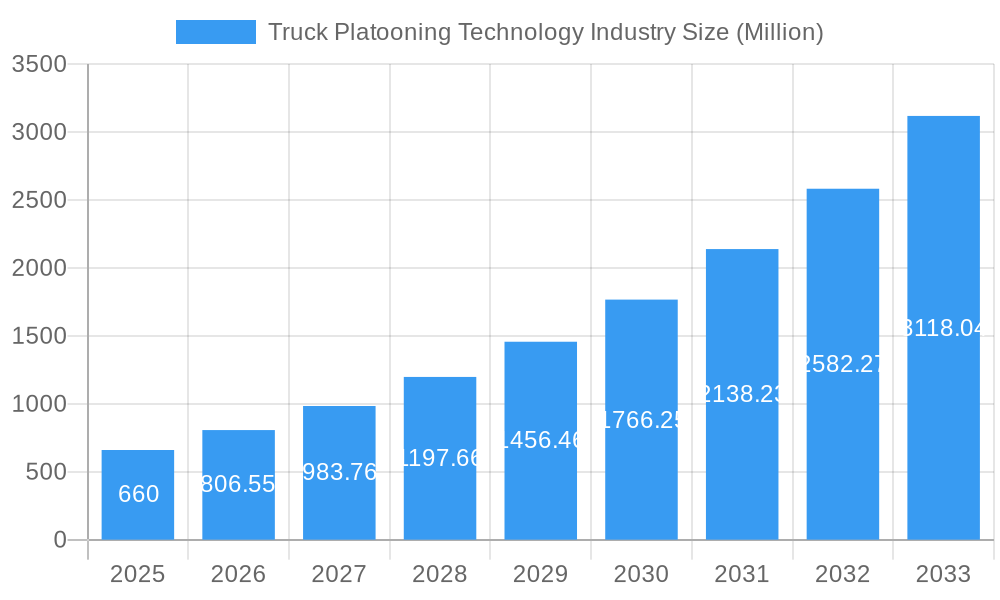

The competitive landscape is characterized by a mix of established automotive giants and specialized technology providers. The presence of both established automotive manufacturers and technology specialists fosters innovation and ensures a diverse range of solutions. Strategic partnerships and collaborations are common, combining the manufacturing expertise of established players with the technological prowess of specialized companies. This collaborative approach expedites the development and deployment of truck platooning systems, accelerating market penetration. Future growth will depend on addressing the technical challenges, securing regulatory approvals, and building public confidence in the safety and reliability of autonomous platooning systems. Continuous advancements in Artificial Intelligence (AI), machine learning, and sensor technologies are expected to further enhance the capabilities and efficacy of truck platooning solutions, leading to increased market adoption in the coming years.

Truck Platooning Technology Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Truck Platooning Technology industry, projecting a market value of $XX Million by 2033. It covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This insightful study is essential for stakeholders seeking to understand the current market landscape and anticipate future trends in this rapidly evolving sector.

Truck Platooning Technology Industry Market Composition & Trends

The Truck Platooning Technology market, valued at $XX Million in 2025, is experiencing significant growth driven by increasing adoption of autonomous driving technologies and a focus on improving fuel efficiency and reducing transportation costs. Market concentration is moderate, with key players such as Daimler Truck AG, Daimler Truck AG, Wabco Holdings Inc, NXP Semiconductors N.V., and others holding significant market shares. However, the entrance of new players and technological advancements are leading to increased competition.

- Market Share Distribution (2025): Daimler Truck AG (XX%), Wabco Holdings Inc (XX%), NXP Semiconductors N.V. (XX%), Others (XX%). Exact figures are detailed within the full report.

- Innovation Catalysts: Advancements in sensor technology, Artificial Intelligence (AI), and 5G communication are pivotal.

- Regulatory Landscape: Government regulations regarding autonomous vehicle deployment and safety standards significantly influence market growth.

- Substitute Products: Traditional trucking methods and other logistics solutions act as indirect substitutes, though the efficiency advantages of platooning are driving adoption.

- End-User Profiles: Primarily logistics companies, freight carriers, and long-haul trucking operations.

- M&A Activities: The report details several significant M&A activities within the period 2019-2024, with a total deal value exceeding $XX Million. Specific transactions and their impact on market dynamics are thoroughly analyzed.

Truck Platooning Technology Industry Industry Evolution

The Truck Platooning Technology market has witnessed remarkable growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of XX%. This growth trajectory is anticipated to continue, driven by increasing demand for efficient and sustainable transportation solutions. The early adoption of Driver-Assistive Truck Platooning (DATP) is paving the way for the wider adoption of fully Autonomous Truck Platooning, which is anticipated to accelerate in the coming decade. Several technological advancements, including improved sensor fusion, advanced driver-assistance systems (ADAS), and enhanced V2X communication are contributing to this progress. Consumer demand is primarily focused on cost reduction, enhanced safety, and improved fuel efficiency. The report provides detailed insights into the changing needs of logistics companies and trucking firms, and examines how these demands impact innovation within the industry. Adoption rates for various technologies are meticulously tracked throughout the report.

Leading Regions, Countries, or Segments in Truck Platooning Technology Industry

The North American and European regions are currently leading the Truck Platooning Technology market, driven by significant investments in infrastructure and supportive regulatory frameworks. Within these regions, specific countries such as the United States, Germany, and the Netherlands demonstrate strong adoption.

By Platooning Type: Driver-Assistive Truck Platooning (DATP) currently holds the largest market share due to its lower implementation cost and immediate benefits. However, Autonomous Truck Platooning is experiencing exponential growth, with forecasts indicating it will dominate the market by 2033.

By Technology Type: Adaptive Cruise Control and Forward Collision Warning systems are widely adopted, providing a strong foundation for more advanced features like Automated Emergency Braking and Lane Keep Assist.

By Infrastructure Type: Vehicle-to-Vehicle (V2V) communication is crucial for real-time coordination within platoons, whereas Vehicle-to-Infrastructure (V2I) communication plays a critical role in optimizing route planning and traffic management. GPS remains essential for location tracking and navigation.

Key Drivers: High levels of government funding and incentives are crucial for promoting technology adoption, as are supportive regulatory frameworks that streamline the deployment of autonomous vehicles. Furthermore, increased public awareness of the environmental and economic advantages of platooning contributes to its growth.

Truck Platooning Technology Industry Product Innovations

Recent innovations focus on improving the safety, reliability, and efficiency of truck platooning systems. This includes the development of advanced sensor fusion algorithms for enhanced situational awareness, the integration of AI for optimized decision-making, and improvements in V2X communication protocols. These innovations result in improved fuel efficiency, reduced driver fatigue, and minimized accident risk. The unique selling propositions revolve around creating safer, more efficient, and cost-effective transportation solutions.

Propelling Factors for Truck Platooning Technology Industry Growth

Several key factors are driving the growth of the Truck Platooning Technology industry: Firstly, the increasing demand for efficient and cost-effective logistics solutions is significant. Secondly, technological advancements in autonomous driving, sensor technology, and communication systems are making platooning more viable. Finally, supportive government regulations and funding initiatives are crucial in encouraging wider adoption of this technology.

Obstacles in the Truck Platooning Technology Industry Market

Despite significant growth potential, several obstacles hinder the widespread adoption of Truck Platooning Technology. These include high initial investment costs, regulatory hurdles in autonomous vehicle deployment, and concerns regarding cybersecurity and data privacy. Supply chain disruptions and lack of standardized communication protocols pose further challenges. The report quantifies these challenges, analyzing their respective impacts on market growth.

Future Opportunities in Truck Platooning Technology Industry

Future opportunities lie in expanding into new geographical markets, particularly in developing economies with growing logistics needs. Further advancements in AI and machine learning, along with the deployment of 5G infrastructure, will significantly enhance the capabilities and safety of truck platooning systems. Emerging trends in sustainable transportation and the increased need for efficient delivery systems will also fuel industry growth.

Major Players in the Truck Platooning Technology Industry Ecosystem

- Daimler Truck AG

- Wabco Holdings Inc

- NXP Semiconductors N.V.

- Toyota Motor Corporation (Toyota Tsusho)

- ZF Friedrichshafen

- Continental AG

- Peloton Technology

- Hyundai Motor Company

- Paccar Inc (DAF Trucks)

- Robert Bosch GmbH

- Iveco S.p.A

- Volkswagen Group (MAN Scania)

- Knorr-Bremse AG

- AB Volvo

Key Developments in Truck Platooning Technology Industry Industry

- December 2023: Softbank and West Japan Railway Company partner to research 5G-enabled V2V technology for BRT systems and truck platooning, addressing driver shortages.

- July 2023: FPInnovations and RRAI collaborate on off-highway truck platooning for the forestry sector, funded by Société du Plan Nord and Natural Resources Canada, addressing lower-qualified driver issues.

- March 2023: Ohmio demonstrates three-vehicle platooning of driverless shuttles at JFK International Airport.

Strategic Truck Platooning Technology Industry Market Forecast

The Truck Platooning Technology market is poised for significant growth in the coming years, driven by technological advancements, increasing demand for efficient logistics, and supportive government policies. The market's potential is immense, with the continued expansion of autonomous driving technologies and the emergence of new applications, such as in the off-highway and urban delivery sectors, promising further acceleration in growth.

Truck Platooning Technology Industry Segmentation

-

1. Platooning Type

- 1.1. Driver-Assistive Truck Platooning (DATP)

- 1.2. Autonomous Truck Platooning

-

2. Technology Type

- 2.1. Adaptive Cruise Control

- 2.2. Forward Collision Warning

- 2.3. Automated Emergency Braking

- 2.4. Active Brake Assist

- 2.5. Lane Keep Assist

- 2.6. Others (Blind Spot Warning, etc.)

-

3. Infrastructure Type

- 3.1. Vehicle-to-Vehicle (V2V)

- 3.2. Vehicle-to-Infrastructure (V2I)

- 3.3. Global Positioning System (GPS)

Truck Platooning Technology Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Truck Platooning Technology Industry Regional Market Share

Geographic Coverage of Truck Platooning Technology Industry

Truck Platooning Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments' Aggressive Push Towards Lowering Fuel Consumption and Co2 Emission of Vehicles to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Platooning Technology Deters Market Growth

- 3.4. Market Trends

- 3.4.1. Adaptive Cruise Control Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platooning Type

- 5.1.1. Driver-Assistive Truck Platooning (DATP)

- 5.1.2. Autonomous Truck Platooning

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Adaptive Cruise Control

- 5.2.2. Forward Collision Warning

- 5.2.3. Automated Emergency Braking

- 5.2.4. Active Brake Assist

- 5.2.5. Lane Keep Assist

- 5.2.6. Others (Blind Spot Warning, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.3.1. Vehicle-to-Vehicle (V2V)

- 5.3.2. Vehicle-to-Infrastructure (V2I)

- 5.3.3. Global Positioning System (GPS)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Platooning Type

- 6. North America Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platooning Type

- 6.1.1. Driver-Assistive Truck Platooning (DATP)

- 6.1.2. Autonomous Truck Platooning

- 6.2. Market Analysis, Insights and Forecast - by Technology Type

- 6.2.1. Adaptive Cruise Control

- 6.2.2. Forward Collision Warning

- 6.2.3. Automated Emergency Braking

- 6.2.4. Active Brake Assist

- 6.2.5. Lane Keep Assist

- 6.2.6. Others (Blind Spot Warning, etc.)

- 6.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.3.1. Vehicle-to-Vehicle (V2V)

- 6.3.2. Vehicle-to-Infrastructure (V2I)

- 6.3.3. Global Positioning System (GPS)

- 6.1. Market Analysis, Insights and Forecast - by Platooning Type

- 7. Europe Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platooning Type

- 7.1.1. Driver-Assistive Truck Platooning (DATP)

- 7.1.2. Autonomous Truck Platooning

- 7.2. Market Analysis, Insights and Forecast - by Technology Type

- 7.2.1. Adaptive Cruise Control

- 7.2.2. Forward Collision Warning

- 7.2.3. Automated Emergency Braking

- 7.2.4. Active Brake Assist

- 7.2.5. Lane Keep Assist

- 7.2.6. Others (Blind Spot Warning, etc.)

- 7.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.3.1. Vehicle-to-Vehicle (V2V)

- 7.3.2. Vehicle-to-Infrastructure (V2I)

- 7.3.3. Global Positioning System (GPS)

- 7.1. Market Analysis, Insights and Forecast - by Platooning Type

- 8. Asia Pacific Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platooning Type

- 8.1.1. Driver-Assistive Truck Platooning (DATP)

- 8.1.2. Autonomous Truck Platooning

- 8.2. Market Analysis, Insights and Forecast - by Technology Type

- 8.2.1. Adaptive Cruise Control

- 8.2.2. Forward Collision Warning

- 8.2.3. Automated Emergency Braking

- 8.2.4. Active Brake Assist

- 8.2.5. Lane Keep Assist

- 8.2.6. Others (Blind Spot Warning, etc.)

- 8.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.3.1. Vehicle-to-Vehicle (V2V)

- 8.3.2. Vehicle-to-Infrastructure (V2I)

- 8.3.3. Global Positioning System (GPS)

- 8.1. Market Analysis, Insights and Forecast - by Platooning Type

- 9. Rest of the World Truck Platooning Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platooning Type

- 9.1.1. Driver-Assistive Truck Platooning (DATP)

- 9.1.2. Autonomous Truck Platooning

- 9.2. Market Analysis, Insights and Forecast - by Technology Type

- 9.2.1. Adaptive Cruise Control

- 9.2.2. Forward Collision Warning

- 9.2.3. Automated Emergency Braking

- 9.2.4. Active Brake Assist

- 9.2.5. Lane Keep Assist

- 9.2.6. Others (Blind Spot Warning, etc.)

- 9.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9.3.1. Vehicle-to-Vehicle (V2V)

- 9.3.2. Vehicle-to-Infrastructure (V2I)

- 9.3.3. Global Positioning System (GPS)

- 9.1. Market Analysis, Insights and Forecast - by Platooning Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Daimler Truck AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wabco Holdings Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NXP Semiconductors N V

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toyota Motor Corporation (Toyota Tsusho)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ZF Friedrichshafen

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Peloton Technology

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hyundai Motor Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Paccar Inc (DAF Trucks)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Robert Bosch GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Iveco S p A

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Volkswagen Group (MAN Scania)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Knorr-Bremse AG

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 AB Volvo

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Daimler Truck AG

List of Figures

- Figure 1: Global Truck Platooning Technology Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 3: North America Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 4: North America Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 5: North America Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 6: North America Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 7: North America Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 8: North America Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 11: Europe Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 12: Europe Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 13: Europe Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 14: Europe Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 15: Europe Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 16: Europe Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 19: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 20: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 21: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 22: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 23: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 24: Asia Pacific Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Platooning Type 2025 & 2033

- Figure 27: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Platooning Type 2025 & 2033

- Figure 28: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Technology Type 2025 & 2033

- Figure 29: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 30: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 31: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 32: Rest of the World Truck Platooning Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Truck Platooning Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 2: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 3: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 4: Global Truck Platooning Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 6: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 7: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 8: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 13: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 14: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 15: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 22: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 23: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 24: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Truck Platooning Technology Industry Revenue Million Forecast, by Platooning Type 2020 & 2033

- Table 31: Global Truck Platooning Technology Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 32: Global Truck Platooning Technology Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 33: Global Truck Platooning Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Truck Platooning Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Truck Platooning Technology Industry?

The projected CAGR is approximately 22.25%.

2. Which companies are prominent players in the Truck Platooning Technology Industry?

Key companies in the market include Daimler Truck AG, Wabco Holdings Inc, NXP Semiconductors N V, Toyota Motor Corporation (Toyota Tsusho), ZF Friedrichshafen, Continental AG, Peloton Technology, Hyundai Motor Company, Paccar Inc (DAF Trucks), Robert Bosch GmbH, Iveco S p A, Volkswagen Group (MAN Scania), Knorr-Bremse AG, AB Volvo.

3. What are the main segments of the Truck Platooning Technology Industry?

The market segments include Platooning Type, Technology Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Governments' Aggressive Push Towards Lowering Fuel Consumption and Co2 Emission of Vehicles to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Adaptive Cruise Control Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Platooning Technology Deters Market Growth.

8. Can you provide examples of recent developments in the market?

In December 2023, Softbank announced its partnership with West Japan Railway Company to research 5G-enabled Vehicle-to-Vehicle (V2V) technology for a Bus Rapid Transit (BRT) system and truck platooning on Japanese highways. The research aims to enhance the country's logistics sector by facilitating advanced communication technology while assisting in addressing the issue of driver shortages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Truck Platooning Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Truck Platooning Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Truck Platooning Technology Industry?

To stay informed about further developments, trends, and reports in the Truck Platooning Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence