Key Insights

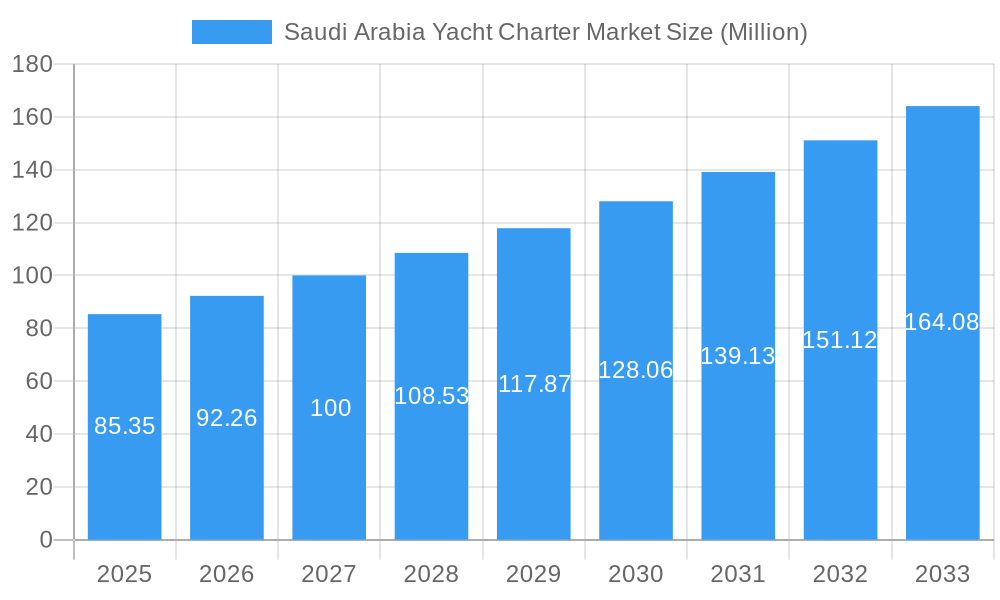

The Saudi Arabian yacht charter market, valued at $85.35 million in 2025, is projected to experience robust growth, driven by a burgeoning affluent population with a penchant for luxury leisure activities and increasing government initiatives promoting tourism and diversification of the national economy. This growth is further fueled by the development of world-class marinas and improved infrastructure in key coastal regions, particularly along the Red Sea. The market segmentation reveals a preference for crewed charters, indicating a strong demand for a hassle-free, premium experience. Sailing yachts and motorboats dominate the yacht type segment, reflecting the varied preferences of charterers. Regional variations within Saudi Arabia showcase a strong demand across all regions—Central, Eastern, Western, and Southern— though specific market share data for each region would require further investigation. The consistent 8.25% CAGR projected through 2033 suggests a sustained upward trajectory, potentially surpassing $150 million by the end of the forecast period, contingent on continued economic growth and sustained government support for tourism infrastructure.

Saudi Arabia Yacht Charter Market Market Size (In Million)

Constraints to market growth might include potential seasonality in demand, the need for enhanced marine safety regulations and professional training for charter operators, and fluctuating global economic conditions that could affect high-net-worth individual spending. To mitigate these, operators can focus on strategic marketing targeting both domestic and international high-net-worth individuals, diversifying their offerings to cater to various budgets and preferences, and ensuring adherence to highest safety standards. Successful players will also need to cultivate strong relationships with local authorities to ensure smooth operations within the evolving regulatory landscape. The market's impressive projected growth signals a significant opportunity for both established players and new entrants seeking to capitalize on the burgeoning luxury tourism sector in Saudi Arabia.

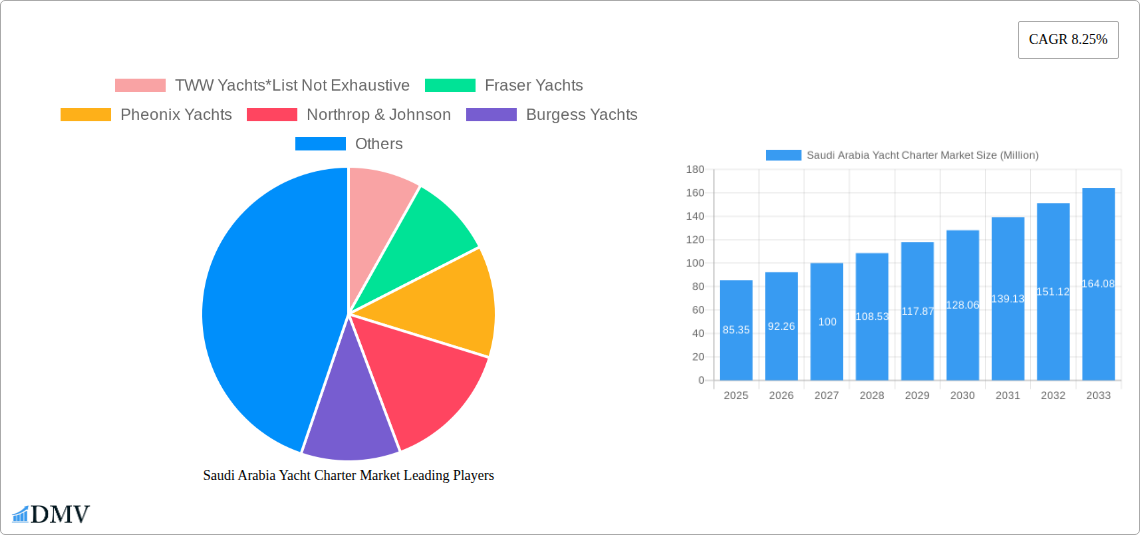

Saudi Arabia Yacht Charter Market Company Market Share

Saudi Arabia Yacht Charter Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the burgeoning Saudi Arabia yacht charter market, offering valuable insights for stakeholders seeking to navigate this dynamic sector. With a detailed study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report delivers a precise and data-driven perspective on market trends, growth trajectories, and future opportunities. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Saudi Arabia Yacht Charter Market Composition & Trends

This section delves into the intricate composition of the Saudi Arabia yacht charter market, examining market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The market exhibits a moderately concentrated landscape with key players holding significant shares; however, the entry of new players and increasing competition is anticipated. Market share distribution is currently estimated at xx% for the top three players, with the remaining share distributed amongst numerous smaller operators. Innovation is driven by technological advancements in yacht design, onboard amenities, and charter management systems. The regulatory environment is evolving, with ongoing initiatives to streamline licensing and enhance safety standards. Substitute products, such as luxury cruises and private island rentals, pose some competition, though the unique experience offered by yacht charters maintains its appeal. End-user profiles are diverse, encompassing high-net-worth individuals, corporate groups, and families seeking luxury experiences. M&A activity in the sector is anticipated to increase, with deal values projected to reach xx Million in the next few years, driven by consolidation and expansion strategies amongst industry players. This is further supported by the recent surge in investments and partnerships, as seen with the development of luxury marinas.

Saudi Arabia Yacht Charter Market Industry Evolution

The Saudi Arabia yacht charter market has experienced significant evolution during the historical period (2019-2024), marked by a compound annual growth rate (CAGR) of xx%. This growth is attributed to increasing disposable incomes among affluent Saudis, coupled with government initiatives promoting tourism and luxury hospitality. Technological advancements, particularly in yacht construction and navigational systems, have enhanced the overall charter experience. The demand for crewed charters has notably increased, reflecting the desire for seamless and luxurious experiences. Consumer preferences are increasingly shifting towards sustainable and eco-friendly yachts, influencing both charter operators and yacht builders. The market exhibits a robust growth trajectory, with expectations of a CAGR of xx% during the forecast period (2025-2033), driven by the continued development of luxury tourism infrastructure and the ongoing Vision 2030 initiatives. Adoption of advanced technologies like digital booking platforms and personalized concierge services is further accelerating market expansion. Furthermore, the rise of experiential travel and the increasing popularity of yachting amongst a younger demographic fuel consistent growth.

Leading Regions, Countries, or Segments in Saudi Arabia Yacht Charter Market

The Saudi Arabia yacht charter market is predominantly driven by the coastal regions, with the Red Sea and Arabian Gulf witnessing the highest demand for charter services.

- Charter Type: Crewed charters dominate the market, accounting for xx% of the total revenue, driven by the high demand for personalized luxury experiences and concierge services.

- Yacht Type: Motorboat yachts hold the largest segment, with xx% market share, followed by sailing yachts at xx%. The preferences for motorboat yachts stem from their speed, comfort, and suitability for various itineraries.

Key Drivers:

- Government Initiatives: Saudi Arabia's Vision 2030 is a pivotal driver, focusing on diversifying the economy and promoting tourism, including luxury yachting.

- Investment in Infrastructure: Significant investments in marinas, ports, and related infrastructure are boosting the sector’s capacity and appeal.

- Regulatory Support: Favorable regulations and streamlined licensing procedures are attracting both domestic and international operators.

The dominance of crewed motorboat yacht charters reflects the focus on high-end luxury travel within the Saudi Arabian context. The strategic investments and supportive regulatory environment further cement this market leadership.

Saudi Arabia Yacht Charter Market Product Innovations

Recent innovations in the Saudi Arabia yacht charter market encompass advanced navigation systems, enhanced onboard entertainment technologies (including personalized streaming options), and the incorporation of sustainable features. Luxury yacht builders are focusing on customization, offering personalized interior designs and bespoke amenity packages to cater to individual preferences. Eco-friendly materials and technologies are increasingly being incorporated, reflecting growing awareness of environmental sustainability. These innovations are key to boosting market appeal by providing a more luxurious, personalized, and responsible yachting experience.

Propelling Factors for Saudi Arabia Yacht Charter Market Growth

Several factors contribute to the projected growth of the Saudi Arabia yacht charter market. The government's Vision 2030 initiative, aimed at diversifying the economy and boosting tourism, is a primary driver. Significant investments in luxury infrastructure, including new marinas and ports, are attracting international yacht operators and enhancing the overall yachting experience. The rising disposable income of the Saudi population and the increasing popularity of luxury travel are also significant factors. Technological advancements, such as improved navigation systems and eco-friendly yacht designs, add to the overall appeal of chartering yachts.

Obstacles in the Saudi Arabia Yacht Charter Market

The Saudi Arabia yacht charter market faces certain challenges. Seasonality can impact demand, with peak periods experiencing higher rates and potential booking limitations. The relatively high cost of chartering yachts can limit accessibility for some segments of the population. Competition from other luxury travel options, such as private jet charters and luxury resort stays, also exists. Maintaining a high level of safety standards and ensuring efficient regulatory compliance are ongoing concerns. These factors contribute to the market's complex dynamics and necessitate strategic planning by stakeholders.

Future Opportunities in Saudi Arabia Yacht Charter Market

Future opportunities in the Saudi Arabia yacht charter market include the expansion into niche segments, such as specialized diving charters and luxury fishing trips. The development of sustainable and eco-friendly yachting options will further appeal to environmentally conscious travelers. The integration of advanced technologies, such as virtual and augmented reality, can enhance the pre-booking and onboard experiences. Collaborations between charter operators and local businesses can create more holistic and immersive tourism experiences for clients. The continued development of tourism infrastructure in line with Vision 2030 will contribute to market expansion and new opportunities.

Major Players in the Saudi Arabia Yacht Charter Market Ecosystem

- TWW Yachts

- Fraser Yachts

- Pheonix Yachts

- Northrop & Johnson

- Burgess Yachts

- FGI Yacht Group

- Gulf Craft

- Yachting Partners International

Key Developments in Saudi Arabia Yacht Charter Market Industry

- June 2023: IGY Marinas partnered with NEOM to develop a new superyacht marina in Sindalah, significantly expanding the infrastructure for superyacht tourism.

- November 2023: Saudi Arabia's agreement with a prominent luxury yacht provider signifies a commitment to establishing Sindalah as a leading yachting destination, boosting the market's future prospects. This, coupled with the NEOM-Burgess partnership, highlights the strategic investments supporting the industry's growth.

Strategic Saudi Arabia Yacht Charter Market Forecast

The Saudi Arabia yacht charter market is poised for substantial growth, driven by a confluence of factors including supportive government policies, significant investments in infrastructure, and the increasing demand for luxury travel experiences. The development of Sindalah as a premier yachting destination and strategic partnerships between international players and local entities indicate a vibrant and expanding sector. The market's future hinges on continued investment in infrastructure, sustainable tourism practices, and the effective implementation of government initiatives. The long-term outlook is positive, reflecting significant growth potential within this dynamic and evolving market.

Saudi Arabia Yacht Charter Market Segmentation

-

1. Charter Type

- 1.1. Bareboat

- 1.2. Cabin

- 1.3. Crewed

-

2. Yacht Type

- 2.1. Sailing Yacht

- 2.2. Motorboat Yacht

- 2.3. Other Yacht Types

Saudi Arabia Yacht Charter Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Yacht Charter Market Regional Market Share

Geographic Coverage of Saudi Arabia Yacht Charter Market

Saudi Arabia Yacht Charter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of The Global Automotive Turbocharger Market

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Modern Vehicles

- 3.4. Market Trends

- 3.4.1. The Crewed Segment to Lead the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Yacht Charter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Charter Type

- 5.1.1. Bareboat

- 5.1.2. Cabin

- 5.1.3. Crewed

- 5.2. Market Analysis, Insights and Forecast - by Yacht Type

- 5.2.1. Sailing Yacht

- 5.2.2. Motorboat Yacht

- 5.2.3. Other Yacht Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Charter Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TWW Yachts*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fraser Yachts

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pheonix Yachts

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Northrop & Johnson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Burgess Yachts

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FGI Yacht Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gulf Craft

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yachting Partners International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 TWW Yachts*List Not Exhaustive

List of Figures

- Figure 1: Saudi Arabia Yacht Charter Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Yacht Charter Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Yacht Charter Market Revenue Million Forecast, by Charter Type 2020 & 2033

- Table 2: Saudi Arabia Yacht Charter Market Revenue Million Forecast, by Yacht Type 2020 & 2033

- Table 3: Saudi Arabia Yacht Charter Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Yacht Charter Market Revenue Million Forecast, by Charter Type 2020 & 2033

- Table 5: Saudi Arabia Yacht Charter Market Revenue Million Forecast, by Yacht Type 2020 & 2033

- Table 6: Saudi Arabia Yacht Charter Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Yacht Charter Market?

The projected CAGR is approximately 8.25%.

2. Which companies are prominent players in the Saudi Arabia Yacht Charter Market?

Key companies in the market include TWW Yachts*List Not Exhaustive, Fraser Yachts, Pheonix Yachts, Northrop & Johnson, Burgess Yachts, FGI Yacht Group, Gulf Craft, Yachting Partners International.

3. What are the main segments of the Saudi Arabia Yacht Charter Market?

The market segments include Charter Type, Yacht Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.35 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of The Global Automotive Turbocharger Market.

6. What are the notable trends driving market growth?

The Crewed Segment to Lead the Market.

7. Are there any restraints impacting market growth?

Increasing Complexity of Modern Vehicles.

8. Can you provide examples of recent developments in the market?

November 2023: Ahead of Sindalah's anticipated opening in 2024, Saudi Arabia envisioned the island to undergo a global transformation into a premier yachting destination, marked by the recent agreement with a prominent luxury yacht provider. NEOM, the USD 500 billion mega-project in the Kingdom, revealed a strategic collaboration with Burgess to deliver a comprehensive array of services catering to Sindalah's yachting clientele.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Yacht Charter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Yacht Charter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Yacht Charter Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Yacht Charter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence