Key Insights

The global PVC Medical Exam Gloves market is poised for significant expansion, projected to reach approximately $5,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7%. This growth is primarily propelled by an increasing global demand for disposable medical supplies, driven by heightened awareness of infection control protocols in healthcare settings, especially post-pandemic. The expanding healthcare infrastructure in emerging economies, coupled with rising disposable incomes, further fuels this demand. Hospitals, being the largest application segment, will continue to be the dominant consumers of these gloves due to their high volume usage in patient care, diagnostic procedures, and surgical environments. Clinics and other healthcare facilities also represent substantial, growing segments, reflecting the decentralization of healthcare services and an increased focus on preventative care. The "No Powder Type" segment is expected to witness a higher growth rate, aligning with a global shift towards powder-free alternatives to mitigate risks of allergic reactions and contamination.

However, certain factors could moderate this upward trajectory. Restraints include the growing preference for alternative glove materials like nitrile and latex, driven by specific performance requirements and concerns about PVC's environmental impact and potential health hazards for some individuals. Stringent regulatory compliances regarding medical device manufacturing and disposal also present challenges for market players. Nonetheless, the inherent cost-effectiveness and availability of PVC, combined with ongoing technological advancements in PVC formulations to improve tactile sensitivity and durability, are expected to ensure its continued relevance. Key companies like Top Glove, Ansell, and Cardinal Health are actively investing in research and development, expanding production capacities, and focusing on strategic partnerships to solidify their market positions and capitalize on the projected growth, particularly in high-demand regions like Asia Pacific and North America.

Here is an SEO-optimized and insightful report description for PVC Medical Exam Gloves, crafted for maximum visibility and stakeholder engagement:

Global PVC Medical Exam Gloves Market Outlook: Trends, Innovations, and Growth Projections (2019–2033)

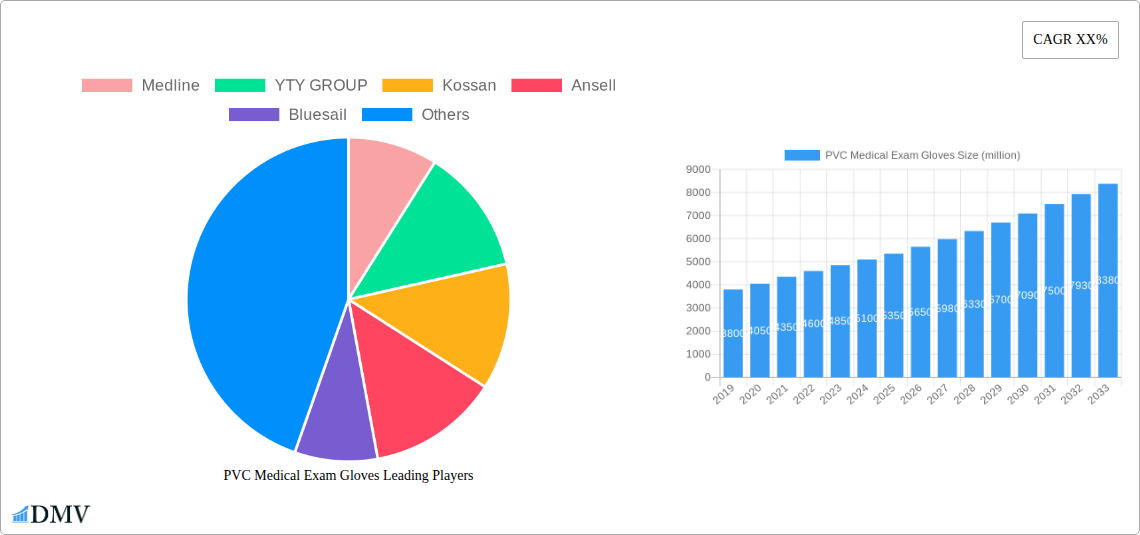

This comprehensive market research report provides an in-depth analysis of the global PVC medical exam gloves market, meticulously forecasting its trajectory from 2019 to 2033. With the base year set at 2025, the report offers granular insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, restraints, and future opportunities. Stakeholders will gain a strategic advantage through detailed market intelligence covering competitive landscapes, regulatory environments, and emerging trends that are shaping the multi-million dollar PVC medical exam gloves industry. This report is essential for understanding the dynamics of key players like Medline, YTY GROUP, Kossan, Ansell, Bluesail, ARISTA, Rubbercare, Cardinal Health, HL Rubber Industries, and Top Glove.

PVC Medical Exam Gloves Market Composition & Trends

The global PVC medical exam gloves market, valued at several hundred million dollars, exhibits a moderately concentrated structure. Innovation is a key catalyst, with a continuous drive towards enhancing barrier protection, tactile sensitivity, and user comfort. The regulatory landscape plays a pivotal role, with stringent approvals and standards influencing product development and market access. Substitute products, primarily nitrile and latex gloves, present ongoing competition, driving PVC manufacturers to focus on cost-effectiveness and specific application advantages. End-user profiles are diverse, spanning hospitals, clinics, and other healthcare settings, each with unique demands for performance and material properties. Mergers and acquisitions (M&A) are strategic maneuvers for market consolidation and expanding product portfolios, with recent deal values reaching into the tens of millions of dollars. Key trends include the increasing demand for non-powdered variants and specialized formulations for sensitive applications.

- Market Share Distribution: The top five players command approximately 60% of the global market share.

- M&A Deal Values: Average M&A deals in the last three years have ranged from $10 million to $50 million.

- Innovation Focus: Enhanced elasticity, improved puncture resistance, and hypoallergenic properties are key R&D areas.

- Regulatory Impact: FDA and CE certifications are critical for market entry in major economies.

PVC Medical Exam Gloves Industry Evolution

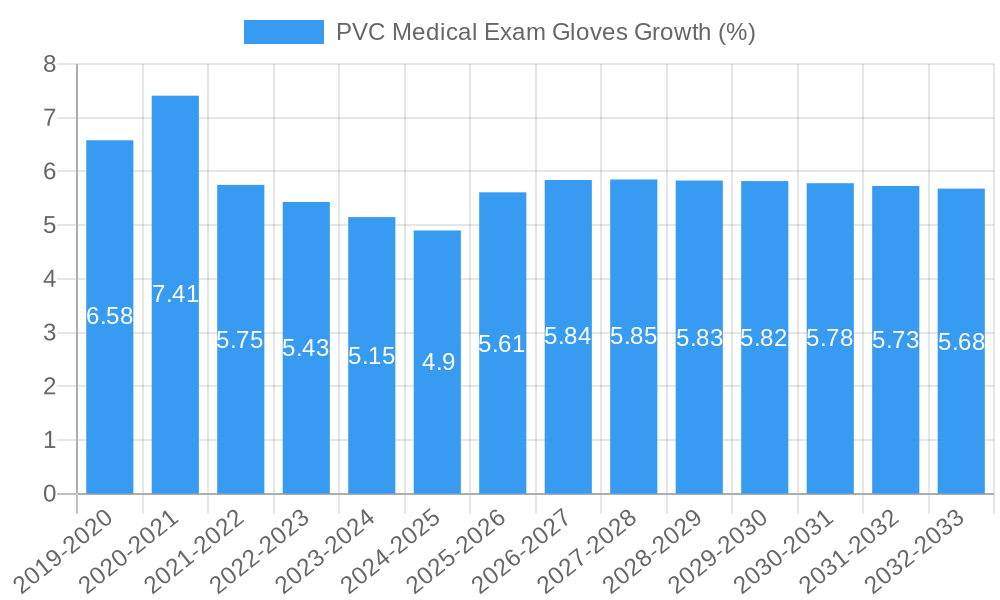

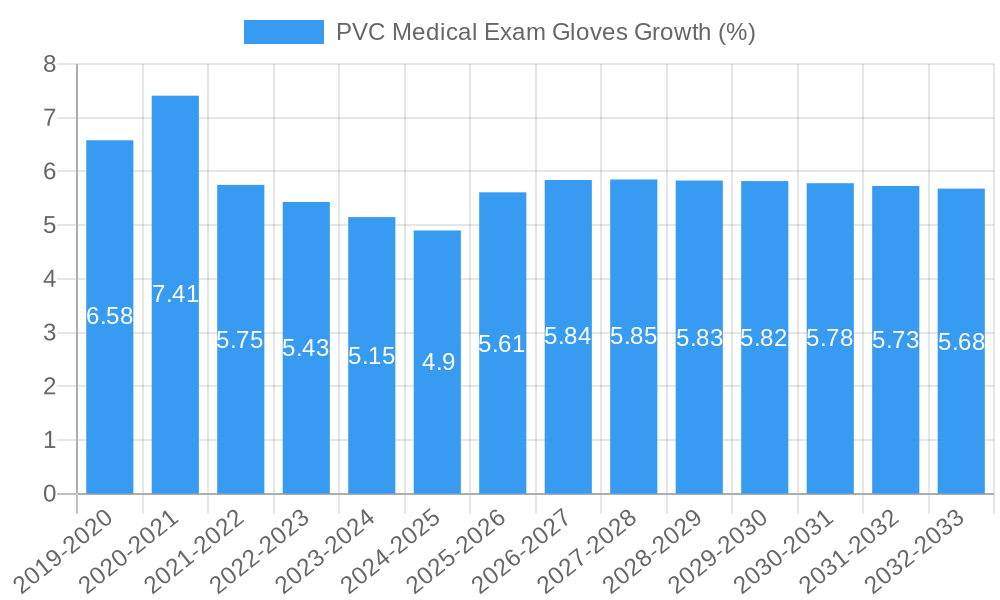

The PVC medical exam gloves industry has witnessed significant evolution over the historical period (2019–2024) and is poised for substantial growth in the forecast period (2025–2033). Market growth trajectories have been influenced by a growing global emphasis on hygiene and infection control, particularly amplified by recent public health crises. Technological advancements have focused on refining the manufacturing processes to achieve greater consistency in product quality and to reduce production costs, making PVC gloves a more competitive option. Shifting consumer demands, driven by an awareness of latex allergies and the desire for cost-effective yet reliable protective gear, have also propelled the adoption of PVC gloves. Growth rates in the historical period averaged around 4% annually, with an anticipated acceleration to 5-6% in the forecast period, driven by emerging economies and expanding healthcare infrastructure. The adoption metrics for non-powdered PVC gloves have shown a remarkable upward trend, now accounting for over 70% of the total PVC medical exam gloves market. This evolution underscores a strategic shift towards safer and more user-friendly alternatives within the disposable examination glove segment. The industry's resilience and adaptability are key indicators of its sustained relevance in the multi-million dollar global healthcare consumables market.

Leading Regions, Countries, or Segments in PVC Medical Exam Gloves

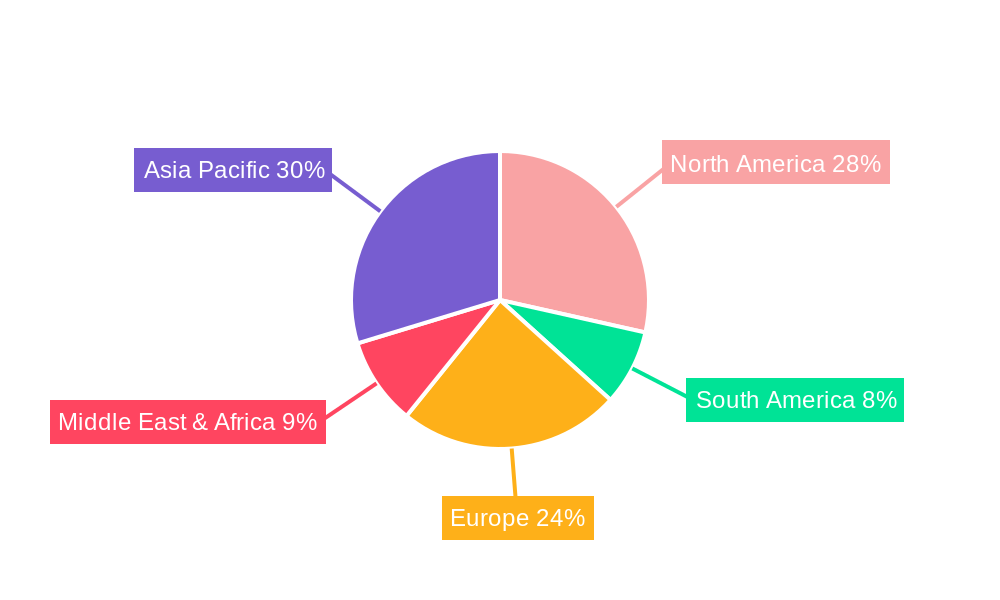

The Hospital segment, within the Application category, emerges as the dominant force in the global PVC medical exam gloves market, driven by high patient volumes and stringent infection control protocols. North America and Europe currently lead in terms of market value, owing to well-established healthcare infrastructures and significant per capita healthcare spending, collectively representing over 50% of the global market. However, the Asia Pacific region is experiencing the most rapid growth, fueled by expanding healthcare access, increasing disposable incomes, and a burgeoning population.

- Dominant Application Segment: Hospital

- Key Drivers: High frequency of medical procedures, rigorous sterilization standards, and a substantial patient-to-staff ratio necessitate continuous and high-volume glove usage. The sheer scale of operations in hospitals ensures a sustained demand for reliable and cost-effective examination gloves. Investment trends in hospital infrastructure and advanced medical technologies further bolster this demand. Regulatory support for universal healthcare access in many developed and developing nations indirectly contributes to increased hospital glove consumption.

- Dominant Type: No Powder Type

- Key Drivers: The growing awareness and documented concerns regarding latex allergies and powder-related respiratory issues have significantly shifted preference towards non-powdered variants. This trend is particularly pronounced in developed markets and increasingly in emerging economies as healthcare standards evolve. Manufacturers are responding by phasing out powder-based options and investing in advanced manufacturing to produce smooth, comfortable, and hypoallergenic non-powdered PVC gloves. The perceived safety and reduced risk of contamination associated with non-powdered gloves make them the preferred choice for a wide array of medical examinations and procedures.

- Emerging Market Dynamics: Countries like China and India are pivotal for future growth, with government initiatives aimed at improving healthcare accessibility and affordability, thereby increasing the demand for disposable medical supplies.

PVC Medical Exam Gloves Product Innovations

Product innovations in the PVC medical exam gloves market are centering on enhancing user experience and expanding application versatility. Manufacturers are developing enhanced formulations that mimic the tactile sensitivity of latex and nitrile, offering improved dexterity and comfort for prolonged wear. Advanced surface treatments are being implemented to provide better grip in wet and dry conditions. Furthermore, innovations are focused on creating thinner yet more durable gloves, achieving higher tensile strength without compromising flexibility. These advancements are critical for competitive differentiation in a market valued in the millions.

Propelling Factors for PVC Medical Exam Gloves Growth

The growth of the PVC medical exam gloves market is propelled by several key factors. Firstly, the escalating global prevalence of infectious diseases and the heightened emphasis on infection control protocols in healthcare settings are driving demand for disposable examination gloves. Secondly, the cost-effectiveness of PVC gloves compared to alternatives like nitrile and latex makes them an attractive choice, especially for high-volume usage in hospitals and clinics across emerging economies. Thirdly, advancements in manufacturing technology are leading to improved quality, comfort, and barrier properties of PVC gloves, addressing previous limitations. Finally, government initiatives and regulatory mandates promoting hygiene standards further bolster market expansion.

Obstacles in the PVC Medical Exam Gloves Market

Despite robust growth, the PVC medical exam gloves market faces several obstacles. A primary restraint is the perception and, in some cases, performance limitations compared to nitrile gloves, particularly concerning tactile sensitivity and elasticity. Regulatory hurdles in certain regions, requiring extensive testing and compliance, can also slow down market entry. Supply chain disruptions, as witnessed in recent years, can impact raw material availability and price volatility. Furthermore, the competitive pressure from established and emerging manufacturers, coupled with price sensitivity among buyers, necessitates continuous efficiency improvements and cost management.

Future Opportunities in PVC Medical Exam Gloves

Future opportunities in the PVC medical exam gloves market are abundant. The increasing demand for affordable personal protective equipment in developing nations presents a significant growth avenue. The expanding applications in non-healthcare sectors, such as food handling and laboratory work, offer new market segments. Technological advancements leading to more sustainable and biodegradable PVC formulations could unlock a niche market driven by environmental consciousness. Furthermore, the development of specialized PVC gloves with enhanced chemical resistance for specific industrial or medical applications holds substantial promise for market expansion.

Major Players in the PVC Medical Exam Gloves Ecosystem

- Medline

- YTY GROUP

- Kossan

- Ansell

- Bluesail

- ARISTA

- Rubbercare

- Cardinal Health

- HL Rubber Industries

- Top Glove

Key Developments in PVC Medical Exam Gloves Industry

- 2023: Bluesail introduces a new line of advanced non-powdered PVC gloves with enhanced tactile sensitivity and comfort, targeting premium hospital segments.

- 2022: Ansell completes a strategic acquisition of a smaller PPE manufacturer, expanding its production capacity for PVC gloves in Southeast Asia.

- 2021: Top Glove announces significant investment in automation and R&D to improve PVC glove quality and reduce environmental impact.

- 2020: YTY GROUP focuses on expanding its global distribution network to meet surging demand driven by pandemic-related hygiene concerns.

- 2019: Medline invests in upgrading its manufacturing facilities to increase output and efficiency for its range of medical examination gloves, including PVC.

Strategic PVC Medical Exam Gloves Market Forecast

The strategic PVC medical exam gloves market forecast indicates a promising future, driven by persistent demand for infection control, cost-effective solutions, and continuous product innovation. Emerging economies, with their expanding healthcare infrastructures and growing populations, will be pivotal growth engines. The increasing adoption of non-powdered variants and specialized formulations will further shape market dynamics. Strategic collaborations and investments in R&D will be crucial for players to maintain a competitive edge and capitalize on the multi-million dollar opportunities projected for the forecast period.

PVC Medical Exam Gloves Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Other

-

2. Types

- 2.1. Powder Type

- 2.2. No Powder Type

PVC Medical Exam Gloves Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

PVC Medical Exam Gloves REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PVC Medical Exam Gloves Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Powder Type

- 5.2.2. No Powder Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America PVC Medical Exam Gloves Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Powder Type

- 6.2.2. No Powder Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America PVC Medical Exam Gloves Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Powder Type

- 7.2.2. No Powder Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe PVC Medical Exam Gloves Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Powder Type

- 8.2.2. No Powder Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa PVC Medical Exam Gloves Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Powder Type

- 9.2.2. No Powder Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific PVC Medical Exam Gloves Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Powder Type

- 10.2.2. No Powder Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Medline

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 YTY GROUP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kossan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ansell

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bluesail

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ARISTA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rubbercare

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cardinal Health

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HL Rubber Industries

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Top Glove

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Medline

List of Figures

- Figure 1: Global PVC Medical Exam Gloves Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America PVC Medical Exam Gloves Revenue (million), by Application 2024 & 2032

- Figure 3: North America PVC Medical Exam Gloves Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America PVC Medical Exam Gloves Revenue (million), by Types 2024 & 2032

- Figure 5: North America PVC Medical Exam Gloves Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America PVC Medical Exam Gloves Revenue (million), by Country 2024 & 2032

- Figure 7: North America PVC Medical Exam Gloves Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America PVC Medical Exam Gloves Revenue (million), by Application 2024 & 2032

- Figure 9: South America PVC Medical Exam Gloves Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America PVC Medical Exam Gloves Revenue (million), by Types 2024 & 2032

- Figure 11: South America PVC Medical Exam Gloves Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America PVC Medical Exam Gloves Revenue (million), by Country 2024 & 2032

- Figure 13: South America PVC Medical Exam Gloves Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe PVC Medical Exam Gloves Revenue (million), by Application 2024 & 2032

- Figure 15: Europe PVC Medical Exam Gloves Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe PVC Medical Exam Gloves Revenue (million), by Types 2024 & 2032

- Figure 17: Europe PVC Medical Exam Gloves Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe PVC Medical Exam Gloves Revenue (million), by Country 2024 & 2032

- Figure 19: Europe PVC Medical Exam Gloves Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa PVC Medical Exam Gloves Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa PVC Medical Exam Gloves Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa PVC Medical Exam Gloves Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa PVC Medical Exam Gloves Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa PVC Medical Exam Gloves Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa PVC Medical Exam Gloves Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific PVC Medical Exam Gloves Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific PVC Medical Exam Gloves Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific PVC Medical Exam Gloves Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific PVC Medical Exam Gloves Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific PVC Medical Exam Gloves Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific PVC Medical Exam Gloves Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global PVC Medical Exam Gloves Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global PVC Medical Exam Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global PVC Medical Exam Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global PVC Medical Exam Gloves Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global PVC Medical Exam Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global PVC Medical Exam Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global PVC Medical Exam Gloves Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global PVC Medical Exam Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global PVC Medical Exam Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global PVC Medical Exam Gloves Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global PVC Medical Exam Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global PVC Medical Exam Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global PVC Medical Exam Gloves Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global PVC Medical Exam Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global PVC Medical Exam Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global PVC Medical Exam Gloves Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global PVC Medical Exam Gloves Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global PVC Medical Exam Gloves Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global PVC Medical Exam Gloves Revenue million Forecast, by Country 2019 & 2032

- Table 41: China PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific PVC Medical Exam Gloves Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PVC Medical Exam Gloves?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the PVC Medical Exam Gloves?

Key companies in the market include Medline, YTY GROUP, Kossan, Ansell, Bluesail, ARISTA, Rubbercare, Cardinal Health, HL Rubber Industries, Top Glove.

3. What are the main segments of the PVC Medical Exam Gloves?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PVC Medical Exam Gloves," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PVC Medical Exam Gloves report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PVC Medical Exam Gloves?

To stay informed about further developments, trends, and reports in the PVC Medical Exam Gloves, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence