Key Insights

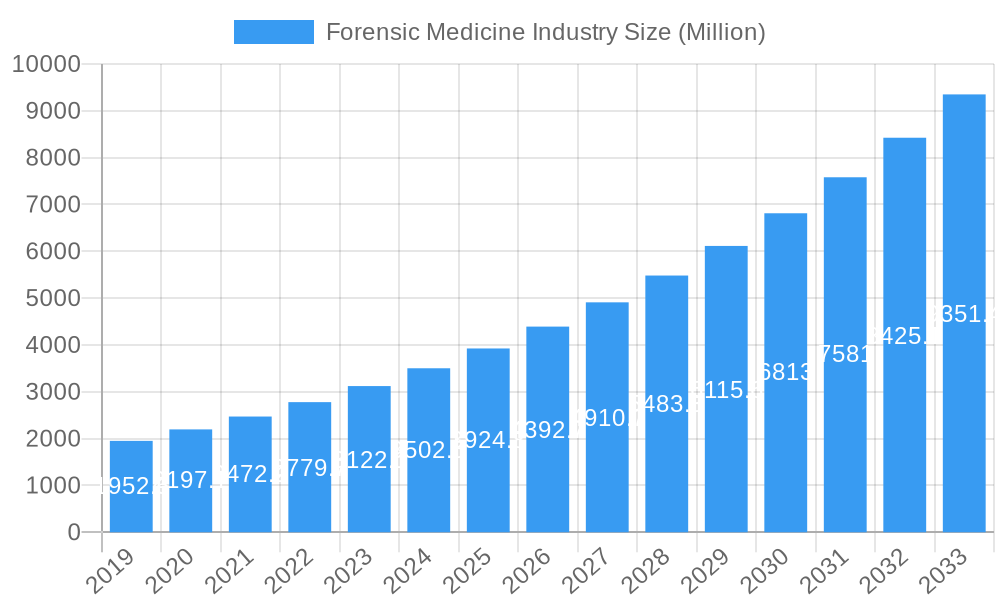

The global Forensic Medicine industry is projected for substantial growth, expected to reach a market size of USD 9.69 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 12.92% from a base year valuation of USD 5.76 billion in 2025. This expansion is driven by the increasing need for accurate evidence in legal proceedings and advancements in scientific techniques, particularly in DNA analysis and criminal investigations. Growing judicial and law enforcement capacities, alongside a greater understanding of forensic science's role in public safety and justice, are further contributing factors. Innovations in DNA profiling and advanced chemical analysis are enhancing precision and speed, fueling market demand.

Forensic Medicine Industry Market Size (In Billion)

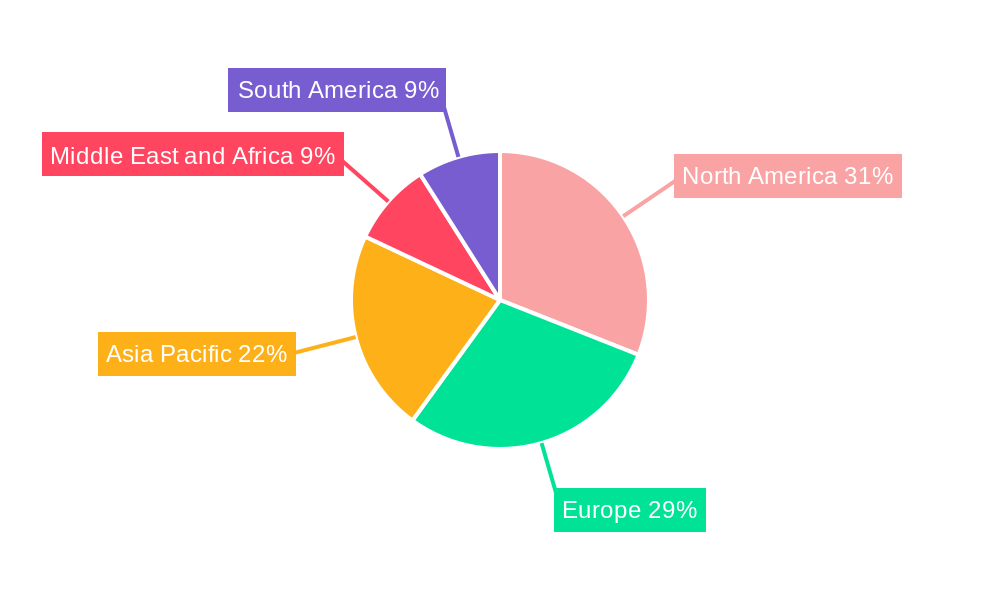

Key market segments include DNA profiling and judicial/law enforcement applications, driven by their critical role in identification and prosecution. The adoption of Next-Generation Sequencing (NGS) in forensic genomics is a significant trend. Challenges include the high cost of advanced equipment, the requirement for skilled professionals, and stringent regulatory environments. Geographically, North America and Europe are expected to lead due to established infrastructure and R&D investment. The Asia Pacific region presents high growth potential, attributed to urbanization, rising crime rates, and government efforts to improve forensic capabilities. Market leaders are focusing on technological advancements, strategic collaborations, and portfolio expansion.

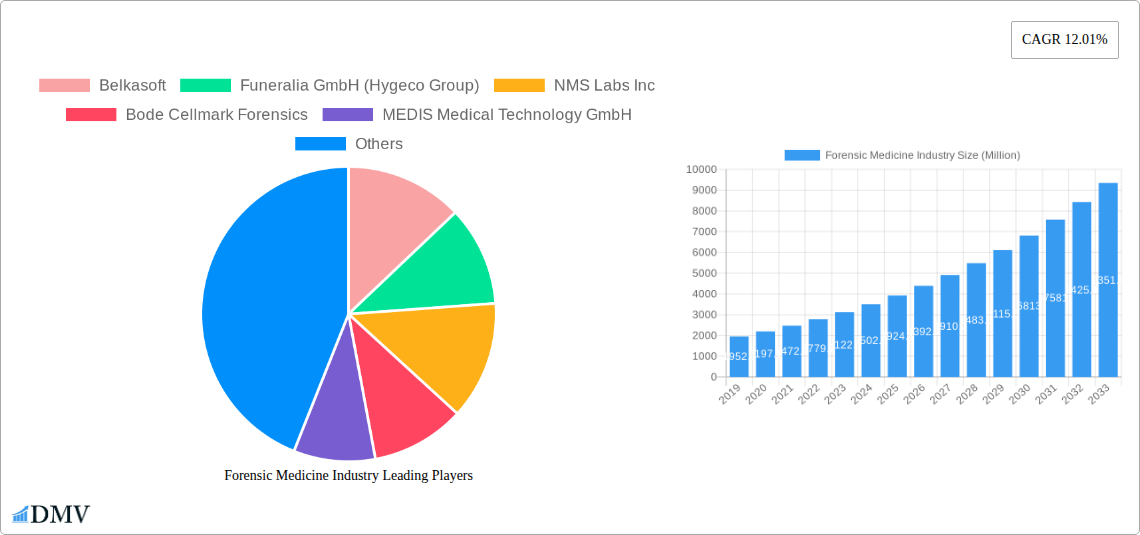

Forensic Medicine Industry Company Market Share

This comprehensive report offers deep insights into the Forensic Medicine industry from 2019 to 2033, with a focus on the base year 2025 and the forecast period 2025–2033. It covers market dynamics, trends, regional analysis, product innovations, growth drivers, challenges, opportunities, and key player strategies. Essential for understanding forensic science, digital forensics, DNA profiling, fingerprint analysis, chemical analysis, genome sequencing, and their applications in judicial and law enforcement contexts.

Forensic Medicine Industry Market Composition & Trends

The Forensic Medicine Industry exhibits a moderately concentrated market, driven by significant investment in technological innovation and a robust regulatory framework. Key players like Agilent Technologies, Belkasoft, and Eurofins Medigenomix GmbH are consistently pushing boundaries in areas such as DNA profiling and genome sequencing. Market share distribution is influenced by the specialized nature of services and the capital-intensive requirements for advanced instrumentation. M&A activities, while not dominating the landscape, play a crucial role in market consolidation and capability expansion. For instance, recent strategic alliances, such as Belkasoft joining Grayshift's Technology Alliances Program, underscore a trend towards ecosystem integration. The market is characterized by a steady stream of new product development, focusing on enhanced accuracy, speed, and broader analytical capabilities in forensic science.

- Market Concentration: Moderately concentrated, with a few dominant players and a growing number of specialized niche providers.

- Innovation Catalysts: Advancements in DNA sequencing technology, AI in digital forensics, and miniaturization of analytical equipment.

- Regulatory Landscapes: Stringent validation and accreditation processes shape market entry and service offerings.

- Substitute Products: Emerging AI-driven analytical tools in digital forensics may offer alternatives to traditional methods.

- End-User Profiles: Primarily judicial systems, law enforcement agencies, private investigators, and research institutions.

- M&A Activities: Strategic partnerships and acquisitions to expand service portfolios and geographical reach. Deal values are estimated to be in the range of hundreds of millions to a billion.

Forensic Medicine Industry Industry Evolution

The Forensic Medicine Industry has witnessed remarkable evolution, driven by a confluence of accelerating technological advancements and escalating demand for accurate, irrefutable evidence in criminal investigations and civil litigations. The historical period (2019–2024) saw substantial growth, fueled by increased governmental funding for forensic laboratories and the expanding scope of forensic applications beyond traditional criminal justice. The Base Year 2025 positions the market at a critical juncture, with established players and emerging innovators vying for dominance. Market growth trajectories are significantly influenced by the increasing sophistication of criminal activities, particularly in the digital realm, necessitating advanced digital forensics solutions.

Technological advancements are at the forefront of this evolution. The widespread adoption of Next-Generation Sequencing (NGS) has revolutionized DNA profiling, enabling more detailed genetic analysis, including ancestry and phenotypic prediction, thereby enhancing its application in Genome Sequencing for forensic purposes. The accuracy and speed of Finger Print Analysis have also seen significant improvements through automated identification systems and advanced algorithmic approaches. Chemical Analysis techniques, such as mass spectrometry and chromatography, are continuously being refined for the detection of trace evidence, controlled substances, and explosives with unprecedented sensitivity. The market's growth rate, which has consistently been in the high single digits annually historically, is projected to accelerate during the forecast period (2025–2033). This acceleration is attributed to the ongoing integration of artificial intelligence and machine learning in analyzing vast datasets generated by forensic examinations, leading to quicker case resolution and improved investigative efficiency. Furthermore, the increasing global focus on crime prevention and victim justice is a persistent driver for enhanced forensic capabilities, further solidifying the industry's upward trend. The adoption metrics for advanced forensic technologies are steadily increasing, with law enforcement agencies and judicial bodies worldwide prioritizing investment in state-of-the-art equipment and expertise. This sustained demand, coupled with continuous innovation, paints a robust picture for the future expansion of the Forensic Medicine Industry.

Leading Regions, Countries, or Segments in Forensic Medicine Industry

The Forensic Medicine Industry is characterized by strong regional dominance, with North America and Europe emerging as the leading powerhouses. Within these regions, countries such as the United States and Germany consistently exhibit the highest market penetration and investment. The Method segment of DNA Profiling holds a significant lead, driven by its indispensable role in identifying individuals with high certainty, whether for criminal investigations, paternity testing, or disaster victim identification. This segment's dominance is further amplified by advancements in genome sequencing technologies, making it a cornerstone for applications in Judicial/Law Enforcement.

Dominant Segment (Method): DNA Profiling

- Key Drivers: High accuracy, established protocols, increasing demand for personalized identification, and continuous technological advancements in sequencing.

- Investment Trends: Significant R&D investment by companies like Bode Cellmark Forensics and NMS Labs Inc. to enhance STR analysis and develop novel profiling techniques.

- Regulatory Support: Robust legal frameworks in North America and Europe that mandate and recognize DNA evidence.

- Market Size: Estimated to be in the range of several billion, with significant growth projected.

Dominant Application: Judicial/Law Enforcement

- Key Drivers: The primary mandate of forensic medicine is to serve justice systems by providing scientific evidence.

- Investment Trends: Government agencies are the largest investors, funding forensic laboratories, training, and technology acquisition.

- Regulatory Support: Laws and legal precedents that rely heavily on forensic evidence for convictions and acquittals.

- Market Size: This application segment is the largest contributor, with an estimated market size exceeding ten billion.

While DNA Profiling and Judicial/Law Enforcement applications lead, Finger Print Analysis remains a critical and widely used method, with advancements in automated fingerprint identification systems (AFIS) enhancing its efficiency. Chemical Analysis is crucial for identifying illicit substances, explosives, and trace evidence, with companies like Eurofins Medigenomix GmbH and MEDIS Medical Technology GmbH offering specialized analytical services. The application of Genome Sequencing is rapidly expanding beyond traditional DNA profiling, finding utility in areas like pathogen identification and understanding genetic predispositions to certain crimes or behaviors, though it is still a growing niche compared to established methods. The overall market value for these segments combined is estimated to be in the tens of billions, with substantial growth anticipated across all categories during the forecast period.

Forensic Medicine Industry Product Innovations

Product innovations in the Forensic Medicine Industry are rapidly transforming analytical capabilities and efficiency. Companies are developing advanced DNA sequencing kits that offer higher throughput and faster turnaround times, enabling the analysis of degraded or low-quantity samples. Belkasoft's continued development of digital forensic software, exemplified by its integration into Grayshift's ecosystem, highlights innovation in extracting and analyzing digital evidence from mobile devices and computers. Furthermore, advancements in portable chemical analysis devices allow for on-site testing, streamlining investigations. The integration of AI and machine learning into fingerprint analysis software is also enhancing pattern recognition and reducing human error. These innovations are characterized by enhanced sensitivity, specificity, and the ability to process complex datasets, significantly improving the evidentiary value of forensic findings and reducing the time to resolution in critical cases.

Propelling Factors for Forensic Medicine Industry Growth

Several key factors are propelling the growth of the Forensic Medicine Industry. Technologically, the continuous evolution of DNA sequencing technologies, mass spectrometry, and digital forensic tools provides more powerful and precise analytical capabilities. Economically, increased government funding for law enforcement and judicial systems, coupled with a global rise in crime rates and the complexity of criminal activities, drives demand for forensic services. Regulatory influences also play a significant role, as evolving legal frameworks often mandate the use of advanced forensic techniques for accurate and fair justice. The growing acceptance of digital forensics in legal proceedings, driven by cases involving cybercrime and data breaches, is a major catalyst. The investment of USD 2 million by Bode Technology to expand its DNA testing lab in Fairfax County exemplifies this growth.

Obstacles in the Forensic Medicine Industry Market

Despite robust growth, the Forensic Medicine Industry faces several obstacles. Regulatory Challenges can arise from the evolving standards and accreditation requirements for new technologies, potentially slowing their adoption. Supply Chain Disruptions, as seen globally, can impact the availability of critical reagents and specialized equipment, leading to delays in testing and analysis. Competitive Pressures from a growing number of service providers, while beneficial for innovation, can also lead to price wars and strain profit margins for smaller entities. Furthermore, the high cost of advanced instrumentation and the need for specialized, highly trained personnel can present significant barriers to entry and expansion for some organizations. The ongoing need for rigorous validation of all forensic methods also contributes to longer development cycles.

Future Opportunities in Forensic Medicine Industry

Emerging opportunities in the Forensic Medicine Industry are abundant, particularly in the realm of digital forensics and cybersecurity. The increasing volume of digital data generated by individuals and organizations presents a vast area for growth in data recovery, malware analysis, and mobile device forensics. Advanced DNA analysis, including forensic genomics and the interpretation of complex genetic mixtures, offers opportunities for more nuanced individual identification and ancestral tracing. The development of AI-powered predictive analytics for crime scene reconstruction and suspect profiling is another promising avenue. Expanding services to emerging markets and catering to specialized needs, such as environmental forensics or forensic accounting, also represent significant growth potential.

Major Players in the Forensic Medicine Industry Ecosystem

- Agilent Technologies

- Belkasoft

- Bode Cellmark Forensics

- Eurofins Medigenomix Gmbh

- Funeralia GmbH (Hygeco Group)

- MEDIS Medical Technology GmbH

- NMS Labs Inc

Key Developments in Forensic Medicine Industry Industry

- August 2022: Belkasoft, a pioneer in digital forensics and incident response, joined Grayshift's Technology Alliances Program and officially partnered with Technology Alliances Program (TAP), enhancing its capabilities in mobile device forensics.

- April 2022: Bode Technology, one of the top providers of forensic services across the world, invested USD 2 million to expand its DNA testing lab in Fairfax County to meet the growing customer demand, signaling a significant expansion of DNA profiling services.

Strategic Forensic Medicine Industry Market Forecast

The strategic forecast for the Forensic Medicine Industry is overwhelmingly positive, driven by sustained technological innovation and an ever-increasing demand for robust, scientific evidence. The expansion of digital forensics, fueled by the proliferation of cybercrime and the need to analyze vast digital footprints, will be a primary growth catalyst. Advancements in DNA profiling and genome sequencing, enabling more precise identification and the potential for predictive analysis, will further solidify its market position. Governmental investment in justice systems worldwide will continue to provide a stable revenue stream, while emerging markets present significant untapped potential. The industry is poised for continued expansion, with market value expected to grow substantially throughout the forecast period.

Forensic Medicine Industry Segmentation

-

1. Method

- 1.1. DNA Profiling

- 1.2. Finger Print Analysis

- 1.3. Chemical Analysis

- 1.4. Other Methods

-

2. Application

- 2.1. Genome Sequencing

- 2.2. Judicial/Law Enforcement

- 2.3. Other Applications

Forensic Medicine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Forensic Medicine Industry Regional Market Share

Geographic Coverage of Forensic Medicine Industry

Forensic Medicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Global Crime Rate; Sophistication of Crime; Increasing Demand for Forensic Technologies

- 3.3. Market Restrains

- 3.3.1. Declining Supply of Forensic Services; Regulatory Constraints

- 3.4. Market Trends

- 3.4.1. Fingerprint Analysis Segment is Expected to Witness Considerable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Method

- 5.1.1. DNA Profiling

- 5.1.2. Finger Print Analysis

- 5.1.3. Chemical Analysis

- 5.1.4. Other Methods

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Genome Sequencing

- 5.2.2. Judicial/Law Enforcement

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Method

- 6. North America Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Method

- 6.1.1. DNA Profiling

- 6.1.2. Finger Print Analysis

- 6.1.3. Chemical Analysis

- 6.1.4. Other Methods

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Genome Sequencing

- 6.2.2. Judicial/Law Enforcement

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Method

- 7. Europe Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Method

- 7.1.1. DNA Profiling

- 7.1.2. Finger Print Analysis

- 7.1.3. Chemical Analysis

- 7.1.4. Other Methods

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Genome Sequencing

- 7.2.2. Judicial/Law Enforcement

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Method

- 8. Asia Pacific Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Method

- 8.1.1. DNA Profiling

- 8.1.2. Finger Print Analysis

- 8.1.3. Chemical Analysis

- 8.1.4. Other Methods

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Genome Sequencing

- 8.2.2. Judicial/Law Enforcement

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Method

- 9. Middle East and Africa Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Method

- 9.1.1. DNA Profiling

- 9.1.2. Finger Print Analysis

- 9.1.3. Chemical Analysis

- 9.1.4. Other Methods

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Genome Sequencing

- 9.2.2. Judicial/Law Enforcement

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Method

- 10. South America Forensic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Method

- 10.1.1. DNA Profiling

- 10.1.2. Finger Print Analysis

- 10.1.3. Chemical Analysis

- 10.1.4. Other Methods

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Genome Sequencing

- 10.2.2. Judicial/Law Enforcement

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Method

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Belkasoft

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Funeralia GmbH (Hygeco Group)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NMS Labs Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bode Cellmark Forensics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MEDIS Medical Technology GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eurofins Medigenomix Gmbh

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Agilent Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Belkasoft

List of Figures

- Figure 1: Global Forensic Medicine Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Forensic Medicine Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Forensic Medicine Industry Revenue (billion), by Method 2025 & 2033

- Figure 4: North America Forensic Medicine Industry Volume (K Unit), by Method 2025 & 2033

- Figure 5: North America Forensic Medicine Industry Revenue Share (%), by Method 2025 & 2033

- Figure 6: North America Forensic Medicine Industry Volume Share (%), by Method 2025 & 2033

- Figure 7: North America Forensic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Forensic Medicine Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Forensic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Forensic Medicine Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Forensic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Forensic Medicine Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Forensic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Forensic Medicine Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Forensic Medicine Industry Revenue (billion), by Method 2025 & 2033

- Figure 16: Europe Forensic Medicine Industry Volume (K Unit), by Method 2025 & 2033

- Figure 17: Europe Forensic Medicine Industry Revenue Share (%), by Method 2025 & 2033

- Figure 18: Europe Forensic Medicine Industry Volume Share (%), by Method 2025 & 2033

- Figure 19: Europe Forensic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Forensic Medicine Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Forensic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Forensic Medicine Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Forensic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Forensic Medicine Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Forensic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Forensic Medicine Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Forensic Medicine Industry Revenue (billion), by Method 2025 & 2033

- Figure 28: Asia Pacific Forensic Medicine Industry Volume (K Unit), by Method 2025 & 2033

- Figure 29: Asia Pacific Forensic Medicine Industry Revenue Share (%), by Method 2025 & 2033

- Figure 30: Asia Pacific Forensic Medicine Industry Volume Share (%), by Method 2025 & 2033

- Figure 31: Asia Pacific Forensic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Pacific Forensic Medicine Industry Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Forensic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Forensic Medicine Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Forensic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Forensic Medicine Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Forensic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Forensic Medicine Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Forensic Medicine Industry Revenue (billion), by Method 2025 & 2033

- Figure 40: Middle East and Africa Forensic Medicine Industry Volume (K Unit), by Method 2025 & 2033

- Figure 41: Middle East and Africa Forensic Medicine Industry Revenue Share (%), by Method 2025 & 2033

- Figure 42: Middle East and Africa Forensic Medicine Industry Volume Share (%), by Method 2025 & 2033

- Figure 43: Middle East and Africa Forensic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 44: Middle East and Africa Forensic Medicine Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Middle East and Africa Forensic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Forensic Medicine Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Forensic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East and Africa Forensic Medicine Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Forensic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Forensic Medicine Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Forensic Medicine Industry Revenue (billion), by Method 2025 & 2033

- Figure 52: South America Forensic Medicine Industry Volume (K Unit), by Method 2025 & 2033

- Figure 53: South America Forensic Medicine Industry Revenue Share (%), by Method 2025 & 2033

- Figure 54: South America Forensic Medicine Industry Volume Share (%), by Method 2025 & 2033

- Figure 55: South America Forensic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 56: South America Forensic Medicine Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: South America Forensic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Forensic Medicine Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Forensic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: South America Forensic Medicine Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Forensic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Forensic Medicine Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 2: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 3: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Forensic Medicine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Forensic Medicine Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 8: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 9: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Forensic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Forensic Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 20: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 21: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Forensic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Forensic Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 38: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 39: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Forensic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Forensic Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 56: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 57: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 58: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 59: Global Forensic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Forensic Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: GCC Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Forensic Medicine Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 68: Global Forensic Medicine Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 69: Global Forensic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 70: Global Forensic Medicine Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 71: Global Forensic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Forensic Medicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Forensic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Forensic Medicine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Forensic Medicine Industry?

The projected CAGR is approximately 12.92%.

2. Which companies are prominent players in the Forensic Medicine Industry?

Key companies in the market include Belkasoft, Funeralia GmbH (Hygeco Group), NMS Labs Inc , Bode Cellmark Forensics, MEDIS Medical Technology GmbH, Eurofins Medigenomix Gmbh, Agilent Technologies.

3. What are the main segments of the Forensic Medicine Industry?

The market segments include Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.69 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Global Crime Rate; Sophistication of Crime; Increasing Demand for Forensic Technologies.

6. What are the notable trends driving market growth?

Fingerprint Analysis Segment is Expected to Witness Considerable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Declining Supply of Forensic Services; Regulatory Constraints.

8. Can you provide examples of recent developments in the market?

In August 2022, Belkasoft, a pioneer in digital forensics and incident response, joined Grayshift's Technology Alliances Program and officially partnered with Technology Alliances Program (TAP).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Forensic Medicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Forensic Medicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Forensic Medicine Industry?

To stay informed about further developments, trends, and reports in the Forensic Medicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence