Key Insights

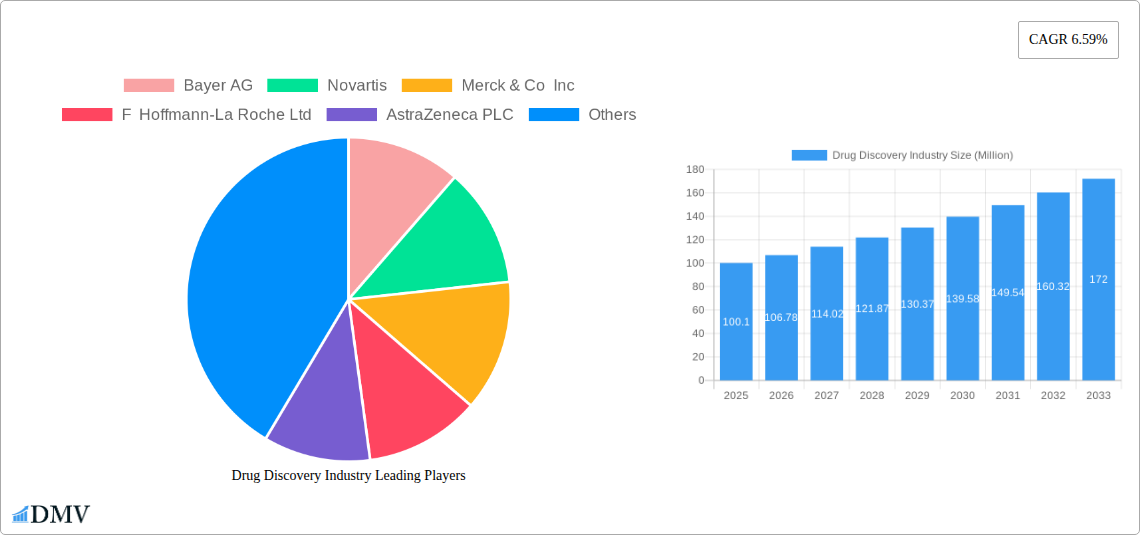

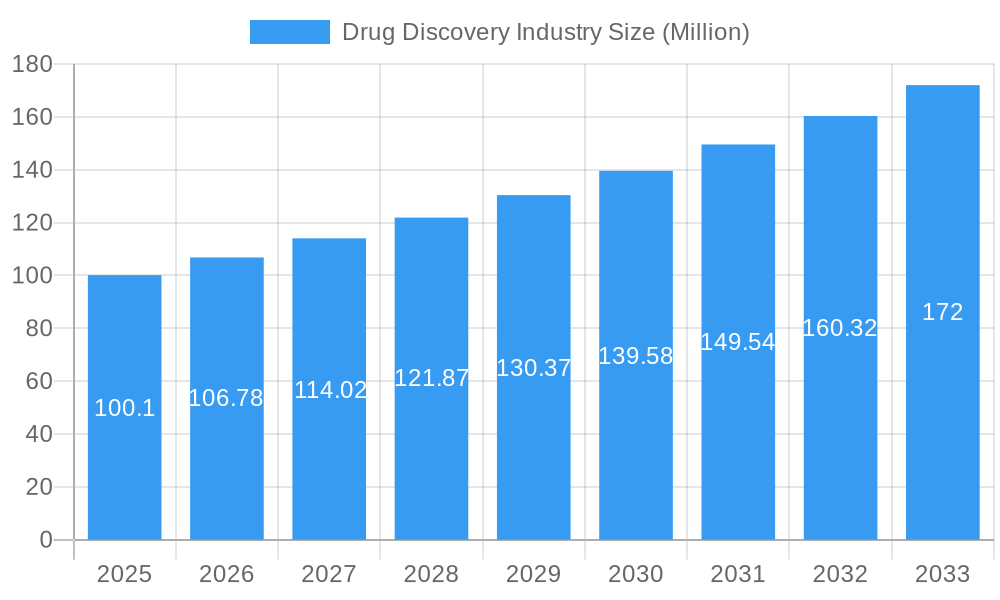

The global Drug Discovery market is poised for significant expansion, projected to reach \$100.10 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.59% expected to continue through 2033. This growth is primarily propelled by advancements in high-throughput screening, the increasing adoption of pharmacogenomics for personalized medicine, and the innovative power of combinatorial chemistry. The rising prevalence of chronic diseases and an aging global population are fueling the demand for novel therapeutics, making drug discovery a critical area of investment and innovation. Furthermore, the integration of cutting-edge technologies like nanotechnology is revolutionizing the speed and efficiency of identifying and validating potential drug candidates, thereby accelerating the development pipeline. Pharmaceutical companies and contract research organizations (CROs) are at the forefront of this market, actively investing in research and development to address unmet medical needs across various therapeutic areas.

Drug Discovery Industry Market Size (In Million)

The competitive landscape is characterized by the presence of major global players, including Bayer AG, Novartis, Merck & Co. Inc., and F. Hoffmann-La Roche Ltd., who are consistently pushing the boundaries of scientific exploration. Emerging trends such as artificial intelligence and machine learning are further optimizing the drug discovery process by enabling predictive modeling and data-driven insights, promising to reduce development timelines and costs. While the market is driven by innovation, it also faces certain restraints, including the high cost and complexity of drug development, stringent regulatory hurdles, and the inherent risks associated with clinical trials. However, the persistent need for breakthrough treatments for diseases like cancer, Alzheimer's, and infectious diseases, coupled with increasing healthcare expenditure globally, provides a strong foundation for sustained market growth and innovation in the coming years.

Drug Discovery Industry Company Market Share

Drug Discovery Industry Market Insights and Forecast 2025-2033

Embark on a comprehensive exploration of the drug discovery market, a rapidly evolving landscape crucial for advancing global health. This in-depth report provides unparalleled insights into the pharmaceutical R&D sector, covering market dynamics, technological innovations, leading players, and future growth projections. With a study period spanning from 2019 to 2033, and a base year of 2025, our analysis equips stakeholders with actionable intelligence for strategic decision-making. Dive into a market projected to reach billions in value, driven by breakthroughs in small molecule drugs and biologic drugs, and empowered by cutting-edge technologies like high throughput screening and pharmacogenomics. This report is essential for pharmaceutical companies, Contract Research Organizations (CROs), investors, and policymakers seeking to understand and capitalize on the future of medicine.

Drug Discovery Industry Market Composition & Trends

The drug discovery industry is characterized by a dynamic market concentration, with a few dominant players alongside a robust ecosystem of innovative biotechs and CROs. Key innovation catalysts include the relentless pursuit of novel therapeutics for unmet medical needs, significant advancements in artificial intelligence (AI) and machine learning for target identification and compound screening, and increased investment in precision medicine. The regulatory landscape, governed by agencies like the FDA and EMA, plays a pivotal role, influencing development timelines and approval pathways. Substitute products, while emerging in certain therapeutic areas, often spur further innovation rather than outright market displacement. End-user profiles reveal a strong reliance on pharmaceutical companies as primary drivers, supported by a growing number of specialized Contract Research Organizations (CROs) and academic institutions. Mergers and acquisitions (M&A) activities are a significant trend, with deal values often reaching into the millions and billions, aimed at consolidating portfolios, acquiring promising technologies, and expanding market reach. For instance, the historical period (2019-2024) has witnessed strategic acquisitions totaling over XX million in value. The market share distribution, while diverse, sees major pharmaceutical players holding substantial portions, while specialized biotech firms carve out niches through disruptive innovation.

Drug Discovery Industry Industry Evolution

The drug discovery industry has undergone a remarkable evolution, transforming from serendipitous findings to a data-driven, technologically advanced sector. Over the historical period (2019–2024), the market witnessed a Compound Annual Growth Rate (CAGR) of approximately XX%, a testament to its robust expansion. This growth trajectory is fundamentally shaped by significant technological advancements. The integration of artificial intelligence (AI) and machine learning has revolutionized target identification, lead optimization, and even clinical trial design, drastically reducing timelines and costs. High throughput screening (HTS) technologies have become indispensable, enabling the rapid evaluation of millions of compounds. Furthermore, the rise of biologic drugs, including monoclonal antibodies, gene therapies, and cell therapies, has opened up new avenues for treating complex diseases previously considered intractable. Pharmacogenomics, which studies how genes affect a person's response to drugs, is increasingly being leveraged for personalized medicine, leading to more effective and safer treatments. Combinatorial chemistry continues to play a role in generating vast libraries of potential drug candidates, while nanotechnology offers novel drug delivery systems and imaging capabilities. Shifting consumer demands, driven by an aging global population, increasing prevalence of chronic diseases like cancer and Alzheimer's, and a greater patient desire for targeted and effective therapies, are compelling pharmaceutical companies to invest heavily in R&D. The market is expected to maintain a strong growth momentum, with the forecast period (2025–2033) anticipating a CAGR of around XX%. This sustained growth will be fueled by ongoing innovation, increasing global healthcare expenditure, and a growing pipeline of novel drug candidates across various therapeutic areas. The adoption rate of advanced technologies, such as AI-powered drug discovery platforms, has seen a significant increase, with an estimated XX% of R&D budgets now allocated to such innovations in the estimated year of 2025.

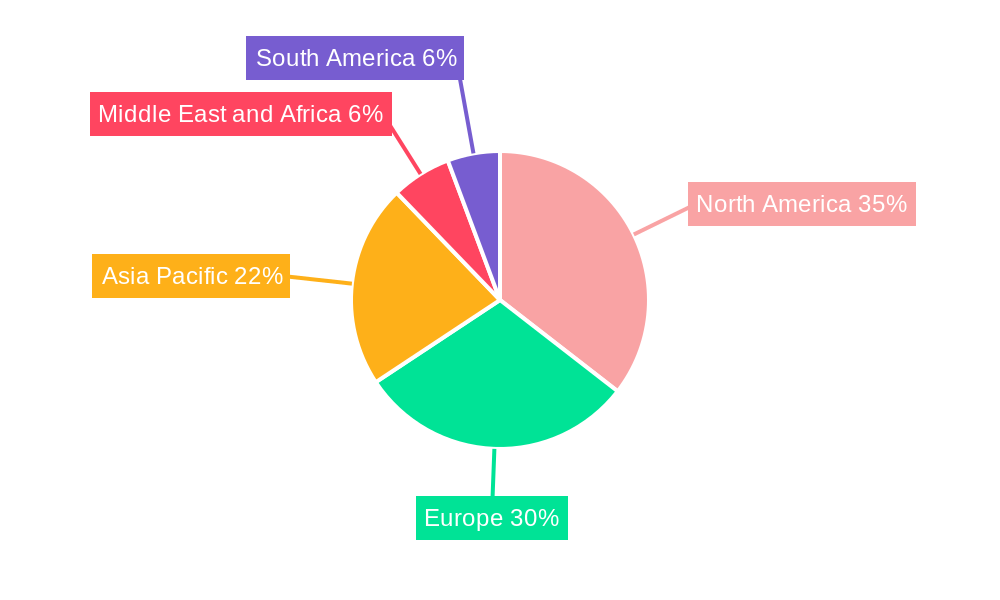

Leading Regions, Countries, or Segments in Drug Discovery Industry

The drug discovery industry is significantly influenced by regional strengths, technological adoption, and end-user specialization. Among the drug types, biologic drugs are experiencing rapid growth, with a projected market share of approximately XX% in 2025, driven by their efficacy in treating complex diseases like autoimmune disorders and cancer. Small molecule drugs continue to hold a substantial market share, estimated at XX%, due to their established efficacy and diverse applications. In terms of technology, High Throughput Screening (HTS) remains a cornerstone, estimated to capture XX% of the technology market in 2025, enabling the rapid assessment of vast compound libraries. Pharmacogenomics is a rapidly expanding segment, projected to grow at a CAGR of XX% during the forecast period, underpinning the shift towards personalized medicine. Contract Research Organizations (CROs) are a dominant end-user segment, accounting for an estimated XX% of the market in 2025, as pharmaceutical companies increasingly outsource R&D functions. North America, particularly the United States, consistently emerges as the leading region in the drug discovery industry. This dominance is attributed to several key drivers:

- Substantial R&D Investment: North America attracts billions of dollars in R&D investment annually, fueled by a robust venture capital ecosystem and strong government funding for biomedical research.

- Presence of Major Pharmaceutical Hubs: The region is home to numerous leading pharmaceutical companies and a dense network of biotechnology startups, fostering a collaborative and competitive environment.

- Favorable Regulatory Environment: While stringent, the FDA's regulatory framework, coupled with a clear path for drug approval, encourages innovation and investment.

- Academic Excellence and Translational Research: Top-tier universities and research institutions in North America are at the forefront of scientific discovery, effectively translating basic research into clinical applications.

- Advanced Technological Infrastructure: The region boasts advanced infrastructure for cutting-edge technologies like AI-driven drug discovery, genomics, and proteomics.

In-depth analysis reveals that the United States alone accounts for over XX% of the global drug discovery market. This concentration is bolstered by the presence of major players like Merck & Co. Inc. and Pfizer Inc., alongside a vibrant ecosystem of specialized biotech firms. The increasing adoption of AI and machine learning in drug discovery is further cementing North America's leadership, with a significant portion of AI-powered drug discovery companies headquartered in this region. The robust pipeline of clinical trials and the high success rate of drug approvals contribute to the sustained dominance of North America in shaping the future of drug discovery.

Drug Discovery Industry Product Innovations

The drug discovery industry is a hotbed of innovation, continuously yielding novel therapeutic candidates and groundbreaking technologies. Recent advancements include the development of highly selective kinase inhibitors for targeted cancer therapies, boasting improved efficacy and reduced off-target side effects. In the realm of biologics, the refinement of antibody-drug conjugates (ADCs) has led to more potent and targeted delivery of chemotherapeutics. Furthermore, advancements in mRNA technology are extending beyond vaccines to novel treatments for genetic disorders. Nanotechnology is revolutionizing drug delivery, enabling the precise targeting of diseased cells and improved bioavailability, while AI-powered platforms are accelerating the identification of novel drug targets and the design of novel molecular structures, significantly shortening the lead optimization phase.

Propelling Factors for Drug Discovery Industry Growth

The drug discovery industry is propelled by a confluence of potent factors, driving its impressive growth trajectory. Technological advancements, particularly in artificial intelligence (AI) and machine learning for drug target identification and compound screening, are revolutionizing R&D efficiency. The increasing global burden of chronic diseases, such as cancer, cardiovascular diseases, and neurodegenerative disorders, fuels the demand for novel and effective therapeutics. Growing healthcare expenditure worldwide, especially in emerging economies, translates to increased investment in pharmaceutical R&D. Furthermore, favorable government initiatives and funding for biomedical research, alongside evolving regulatory pathways that encourage innovation, provide a supportive environment. The rising prevalence of personalized medicine, driven by advancements in genomics and pharmacogenomics, also stimulates the development of targeted therapies.

Obstacles in the Drug Discovery Industry Market

Despite its promising outlook, the drug discovery industry faces significant obstacles. The exceptionally high cost and long timelines associated with bringing a new drug to market remain a persistent challenge, often reaching billions of dollars and over a decade. Regulatory hurdles and the stringent approval processes by bodies like the FDA and EMA can lead to significant delays and attrition rates. The increasing complexity of diseases and the need for highly targeted therapies require sophisticated research methodologies, increasing development costs. Fierce competition among pharmaceutical companies and the constant threat of patent expirations necessitate continuous innovation and pipeline replenishment. Supply chain disruptions, particularly for specialized raw materials and advanced manufacturing processes, can also impede progress.

Future Opportunities in Drug Discovery Industry

The drug discovery industry is brimming with exciting future opportunities. The growing understanding of the human microbiome presents a fertile ground for developing novel therapeutics for a wide range of diseases. The continued advancement and wider adoption of artificial intelligence (AI) and machine learning will further accelerate drug discovery and development, leading to more efficient and cost-effective R&D. Emerging markets, with their expanding middle class and increasing healthcare access, offer significant untapped potential for new drug launches. The development of precision medicines tailored to individual genetic profiles and disease subtypes will continue to be a major growth area. Furthermore, the exploration of novel therapeutic modalities, such as gene editing and cell therapies, holds immense promise for treating previously intractable conditions.

Major Players in the Drug Discovery Industry Ecosystem

- Bayer AG

- Novartis

- Merck & Co Inc

- F Hoffmann-La Roche Ltd

- AstraZeneca PLC

- Sanofi

- Eli Lilly and Company

- Takeda Pharmaceuticals

- AbbVie Inc

- Bristol-Myers Squibb Company

- GlaxoSmithKline PLC

- Pfizer Inc

Key Developments in Drug Discovery Industry Industry

- October 2022: Verge Genomics, a clinical-stage and technology-enabled biotechnology company pioneering the use of artificial intelligence (AI) and human data to transform drug discovery, announced dosing the first subject in its Phase 1 clinical trial of VRG50635. This development highlights the increasing integration of AI in early-stage drug development, potentially accelerating the identification of novel targets and therapies.

- October 2022: NGM Bio released topline results from the CATALINA Phase 2 Trial of NGM621 in patients with geographic atrophy (GA) secondary to age-related macular degeneration. This outcome signifies progress in the development of novel treatments for ophthalmic diseases, a significant area of unmet medical need, and impacts investor sentiment and pipeline evaluations for the involved companies.

Strategic Drug Discovery Industry Market Forecast

The drug discovery industry market is poised for substantial growth, driven by a robust pipeline of innovative therapies and transformative technologies. The increasing adoption of artificial intelligence (AI) and machine learning in R&D processes is set to significantly expedite the drug discovery lifecycle, reducing both time and cost. A growing global prevalence of chronic diseases, coupled with an expanding healthcare infrastructure, will continue to fuel demand for novel pharmaceuticals. Strategic collaborations between pharmaceutical giants and agile biotechnology firms, along with a surge in venture capital funding for cutting-edge research, will further accelerate innovation. The forecast period (2025–2033) anticipates continued expansion, with significant market potential emerging from personalized medicine, novel therapeutic modalities, and the exploration of new disease targets. The market is expected to reach an estimated XX Billion by 2033, reflecting sustained investment and groundbreaking advancements in pharmaceutical R&D.

Drug Discovery Industry Segmentation

-

1. Drug Type

- 1.1. Small Molecule Drugs

- 1.2. Biologic Drugs

-

2. Technology

- 2.1. High Throughput Screening

- 2.2. Pharmacogenomics

- 2.3. Combinatorial Chemistry

- 2.4. Nanotechnology

- 2.5. Other Technologies

-

3. End User

- 3.1. Pharmaceutical Companies

- 3.2. Contract Research Organizations (CROs)

- 3.3. Other End Users

Drug Discovery Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Drug Discovery Industry Regional Market Share

Geographic Coverage of Drug Discovery Industry

Drug Discovery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Various Chronic Diseases; Increasing R&D Expenditure and Investment in the Development of Novel Drug Molecules

- 3.3. Market Restrains

- 3.3.1. Huge Capital Investment with Low Profit Margins; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. Biologics Drug Segment is Expected to Show a Significant Growth Over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drug Discovery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 5.1.1. Small Molecule Drugs

- 5.1.2. Biologic Drugs

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. High Throughput Screening

- 5.2.2. Pharmacogenomics

- 5.2.3. Combinatorial Chemistry

- 5.2.4. Nanotechnology

- 5.2.5. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical Companies

- 5.3.2. Contract Research Organizations (CROs)

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 6. North America Drug Discovery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 6.1.1. Small Molecule Drugs

- 6.1.2. Biologic Drugs

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. High Throughput Screening

- 6.2.2. Pharmacogenomics

- 6.2.3. Combinatorial Chemistry

- 6.2.4. Nanotechnology

- 6.2.5. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical Companies

- 6.3.2. Contract Research Organizations (CROs)

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 7. Europe Drug Discovery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 7.1.1. Small Molecule Drugs

- 7.1.2. Biologic Drugs

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. High Throughput Screening

- 7.2.2. Pharmacogenomics

- 7.2.3. Combinatorial Chemistry

- 7.2.4. Nanotechnology

- 7.2.5. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical Companies

- 7.3.2. Contract Research Organizations (CROs)

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 8. Asia Pacific Drug Discovery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 8.1.1. Small Molecule Drugs

- 8.1.2. Biologic Drugs

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. High Throughput Screening

- 8.2.2. Pharmacogenomics

- 8.2.3. Combinatorial Chemistry

- 8.2.4. Nanotechnology

- 8.2.5. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical Companies

- 8.3.2. Contract Research Organizations (CROs)

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 9. Middle East and Africa Drug Discovery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 9.1.1. Small Molecule Drugs

- 9.1.2. Biologic Drugs

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. High Throughput Screening

- 9.2.2. Pharmacogenomics

- 9.2.3. Combinatorial Chemistry

- 9.2.4. Nanotechnology

- 9.2.5. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical Companies

- 9.3.2. Contract Research Organizations (CROs)

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 10. South America Drug Discovery Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 10.1.1. Small Molecule Drugs

- 10.1.2. Biologic Drugs

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. High Throughput Screening

- 10.2.2. Pharmacogenomics

- 10.2.3. Combinatorial Chemistry

- 10.2.4. Nanotechnology

- 10.2.5. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceutical Companies

- 10.3.2. Contract Research Organizations (CROs)

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bayer AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novartis

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck & Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Hoffmann-La Roche Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AstraZeneca PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sanofi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eli Lilly and Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Takeda Pharmaceuticals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AbbVie Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bristol-Myers Squibb Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GlaxoSmithKline PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pfizer Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Bayer AG

List of Figures

- Figure 1: Global Drug Discovery Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Drug Discovery Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Drug Discovery Industry Revenue (Million), by Drug Type 2025 & 2033

- Figure 4: North America Drug Discovery Industry Volume (K Unit), by Drug Type 2025 & 2033

- Figure 5: North America Drug Discovery Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 6: North America Drug Discovery Industry Volume Share (%), by Drug Type 2025 & 2033

- Figure 7: North America Drug Discovery Industry Revenue (Million), by Technology 2025 & 2033

- Figure 8: North America Drug Discovery Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 9: North America Drug Discovery Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: North America Drug Discovery Industry Volume Share (%), by Technology 2025 & 2033

- Figure 11: North America Drug Discovery Industry Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Drug Discovery Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Drug Discovery Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Drug Discovery Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Drug Discovery Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Drug Discovery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Drug Discovery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Drug Discovery Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Drug Discovery Industry Revenue (Million), by Drug Type 2025 & 2033

- Figure 20: Europe Drug Discovery Industry Volume (K Unit), by Drug Type 2025 & 2033

- Figure 21: Europe Drug Discovery Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 22: Europe Drug Discovery Industry Volume Share (%), by Drug Type 2025 & 2033

- Figure 23: Europe Drug Discovery Industry Revenue (Million), by Technology 2025 & 2033

- Figure 24: Europe Drug Discovery Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 25: Europe Drug Discovery Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 26: Europe Drug Discovery Industry Volume Share (%), by Technology 2025 & 2033

- Figure 27: Europe Drug Discovery Industry Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Drug Discovery Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Drug Discovery Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Drug Discovery Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Drug Discovery Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Drug Discovery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Drug Discovery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Drug Discovery Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Drug Discovery Industry Revenue (Million), by Drug Type 2025 & 2033

- Figure 36: Asia Pacific Drug Discovery Industry Volume (K Unit), by Drug Type 2025 & 2033

- Figure 37: Asia Pacific Drug Discovery Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 38: Asia Pacific Drug Discovery Industry Volume Share (%), by Drug Type 2025 & 2033

- Figure 39: Asia Pacific Drug Discovery Industry Revenue (Million), by Technology 2025 & 2033

- Figure 40: Asia Pacific Drug Discovery Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 41: Asia Pacific Drug Discovery Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Asia Pacific Drug Discovery Industry Volume Share (%), by Technology 2025 & 2033

- Figure 43: Asia Pacific Drug Discovery Industry Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Drug Discovery Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Drug Discovery Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Drug Discovery Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Drug Discovery Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Drug Discovery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Drug Discovery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Drug Discovery Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Drug Discovery Industry Revenue (Million), by Drug Type 2025 & 2033

- Figure 52: Middle East and Africa Drug Discovery Industry Volume (K Unit), by Drug Type 2025 & 2033

- Figure 53: Middle East and Africa Drug Discovery Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 54: Middle East and Africa Drug Discovery Industry Volume Share (%), by Drug Type 2025 & 2033

- Figure 55: Middle East and Africa Drug Discovery Industry Revenue (Million), by Technology 2025 & 2033

- Figure 56: Middle East and Africa Drug Discovery Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 57: Middle East and Africa Drug Discovery Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 58: Middle East and Africa Drug Discovery Industry Volume Share (%), by Technology 2025 & 2033

- Figure 59: Middle East and Africa Drug Discovery Industry Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East and Africa Drug Discovery Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: Middle East and Africa Drug Discovery Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Drug Discovery Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Drug Discovery Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Drug Discovery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Drug Discovery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Drug Discovery Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Drug Discovery Industry Revenue (Million), by Drug Type 2025 & 2033

- Figure 68: South America Drug Discovery Industry Volume (K Unit), by Drug Type 2025 & 2033

- Figure 69: South America Drug Discovery Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 70: South America Drug Discovery Industry Volume Share (%), by Drug Type 2025 & 2033

- Figure 71: South America Drug Discovery Industry Revenue (Million), by Technology 2025 & 2033

- Figure 72: South America Drug Discovery Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 73: South America Drug Discovery Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 74: South America Drug Discovery Industry Volume Share (%), by Technology 2025 & 2033

- Figure 75: South America Drug Discovery Industry Revenue (Million), by End User 2025 & 2033

- Figure 76: South America Drug Discovery Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: South America Drug Discovery Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Drug Discovery Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Drug Discovery Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Drug Discovery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Drug Discovery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Drug Discovery Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Drug Discovery Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 2: Global Drug Discovery Industry Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 3: Global Drug Discovery Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Drug Discovery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 5: Global Drug Discovery Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Drug Discovery Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Drug Discovery Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Drug Discovery Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Drug Discovery Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 10: Global Drug Discovery Industry Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 11: Global Drug Discovery Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Drug Discovery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 13: Global Drug Discovery Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Drug Discovery Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Drug Discovery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Drug Discovery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Drug Discovery Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 24: Global Drug Discovery Industry Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 25: Global Drug Discovery Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 26: Global Drug Discovery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Global Drug Discovery Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Drug Discovery Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Drug Discovery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Drug Discovery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: United Kingdom Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Germany Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Germany Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Drug Discovery Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 44: Global Drug Discovery Industry Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 45: Global Drug Discovery Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 46: Global Drug Discovery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 47: Global Drug Discovery Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 48: Global Drug Discovery Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global Drug Discovery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Drug Discovery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Drug Discovery Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 64: Global Drug Discovery Industry Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 65: Global Drug Discovery Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 66: Global Drug Discovery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 67: Global Drug Discovery Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global Drug Discovery Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global Drug Discovery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Drug Discovery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Drug Discovery Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 78: Global Drug Discovery Industry Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 79: Global Drug Discovery Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 80: Global Drug Discovery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 81: Global Drug Discovery Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 82: Global Drug Discovery Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 83: Global Drug Discovery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Drug Discovery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Drug Discovery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Drug Discovery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Drug Discovery Industry?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Drug Discovery Industry?

Key companies in the market include Bayer AG, Novartis, Merck & Co Inc, F Hoffmann-La Roche Ltd, AstraZeneca PLC, Sanofi, Eli Lilly and Company, Takeda Pharmaceuticals, AbbVie Inc, Bristol-Myers Squibb Company, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Drug Discovery Industry?

The market segments include Drug Type, Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 100.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Various Chronic Diseases; Increasing R&D Expenditure and Investment in the Development of Novel Drug Molecules.

6. What are the notable trends driving market growth?

Biologics Drug Segment is Expected to Show a Significant Growth Over the Forecast Period..

7. Are there any restraints impacting market growth?

Huge Capital Investment with Low Profit Margins; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

October 2022: Verge Genomics, a clinical-stage and technology-enabled biotechnology company pioneering the use of artificial intelligence (AI) and human data to transform drug discovery, announced dosing the first subject in its Phase 1 clinical trial of VRG50635.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Drug Discovery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Drug Discovery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Drug Discovery Industry?

To stay informed about further developments, trends, and reports in the Drug Discovery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence